Oceanside Harbor

There is nothing like Oceanside Harbor between Dana Point and Mission Beach!

There is nothing like Oceanside Harbor between Dana Point and Mission Beach!

It’s been well-documented here what a lucky guy I am, and here’s another.

In 2016, Natalie was studying abroad in Florence, and we went to visit.

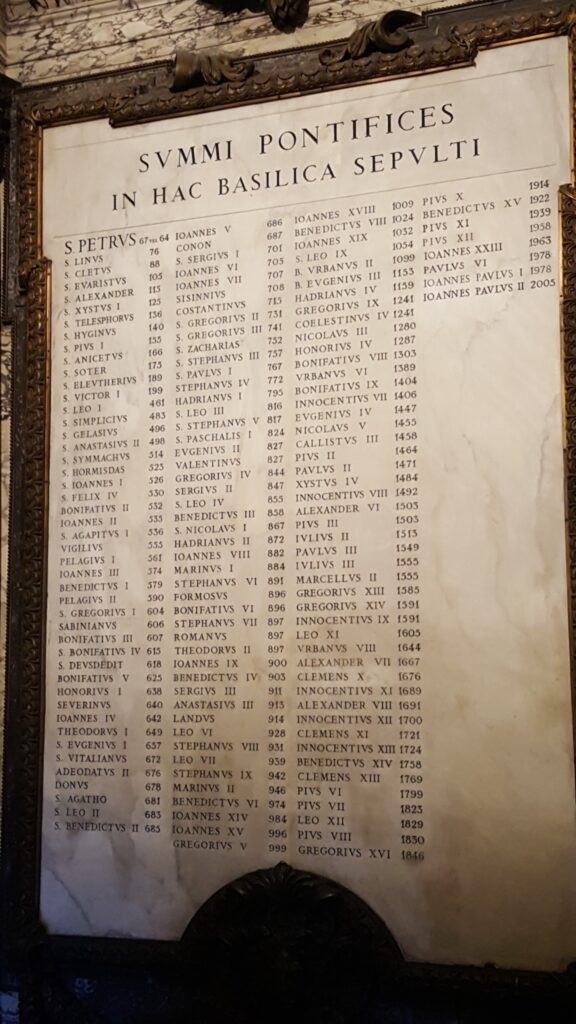

Kayla had done her study abroad in Rome five years earlier, but we didn’t visit then. So we started our tour in Rome so she could show us around. Being good Catholics, we went to the Sistine Chapel, where usually the guards are adamant about not taking any photos.

But the day we were there, the guards were on strike!

They had a skeleton crew of staff at the door who were encouraging us to take as many photos as we wanted!

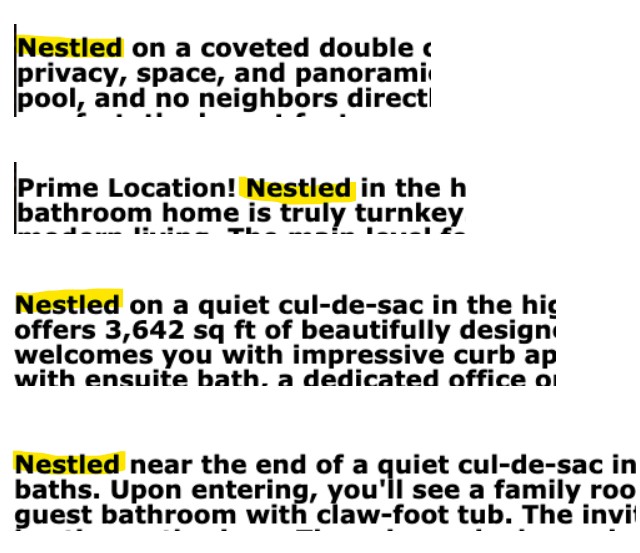

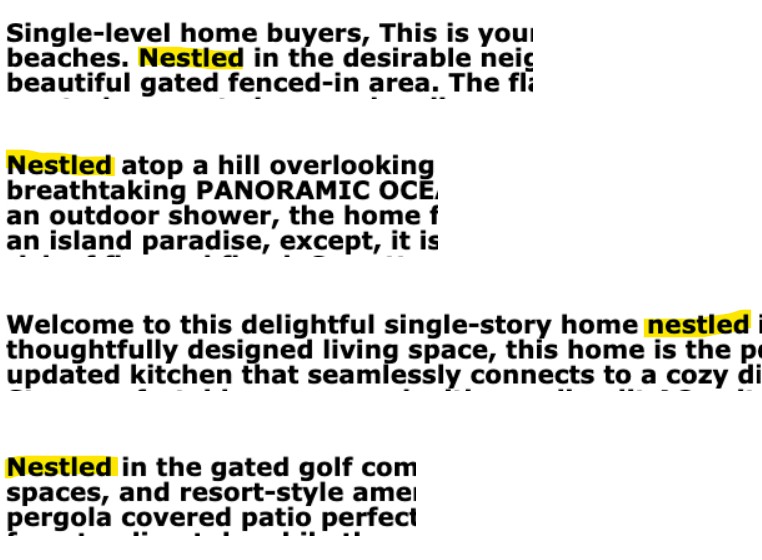

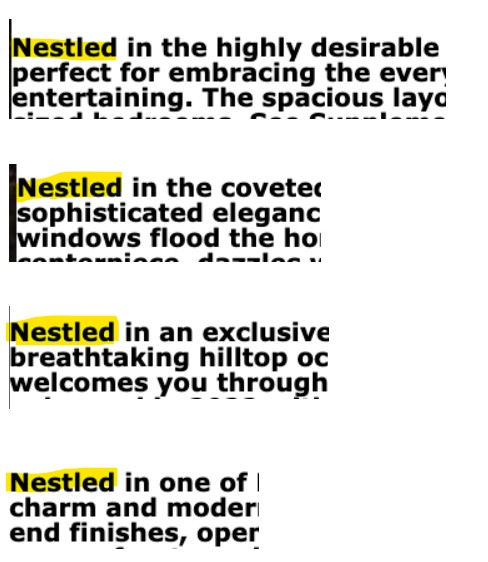

Of the 3,122 detached-home listings in San Diego County, 672 of them (22%) include the word ‘nestled’. It is followed closely by ‘dream’, which is in 19% of the listings.

If you don’t want to be replaced by robots, don’t be so robotic.

According to Opendoor’s new First-Time Home Seller Report, the COVID-era buying spree is not only over, it is biting back.

The low-interest rate buying frenzy in 2020 and newfound flexibility with remote work led to a wave of regret – 79% of first-time home sellers admit they made mistakes, with 91% saying these errors played a major role in their decision to sell.

The biggest culprits?

These regrets could be fueling a shift away from the traditional “forever home” mentality. Once seen as the ultimate goal, it now feels unrealistic for many, especially with changing lifestyles and economic pressures. In fact, 68% of first-time home sellers no longer see it as attainable, and 81% are selling what they once thought would be their lifelong home.

Read full report here:

It’s easy for sellers to miss these days!

Just because you have comps doesn’t mean you’re going to sell. Adjust on the fly!

Bob Seger and the Silver Bullet Band will be on tour later this year!

The NAR settlement went into effect on August 17th of last year.

How’s it working?

I heard this story from another agent – it didn’t happen to me.

A home has been on the market for a couple of weeks, listed for $1,200,000. An offer was received at $1,220,000, and it asked for the seller to credit the buyer 2.5% ($30,500) to compensate for the buyer-agent’s compensation. Minus the credit, the net offer would be $1,189,500, which is only $10,500 under list.

The buyer offered to pay $20,000 over list to help compensate for the credit.

But the seller only wanted to pay 1.5% to any buyer-agent.

The seller turned down the deal.

Here’s why I bring it up:

The solution?

Get Good Help!

Mother’s Day is this Sunday and it’s not too late to ensure the special women in your life feel celebrated! If you’re looking to celebrate in San Diego, there are plenty of Sunday brunch specials happening at various restaurants.

Take a look!

333 Pacific, Oceanside

Chandler’s, Carlsbad

Park Hyatt Aviara, Carlsbad – plus they have a Mommy & Me Wellness activity at 4:30pm!

Herb & Sea, Encinitas

Fairmont Grand Del Mar, Carmel Valley

The Marine Room, La Jolla

La Valencia, La Jolla

Cellar Hand, Hillcrest

El Prado, Balboa Park

Café Sevilla, Downtown – Special Flamenco show & champagne brunch!

Hotel Del, Coronado

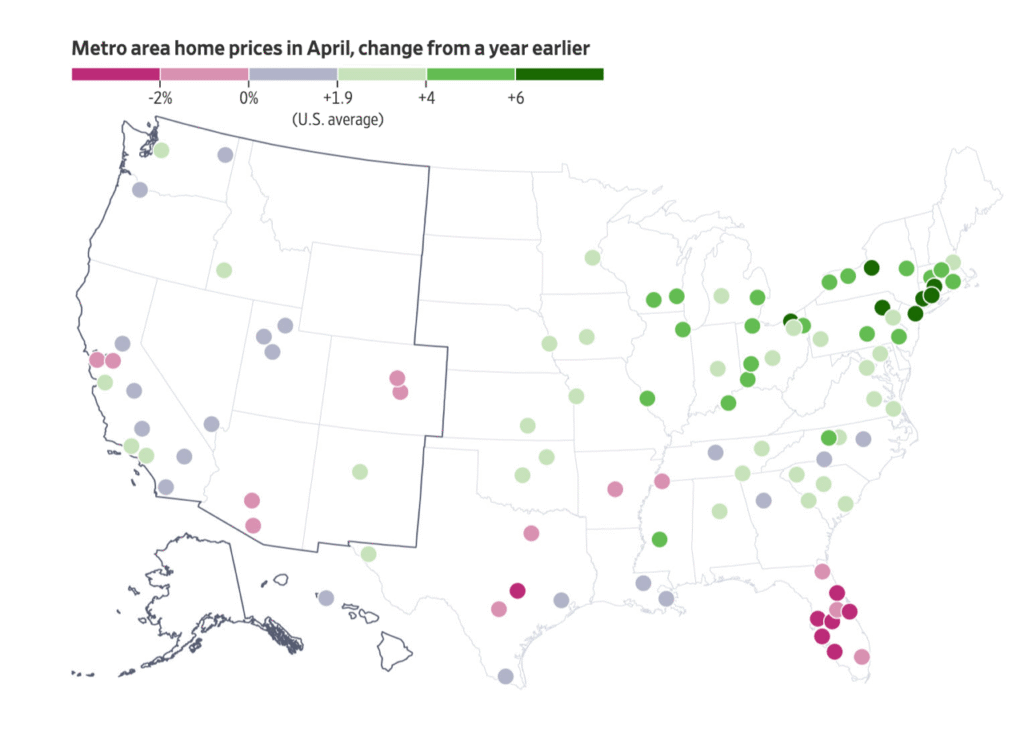

A reminder how all real estate is local….pricing in San Diego is holding up ok.

There are an amazing number of green dots, but for us, Flat City will do for now.

Link to free WSJ article

I give the Over-List sales plenty of attention.

How about the Under-Lists?

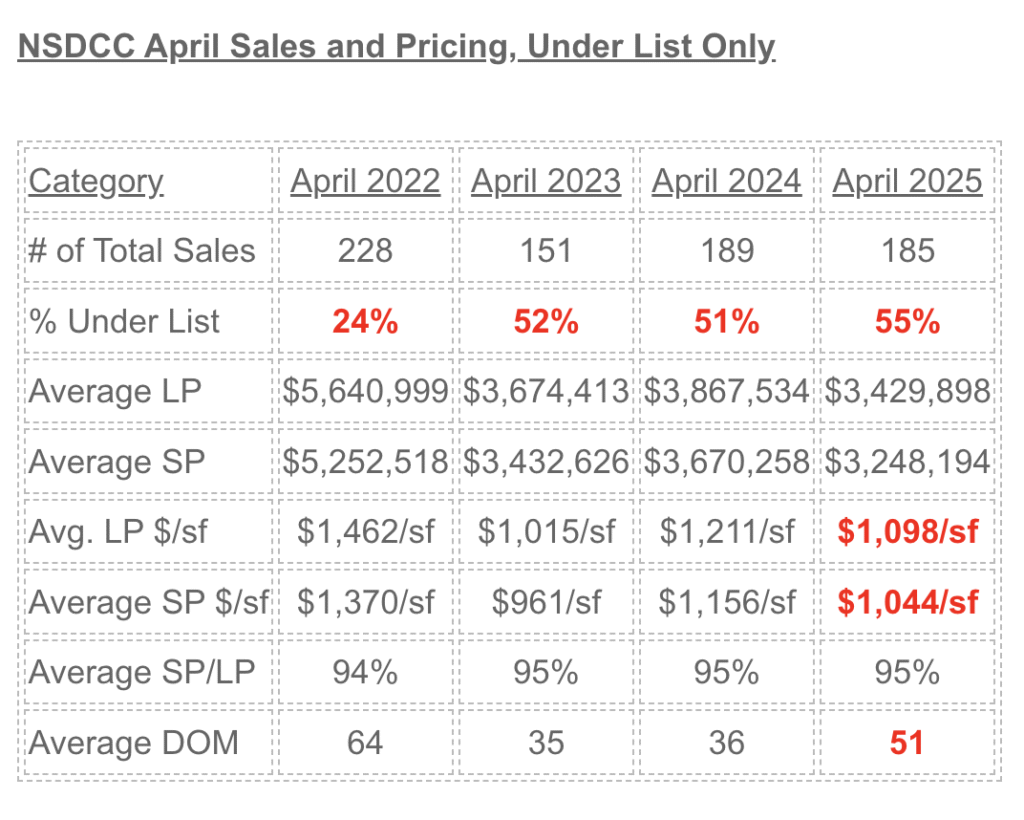

Most buyers today (55%) are paying under the original list price.

Back in the 2022 frenzy days, only 12 of 142, or 8% of the sales under $3,000,000 sold for less than their original list price – wow, remember those days? You can tell by the $3,248,194 average sales price last month that buyers are paying under list at all price points today.

Interestingly, the homes that needed to sell for less were priced 10% lower than they were last April, but they still sold for 5% under their list price.

Buyers are willing to pay over the list price if they see a spectacular home (great location and condition) which happens to about a third of the sales. However, the majority of homes aren’t flashy enough to impress the buyer pool, and both buyers and sellers are waiting longer (avg. 51 days) to commit to the inevitable discount.