by Jim the Realtor | Jul 23, 2024 | Commission Lawsuit, Realtor, Realtor Training, Why You Should List With Jim |

The California Association of Realtors had to re-write a few of their new forms in order to comply with the DOJ critique. These revised forms get released tomorrow, and they will probably help chart the final path for buyer-agents.

There are two noteworthy points in them.

1. The old listing agreement mentioned the full commission rate the seller would pay at closing, and then in a separate paragraph at the bottom of the same page, it listed how much of that full commission that would be paid to the buyer-agent. The second rate was determined by the listing agent with little if any involvement of the sellers.

The new listing agreement will dictate the commission rate the seller will pay at closing for seller representation only. There won’t be any mention of the seller paying the buyer-agent.

But there will be a second paragraph where the listing agent can add an additional fee for handling the extra work created if the buyer is unrepresented.

In summary: Agents who only use the basic listing agreement can completely ignore buyer-agents, and can also tack on an extra rate or fee for bringing in unrepresented buyers. It will encourage single agency, and buyers will really have to be committed to getting good help!

2. If the listing agent is committed to having their seller offer “concessions” to a buyer that may be used towards a buyer-agent commission, they will need to include a separate and optional form. The form will ask the seller if they want to offer concessions (Yes or No), and if so, how much do they want to offer.

Ed Zorn is the vice president and general counsel of CRMLS, the largest MLS in the state. When asked about the concessions amount, he said sellers should not ‘commit to any kind of number whatsoever.’ Our Compass management agrees.

To the ivory-tower folks, not offering a specific commission rate to buyer-agents sounds safe and compliant. But it will expedite the death march of the buyer-agent.

The listing agreement will be encouraging single agency and if a buyer-agent can find their way to the negotiating table, there won’t be any guarantee of the seller paying anything towards your commission.

Literally, there was a chance for this to all work itself out by using concessions to pay buyer-agents. But everyone is so nervous about future litigation that these revised forms will lead us down the path of eliminating the buyer-agents. Single agency is upon us!

by Jim the Realtor | Jul 12, 2024 | Commission Lawsuit, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

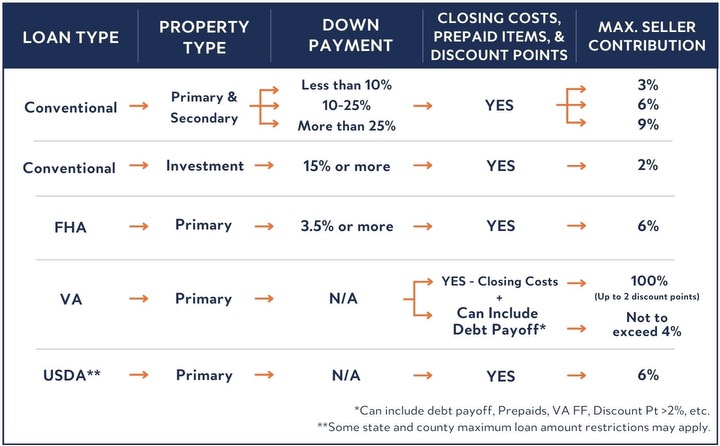

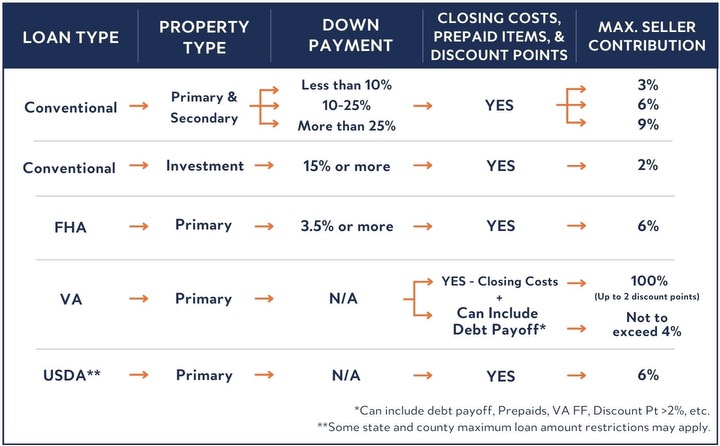

Hat tip to Carl Streicher, mortgage broker, for sending over this handy chart on allowable concessions, also known as seller contributions. This is how the buyer-agent commission can be included as a part buyer’s mortgage package, even if the seller didn’t sign the optional form with his listing.

If the buyer-agent writes the offer with a 3% or 4% seller contribution to the buyers’ closing costs, then the commission can get paid plus cover some or all of the buyers’ other closing costs too. Sellers typically want to offset with a higher price to compensate, which can make the appraisal more challenging, but once the home has been on the market for a few weeks maybe the seller will take less?

This is the reasonable solution that can solve everything.

Prior to the Frenzy, seller contributions were more common, especially with first-time homebuyers who were tight on cash. But concessions all but went away once bidding wars started breaking out everywhere. If there are multiple offers now, the ones without a request for seller concessions will probably float to the top of the pile.

Why am I skeptical?

Three reasons:

- Sellers will have already been told that they don’t have to pay for the buyer-agent.

- If there is another offer that doesn’t request a concession, then it will likely be favored.

- The seller and listing agent will want to negotiate the amount.

You would think that sellers could just focus on the amount of their net proceeds, but some get weird about paying concessions. If the listing agent is experienced/strong and wants to stand by his fellow agents, then he will explain it in a way that the sellers see the obvious benefit – it gets your house sold.

But it’s not a slam dunk. At least not yet, though a solid advertising campaign by NAR and CAR could go a long ways to making it the palatable solution for everyone in America to transact the same old way that we’ve been doing it for 100+ years.

by Jim the Realtor | Jul 12, 2024 | Commission Lawsuit, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop, Why You Should List With Jim |

This business used to be civil.

It was probably obvious that the contracts were drawn up by the realtor attorneys to protect realtors, but there were adequate protections for buyers and sellers too.

This commission lawsuit has changed everything, and now they only care about the realtor associations.

When Docusign pioneered the electronic signature, it was one of the best advancements in the history of real estate. But it causes clients to whip through the signing process without having to read anything! The attorneys make it worse by originating new forms every year, and currently a seller has to initial or sign 18 pages to list their home for sale, and a buyer who makes an offer to purchase has to sign or initial 28 pages!

The coming changes are going to add another half-dozen pages to each, and you better read them now!

BUYERS – You have to hire an agent to see homes for sale, which means signing a contract. It sounds ridiculous, which it is, but we are going to have to get used to it. The key part is how long the buyer is obligated to the agent.

If you don’t read the contract and just sign it real quick, you could be obligated to pay this agent a commission whether they represent you or not when buying a home. Buyers should only agree to sign any buyer-broker contract if it includes a cancellation clause so you can get out of it if things don’t work out.

SELLERS – The basic listing agreement won’t allow you to pay an incentive to a buyer’s agent. Your listing agent will have to include a optional form and have you agree to pay “concessions” which can go towards any buyer expense. I’m guessing that this form won’t be used much, and instead the listing agents will want to be heroes and tell their sellers that they get to save money now because they don’t have to pay buyer-agents any more – even though it’s going to kill the business as we’ve known it for 100+ years.

It may sound like a good idea to not pay buyer-agents in the beginning, but if your house hasn’t sold for weeks or months, you might reconsider. Paying incentives to get what you want is an American tradition.

AGENTS – You better be committed to getting paid, because everyone is going to be looking to screw you out of a paycheck – especially the other agents. The MLS used to protect buyer-agents because once a commission rate was entered onto a listing, the seller had to pay it. The rate was protected, and it became accepted as part of the package.

But it’s going to be different now, and the buyer-agents who include their commission in their offer to purchase will be under attack. If you make an offer that is less than the list price, the first thing the seller will want to do is pay you less, and I doubt that the listing agent will stand up for you. I can imagine it already from listing agents – “Ok, we accepted your buyer’s price but we’re not going to pay you anything!”

It means that any buyer-agent who wants to be paid will have to get it from their buyer. It will be another huge burden loaded onto the buyers, and only the most motivated will endure paying the same fees to which we have become accustomed.

So hey, maybe agents won’t get paid as much, but selling homes is going to be a mess – unless buyers can find a way to Get Good Help!

by Jim the Realtor | Jul 11, 2024 | 2024, Commission Lawsuit, Realtor, Realtor Training |

Due to expected scrutiny from the DOJ, the California Association of Realtors has abandoned buyers, and the buyer-agents. If a listing agent wants to include paying an incentive to buyer-agents, not only do they have to convince a seller that it’s a good idea, but then they have to use an optional form and NEVER call it a commission. Beginning on July 24th:

The Residential Listing Agreement will no longer provide for any offer of compensation from the listing broker to the buyer’s broker. C.A.R. confirmed that they will no longer facilitate broker-to-broker compensation agreements. The Cooperating Broker Compensation Agreement is being retired and will no longer be part of the C.A.R. forms library; the same applies to the Anticipated Broker Compensation Disclosure. The message is clear: C.A.R. will not produce/provide any forms related to broker-to-broker compensation.

The newly revised RLA will only include the agreement between the seller and the listing broker as it relates to compensation. The option for the listing broker to charge an additional fee if the buyer comes to the table unrepresented will remain. This option is available to account for the additional work that may be required of the listing agent when buyers elect to self represent.

In transactions where a buyer is unrepresented it is imperative that the listing agent not act as a fiduciary. The Buyer Non Agency Agreement form must be provided to and signed by the buyer. It is important that listing agents are careful with their words and actions, so as not to imply a fiduciary relationship with an unrepresented buyer.

As it relates to concessions that a seller may wish to offer to a buyer, the listing agreement will not specifically reference such offers. However the Multiple Listing Service Addendum includes the concession language. Paragraph five of “MLSA” will inform the seller as to the option of offering a concession to the buyer. The default will indicate that there are no concessions, however, there will be a checkbox in paragraph 5B2 wherein the seller may agree to consider a concession to the buyer to be used toward the buyer’s closing cost. No amount, either flat fee or percentage, shall be stated without the express written consent of the seller.

It is important to remember that concessions may not be designated for commission rather they are a seller to buyer offer extended solely to assist a buyer with closing costs which may include a variety of fees including broker compensation.

First, the National Association of Realtors botched the defense of buyer agency – allowing the world to believe there has been a conspiracy to inflate commissions – which could not be further from the truth. Now the California Association of Realtors has caved to the implied DOJ threat and revised all their forms to cover themselves, instead of fighting for buyers and buyer-agents. They didn’t even try to fight it – they just caved and revised their forms instead and expect agents to adjust.

In addition, the new listing agreement won’t mention any buyer-agent compensation, but it has a paragraph for the listing agent to include more pay for handling the unrepresented buyer without providing any fiduciary duty. The form is promoting single agency!

This is a disaster. Buyer-agents will be expected to convince buyers that they need to commit in writing to paying the buyer on-agent commission before buyers even find a house. They don’t think they need help finding a house – they have access to Zillow.

They will go direct to the listing agent instead.

SINGLE AGENCY IS UPON US – IT IS HERE, STARTING AUGUST 17TH AT THE LATEST.

It will be the worst thing to happen to real estate ever, yet outsiders will claim that they got commissions reduced so it worked and everything is fine.

Sales will plummet the rest of the year – I guarantee it – but we won’t know if it’s due to buyers waiting it out and/or not knowing what to do, the insane political circus that will only get worse, or if home prices and rates are too high. But that is a wicked triple threat!

by Jim the Realtor | Jun 30, 2024 | Realtor, Realtor Training |

by Jim the Realtor | May 16, 2024 | Commission Lawsuit, Realtor, Realtor Training, Why You Should Hire Jim as your Buyer's Agent, Why You Should List With Jim |

While management believes that buyer-agents will adapt and the implementation of the buyer-broker agreement will happen over the next few months, I have my doubts. It’s more likely that buyers will resist paying 2% to 3% to their agent, unless they are convinced that they can Get Good Help.

Without having to commit to paying anything to buyer-agents up front, sellers will choose to pay less or zero once an offer is submitted, and their listing agents will just let it go and just be thankful that they will be getting paid.

Buyer-agents will either have to accept the peanuts the sellers will be paying (0.5% to 1.5%), and/or talk their buyers into paying the rest. Or they will ‘retire’, which sounds groovy to the agents who are 50+.

Left in the rubble will be home buyers who are mastering the matterports, and listing agents who desperately want buyers to come to them direct.

The form above will be the gateway drug to the future.

It will be used as a defense mechanism by listing agents who resist giving any of their commission to the buyers (who are thinking they deserve a bonus for coming direct).

“Yes, come direct to the listing agent so you don’t have to pay a commission”, and once you get here then sign this form and be unrepresented. Everyone saves!

If commissions are less, agents will want to do less. For those agents who already don’t do much, it will be a struggle – but they will find a way!

They aren’t going to step up and justify why every buyer deserves good representation.

Instead, they will do nothing for you. Sign the form above and good luck getting to the finish line!

In a marketplace where the stakes are rising every day, there will be a growing trend of getting less help – and virtually no Good Help available unless buyers want to pay for it themselves.

by Jim the Realtor | Apr 29, 2024 | Commission Lawsuit, Realtor, Realtor Training

The undated FAQs were released today. Buyers don’t have to sign a written buyer-agent agreement just to tour an open house! The clarifications from NAR:

The practice change requiring written agreements with buyers is triggered by two conditions: it only applies to MLS participants “working with” buyers and is triggered by “touring a home.”

What does it mean to be “working with” a buyer?

The “working with” language is intended to distinguish MLS participants who provide brokerage services to a buyer — such as identifying potential properties, arranging for the buyer to tour a property, performing or facilitating negotiations on behalf of the buyer, presenting offers by the buyer, or other services for the buyer —from MLS participants who simply market their services or just talk to a buyer — like at an open house or by providing an unrepresented buyer access to a house they have listed.

If the MLS participant is working only as an agent or subagent of the seller, then the participant is not “working with the buyer.” In that scenario, an agreement is not required because the participant is performing work for the seller and not the buyer.

Authorized dual agents, on the other hand, work with the buyer (and the seller).

What does it mean to tour a home?

Written buyer agreements are required before a buyer tours a home for sale listed on the MLS.

Touring a home means when the buyer and/or the MLS participant, or other agent, at the direction of the MLS participant working with the buyer, enter(s) the house. This includes when the MLS participant or other agent, at the direction of the MLS participant, working with the buyer enters the home to provide a live, virtual tour to a buyer not physically present.

A “home” means a residential property consisting of not less than one nor more than four residential dwelling units.

If an MLS participant hosts an open house or provides access to a property, on behalf of the seller only, to an unrepresented buyer, will they be required to enter into a written agreement with those buyers touring the home?

No. The new rule will cover every type of relationship where an MLS participant is working with a buyer.

Are written buyer agreements required when listing agents talk with a buyer on behalf of a seller only or as subagents of the seller?

No. If the MLS participant is working only as an agent or subagent of the seller, then the participant is not working for the buyer. In that scenario, an agreement is not required because the participant is performing work for the seller and not the buyer.

Are written buyer agreements required when MLS participants perform ministerial acts?

Yes. The obligation is triggered once the MLS participant is working with that buyer and has taken them to tour a home, regardless of what other acts the MLS participant performs.

But an MLS participant performing only ministerial acts — without the expectation of being paid for those acts and who has not taken the buyer to tour a home — is not working for the buyer.

Are written buyer agreements required in a dual agency scenario, when a single agent works both for the seller and for the buyer?

Yes. If an MLS participant is working as an agent for a buyer, a written agreement is required.

Are written buyer agreements required in a designated agency scenario, when a single broker works both for the seller and for the buyer, and designates an agent to represent the buyer?

Yes. If an MLS participant is working as an agent for a buyer, a written agreement is required.

by Jim the Realtor | Apr 29, 2024 | 2024, Commission Lawsuit, Jim's Take on the Market, Realtor, Realtor Training |

Think of the monumental change needed in the listing agent’s psyche to get them to stop scolding the buyer-agents and give some respect – but instead they are shorting the commissions too. If you blow off the buyer-agents, then you’re on your own – and the vast majority of agents will have no clue how to find their own buyers.

From the confidential remarks in recent MLS listings:

Buyer did not perform! Seller wants it gone. Seller is going to request your EMD deposit released upon receipt! $25K No games! This home will not go VA, or FHA because of the state of repair. Seller has unfinished work do to other buyers wanting him to stop work because they were buying AS-IS. Sellers are not going to do any repairs. Enter house thought side door do not open front door, BE VERY CAREFUL! Very unsafe! Good luck!

Broker/Agent does not guarantee accuracy of permits, square footage, lot size, zoning, rent control, use codes, schools, and/or other information concerning the condition or features of the property provided by the seller or obtained by public records. Buyer is advised to independently verify the accuracy of all information through personal inspections, the City, and with appropriate professionals.

Please confirm with the listing agent (via text) that the front door is locked properly before leaving property.

Be timely, turn off lights and lock all doors behind you.

Do not contact agent to hold open house or ask to market the property online or through Social Media.

I have tried to be available to everyone for showings and conversations, however I am finished answering questions on what the seller’s want. Thank you for your hard work.

Seller accepted an offer prior to coming to market. There is not a bedroom on the first floor. Please do not request a showing if your clients need a downstairs bedroom. Please do not request to hold open, we hold open houses internally with our team.

NO MORE SHOWINGS OR OFFERS ! MULTIPLE OFFERS RECEIVED!

new double pain windows

Photos along with offer instructions coming soon. Do not contact agent to hold open house or ask to market the property online or through Social Media.

Must provide POF / Lender letter for showing. Only qualified buyers. Listing agent at all showings. No lockbox. Dog on property.

Strictly showing by appointment only.

Only selling 1/2 of the building. No HOA has been formed for the building. 1 bedroom is tenant occupied with lease ending 7/31/24. A/C only in 1 bedroom. Tenant interested in staying.

Home has video cameras inside and out. Seller will be removing Lutron Casseria smart home (switches) and replacing with standard. Security cameras, wine fridge and outside fridge do not convey.

Multiple generous offers already received, all are due by noon, Monday 4/29. You must register your showing using the Sentrilock box or physically attend the open house on Sunday 1 to 4, 4/28. DO NOT USE SHOWING TIME. Touring the property will be a condition of acceptance along with loan cross qualification by (the listing agent’s lender). Please send in your best and highest offer with POFs and loan letter. Offers that do not have all the requirements or are sent to the wrong email, will not be considered. Seller reserves the right to select the best one offer or send out multiple counter offers. Seller to select services.

You’re open? Sure gives the feeling that they plan to work you over on the buyer-side commission.

How about 3%? Oh, you want to negotiate – make it 4% then!

by Jim the Realtor | Apr 22, 2024 | 2024, Commission Lawsuit, Realtor Training, Why You Should List With Jim |

On Friday, the Plaintiffs’ counsel filed a Motion for Preliminary Approval of the commission-lawsuit settlement agreement with the federal court, so the two new rules will go into effect in late July, apparently. The plaintiffs have requested a hearing on final approval of the settlement by the court to be held on November 22, 2024.

The second rule about buyers having to hire a buyer-agent before touring a home is a done deal, mostly because nobody is objecting. At least not yet. It will become a major headache for all.

The first rule about home sellers not being required to pay a buyer-agent commission will be affected by the overall market conditions. Red-hot markets like Silicon Valley will likely be seeing zero percent (or close) being offered as a reward to buyer-agents. The demand is so strong there, the inventory is so thin, and the buyer-agents are so desperate that the sellers will get away with it. How much will buyers be willing to pay to hire a buyer-agent there? Not much – 1% tops – but the entry level there is $3,000,000.

But other markets will have different challenges – especially those that are slowing (or buckling under) from a heavier load of unsold listings and stingier demand.

The conversations will go like this:

Seller: It’s been thirty days, how come my house isn’t sold?

Listing Agent: I feel good, and it should be selling any day now. People are looking.

Seller: What are you doing to sell my home?

Listing Agent: I’m showering every day now in case someone wants to show your home.

Seller: Are you advertising in SF, LA, and NYC where all the rich people live?

Listing Agent: We are advertising world-wide.

Seller: Then what do you suggest we do?

Listing Agent: You should lower the price and pay more commission to the buyer-agents.

Seller: The last thing I’m going to do is lower the price. Aren’t I paying 4% commission already?

Listing Agent: Yes, because you saw in the news that realtors imploded, so commissions are less now.

Seller: You’re saying 4% isn’t enough?

Listing Agent: Correct, because I work for 3% and that leaves only 1% for the buyer-agents. You should increase it to encourage more buyer-agents to show it.

Seller: It sounds like you’re backing into a 6% listing.

Listing Agent: I’m sorry you feel that way, but yes. But hey, you got to try out lower commissions!

Seller: Well, I guess you got me because I want to sell. Knock off $5,000 off my price too.

Listing Agent: Off your $3,000,000 listing?

Seller: Ok, ok, knock off $10,000, but that’s it. I’m Not Going To Give It Away!

Realtors will still be holding all the cards, and will game any system you throw at them. I said this will blow over quickly, and a softer market will help keep the status quo. Listing agents may appreciate buyer-agents (finally), though paying them more won’t be an obvious solution for many. Expect a slower market instead.

by Jim the Realtor | Mar 26, 2024 | Commission Lawsuit, Realtor, Realtor Training |

From the CEO of a large Sotheby’s brokerage based in Florida:

Last week the National Association of Realtors announced a settlement agreement in the Sitzer Burnett case that would take effect in July. For those who missed the declarations in the media that this outcome will render transacting real estate almost free, protect consumers, and make homeownership affordable once again, the settlement does none of that.

Here’s the truth.

1. The settlement forces brokers to reduce their compensation. False.

The settlement in no way establishes a standard or limitation on Realtors for what they may charge, nor services they elect to deliver. Those fees have always been negotiable and there has never been any collective bargaining. In every market, there is a wide variety of fees, just as there are levels of marketing, service and competence.

2. The settlement will, for the first time, allow sellers to no longer pay compensation for an agent bringing the buyer. False.

There has never been an obligation for a seller to pay buyer agent compensation, yet it is a practice that’s worked well. A past rule requiring an offer of some amount of compensation was a rule of display on a Realtor-owned MLS, yet it could have been as low as $1. That limitation was removed and today the MLS accepts all listings, regardless of buyer agent consideration.

3. The settlement prohibits sellers from paying a commission to a buyer’s agent and relieves sellers of the financial burden. False.

The mandate restricts properties with an offer of buyer agent compensation from displaying on association-owned MLS, yet the practice can’t be restricted in any other form of marketing. Sellers may still elect to pay buyer agent compensation to differentiate their properties. While sellers can elect not to pay buyer agent compensation, that doesn’t mean they will avoid the economics as buyers may write into any offer a contingency requiring the seller to cover the cost or request other concessions.

4. The settlement will serve to meaningfully lower prices and make homeownership affordable again. False.

Values in real estate are determined by supply and demand. Fees in a real estate transaction represent additional expenses, yet these include not only commissions but many other related charges. Should real estate commissions be reduced by 1% because of compression, that $500,000 home will now cost $495,000. Not only is the potential impact marginal at best, but do you think the seller now believes the home is worth less and will happily give the difference to the buyer? The reason home ownership is increasingly less affordable is that homes in our market have significantly risen in value these last few years.

5. The settlement is a win for buyers who will now be able to negotiate the fee for representation. Questionable.

For readers who have purchased homes, it is more than likely you were happy to have the seller compensate your agent so you didn’t have to. For buyers who had to provide the down payment and closing expenses, having the commission paid by the seller and incorporated in the home price allowed them to finance the amount over time instead of coming up with additional cash at closing.

6. The settlement will result in significant restitution to consumers who were “harmed” over recent years in their transactions by Realtors. False.

The settlement is huge, yet when one divides the amount by the number of potentially qualifying consumers it works out to about $10 per person. Those benefiting are the attorneys who have submitted a request to the court for over $80 million in fees.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

As a real estate professional for over 40 years, I have had the privilege of working with Realtors who represent the public in what is likely their largest investment. What I have witnessed are the countless situations where an agent has gone above and beyond to help buyers realize their dreams and sellers maximize their returns, often serving in ways far beyond their job description.

Everyone would like to see costs lowered yet I do not see the Department of Justice going after attorneys or other professions we wish would charge less. I always believed in the concept of free enterprise. If one is willing to assume the risk of running a business, one may do so at rates that allow a reasonable return for the capital investment and time. As my dad would say during his 60-year career, you wake up every day unemployed and have to find a job. Then you spend out of pocket and don’t make a cent unless you achieve someone else’s goals.

The brokerage community has always adapted to best represent buyers and sellers whenever there is a shift in the environment. And we will again. Yet when an industry I love is singled out and the justification is for false reasons, I will not be quiet.

https://www.heraldtribune.com/story/opinion/columns/2024/03/22/budge-huskey-says-dont-believe-the-myths-about-the-realtor-settlement/73055934007/