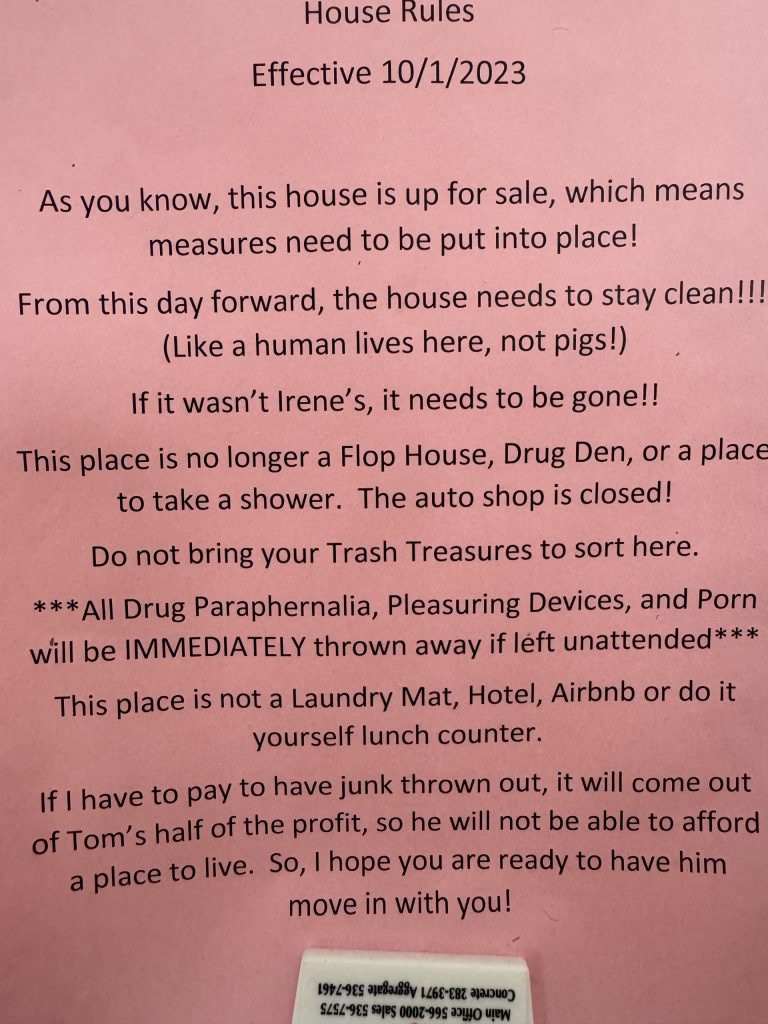

Showing Rules

Zillow CEO Rich Barton weighed in on the bombshell cases in both an investor call and a shareholder letter. Barton’s key comment came early in the call when he said “We also believe complete disruption to the existence of buyer’s agents is improbable for a few reasons.”

Barton reaffirmed his support for buyer agents and the theme of buyers having their own representation. “We believe a well-lit game is cleaner and more equitable. People deserve and need independent representation,” Barton said. “We’ve seen double-siding in the industry, which is clearly a conflict and is at certain times more expensive to the transaction.”

Damien Eales, CEO of Realtor.com said, “I don’t think that from a consumer perspective, they are paying a great deal of attention to what is occurring more broadly in the industry. And as much as these court cases play out, I think it will be in some respects very much confined to the industry conversation as opposed to the consumer conversation.”

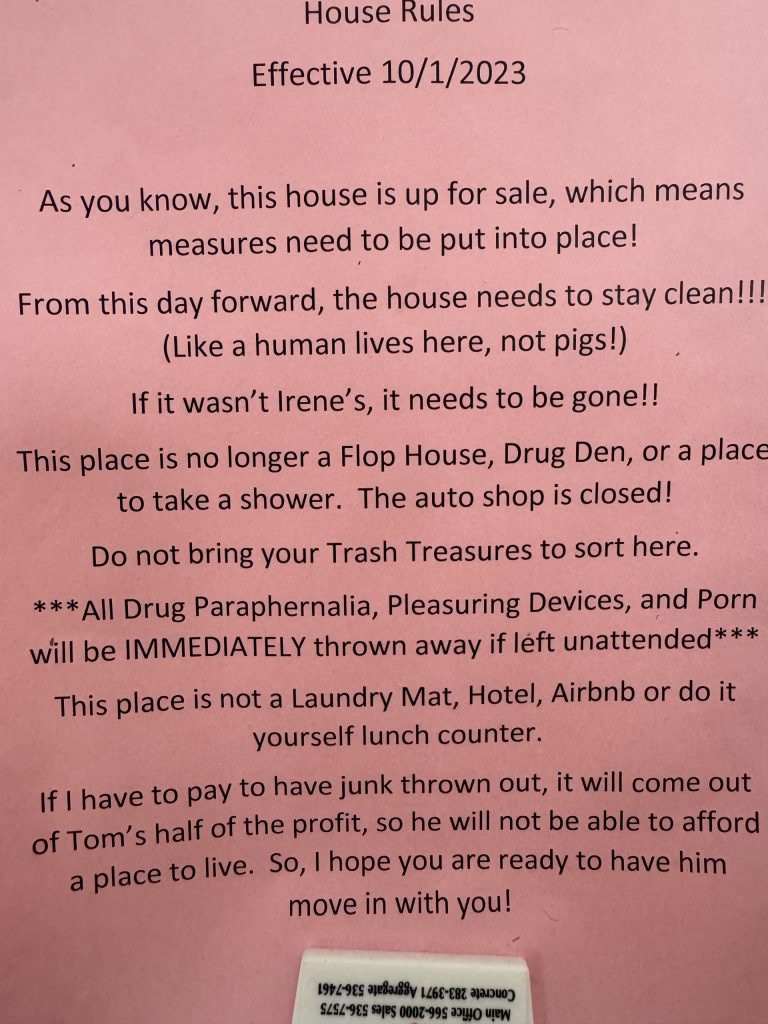

During his own investor call, Compass CEO Robert Reffkin pointed to the Seattle region, where sellers have not been required to offer buyers’ agent commissions for several years. Despite that change, Reffkin said, commissions in the area remain in line with the rest of the country — an outcome that suggests the bombshell lawsuits may not radically upend the status quo.

“I don’t think there’s any evidence to suggest that there will be pressure on commissions,” Reffkin said.

The history of steady commission rates will be mentioned in the lawsuit appeals.

Doesn’t the history suggest a conspiracy? Especially when combined with the ascent of home prices? Lawyers for the plaintiffs will note that the annual home appreciation gives the appearance of realtors getting a raise in income every year – including +40% since 2020.

There is no conspiracy on the street. It’s too competitive between agents!

Any pressure on commission rates will come from agents who are desperate to eat. The perfect storm of market conditions should push hundreds of thousands of agents out of the business. As they exit, they might give a seller a deal – if they can find a listing opportunity.

What do sellers and buyers want – the best rate, or the best agent? It’s one or the other.

Hopefully this mess will cause consumers to thoroughly investigate the choices. Otherwise, this will all blow over in a few months – unless the Department of Justice does something permanent.

Get Good Help!

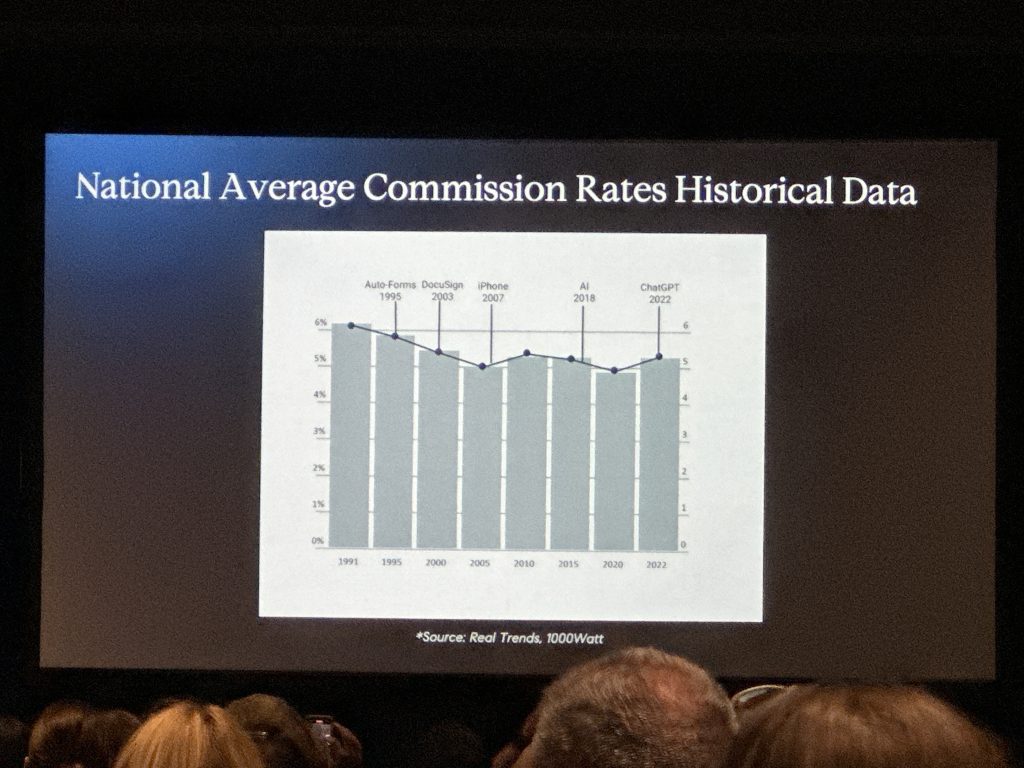

For those local homeowners who might want to move up….here’s a list to get you started. These are the towns that keep our market going – people downsizing from these areas love the home values in San Diego!

AB 1033 is the latest state law designed to develop a market for ADUs, and thus lessen California’s grinding housing crisis. However, past legislative attempts have not met with much success.

In 2021, the legislature passed SB 9, which allowed homeowners to split their single-family parcel into two lots and build up to two units on each lot. It went into effect in January 2022.

Earlier this year, UC Berkeley’s Terner Center, a housing policy research group, released a study following the progress of ADU development after the passage of SB 9. It looked at 13 cities where developing ADUs seemed to make the most financial sense for property owners and “found that SB 9 activity is limited or non-existent in these 13 cities.”

https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=202320240AB1033

This is a nightmare for title insurance. If you want to get a clear and marketable title, the property would need to be officially subdivided, or turn into condos – which the new law did address:

(10) In addition to the requirement that a local agency allow the separate sale or conveyance of an accessory dwelling unit pursuant to Section 65852.26, a local agency may also adopt a local ordinance to allow the separate conveyance of the primary dwelling unit and accessory dwelling unit or units as condominiums. Any such ordinance shall include all of the following requirements:

(A) The condominiums shall be created pursuant to the Davis-Stirling Common Interest Development Act (Part 5 (commencing with Section 4000) of Division 4 of the Civil Code).

(B) The condominiums shall be created in conformance with all applicable objective requirements of the Subdivision Map Act (Division 2 (commencing with Section 66410)) and all objective requirements of a local subdivision ordinance.

(C) Before recordation of the condominium plan, a safety inspection of the accessory dwelling unit shall be conducted as evidenced either through a certificate of occupancy from the local agency or a housing quality standards report from a building inspector certified by the United States Department of Housing and Urban Development.

(D) (i) Neither a subdivision map nor a condominium plan shall be recorded with the county recorder in the county where the real property is located without each lienholder’s consent.

Lenders aren’t going to give their consent, so in order to sell off an ADU, all you have to do is have a property with no mortgages, and file a condo map with the state and work it through the process for a few years!

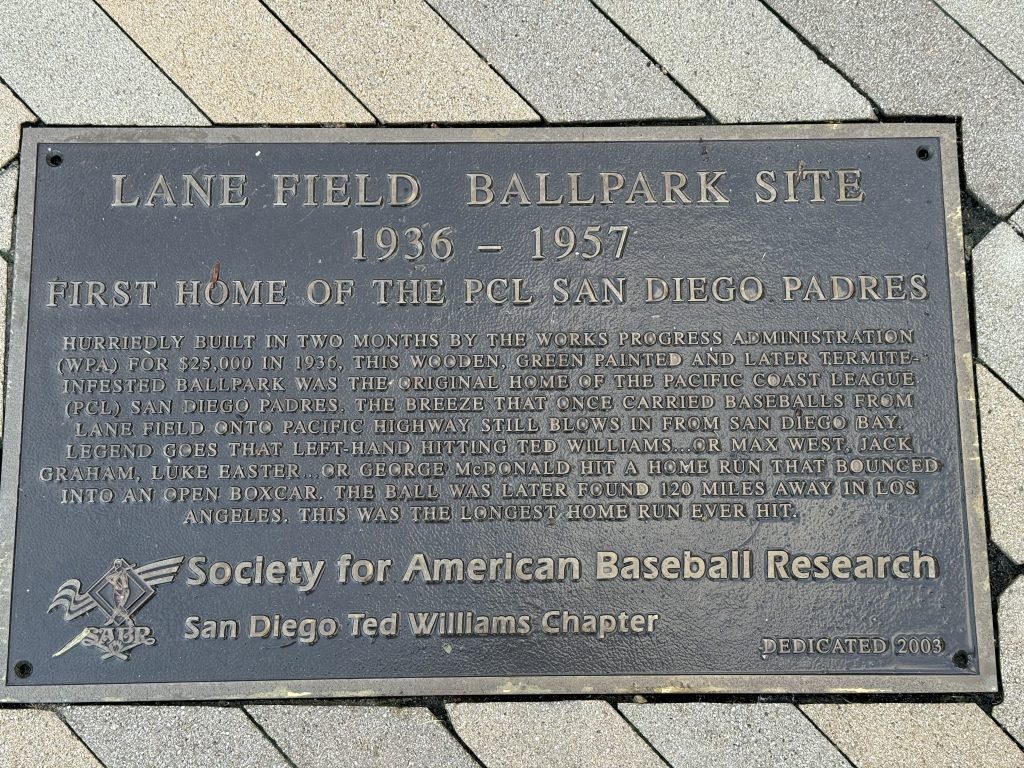

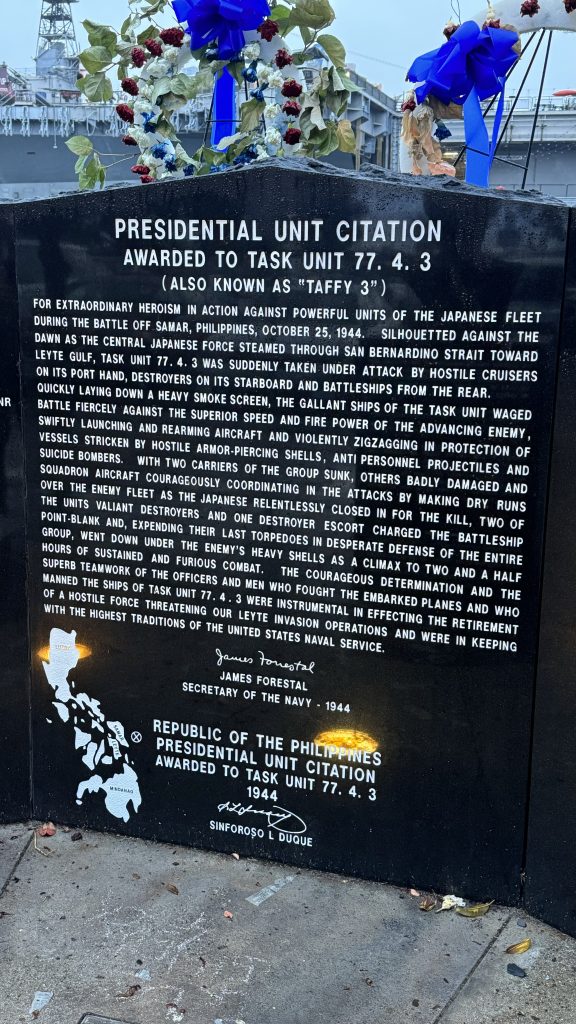

We are wrapping up the Compass convention downtown – photos I took today:

USS San Diego logged 300,000+ nautical miles around the Pacific Ocean and earned 18 battle stars during WWII

Salute to Bob Hope

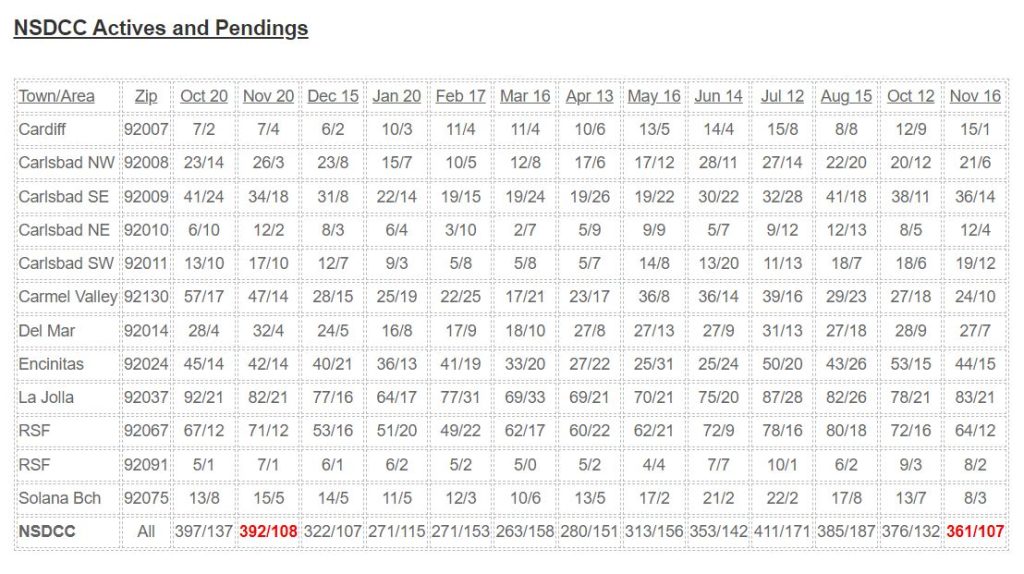

With multiple wars, raging rates, and lawsuits flying everywhere, it sure feels like chaos and doom are prevailing. But underneath it all, our local market looks a lot like it did last year at this time.

Keep your head down, and keep pedaling!

I am willing to take the stand if it will help the realtor commission lawsuits, but the defense might have second thoughts. The complaint is that realtors have conspired to force sellers to pay a standard, non-negotiable commission rate to the buyer’s agent. My testimony could go like this:

Plaintiff Attorney: You look like you’ve been around a while. Have you ever sold a house to a buyer that cost less than $100,000?

JtR: Yes

PA: Was the commission rate offered by the seller and publicized in the MLS in the 2.5% to 3% range?

JtR: Yes

PA: Have you ever sold a house to a buyer that cost more than $2,000,000?

JtR: Yes

PA: Was the commission rate offered in the MLS in the same 2.5% to 3% range?

JtR: Yes

PA: Have you ever sold a house to a buyer on the first day you met them?

JtR: Yes

PA: Has it ever taken one to two years to sell a house to a buyer?

JtR: Yes

PA: Were the commissions in both cases in the same 2.5% to 3% range?

JtR: Yes

PA: As a buyer-agent, have you ever negotiated your commission rate with the seller or listing agent?

JtR: No

PA: No? Why not?

JtR: It is strictly forbidden by the rules.

PA: The rules? What rules?

JtR: The NAR Code of Ethics forbids any negotiation of the buyer-agent’s commission paid by the seller.

PA: Is that the strict Code of Ethics that all NAR Realtors abide by, and what makes them different then all other licensees? The Code of Ethics that NAR has advertised on TV ad nauseum for decades?

JtR: Yes

PA: Judge, I rest my case.

A columnist reflected on history to help measure whether it’s a seller’s market, or a buyer’s market. I like it!

House-hunting’s transformation includes several market trends including people moving less often, consumers accessing detailed market info, near-instant cash buyers and tighter lending standards. Maybe the buyer/seller-market math should morph, too.

From 1990 through 2006, just before the bubble burst, California was a “buyer’s market” in 49 percent of all months and a “seller’s market” 17 percent of the time — using the traditional 6-month/3-month template and Realtor data.

Looking at the past 12 post-crash years — assuming you’d want to match that pattern — a buyer’s market would be 3.25 months-plus of supply and a seller’s market would be 2.25 months or less.

This evolving gap in homebuying supply is another reminder of today’s steep house-hunting challenges.

Link to the Full Article with dataCurrently there are 359 active detached-home listings between La Jolla and Carlsbad, and last month there were 140 sales. The 359/140 = 2.56, which, by the new definition, is pretty close to a seller’s market!

Yesterday, 2,400 Compass agents came to the Rady Shell to hear CEO Robert Reffkin discuss the accomplishments of his clients, the agents. Here are this year’s facts to plug into our presentations:

Compass #1 in sales volume nationwide last two years.

Compass agents sell 2.5x the average agent.

Retention – 98% of Compass agents stayed last year, and 300 who left have come back.

$1.5 billion invested into the agent/client platform.

500+ people in the engineering department improving tech daily.

$1.0 billion in Compass Concierge money spent to maximize the sales price for sellers.

$1 trillion in sales volume in less than ten years.

High tech and high touch!

The support that Compass agents receive from the brokerage enables us to be more effective with helping our clients, and run our businesses with high efficiency!

Robert is one heck of a leader. This year, he has visited 40 metro areas to meet with agents in most of the 200+ Compass offices. Then on the weekends, he takes his wife and three little kids to open houses around the NYC area in support of Compass agents – including on Mother’s Day!

But in the end, it is up to the individual agents to perfect their own presentations. The best thing any leader can do to support highly competitive people is to create a contest!

There will be local, regional, and national prizes for the agents who deliver the most buyer-broker agreements and sales in 2024 – with the top ten agents being flown to NYC for dinner at Robert’s home!