by Jim the Realtor | Jul 18, 2024 | Jim's Take on the Market, North County Coastal, Why You Should List With Jim |

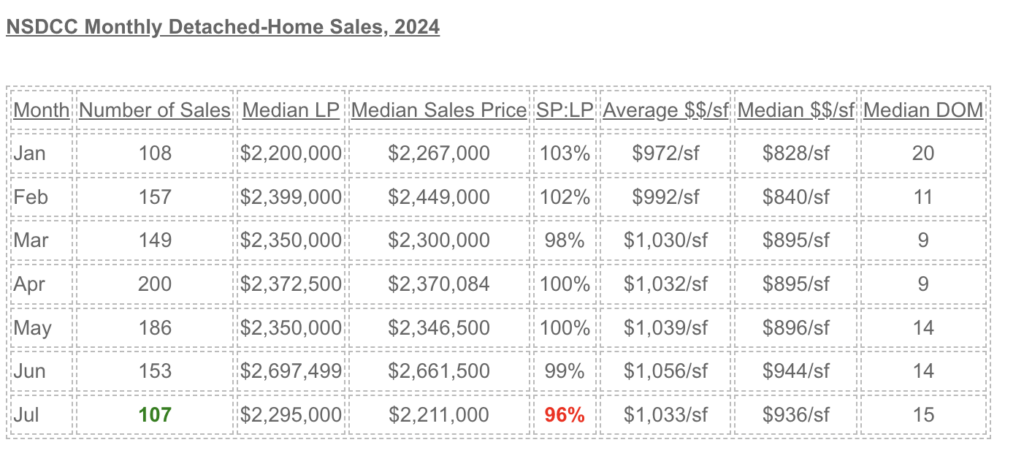

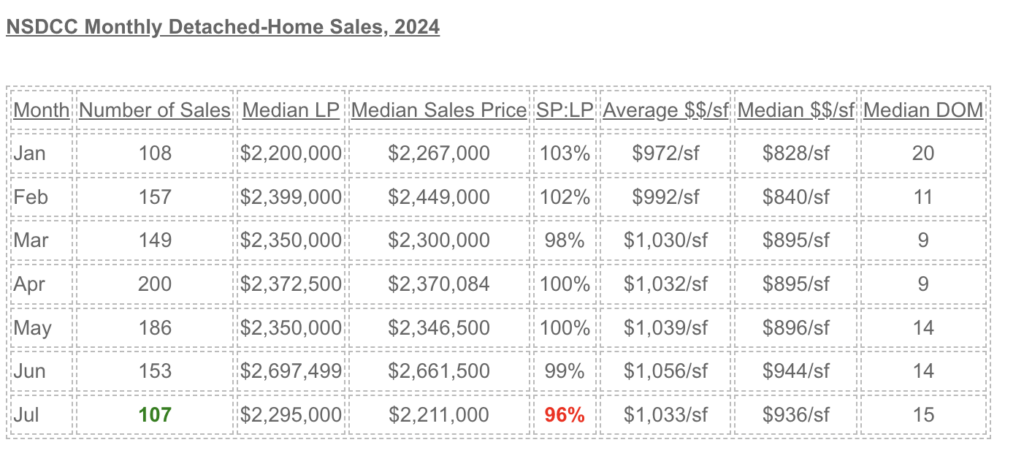

The other day I popped off about how the market was deteriorating and we’d be lucky to see 100+ monthly sales the rest of the way in 2024. What do I know? Here is the sales data for this month so far:

There are two solid weeks left in July – could we get to 200 sales this month?

If so, it will leave the pendings drawer a little light – we’re down to 169 homes in escrow today. But there are 505 actives, and when the coming-soons are included, the count is up to 528 detached-homes for buyers to choose from!

The June median list and sales prices were outliers – the rest of the pricing data looks steady, though the buyers are looking for discounts now – and judging by the 96%, the sellers are obliging!

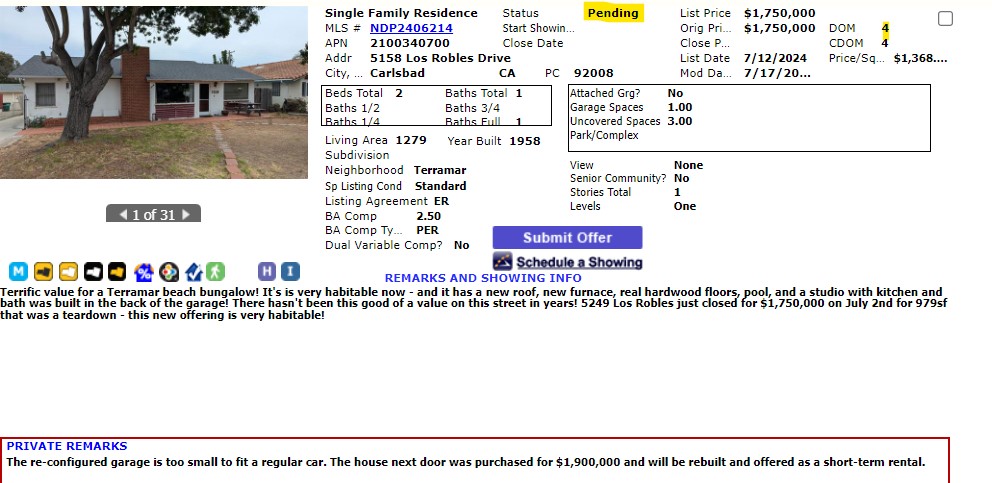

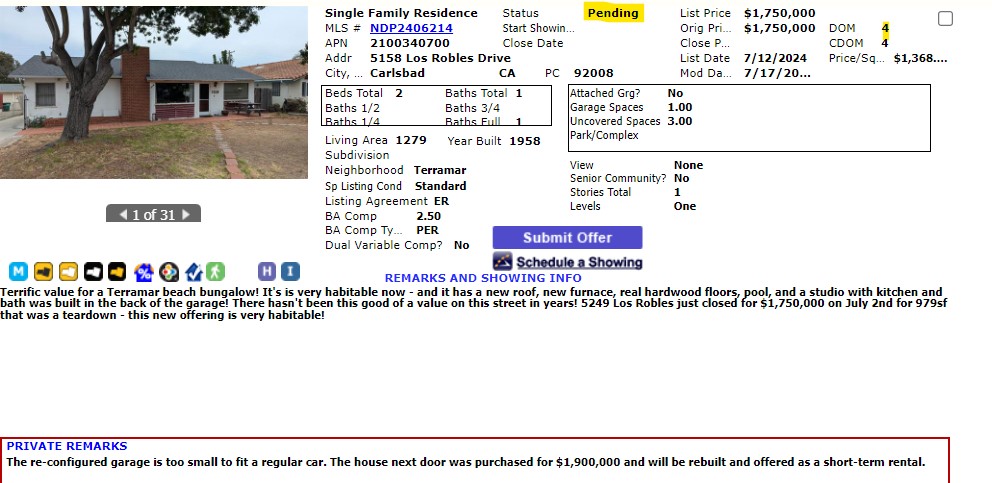

My new listing (below) went over list price though, and I have buyers in a 5-offer bidding war on a different home right now so there is plenty of hot action:

by Jim the Realtor | Jul 16, 2024 | Jim's Take on the Market |

I left this story in the comment section in June when Winstanley was pending – it closed yesterday so we can finish the saga. Surfrider had asked when I knew the market had changed, and I filed this response:

It was in mid-May.

Example:

Here the timing was perfect – they hit the market in early March. They listed for $2,985,000, and boom, it gets bid up to $3,100,000. I did a video so you can compare too:

https://www.compass.com/listing/13557-penfield-san-diego-ca-92130/1524821148249056649/

It was inferior to this nearby house on Winstanley in just about every way, which went active on May 15th:

https://www.compass.com/listing/13335-winstanley-way-san-diego-ca-92130/1576977769399823273/

On May 21st, I saw it on broker preview, and the listing agents asked me what I thought. I usually never answer because most agents can’t handle the truth and just get defensive and want to argue instead. But these agents were long-timers so I thought they might appreciate my feedback.

I said that it felt like the market had shifted, and it was going to get harder to sell homes from now on. I told them about Penfield, and how I thought they had gotten lucky. The agents didn’t jump up and agree with me, but I could tell that they had their reservations too. All good agents feel it.

Their listing on Winstanley was priced at $3,199,000, and three weeks after I saw them, they lowered the price to $3,049,000. It went pending four days later.

Even though Winstanley had 500sf more square feet and a better kitchen (Penfield’s kitchen cabinets were painted), it will end up selling for less. If they wouldn’t have lowered their price early, they could still be sitting around unsold too!

Here’s the end of story:

Winstanley closed for $2,900,000, which was $200,000 less than the inferior house on Penfield, and then this smaller house around the corner closed for $2,800,000. So just when the Penfield sale made the neighbors think their homes were worth somewhere into the $3-millions, two sales indicate otherwise only three months later.

Both of those recent sellers bought their house in 2005 and paid in the $1,300,000s.

This could happen in any neighborhood too. Existing homeowners have so much equity that if buyers lowball them by a couple of hundred thousand dollars, they can easily make the deal if they want to. The time of the year is one of the critical components too.

It’s how you can lose 5% or 10% of your imagined equity in a matter of weeks – poof, just like that.

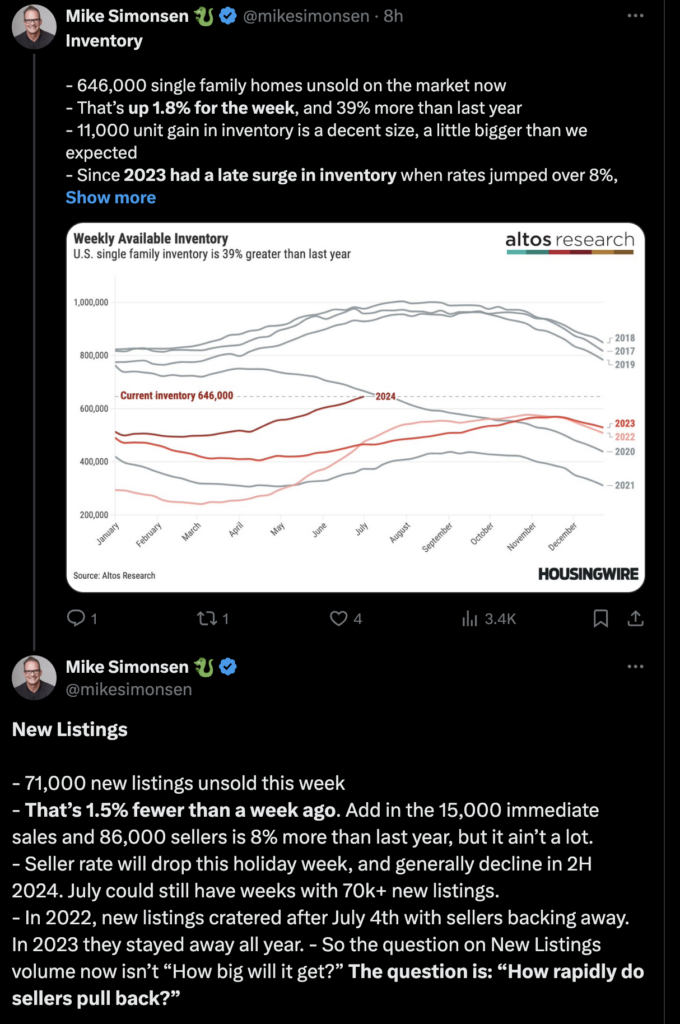

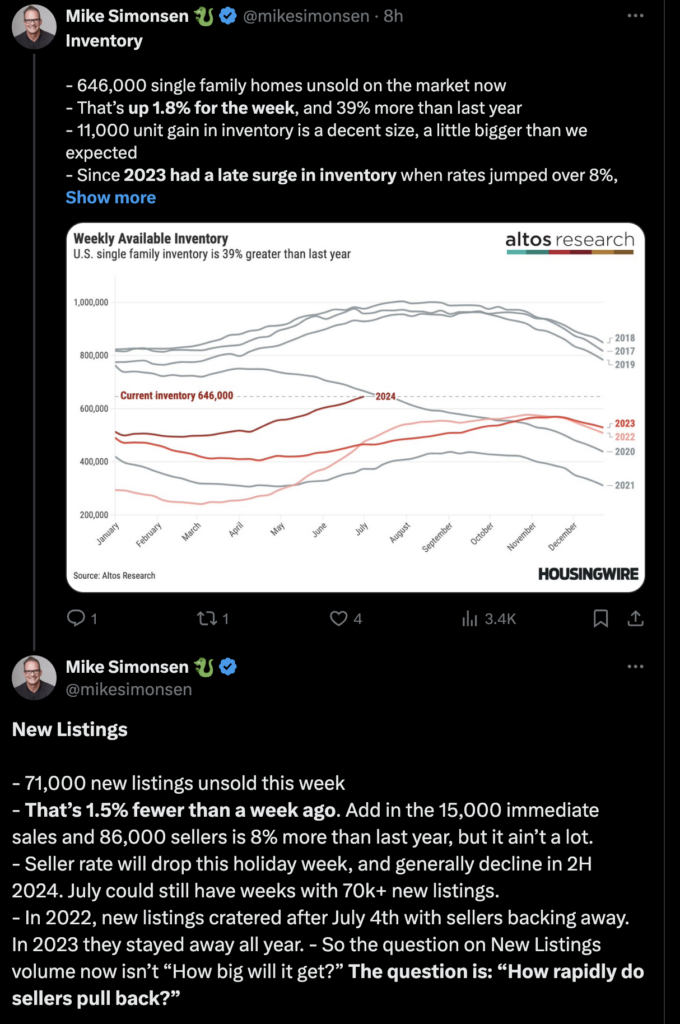

by Jim the Realtor | Jul 15, 2024 | Inventory, Jim's Take on the Market |

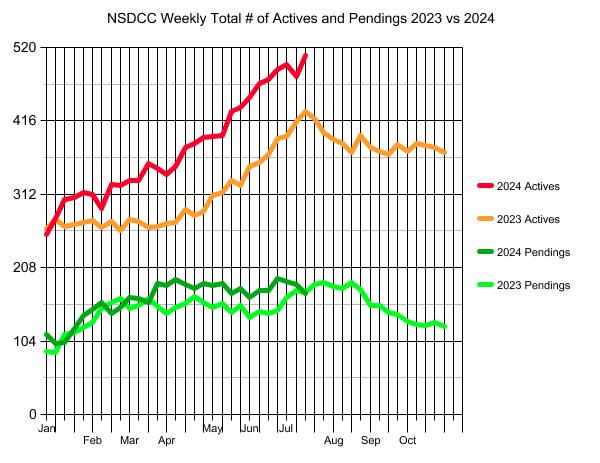

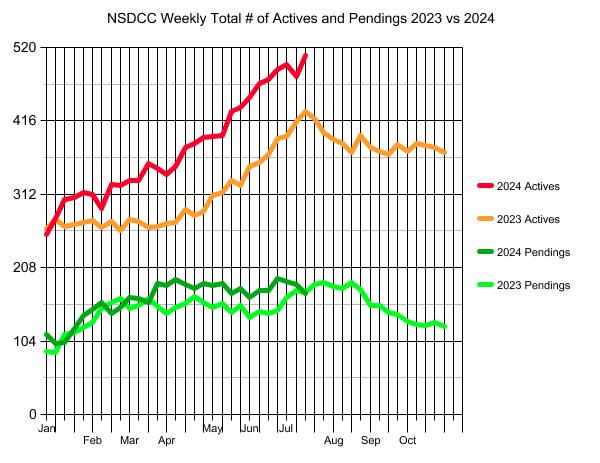

The number of NSDCC active listings blew right through the 500 mark, and the count is now up to 509 unsolds. The number of pendings had stayed above last year’s count primarily because there have been more homes for sale.

But it looks like all the quality homes have been taken now, and pendings’ count started decelerating three weeks ago. There will be very few hot buys listed over the next 4-5 months, so buyers will have to earn it by lowballing the existing inventory if they want to move this year.

My prediction that the political circus would be a big distraction to home sales didn’t include an assassination attempt! But if both candidates make good on their promise to lower the vitriol, it would be good for home sales, especially if mortgage rates keep coming down.

But it will take a massive surge in price reductions this week to create a late-summer rally. It’s going to be too easy for buyers to pack it in for 2024, and hope that next year brings lower prices and rates.

When is the best time to buy? When nobody else is!

(more…)

by Jim the Realtor | Jul 5, 2024 | 2024, Jim's Take on the Market, North County Coastal, Sales and Price Check |

Here are four tepid responses to the question on whether home prices will drop this summer:

https://www.cbsnews.com/news/will-home-prices-finally-drop-this-summer-heres-what-experts-say/

The lame last paragraph sums it up:

The bottom line

The real estate market seems unlikely to experience significant price decreases nationally this summer, but it’s possible that in specific local markets, there will be dips. Still, until conditions change, like with more housing inventory, it could be tough for prices to decrease. Even then, it could take time for pent-up demand to temper, but it’s possible that overall affordability at least increases, such as if mortgage rates drop.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~`

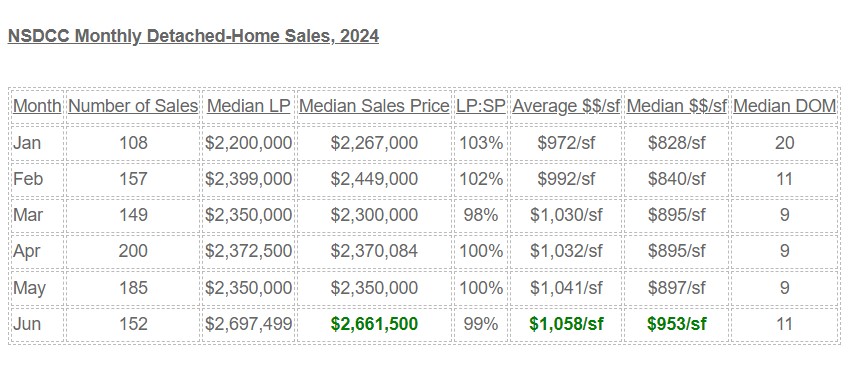

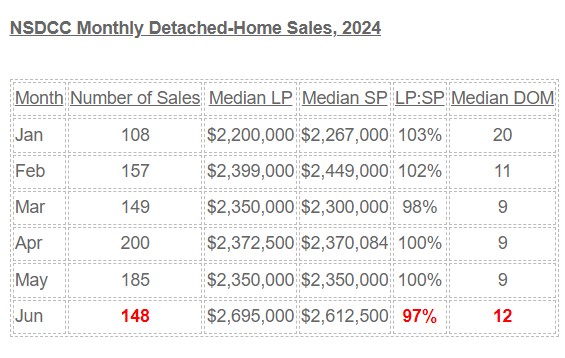

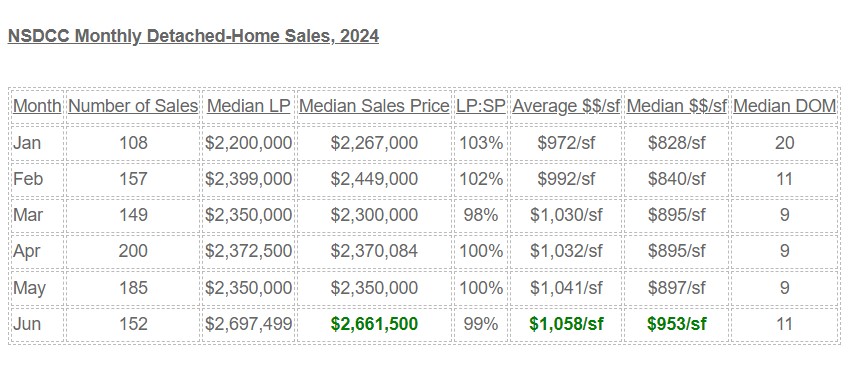

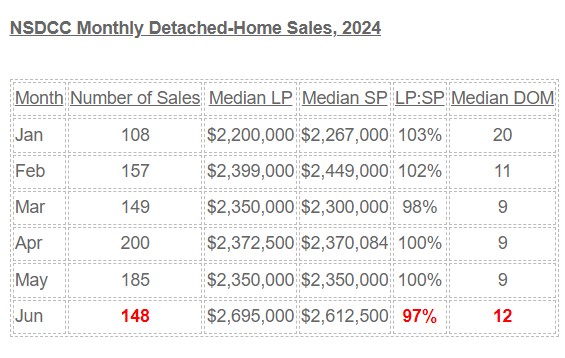

You can’t come to much of a conclusion about summer pricing in July, but let’s check the data! How we measure the pricing has been strong all year between La Jolla and Carlsbad:

The world is too crazy for something not to give. My opinion of the pricing trend above is that the higher-priced superior homes are gaining in market share (who wants to buy a dump in this environment?) and it’s providing a head-fake that disguises the truth.

What’s going to give is the number of sales – we may not see 152 monthly sales the rest of 2024.

The commission debacle will be discouraging to the marketplace, mortgage rates aren’t going down enough to make a difference, and the political firestorm will get worse. The only way a buyer will ignore all of that and keep buying is if they see the perfect home.

There will be some nice deals for those who are willing to dig them out.

But I think by the screwy ways we measure it, the NSDCC pricing will look fairly strong, but the best precursor of the future – the number of sales – will be dropping the rest of the year, which will create even more softness. Buyers won’t feel confident about the price they are paying unless they have some decent comps to rely on, and those will be few and far between.

by Jim the Realtor | Jul 3, 2024 | Jim's Take on the Market, Market Conditions |

San Diego is already an affluent market, and with the extreme weather conditions now affecting the rest of the country year-round, we have to look like a fantastic upgrade to people who just came into some big money. From Leonard Steinberg, the Compass chief evangelist:

Over $82 TRILLION will transfer from older to younger generations in the US over the next twenty years…..that is over $4 trillion of stimulus per year, every year, for the next 20 years!

Over the next 10 years, 1.2 million people worth at least $5 million will transfer an estimated $31 trillion to their heirs and about two-thirds of that extraordinary amount of wealth – or $19.9 trillion – is forecast to be passed on by 2033 by about 155,000 individuals with a net worth of $30 million or more according to research firm Altrata. That is MULTIPLES of the amount of stimulus spent on ALL Americans during COVID that many attribute to spiking inflation…..concentrated in a much, much smaller group, mostly wealthier already.

Yes, luxury market pricing could grow well beyond our imagination.

What might this do to luxury real estate? It’s very possible that we’re about to enter an era of RUNAWAY Luxe-flation. The ability for markets to keep up the supply for this growing demand is almost certain to trigger massive price hikes. That $1,000 per night hotel room that is now $1,750 per night could easily go to $3,000. That $50 million Palm Beach mansion that now sells for $100 million could become a $250 million mansion. Yes, luxury and ultra luxury markets will see massive infusions of capital that may result in lowered buying power per dollar as prices soar.

If this capital infusion is not limited to luxury markets and spreads into other markets that simply cannot afford the higher prices, we may have a problem. Sadly, the pressures for less-wealthy people to squander their money on things that buy them perceived status keeps growing. If builders focus more on more profitable, more expensive properties, everyone else will suffer the consequences too.

by Jim the Realtor | Jul 2, 2024 | Commission Lawsuit, Jim's Take on the Market, Local Government, Realtor |

We know that the current DOJ wants to de-couple commissions, and have buyers pay for their own help. How does Team Trump feel about real estate commissions? I checked with Project 2025:

Project 2025 proposes significant changes to the traditional real estate commission structure to promote more transparency and direct negotiations between consumers and real estate professionals. Currently, in many U.S. real estate transactions, the seller typically pays a combined commission of 5-6% of the sale price, which is split between the listing agent and the buyer’s agent. This conventional arrangement has been criticized for creating potential conflicts of interest and lack of transparency regarding the actual costs associated with buying a home.

The new guidelines suggested under Project 2025 aim to shift this dynamic. The recommendations encourage a system where buyers directly pay their agents, allowing for more transparent negotiation of services and fees. This change is expected to lead to a more competitive market for real estate services, where commission rates are negotiated separately and may potentially decrease as a result.

One significant component of these changes is the move away from blanket offers of cooperative compensation to buyer’s agents on multiple listing services (MLS). Instead, buyers will negotiate and pay their agents directly, fostering a clearer understanding of the costs involved in their transactions. This is anticipated to lead to a more consumer-friendly environment where buyers have greater control and can choose services that best fit their needs and budgets.

Geez…it sounds identical to the current DOJ solution! It will be the worst thing that ever happens to the real estate market, mostly because weaker agents will oblige.

To clear things up for consumers, we should change one word.

Real estate commissions are NOT negotiable. They are DIFFERENT!

Everyone (especially NAR) is pushing the catch phrase, Commissions Are Negotiable, so they don’t get sued any more. But that isn’t helping anyone. All it does is make the consumer think they just need to find an agent and then work them over for a lower commission rate.

But if we said, Commissions Are Different, then consumers would wonder what is different – and conduct an investigation among agents to determine the differences, and what is best for them. It’s what has been missing all along!

Instead, it will be about beating down agents on their pay, without realizing that an inferior experience will be the likely outcome.

How is the experiment going so far?

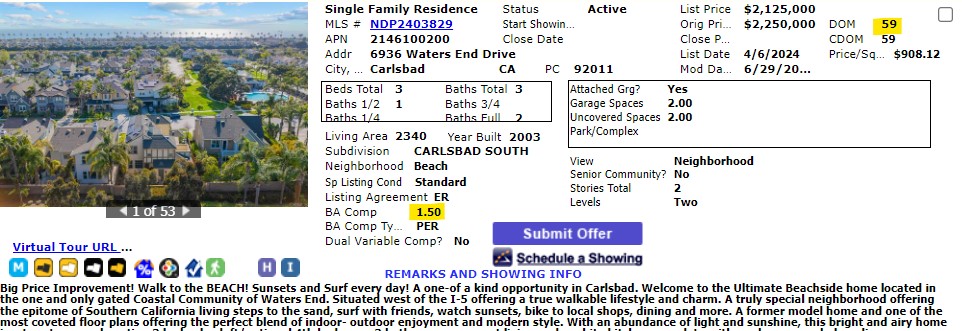

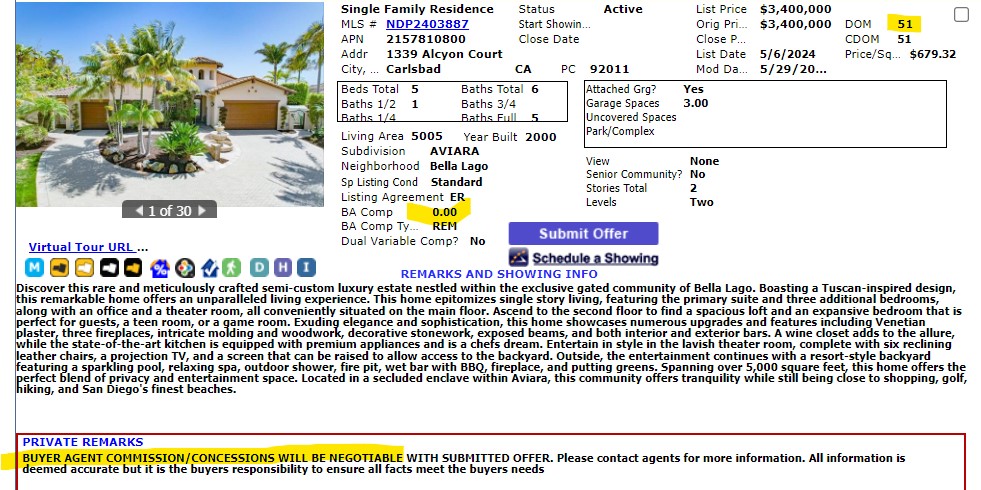

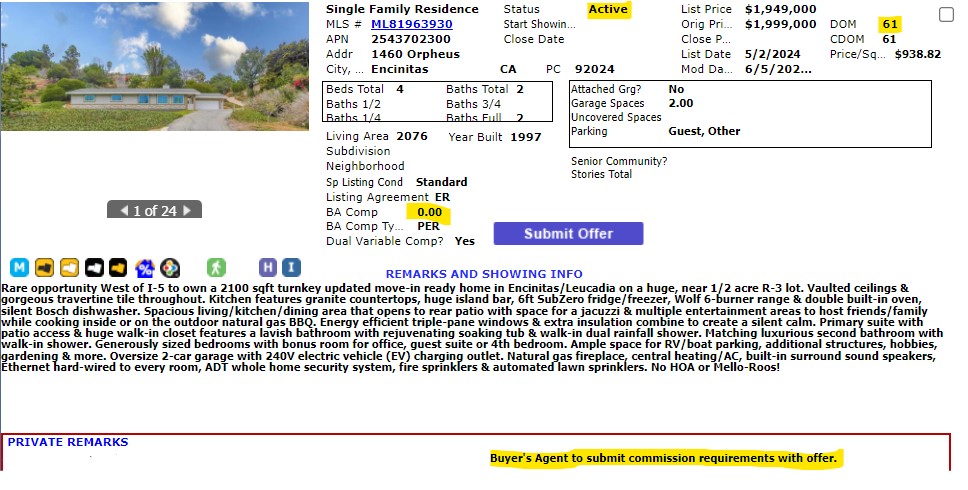

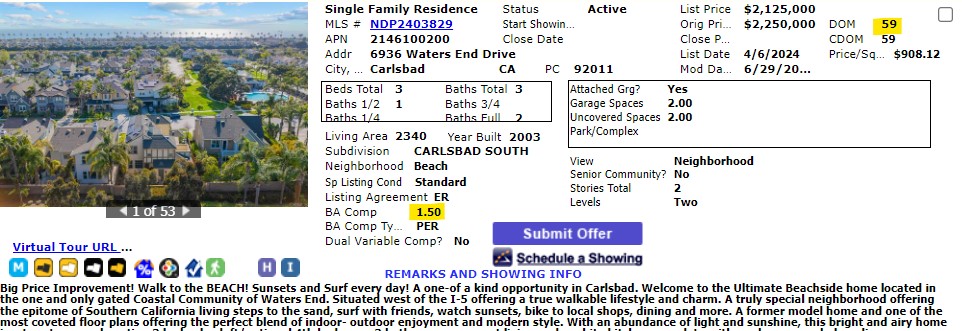

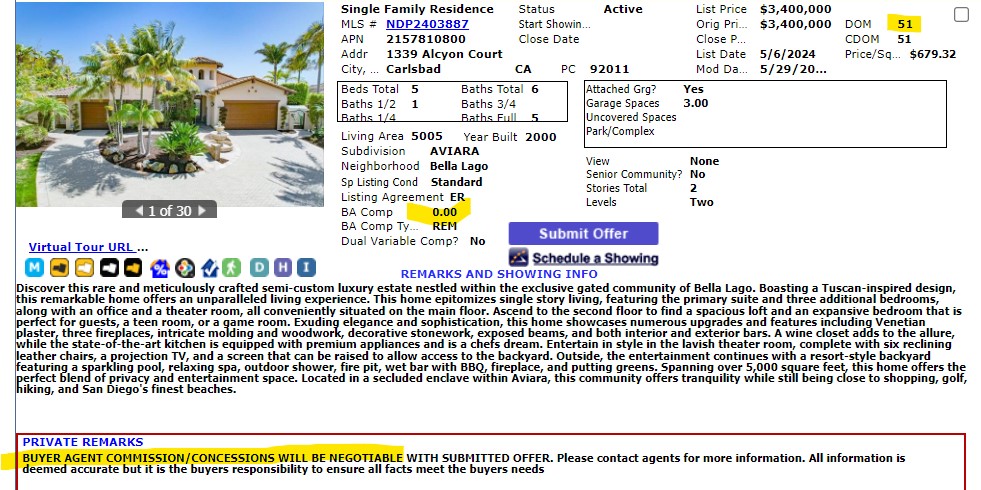

It is still legal to advertise seller-paid commissions in the MLS, but some think it’s a good time to try out the idea of offering little or no seller-paid commissions to the buyer-agent to save some money. Here are three active (unsold) listings that have been lingering:

True, there are also hundreds of unsold listings piling up that offer a 2.5% commission so it’s not just the discounters/experimenters who are having trouble with today’s market. We don’t know if it’s the lack of commission or the list price that is causing these not to sell, but after two months on the market, you can expect buyers will want concessions on one or both….or maybe they will just wait until next year.

With the market already stuttering a bit, sellers may want to consider getting it done now while they can still pay a commission to a buyer-agent. It will not be easier to sell during the ‘decoupling adjustment period’ that commences on August 17th. In fact, between the adjustment period and the political circus, the market will be in stallout mode for at least the last four months of this year.

Hopefully there will be an announcement any day about the brokerages suing NAR that might postpone the elimination of seller-paid commissions. Can we at least put it off until Spring, 2025 please?

by Jim the Realtor | Jul 2, 2024 | 2024, Inventory, Jim's Take on the Market

It’s considered normal for a market to have six months’ worth of inventory, where the number of homes for sale this month equals 6x the number of sales last month.

Our market has done better over the last few years, and three months’ worth seems normal now:

Here are the interactive graphs for the last five years, and the last sixteen years!

While we’re at it, here are the graphs for the median sales price per square footage. Carmel Valley (92130) is up 84%, and both Carlsbad and Encinitas have both more than doubled in the last five years. Normal?

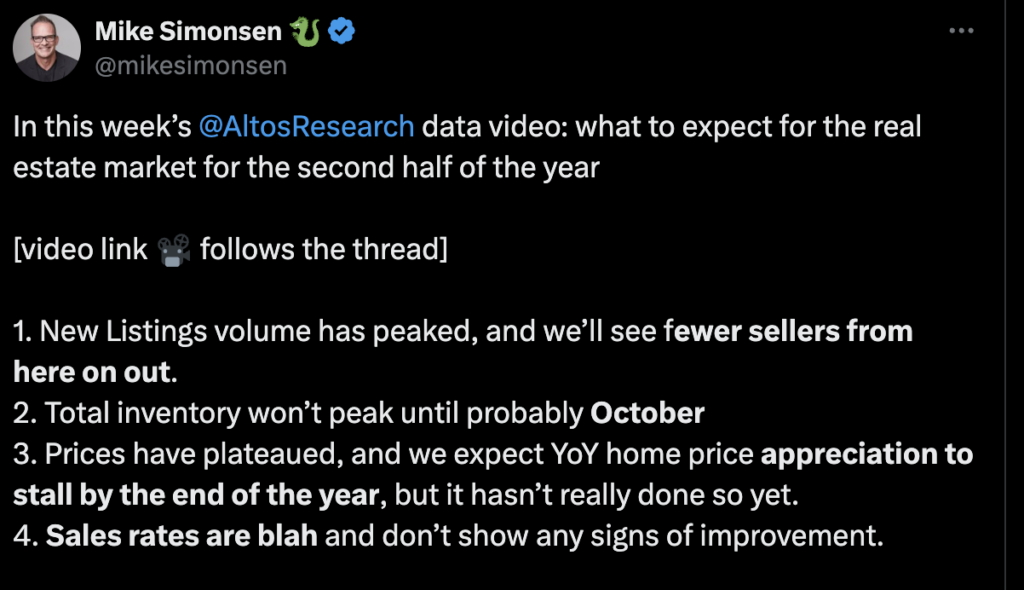

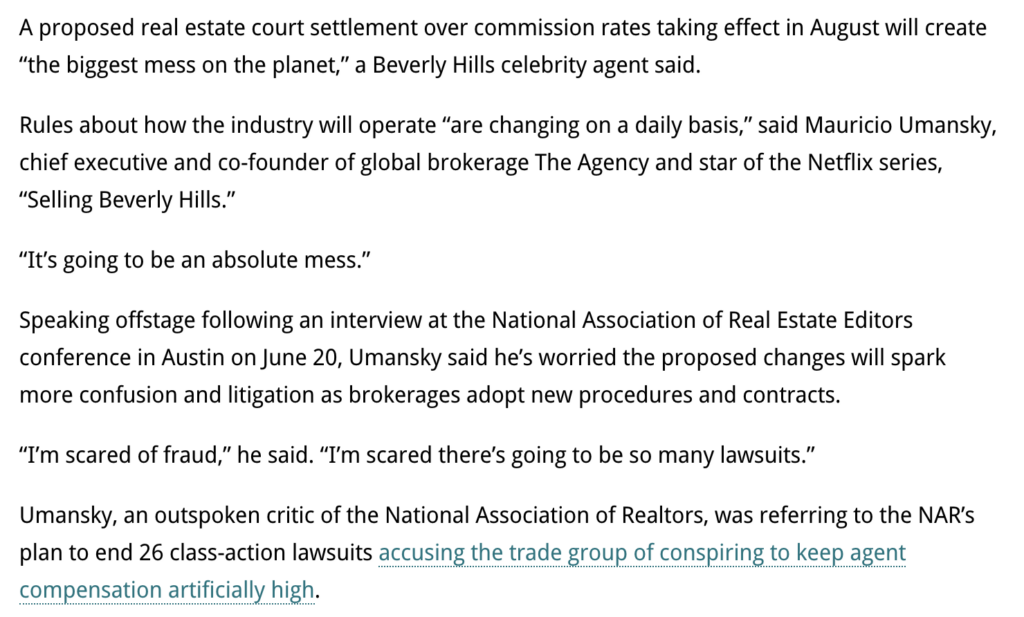

by Jim the Realtor | Jul 1, 2024 | 2024, Forecasts, Jim's Take on the Market |

Above is what’s coming for the next six months, and it’s going to be a slugfest as buyers and sellers grapple with price. The relation of sales price to the days on market will be exact.

How much should buyers offer as we cruise into lowball season 2H24? The price that makes you cringe, relative to how bad you want it. If wifey says buy it, then pull out all the stops.

June 30 is the peak of the year, so we have some visibility.

Here’s Mike’s video for all the details: https://youtu.be/CW9V-ELOlxI

by Jim the Realtor | Jun 28, 2024 | Jim's Take on the Market, North County Coastal, Sales and Price Check

It’s the last business day of June, and while there will be a few more sales added to this total, there will be at least 10% fewer closings than last month:

updated June 30th

The median pricing is higher this month, but I don’t think that means home prices in general are rising. It’s probably because the more desirable properties are the ones selling.

The red numbers suggest the market is slowing down.

by Jim the Realtor | Jun 23, 2024 | Jim's Take on the Market

The last time a new season of “Million Dollar Listing Los Angeles” aired on Bravo, the show was its usual unbridled celebration of infinity pools, imported marble and luxury amenities that historians will cite if they ever have to explain the collapse of civilization (bathtub by the balcony, anyone?). “To be honest, I’m having a hell of a year,” real-estate agent Tracy Tutor told the cameras in the early-2023 finale, which only glanced at market troubles. “So I don’t want to be cocky, but I might just be entering the humblebrag era.”

Bah, humblebrag. In the new season premiering next month, Tutor is stressed out. “This is an incredibly frustrating market,” she says to a group of agents before the show cuts to an edit of dismal real estate news. “Listings were coming last year that were super easy. It ain’t that market anymore.”

Perhaps no profession has been more glamorized by reality TV than real estate. The shows don’t just create drama, but offer their own aspirational version of the industry, selling audiences on a view of homeownership that is escapist and full of vicarious thrills.

Now the genre faces a new challenge: walking the line between celebrating the sales that still happen and acknowledging the drop-off in deals that has upended the business. All while some viewers are struggling to find houses to buy or grappling with real estate careers they can’t sustain.

Real estate shows have ruled reality TV for years thanks to eight-figure properties and celebrity agents. Now the genre has a new star: the overpriced mansion nobody’s buying. High-end home inventory is down in choice markets. Mortgage rates remain higher than 2022 levels. Recent legal battles have agents warning of diminished commissions. And real estate professionals, some of whom only joined the business because of what they saw on TV, are feeling the strain.

Link to Free WSJ Article

My blog host has been feeling it too. Should get resolved by tomorrow.