Thank You Vietnam Vets

Veteran’s Day

The USS Carl Vinson returned to its home port of San Diego this summer after a lengthy deployment in the Gulf region. Here is a great video with interviews of crew members – thank you for your service!

https://en.wikipedia.org/wiki/USS_Carl_Vinson

Carl Vinson returned to San Diego on 4 June 2015. Over the course of the deployment, supporting strike operations in Iraq and Syria, CVW-17 successfully flew 12,300 sorties, including 2,382 combat missions and dropped more than half a million pounds (230 tons) of ordnance against ISIS.

On 14 August 2015, Carl Vinson began a planned incremental availability (PIA) period at Naval Air Station North Island. The ship is receiving more than $300 million worth of improvements over the next six months during this modernisation.

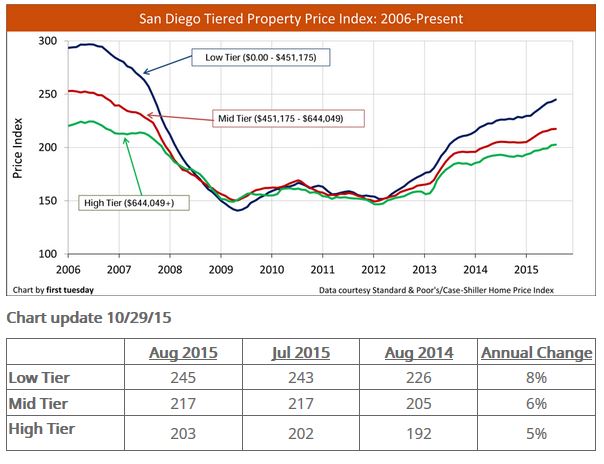

San Diego 2015 Home Pricing

http://journal.firsttuesday.us/california-tiered-home-pricing-2/1592/

The San Diego lower-end market has been red hot this year!

No big surprise – when mortgage rates are in the 3s, houses priced under $500,000 have monthly payments that are similar to their rents.

But the high-end market is holding up well too, suggesting that buyers will find a way to pay more for the better-quality areas. Last year got a little sluggish, but as rates dipped back into the 3s, the buyers kept coming:

NSDCC Detached-Home Sales

| Year | ||

| 2012 | ||

| 2013 | ||

| 2014 | ||

| 2015 |

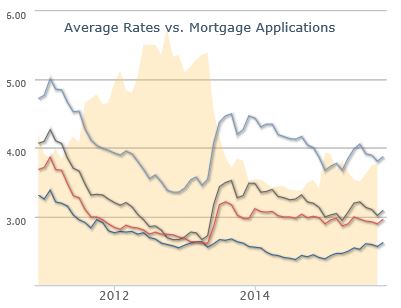

Mortgage Rates Higher

Interest rates have been moving higher for the last six days, and have priced in the 1/4% increase that the Fed is expected to do next month. If the Fed does finally bump the Fed Funds rate, there should be some relief that’s it’s over, but don’t expect that lenders will give much back.

From MND:

http://www.mortgagenewsdaily.com/consumer_rates/529211.aspx

Mortgage rates continued pressing into the highest levels since July–themselves the highest levels of the year. In just over a week, the most frequently quoted conventional 30yr fixed rate has moved from 3.75 to a range of 4.0-4.125%. Most lenders are quoting the same contract rates as Friday, with the weakness instead seen in the form of higher upfront costs.

What’s with all the drama? In a word: the Fed. There had been some remaining disagreement about when the Fed was most likely to begin raising rates after nearly 7 years of the record low 0-.25% target. Last Friday’s jobs report helped get everyone on the same page. Unfortunately, the consensus is that the hike is all the more likely. While mortgage rates are not directly linked to the Fed Funds Rate, most interest rates tend to rise when expectations for a Fed rate hike increase.

When rates rise as much as they have and for as many consecutive days as they have, it becomes increasingly likely that they’ll take a break and bounce back somewhat. If you wait to lock, you will feel like a genius if that happens, but you could be looking at significantly higher costs if it doesn’t. In this case, the risk of loss is greater than the potential reward for timing the bounce correctly. Lenders aren’t likely to give back meaningful amounts of the ground we just lost unless the bounce is sustained and substantial.

“Borrowers and loan officers hoping for a fast rebound from Friday’s sell off were disappointed today, as we lost further ground and rates rose slightly. Since October 27th, treasury yields have soared from 2.03% to 2.35%. MBS lost roughly 150 bps during the same period, and our “sub 4%” rates are in the rear view mirror at the moment. At some point, we’ll level off, and perhaps even undo some of the carnage, but until we do, I’ll be advising locking early rather than risking further losses.”

It wouldn’t take much for homebuyer demand to soften a bit. Higher rates, fewer foreign buyers, the lack of good buys, and the holiday malaise could send the market into a slumber for the next 2-3 months.

Inventory Watch

We are wrapping up two full years of tracking the inventory each Monday. The three lower-priced categories are looking like they did in 2013 – about 10% lower than last year. The exception is the high-enders, which is a mess.

There are 391 houses listed for sale priced over $2,400,000, and 20 sold last month. Buyers should be picky!

Click on the link below for the complete NSDCC active-inventory data:

Sunday Sunset

Dangers of Overpricing Your Home

If you don’t have to sell and just want to test the market, is there any harm in listing high? Just because there is no urgency doesn’t mean some nice young family with 2.2 kids won’t come along and love it like you do.

Around 60% to 65% of the listings sell each year.

I like those odds, and I’m happy to list your home and shoot for the lucky sale. As long as prices keep going up, it’s possible!

Here are the potential pitfalls:

The Best Buyers Will Pass – The motivated buyers have seen the comparable listings nearby, and they know the market as well as the agents (or better!). You are left with the casual, inexperienced buyers – the ones who are most likely to fall out of escrow.

The Best Agents Will Pass – Buyers working with great agents will get talked out of paying too much.

Lowball Offers – Don’t be insulted, you knew from the beginning you were pushing the price. You don’t have to take them – but while you have a buyer at the table, you may want to review the results so far and decide if now is the time to make a deal.

Your House Will Be Used to Sell Others – Regardless of your list-price accuracy, you will get lookers – especially when the listing is fresh on the market. Sellers get encouraged, and think a sale must be imminent. But you don’t know if your house is just being used by agents to sell better-priced homes nearby.

New Listings Will Undercut Yours – Neighbors will go to school on your price. When they see that your house is not selling, they will price theirs under yours.

Showings Are a Hassle – The inconvenience of having strangers running through your house with little notice gets old. Keeping the house clean and having to leave the house isn’t convenient – especially if you have kids.

Price is Intoxicating – The higher you go, the drunker you get. Your ego refuses to back down, in spite of the overwhelming evidence stacking up all around.

One-third of the sellers fall into this predicament, and never sell.

For those that don’t mind the risk, let’s go!

Key point – you need a great listing agent. The buyers are skittish, the agents are inexperienced, and the appraisal will take a miracle. Just because you aren’t that motivated doesn’t mean you should compromise on who you hire as your listing agent – Get Good Help!

Grand Opening

Today is the first day of sales at this new tract next to Black Mountain Park – take your favorite realtor with you!

The middle plan:

PQ Follow Up Part 2

The process of selling a house has many variables – let’s keep examining.

What were the comps used to determine the price?

The most important thing about evaluating the comps is to see them through the eyes of the buyers. I cannot stress enough how critical this is to selecting an attractive price – every seller has a high opinion about their house, but they’re not the ones buying it. Today’s buyers are looking for any reason not to buy, and they are being conservative.

Consider those thoughts as we progress here:

A. The last sale of this model closed for $612,000 in June, 2014:

http://www.sdlookup.com/MLS-140023602-13493_Chelly_Ct_San_Diego_CA_92129

It had been moderately upgraded to sell, and you could say that the backyard was a more normal setting. My listing on Chaco had superior upgrades, which makes buyers feel good, but they prefer to pay about the same as the last guy for them. This is where over-improving your house for the neighborhood can get you into trouble, price-wise – you’re not going to get a dollar-for-dollar return for the good stuff.

A discerning buyer would probably call them even at best, because they will be tempted to ignore it altogether because of it being old news The San Diego Case-Shiller Index has gone up 6% since, so let’s adjust accordingly, even though no appraiser will use it (they want/need comps from the last six months).

Comp #1 adjusted value = $648,720.

B. This is a 5% larger one-story model in Crestmont that closed for $612,000:

http://www.sdlookup.com/MLS-150041823-8811_Sparren_Way_San_Diego_CA_92129

The original list price was $645,000, but after three weeks they put it on the range $615,000 – $645,000. Eighteen days later, the listing agent found his own buyer who paid $612,000 cash, and it closed on September 16th.

The house only had a couple of upgrades, and my listing had at least $100,000 of improvements. We already mentioned that you don’t get full value, but for the sake of evaluating I’ll assign a 50% credit. It means we need to deduct $50,000 off this comp – but then add back 10% because it was a one-story plan which have been selling for a premium over two-story plans because of the older folks. The ‘cash’ purchase would indicate these buyers were probably elderly on this sale, and they probably ignored or didn’t realize that nobody else was willing to pay $615,000 for this house so they may have been able to grind out a better deal.

Buyers evaluating this sale as a comp may not think that hard, but as a listing agent trying to factor in every variable, I need to consider that the $612,000 sales price here could have been optimistic. But I’ll subtract the $50,000 for improvements and add 10% for one-story.

Comp #2 adjusted value = $623,200.

C. Same one-story model as above that closed for $605,000 two weeks ago:

http://www.sdlookup.com/MLS-150047953-8849_Ellingham_San_Diego_CA_92129

This house was in original condition, so I’m going to subtract a little more – $70,000 – and add back the same 10% even though this was an estate sale by the original owners who paid $150,000 in 1988. The seller was recently widowed and didn’t try too hard to sell, and let’s face it, a quick $605,000 was a big win. It was listed on the range $590,000 to $605,000, and the buyer went direct to the listing agent, but we can call it a mostly-retail sale of a house in original condition.

Comp #3 adjusted value = $595,500.

There are two pending comps to consider too:

D. This 1,486sf one-story with $50,000 in improvements was listed for $635,000 and went pending in five days:

http://www.zillow.com/homedetails/8756-Twin-Trails-Dr-San-Diego-CA-92129/99572944_zpid/

E. This newer 4 br/2.5 ba, 1,733sf house listed the day before us for $674,900, and went pending in 4 days. Hopefully it got bid up:

http://www.zillow.com/homedetails/13347-Russet-Leaf-Ln-San-Diego-CA-92129/16774611_zpid/

The Wild Card

F. This 1,681sf two-story house has $120,000 in improvements with pool and backs to the canyon. It sold for a whopping $730,000, which was above the top of the range ($699-$729) in six days:

http://www.sdlookup.com/MLS-150030194-13587_Calderon_Rd_San_Diego_CA_92129

THE LIST PRICE SUMMARY

My seller has taken a new job out of the area, and wanted a realistic assessment of the market. Many sellers would ignore the rest, and jump on the $730,000 as proof that more buyers will come along and pay the same. But given the rest of the evidence, a normal buyer will throw out the high sale and use the rest as the accurate market data.

The realistic range for my listing was $600,000 to $650,000, and because we had the 100,000 in improvements it deserved to be at the top of the range.

I didn’t have a problem with angryPQneighbor expecting a higher sale – I had every intention of selling it for more. My seller saw my reasoning that pricing the home attractively would create more action and urgency early on, and create a frenzy-like bidding war.

Other Factors:

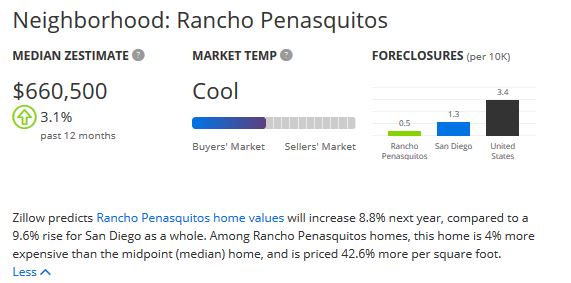

1. Zillow reported lower school scores on the subject property’s zillow page. I addressed them in my remarks, and included snips of the actual scores of 10 for each school in my photo galleries. I think that lends respect to the equation in the buyers’ minds.

2. The zestimate for my listing was $630,000, and after I inputted my listing there, they dropped the zestimate to $614,749. You have to anticipate that bad things will happen that are out of your control. But price fixes everything.

3. Zillow also has this new local market meter that is positive for Rancho Penasquitos in the small print, but the ‘Cool’ and blue color could dissuade buyers from looking at it much harder:

4. The biggest factor in my mind was the experience of the buyers’ agents. Any agent can handle writing an offer on an attractively-priced listing, but the houses priced too high tend to befuddle all but the best agents (who are good enough to lowball you anyway).

It was competitive to the end between the six offers – five submitted their highest-and best offer, and it was close. We took the buyer represented by an agent who had closed 32 sales in the last 12 months. The other agents averaged 8 sales in the last year, which was still pretty good. But if we hit any bumps in the road, I want to take my chances with the most experienced agent.

We still have a long way to go to the finish line. But this is the type of start every seller should appreciate – you got a good price, the hassle of showing the house was over in 6 days, and the chances of it closing are pretty good when the buyers knows he beat out five other contenders!

Get Good Help!