We know that the current DOJ wants to de-couple commissions, and have buyers pay for their own help. How does Team Trump feel about real estate commissions? I checked with Project 2025:

Project 2025 proposes significant changes to the traditional real estate commission structure to promote more transparency and direct negotiations between consumers and real estate professionals. Currently, in many U.S. real estate transactions, the seller typically pays a combined commission of 5-6% of the sale price, which is split between the listing agent and the buyer’s agent. This conventional arrangement has been criticized for creating potential conflicts of interest and lack of transparency regarding the actual costs associated with buying a home.

The new guidelines suggested under Project 2025 aim to shift this dynamic. The recommendations encourage a system where buyers directly pay their agents, allowing for more transparent negotiation of services and fees. This change is expected to lead to a more competitive market for real estate services, where commission rates are negotiated separately and may potentially decrease as a result.

One significant component of these changes is the move away from blanket offers of cooperative compensation to buyer’s agents on multiple listing services (MLS). Instead, buyers will negotiate and pay their agents directly, fostering a clearer understanding of the costs involved in their transactions. This is anticipated to lead to a more consumer-friendly environment where buyers have greater control and can choose services that best fit their needs and budgets.

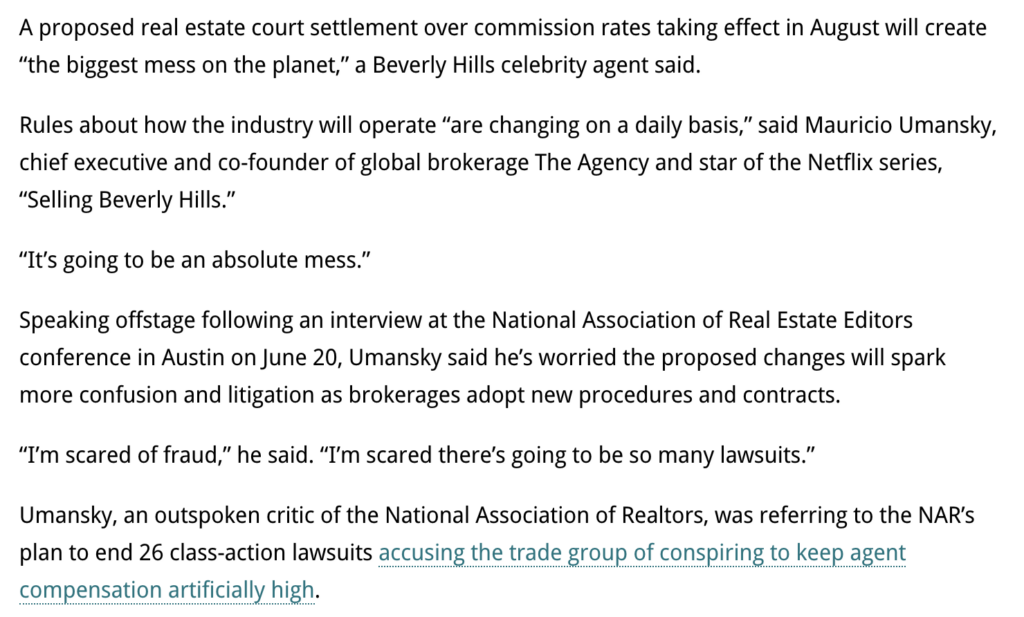

Geez…it sounds identical to the current DOJ solution! It will be the worst thing that ever happens to the real estate market, mostly because weaker agents will oblige.

To clear things up for consumers, we should change one word.

Real estate commissions are NOT negotiable. They are DIFFERENT!

Everyone (especially NAR) is pushing the catch phrase, Commissions Are Negotiable, so they don’t get sued any more. But that isn’t helping anyone. All it does is make the consumer think they just need to find an agent and then work them over for a lower commission rate.

But if we said, Commissions Are Different, then consumers would wonder what is different – and conduct an investigation among agents to determine the differences, and what is best for them. It’s what has been missing all along!

Instead, it will be about beating down agents on their pay, without realizing that an inferior experience will be the likely outcome.

How is the experiment going so far?

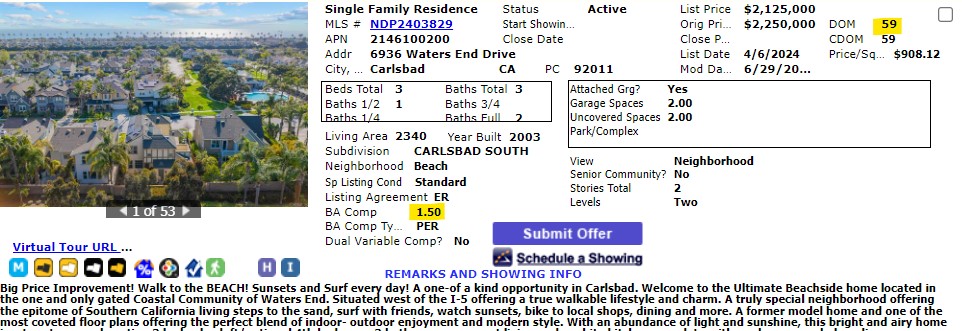

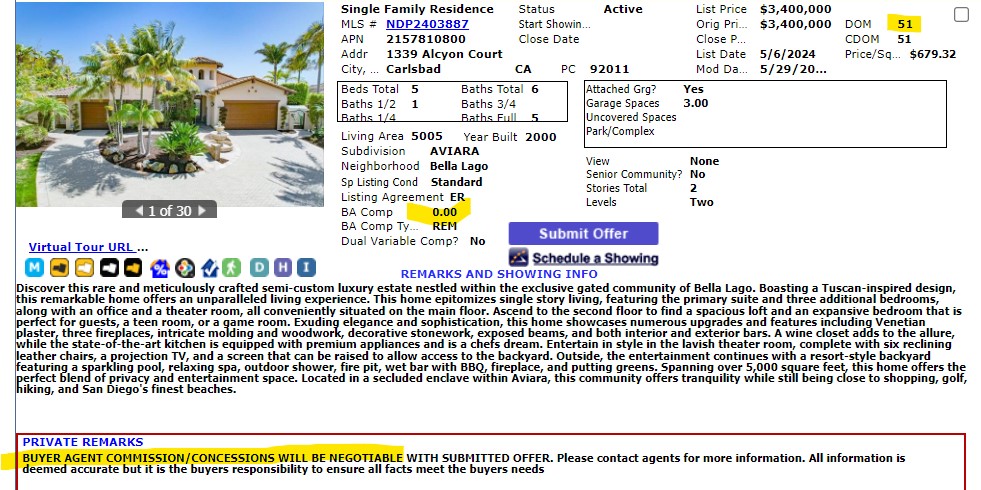

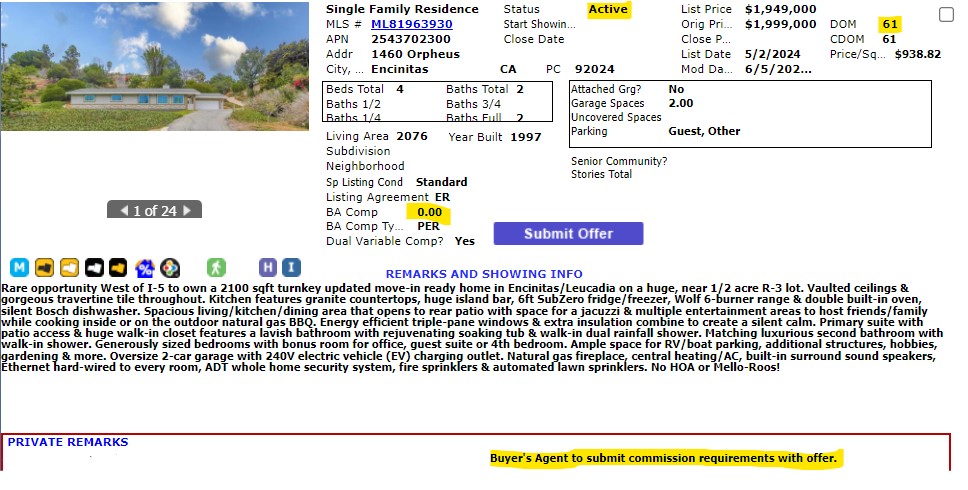

It is still legal to advertise seller-paid commissions in the MLS, but some think it’s a good time to try out the idea of offering little or no seller-paid commissions to the buyer-agent to save some money. Here are three active (unsold) listings that have been lingering:

True, there are also hundreds of unsold listings piling up that offer a 2.5% commission so it’s not just the discounters/experimenters who are having trouble with today’s market. We don’t know if it’s the lack of commission or the list price that is causing these not to sell, but after two months on the market, you can expect buyers will want concessions on one or both….or maybe they will just wait until next year.

With the market already stuttering a bit, sellers may want to consider getting it done now while they can still pay a commission to a buyer-agent. It will not be easier to sell during the ‘decoupling adjustment period’ that commences on August 17th. In fact, between the adjustment period and the political circus, the market will be in stallout mode for at least the last four months of this year.

Hopefully there will be an announcement any day about the brokerages suing NAR that might postpone the elimination of seller-paid commissions. Can we at least put it off until Spring, 2025 please?

We can’t even agree on the forms…..and August 17th is right around the corner.

The Consumer Federation of America (CFA) yesterday released a report on C.A.R.’s new buyer representation agreement. While C.A.R. welcomes valid feedback, this report is, for the most part, a misguided critique of the forms.

Amid the significant changes facing the industry as a result of the NAR settlement and the recent inquiry from the Department of Justice (DOJ), C.A.R. continues to revise its forms in order to produce the best possible documents for buyers, sellers, and C.A.R. members. Prior to the release of any revised or new forms, C.A.R. solicits broad input and takes all feedback into consideration. This CFA commentary is on an earlier draft of our agreement that was still a work in progress. In fact, C.A.R. has already made changes that address many of the concerns from the CFA.

For example, the CFA piece says the form doesn’t comply with the NAR settlement. That is wrong. Both the draft reviewed and the latest draft of the form comply with all practice changes required by the NAR settlement, as well as with California law. The CFA also suggests that buyers might expect their agents to represent them even if the buyer says they don’t have enough funds to pay the broker. They suggest that offers of compensation outside the MLS are attempts to circumvent the NAR settlement, even though the settlement explicitly makes clear this is permitted. The CFA’s suggestions are absurd. Hardworking buyers’ agents are entitled to be compensated by their clients according to the terms of their agreements. Indeed, that clarity around compensation is the very substance of the NAR settlement. Nearly half the report consists of commentary on punctuation, capitalization, and the author’s opinions on design, rather than substantive legal issues.

C.A.R. forms are drafted to comply with California law and facilitate California real estate transactions. The report demonstrates the author’s lack of familiarity with California-specific statutory language required for our real estate contracts. Moreover, consistent forms that cover myriad situations are important so that buyers, sellers and their agents can efficiently manage complex transactions.

For decades, C.A.R. forms have been the best in the industry for a number of reasons, from transparency to compliance. C.A.R. continues to work diligently to create new forms that will continue that tradition.

Calls are piling up to overturn a district court’s final approval of nationwide settlements to resolve antitrust claims against major real estate franchisors Anywhere, Keller Williams and RE/MAX.

On July 1, law firm Knie and Shealy, which represents South Carolina homesellers in a commission suit filed in November, filed a notice of appeal in the U.S. District Court for the Western District of Missouri. The notice informed the court that the firm’s clients would ask an appeals court to reverse a decision from Judge Stephen R. Bough granting the approvals on May 9.

BEHIND THE NEWS: The homesellers’ legal filings regarding the appeal so far do not contain any arguments, but earlier legal filings offer hints. On April 12, the homesellers objected to final approval of the franchisor settlements on the grounds that the settlements far exceed the scope of the original suits that led to the deals.

The South Carolina homesellers also objected that the combined settlement amount among the three franchisors, $208.5 million, “is far too low to adequately compensate the massive number of injured parties here.”