by Jim the Realtor | Jul 26, 2024 | Commission Lawsuit, Why You Should List With Jim |

Brokerages are at the crossroads – they can either encourage sales with all buyer-agents, or go the same way as C.A.R. and make it harder on them (which promotes single agency) and add blustery headlines. I think brokerages should stand up for all buyer-agents; not only because buyers deserve representation but it also gives us more qualified buyers for our listings!

eXp Realty has in recent days taken the notable step of updating its much-discussed listing agreement with language stating the company “does not share commissions with a buyer’s broker” — language that has prompted a flurry of debate online.

The brokerage published its new listing agreement internally on Friday. In a conversation on Wednesday with Holly Mabery — senior vice president of brokerage operations at eXp — she said that the document was updated because “we wanted to make sure our agents are best protected.” She added that “we’re not going to do broker-to-broker compensation.”

“We’re not going to do pre-determined compensation,” she continued, adding that instead, eXp listing agents will provide their clients with “a menu of options.”

The document reflects this approach, stating on the first page that the “broker (eXp) does not share commissions with a buyer’s broker.” However, that language does not mean buyers’ brokers can’t collect compensation from sellers. The document goes on to state that buyers may request concessions from sellers, and those concessions could be used to pay for brokers among other things. Homesellers using eXp agents are free to offer compensation as they see fit.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Everyone will be able to see the seller-concession amounts on Compass listings:

Compass Technology Platform Enhancements:

On August 15, we will be rolling out enhancements to the Compass technology platform that will empower Compass listing agents to effectively communicate offers of Buyer’s Agent compensation for their listings without relying on data from the MLS.

- Compass Listing Agents can open their MLS listing in Listing Editor to add Buyer’s Agent compensation offers for display on Compass.

- Compass-entered Buyer’s Agent compensation offers will be displayed on agent and consumer Compass listing pages.

- Compass-entered Buyer’s Agent compensation offers will be displayed in agent search results.

Publicizing the seller-concessions amount will make it easier for buyers and their agents to know what to expect, and it feels more like a promise. Those who say they don’t do broker-to-broker compensation or ‘just negotiate it in the offer’ are giving the middle finger to buyer-agents because without some sort of commitment up front, any possible seller concessions during negotiations will be little or none (it’s too late/too easy for seller to say no).

Compass is doing it – can’t every brokerage who believes in buyer-agents at least publicize the seller-concessions amount on their company website? If the seller or agent doesn’t want to disclose, fine – they don’t have to. But buyers and their agents will be flocking to those that do!

Save the buyer-agents!

by Jim the Realtor | Jul 25, 2024 | Commission Lawsuit, Why You Should Hire Jim as your Buyer's Agent |

Yesterday, our reader ‘just some guy’ said,

“hiring the right (listing) agent also lets buyers know you are serious about selling.”

It’s true, and every decision a seller makes is telegraphing their motivation to sell.

What are buyers hoping to figure out?

- Is the list price in the right ballpark?

- Do the photos make a good first impression?

- Will the listing agent be helpful or a barrier to sale?

It is going to be more critical than ever to hire a great listing agent. Buyers will be deciding if they are going to hire their own buyer-agent, or go direct to the listing agent unrepresented (if they are assuming that going direct will make a difference in winning the property).

How are buyers going to figure it out?

1. If the buyers and/or their buyer-agent have been around for a while, they will recognize the successful listing agents – they have seen their signs around, and have probably seen some of their advertising too. Buyers will have a feel for the pricing accuracy of the listing agents they recognize. Sellers should hire the agents who have a good reputation among those in the buyer pool because buyers and buyer-agents want to work with a listing agent who is transparent and someone they feel good about.

2. But buyers aren’t going to bank on what they think might be a good reputation. In 2024, every buyer is going to check out the agents online. Listing agents with a good track record of sales on Zillow will help put the buyers’ fears at rest. The agents with 12 sales per year have something good to offer in this challenging environment.

Example: I mentioned the 5-offer bidding war last week. I look up the sales of the listing agent every time, and in this case she had six sales in the last 12 months. I knew right then that it would be trouble trying to win it, and after 2-3 days of not delivering the highest-and-best counter that she promised, I knew we were toast (she sold it to a neighbor instead).

The sales history on Zillow is the most revealing data point about any agent.

3. Some listing agents have a reputation for pricing high, and letting it ride. Check how long their listings take to sell – it will tell you a lot about the price accuracy of this new listing they are offering.

4. How is the listing agent going to handle unrepresented buyers? Call them on the phone and ask. Just getting the listing agent on the phone is a miracle these days, so if you get them to answer, you might have a good one.

I guarantee this – every agent will struggle with the ‘unrepresented buyer’ question for months to come. Many already refuse to do dual agency, and an unrepresented buyer is similar so some listing agents won’t have any solution, other than, ‘go find a buyer-agent and pay them’. The other agents who get giddy about ‘unrepresentation’ probably just want to take advantage of the situation. A good listing agent would cover a few of the good and bad points.

5. Is the seller offering concessions? How much? How your listing agent handles these two questions will determine if the buyers will have their own representation, or if you and the listing agent want to take a chance on unrepresentation being a viable solution when everyone in the realtor universe is throwing mountains of disclaimers at you.

Any listing agent who declares that the seller is offering a 2.5% concession will have a parade of buyers through the house. Not only does it fix the buyer’s representation issue, but it also tells them that the listing agent gets it about creating a win-win for all.

These are some of the biggest concerns for buyers, so sellers should hire their listing agent in direct relation to how well they handle these points above! Get Good Help!

by Jim the Realtor | Jul 24, 2024 | Commission Lawsuit, Why You Should List With Jim |

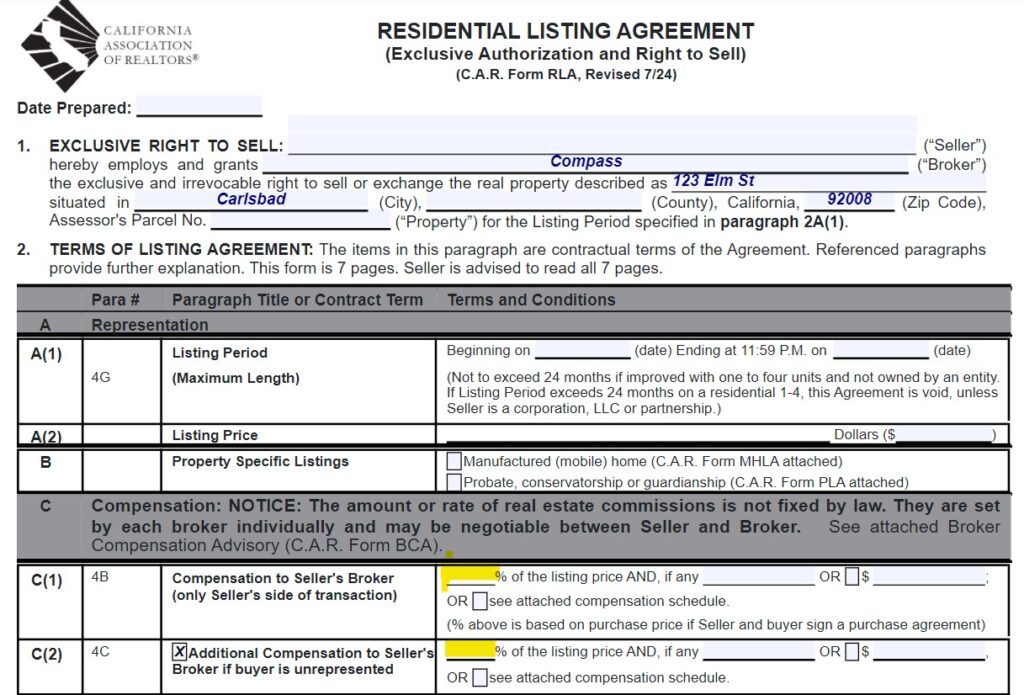

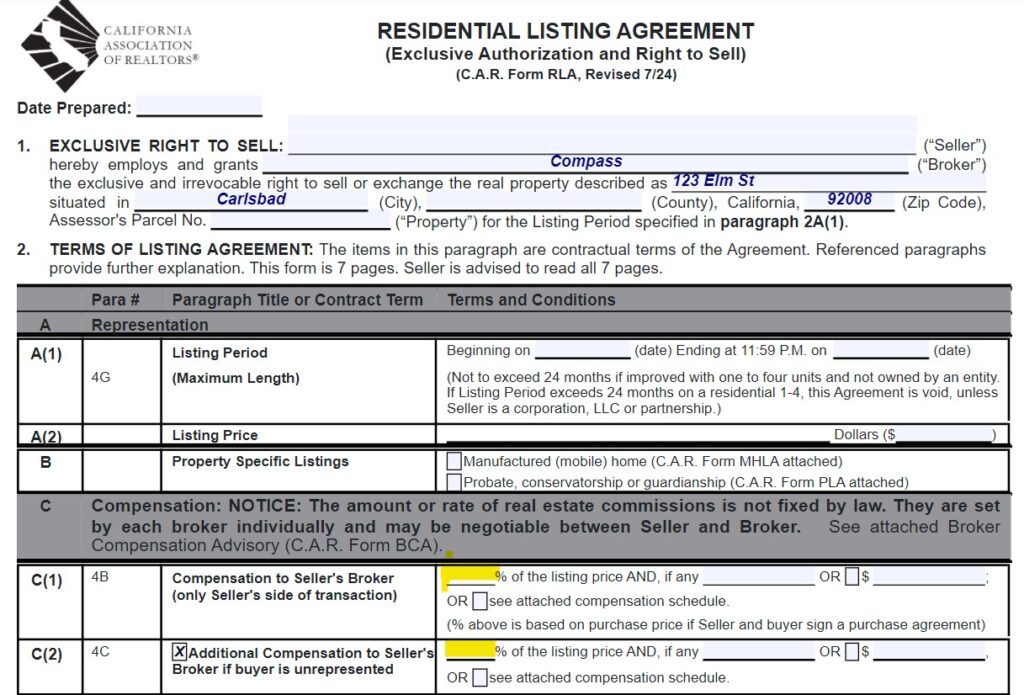

The new 19-page listing agreement is out! They didn’t waste any time getting to the listing agent’s pay. Boom, right at the top of the newly revised form, it commits to the commission rate plus a little extra if the buyer is unrepresented.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

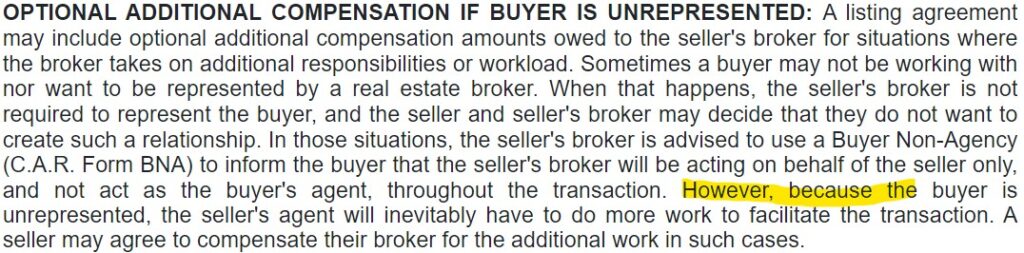

All the way down on page 14, the Optional Additional Compensation is described:

We’ve never had this option before and everyone is probably wondering what the extra work is worth? It will look a lot like dual agency in practice and the liability is 2x on those, compared to when two agents are involved. When faced with the buyer wanting to cancel their purchase, most every agent will be forced to provide what’s needed to get them through.

Extra pay is warranted, but how much? It will be interesting to see how this plays out.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

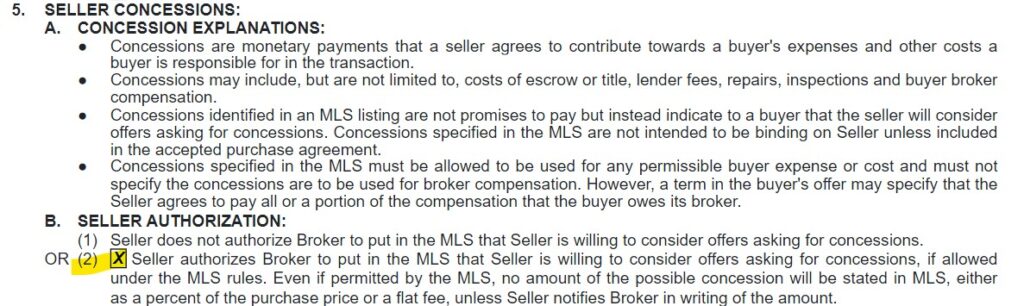

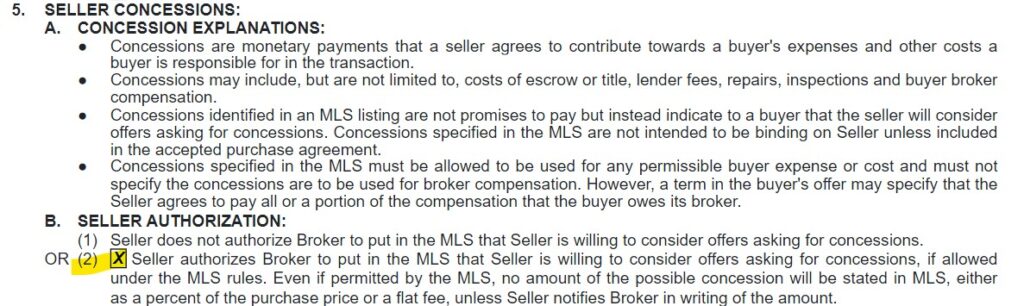

Seller Concessions finally get an explanation on page 11:

The MLS will have an entry for the amount of concessions, but the new form insists that the seller must notify the broker in writing of the amount, BUT THIS FORM DOESN’T PROVIDE A PLACE FOR THE SELLER TO NOTIFY. It is as if the C.A.R. wants to make it near-impossible for buyer-agents to exist.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

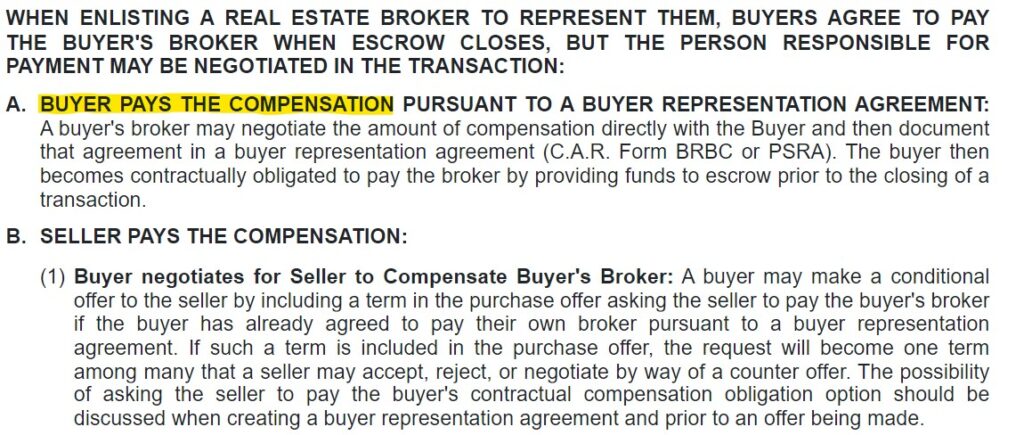

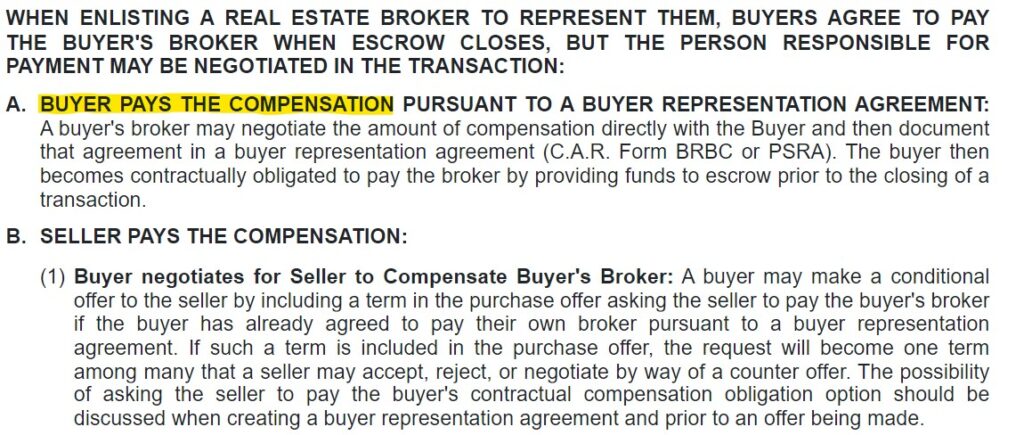

They did get around to some explaining on page 15, but if you’re a seller and happen to get this far, it sure looks like the buyer is paying the buyer-agent commission:

Buyer-agents need to rely on their buyers paying their fee, because these forms aren’t giving much hope to sellers paying them any compensation. The authors of these forms have abandoned buyer-agents to cover their own backside. It is embarrassing that they don’t fight for buyer-agents instead.

by Jim the Realtor | Jul 23, 2024 | Commission Lawsuit, Realtor, Realtor Training, Why You Should List With Jim |

The California Association of Realtors had to re-write a few of their new forms in order to comply with the DOJ critique. These revised forms get released tomorrow, and they will probably help chart the final path for buyer-agents.

There are two noteworthy points in them.

1. The old listing agreement mentioned the full commission rate the seller would pay at closing, and then in a separate paragraph at the bottom of the same page, it listed how much of that full commission that would be paid to the buyer-agent. The second rate was determined by the listing agent with little if any involvement of the sellers.

The new listing agreement will dictate the commission rate the seller will pay at closing for seller representation only. There won’t be any mention of the seller paying the buyer-agent.

But there will be a second paragraph where the listing agent can add an additional fee for handling the extra work created if the buyer is unrepresented.

In summary: Agents who only use the basic listing agreement can completely ignore buyer-agents, and can also tack on an extra rate or fee for bringing in unrepresented buyers. It will encourage single agency, and buyers will really have to be committed to getting good help!

2. If the listing agent is committed to having their seller offer “concessions” to a buyer that may be used towards a buyer-agent commission, they will need to include a separate and optional form. The form will ask the seller if they want to offer concessions (Yes or No), and if so, how much do they want to offer.

Ed Zorn is the vice president and general counsel of CRMLS, the largest MLS in the state. When asked about the concessions amount, he said sellers should not ‘commit to any kind of number whatsoever.’ Our Compass management agrees.

To the ivory-tower folks, not offering a specific commission rate to buyer-agents sounds safe and compliant. But it will expedite the death march of the buyer-agent.

The listing agreement will be encouraging single agency and if a buyer-agent can find their way to the negotiating table, there won’t be any guarantee of the seller paying anything towards your commission.

Literally, there was a chance for this to all work itself out by using concessions to pay buyer-agents. But everyone is so nervous about future litigation that these revised forms will lead us down the path of eliminating the buyer-agents. Single agency is upon us!

by Jim the Realtor | Jul 12, 2024 | Commission Lawsuit, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

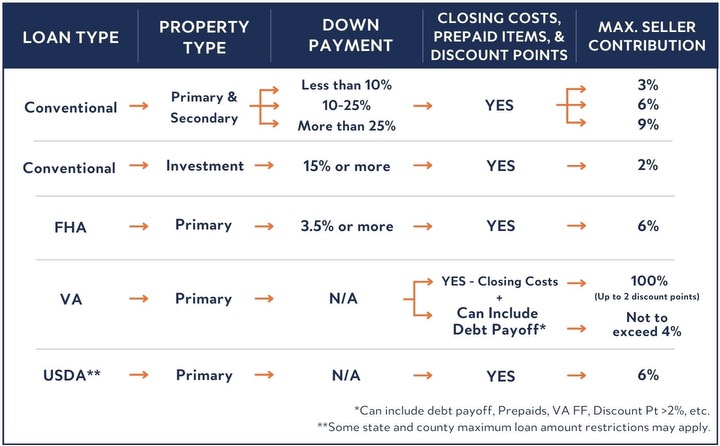

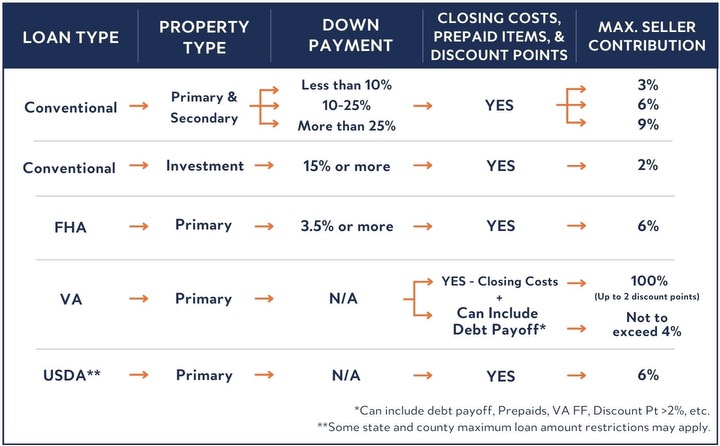

Hat tip to Carl Streicher, mortgage broker, for sending over this handy chart on allowable concessions, also known as seller contributions. This is how the buyer-agent commission can be included as a part buyer’s mortgage package, even if the seller didn’t sign the optional form with his listing.

If the buyer-agent writes the offer with a 3% or 4% seller contribution to the buyers’ closing costs, then the commission can get paid plus cover some or all of the buyers’ other closing costs too. Sellers typically want to offset with a higher price to compensate, which can make the appraisal more challenging, but once the home has been on the market for a few weeks maybe the seller will take less?

This is the reasonable solution that can solve everything.

Prior to the Frenzy, seller contributions were more common, especially with first-time homebuyers who were tight on cash. But concessions all but went away once bidding wars started breaking out everywhere. If there are multiple offers now, the ones without a request for seller concessions will probably float to the top of the pile.

Why am I skeptical?

Three reasons:

- Sellers will have already been told that they don’t have to pay for the buyer-agent.

- If there is another offer that doesn’t request a concession, then it will likely be favored.

- The seller and listing agent will want to negotiate the amount.

You would think that sellers could just focus on the amount of their net proceeds, but some get weird about paying concessions. If the listing agent is experienced/strong and wants to stand by his fellow agents, then he will explain it in a way that the sellers see the obvious benefit – it gets your house sold.

But it’s not a slam dunk. At least not yet, though a solid advertising campaign by NAR and CAR could go a long ways to making it the palatable solution for everyone in America to transact the same old way that we’ve been doing it for 100+ years.

by Jim the Realtor | Jul 12, 2024 | Commission Lawsuit, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop, Why You Should List With Jim |

This business used to be civil.

It was probably obvious that the contracts were drawn up by the realtor attorneys to protect realtors, but there were adequate protections for buyers and sellers too.

This commission lawsuit has changed everything, and now they only care about the realtor associations.

When Docusign pioneered the electronic signature, it was one of the best advancements in the history of real estate. But it causes clients to whip through the signing process without having to read anything! The attorneys make it worse by originating new forms every year, and currently a seller has to initial or sign 18 pages to list their home for sale, and a buyer who makes an offer to purchase has to sign or initial 28 pages!

The coming changes are going to add another half-dozen pages to each, and you better read them now!

BUYERS – You have to hire an agent to see homes for sale, which means signing a contract. It sounds ridiculous, which it is, but we are going to have to get used to it. The key part is how long the buyer is obligated to the agent.

If you don’t read the contract and just sign it real quick, you could be obligated to pay this agent a commission whether they represent you or not when buying a home. Buyers should only agree to sign any buyer-broker contract if it includes a cancellation clause so you can get out of it if things don’t work out.

SELLERS – The basic listing agreement won’t allow you to pay an incentive to a buyer’s agent. Your listing agent will have to include a optional form and have you agree to pay “concessions” which can go towards any buyer expense. I’m guessing that this form won’t be used much, and instead the listing agents will want to be heroes and tell their sellers that they get to save money now because they don’t have to pay buyer-agents any more – even though it’s going to kill the business as we’ve known it for 100+ years.

It may sound like a good idea to not pay buyer-agents in the beginning, but if your house hasn’t sold for weeks or months, you might reconsider. Paying incentives to get what you want is an American tradition.

AGENTS – You better be committed to getting paid, because everyone is going to be looking to screw you out of a paycheck – especially the other agents. The MLS used to protect buyer-agents because once a commission rate was entered onto a listing, the seller had to pay it. The rate was protected, and it became accepted as part of the package.

But it’s going to be different now, and the buyer-agents who include their commission in their offer to purchase will be under attack. If you make an offer that is less than the list price, the first thing the seller will want to do is pay you less, and I doubt that the listing agent will stand up for you. I can imagine it already from listing agents – “Ok, we accepted your buyer’s price but we’re not going to pay you anything!”

It means that any buyer-agent who wants to be paid will have to get it from their buyer. It will be another huge burden loaded onto the buyers, and only the most motivated will endure paying the same fees to which we have become accustomed.

So hey, maybe agents won’t get paid as much, but selling homes is going to be a mess – unless buyers can find a way to Get Good Help!

by Jim the Realtor | Jul 11, 2024 | 2024, Commission Lawsuit, Realtor, Realtor Training |

Due to expected scrutiny from the DOJ, the California Association of Realtors has abandoned buyers, and the buyer-agents. If a listing agent wants to include paying an incentive to buyer-agents, not only do they have to convince a seller that it’s a good idea, but then they have to use an optional form and NEVER call it a commission. Beginning on July 24th:

The Residential Listing Agreement will no longer provide for any offer of compensation from the listing broker to the buyer’s broker. C.A.R. confirmed that they will no longer facilitate broker-to-broker compensation agreements. The Cooperating Broker Compensation Agreement is being retired and will no longer be part of the C.A.R. forms library; the same applies to the Anticipated Broker Compensation Disclosure. The message is clear: C.A.R. will not produce/provide any forms related to broker-to-broker compensation.

The newly revised RLA will only include the agreement between the seller and the listing broker as it relates to compensation. The option for the listing broker to charge an additional fee if the buyer comes to the table unrepresented will remain. This option is available to account for the additional work that may be required of the listing agent when buyers elect to self represent.

In transactions where a buyer is unrepresented it is imperative that the listing agent not act as a fiduciary. The Buyer Non Agency Agreement form must be provided to and signed by the buyer. It is important that listing agents are careful with their words and actions, so as not to imply a fiduciary relationship with an unrepresented buyer.

As it relates to concessions that a seller may wish to offer to a buyer, the listing agreement will not specifically reference such offers. However the Multiple Listing Service Addendum includes the concession language. Paragraph five of “MLSA” will inform the seller as to the option of offering a concession to the buyer. The default will indicate that there are no concessions, however, there will be a checkbox in paragraph 5B2 wherein the seller may agree to consider a concession to the buyer to be used toward the buyer’s closing cost. No amount, either flat fee or percentage, shall be stated without the express written consent of the seller.

It is important to remember that concessions may not be designated for commission rather they are a seller to buyer offer extended solely to assist a buyer with closing costs which may include a variety of fees including broker compensation.

First, the National Association of Realtors botched the defense of buyer agency – allowing the world to believe there has been a conspiracy to inflate commissions – which could not be further from the truth. Now the California Association of Realtors has caved to the implied DOJ threat and revised all their forms to cover themselves, instead of fighting for buyers and buyer-agents. They didn’t even try to fight it – they just caved and revised their forms instead and expect agents to adjust.

In addition, the new listing agreement won’t mention any buyer-agent compensation, but it has a paragraph for the listing agent to include more pay for handling the unrepresented buyer without providing any fiduciary duty. The form is promoting single agency!

This is a disaster. Buyer-agents will be expected to convince buyers that they need to commit in writing to paying the buyer on-agent commission before buyers even find a house. They don’t think they need help finding a house – they have access to Zillow.

They will go direct to the listing agent instead.

SINGLE AGENCY IS UPON US – IT IS HERE, STARTING AUGUST 17TH AT THE LATEST.

It will be the worst thing to happen to real estate ever, yet outsiders will claim that they got commissions reduced so it worked and everything is fine.

Sales will plummet the rest of the year – I guarantee it – but we won’t know if it’s due to buyers waiting it out and/or not knowing what to do, the insane political circus that will only get worse, or if home prices and rates are too high. But that is a wicked triple threat!

by Jim the Realtor | Jul 2, 2024 | Commission Lawsuit, Jim's Take on the Market, Local Government, Realtor |

We know that the current DOJ wants to de-couple commissions, and have buyers pay for their own help. How does Team Trump feel about real estate commissions? I checked with Project 2025:

Project 2025 proposes significant changes to the traditional real estate commission structure to promote more transparency and direct negotiations between consumers and real estate professionals. Currently, in many U.S. real estate transactions, the seller typically pays a combined commission of 5-6% of the sale price, which is split between the listing agent and the buyer’s agent. This conventional arrangement has been criticized for creating potential conflicts of interest and lack of transparency regarding the actual costs associated with buying a home.

The new guidelines suggested under Project 2025 aim to shift this dynamic. The recommendations encourage a system where buyers directly pay their agents, allowing for more transparent negotiation of services and fees. This change is expected to lead to a more competitive market for real estate services, where commission rates are negotiated separately and may potentially decrease as a result.

One significant component of these changes is the move away from blanket offers of cooperative compensation to buyer’s agents on multiple listing services (MLS). Instead, buyers will negotiate and pay their agents directly, fostering a clearer understanding of the costs involved in their transactions. This is anticipated to lead to a more consumer-friendly environment where buyers have greater control and can choose services that best fit their needs and budgets.

Geez…it sounds identical to the current DOJ solution! It will be the worst thing that ever happens to the real estate market, mostly because weaker agents will oblige.

To clear things up for consumers, we should change one word.

Real estate commissions are NOT negotiable. They are DIFFERENT!

Everyone (especially NAR) is pushing the catch phrase, Commissions Are Negotiable, so they don’t get sued any more. But that isn’t helping anyone. All it does is make the consumer think they just need to find an agent and then work them over for a lower commission rate.

But if we said, Commissions Are Different, then consumers would wonder what is different – and conduct an investigation among agents to determine the differences, and what is best for them. It’s what has been missing all along!

Instead, it will be about beating down agents on their pay, without realizing that an inferior experience will be the likely outcome.

How is the experiment going so far?

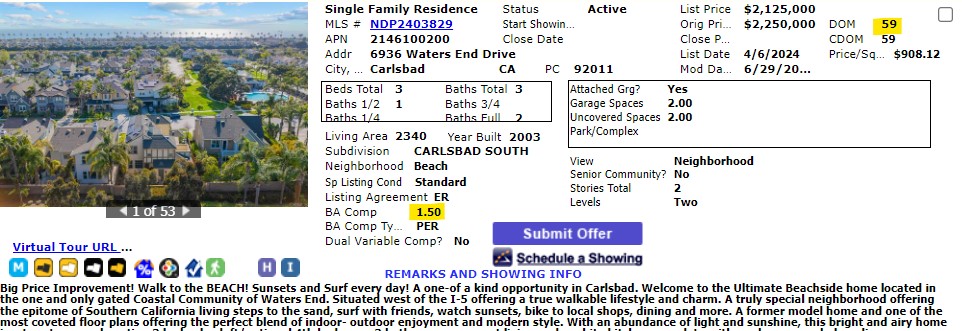

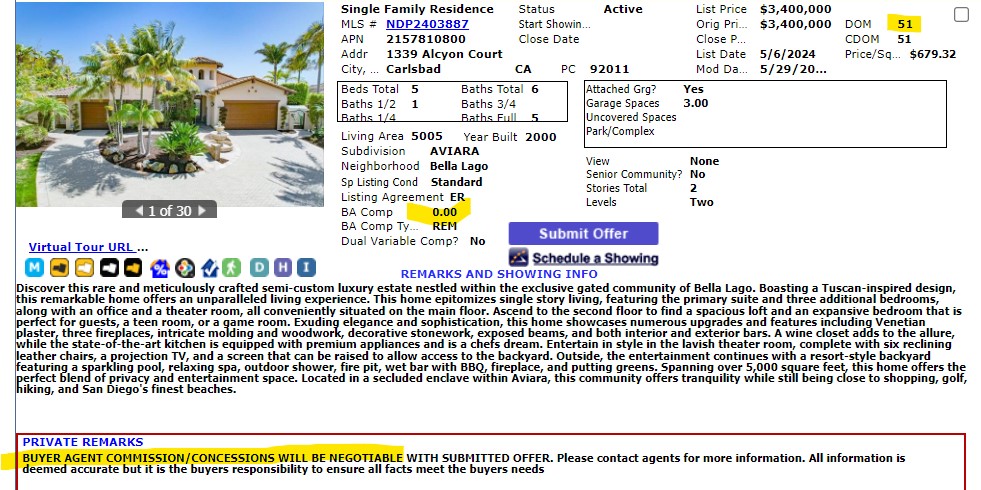

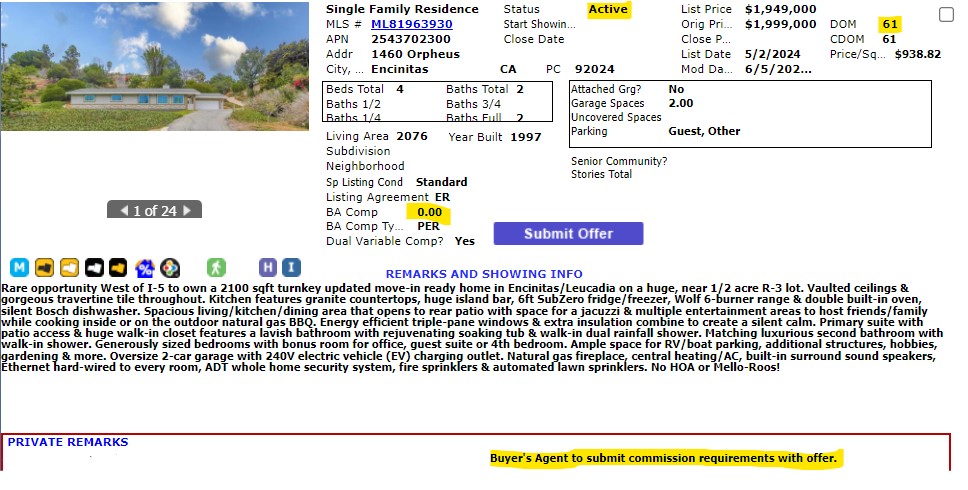

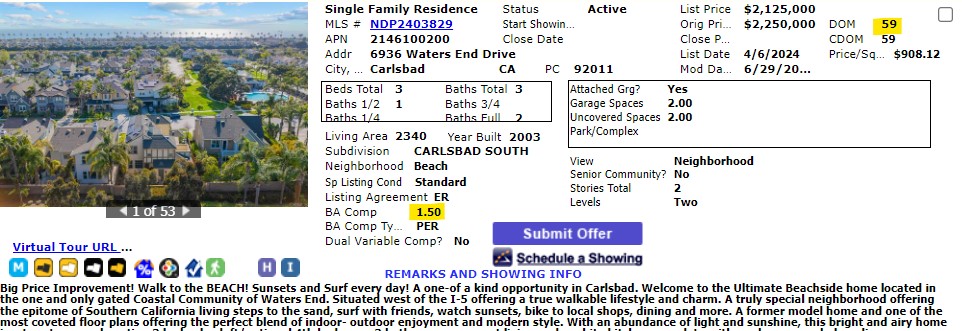

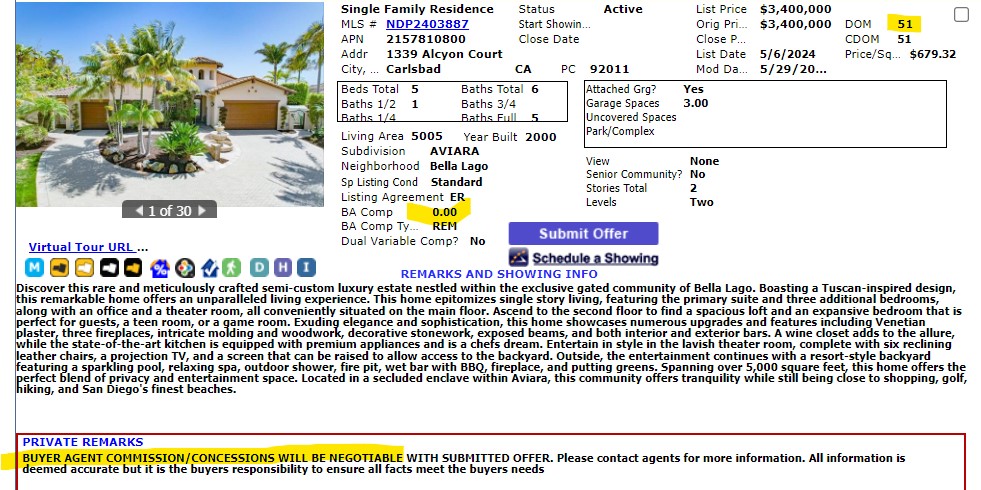

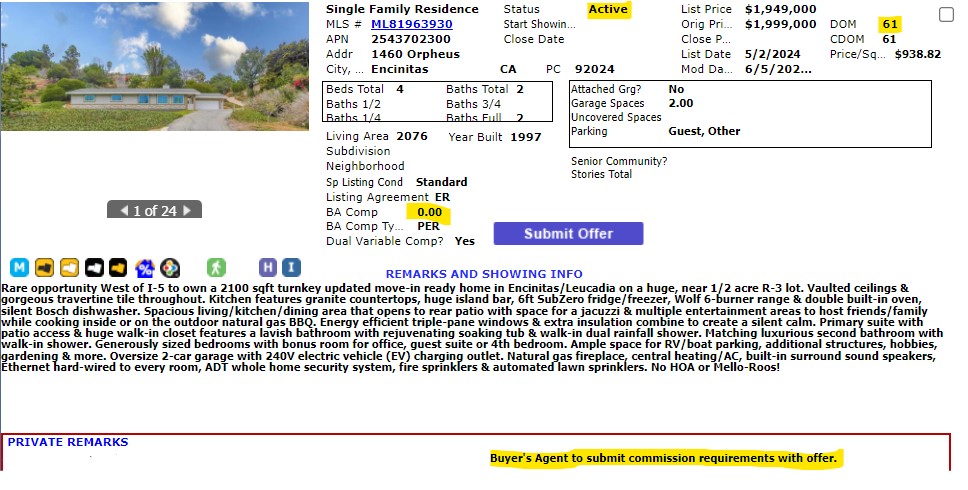

It is still legal to advertise seller-paid commissions in the MLS, but some think it’s a good time to try out the idea of offering little or no seller-paid commissions to the buyer-agent to save some money. Here are three active (unsold) listings that have been lingering:

True, there are also hundreds of unsold listings piling up that offer a 2.5% commission so it’s not just the discounters/experimenters who are having trouble with today’s market. We don’t know if it’s the lack of commission or the list price that is causing these not to sell, but after two months on the market, you can expect buyers will want concessions on one or both….or maybe they will just wait until next year.

With the market already stuttering a bit, sellers may want to consider getting it done now while they can still pay a commission to a buyer-agent. It will not be easier to sell during the ‘decoupling adjustment period’ that commences on August 17th. In fact, between the adjustment period and the political circus, the market will be in stallout mode for at least the last four months of this year.

Hopefully there will be an announcement any day about the brokerages suing NAR that might postpone the elimination of seller-paid commissions. Can we at least put it off until Spring, 2025 please?

by Jim the Realtor | Jun 22, 2024 | Commission Lawsuit

On Monday I talked about the big brokerages coming together to sue NAR for the terrible job they did in looking out for our best interests.

Nothing else happened this week, but the CAR must have heard something:

“Every June, C.A.R. issues new and modified standard forms. This year, of the 67 new and revised forms to be released on June 25, there are 21 of them that are related to the changes in business practices required by the NAR settlement. I am writing to inform you that C.A.R. is postponing the release of those 21 forms.

C.A.R. is continuing to review not just the NAR settlement but also Department of Justice (DOJ) statements to the industry, as well as feedback from our members, and this decision is being made from an abundance of caution. C.A.R. has received a formal inquiry about these forms from the DOJ, and the organization requires additional time to consider the DOJ’s concerns.”

Being the author of our forms and contracts, The California Association of Realtors is at risk of being blamed for the conspiracy.

But this is America, so everything should be litigated for years. Buyers can probably quit worrying about having to pay their own realtor, because the market will flatten out just enough that sellers will be happy to pay a couple of points to make the deal.

by Jim the Realtor | Jun 18, 2024 | Commission Lawsuit |

Here we go!

This week, we’re going to find out more about the DOJ’s stance on home sellers paying commissions to the buyer-agents. Finally!

Everyone agrees that sellers can choose to pay NO commissions. Heck, you don’t have to hire an agent to sell your house – go stick a for-sale sign in your front yard and see what happens.

But sellers should not be prevented from paying an incentive if they believe that is what’s best for them, and that it will get them what they want.

This is where NAR has failed miserably, and the big brokerages have no other choice but fight for what’s right. It’s anti-American to forbid people from spending their money however they want – especially when commissions have always been negotiable.

The DOJ has said that they want commissions to be ‘decoupled’. If they force home buyers to pay for their own agent, how much will be comfortable? Maybe one-half percent? Or maybe 1%? The job is too tough and it takes too long to work for 1%. Good agents won’t do it, and it will force buyers to go direct to the listing agent instead.

Unrepresented buyers will be the worst thing that ever happened to home sales. But nobody sees it coming, and by the time it becomes obvious, it will be too late.

Hopefully somebody will intervene with an auction format instead!