by Jim the Realtor | May 2, 2022 | 2022, Jim's Take on the Market, Why You Should List With Jim, Zillow |

At some point over the last 6-12 months, Zillow started revising their zestimates higher – way higher!

It has been noticed too, and now virtually every potential seller brings their zestimate to the table, and expects to list their home for that amount……or more.

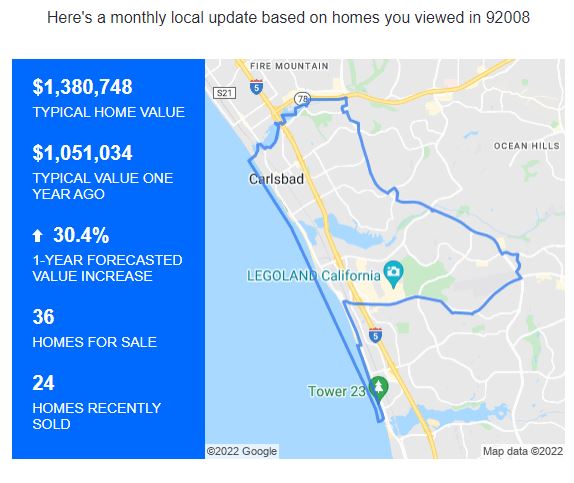

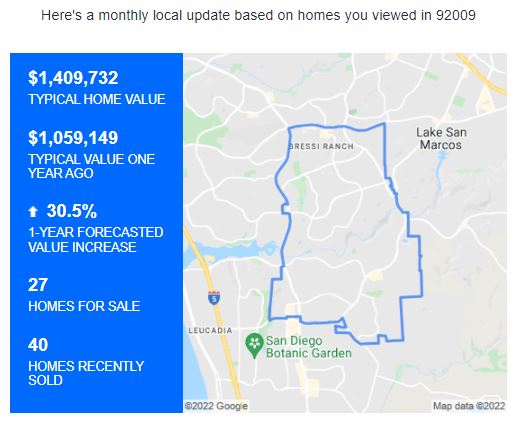

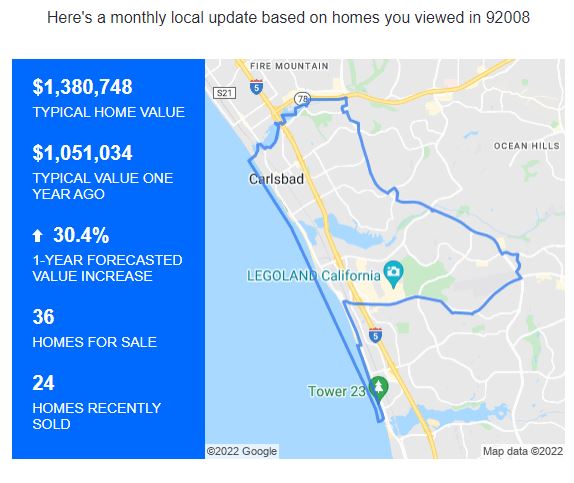

But in the latest Zillow forecasts by zip code, they have SCALED BACK their big percentage increases!

Are they scaling back the zestimates too? If not, the list pricing for the rest of 2022 will be frothy.

Here are their current forecasts, with the previous forecast beside each zip code:

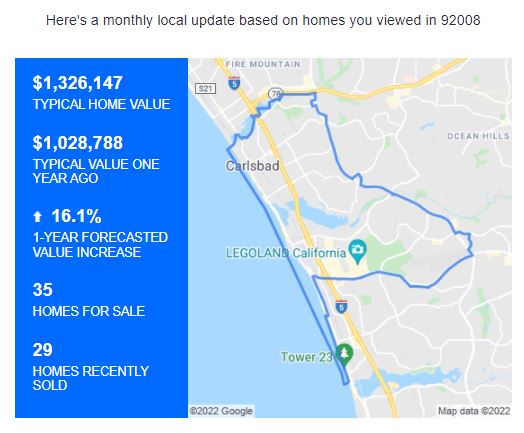

NW Carlsbad, 92008 (+30.4%)

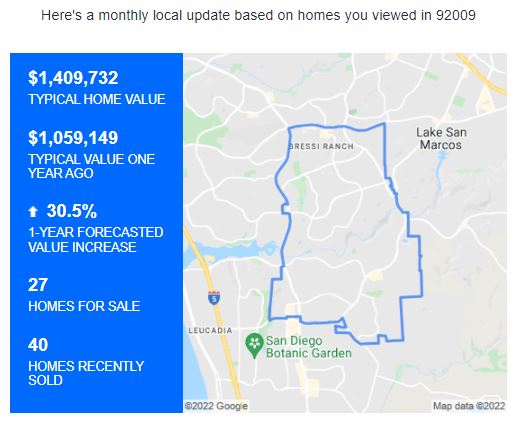

SE Carlsbad, 92009 (+30.5%)

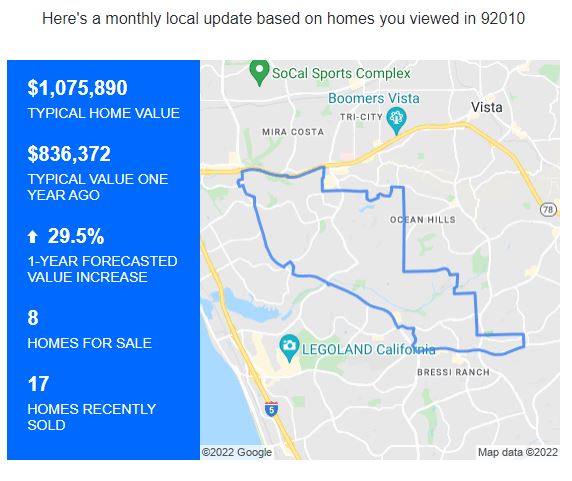

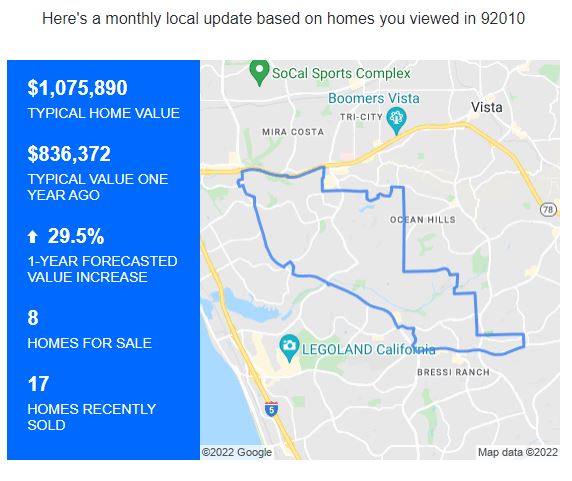

NE Carlsbad, 92010 (+29.5%)

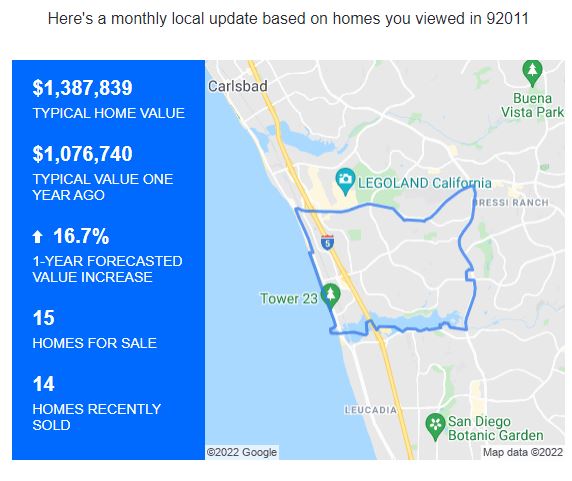

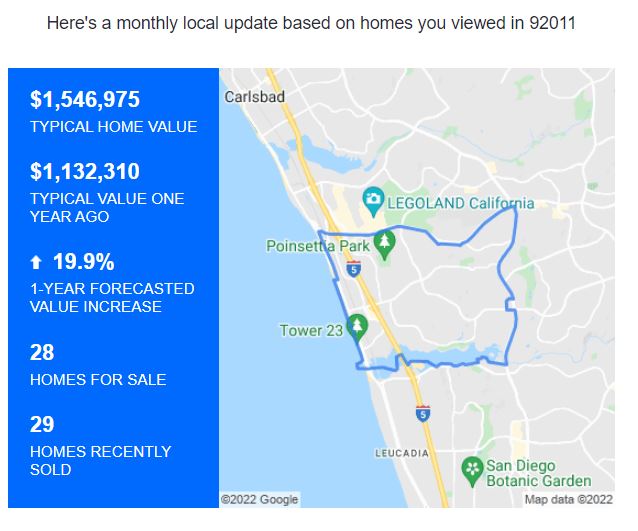

SW Carlsbad 92011

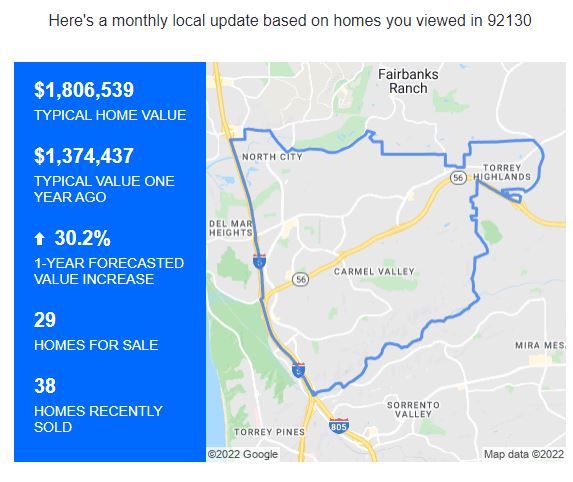

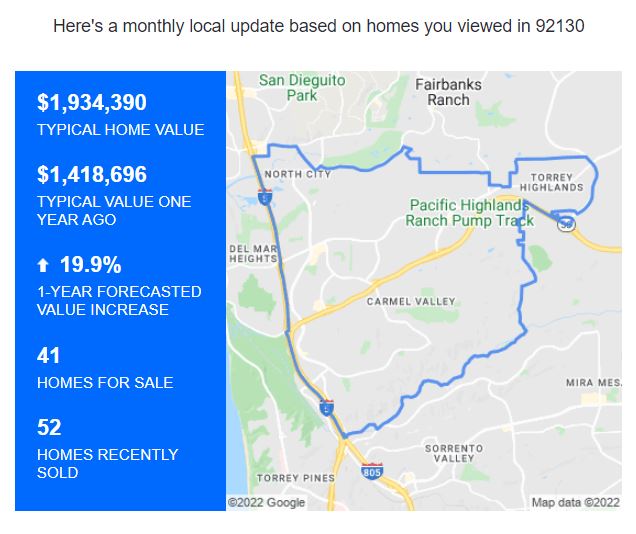

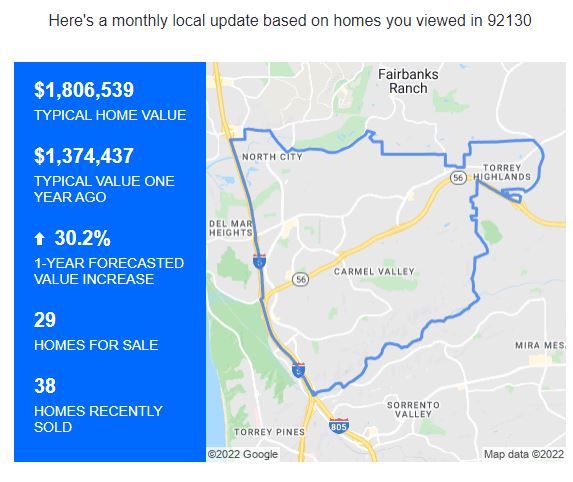

Carmel Valley 92130 (+30.2%)

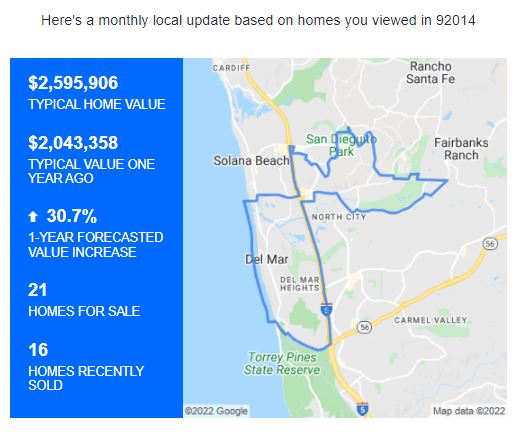

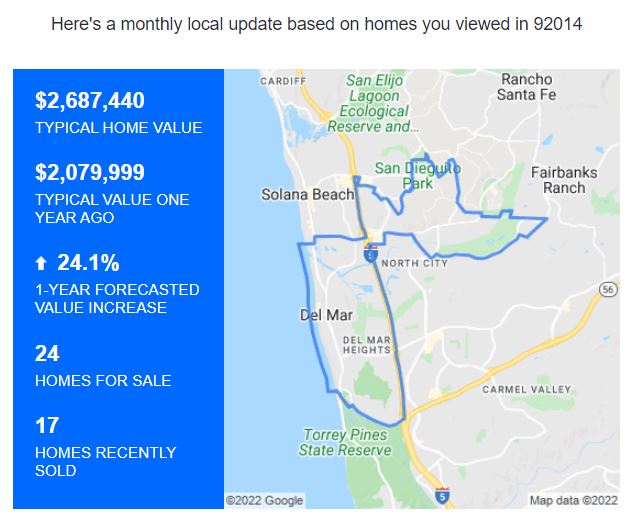

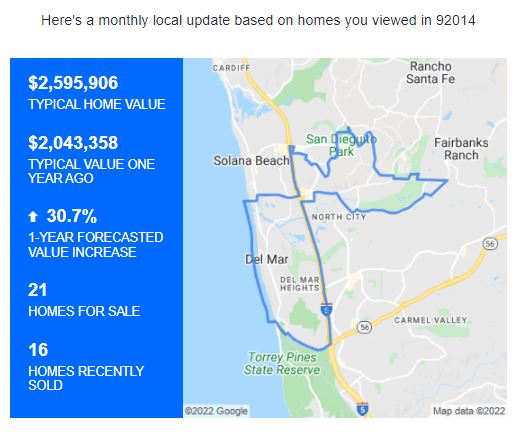

Del Mar, 92014 (+30.7%)

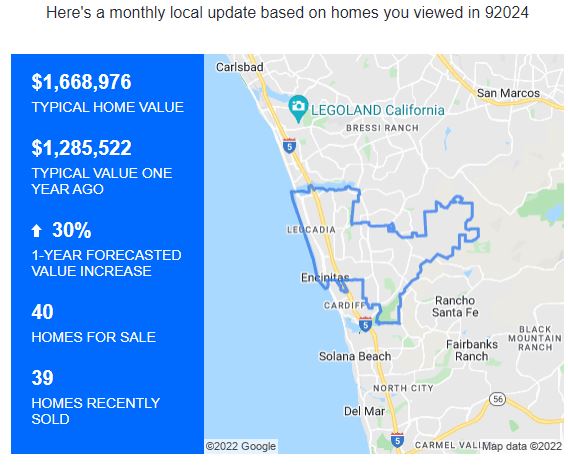

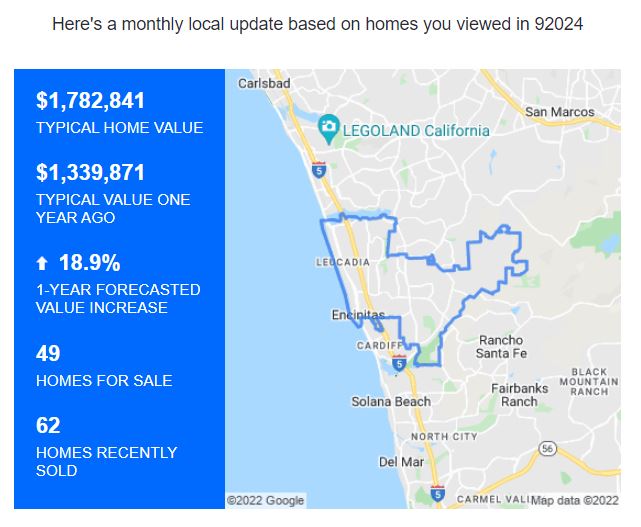

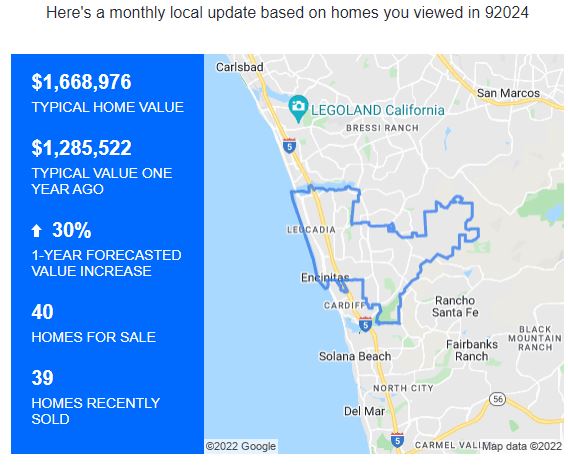

Encinitas, 92024 (+30%)

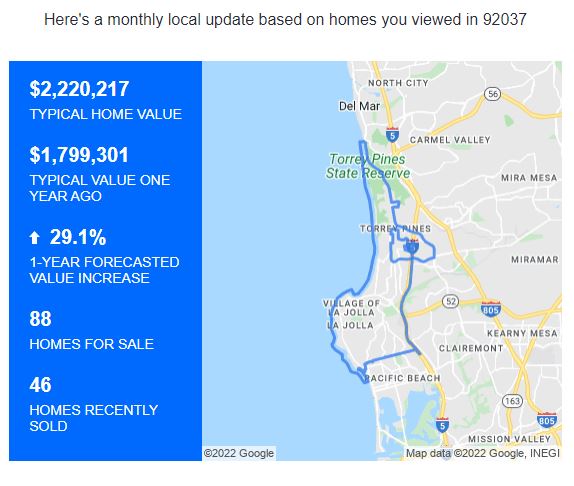

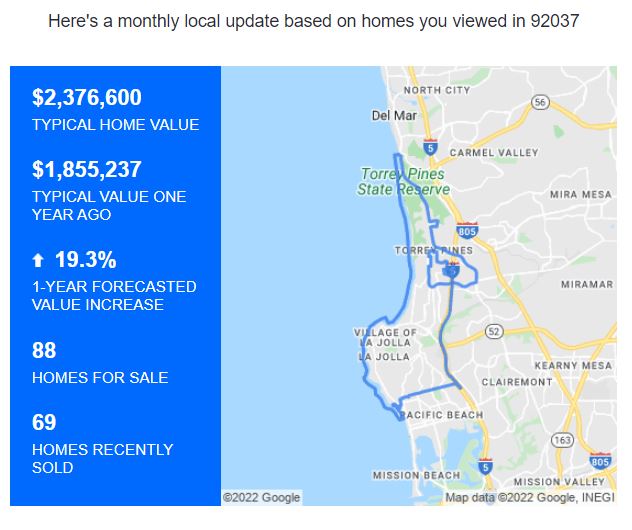

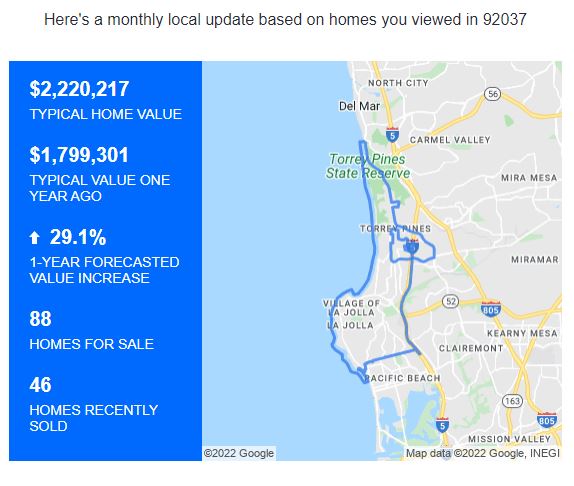

La Jolla, 92037 (+29.1%)

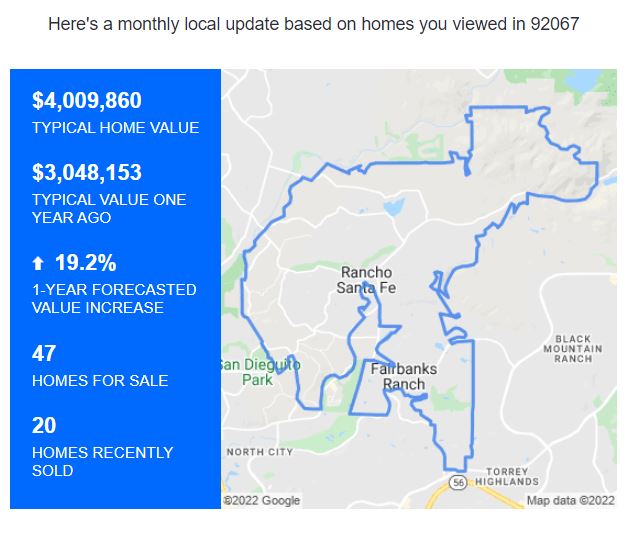

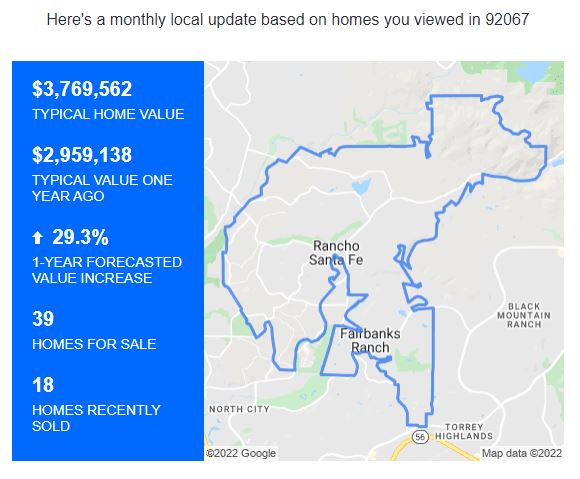

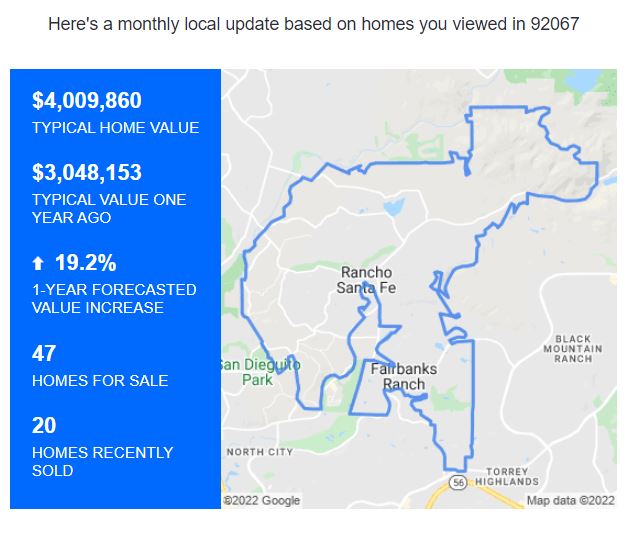

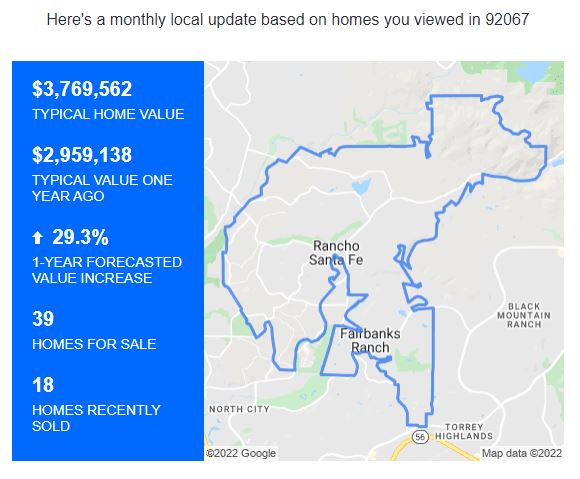

Rancho Santa Fe, 92067 (29.3%)

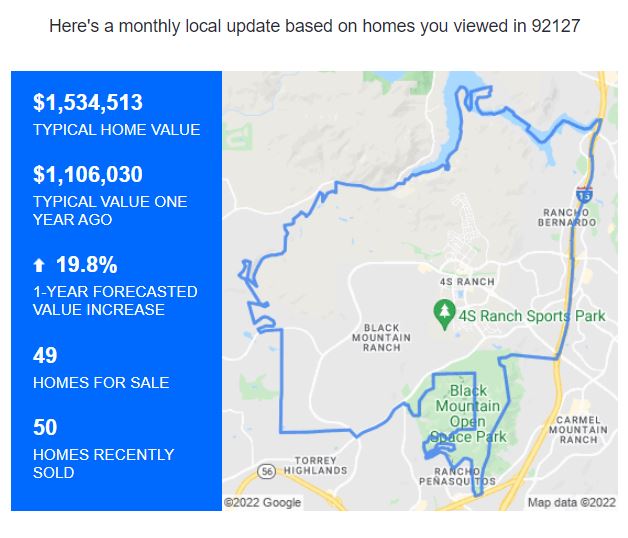

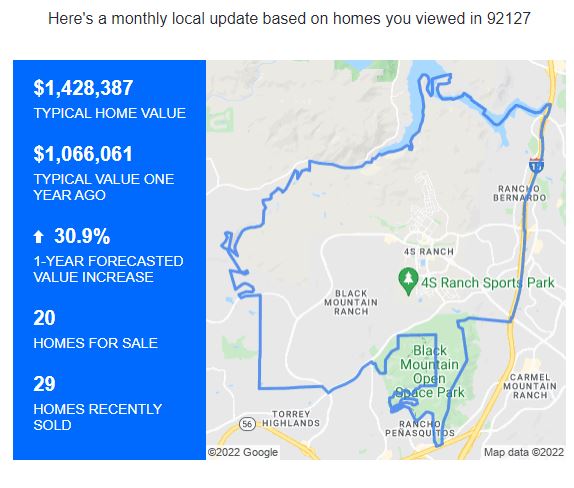

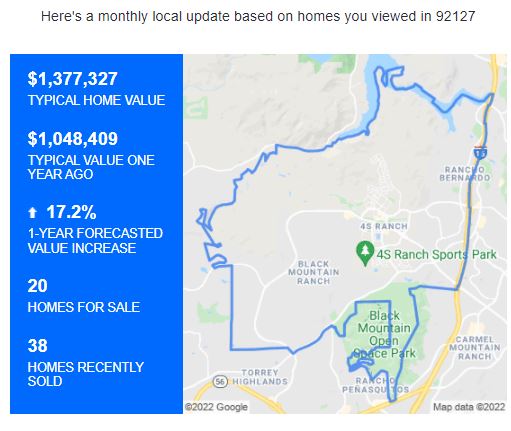

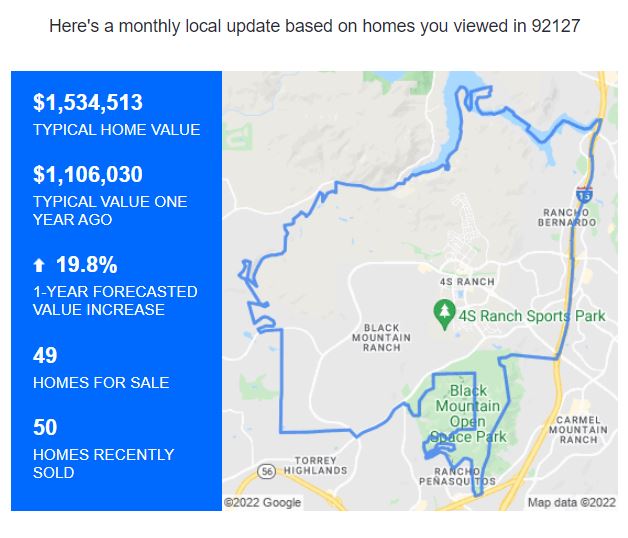

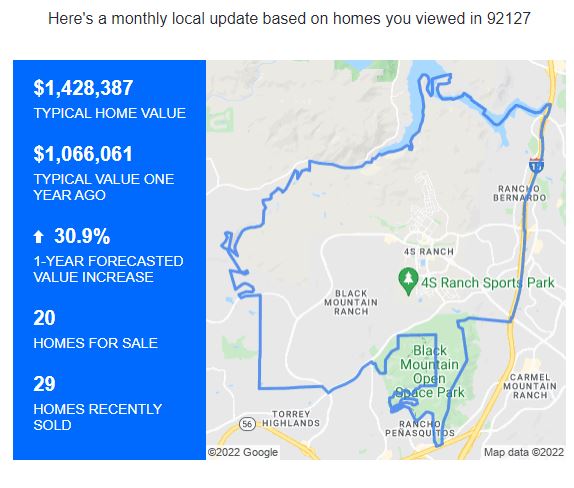

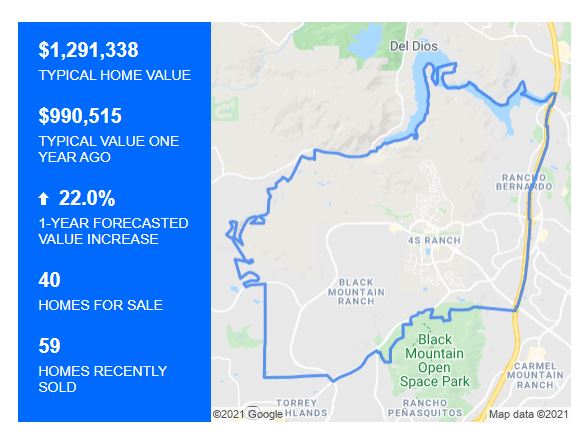

West RB, 92127 (+30.9%)

Previous forecasts here: https://www.bubbleinfo.com/2022/03/01/zillow-now-says-30-appreciation/

They do have something that none of the ivory-tower economists have – the real estate viewer data.

They have lowered their local 1-year pricing forecasts by 5% to 11% in every zip code, which must be resulting from their algorithms sizing up the customer viewing data….doesn’t it?

Are they lowering the zestimates too?

It is hard to track because once a home goes on the MLS, their zestimate is automatically adjusted to within a couple of bucks of the list price. But are consumers – sellers and buyers – aware of that? No, and not even the agents know it. Everyone will wonder if the zestimate is legit, and they want to believe in something.

If we see more active (unsold) listings stacking up, we can attribute some, or all of it to the list pricing being based on the zestimates taken from earlier this year……..and sellers believing that they mean something! And then if they check their latest zestimate, it will be the same as their current list price, which will embolden them to think that the lucky young couple with 2.2 kids is right around the corner.

by Jim the Realtor | Apr 12, 2022 | Jim's Take on the Market, Market Conditions, Market Surge, Zillow |

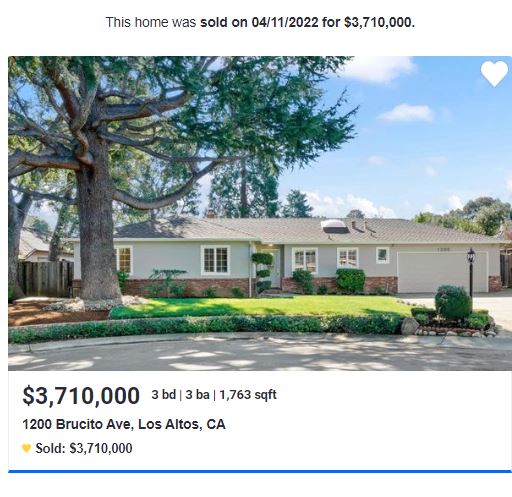

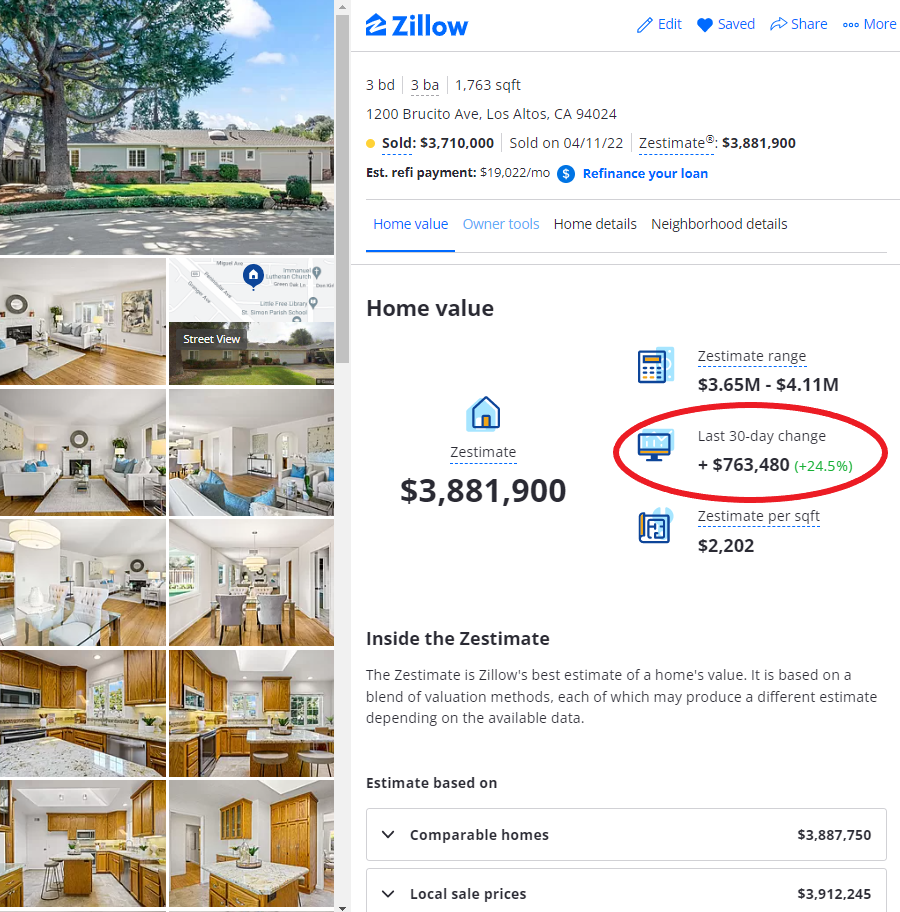

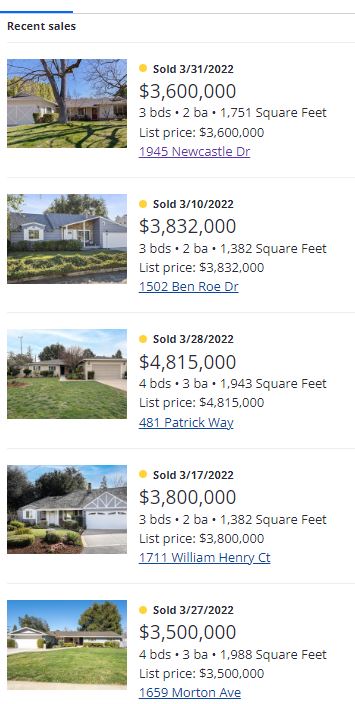

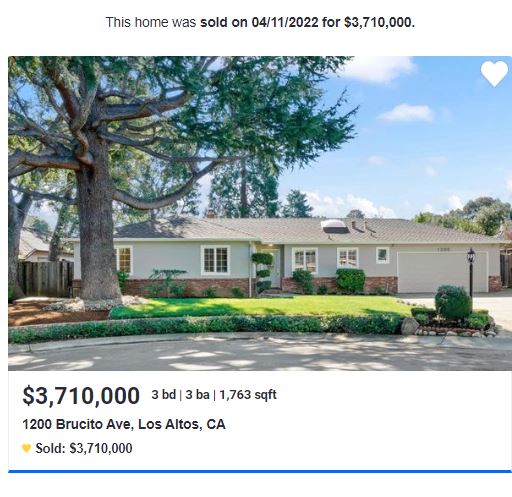

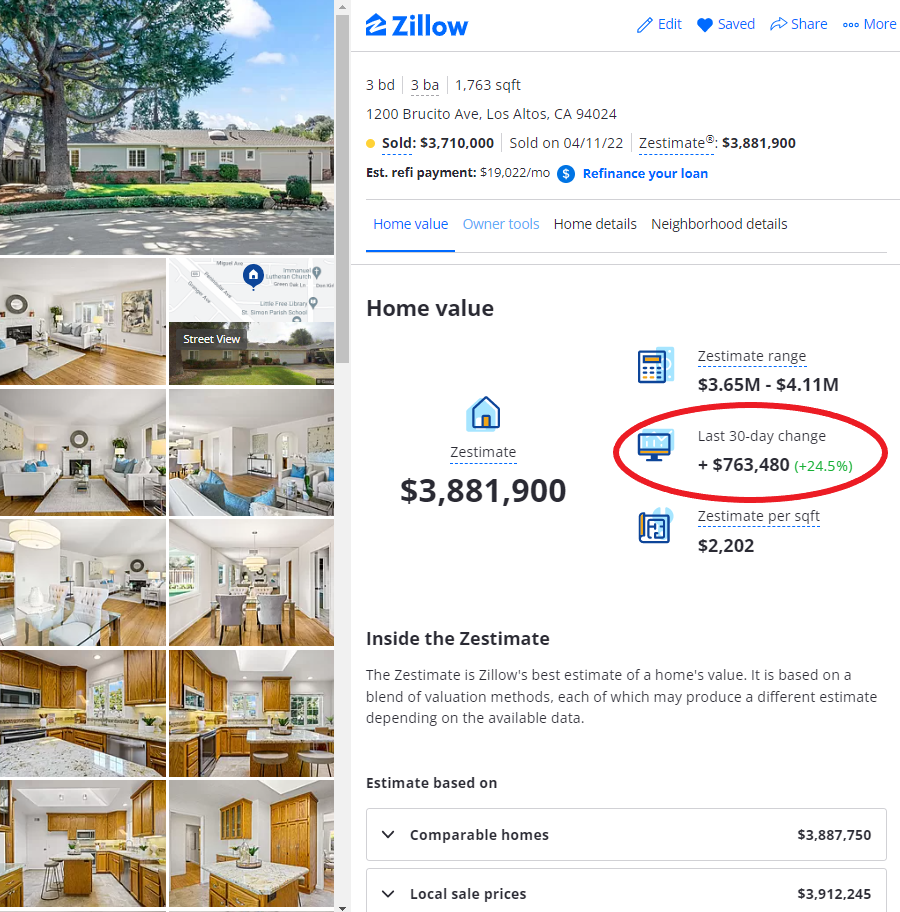

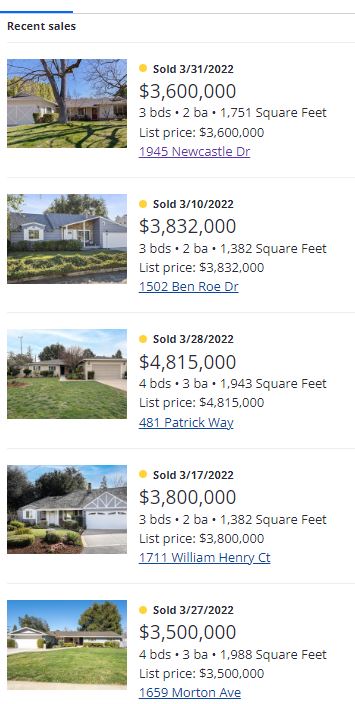

Sally’s former home in Los Altos closed yesterday for what seems to be the obligatory $500,000 over the list price (LP was $3,195,000):

https://www.zillow.com/homedetails/1200-Brucito-Ave-Los-Altos-CA-94024/19620416_zpid/

The bump over the list price is so customary in the local area that the zestimate was raised by $763,480 about the time it was marked pending – the algorithms already had the expected increase baked in!

They are enjoying The 2022 Lucky Windfall of the First Quarter, and we’ll see how well it holds up. But as long as home sales in the Bay Area keep selling for much-higher pricing than in San Diego, one of our main feeder areas will keep sending happy buyers our way!

The list prices mentioned here all say that they sold for 100% of the LP, but it’s a typo – they all sold for well over. For example, Patrick Way sold for $1.1 million over, and William Henry sold for $800,000 over list:

Paying ~$2,000/sf for modest homes in Los Altos has been fairly routine lately!

Hopefully, those sellers keep coming our way. Even if their market were to dip 10% to 20% from these dizzy heights, they will still love what they can buy here for the money.

by Jim the Realtor | Mar 1, 2022 | 2022, Forecasts, Zillow

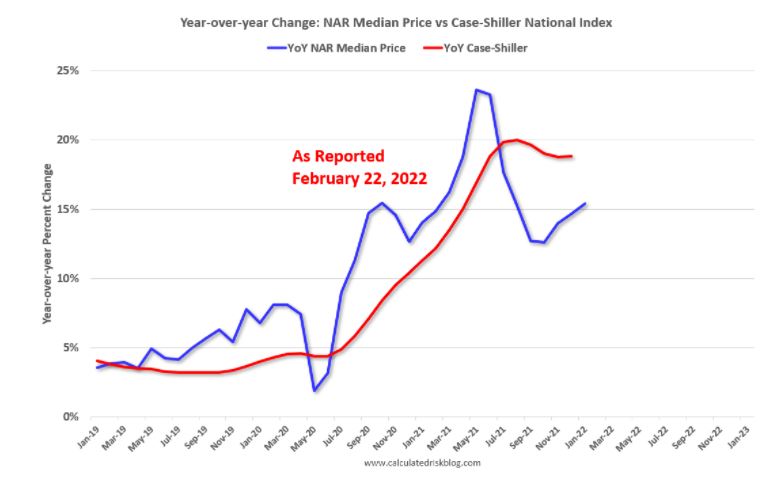

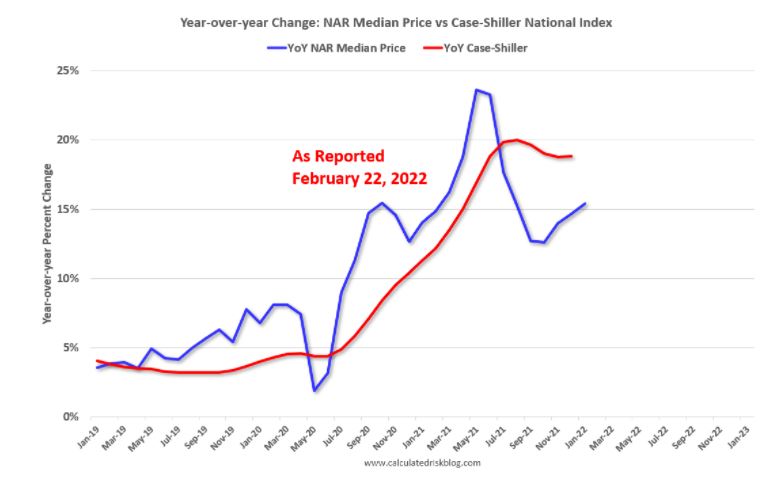

Yesterday Bill talked about how the median home prices have picked up:

https://calculatedrisk.substack.com/p/median-vs-repeat-sales-index-house-198

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Zillow has also done a reversal on where they think home prices are going.

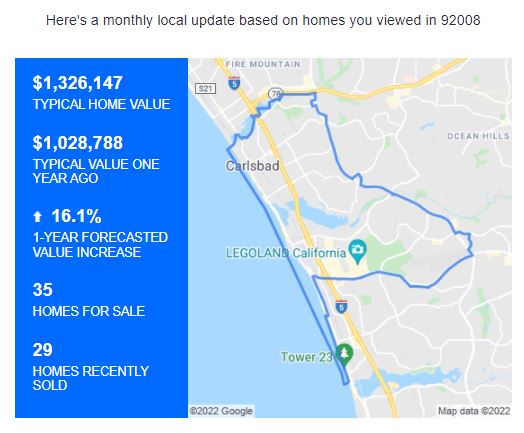

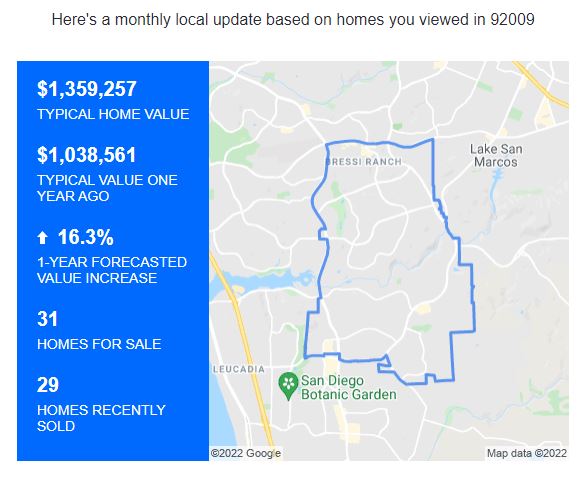

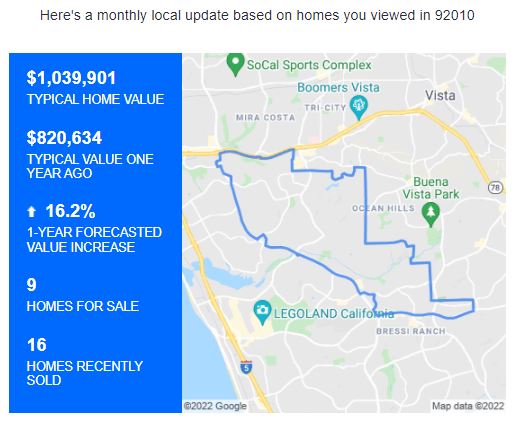

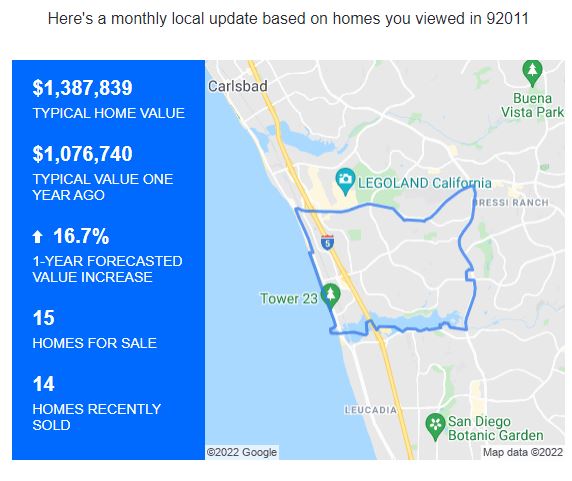

After forecasting three months in a row that homes in our local zip codes would be rising around 20% in 2022, their most recent guesses dropped to around +16% here:

https://www.bubbleinfo.com/2022/02/07/zillow-way-off/

They have been sending me their forecasts one by one over a couple of weeks. Here are their forecasts I’ve received at the end of February for our local areas (more to come):

NW Carlsbad, 92008

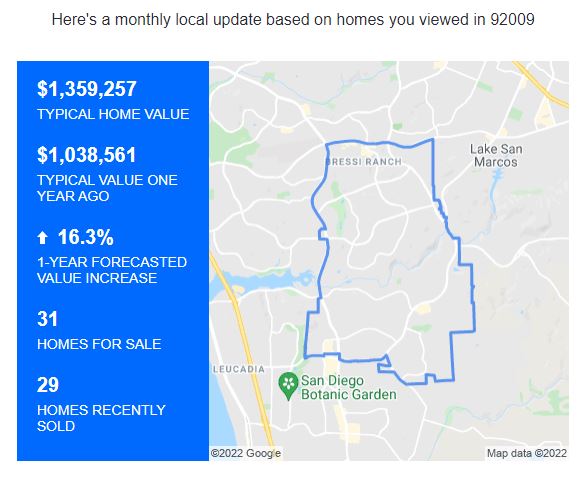

SE Carlsbad, 92009

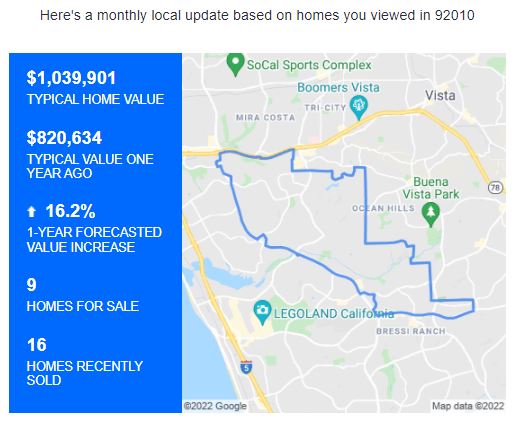

NE Carlsbad, 92010

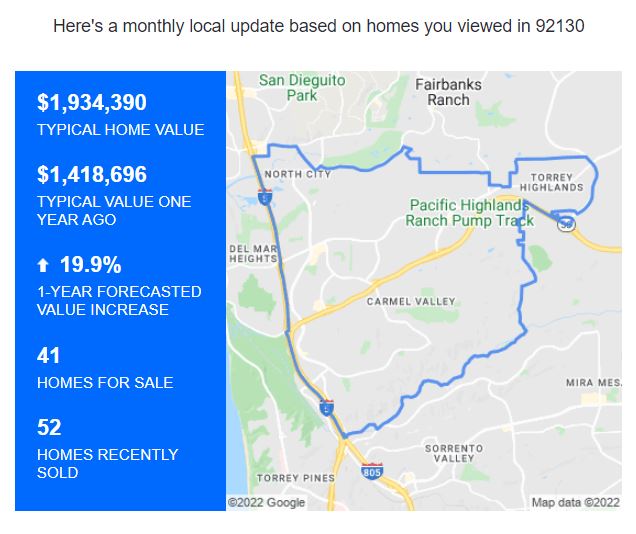

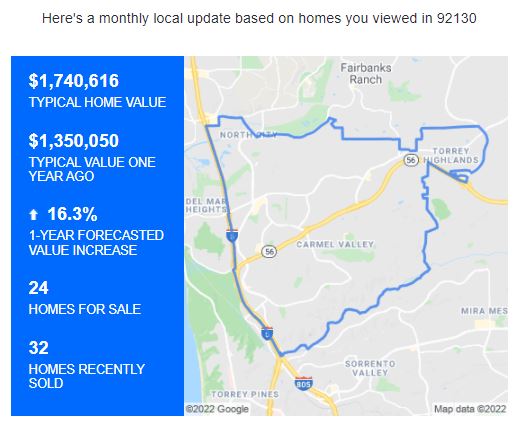

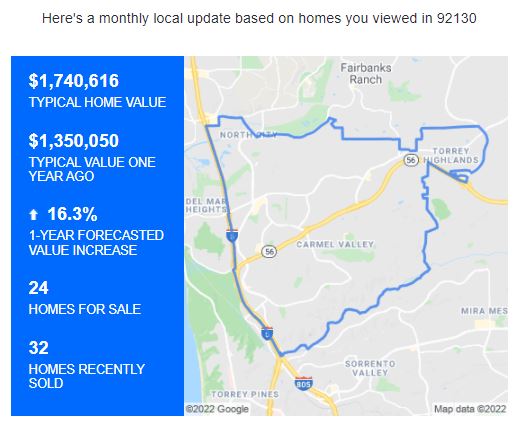

Carmel Valley 92130

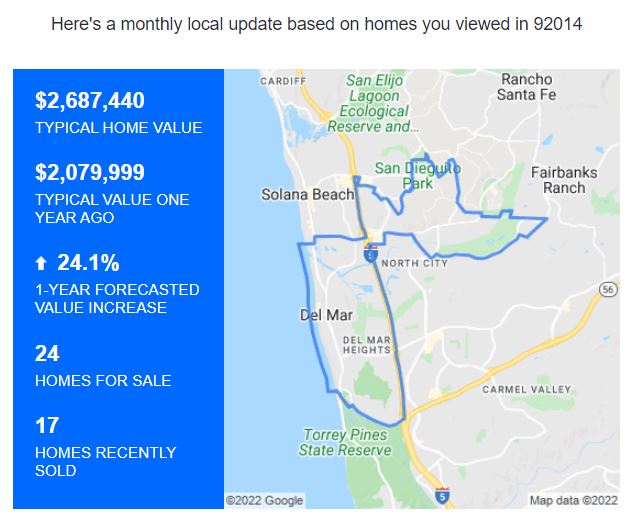

Del Mar, 92014

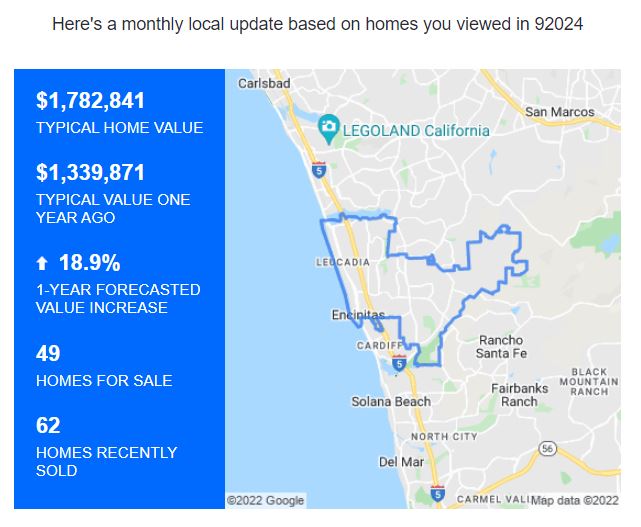

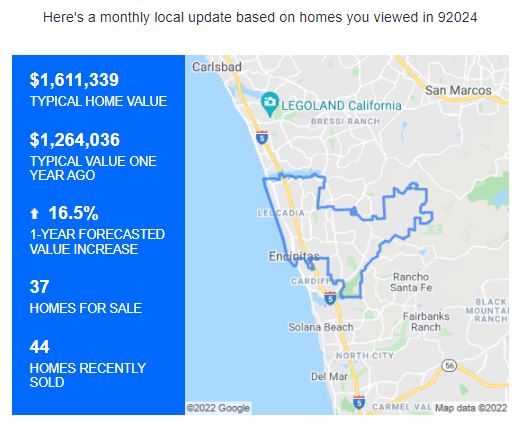

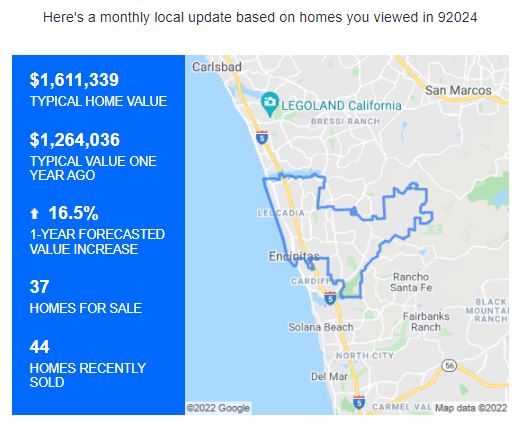

Encinitas, 92024

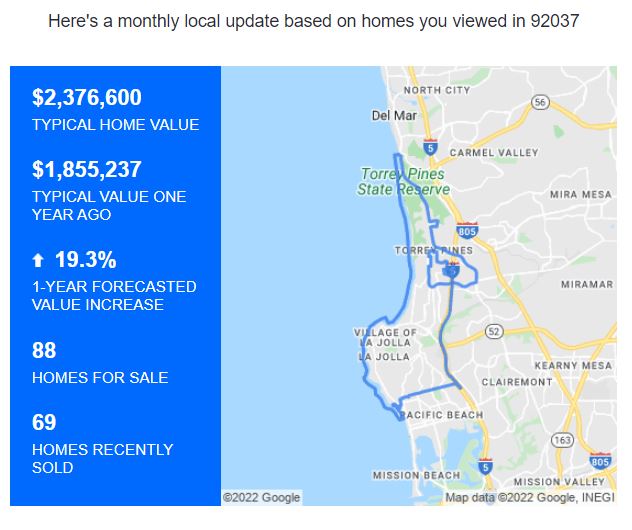

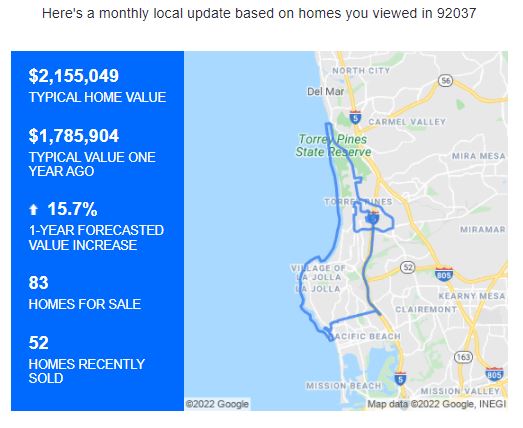

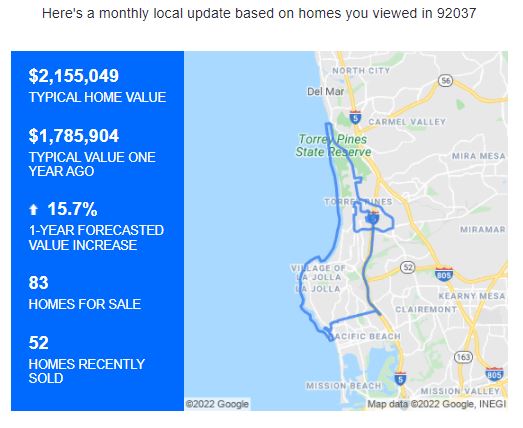

La Jolla, 92037

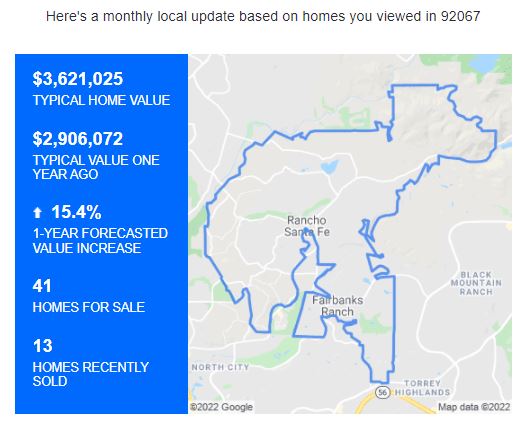

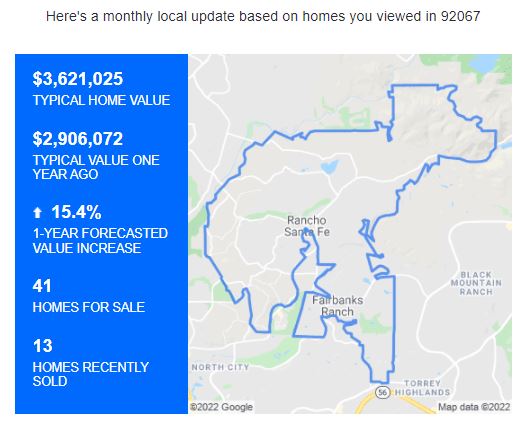

Rancho Santa Fe, 92067

West RB, 92127

Can we do +30% two years in a row? Or is Zillow off their rocker?

They do have something that none of the ivory-tower economists have – the real estate viewer data.

by Jim the Realtor | Feb 13, 2022 | Realtor Training, Zillow

People say there will always be a need for a realtor, but consumers may adapt to new methods:

JG: How is Zillow addressing these different aspects of the consumer journey?

ES: The problem that we are spending a bunch of time on right now is how do you fix the home-touring problem. We’ve noticed that a lot of times we had a consumer who wanted to go see a home, and couldn’t get in. We went and talked to ShowingTime and they told us that there were 92 million showing requests on our platform last year, but only 68 million of those got fulfilled.

This is a boring problem, and what we are doing is attacking it in three different ways.

The first is a new technology that we call “3D Home” and it’s sort of like your next-generation, virtual tour that allows you to walk through the house. What we found is that homes that have these 3D Home tours are viewed 45% more than homes that don’t have them and on average they sold 14% faster.

Then, we’re putting a bunch of technology, resources and engineering into ShowingTime so that when that buy side request comes in to see a home in person, we can make sure that the agents can connect and we can get that person into the house. We also just launched a beta test of a product where you can actually use the Zillow app as a mobile control to get into the house.

So with these three different projects that we have going on right now, we are going to try to fix this boring but incredibly impactful problem of getting into a house.

JG: What other innovation can we expect that will help drive the next generation of Zillow and its business model?

ES: There are a bunch of things that we are doing to simply help consumers buy homes. We have a really sophisticated artificial intelligence engine that sits behind our user search interface.

We’re doing essentially the same thing for listings that Netflix does when it sends users a “here is a show that you’re probably going to like” suggestion. On the second time you come back to the app or site, we’ve looked at not only what you’ve been searching, but also what people similar to you are searching, and our goal is that on that first page of search results to get you a house we think you’re going to like.

The goal is you should never have to go to page two to get a home that you like.

Another thing is we just launched a feature that we call SharePlay, and what it does is set up a FaceTime call and you and another person can use the app at the same time. In our research we found that 86% of our users on Zillow said they were shopping with someone else—either a spouse, housemate or parent.

https://www.rismedia.com/2022/02/11/zillow-looking-ease-homebuying-journey-post-ibuying/

by Jim the Realtor | Feb 7, 2022 | Forecasts, Zillow |

Homebuyers got crushed last year as home prices soared at their highest clip on record. Housing economists saw that price growth—which peaked at a year-over-year rate of 20% last year—as simply unsustainable.

Their economic models agreed: Among the seven forecast models reviewed by Fortune heading into 2022, every single one predicted home price growth would slow significantly this year.

But over the past few weeks, that consensus is no longer so unified. Now, more industry insiders are throwing out their previous forecasts and replacing them with more bullish short-term outlooks. Indeed, some experts say the 2022 spring housing market might go down as one of the most competitive on record.

Look no further than Zillow. Back in December, the home listing site predicted that U.S. home values would climb 11% this year. Economists at Zillow now say that forecast is too conservative. Their latest forecast finds home prices are set to spike 16.4% between December 2021 and December 2022. If it comes to fruition, it would mark another brutal year for home shoppers.

Why is Zillow raising its 2022 home price growth forecast? A lot of it boils down to housing inventory. During the pandemic, inventory plunged to a four-decade low as more buyers rushed into the market. That trend was predicted to reverse late last year as forbearance protection programs lapsed and mortgage rates rose. But not only has that not happened, the inventory situation has gotten worse. In January, there were just over 923,000 U.S. homes listed for sale on Zillow. That’s down 40.5% from the pre-pandemic level in January 2020, and down 19.5% from January 2021.

Simply put: The housing market is tighter right now than it was last year when bidding wars climbed to an all-time high. That explains why Zillow foresees a rough few months ahead for home shoppers.

Homebuyers and sellers alike would be wise to take Zillow’s 16.4% price growth prediction—or any other real estate forecast model—with a grain of salt. After all, none of the major real estate forecast models predicted the historic home price boom we’ve seen over the past two years. Indeed, when the pandemic struck in spring 2020, Zillow and CoreLogic both predicted home prices would fall by spring 2021.

https://fortune.com/2022/02/07/zillow-our-2022-housing-forecast-is-way-off-home-prices-now-set-to-spike/

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Except that real estate is local.

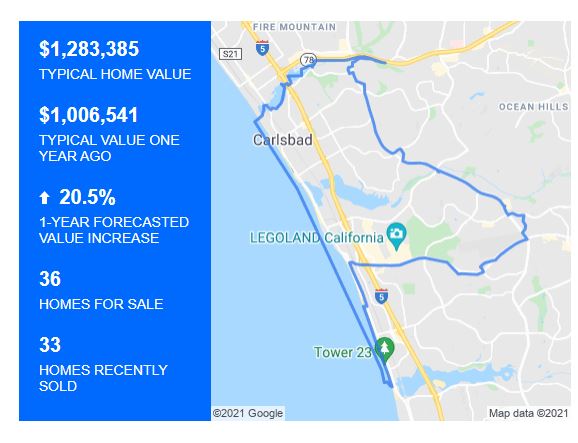

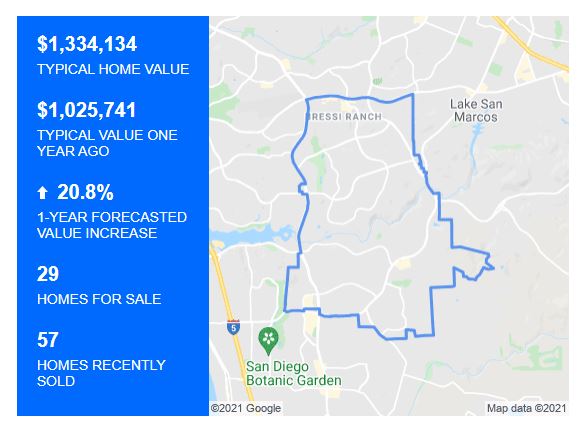

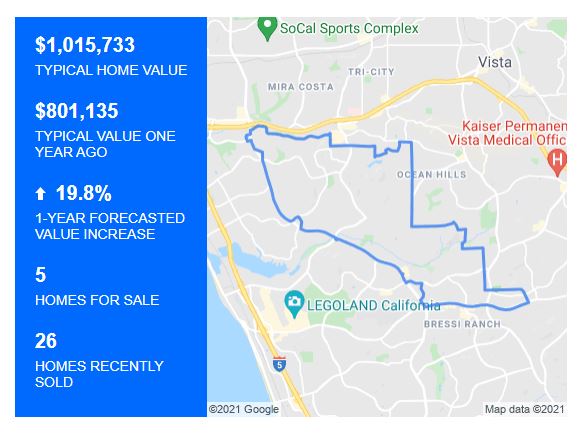

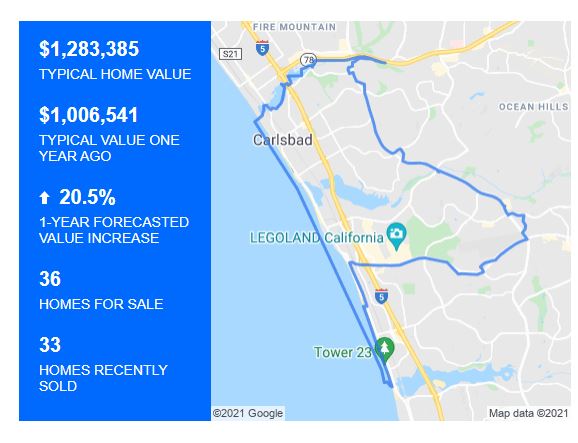

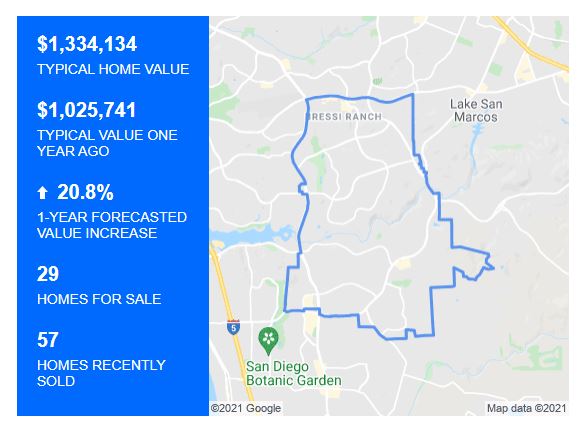

Zillow had been predicting 20% price growth locally for the last three months, but now their latest forecasts have DROPPED significantly:

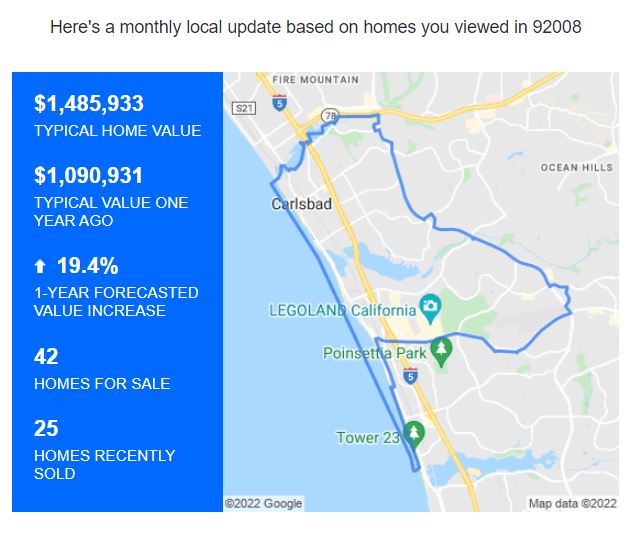

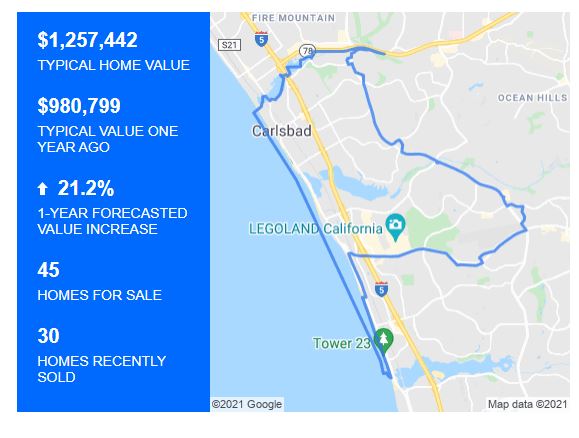

NW Carlsbad, 92008:

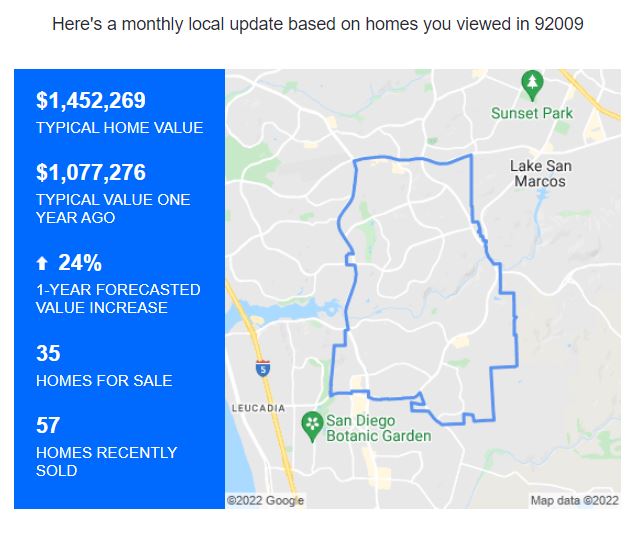

SE Carlsbad, 92009:

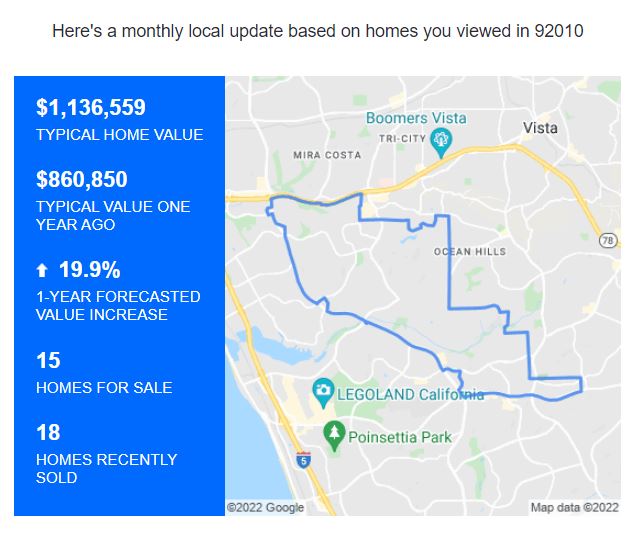

NE Carlsbad, 92010:

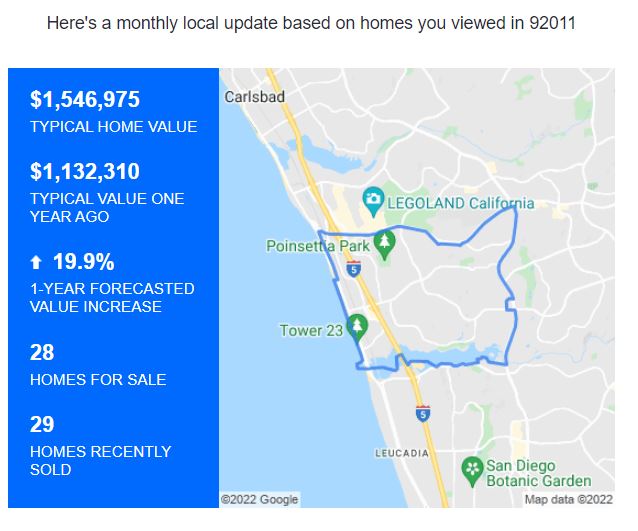

SW Carlsbad, 92011:

Carmel Valley, 92130:

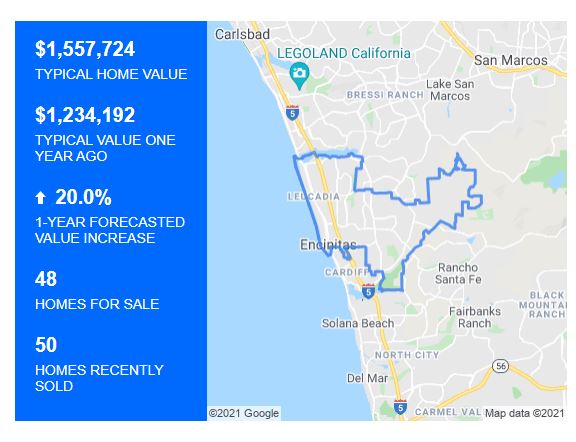

Encinitas, 92024:

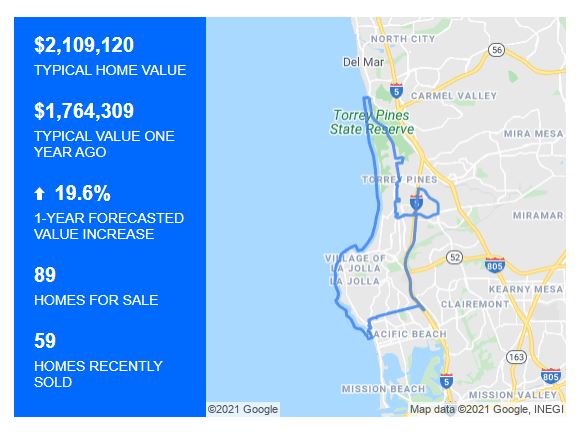

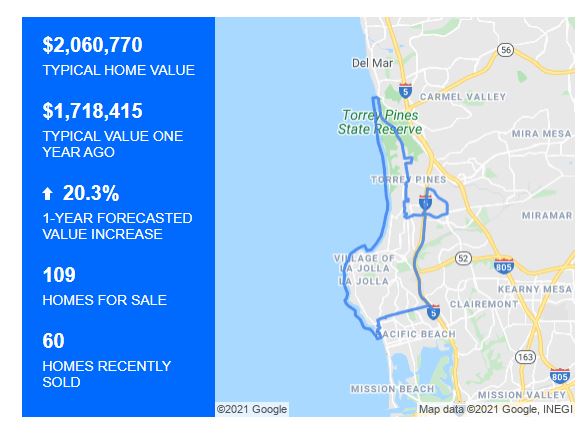

La Jolla, 92037:

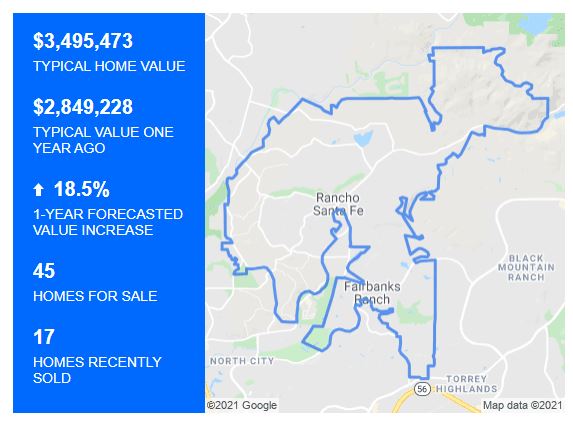

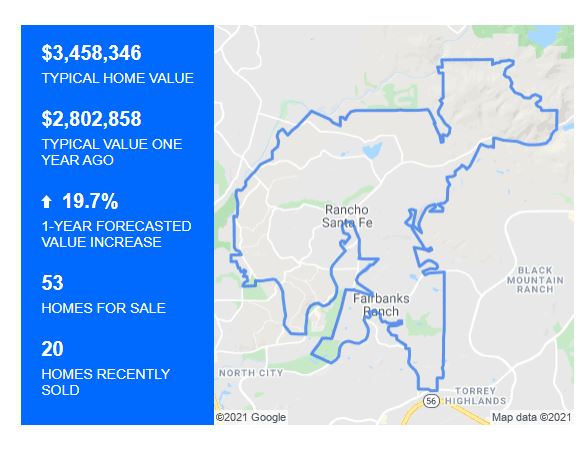

Rancho Santa Fe, 92067

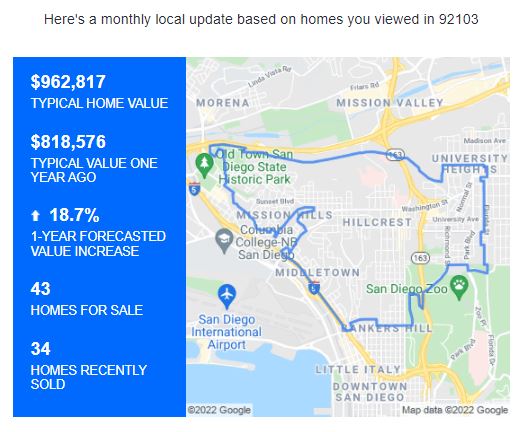

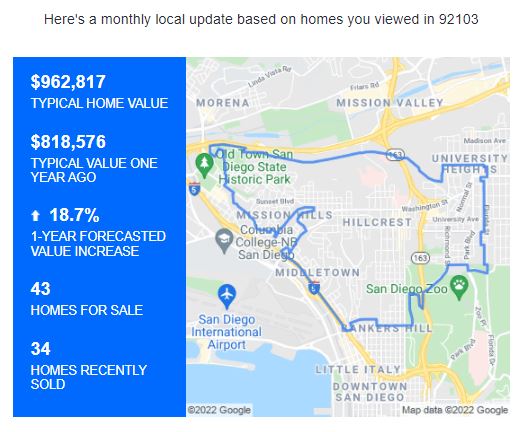

Mission Hills, 92103:

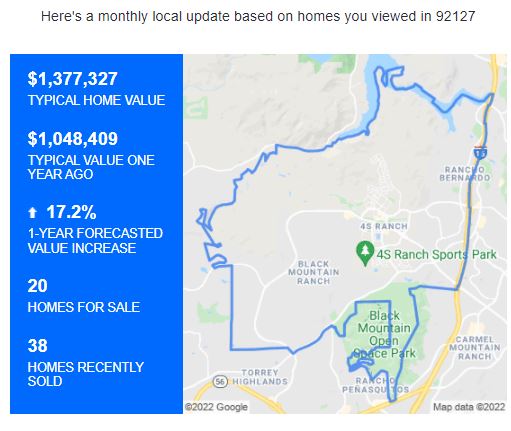

West Rancho Bernardo, 92127:

Their 15% to 18% is still pretty good though!

by Jim the Realtor | Feb 5, 2022 | Carlsbad, Zillow |

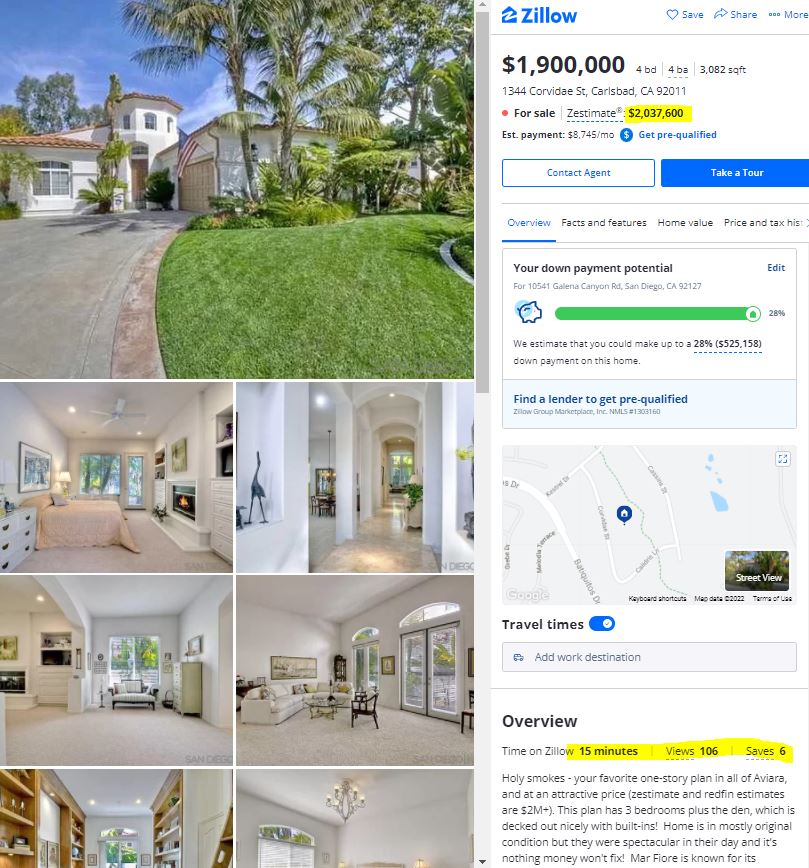

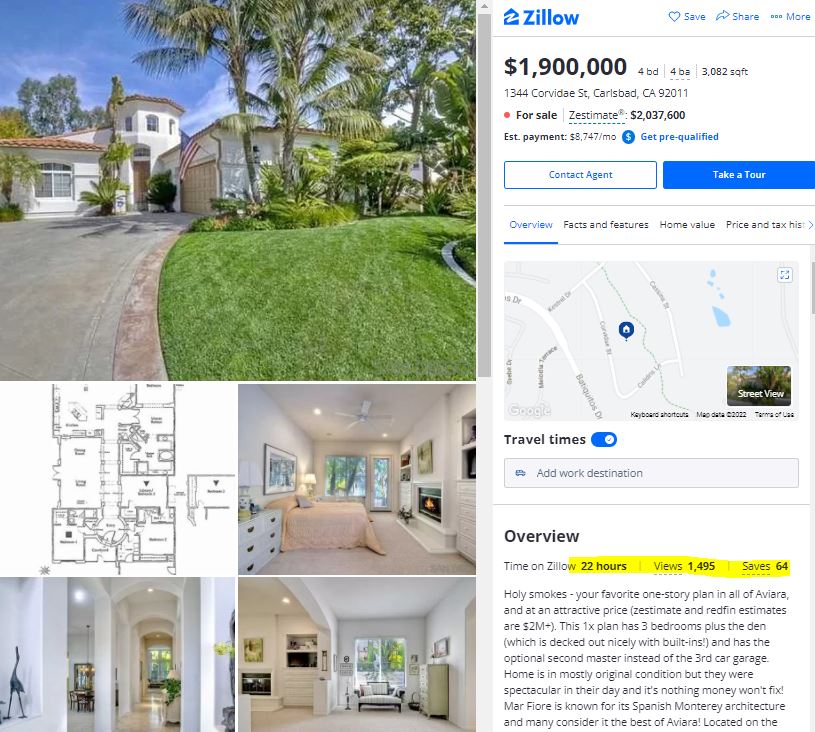

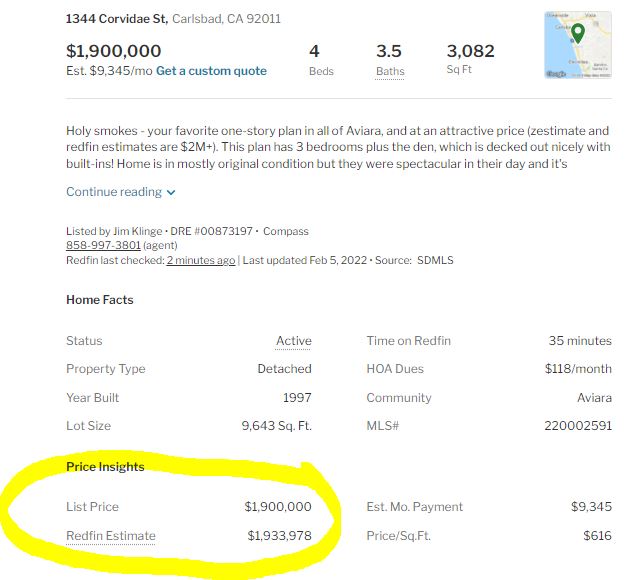

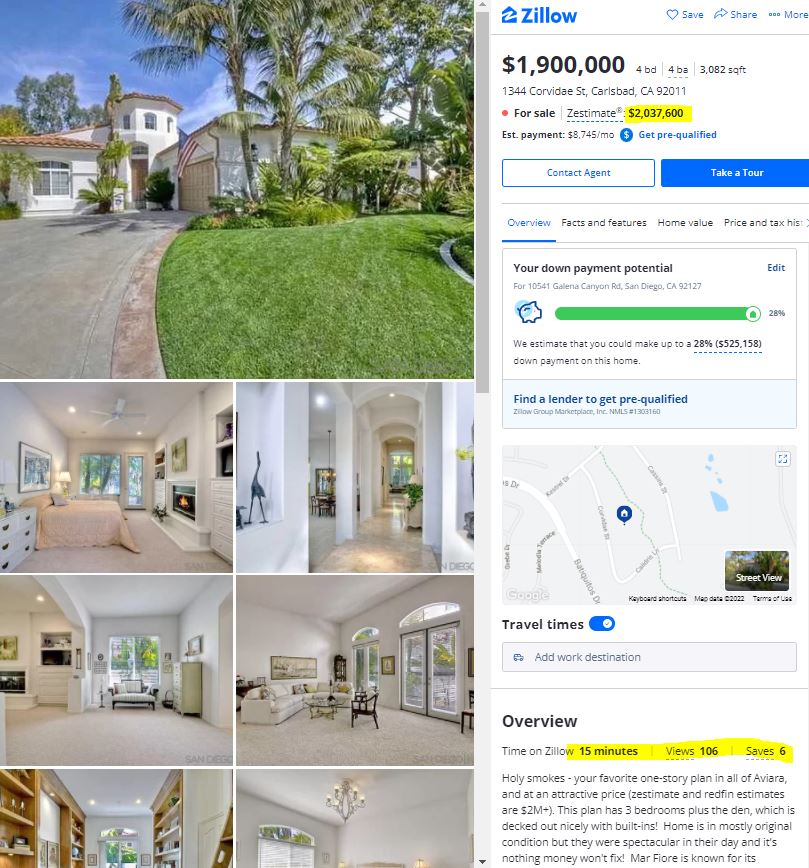

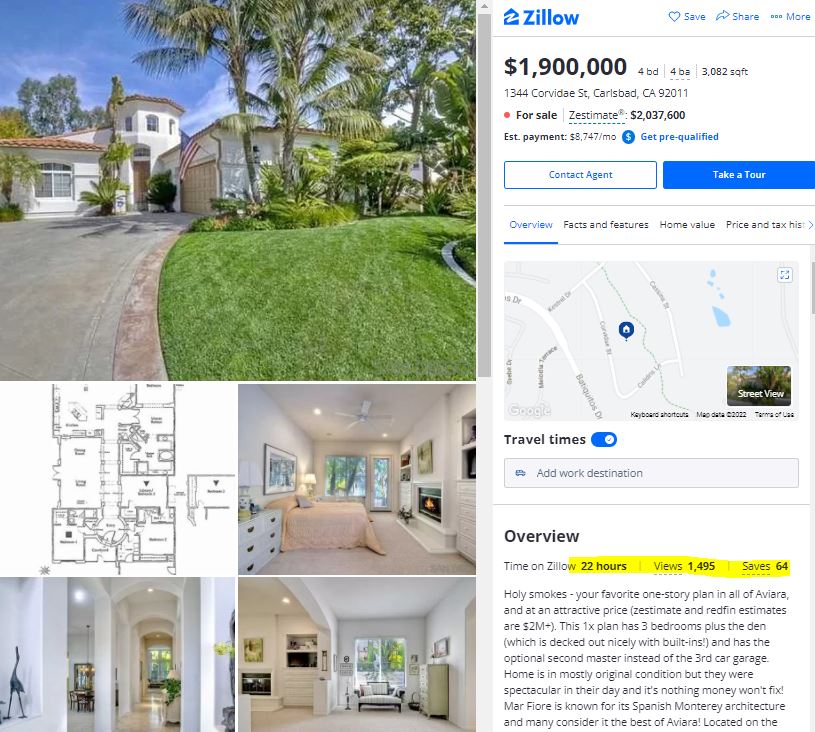

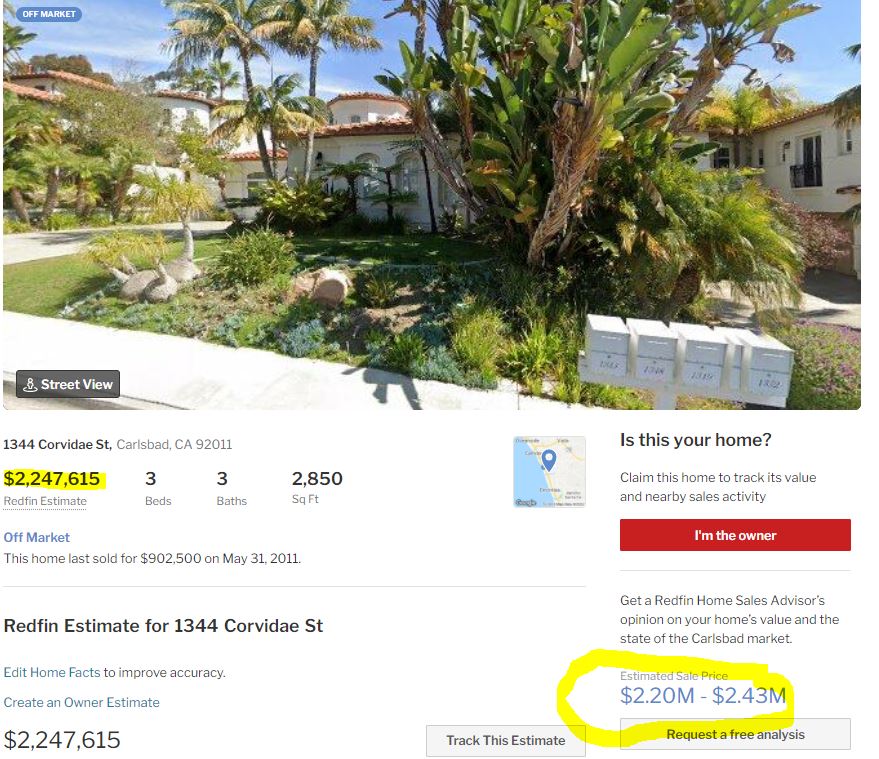

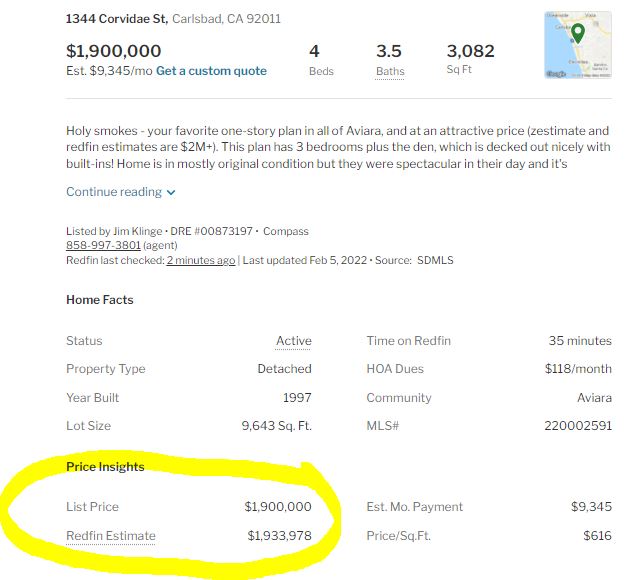

With the inventory so low – especially for the one-story houses – here’s a seller who senses an opportunity. We just listed the premier single-level floor plan in Aviara for a reasonable $1,900,000!

How hot are the one-story homes?

Here’s the action after 15 minutes on Saturday:

Sunday morning’s count:

https://www.zillow.com/homedetails/1344-Corvidae-St-Carlsbad-CA-92011/48180010_zpid/

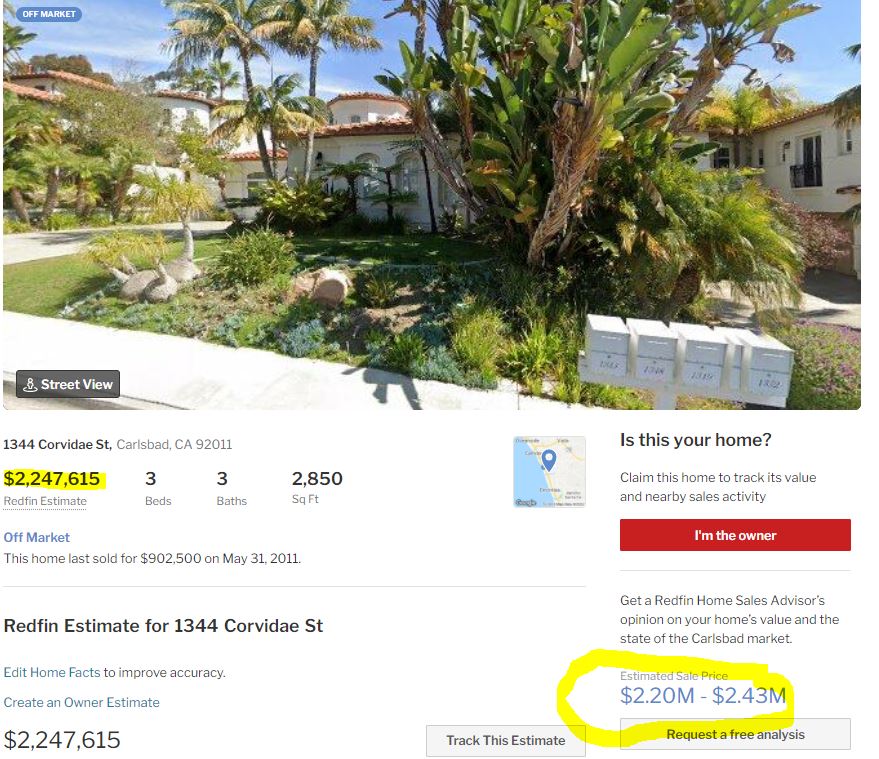

I don’t know how these guys get away with these revisions after the listing hits the market:

Before Listing Hit the Market:

After Listing Hit the Market:

by Jim the Realtor | Jan 5, 2022 | 2022, Where to Move, Zillow |

These look like the towns to which people from New York and California are moving. Excerpts:

The boomer tide in the for-sale housing market is expected to continue to rise for at least the next 8 years; younger millennials will be hitting first-time home buying age at about the same time, meaning the 2020’s will be a period of sustained underlying demand in the housing market.

Year by year, these effects will be felt differently across markets.

In 2022, the market with the most demographic lift in the for-sale market is Austin, with a trend suggesting the formation of 3.4% more owning households (assuming there are homes available for them to buy). Orlando follows at 2.8%, and then Tampa at 2.7%. Of the largest 50 markets, 29 have natural owner household growth exceeding 1% in one year, the rule-of-thumb rate at which the housing stock increases nationally. The markets with the least demographic pressure for growth are Pittsburgh, Hartford and Buffalo.

Risks

There are two large known risk factors for housing markets in 2022. First, mortgage interest rates are expected to rise in 2022, making home loans more expensive for aspiring buyers. At the margin, this would restrict the inventory accessible in the most expensive markets, potentially driving up competition for the lowest-priced homes in those markets or removing them from consideration altogether.

Historically, home value appreciation in the following markets has strong negative correlation with interest rates — so if interest rates go up, these markets are likely to slow the most: San Diego, New Orleans, Washington DC, Los Angeles, San Jose and San Francisco.

Second, forecasts on the performance of stocks are incredibly wide, with analysts’ 2022 year-end targets ranging from -7% to +13%, slower growth in any case than what we’ve seen in the last 2 years if not declines. A slower stock market would mean buyers are bringing relatively less to the table for a down payment in 2022.

This would most affect markets where there are a lot of first time buyers or where more buyers are entering from lower cost areas, bringing less equity from their previous home. (Or if housing is treated as an asset it could mean a substitution to housing in the next few months. What follows addresses only the downside risk.)

In the following markets, growth has strong positive correlation with stock market returns — so if the stock market falters next year, we’d expect home value growth in these places to slow disproportionately: Phoenix, Las Vegas, Cincinnati, Hartford, St. Louis, Miami, Cleveland, Los Angeles and San Jose.

https://www.zillow.com/research/zillow-2022-hottest-markets-tampa-30413/

by Jim the Realtor | Dec 22, 2021 | Carlsbad, Carmel Valley, Del Mar, Encinitas, Forecasts, La Jolla, North County Coastal, Rancho Santa Fe, Zillow |

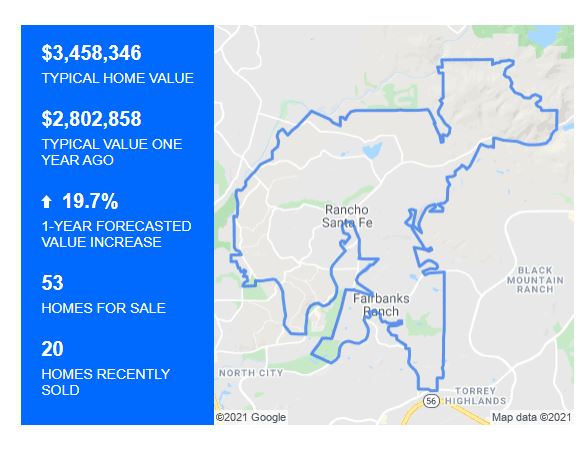

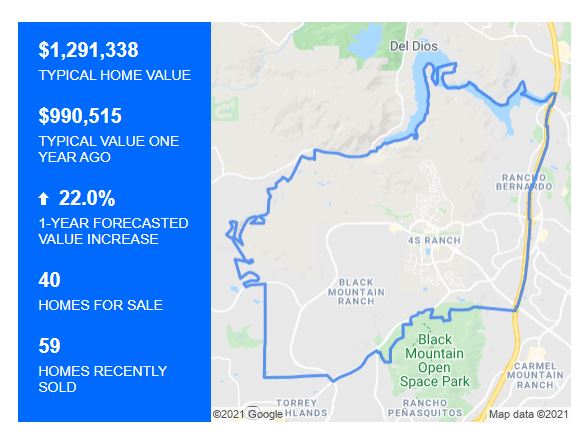

The Zillow 1-Year Forecasted Values are down 1-2 points from their previous guesses last month, but still very strong. This is their third consecutive month with similar forecasts:

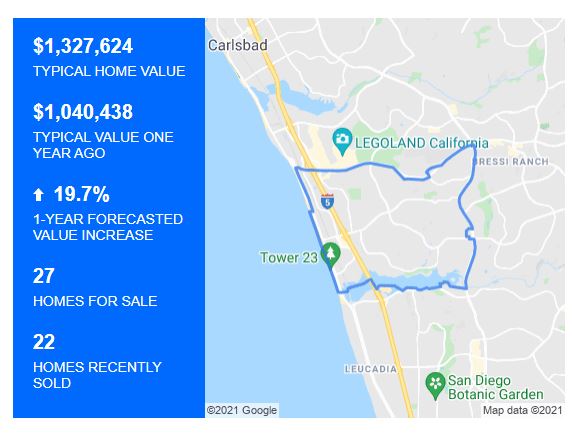

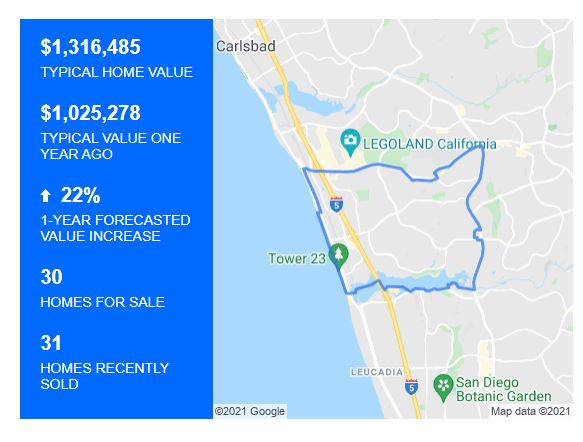

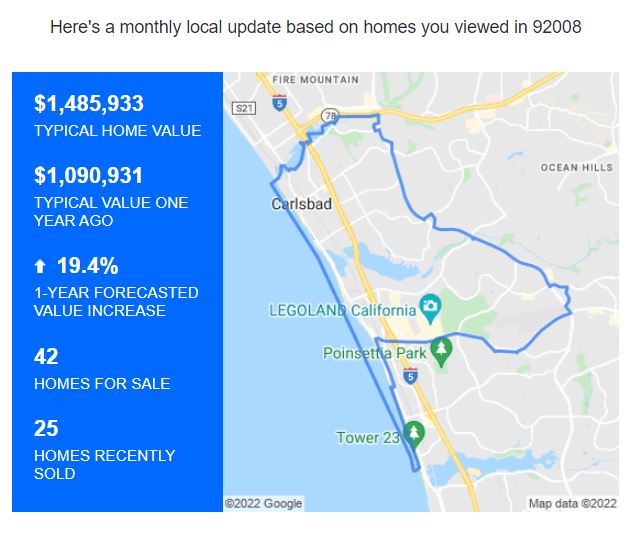

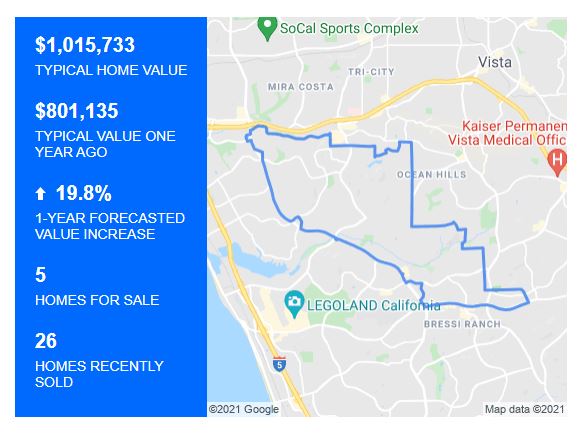

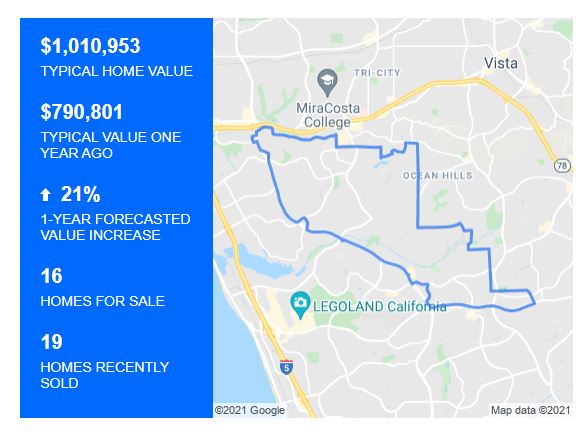

NW Carlsbad, 92008:

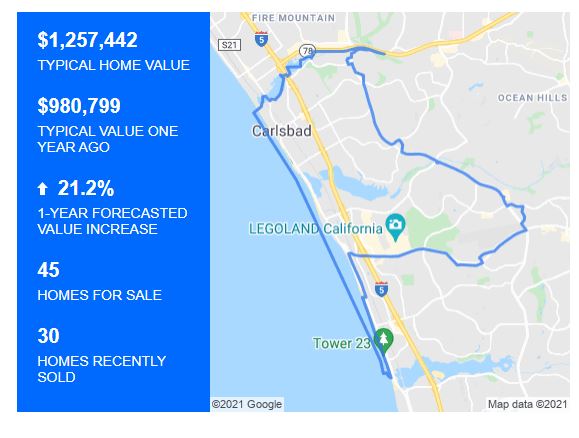

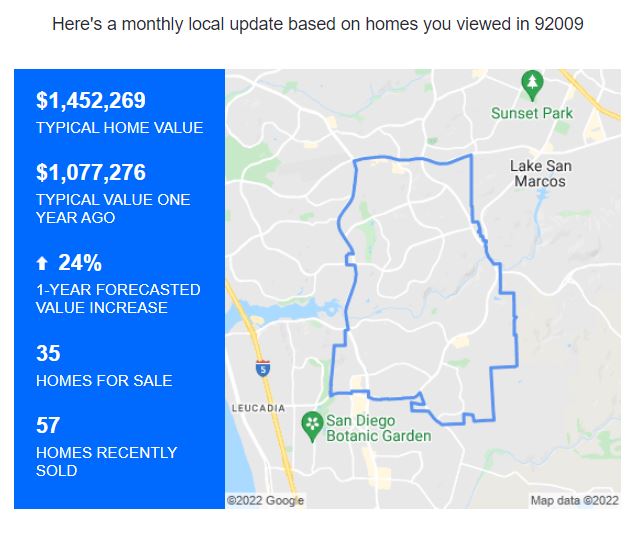

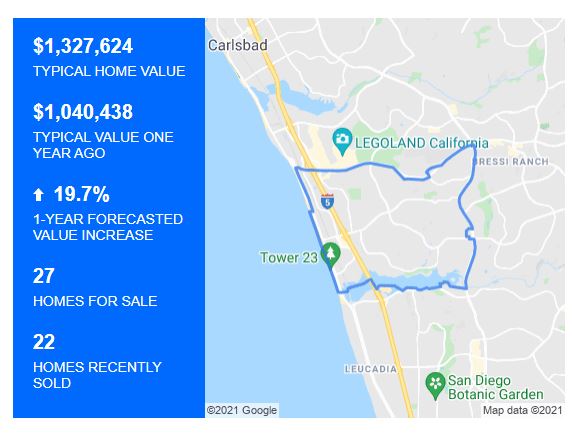

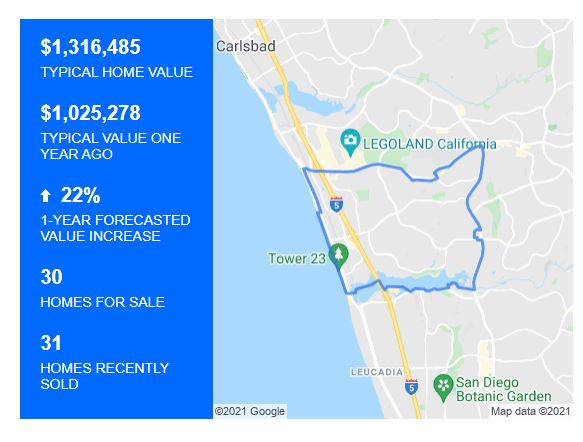

SE Carlsbad, 92009:

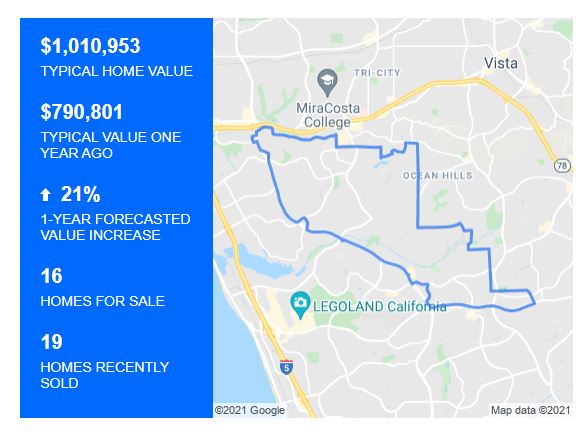

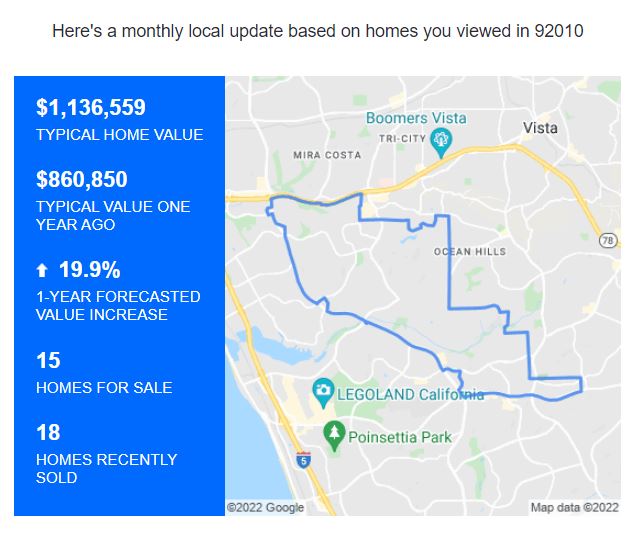

NE Carlsbad, 92010:

SW Carlsbad, 92011:

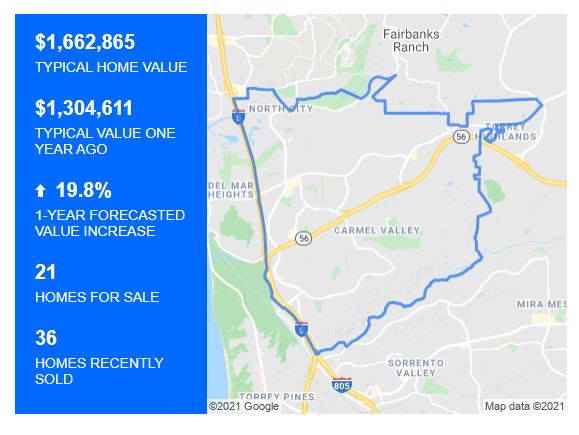

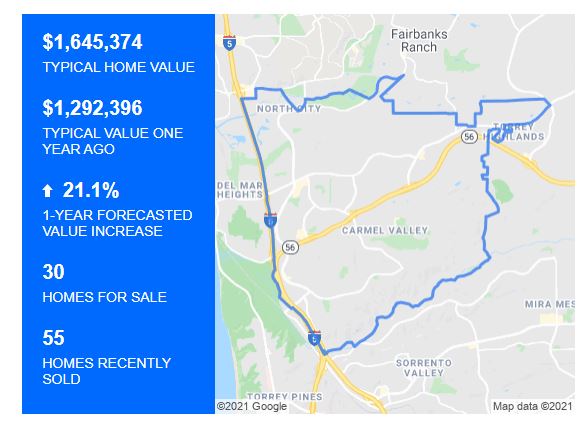

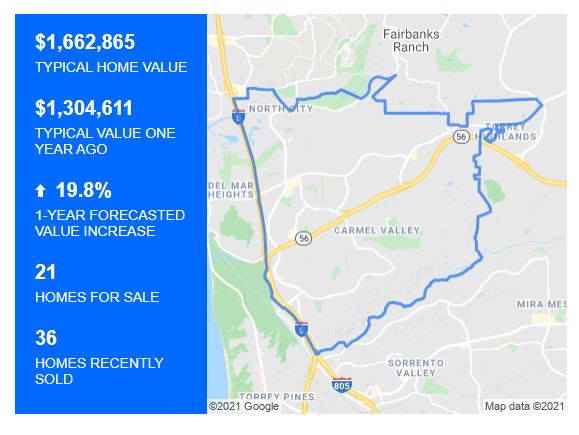

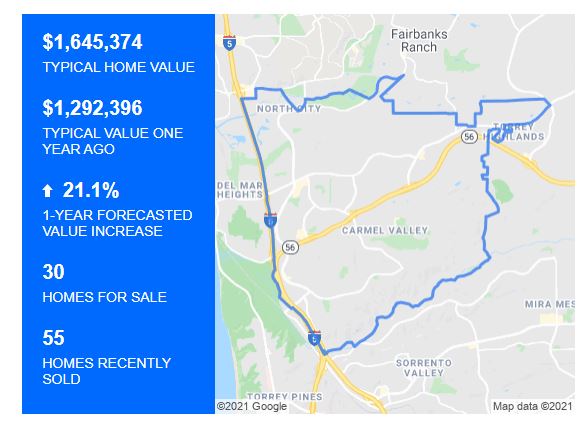

Carmel Valley, 92130:

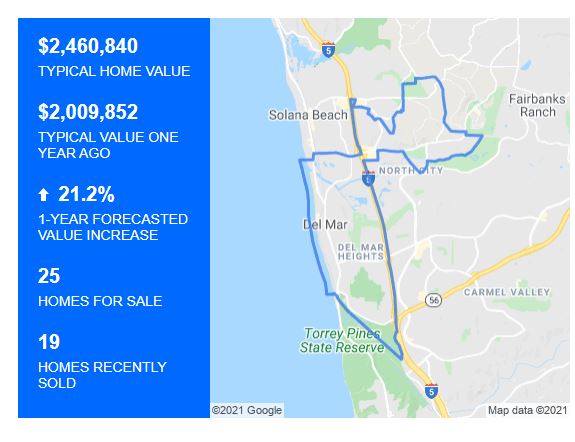

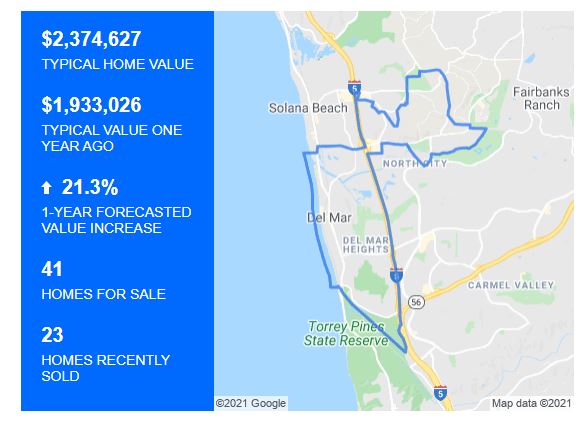

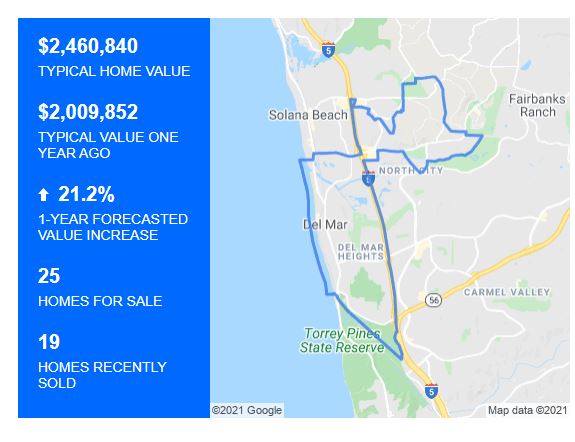

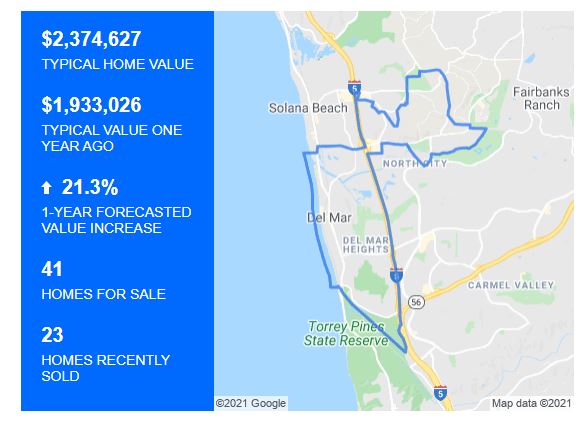

Del Mar, 92014:

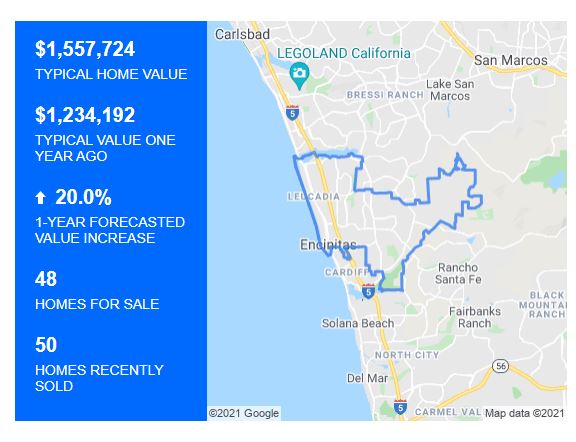

Encinitas, 92024:

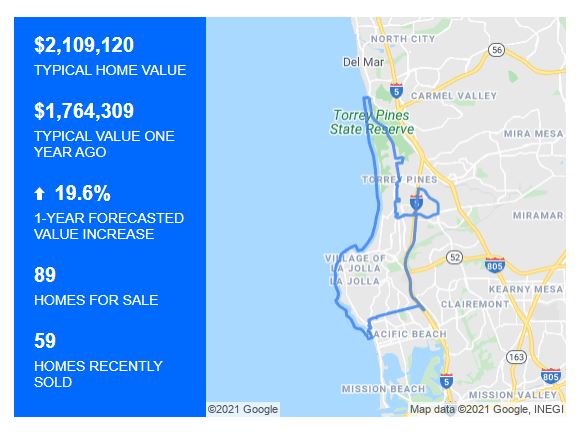

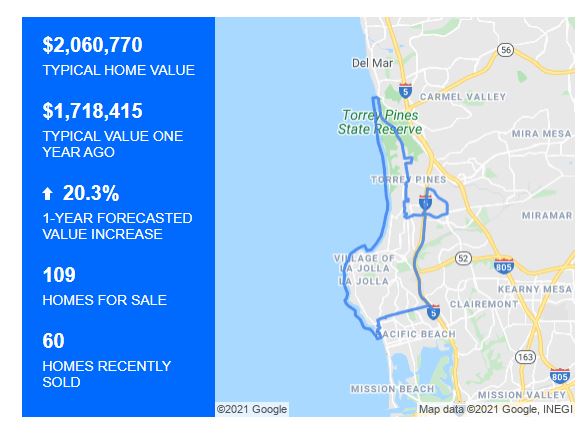

La Jolla:

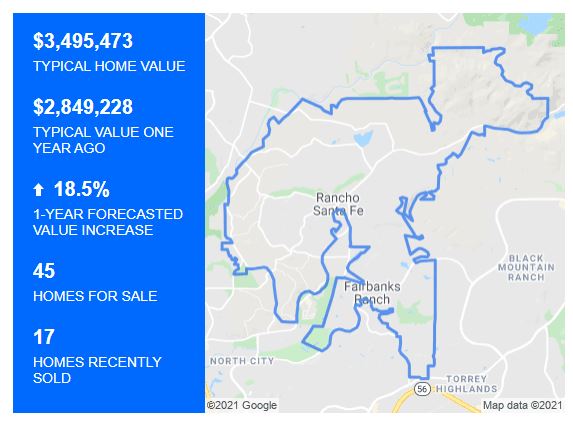

Rancho Santa Fe, 92067:

For those who are steeped in real estate history, it’s hard to comprehend how prices could increase 25% to 30% this year – to think pricing could go up ANOTHER 20% next year is straining the brain!

I think it will happen, and be accomplished by mid-summer.

by Jim the Realtor | Dec 3, 2021 | Zillow

Susie asked for a Zillow Offers update, and yesterday they announced that the unwinding is going just fine. While the debacle did tank their stock price, they figured it would be a good time to buy more for themselves:

SEATTLE, Dec. 2, 2021 – Zillow Group, Inc. today announced it has made significant progress in winding down Zillow Offers inventory and has sold, is under contract to sell or has reached agreement on disposition terms for more than 50% of the homes it expected to resell during the entire wind-down process. Zillow Group’s Board of Directors has also authorized the repurchase of up to $750 million of its Class A common stock, Class C capital stock or a combination of both.

“We are pleased with the progress of our wind-down efforts and recognize that no longer operating Zillow Offers will allow us to have a more capital-efficient balance sheet and business moving forward,” said Zillow Group co-founder and CEO Rich Barton. “With that, we see today as an opportune time to announce a share repurchase program and reduce the cash balance we built up to support Zillow Offers.”

We can expect them to gloss over their little boo-boo and carry on.

More below – thanks Bode:

(more…)

by Jim the Realtor | Nov 16, 2021 | 2022, Forecasts, Jim's Take on the Market, Why You Should List With Jim, Zillow |

Zillow has been vilified for many reasons, but the one thing they have going for them is the viewer data for each area. If their 2022 projections are based on the number of clicks on listings, then their forecast should be a reasonable reflection of the actual demand – a macro look that no one else has.

The Big Question: if they are so confident about the 2022 appreciation, why did they quit home flipping?

Their first move of suspending the program until next year while digesting their inventory was understandable. But why quit altogether? I think it was due to having billions invested in a high-overhead venture that was new to them – and the rich guys hit the panic button, instead of calling me.

I’m sticking with my 2022 NSDCC Pricing Guess of +15%, and agree with Zillow that most areas could see +20%. But this frenzy is going to come to a screeching halt with no notice (they always do), and it will be when you least expect it.

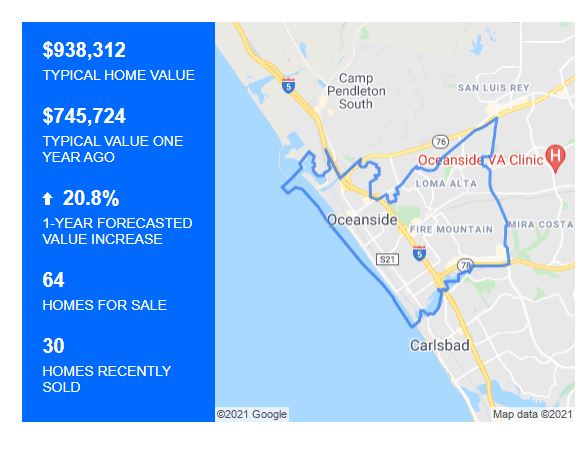

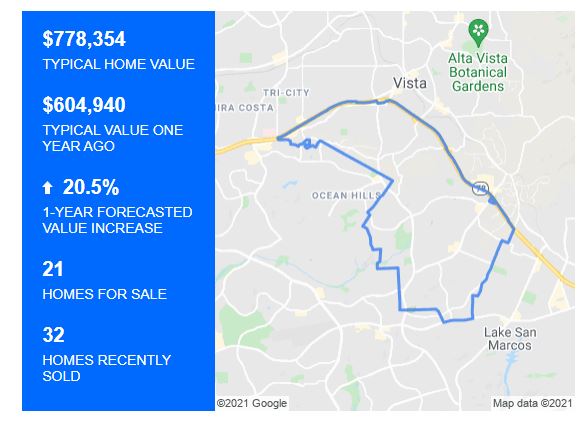

P.S. ALL of their forecasted value increases here are higher than last month:

NW Carlsbad, 92008:

SE Carlsbad, 92009:

NE Carlsbad, 92010:

SW Carlsbad, 92011:

Carmel Valley, 92130:

Del Mar, 92014:

Encinitas, 92024:

La Jolla, 92037:

Rancho Santa Fe, 92067:

Santaluz/Crosby/4S, 92127:

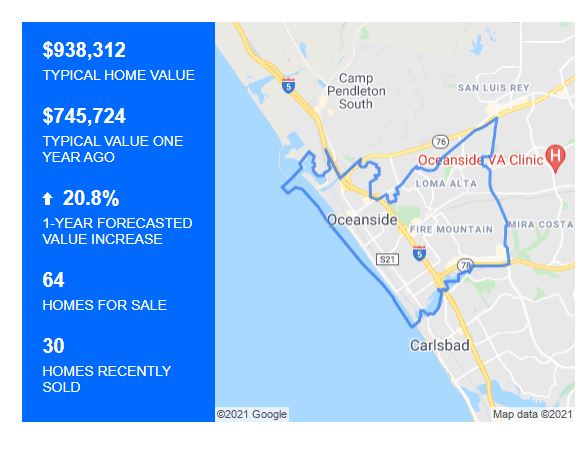

Coastal Oceanside, 92054:

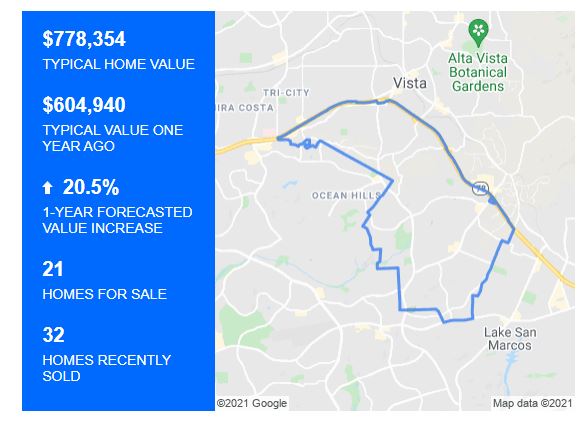

S. Vista, 92081:

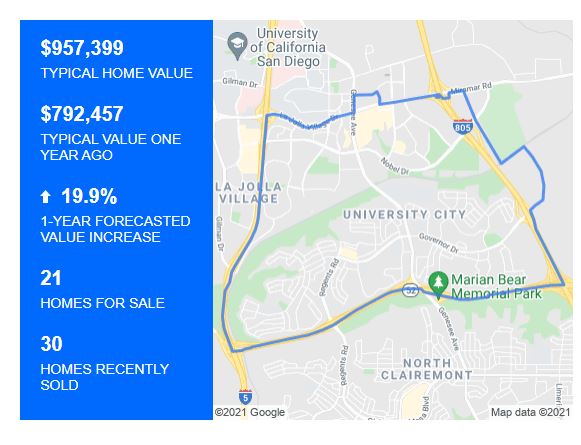

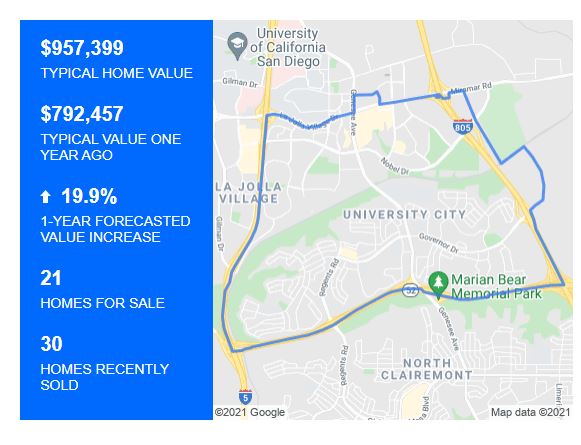

University City, 92122:

The additional last four areas show how overwhelming the demand is for all of north county.