Every Kinda People

Ooh, it takes every kind of people

To make what life’s about, yeah

Every kind of people

To make the world go ’round

Ooh, it takes every kind of people

To make what life’s about, yeah

Every kind of people

To make the world go ’round

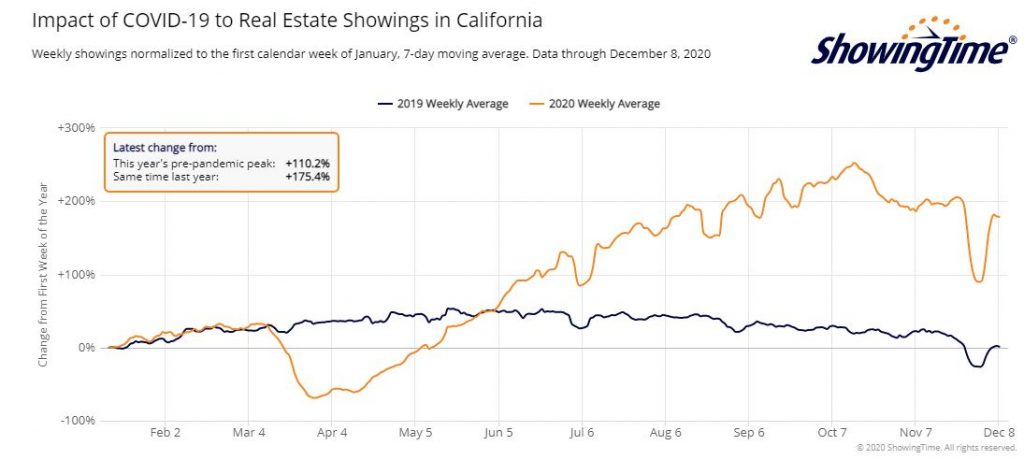

Last year, the showings in early December ended up about where they were during the previous January. But this year we had a huge post-Thanksgiving bounce, and are now 175% above the same time last year!

Next year is going to go nuts!

It’s costing the taxpayers more than $7 billion, but nobody in government wants to be the one who foreclosed or evicted people during a pandemic. I’d guess that a Covid loan-modification program is coming next:

Today, to help borrowers at risk of losing their home due to the coronavirus national emergency, the Federal Housing Finance Agency (FHFA) announced that Fannie Mae and Freddie Mac (the Enterprises) will extend the moratoriums on single-family foreclosures and real estate owned (REO) evictions until at least January 31, 2021. The foreclosure moratorium applies to Enterprise-backed, single-family mortgages only. The REO eviction moratorium applies to properties that have been acquired by an Enterprise through foreclosure or deed-in-lieu of foreclosure transactions. The current moratoriums were set to expire on December 31, 2020.

“Extending Fannie Mae and Freddie Mac’s foreclosure and eviction moratoriums through January 2021 keeps borrowers safe during the pandemic,” said Director Mark Calabria. “This extension gives peace of mind to the more than 28 million homeowners with an Enterprise-backed mortgage.”

Currently, FHFA projects additional expenses of $1.1 to $1.7 billion will be borne by the Enterprises due to the existing COVID-19 foreclosure moratorium and its extension. This is in addition to the $6 billion in costs already incurred by the Enterprises. FHFA will continue to monitor the effect of coronavirus on the mortgage industry and update its policies as needed. To understand the protections and assistance offered by the government to those having trouble paying their mortgage, please visit the joint Department of Housing and Urban Development, FHFA, and the Consumer Financial Protection Bureau website at cfpb.gov/housing.

Check out our new listing!

725 Grand Ave., Carlsbad

2 br/2 ba, 1,206sf

LP = $1,199,000

Unique Luxury opportunity in the Heart of Carlsbad Village! Whether you want to live near the beach or are seeking a second home, this seaside condominium offers all the comforts you desire. Newly built in 2019, this sleek single-level home has been extensively upgraded with California Mid-Century-Modern upgrades with no expense spared. The modern open floor plan features clean, white quartz countertops, a chef’s kitchen with large island and Bertazzoni appliances, and great room that opens up to a large deck overlooking the future Carlsbad Grand Ave Promenade – a pedestrian-friendly improvement that will expand the walking and biking paths out front. The master bath has first class upgrades with a heated Toto and towel warmer, plus an extra-large walk-in closet. The 2nd bedroom features a custom-built murphy bed, closets and office space. Other upgrades include electronic window coverings, huge patio out front, and private garage space and entrance. Walkable to all your favorite destinations in the village, and stick your toes in the sand within minutes – here’s your chance to be a part of the Urban Beach Lifestyle!

https://www.compass.com/listing/725-grand-avenue-carlsbad-ca-92008/668092491986598769/

Video that describes the Grand Avenue Promenade in depth:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The experts at realtor.com think our pricing will go up 5.5% next year, and the folks at Zillow have predicted around 8% for areas between La Jolla and Carlsbad. I think we’ll be hitting +6% to +8% by summertime, so let’s put that aside and look at the number of sales predicted here – because it all starts with inventory.

Here are the annual NSDCC sales from the last big frenzy year, 2013, plus last year and the projected numbers for 2020 (I added the December, 2019 count to the first 11 months of 2020) – to which I multiplied by the 11.3% forecast by realtor.com to get the 2021 listings and sales:

| Year | ||||

| 2013 | ||||

| 2019 | ||||

| 2020 | ||||

| 2021 (f) |

For sales to increase next year, we need more lower-priced homes to sell – there aren’t enough buyers to pick through the hundreds of homes who are asking $2,000,000+ (there are 361 for sale today).

What are the lower-priced homes? The older, smaller homes owned by boomers for decades.

For 2021 to reach the peak frenzy of all-time, we will need the boomer liquidation to commence – or the biggest move-up event in history, which is unlikely because contingent sales get no traction with listing agents. Move-uppers have to buy the dogs to get a contingent deal to stick – and they aren’t moving unless they can really upgrade into a much nicer home.

Prop. 19 will reduce or eliminate some generous tax breaks that families get when property is transferred between parents and children. But it won’t change the rules for trusts themselves.

Some transfers are exempt from reassessment. Transfers between spouses are always exempt.

Another exclusion applies to transfers between parents and children, and between grandparents and grandchildren if the parents are not alive. For simplicity, we’ll assume here the transfer is from parents to children, but it also works in reverse.

Under current law, parents can transfer — by sale, gift or inheritance — their primary residence to their children and it won’t be reassessed, no matter how much it’s worth or how the kids use it.

In addition to a primary home, each parent can transfer “other property” — such as a vacation home, rental or commercial property — and exempt up to $1 million in assessed value (not market value).

Prop. 19 changes these rules on parent transfers that take place after Feb. 15 in the following ways:

Prop. 19 is not retroactive and won’t apply to any property until it is transferred (or deemed transferred) after Feb. 15.

There were 37 new SFR listings between La Jolla and Carlsbad since last Monday (and 58 new pendings!). Only one of the new listings went pending though – mine on Sitio Corazon where we had 25 showings and three offers. We’re opening escrow today at well over list price!

The market would be hotter if there were more active listings.

There are only 47 houses for sale listed under $1,500,000, and the NSDCC median list price today is $3,486,000. It’s a great time to be a high-end buyer!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2020 was a truly unprecedented year. With it behind us, let’s look ahead at three housing market trends that are likely during the next three years.

First, exceptionally low mortgage rates are likely to be around for an extended period. We expect 30-year fixed-rate loans to remain below 3% during early 2021 and average about 3.2% during the next three years. This would be nearly a percentage point lower than the average over the 2010-2019 decade. These low rates will provide an excellent opportunity for families with good credit to buy or refinance homes.

Second, Millennials will add substantial demand for housing over the next few years. Looking at America’s population by age, the largest numbers of Millennials are those aged 28 to 30. With 33 as the median age of recent first-time buyers, demographic forces will add an important tailwind to home-buying demand.

In fact, we expect home sales relative to the housing stock, a measure of home “turnover”, in 2021 to 2023 to be above the average annual turnover rate of the prior two decades.

Read full article here:

https://www.corelogic.com/blog/2020/12/three-year-housing-and-mortgage-outlook.aspx

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Attention multi-gen buyers! Our new listing in La Costa Oaks has the master suite on the first level plus the perfect granny flat too! The flex space upstairs includes two regular bedrooms, two full baths, a massive bonus room, plus library/gaming loft too, all situated on an 8,500sf lot which is rare for newer homes in Carlsbad. Full solar (18 panels!) with battery, immaculate garage with workshop, and Encinitas schools too!

7168 Sitio Corazon, Carlsbad

5 br/5 ba, 3,352sf

YB: 2011

HOA fee = $241/month

Mello-Roos = $800/year

LP: $1,399,000

LP: $1,470,000 – Sold for $91,000 over list!

We represented the sellers in a three-offer bidding war!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Lenders learned their lesson last time – instead of foreclosing on non-payers and risk losing money, it’s better to extend and pretend. There won’t be a time coming where we are flooded with REOs….ever again:

Mortgage forbearances for homeowners affected financially by the pandemic declined slightly over the past week. Black Knight said that there were 200,000 plans scheduled to expire at the end of November, probably accounting for the majority of the 39,000-loan downturn in the various forbearance programs. Another 1 million plans are due to expire at the end of this month.

As of December 1, there were a total of 2.76 million loans remaining in plans, 5.2 percent of the 53 million active mortgages in servicer portfolios and representing $561 billion in unpaid principal. Eighty-one percent of those loans have had their terms extended at some point since March.

The number of GSE (Fannie Mae and Freddie Mac) loans in forbearance dropped by 25,000 during the week, leaving a total of 967,000 homeowners remaining in plans. This is 3.5 percent of the companies’ combined portfolios. FHA and VA loans decreased by 14,000 units to a total of 1.118 million or 9.2 percent of those loans. Loans serviced for bank portfolios or private label securities held steady at 677,000 loans or 5.2 percent of the total. There are 91,000 fewer loans in forbearance plans than one month ago, a 3.2 percent decline.

http://www.mortgagenewsdaily.com/12042020_covid_19_forbearance.asp

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~