Billy Gibbons @ Blues Fest

Billy is a minister and he married a couple back stage right before Saturday’s show (I saw the photo), then cranked out a great set – here’s how it started for those of you who missed it:

Billy is a minister and he married a couple back stage right before Saturday’s show (I saw the photo), then cranked out a great set – here’s how it started for those of you who missed it:

Chris asked how the current environment compares to the 2008 downturn.

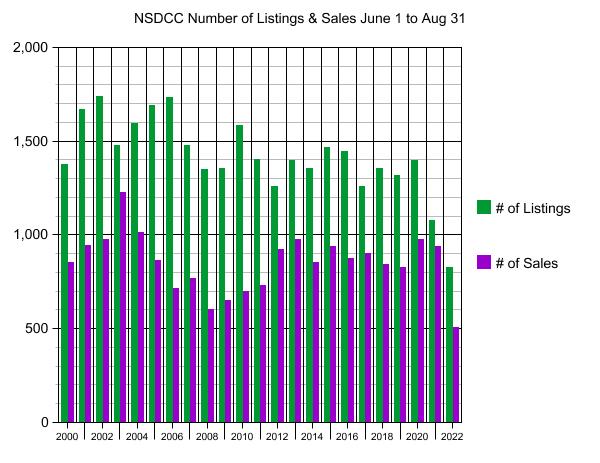

In the summer of 2008, there were only 601 NSDCC sales between June 1st and August 31st, in spite of there being 1,348 listings that summer. For the next two years, the number of listings far exceeded the number of sales, and in the 2008-2010 period there were twice as many listings as sales. The 2010 ratio was the worst at 2.3 to 1.

This summer we only had 825 listings, and 504 sales, which is a 1.6 to 1 ratio!

The 2022 sales were 16% lower than the previous record in 2008, but there were 39% fewer listings!

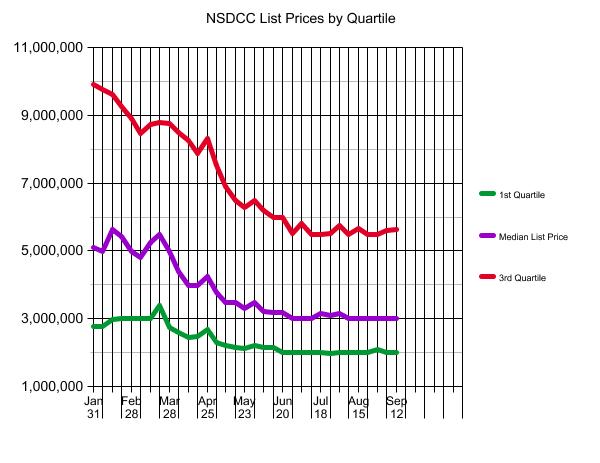

We’ve never had so few listings to consider. Now that the Fed is making it so obvious that they intend to cause a recession, more potential sellers – who tend to casually read the headlines only – will delay their decision to move. Does anybody HAVE to move in 2023? Every potential seller will give it a second or third thought if they believe it will cost them several hundreds of thousands of dollars.

The NSDCC inventory next year will be the lowest ever – even Ray Charles can see that coming.

This Encinitas Ranch home was listed for $3,499,000 on March 29th – which was the week rates started going up – and had no price reductions. After 112 days on the open market, they found a buyer who closed in less than 30 days (Sept.12th) for $3,390,000 cash, which was 3% under the list price.

The buyer’s dilemma: If you are like most buyers, you are turned off by at least 90% of the inventory.

There are probably only one or two listings per month that are nice enough to capture your interest – can you stay passionate in your pursuit? Will you review every auto-notification of a new listing with the likelihood of 85% to 95% of them have no chance of being a possibility for you?

For some, and perhaps for many, it will be easier to just pay within 3% of the list price for a stale old listing. Buy the house and get settled. Pour another 5% to 10% into it during the first year to make it your own.

It’s just money.

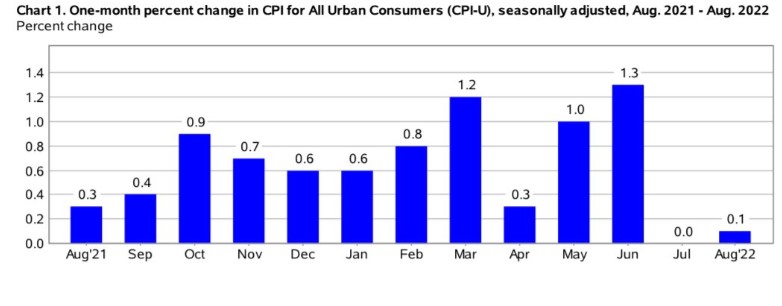

The latest CPI number is out today, and the over-reaction will put more pressure on mortgage rates. They are probably going to be around the 6% range for the foreseeable future.

Let’s predict the NSDCC monthly sales count for the rest of the year.

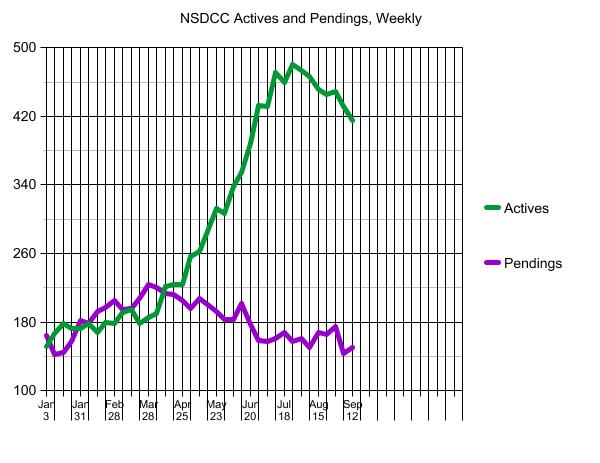

Today, we have 411 active listings, and we are back to the environment where we can expect that only 60% of those have a chance of selling. It’s probably too late for any active listing to close in September, so let’s sprinkle those 247 probable sales over the next three months, or 82 per month.

There are 152 pendings today, and 111 of those went pending before September 1st. They have released all contingencies on most of those, but let’s say only 100 actually close, and 90 are September closings.

Of the other 41 listings that just went pending, only half of them will close, or 20.

There have been 45 sales already close in September, so adding the two is 90 + 45 = 135 sales this month. Last September we had 269 closings.

NSDCC Monthly Sales, estimated:

September: 135

October: 110

November: 90

December: 90

4Q22 = 290

There will be other new listings over the next three months that will close, and it would be great if every month has 100+ closings – so the above is hopefully the worst-case scenario. But even if we have 300 or more closings in the fourth quarter, look at how that compares to recent NSDCC history:

4Q21 = 636

4Q20 = 977

4Q19 = 681

Even though the month-over-month change in the CPI looks very healthy, the panic will ensue and the real estate markets shut down until February….and probably get off to a slow start then.

People still want to buy, and people still want to sell. Everyone will just be waiting around until February, hoping something will be different!

We opened escrow today on my first contingent sale in 2+ years – where my buyer has to sell their home to purchase the subject property.

There were two offers submitted – and BOTH were contingent upon selling another property!

Thankfully, the house we’re going to sell is a single-level home in Aviara, which was well-known to the listing agent – plus I submitted my price, a thorough set of comps, and photos to help him with the decision.

It means we’ll have an open-house extravaganza coming this weekend, and get to test the demand for a prime one-story home with all the extras….including an attractive price! Stay tuned for more on Thursday!

There were 31 and 38 new listings between La Jolla and Carlsbad in each of the last two weeks, which is incredible – the last time we had those numbers was in the beginning of January! As recently as 2019, the number of new listings in the middle of September were 100+ per week.

The NSDCC monthly sales counts will be crushed for the rest of 2022 – there will probably be at least two months when there will be fewer than 100 sales. There have been 40 NSDCC sales so far in September, and only five of them closed over the list price (with two of those at +$1,000 over or less).

Will they be the superior homes where the sellers held out, and buyers paid retail? Or will they be the homes where sellers didn’t Get Good Help, and they give away their home in a panic?

The biggest problem is that the comps used to price homes in 2023 will be fewer and farther between, which will mean that we’ll get off to a slow start in the first quarter as everyone does the wait-and-see.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

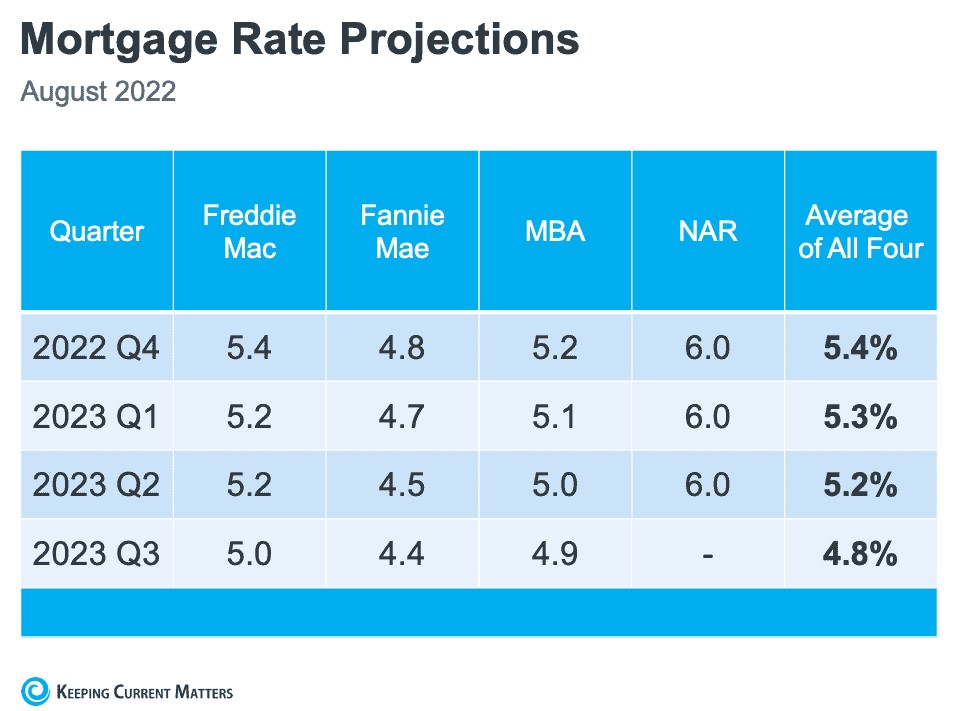

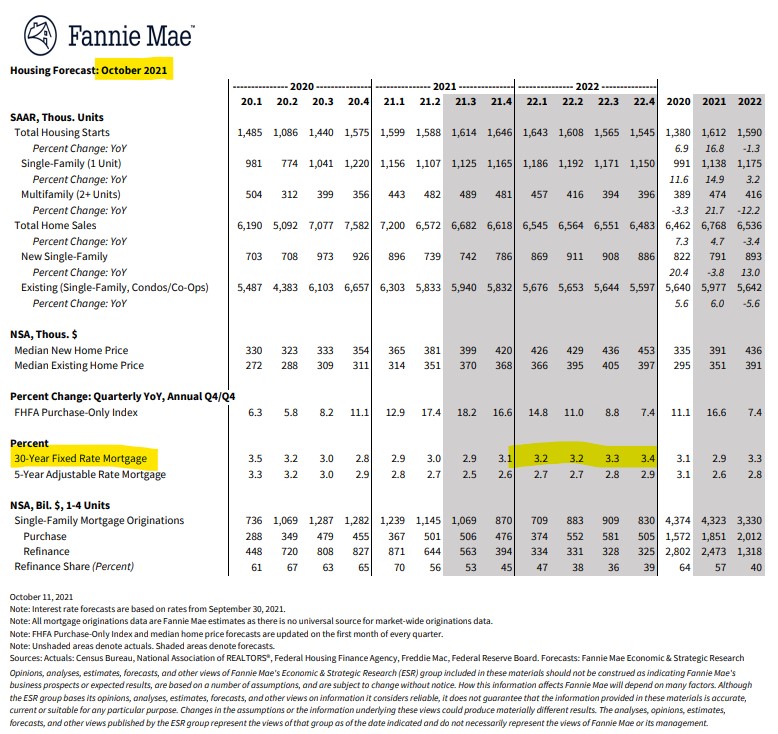

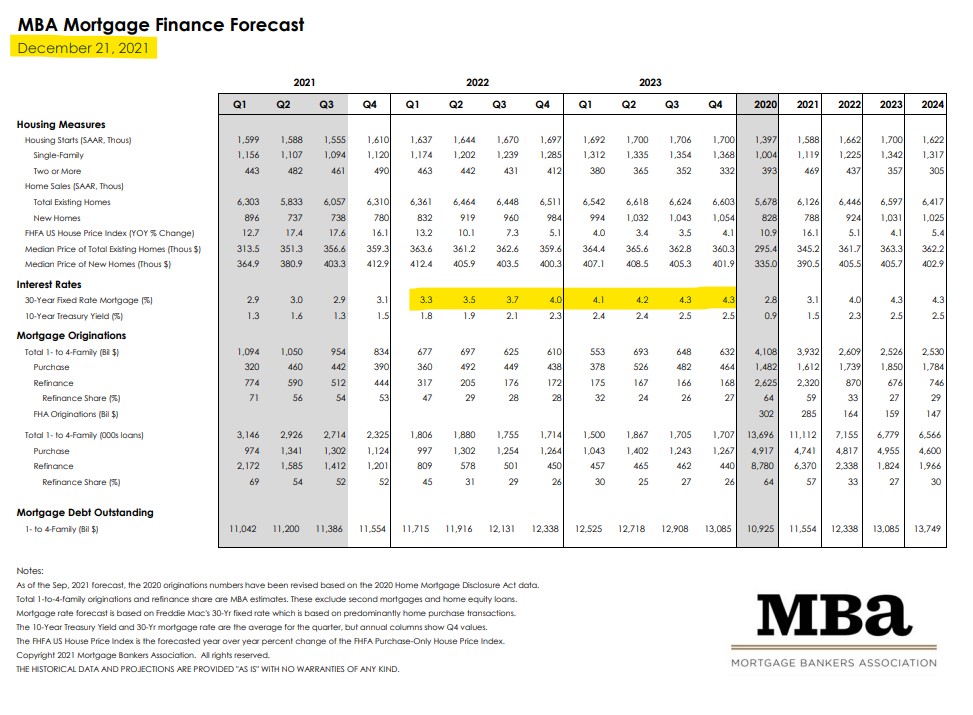

If rates would stay around 5% over the next four quarters, the market should digest it and get comfortable with the new era. But how reliable are these experts? After all, they are the mortgage business – shouldn’t their forecasts be pretty close? Well, hmm, no:

I had mentioned in the comments section that I showed a house on Labor Day that was priced at $2,195,000. The temperature was so hot that I literally said to my buyers that no agents would be working on the holiday, let alone writing offers, so we should have an easy path to escrow. We wrote a full-price offer and expected the seller to sign it on Tuesday.

Donna suggested that I call the listing agent to see if there were any other offers. I shrugged it off, thinking there weren’t going to be any other offers – heck, the market is dying a slow death, right?

So Donna called, and found out that there was an offer, and it was over list price.

By late Tuesday, there were SEVEN offers.

It felt like 2021 all over again as the listing agent gathered the highest-and-best offers from the contestants. Yesterday, she revealed that the decision was going to be between my buyers and one other, and that we were in second place.

We had bumped our offer to $2,450,000, and that wasn’t enough to win? Wow!

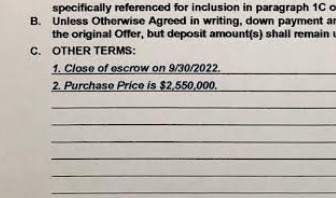

I asked her to tell me the number to beat…..and she did, and sent me the document to prove it (snip above).

Ultimately my buyers decided not to go higher. But I complimented the agent for her transparency, and told her that I wish every listing agent would do that. I guess it’s possible with blind bidding that a buyer might go wild, but we were already 12% over the list price in a non-frenzy environment. It’s much more likely that my buyers would go higher if they had a number to hit, and be able to say yes or no, rather than having to grope around in the dark trying to guess what it would take to win.

Congratulations to the seller and listing agent, and bravo – job well done.

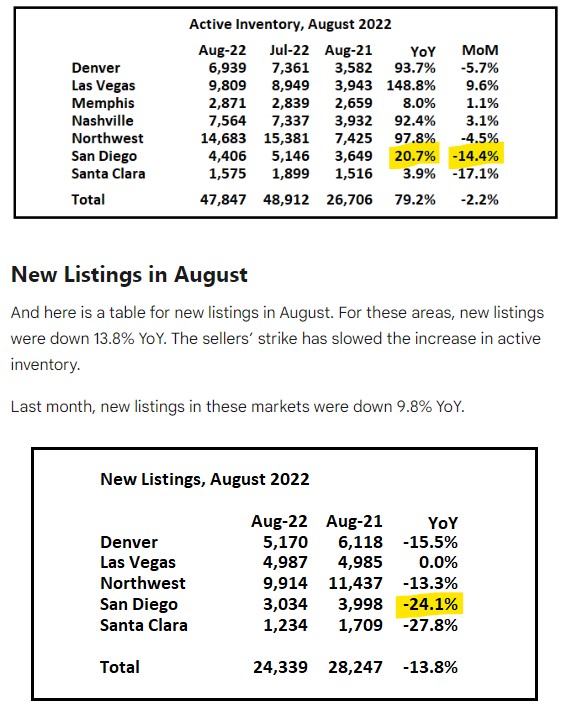

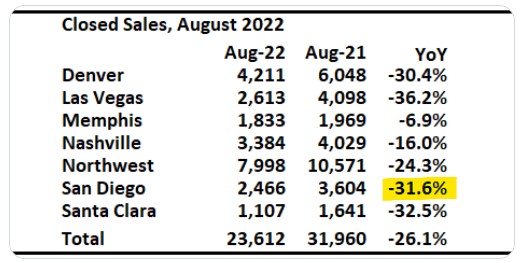

Above, Bill shows how the number of new listings is dropping off in San Diego.

Yes, in the top chart, there were 20.7% more active listings YoY because you can wrongly price a listing today. Last year, just about everything was selling, which is very unusual!

In August, 2019, there were 3,007 detached homes listed for sale in San Diego County, and 67% of them sold. Last August, there were 2,608 detached homes listed for sale, and 83% of them sold!

We don’t want to get alarmed by any comparisons to the Uber-Frenzy of 2021.

The counts are a little different in this graph, but you can see the huge differences between the pandemic inventory, and normal times.

Today, there are 2,859 active listings of detached-homes in San Diego County. I won’t be looking for the panic button until that number gets over 6,000 – which may never happen again:

As recently as 2018, there were 10,000+ houses for sale, and today there are fewer than 3,000?

If there was any panic, it would be because the market isn’t correcting – it’s shutting down:

https://calculatedrisk.substack.com/p/1st-look-at-local-housing-markets-86d

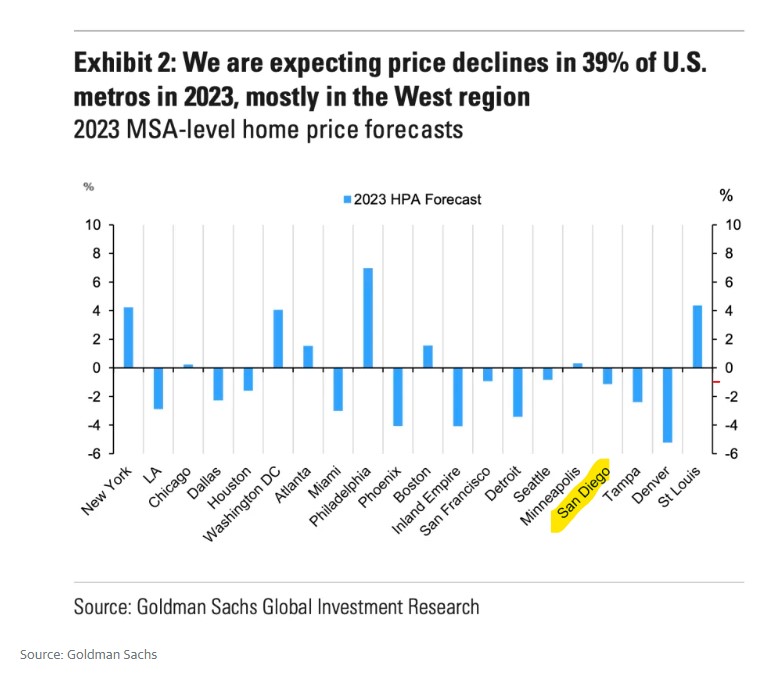

I said: 0% appreciation for NSDCC (La Jolla to Carlsbad) in 2023.

Zillow says: +1.5% to +1.9% for NSDCC.

Goldman Sachs says: -1% for San Diego.

Moody’s has San Diego County home prices changing –3.65% between now and the end of 2023, and then -2.9% by the end of 2024.

What do you say?

Hat tip to shadash for sending this in:

https://finance.yahoo.com/news/home-prices-fall-goldman-sachs-expects-104729829.html