by Jim the Realtor | Sep 6, 2022 | Forecasts, Zillow |

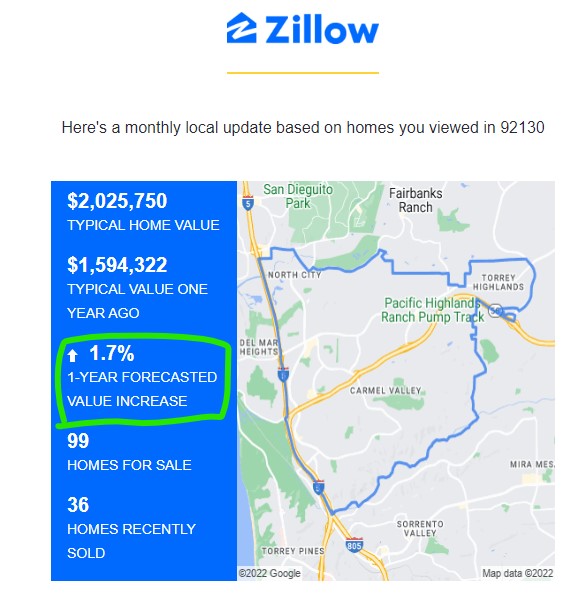

Zillow has recalibrated and is predicting a fairly flat 12 months ahead.

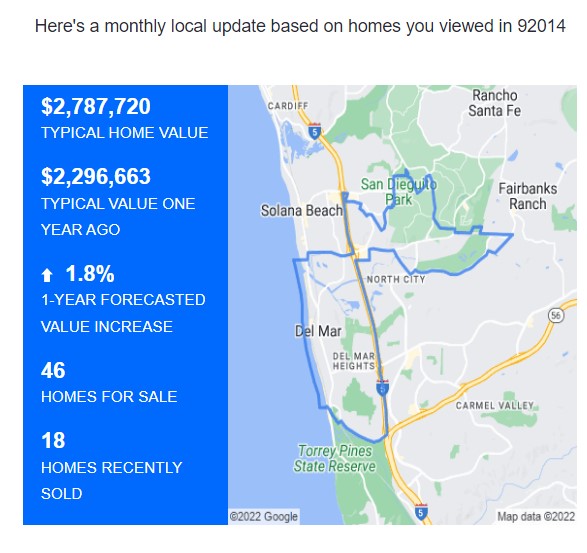

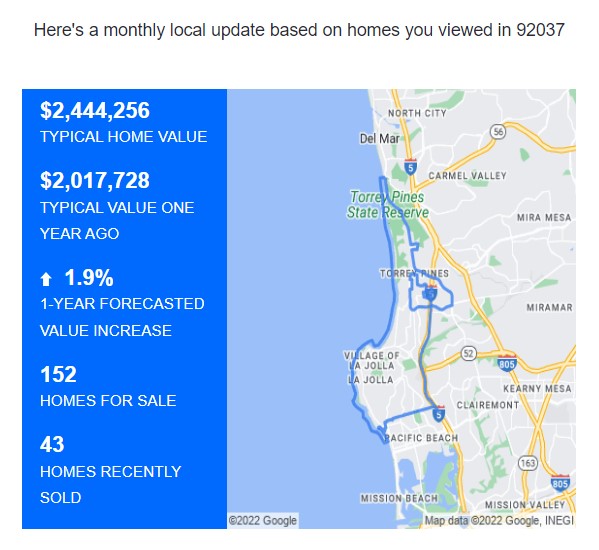

Here are the zip codes I’ve received so far, all ranging between +1.5% and 1.9% appreciation over the next 12 months – the rest of the local zip codes should be similar:

NW Carlsbad

SE Carlsbad

NE Carlsbad

SW Carlsbad

Carmel Valley

Del Mar

La Jolla

by Jim the Realtor | Aug 19, 2022 | 2023, Why You Should List With Jim, Zillow |

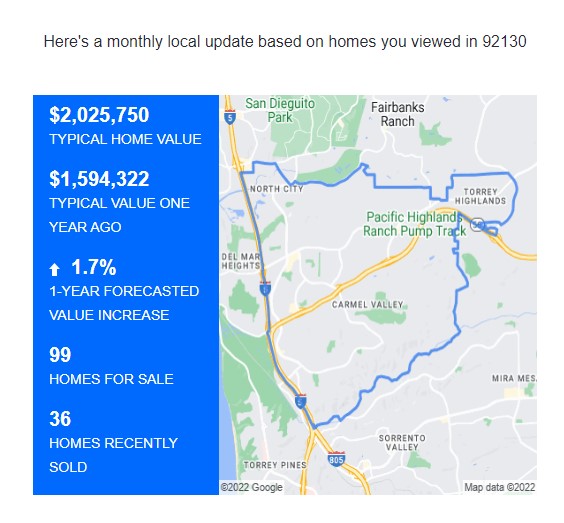

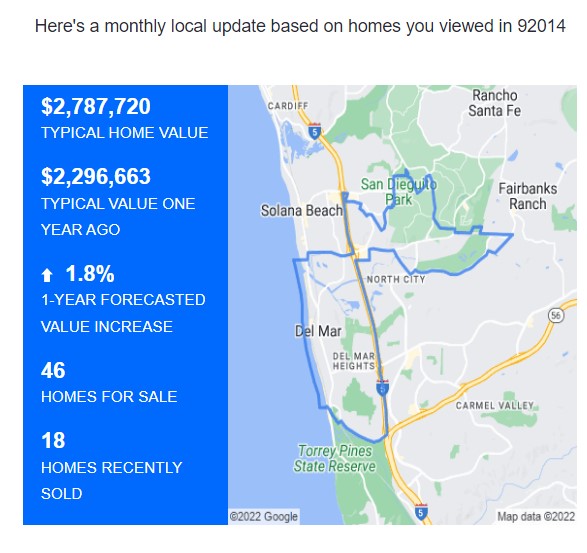

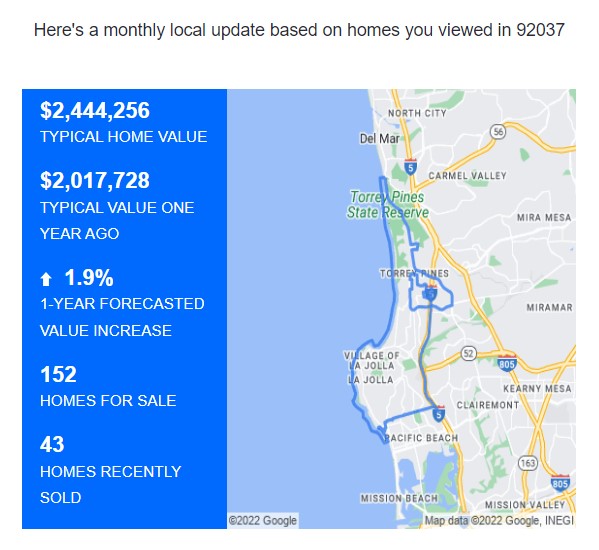

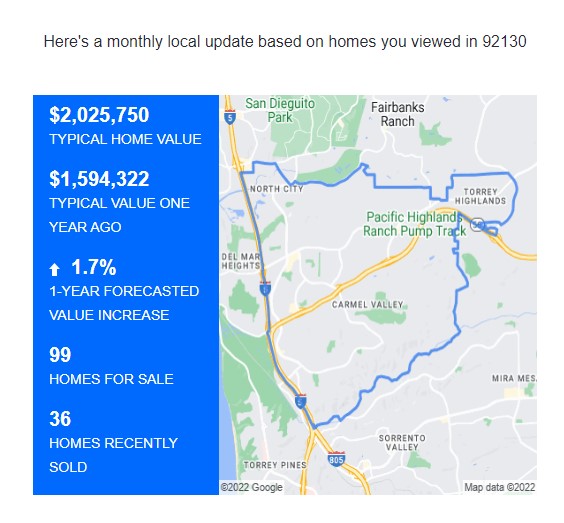

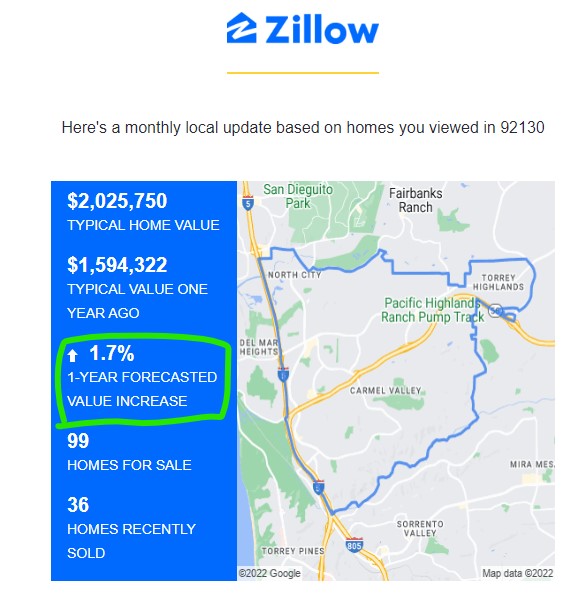

After my blog post yesterday publicizing the confidence Zillow has in our local markets, guess what arrived today. Yep, their first installment of their next round (it usually takes 2-3 weeks to receive the full set):

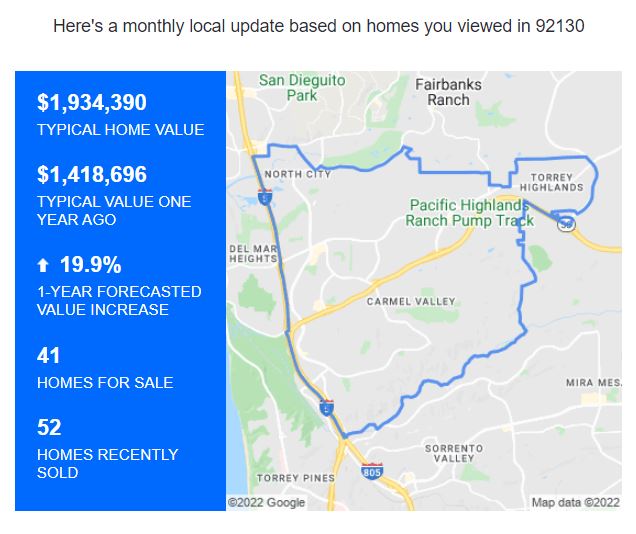

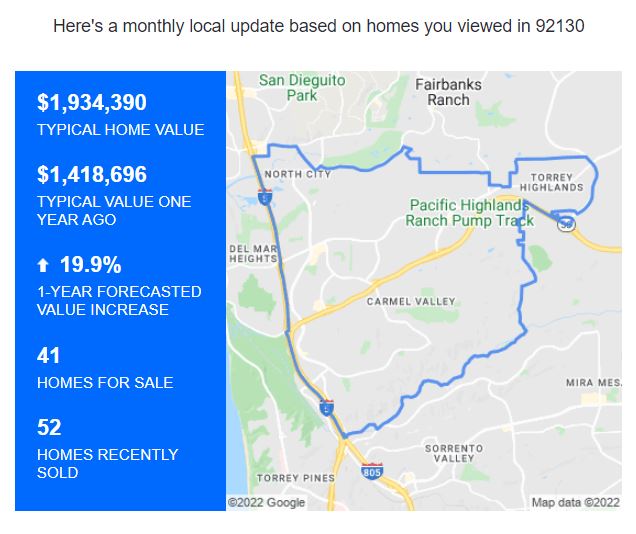

At the end of July, their prediction for Carmel Valley was for a 12.9% increase in values over the next year. Today, their forecast is for +1.7% appreciation over the next year for one of the strongest markets in the county. It means that many other areas are going to have a negative number.

On July 11th, Rob Dawg said:

Don’t panic.

If you do panic, panic first.

I can get your home on the market today!

by Jim the Realtor | Aug 18, 2022 | Forecasts, Jim's Take on the Market, Zillow |

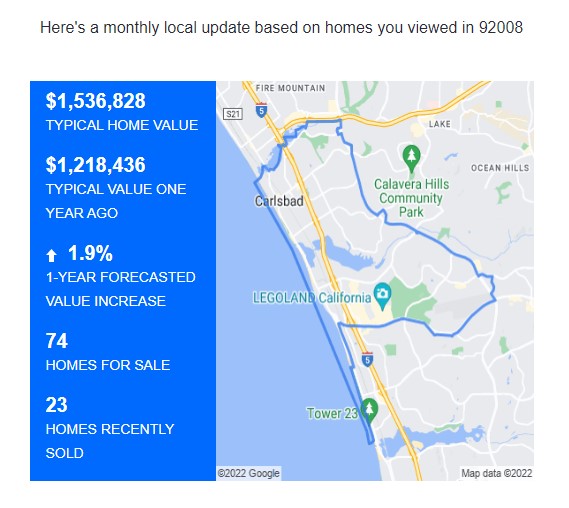

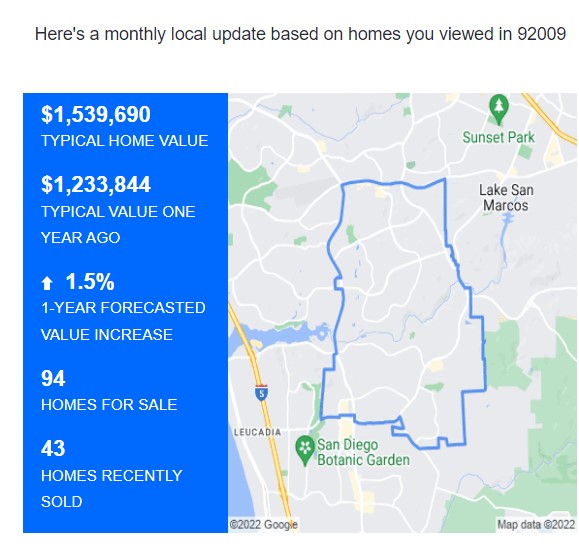

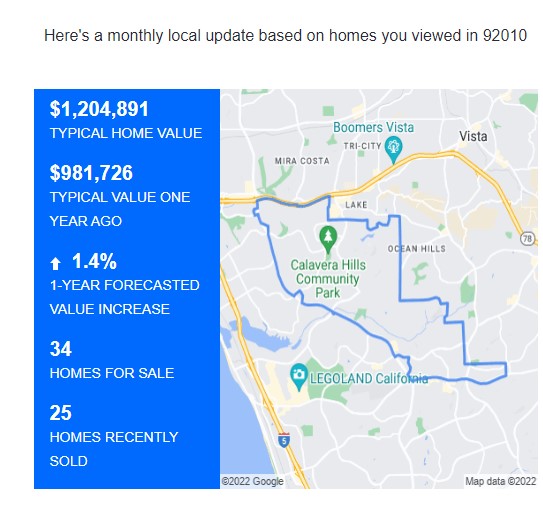

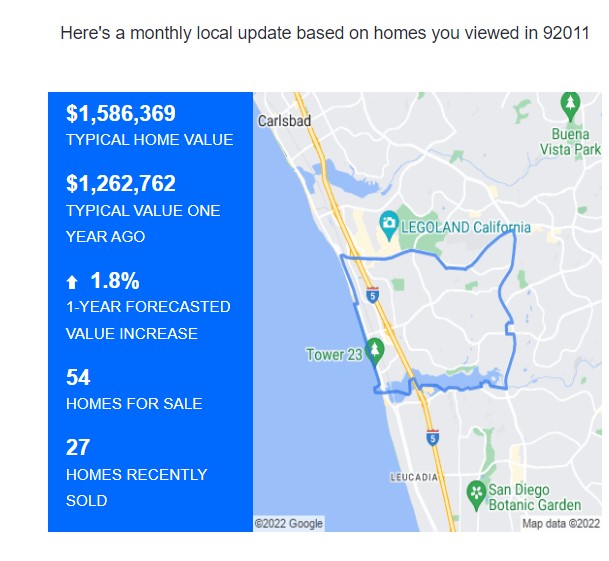

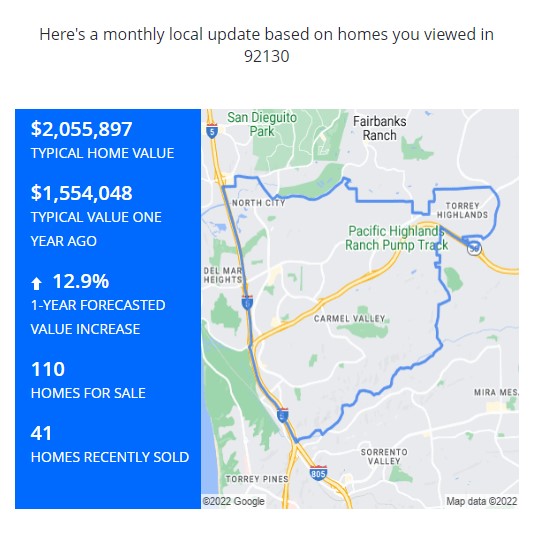

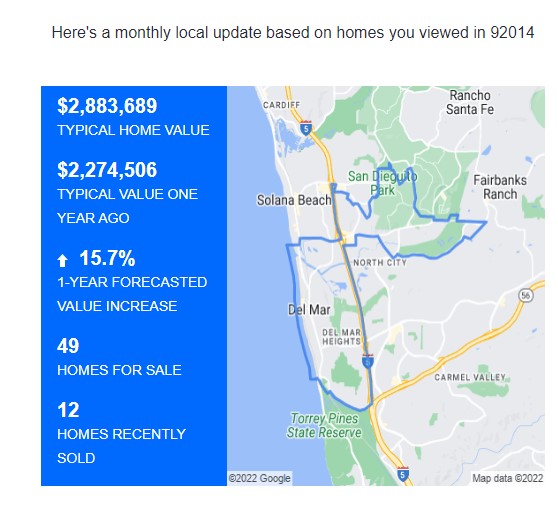

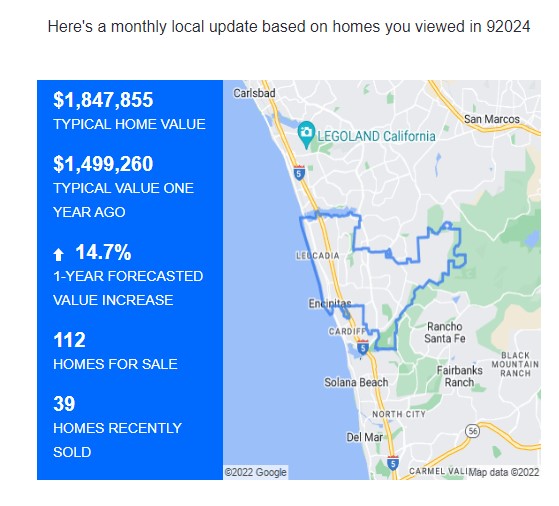

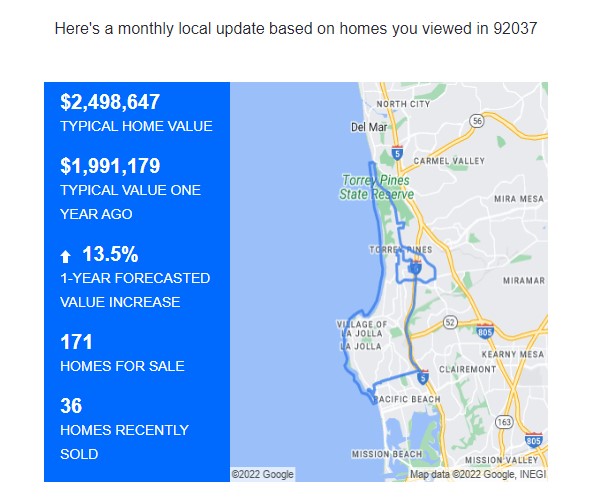

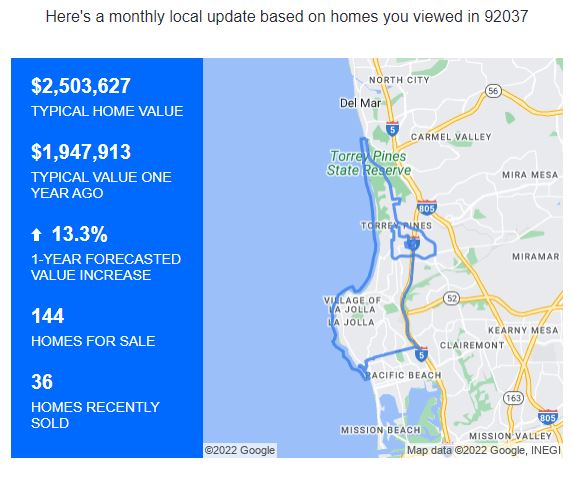

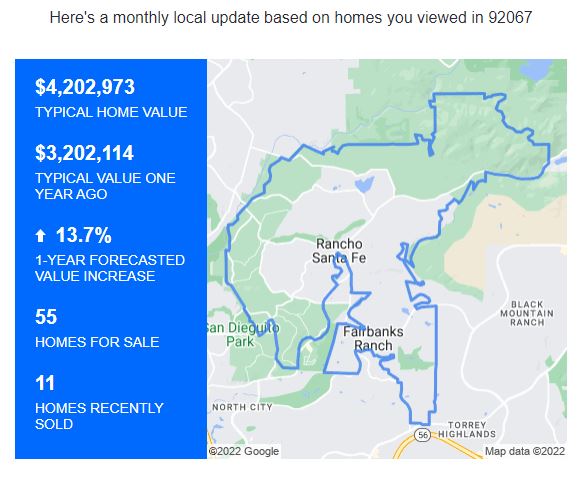

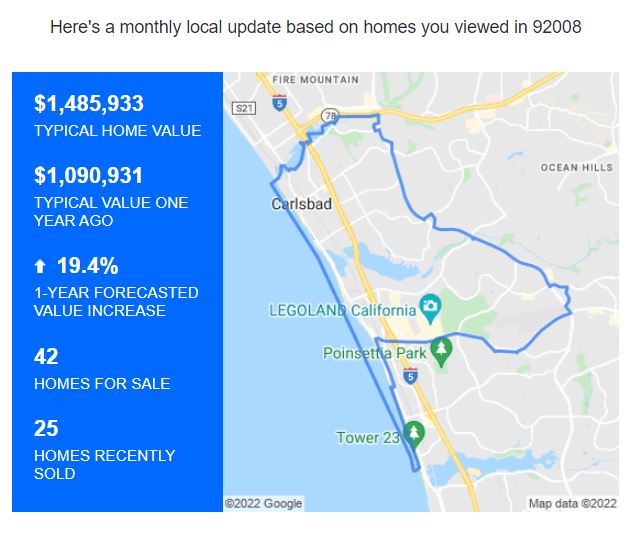

The latest Zillow 1-Year Forecasted Values are still expecting a fairly strong appreciation rate over the next year – these estimates are the same or higher than last month! I can see a path to how this could happen.

The Spring Selling Season gets frenzied up for 3-4 months where buyers and sellers all jump in at the same time, and then the market goes flat for the rest of the year…..kinda like this year!

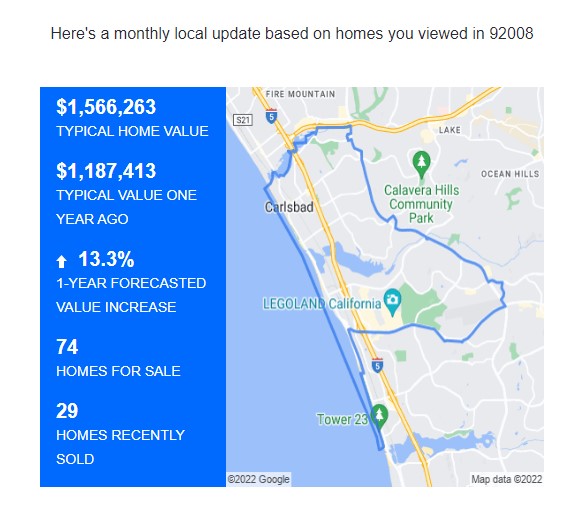

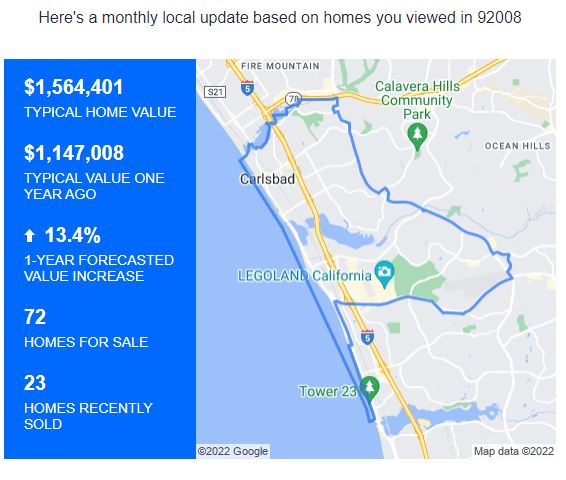

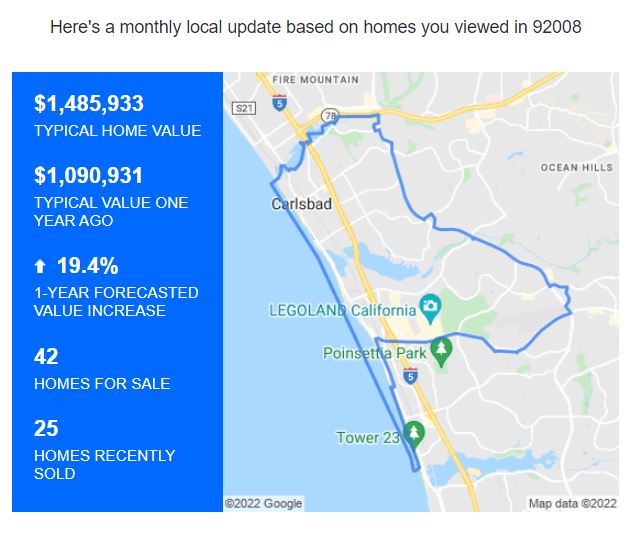

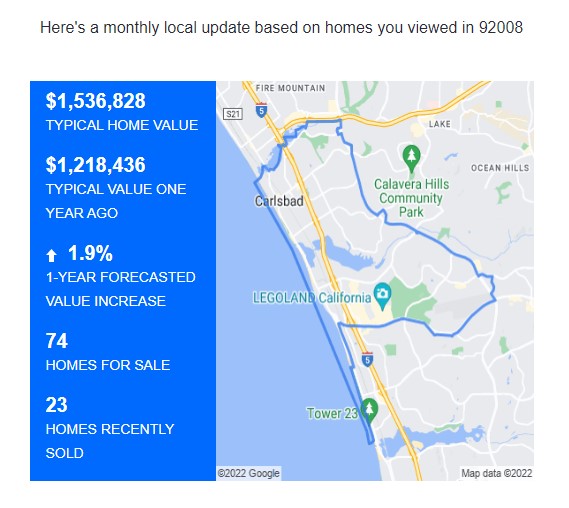

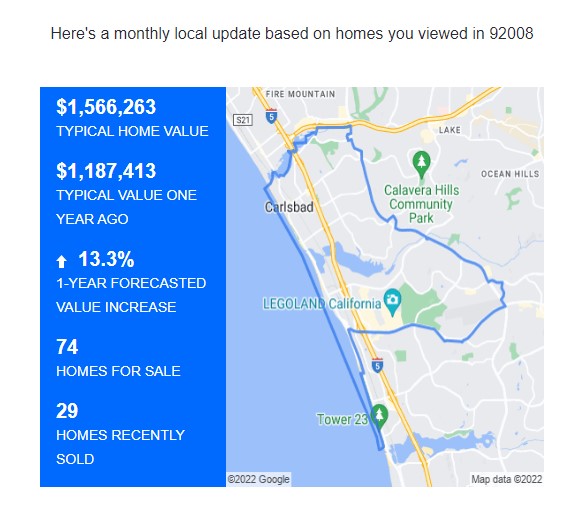

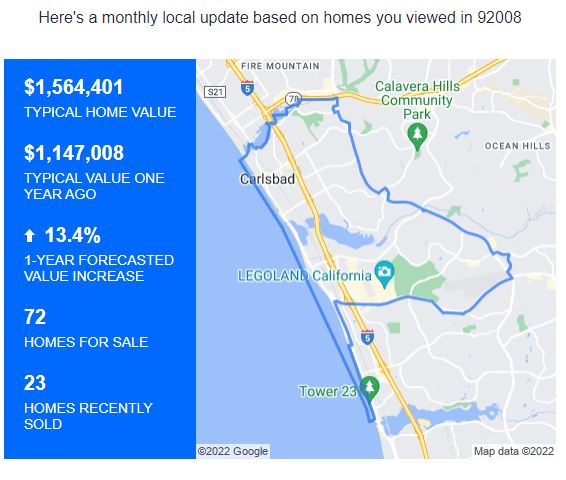

NW Carlsbad, 92008:

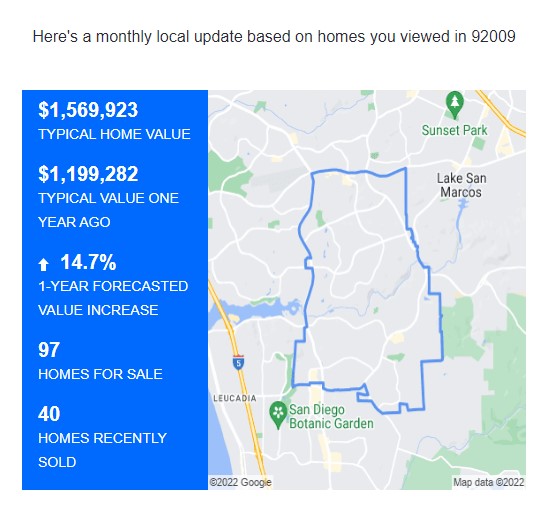

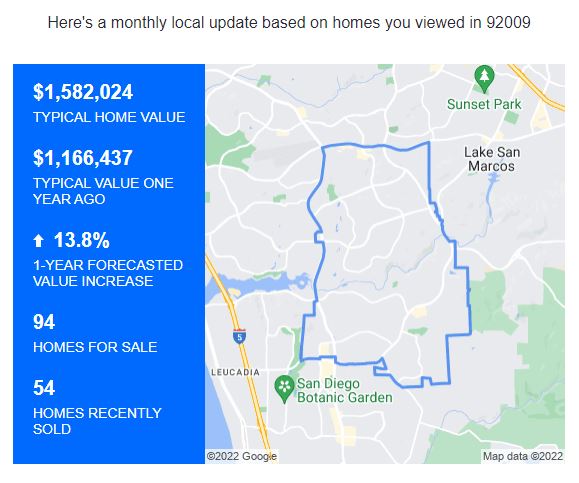

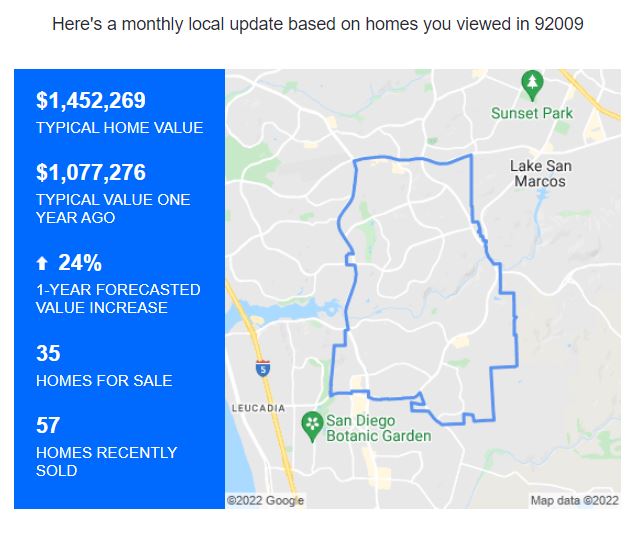

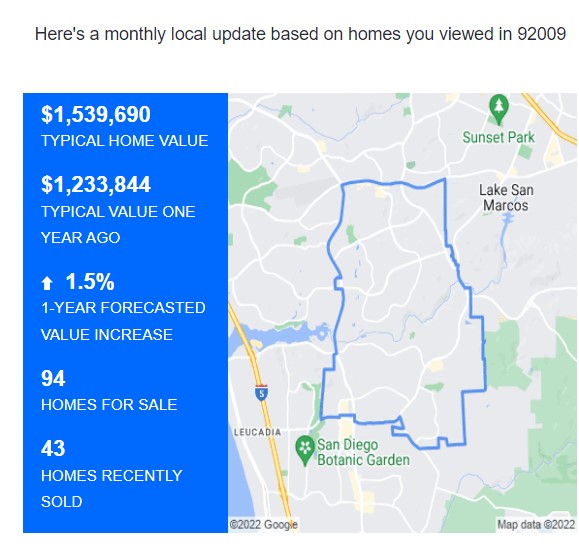

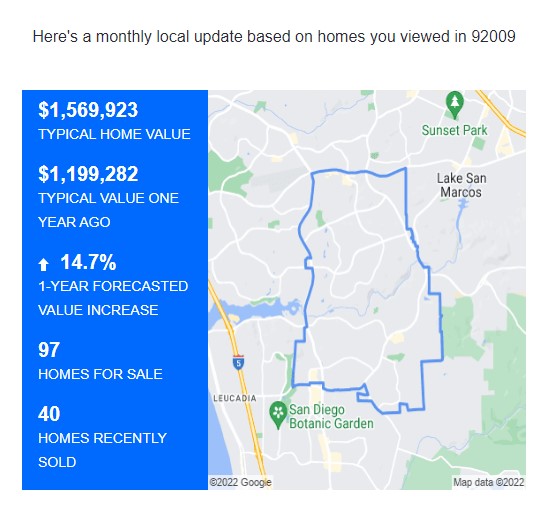

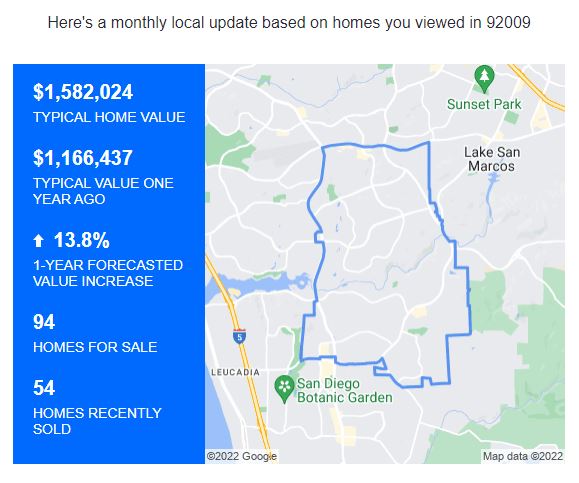

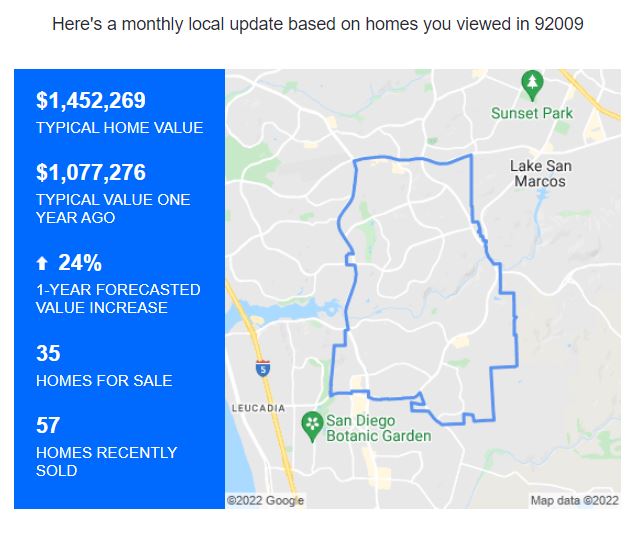

SE Carlsbad, 92009:

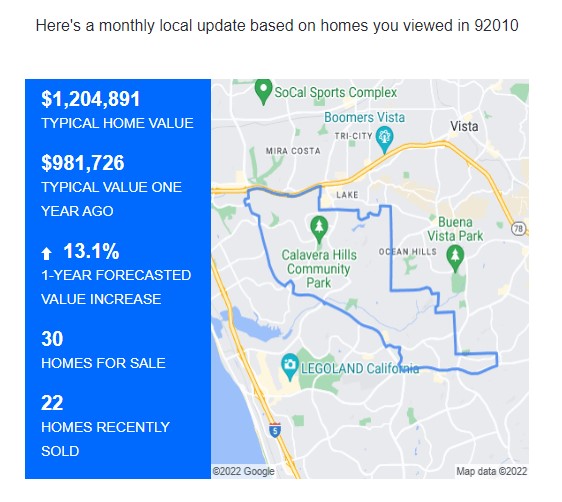

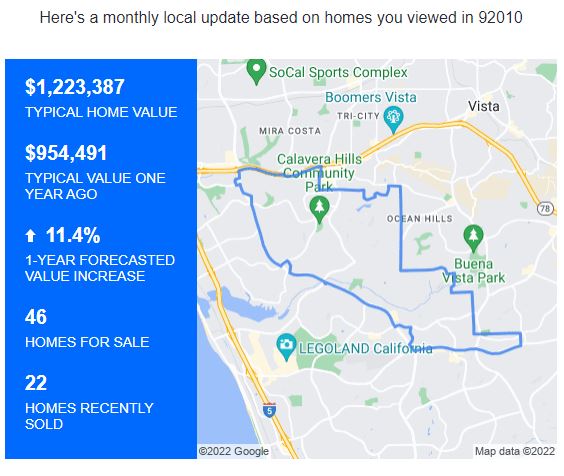

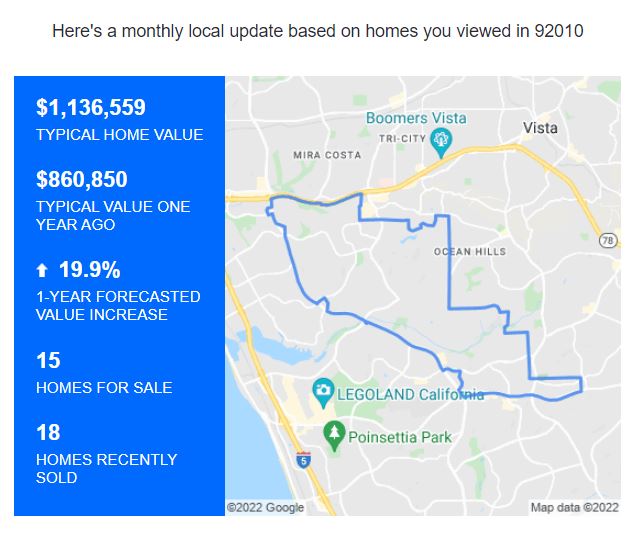

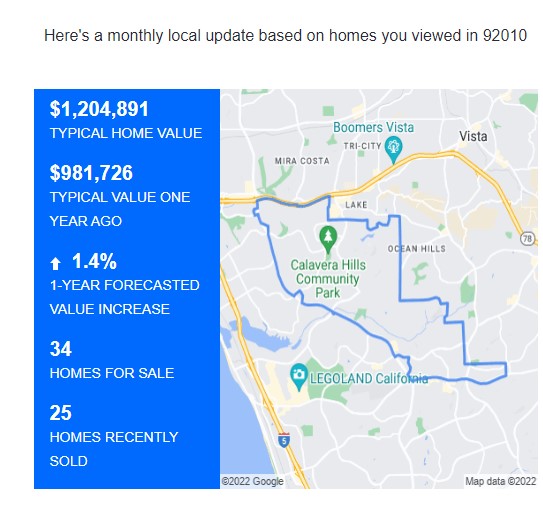

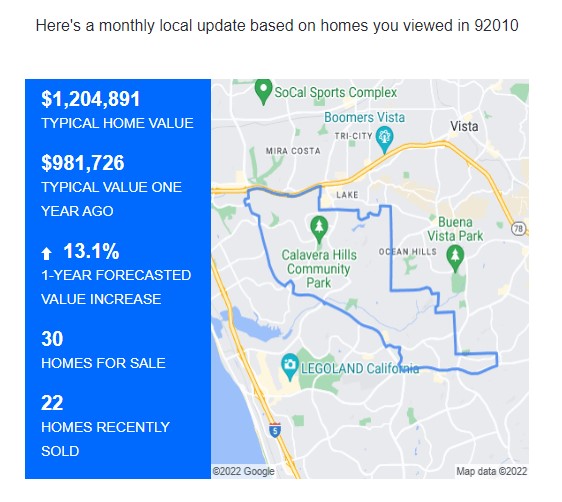

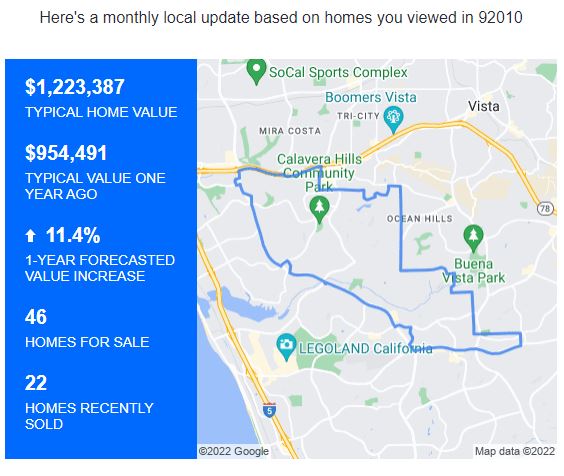

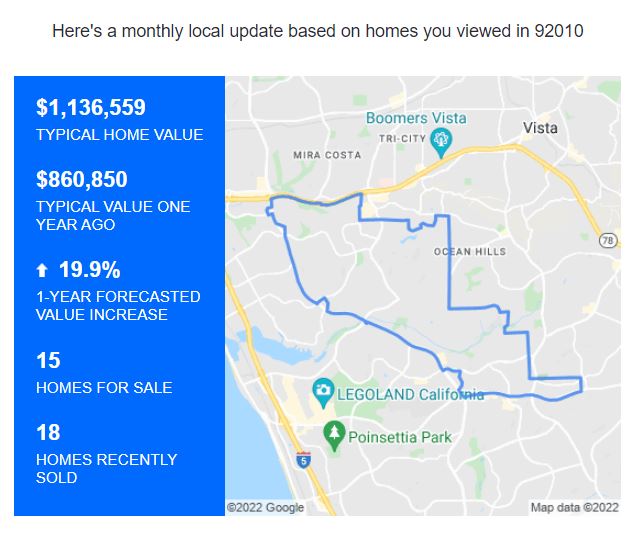

NE Carlsbad, 92010:

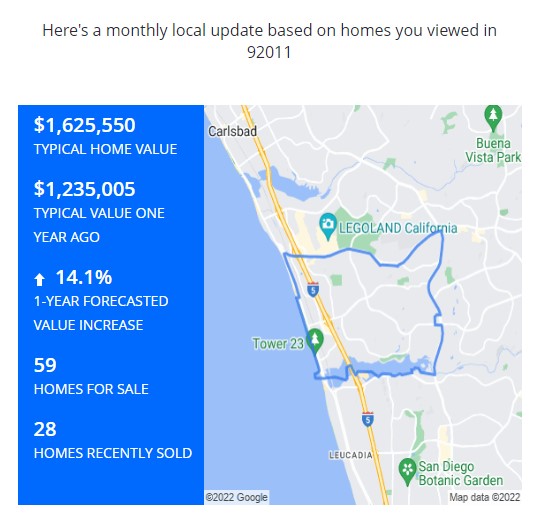

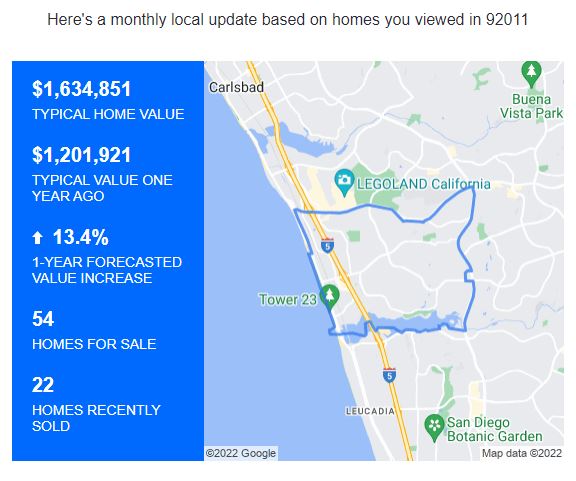

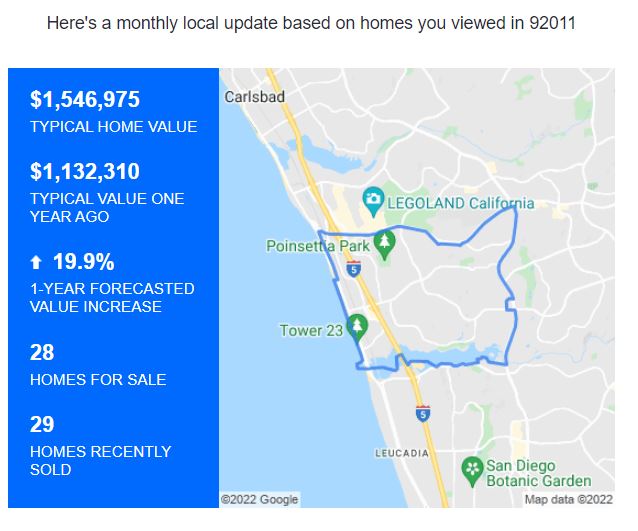

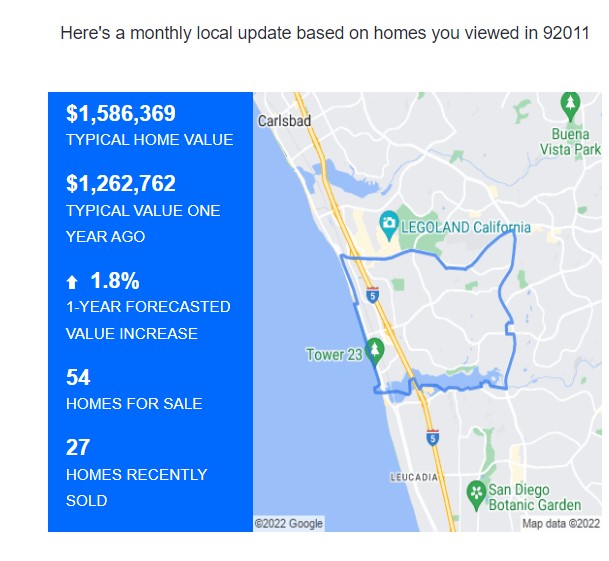

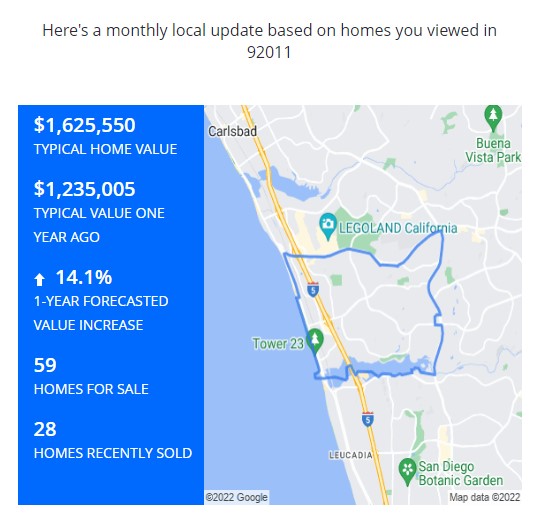

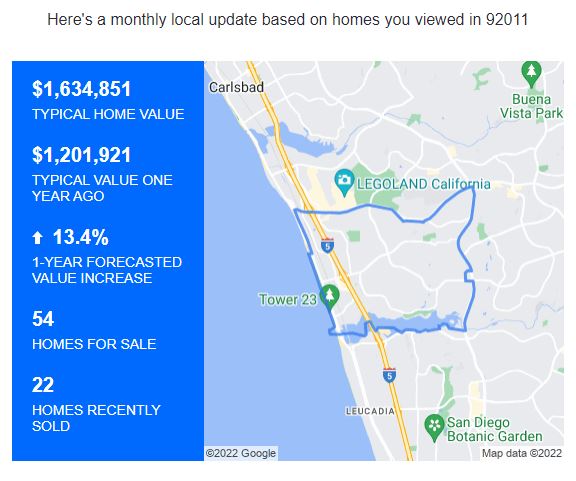

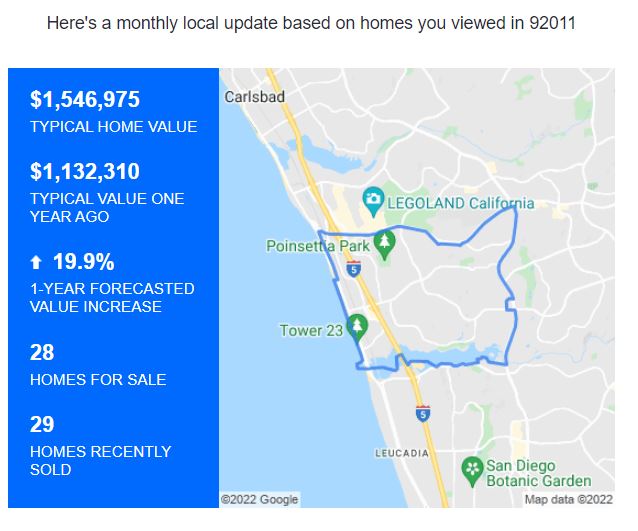

SW Carlsbad, 92011:

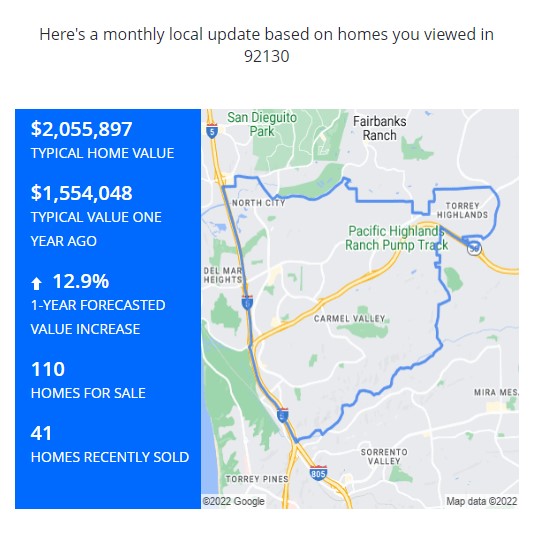

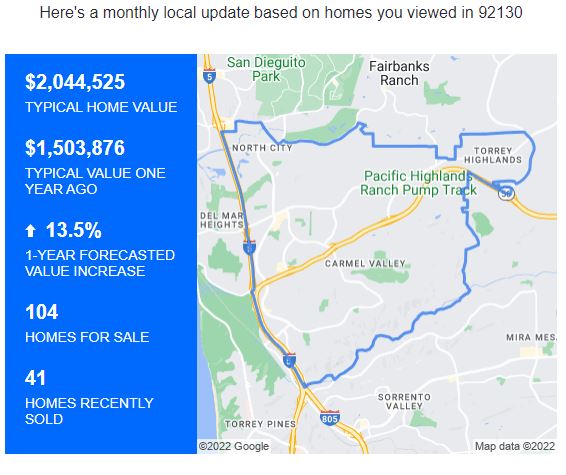

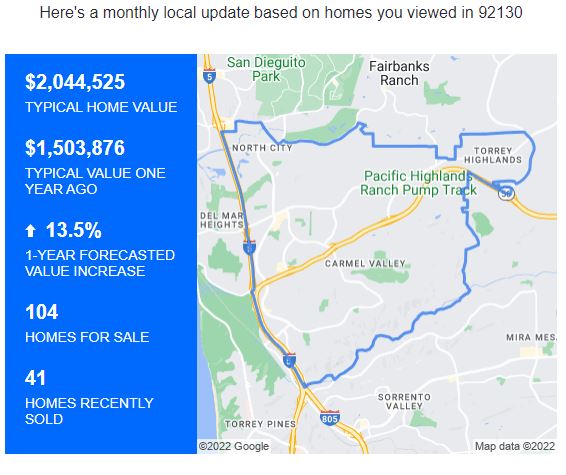

Carmel Valley, 92130:

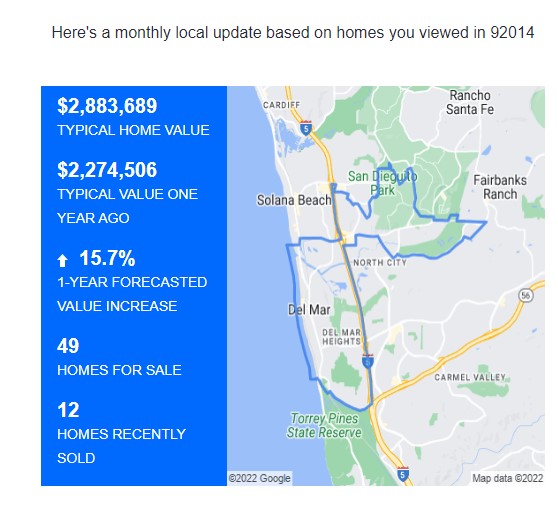

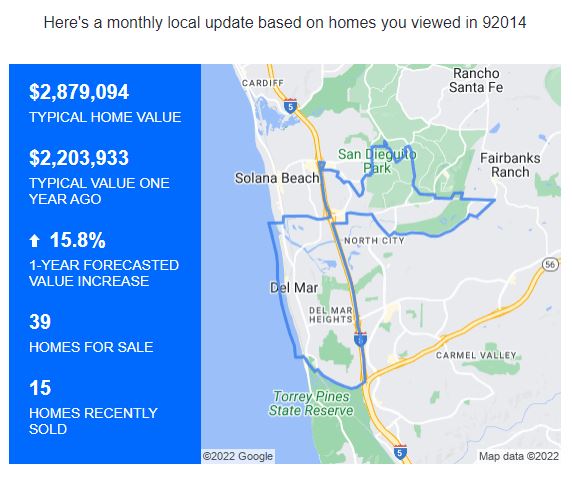

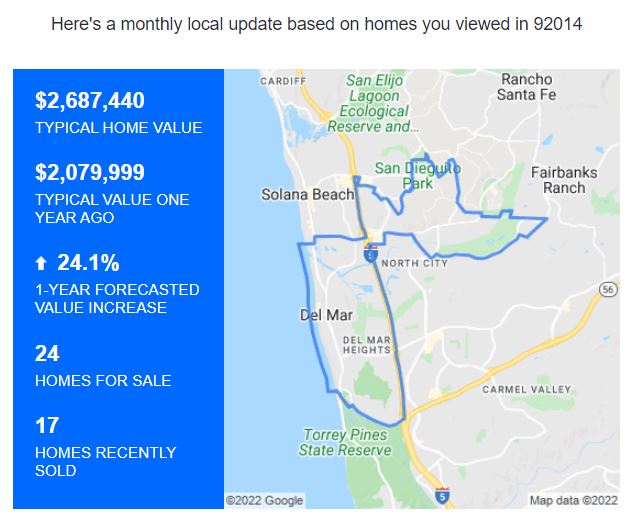

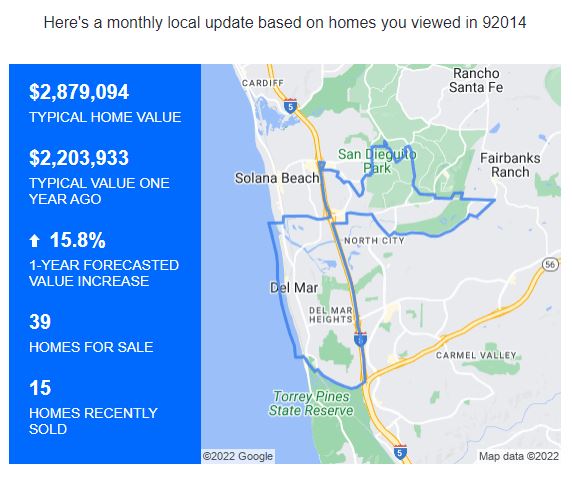

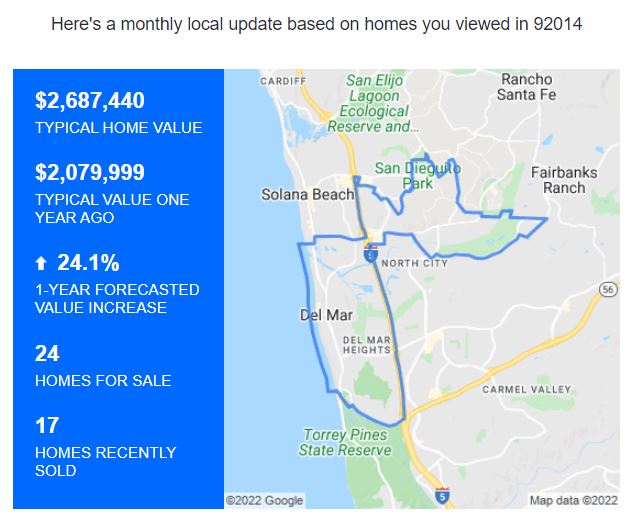

Del Mar, 92014:

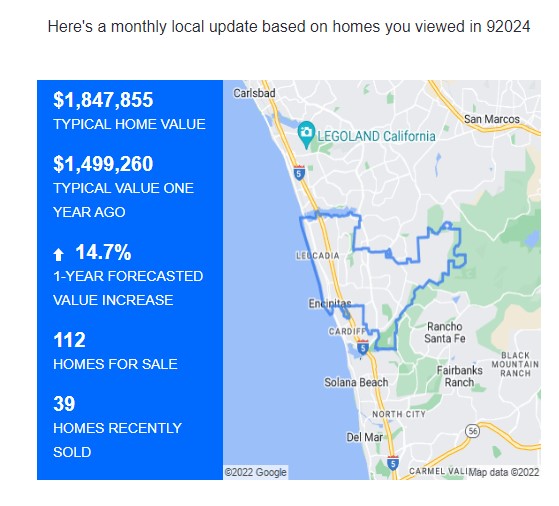

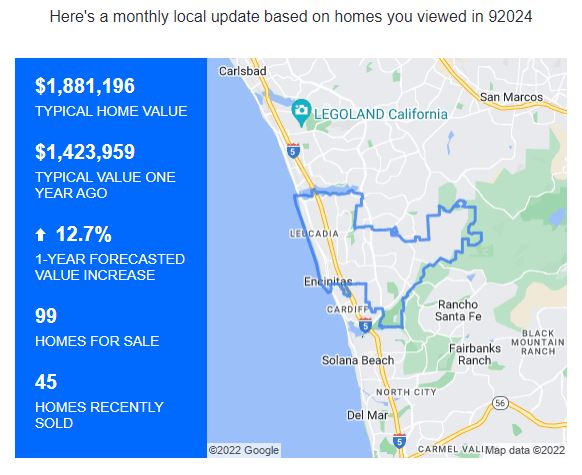

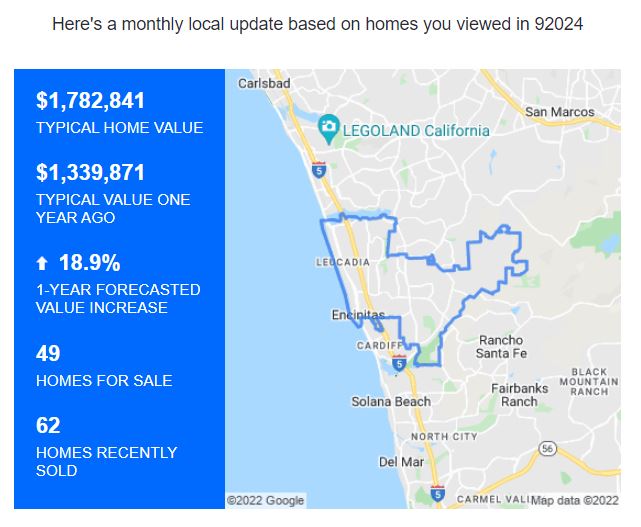

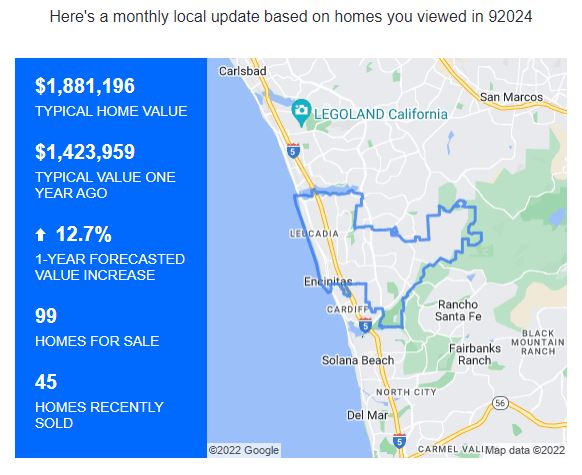

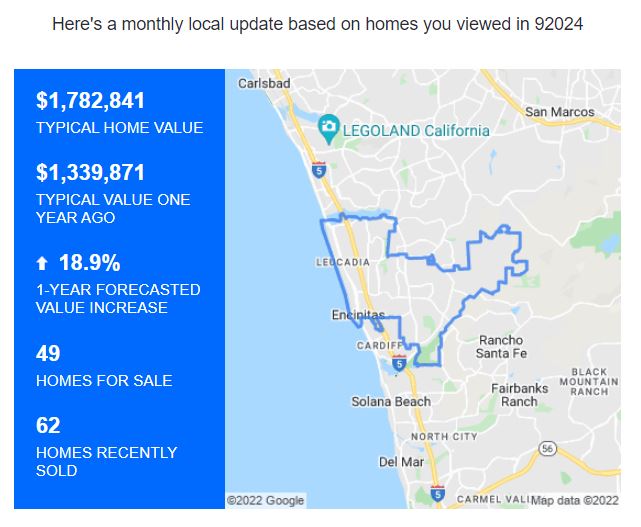

Encinitas, 92024:

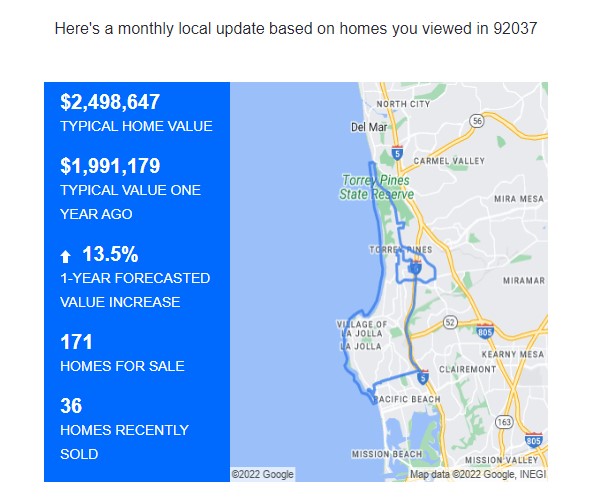

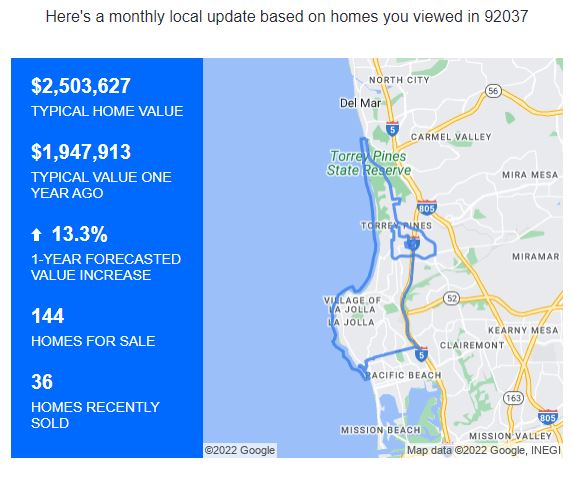

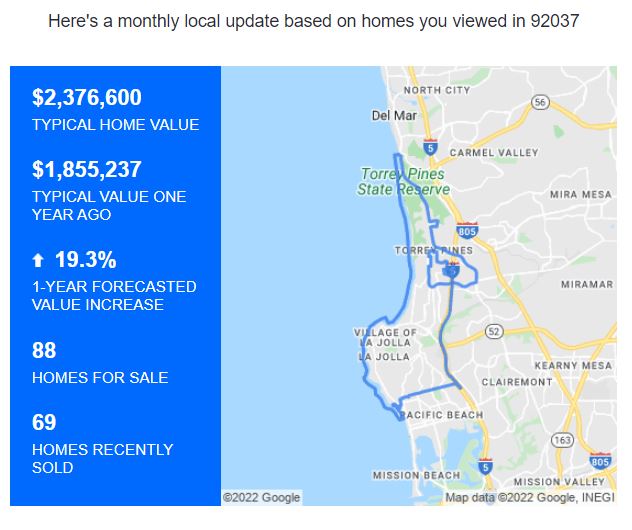

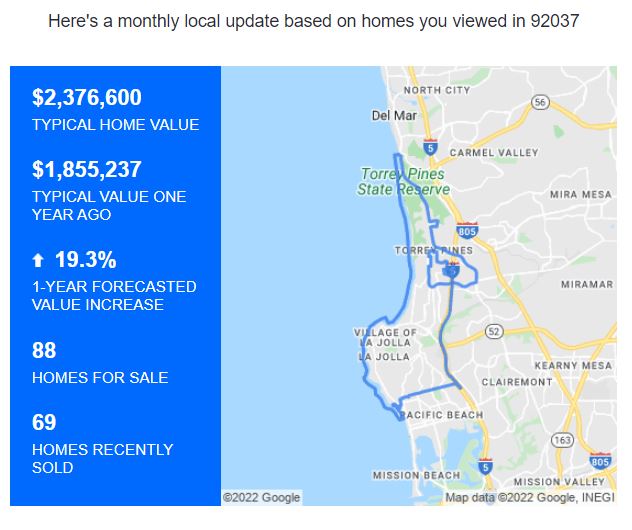

La Jolla:

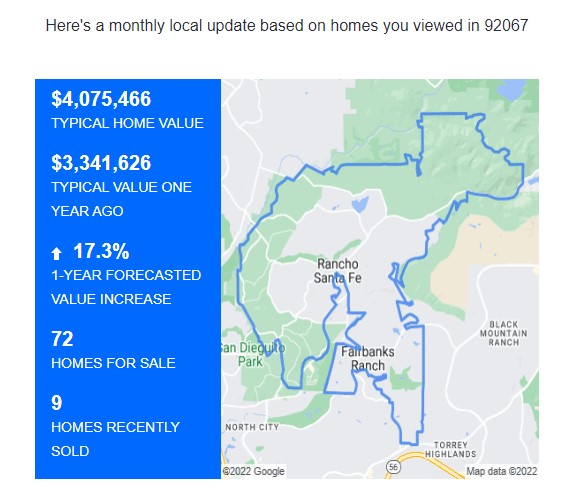

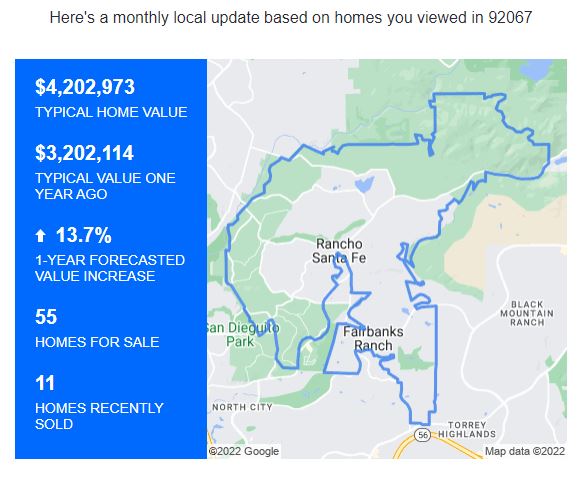

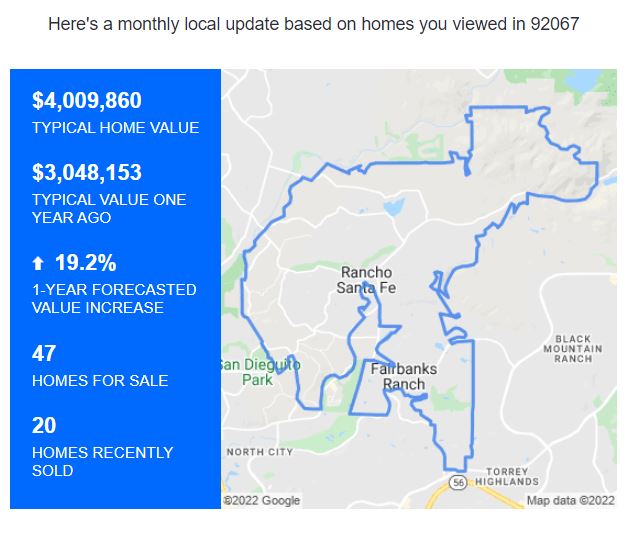

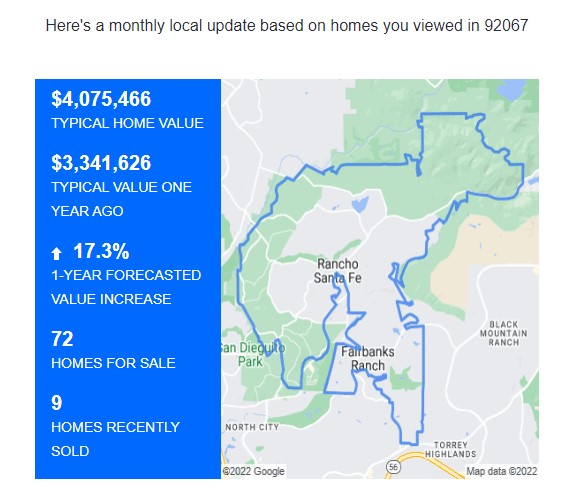

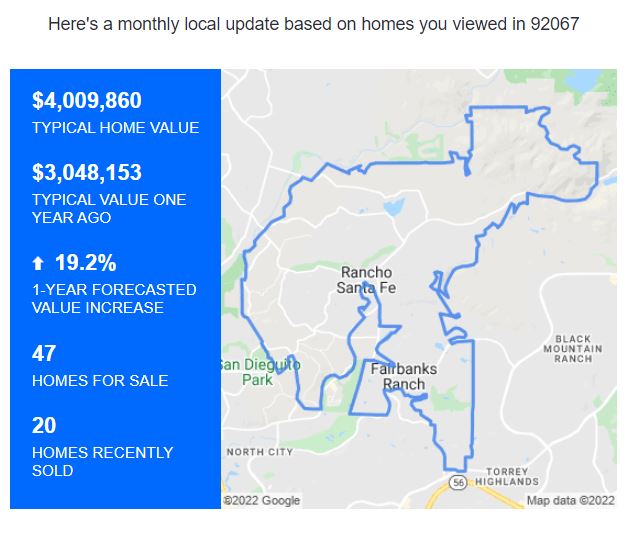

Rancho Santa Fe, 92067:

They do have website-viewer data that nobody else has, and hopefully they are using it to track the activity and make predictions.

by Jim the Realtor | Aug 4, 2022 | Realtor, Realtor Training, Zillow |

Whoever advertises the most, wins the game. I know agents who spend $25,000 to $50,000 per month!

Aug. 4, 2022- Zillow, Inc. and Opendoor Technologies Inc. have announced a multi-year partnership that combines two category leaders to transform how people start their move. The partnership will allow home sellers on the Zillow platform to seamlessly request an Opendoor offer to sell their home.

Selling a home can be full of uncertainty for many consumers who would rather focus on their next chapter than on the stresses of moving. Potential sellers on Zillow apps and sites may request and view an offer directly from Opendoor and easily compare it to an open-market sale using a real estate agent. Opendoor offers will be available on Zillow, and customers will be able to use the service as a standalone offering or package it with other Zillow home shopping services such as financing, closing and agent selection. Additionally, Zillow customers will be able to work with a licensed Zillow advisor who will serve as a helpful guide in understanding these options.

“Zillow is the most visited brand in online real estate. As we bring the housing super app to life, we’re empowering our millions of visitors to understand all their options and transact in the way that best meets their housing needs,” said Zillow Chief Operating Officer, Jeremy Wacksman. “We know choice is important for customers and they can make the best decision when they see all of their selling options up front — including selling on the open market with a Zillow Premier Agent partner and getting a cash offer from Opendoor. This exclusive partnership will pair Zillow’s audience and brand power with Opendoor’s selling solution in one easy place, so customers can evaluate their selling options and easily package it with other Zillow services to buy and finance their next home.”

“At Opendoor, we’re working to turn what is often viewed as one of life’s most stressful moments — the home move — into an e-commerce experience that’s simple, certain and fast. By bringing together Zillow’s market-leading audience and Opendoor’s e-commerce platform, more consumers will have the option to sell to Opendoor and save themselves the stress and uncertainty of a traditional sale process,” said Opendoor President Andrew Low Ah Kee. “For parents looking to upsize, a young professional moving for a new job, and millions of others who regularly use Zillow to explore their home selling options, we will provide them with the ability to move with a tap of a button.”

Zillow and Opendoor are working together to launch this new product experience with the goal of serving shared customers nationwide in the coming months and years.

https://www.prnewswire.com/news-releases/zillow-opendoor-announce-multi-year-partnership-301600329.html

by Jim the Realtor | Jul 15, 2022 | Forecasts, Zillow |

The latest Zillow 1-Year Forecasted Values are still expecting a fairly strong appreciation rate over the next year. In May, they were guessing +19% or more in all areas, so this looks like a soft landing:

NW Carlsbad, 92008:

SE Carlsbad, 92009:

NE Carlsbad, 92010:

SW Carlsbad, 92011:

Carmel Valley, 92130:

Del Mar, 92014:

Encinitas, 92024:

La Jolla:

Rancho Santa Fe, 92067:

They do have website-viewer data that nobody else has, and hopefully they are using it to track the activity and make predictions.

by Jim the Realtor | Jun 3, 2022 | Zillow |

Let’s revisit Encinitas Ranch for an example of how the zestimates will affect the post-frenzy era. Consider the ER comps since my $3,760,000 sale closed in November.

This is where the algorithms should perform beautifully because there have been eight sales of similar tract houses built at the same time on similar sized lots and views. All eight of these sales closed at prices at least $200,000 below my sale.

If zestimates are accurate, ours should have dropped to at least $3,500,000, and there is a model-match sale at $3,050,000 in March – the height of the frenzy.

What does Zillow think?

What they are doing to the marketplace should be criminal, because buyers and sellers both want a quick value check to verify their hopes and dreams – yet even in the very typical tract neighborhoods, the zestimates tend to be way off.

What’s worse is once a home goes on the open market, they reset their zestimate to be close to the list price so no one can tell how wrong they are.

Is it feasible that the traditional way we’ve determined home values gets phased out, and we just let our masters shove garbage down our throats? Absolutely, and because the real estate cycles have been eliminated, we won’t know the difference.

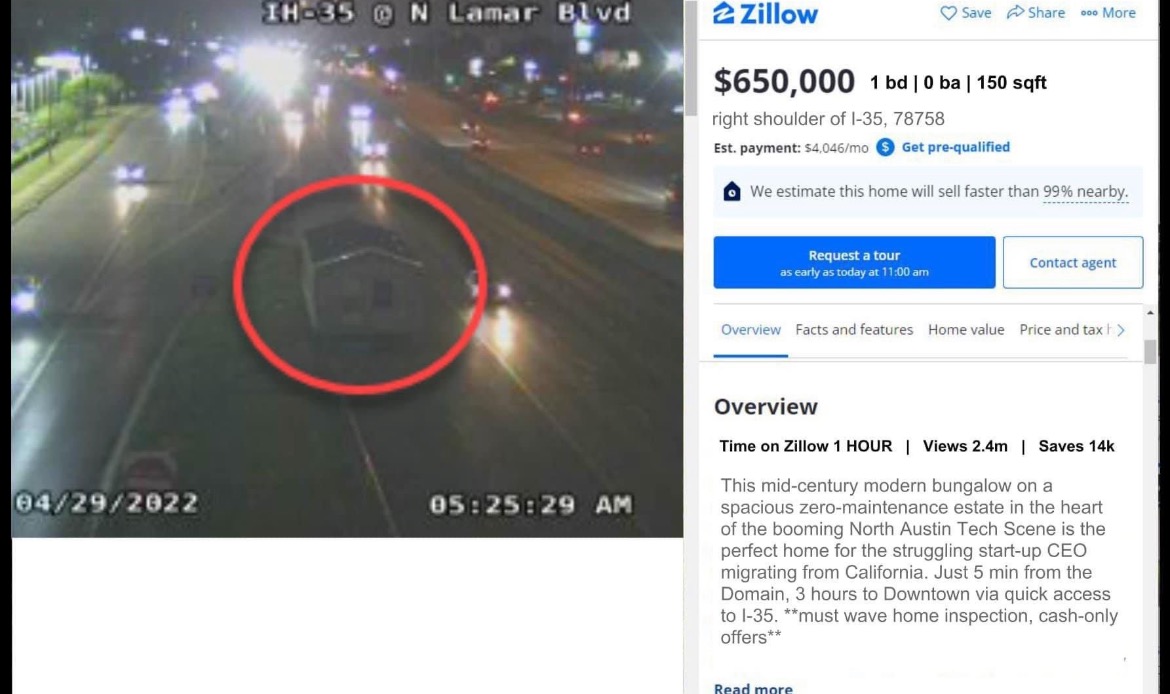

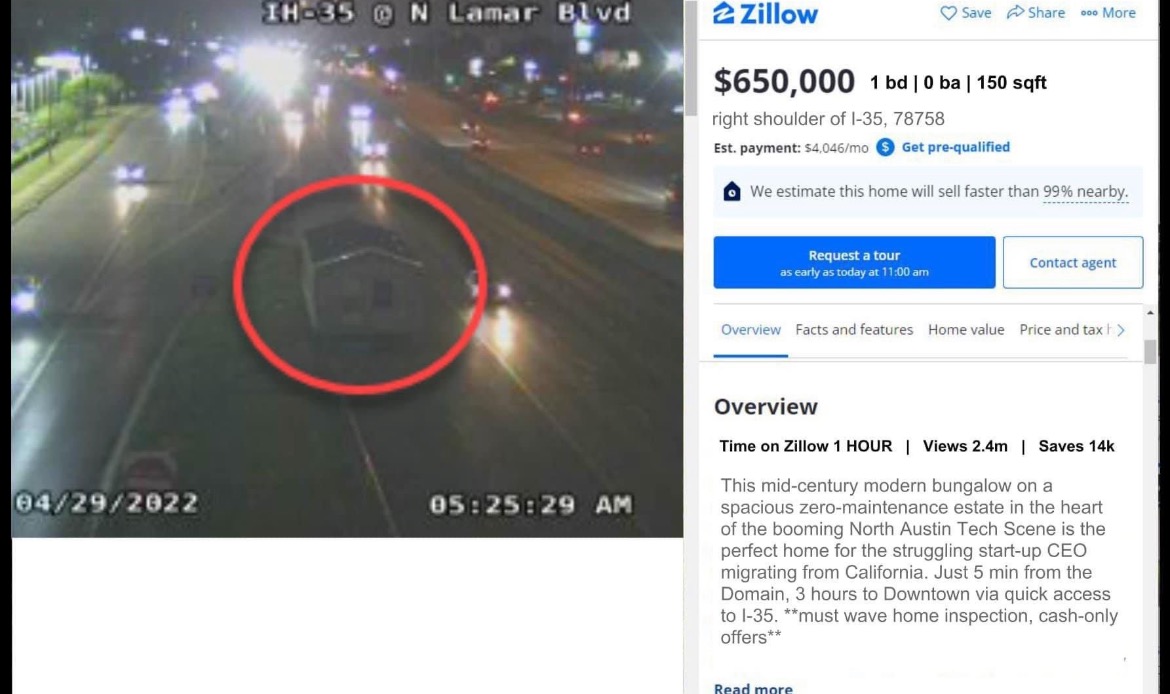

by Jim the Realtor | May 18, 2022 | Interesting Houses, Zillow

You think it’s bad here? Hat tip to ML for sending this in!

by Jim the Realtor | May 16, 2022 | Zillow |

Home buyers who value their privacy don’t like seeing their home’s photo gallery advertised on Zillow after the sale is completed. Zillow has made it easier to remove those photos!

Here are the instructions:

To add or remove photos on your home’s property page, you must claim ownership of your home’s property page and navigate to the Edit Facts screen.

- Sign in to your Zillow profile.

- Click on the profile icon, then select Your Home from the menu option.

- Click on the tile for your home to load the property page. If you have not already claimed your home on Zillow, please follow these steps.

- Once you have claimed your home, click on the Edit Facts icon from the Owner View of the property page.

- To add photos, click the Upload photos button under Photos & media.

- You will be prompted to select photo files stored on your computer to upload.

- To remove a photo, click on an individual photo and click Remove Photo.

- To rearrange photos, click on the individual photo and hold the left mouse button down. Drag any photo to the desired place in the photo grouping order.

- Save your changes by clicking the Save Changes button at the bottom of the page.

https://zillow.zendesk.com/hc/en-us/articles/202036344-How-do-I-add-or-remove-photos-of-my-home-

by Jim the Realtor | May 2, 2022 | 2022, Jim's Take on the Market, Why You Should List With Jim, Zillow |

At some point over the last 6-12 months, Zillow started revising their zestimates higher – way higher!

It has been noticed too, and now virtually every potential seller brings their zestimate to the table, and expects to list their home for that amount……or more.

But in the latest Zillow forecasts by zip code, they have SCALED BACK their big percentage increases!

Are they scaling back the zestimates too? If not, the list pricing for the rest of 2022 will be frothy.

Here are their current forecasts, with the previous forecast beside each zip code:

NW Carlsbad, 92008 (+30.4%)

SE Carlsbad, 92009 (+30.5%)

NE Carlsbad, 92010 (+29.5%)

SW Carlsbad 92011

Carmel Valley 92130 (+30.2%)

Del Mar, 92014 (+30.7%)

Encinitas, 92024 (+30%)

La Jolla, 92037 (+29.1%)

Rancho Santa Fe, 92067 (29.3%)

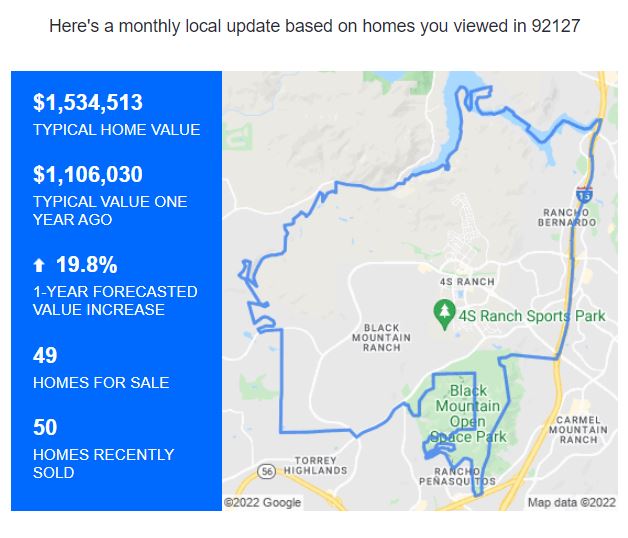

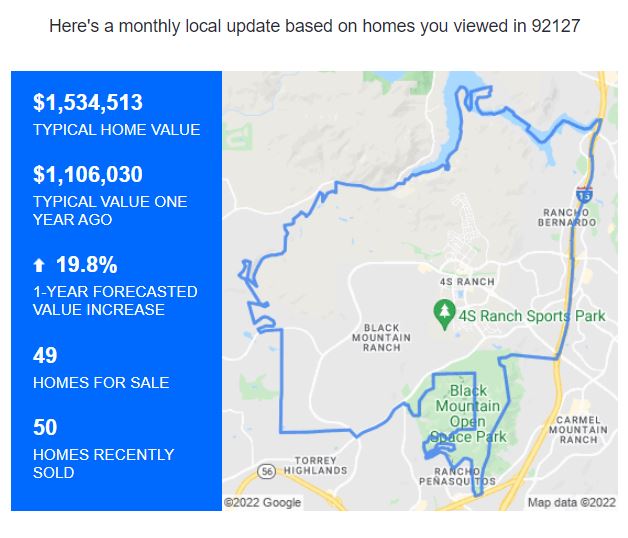

West RB, 92127 (+30.9%)

Previous forecasts here: https://www.bubbleinfo.com/2022/03/01/zillow-now-says-30-appreciation/

They do have something that none of the ivory-tower economists have – the real estate viewer data.

They have lowered their local 1-year pricing forecasts by 5% to 11% in every zip code, which must be resulting from their algorithms sizing up the customer viewing data….doesn’t it?

Are they lowering the zestimates too?

It is hard to track because once a home goes on the MLS, their zestimate is automatically adjusted to within a couple of bucks of the list price. But are consumers – sellers and buyers – aware of that? No, and not even the agents know it. Everyone will wonder if the zestimate is legit, and they want to believe in something.

If we see more active (unsold) listings stacking up, we can attribute some, or all of it to the list pricing being based on the zestimates taken from earlier this year……..and sellers believing that they mean something! And then if they check their latest zestimate, it will be the same as their current list price, which will embolden them to think that the lucky young couple with 2.2 kids is right around the corner.

by Jim the Realtor | Apr 12, 2022 | Jim's Take on the Market, Market Conditions, Market Surge, Zillow |

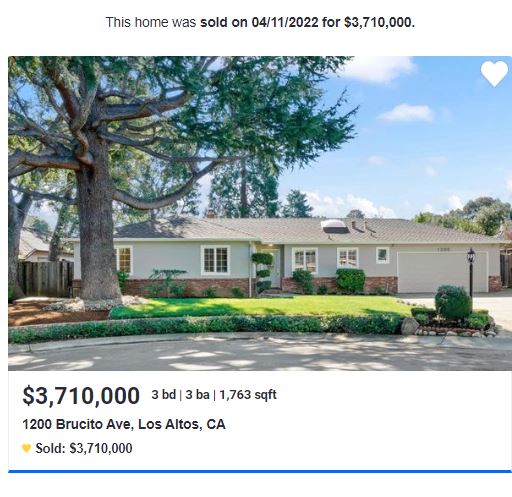

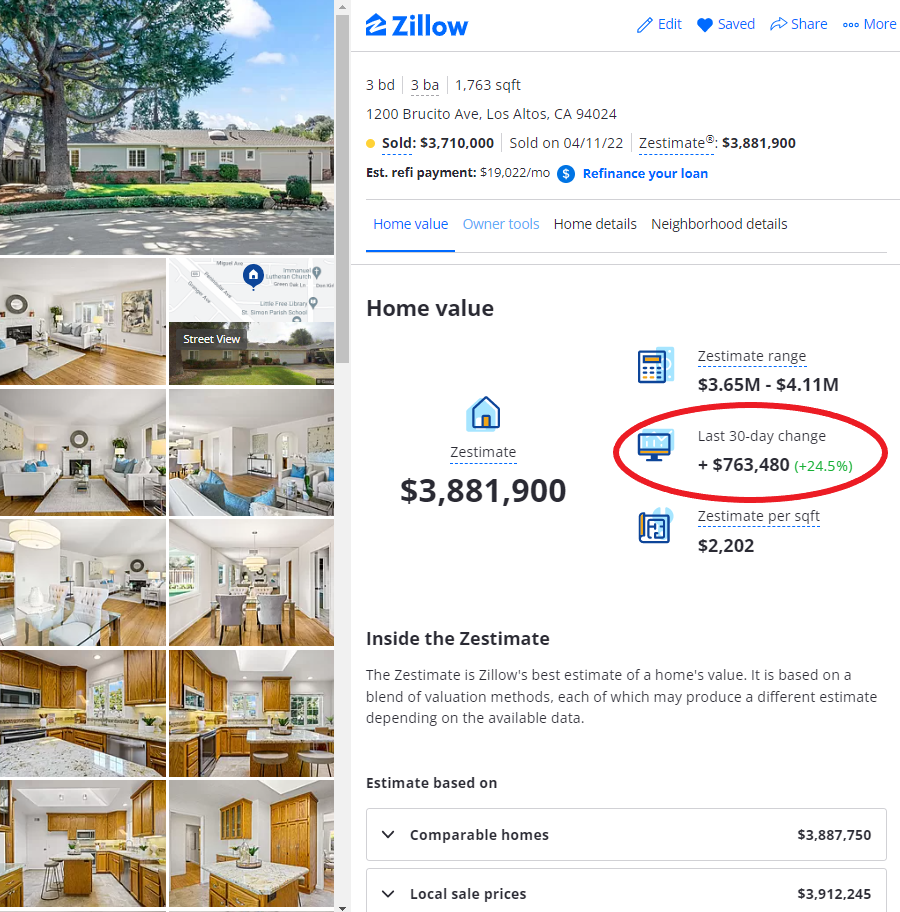

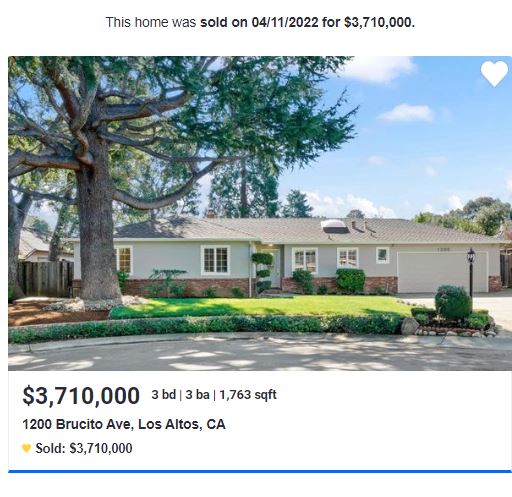

Sally’s former home in Los Altos closed yesterday for what seems to be the obligatory $500,000 over the list price (LP was $3,195,000):

https://www.zillow.com/homedetails/1200-Brucito-Ave-Los-Altos-CA-94024/19620416_zpid/

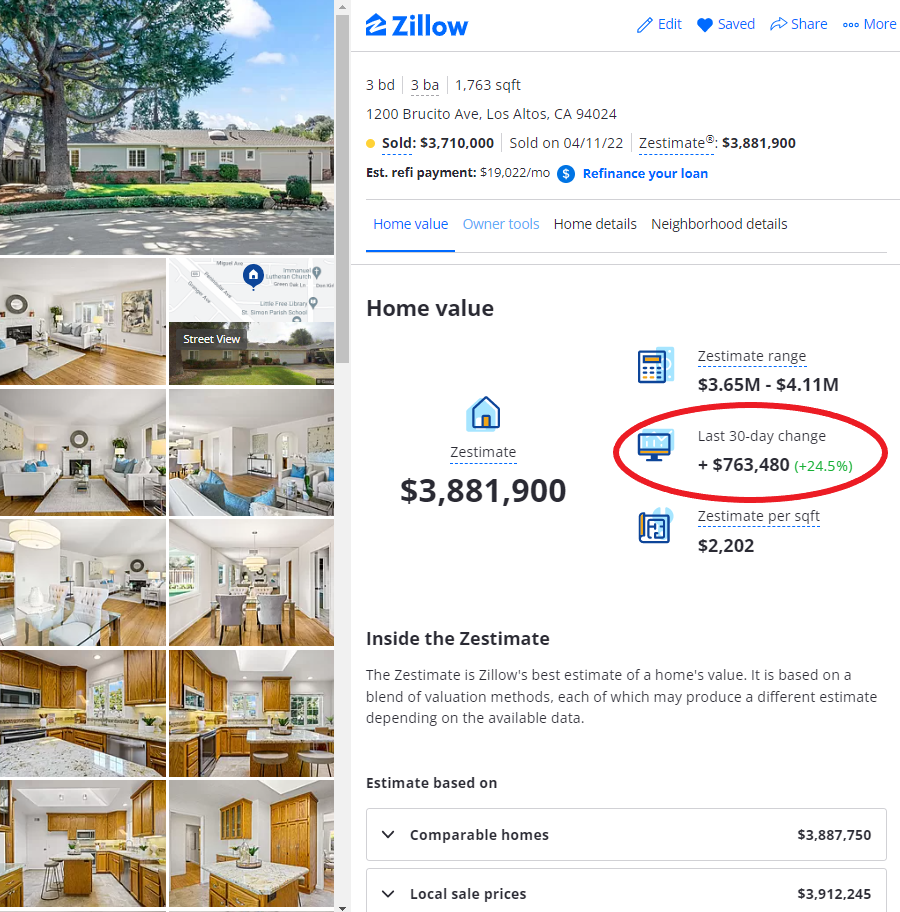

The bump over the list price is so customary in the local area that the zestimate was raised by $763,480 about the time it was marked pending – the algorithms already had the expected increase baked in!

They are enjoying The 2022 Lucky Windfall of the First Quarter, and we’ll see how well it holds up. But as long as home sales in the Bay Area keep selling for much-higher pricing than in San Diego, one of our main feeder areas will keep sending happy buyers our way!

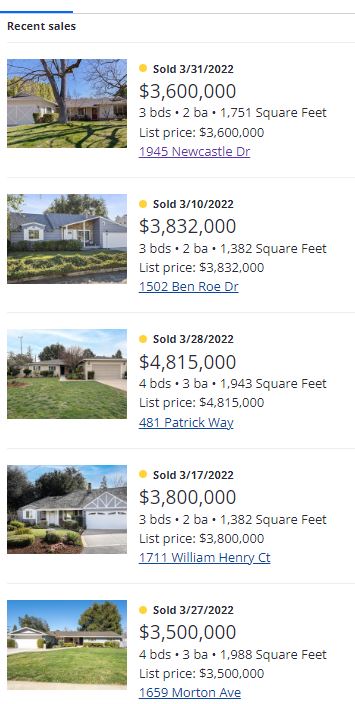

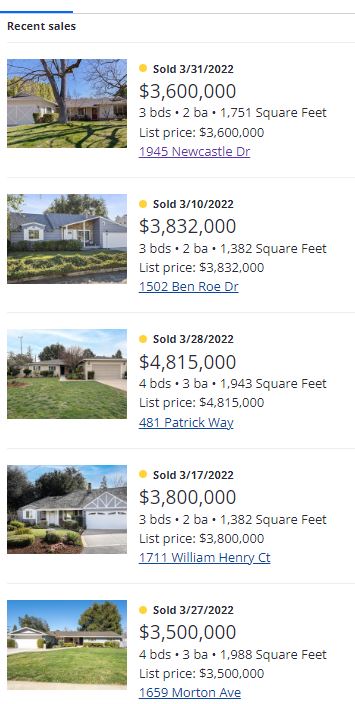

The list prices mentioned here all say that they sold for 100% of the LP, but it’s a typo – they all sold for well over. For example, Patrick Way sold for $1.1 million over, and William Henry sold for $800,000 over list:

Paying ~$2,000/sf for modest homes in Los Altos has been fairly routine lately!

Hopefully, those sellers keep coming our way. Even if their market were to dip 10% to 20% from these dizzy heights, they will still love what they can buy here for the money.