by Jim the Realtor | Apr 19, 2019 | Boomer Liquidations, Boomers, Jim's Take on the Market, The Future, Thinking of Selling?, Where to Move, Why You Should List With Jim |

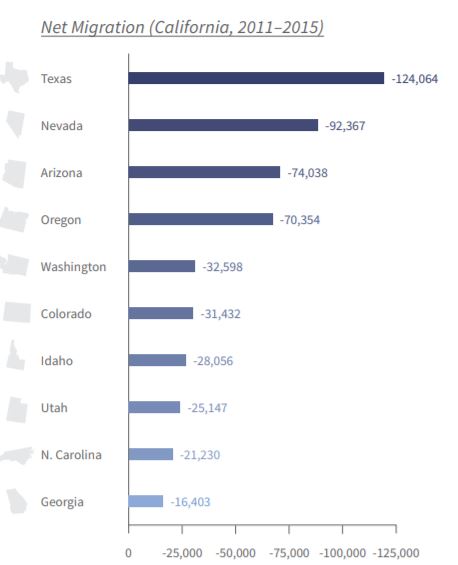

Hat tip to CB Mark for sending in another article on people leaving California – I added the U.S. Census stats for San Diego County at the bottom:

People have long dreamed of moving to California, but increasingly the people in the state are looking to get out.

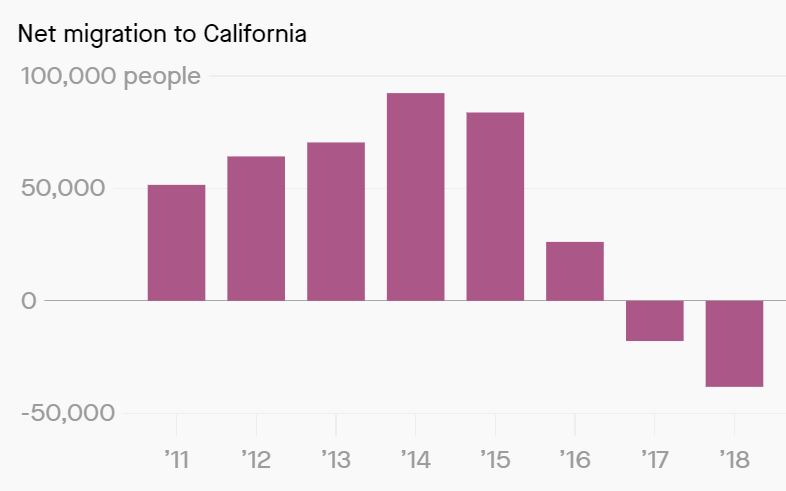

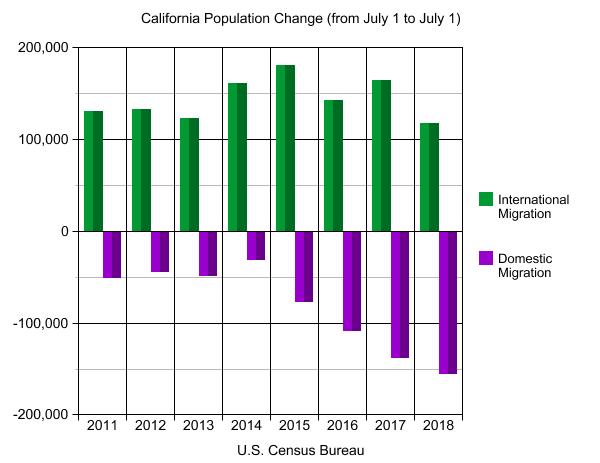

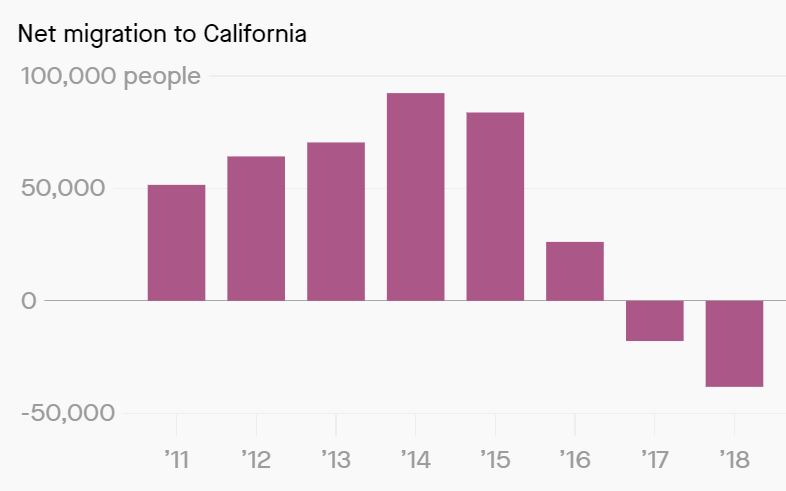

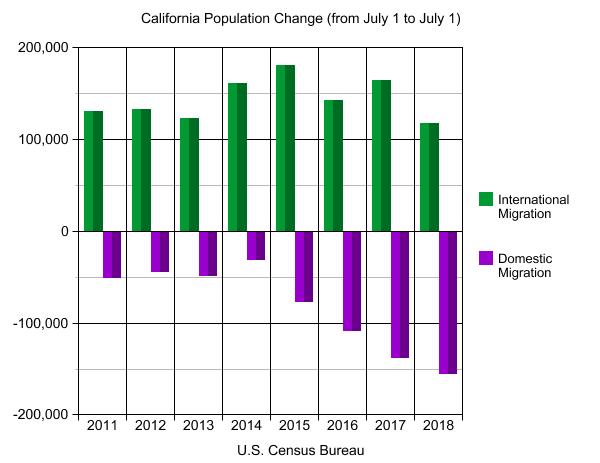

According to recently released data from the US Census, about 38,000 more people left California than entered it in 2018. This is the second straight year that migration to the state was negative, and it’s a trend that is speeding up. Every year since 2014, net migration has fallen.

California’s population did still increase in 2018 by almost 160,000 people, largely due to the 480,000 people born in the state. But while migration out of the state has accelerated over the past few years, the number of annual births has been steady. The trend suggests in the next decade California’s population will begin to decline.

Besides births, the main reason California’s population hasn’t already started falling has been international migration into the state. Every year since 2011, net domestic migration has been negative—i.e., more people leave California than move in from other states. But from 2011 to 2016, the number of international migrants moving into California was larger than the number of locals who were moving out.

Since then, however, domestic departures have outstripped international arrivals. In 2018, 156,000 locals left the state, compared to 118,000 international who came.

Link to full article:

https://qz.com/1599150/californias-population-could-start-shrinking-very-soon/

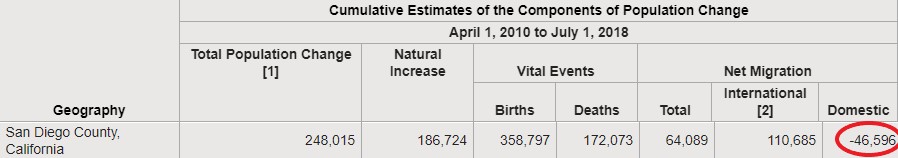

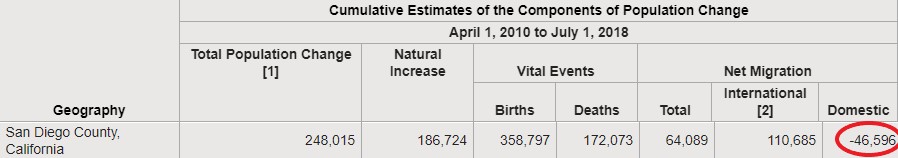

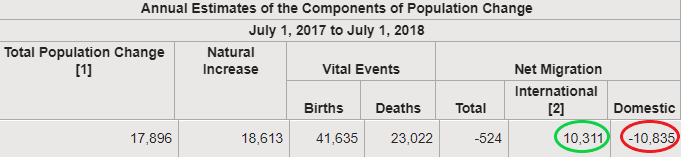

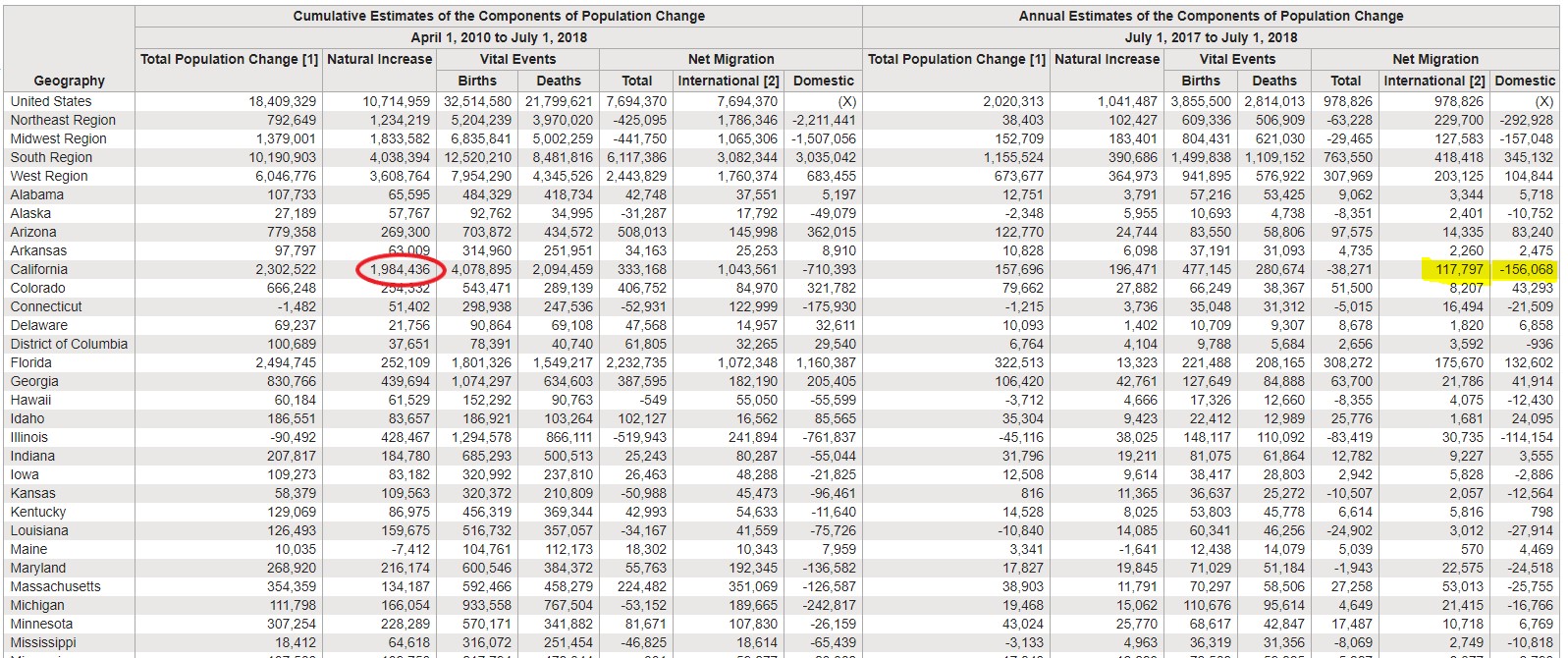

The exodus from San Diego County is picking up steam. Where the cumulative total of domestic migration over the last eight years was only 46,596 (avg. 5,825 per year), we had 10,835 leave in the most recent 12 month segment – and the international arrivals have slowed considerably too:

by Jim the Realtor | Mar 25, 2019 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions

As boomers grow older, it’s inevitable that their housing transitions will affect the real estate market. But it seems spread out enough that the impact will be digested….at least at some price. There will probably be times when a few old homesteads in the same area are sold at the same time, but it should all even out in the long run.

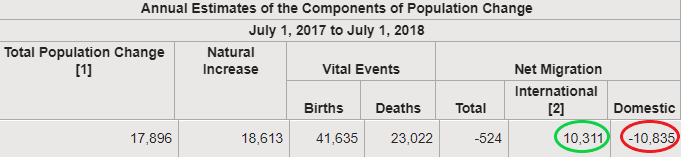

The Baby Boom generation (1946-1964) has an enormous housing market footprint, inhabiting 32 million owner-occupied homes and accounting for two out of five homeowners in the United States with an estimated value of $13.5 trillion. And when they decide to divest, said Fannie Mae, Washington, D.C., the impact could spur fears of a “bursting generational housing bubble.”

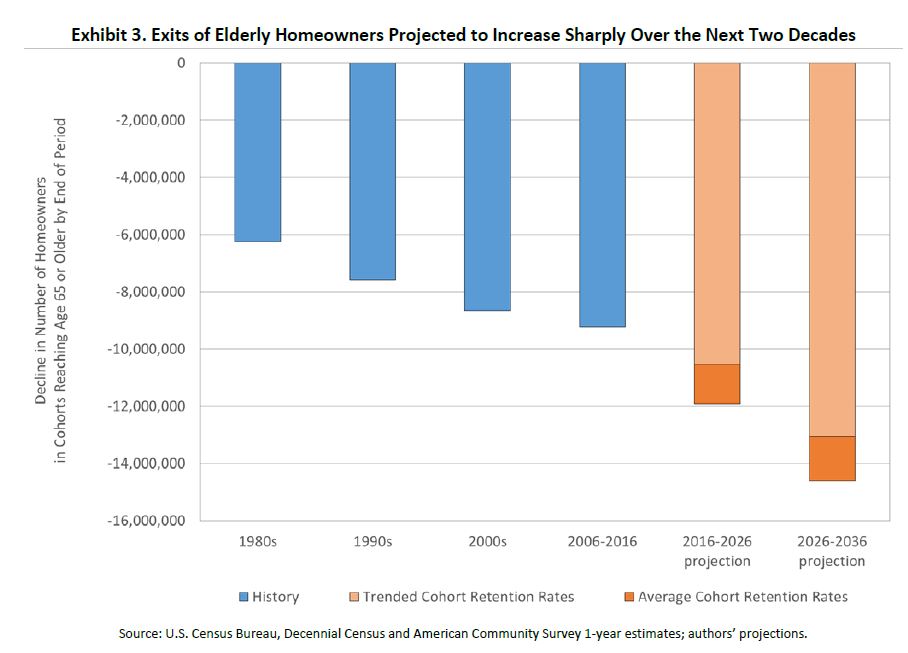

In a report, The Coming Exodus of Older Homeowners, the Fannie Mae Economic and Strategic Research Group said departures of these older adults from the homeownership market–for rentals, senior care facilities or by reason of death–will accelerate as the large Baby Boom generation continues to age.

“With the oldest Boomers now advancing into their 70s, the beginning of a mass exodus looms on the horizon, spurring fears of a bursting ‘generational housing bubble’ in which homeownership demand from younger generations is insufficient to fill the void left by multitudes of departing older owners,” wrote authors Dowell Myers, professor at the University of Southern California; and Patrick Simmons, Fannie Mae Director of Strategic Planning. Further, the authors warned a “fumbled” intergenerational handoff “would reverberate through the housing market and economy.”

(more…)

by Jim the Realtor | Mar 20, 2019 | Boomer Liquidations, Boomers, Jim's Take on the Market, Local Government, Market Conditions |

For the first time in recent history – and probably the first time ever – the net migration out of California has not been offset by the international inflow.

The number of people leaving the state is 3x what it was just 4+ years ago!

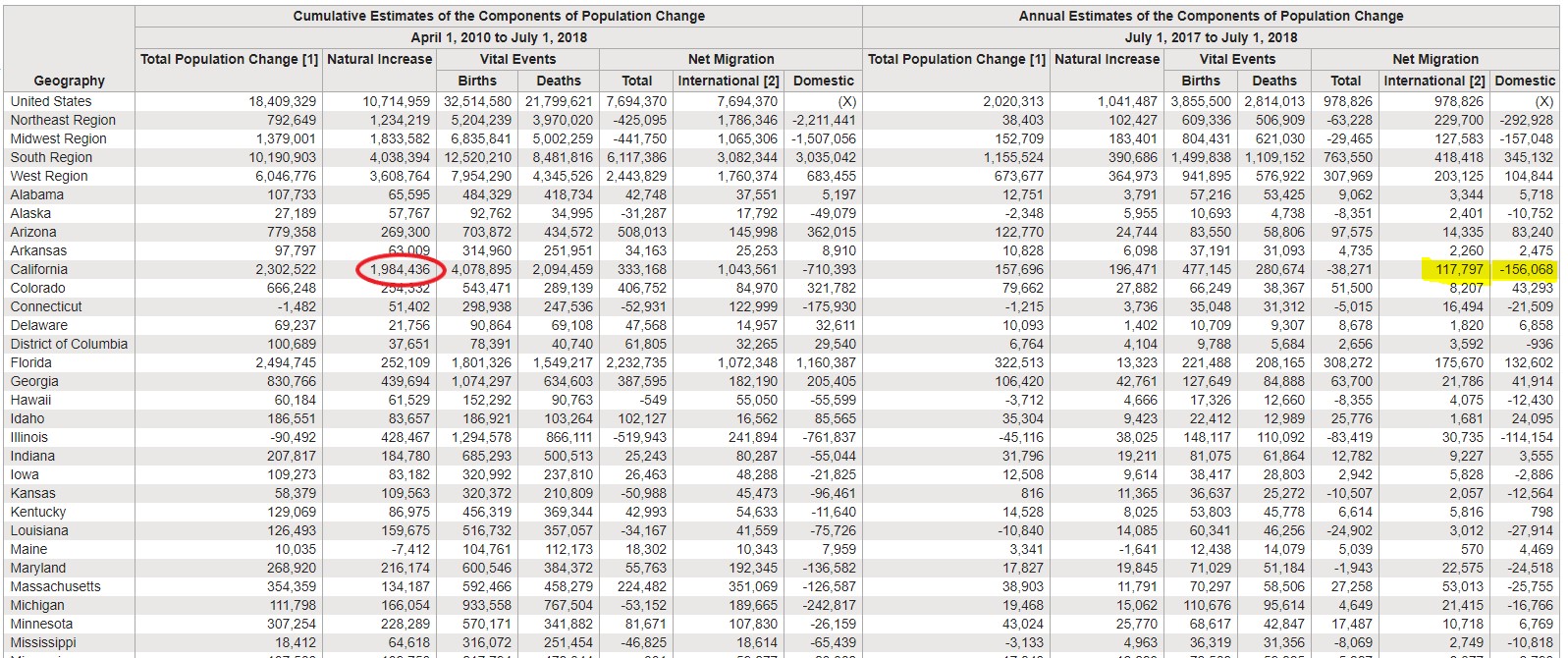

But the state population is still growing….naturally. Over the last eight years, there have been almost 2 million more births than deaths!

With baby boomers living longer, the birth/death balance should level out eventually, but all those young people need to live somewhere – and only the affluent will be able to purchase a home. (click to enlarge)

https://factfinder.census.gov/faces/tableservices/jsf/pages/productview.xhtml?src=bkmk#

by Jim the Realtor | Mar 12, 2019 | Boomer Liquidations, Boomers, Jim's Take on the Market

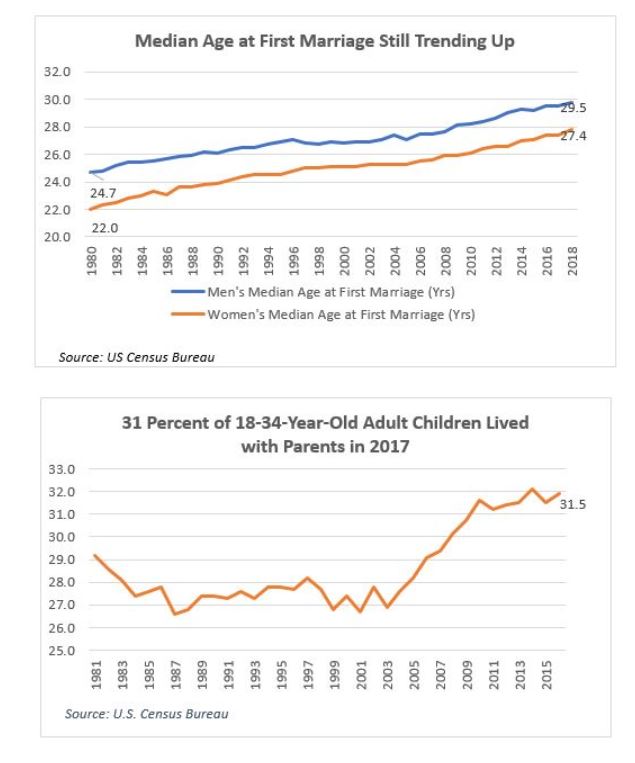

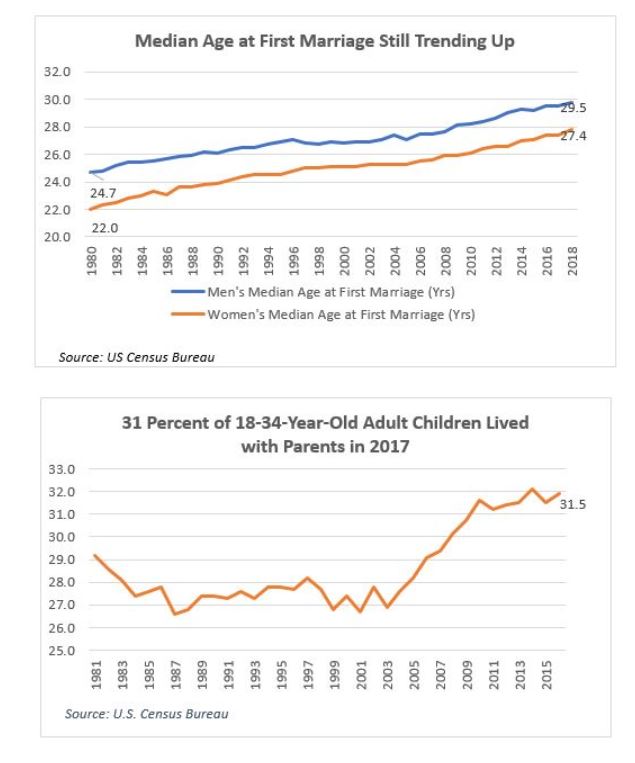

We saw yesterday that fewer NSDCC homes have been coming to market this year, in spite of record pricing. Boomers are reluctant to move for several reasons; aging-in-place, higher mortgage rates, and kids aren’t moving out because of affordability:

First, the number of movers has generally been on the downtrend since during 1985-1986. During 1985-1986, there were 46.470 million people who moved, or 20.2 percent of the population, and by 2017-2018, there were only 32.352 million movers, or 10.1 percent of the population. Comparing 2017-2018 with 2016-2017 data, there were 2.55 million fewer movers during 2017-2018 (32.352 million) than during 2016-2017(34.902 million), with the fraction of movers declining from 11 percent in 2016-2017 to 10 percent in 2016-2017.

The decline in mobility rates is also reflected in the lower turnover rate, or the ratio of existing homes sold to owner occupied housing stock. In 2005, there were nearly 10 houses sold for every 100 owner occupied homes. The turnover rate dipped to 4.8 in 2010 Q3 and was on the rise as the housing market recovered, peaking to 7.3 in 2017 Q1 and Q2. It has since fallen to 6.8 homes in 2018 Q3, as interest rates have increased.

Link to Article

In the 1980s we had roughly twice as many people moving, but rates were dropping precipitously from 18% to 10%, and boomers were much younger. We don’t have either of those going for us now, and boomers are still in control of our destiny – could sales keep dropping?

by Jim the Realtor | Feb 19, 2019 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Buzz |

Can we expect young adults to be tomorrow’s home buyers?

A report from the Urban Institute:

The share of young adults ages 25 to 34 living with their parents increased from 11.9 percent in 2000 to 22.0 percent in 2017. This translates to more than 5.6 million additional young adults under their parents’ roofs between the two years. This trend matches the decline in young adults’ marital rate (from 55.3 percent to 40.0 percent) during this period.

Increases in rents and student debt plays an important role in young adults’ decisions to stay with their parents. Metropolitan statistical areas with higher unemployment rates experienced a greater increase in the share of young adults living under their parents’ roofs.

This early life choice could have long-term consequences. Young adults who stayed with their parents between ages 25 and 34 were less likely to form independent households and become homeowners 10 years later than those who made an earlier departure. Even if they did ultimately buy a home, young adults who stayed with their parents longer did not buy more expensive homes or have lower mortgage debts than did young adults who moved out earlier, suggesting that living with parents does not better position young adults for homeownership, a critical source of future wealth, and may have negative long-term consequences for independent household formation.

Link to 39-page report

by Jim the Realtor | Feb 11, 2019 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions |

Diana had a piece on seniors aging in place, and put some numbers on it:

- With more seniors than ever aging in place and choosing not to sell the family home, an estimated 1.6 million fewer properties are now available in a market already experiencing a critical shortage, according to Freddie Mac.

- That is about the same number of new single-family and multifamily housing units built each year.

- That stay-put trend is crashing into the rising demand for housing from the huge millennial generation: fewer homes for sale will continue to put upward pressure on already overheated home prices.

- “There’s a stalemate,” said Jane Fairweather, a longtime real estate agent in Bethesda, Maryland. “We can’t get enough housing for the couples who want to put their kids in good public school systems.”

“We believe the additional demand for homeownership from seniors aging in place will increase the relative price of owning versus renting, making renting more attractive to younger generations,” said Sam Khater, chief economist at Freddie Mac, who estimates that the current market needs about 2.5 million more homes to meet demand.

The reasons more seniors are choosing to stay in the homes where they raised their families are manifold.

“They love their homes, it’s their chief investment, they love their neighborhoods and their communities, and they love the control they get in their own house,” said 64 year-old Louis Tenenbaum, a housing advocate in Kensington, Maryland. “They decide when to get up, when to go to sleep, what to eat, who to have as visitors.”

Tenenbaum is preparing to age in place himself. He is in the midst of building an elevator into his three-level home. He has also widened doorways, made a curbless shower and lowered his kitchen counters, should he ever be in a wheelchair. he notes that 63 percent of the $383 billion spent on remodeling each year is among people over 50 years of age, according to Harvard’s Joint Center for Housing. The trouble is they don’t always add features for aging in place.

“If we can shift the remodeling industry to be doing those types of things when they’re already remodeling, then we really start to change the housing infrastructure and we create this place where people can enjoy living out their years in their home,” Tenenbaum said.

That’s great for homeowners, but not so great for young buyers hoping to move into larger suburban homes.

Bill featured the article on CR, and he had these thoughts:

Even when people move to retirement communities, many will not sell their homes. They will rent them instead – especially in the higher priced areas with significant capital gains – since they have to pay capital gains if they sell (above $250K exclusion for single, $500K for married), but the property steps up in value when they pass away. So they can leave the property to their kids with no taxes.

This could be fixed with policy changes. Either eliminate “step up” basis (take away the incentive to hold), or give older homeowners a one time unlimited exclusion (so they can sell while they are alive).

Aging in place is great for the senior, but what frequently happens, is a four bedroom house is occupied by just one person (inefficient). This is another area where zoning changes could help – let the senior sell her larger family home without tax consequences, and move to a smaller home in the same community (so they can keep their local ties).

Read more at https://www.calculatedriskblog.com/2019/02/as-more-older-americans-age-in-place.html#gxhgrZmQIIkQesgl.99

Wouldn’t it be nice if everyone had a one-time unlimited exclusion from the capital-gains tax! Would it make you move? Is it the only thing that’s holding seniors back? I don’t think so. The general comfort of staying put has many physical, mental, and emotional benefits to them. But if the government ever gets realistic about fixing the housing crisis, this would be the place to start.

by Jim the Realtor | Jan 11, 2019 | Boomer Liquidations, Boomers, Jim's Take on the Market, North County Coastal, Sales and Price Check, Slowdown |

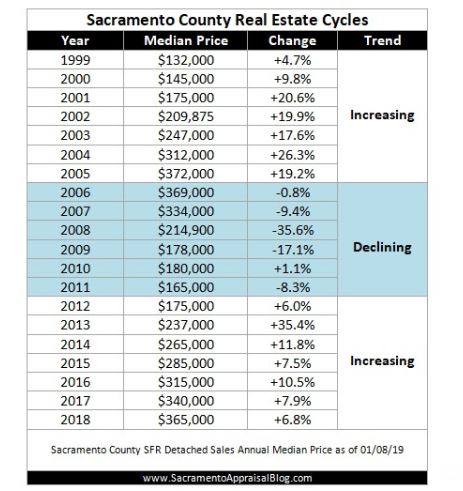

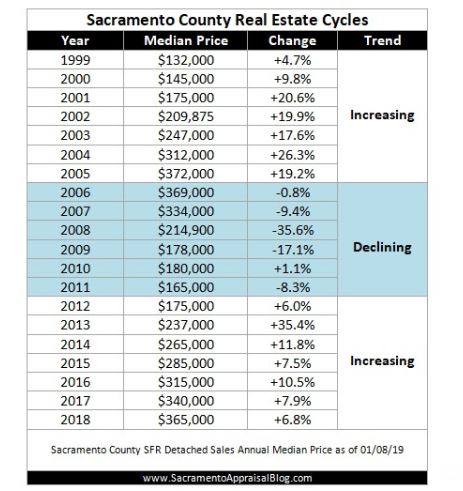

www.sacramentoappraisalblog.com

Ryan posted the history of real estate cycles in Sacramento County, so here are the same years for North San Diego County’s coastal region for comparison. Human nature tends to flow in the same direction everywhere, and as a result, our history looks a little like his:

| Year |

Number of Sales |

Median Sales Price, Annual |

Change |

| 1999 |

3,236 |

$475,000 |

+8% |

| 2000 |

3,285 |

$555,000 |

+17% |

| 2001 |

2,926 |

$570,000 |

+3% |

| 2002 |

3,717 |

$630,000 |

+11% |

| 2003 |

3,932 |

$732,500 |

+16% |

| 2004 |

3,363 |

$948,000 |

+29% |

| 2005 |

3,014 |

$1,000,000 |

+5% |

| 2006 |

2,626 |

$985,000 |

-2% |

| 2007 |

2,479 |

$1,000,000 |

+2% |

| 2008 |

2,037 |

$890,000 |

-11% |

| 2009 |

2,223 |

$817,000 |

-8% |

| 2010 |

2,461 |

$830,000 |

+2% |

| 2011 |

2,562 |

$825,000 |

-1% |

| 2012 |

3,154 |

$830,000 |

+1% |

| 2013 |

3,218 |

$952,250 |

+15% |

| 2014 |

2,850 |

$1,025,000 |

+8% |

| 2015 |

3,079 |

$1,090,000 |

+6% |

| 2016 |

3,103 |

$1,160,000 |

+6% |

| 2017 |

3,084 |

$1,225,000 |

+6% |

| 2018 |

2,797 |

$1,325,000 |

+8% |

At the time it seemed like sky was caving in, but looking back we only had two bad years (2008 and 2009) in the last twenty. There was some scuffling around as we found our way in 2006-2007, and 2010-2012, but given that our market had been injected with the most exotic financing ever known to man, and then tanked by foreclosures and short sales, I think we did pretty good to survive it as well as we did.

Now what?

With 90% of the NSDCC active listings priced over $1M, all we need is wealthy people to keep coming here to buy their forever home. We’re still cheaper than the LA/OC and Bay Area, so we look attractive to downsizers.

Our pricing may bounce around, but without brainless bank clerks dumping properties for any price, who else is going to cause a collapse? We could run low on the number of buyers – and if we did, all it would do is cause a protracted descent; re: soft landing over years.

Boomer liquidations?

Here’s a conversation I had yesterday with a guy who is 80+ years old and who has lived in his house since the 1960s:

Him: Convince me why I should sell my house.

Me: How are you getting around?

Him: I ride my bike to the store.

Me: Do you need the money?

Him: No.

Me: Have you ever dreamed about buying a house on the lake and fishing the rest of your life?

Him: No.

Me: Are you married?

Him: No.

Me: Did you know that if you did sell, you’d have to pay six-figures in taxes? How would that make you feel?

Him: What? I only paid $19,500! I’d never pay that much in taxes!

Me: What happens upon your demise?

Him: My daughter will inherit – she grew up here, and will likely move back in. But I told her if she doesn’t move in, it’s ok with me to sell it.

Me: Do you have a family trust?

Him: Yes.

Me: Did you know that if she sells the house, she will pay no tax?

Him: You’re kidding? If I sell it, I have to pay the tax man six-figures, but if she sells it, she pays nothing? Jim, I think we have the answer!

There will be occasional sales where sellers hire bad agents and get taken advantage of, but there won’t be an avalanche of desperate sellers dumping for any price. It would take a tsunami, earthquake, or terrorist event at the border to cause a drastic shift in housing – which could happen!

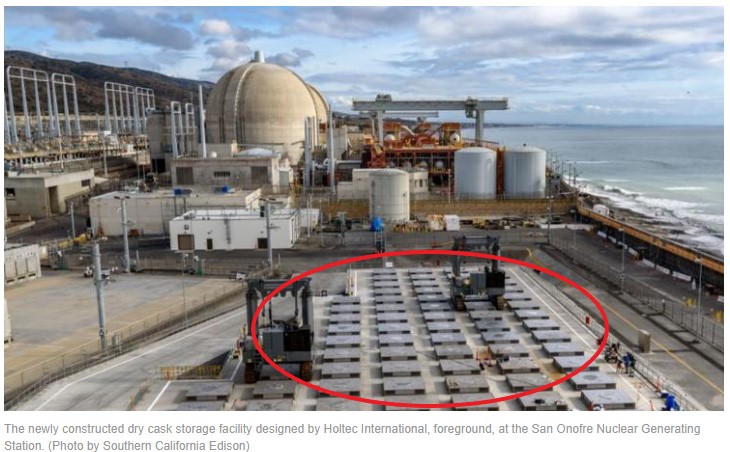

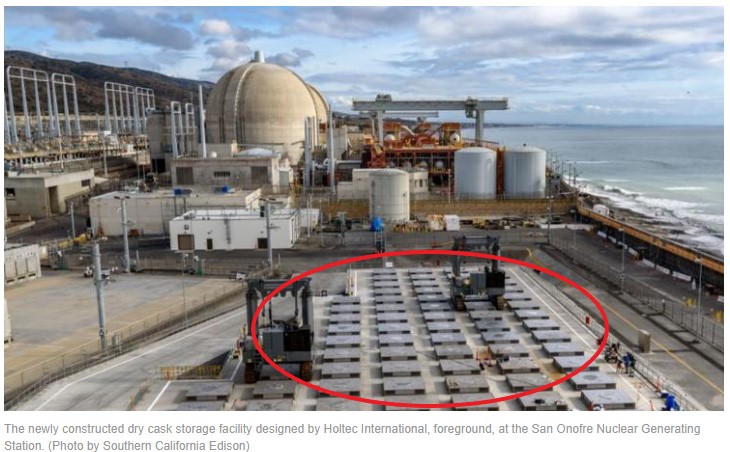

Here’s the latest photo of the nuclear waste being stored right on the surf at San Onofre. All we need is one crack in a storage cask…..

Without a catastrophic event, what’s the worst we can expect?

Maybe 5% drop in pricing in the short-term?

Any more than that, and sellers will just wait it out.

by Jim the Realtor | Dec 8, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market

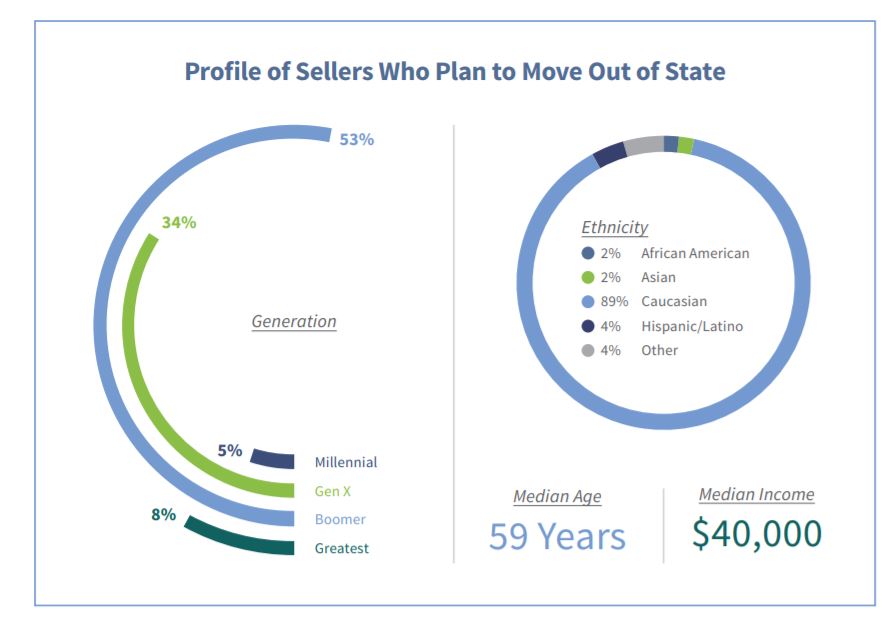

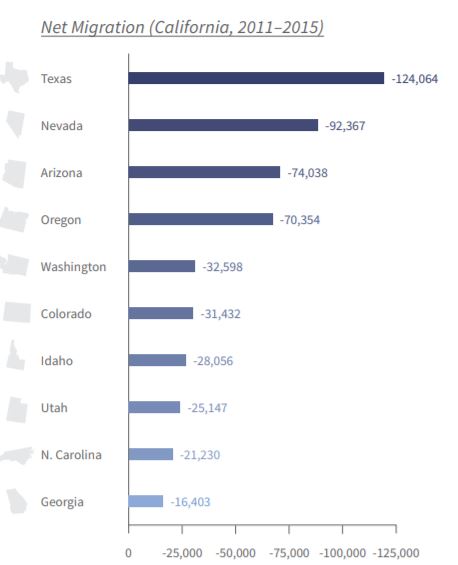

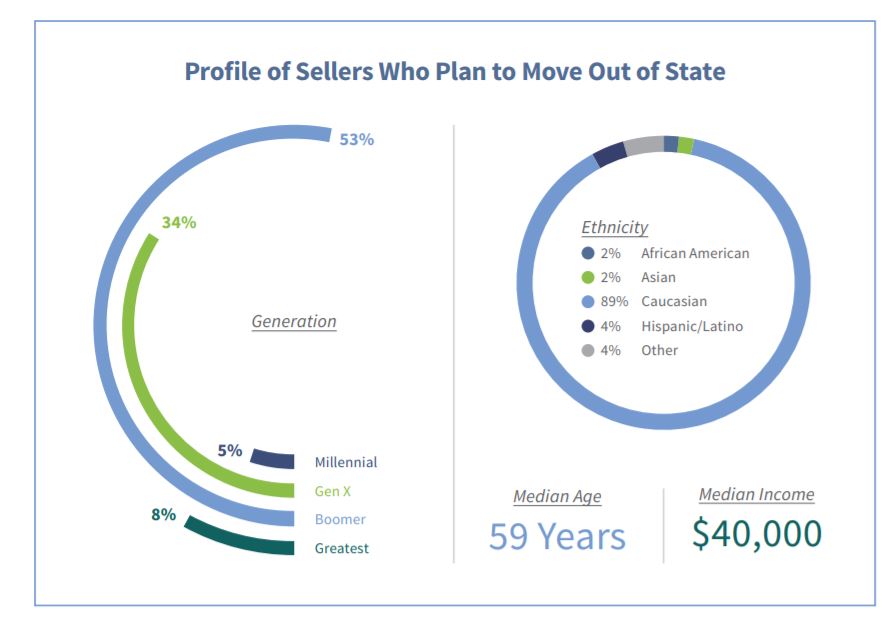

Here’s a visual that sums it up pretty well.

Where are they going?

https://www.car.org/marketdata/surveys/ahs

by Jim the Realtor | Dec 4, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market

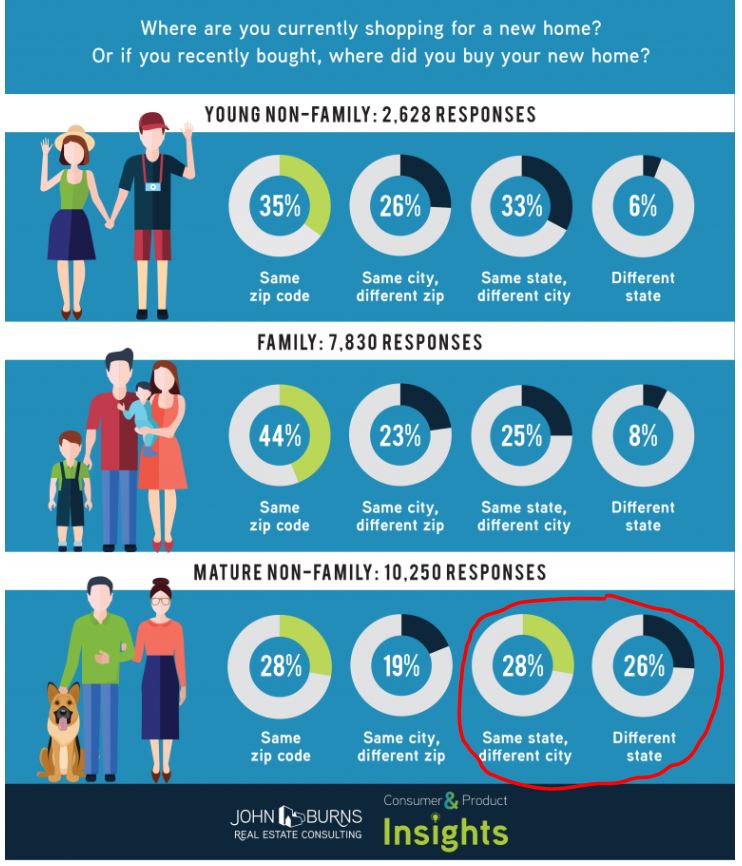

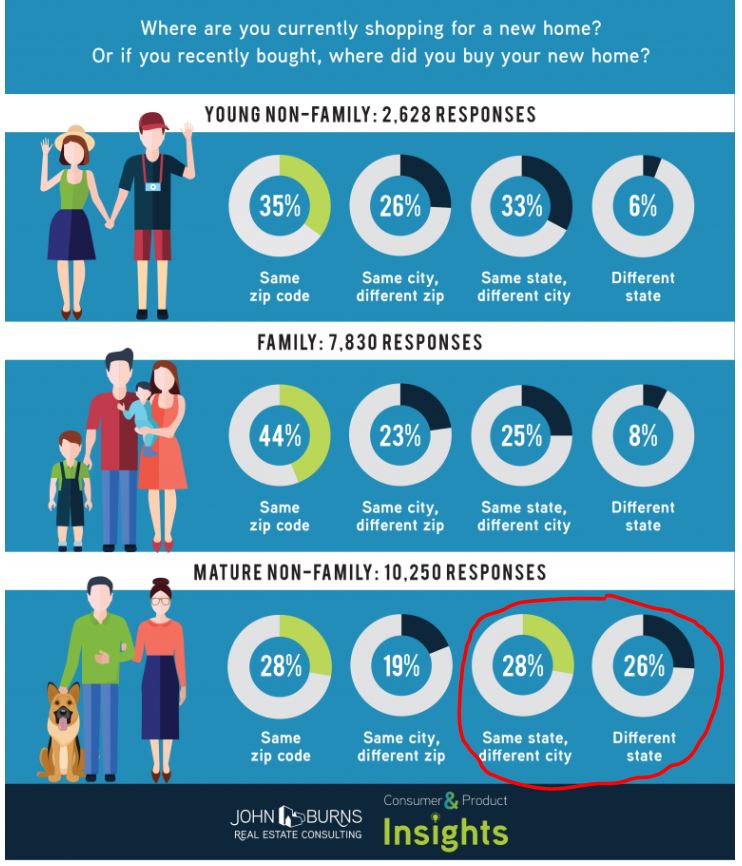

When moving, younger singles, couples, and families tend to stay in their same area, while seniors are more likely to be leaving town.

From our friends at JBREC:

Link to Article

by Jim the Realtor | Dec 1, 2018 | ADU, Boomer Liquidations, Boomers, Homeless Cure, Jim's Take on the Market, Modular Homes, Real Estate Investing, Remodel Projects |

If baby boomers have to sell their home because they need the money, this will be a great alternative – and could help to dry up the housing inventory, especially if you can build an ADU for less than $50,000. Homes with bigger yards would be more valuable too.

Link to Article

Today, Samara is announcing a new initiative called Backyard, “an endeavor to design and prototype new ways of building and sharing homes,” according to a press statement, with the first wave of test units going public in 2019.

It means Airbnb is planning to distribute prototype buildings next year.

The name “Backyard” might imply that Airbnb just wants to build Accessory Dwelling Units (ADUs), those small cottages that sit behind large suburban houses and are often rented on Airbnb. Gebbia clarifies that is not the case. “The project was born in a studio near Airbnb headquarters,” he says in an interview over email. “We always felt as if we were in Airbnb’s backyard–physically and conceptually–and started referring to the project as such.”

Backyard is poised to be much larger than ADUs, in Gebbia’s telling. Yes, small prefabricated dwellings could be in the roadmap, but so are green building materials, standalone houses, and multi-unit complexes. Think of Backyard as both a producer and a marketplace for selling major aspects of the home, in any shape it might come in.

(more…)