by Jim the Realtor | May 17, 2023 | 2023, Zillow

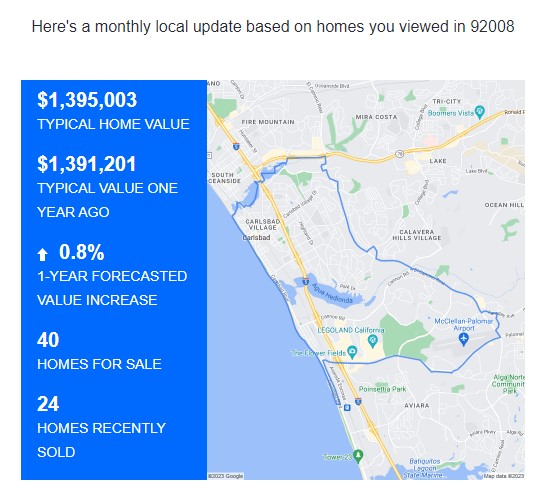

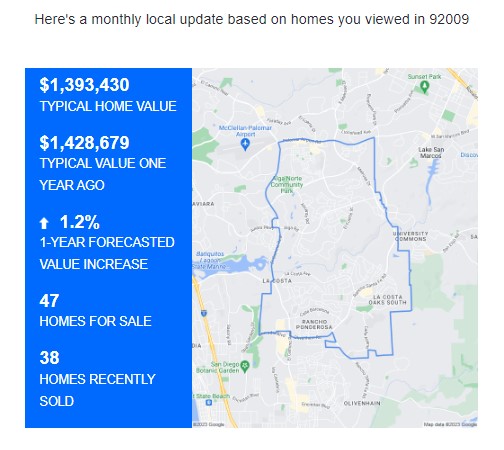

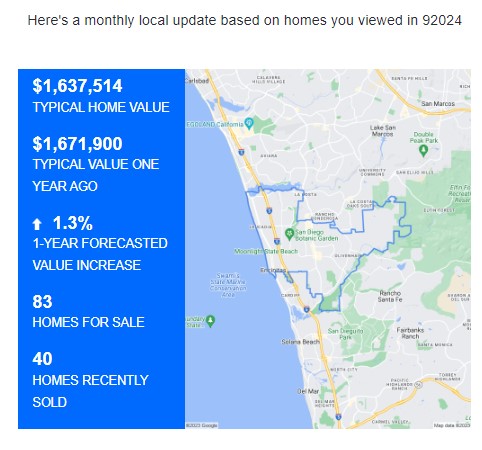

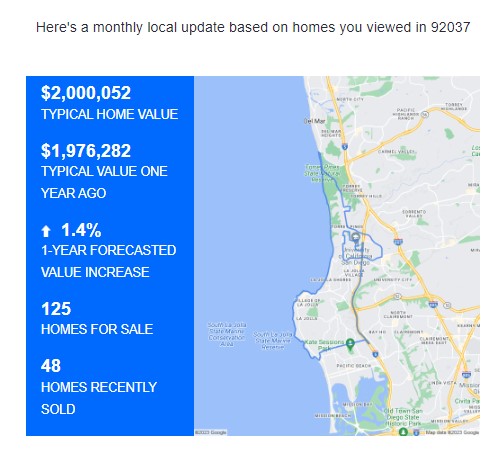

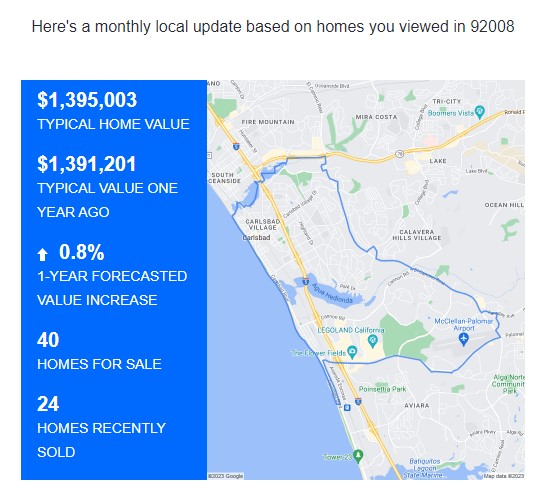

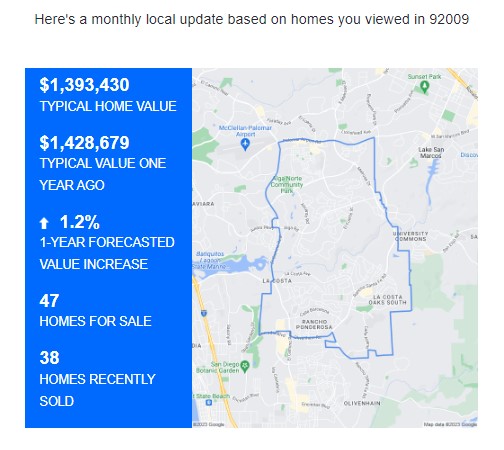

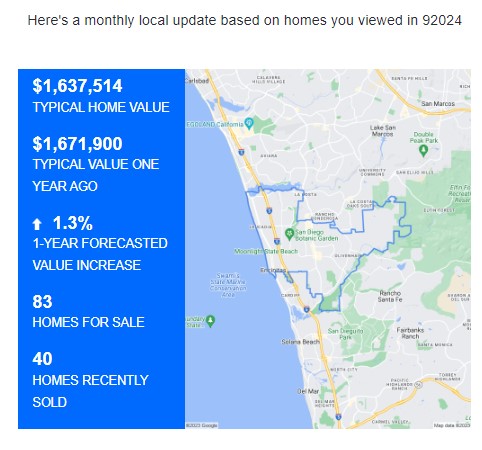

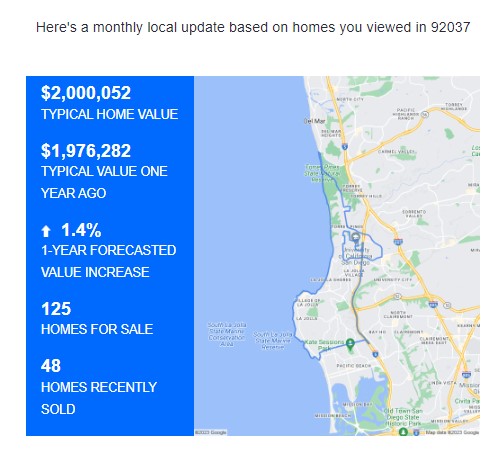

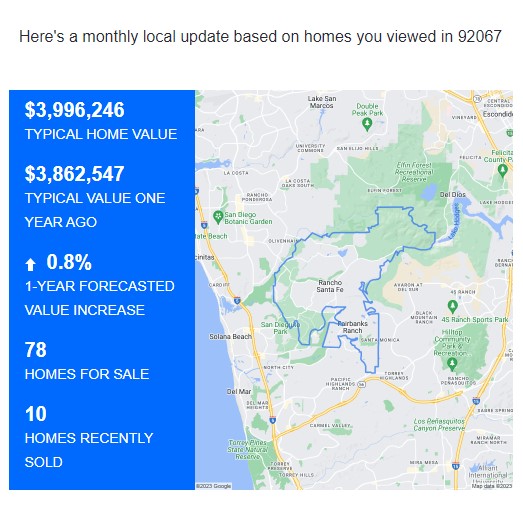

Here are the Zillow estimates of appreciation over the next year – all are back into positive territory! If they are reading it correctly, it means they will have more increases coming over the next couple of months before the appreciation rate relaxes during the off-season.

Their accuracy doesn’t matter – it’s their impact on today’s home buyers that counts:

NW Carlsbad 92008

SE Carlsbad 92009

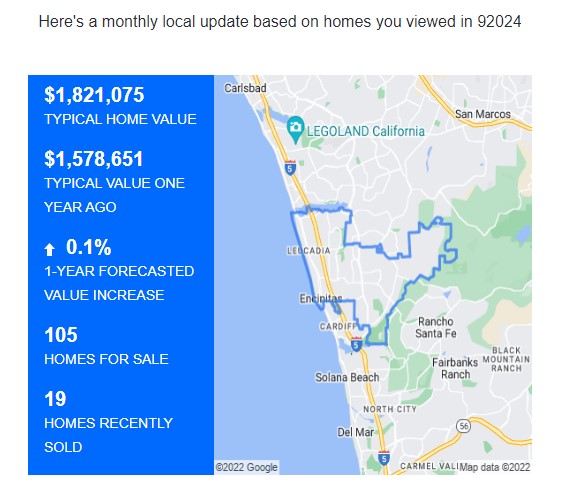

Encinitas 92024

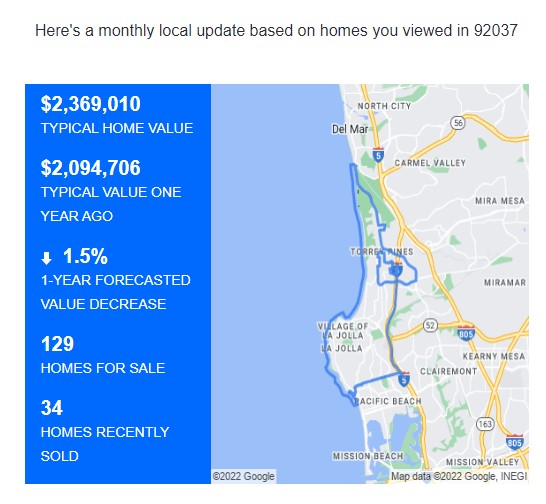

La Jolla 92037

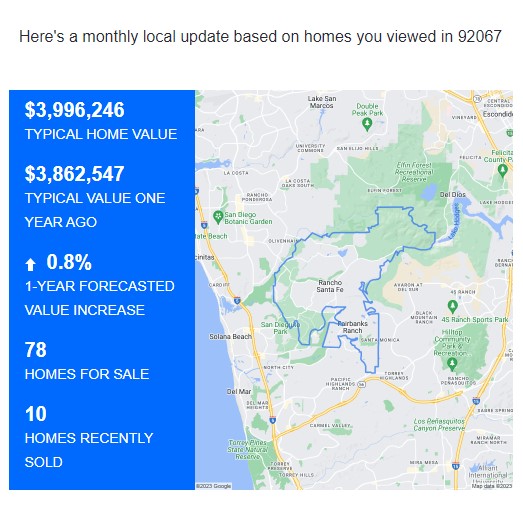

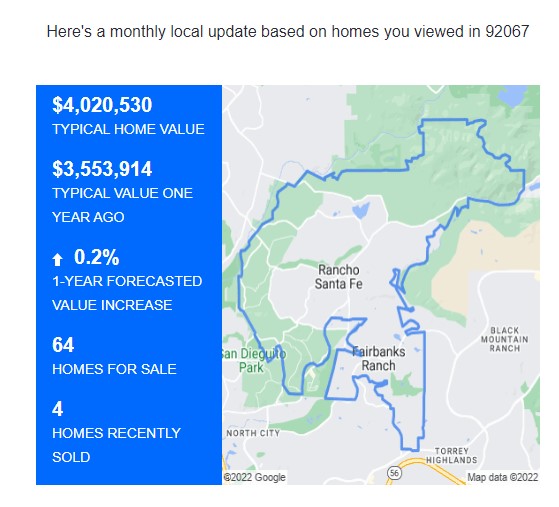

Rancho Santa Fe 92067

https://www.zillow.com/research/may-2023-home-value-sales-forecast-32643/

by Jim the Realtor | May 5, 2023 | Zillow |

Here’s a tip about the automated valuations.

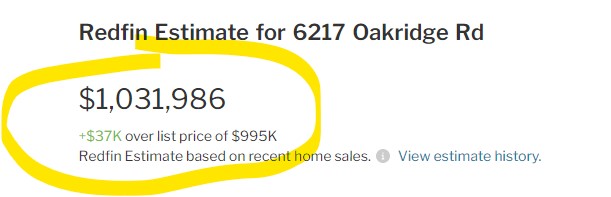

We know that Zillow and Redfin automatically adjust their estimates to within a couple of bucks of the list price once a home goes on the open market, making their estimates worthless to the reader.

But Realtor.com doesn’t.

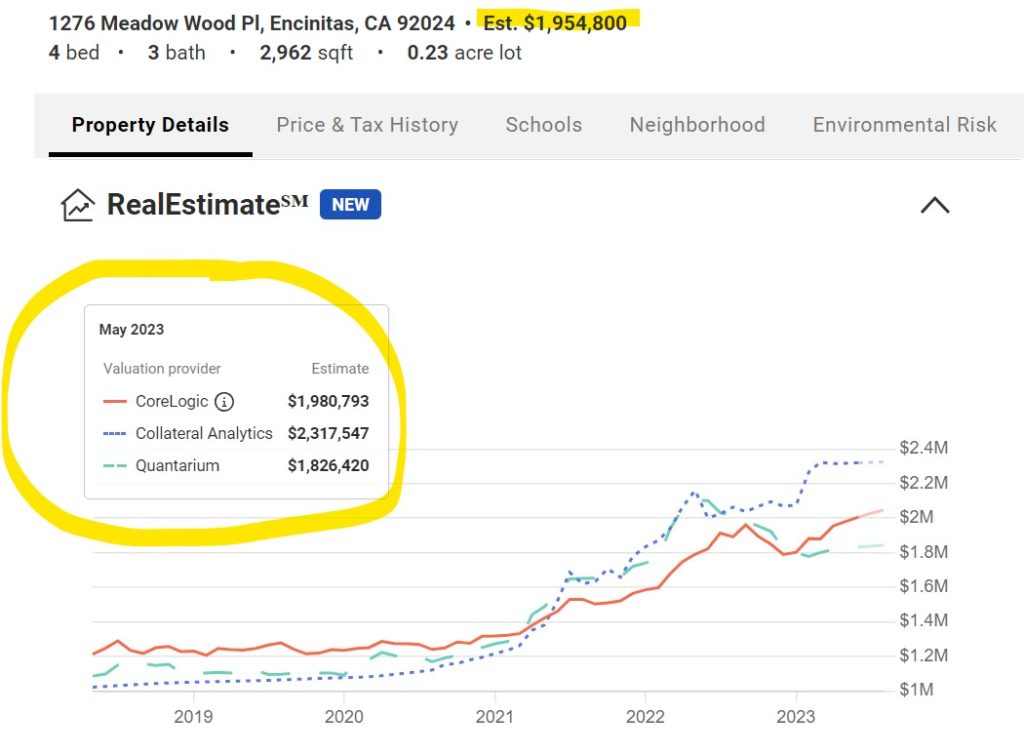

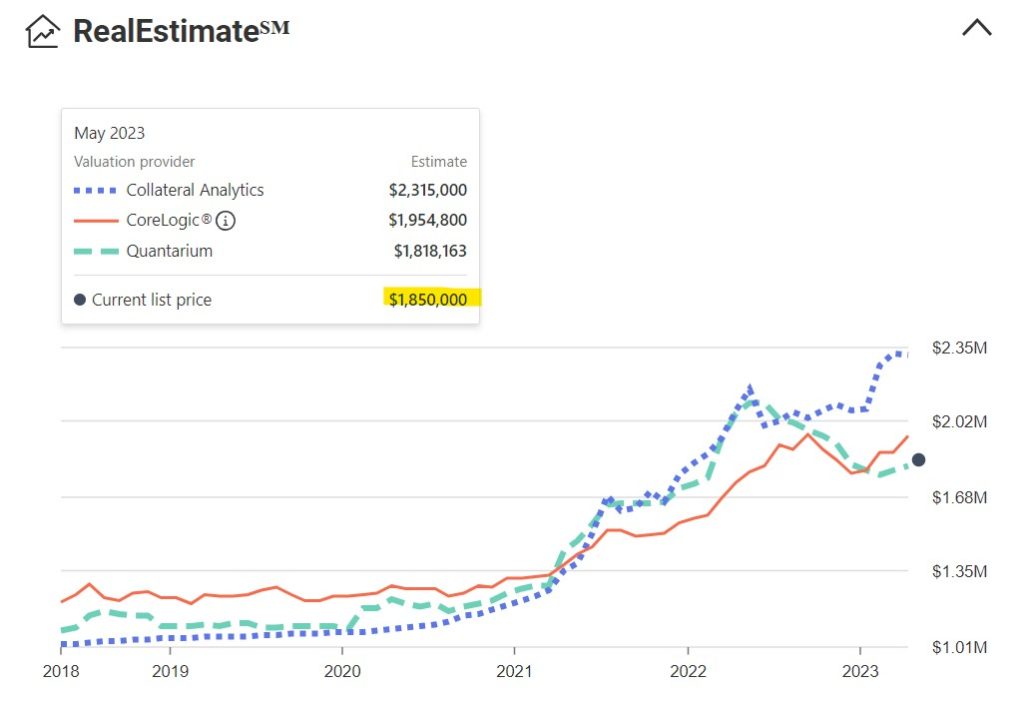

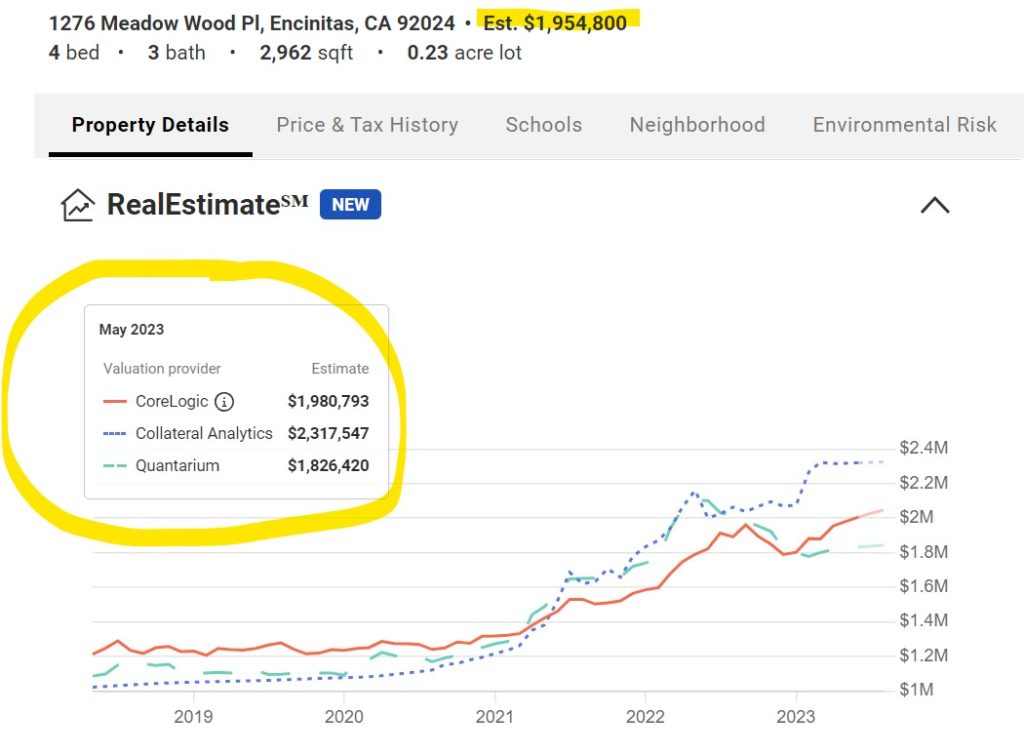

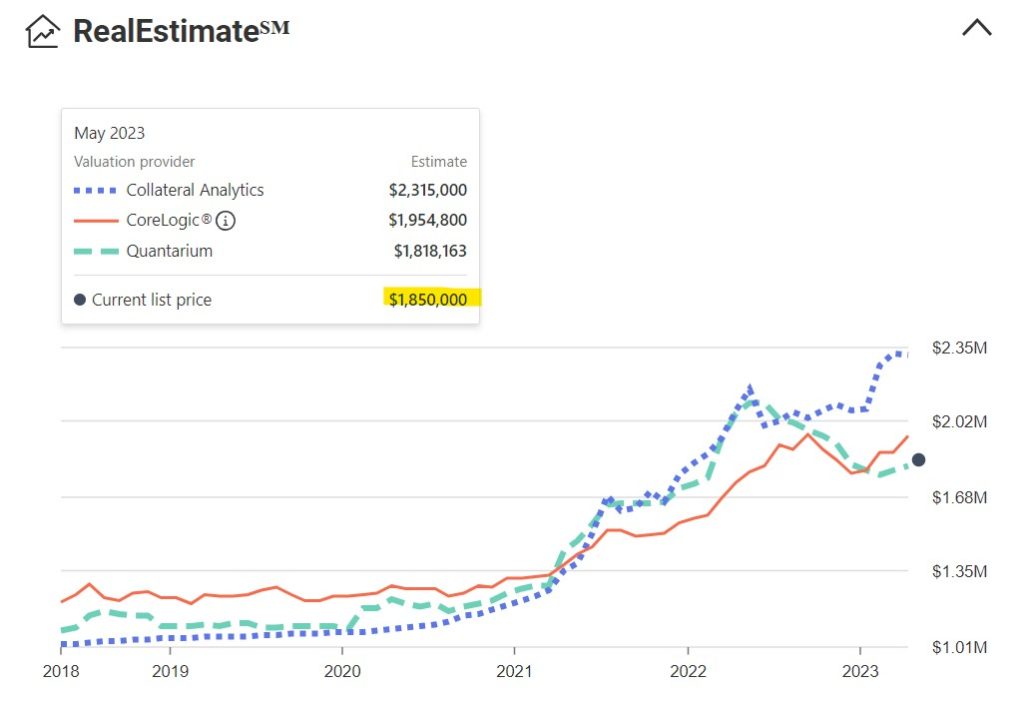

Here are their differences before and after our new listing hit the market yesterday:

BEFORE LISTING ON THE MLS:

TODAY:

If you want estimates of value on a house that is on the open market, check realtor.com.

Click below to see how the Zillow and Redfin estimates have changed:

(more…)

by Jim the Realtor | Mar 7, 2023 | Forecasts, Zillow |

We know that the perception is more important than the reality, especially for potential sellers. If they see some media coverage that is slightly positive, maybe more will come to market this year, instead of waiting for some vague unknown day in the future when the market gets ‘better’.

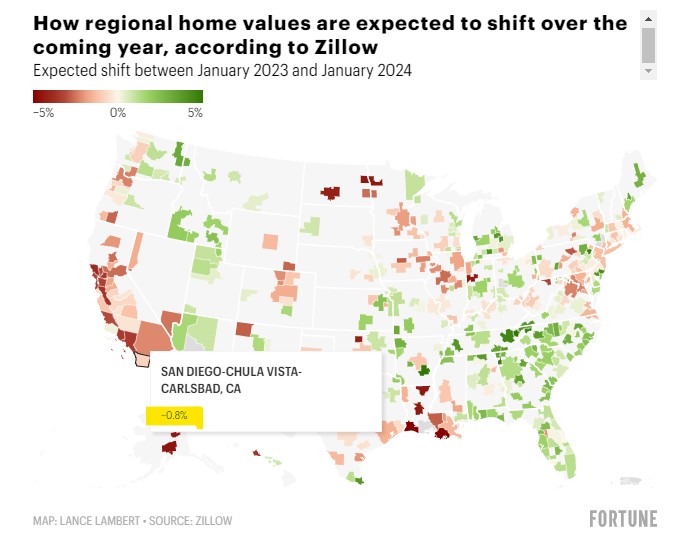

An excerpt:

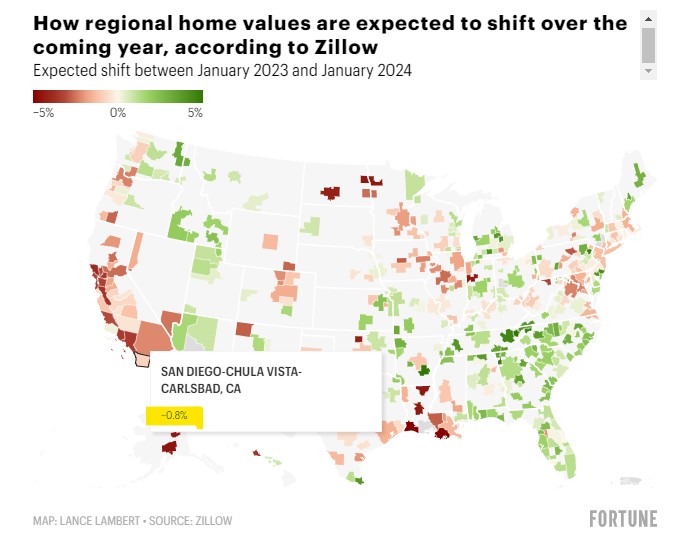

Zillow economists now believe they’re done issuing downward revisions. In fact, they think the national housing market correction could be nearing its bottom.

Heading forward, Zillow economists expect U.S. home values as tracked by the Zillow Home Value Index (ZHVI) to rise 0.5% between January 2023 and January 2024.

Among the 400 largest housing markets tracked by Zillow, the company expects 238 markets to see positive home price growth between January 2023 and January 2024, while it expects six markets to remain flat and 156 markets to notch a home price decline over the next 12 months. Simply put: Zillow expects only 39% of major markets to post a home price decline over the coming year.

Link to Fortune article

by Jim the Realtor | Jan 29, 2023 | Zillow

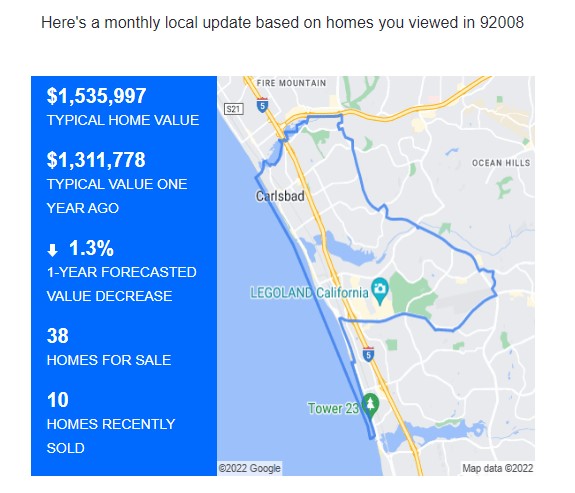

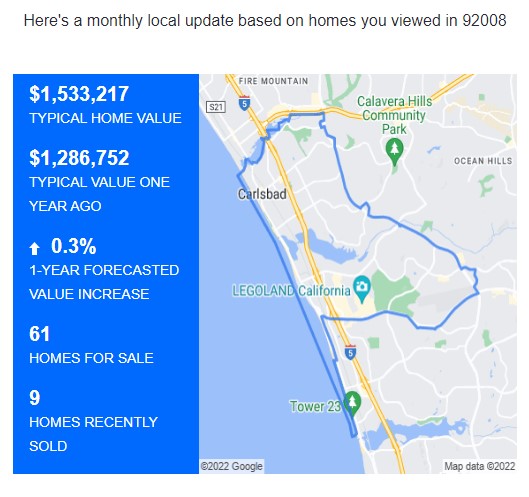

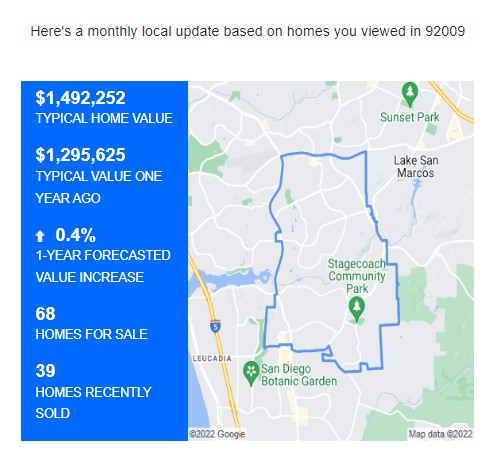

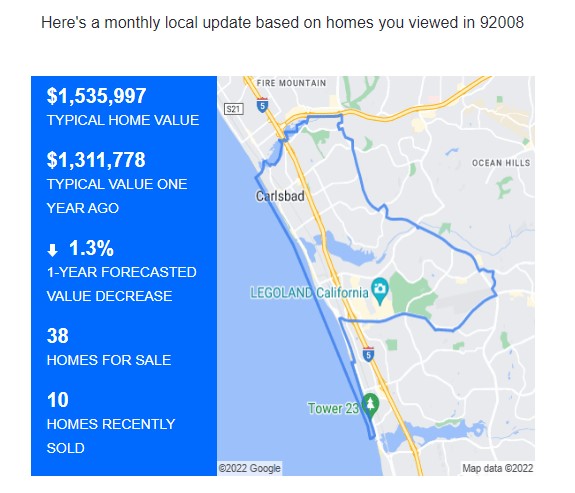

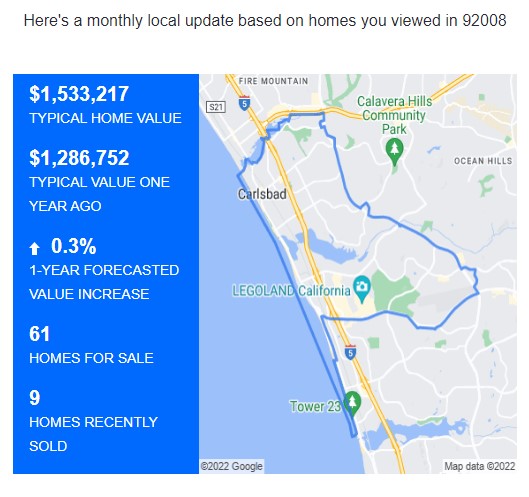

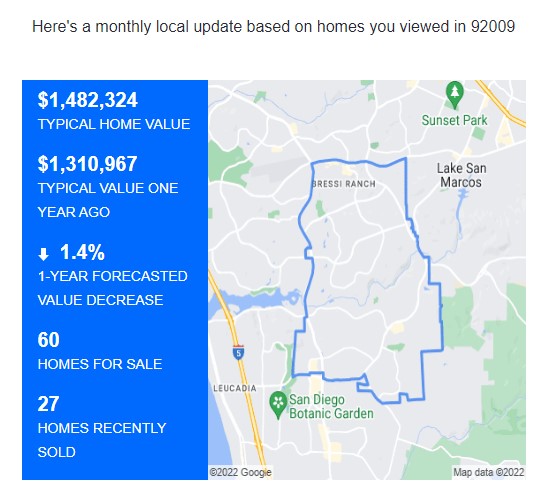

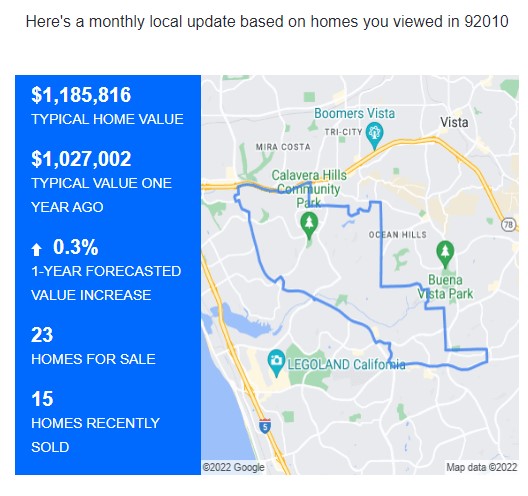

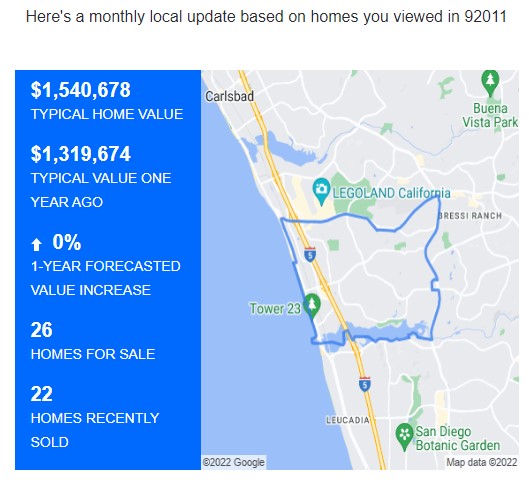

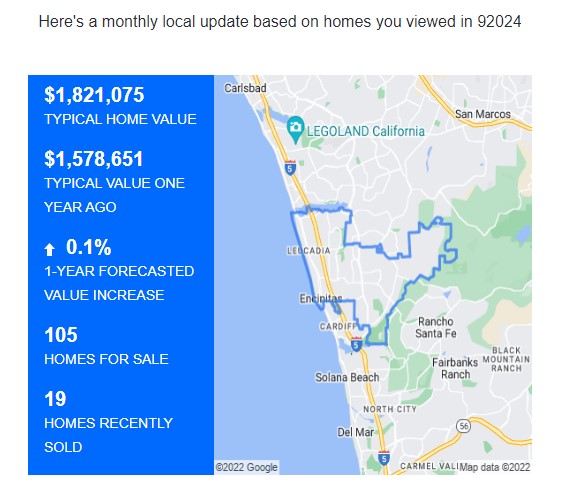

It looks like Zillow is sticking with their relatively flat forecasts for our local areas. It’s probably realistic if appreciation goes like it did in 2022 – everything gained in the spring selling season is given back in the off-season. Note how the ‘typical home value’ is still higher than it was a year ago in every area:

NW Carlsbad – 92008

(more…)

by Jim the Realtor | Dec 21, 2022 | Forecasts, Why You Should List With Jim, Year-End Review, Zillow |

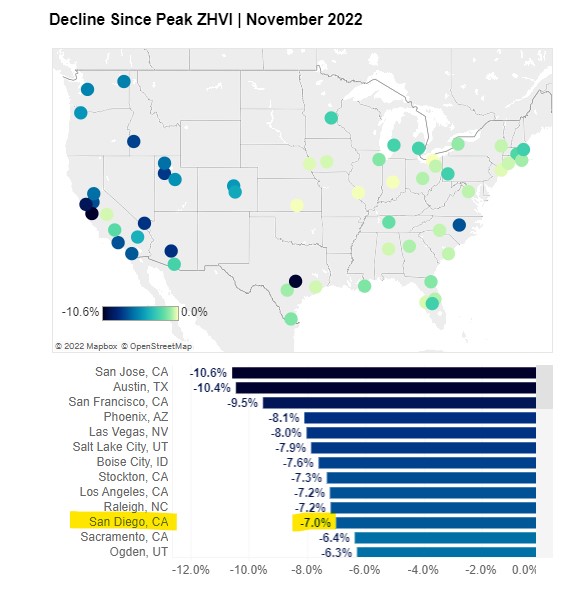

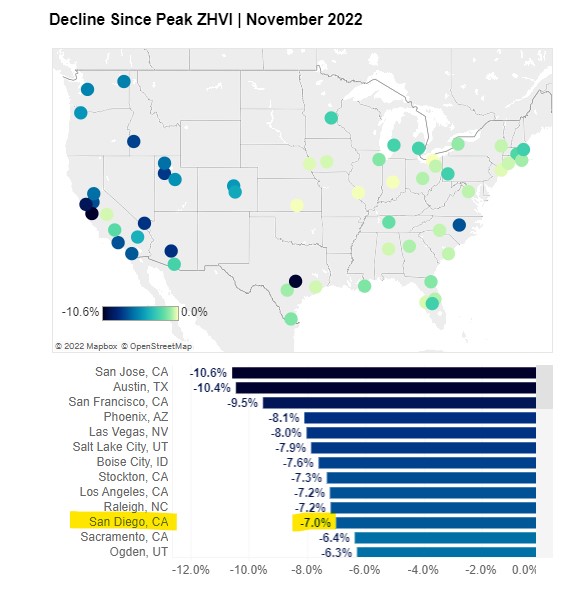

As the national leader of real estate, Zillow is attempting to guide people with data, thankfully. Their Home-Value Index has been decent, and I’ll take the -7% for San Diego….which means our premium areas haven’t felt much decline at all.

Their comment on current conditions isn’t ground-breaking but at least it offers some hope:

Activity in the housing market has slowed to a crawl this winter but the stage is set for a spring thaw: buyers can count on the usual springtime flood of new listings, and less frenzied competition than the last two spring selling seasons in the New Year. But if home shoppers really want to experience some deserted open houses, there’s no time like the present, because this lull won’t last long.

Here are their latest predictions about our local areas, all of which have values that are higher YoY:

NW Carlsbad

SE Carlsbad

NE Carlsbad

SW Carlsbad

Carmel Valley

Del Mar

Encinitas

La Jolla

Rancho Santa Fe

Let’s enjoy our stay in Plateau City – we may be here for a while!

by Jim the Realtor | Dec 18, 2022 | Jim's Take on the Market, Why You Should List With Jim, Zillow

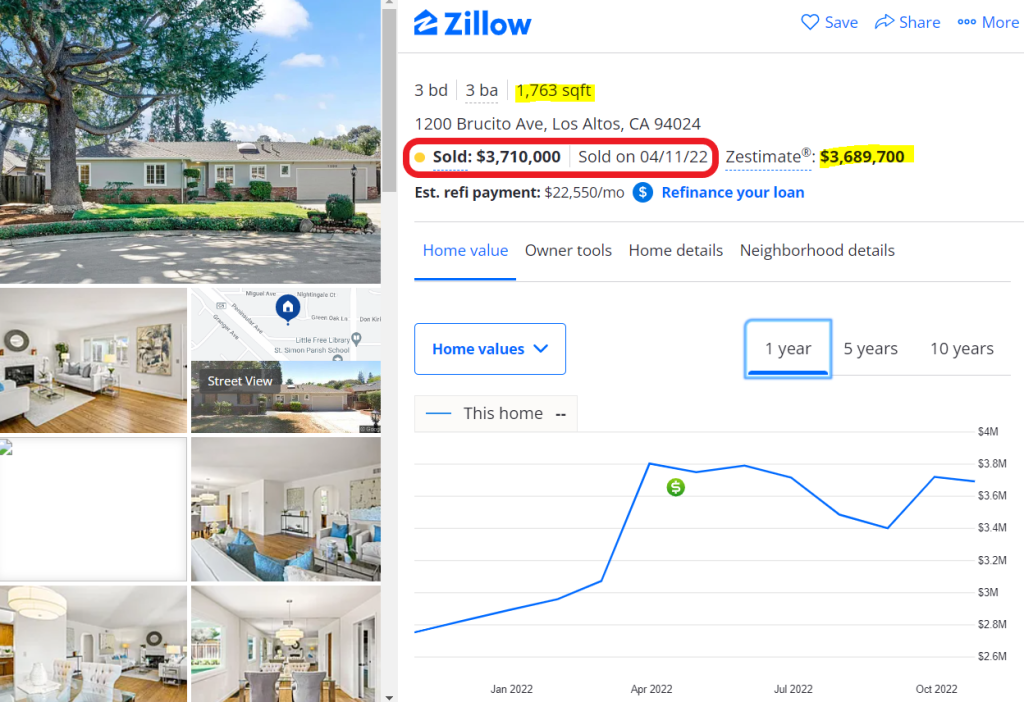

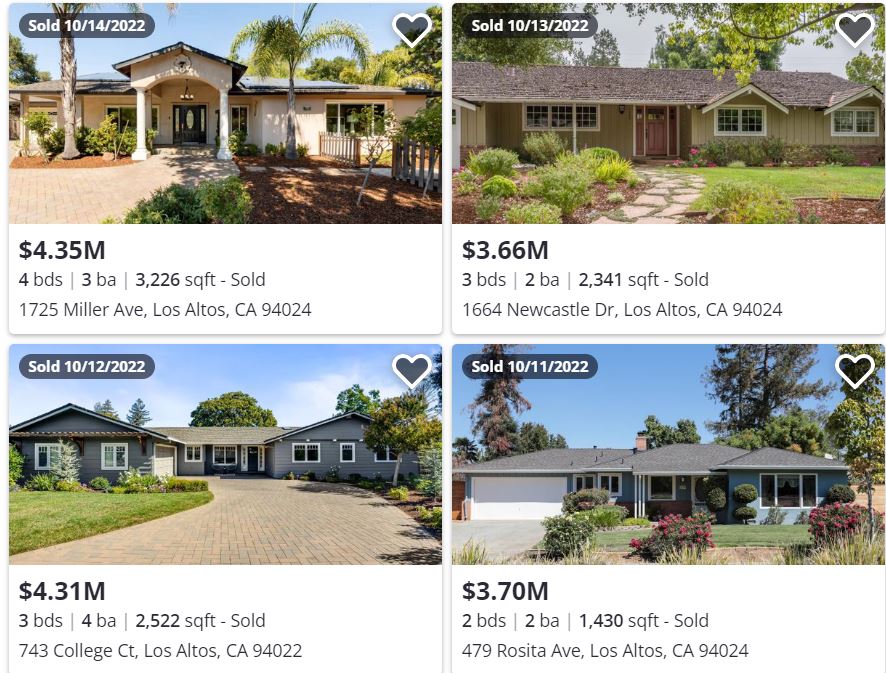

If everyone is relying on the zestimates….are they any good?

It’s a scary thought that we’ve become dependant upon an algorithmic computation of home values run by a third party for profit. Good thing they got out of the home-buying business!

The zestimates have been more accurate lately, but it’s hard to track because they still adjust them once a home is listed for sale. When you get notified of a new listing, check their zestimate immediately because it takes them a few hours to fabricate a new zestimate.

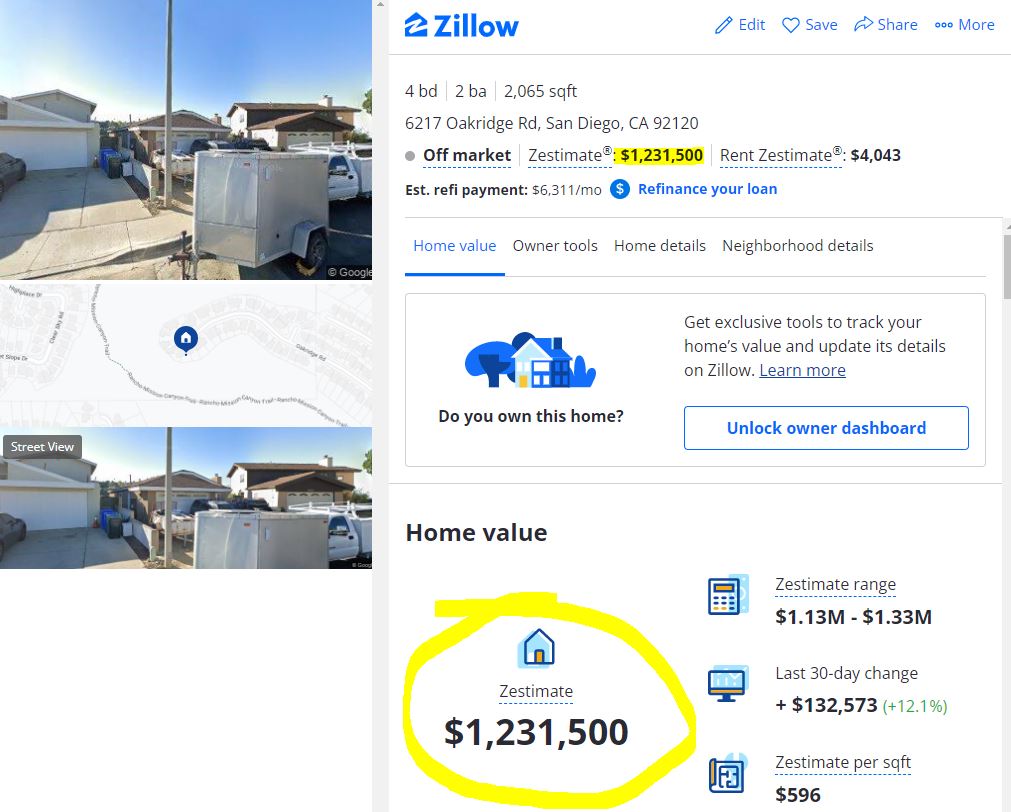

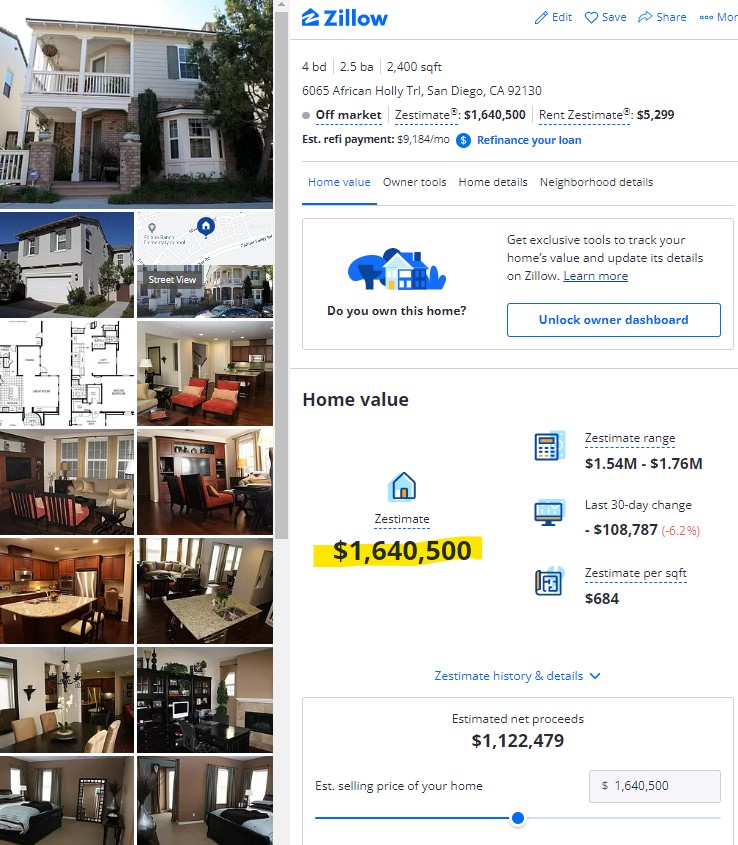

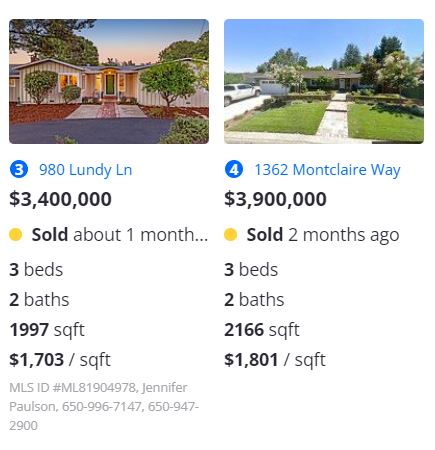

Here are the zestimates that are dated before my last three listings hit the MLS:

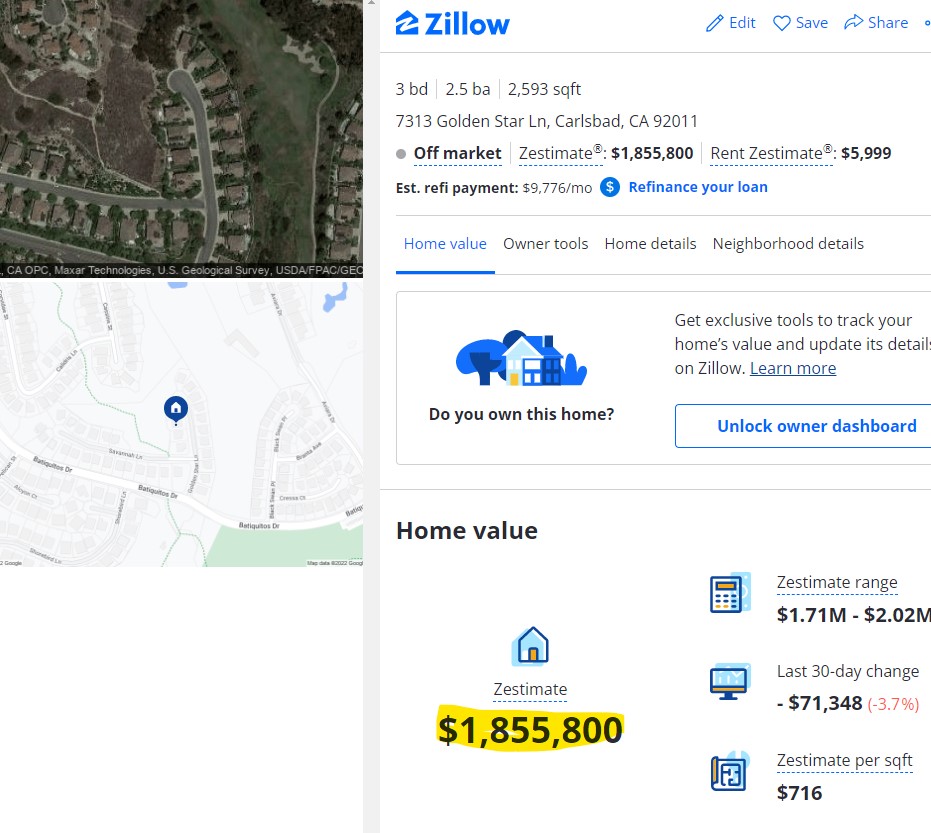

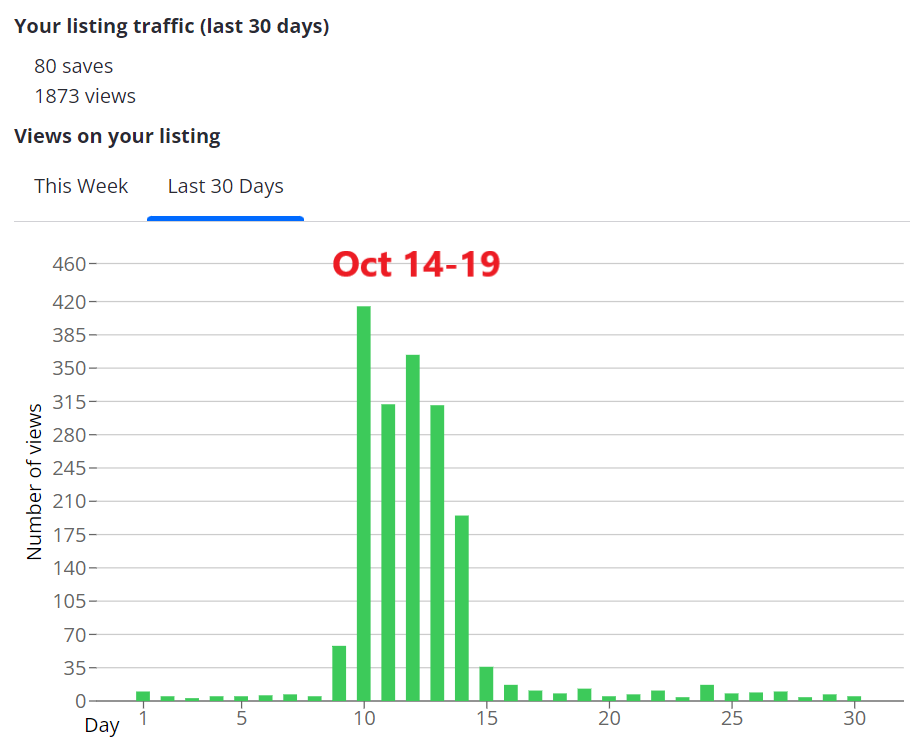

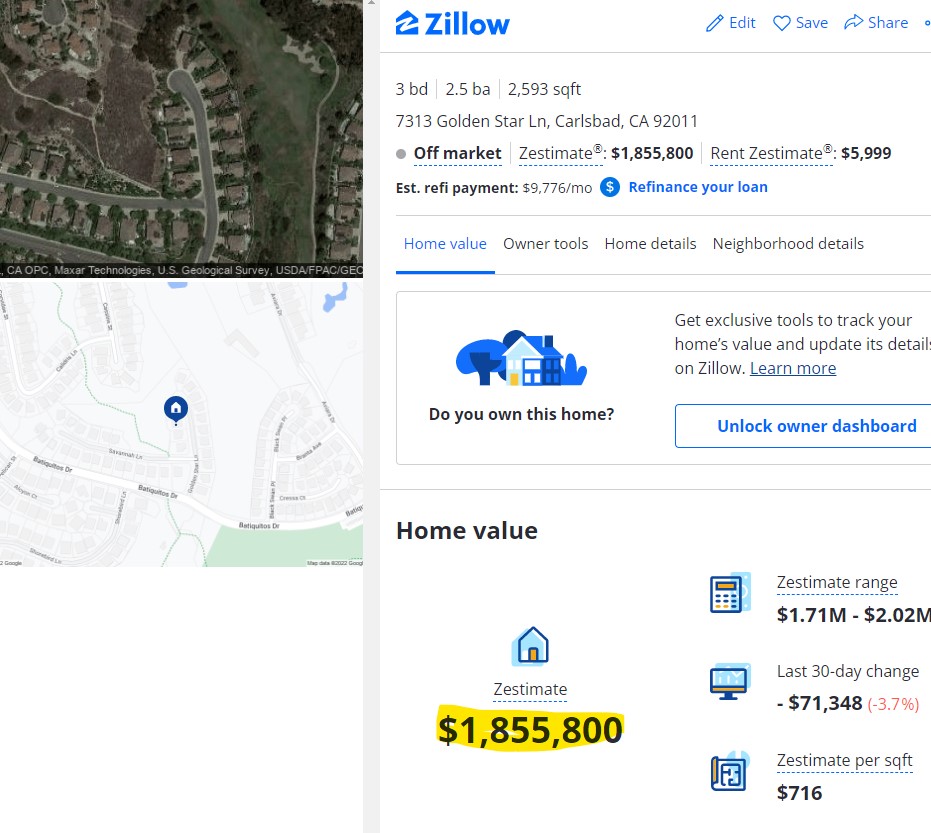

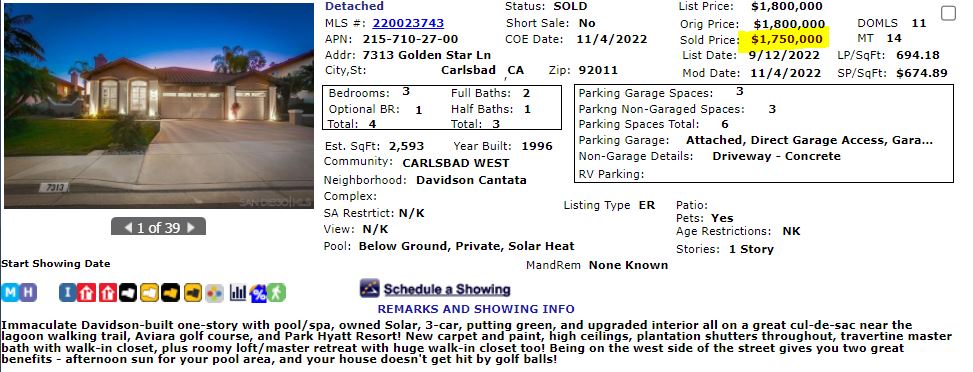

This was run on August 11th. We listed on September 15th for $1,800,000, and closed for $1,750,000:

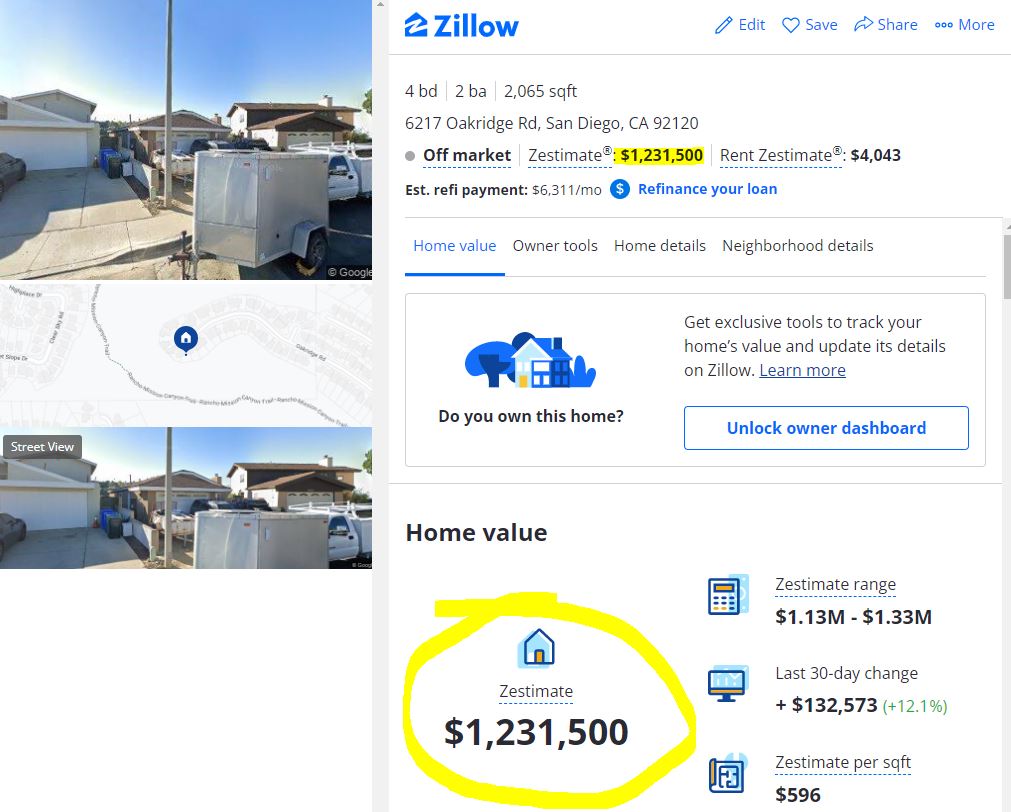

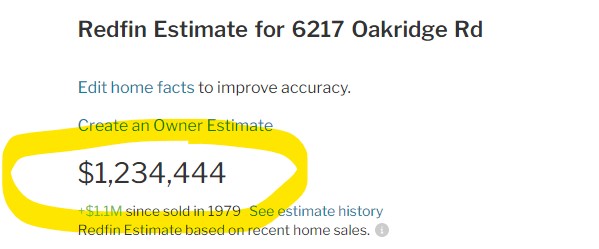

Here’s the zestimate of Oakridge, dated April 21st. It closed for $1,265,000 on November 18th. There is a big gap in the timeline, which means I may have gotten close to peak pricing in October:

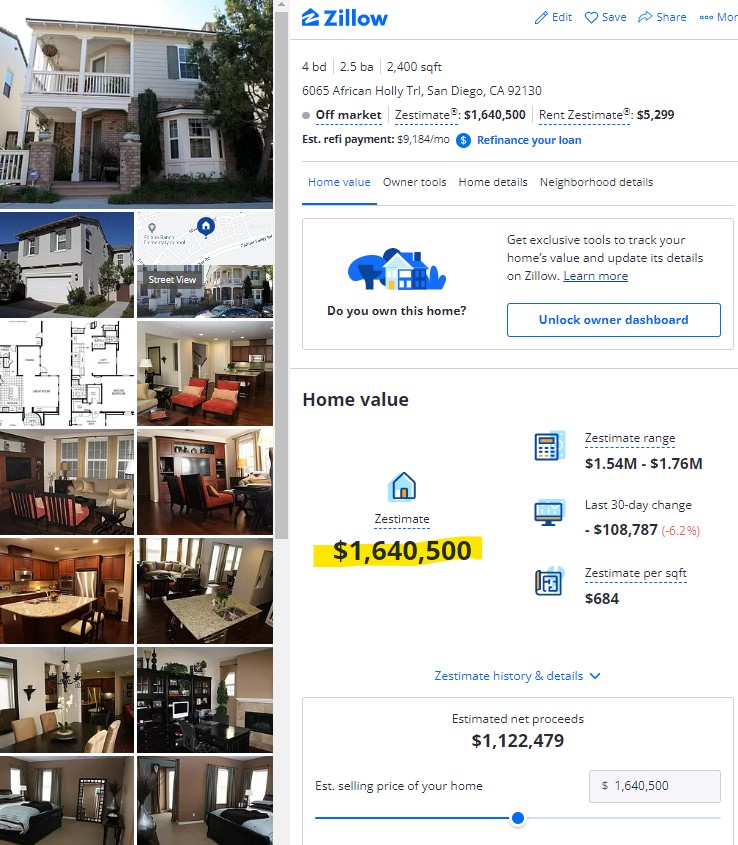

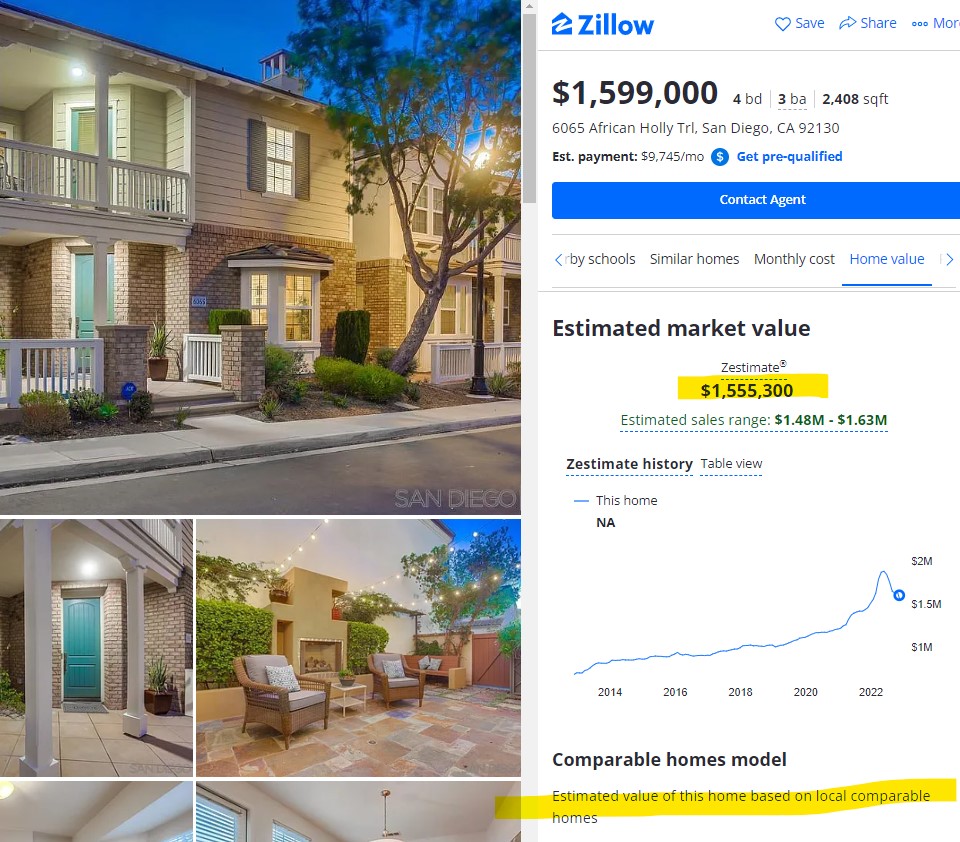

This Carmel Valley zestimate was dated September 12th. It closed for $1,660,000 on December 2nd:

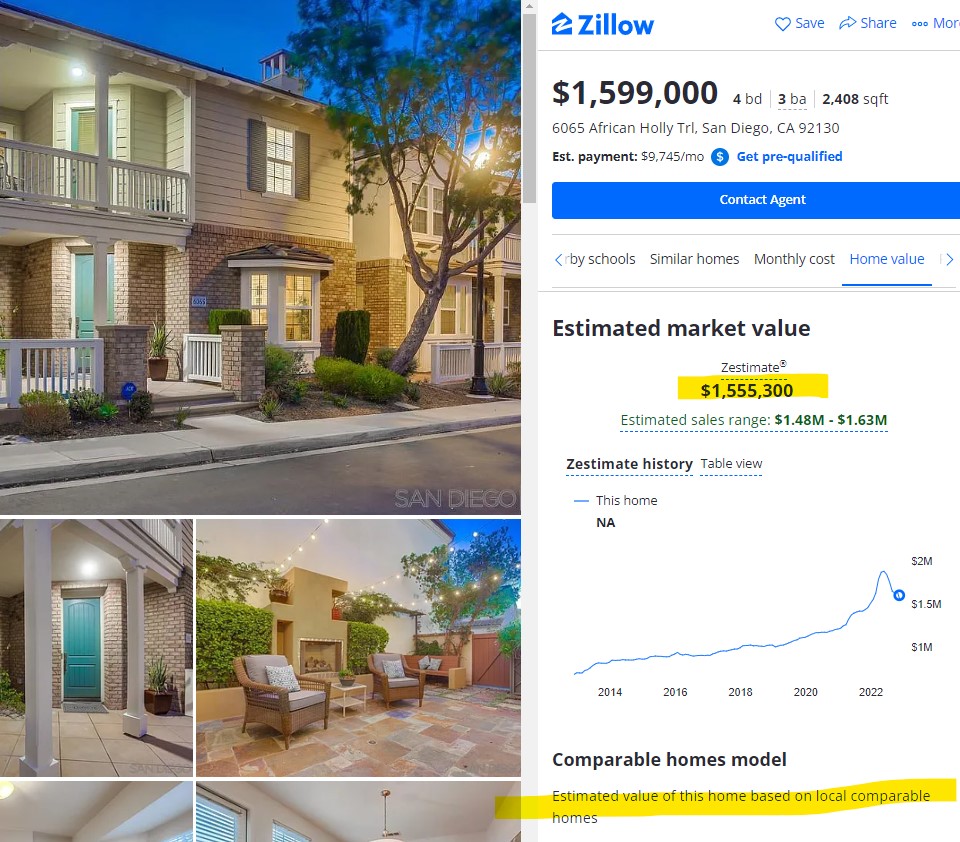

The Carmel Valley example is probably the most interesting because it’s a master-planned community of similar tract houses – their algorithm should be most accurate here. But they still modify their zestimate once a home hits the open market. They must expect homes to sell under the list price now:

At the bottom it says, ‘estimated value of this home based on local comparable homes’. Instead, they should just use their ‘Estimated sales range of $1.48M – $1.63M’, and add this, “depending who your realtor is”.

by Jim the Realtor | Nov 16, 2022 | 2023, Spring Kick, Why You Should List With Jim, Zillow |

There are three types of sellers:

Sure I’m motivated….if I get my price.- I’ll sell for what the market will bear.

- Desperate.

Unless the home is a real trophy property, this isn’t the market that tolerates aspirational sellers. For those who will only sell if they get their price – you should wait this out….and it could take a while.

The high-priced listings might get showings, but mostly to buyers who are considering the better-priced home down the street. It will take another six months and some boost from a strong spring selling season before the listings priced at retail-plus will start selling again. And that’s probably optimistic.

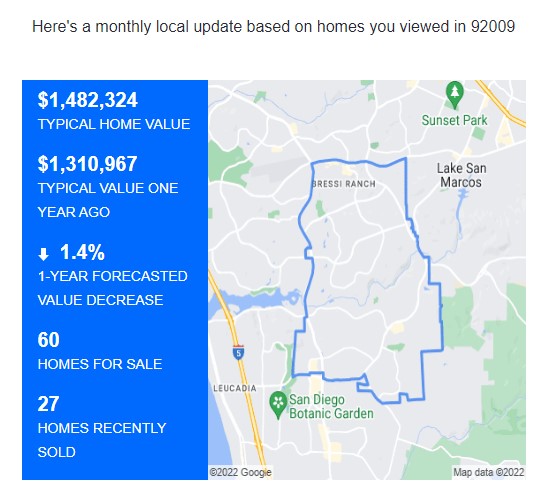

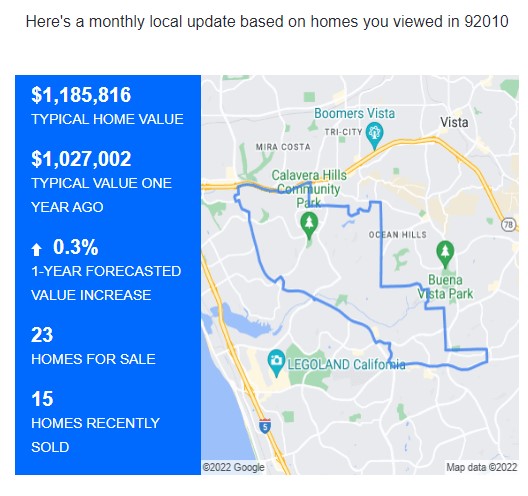

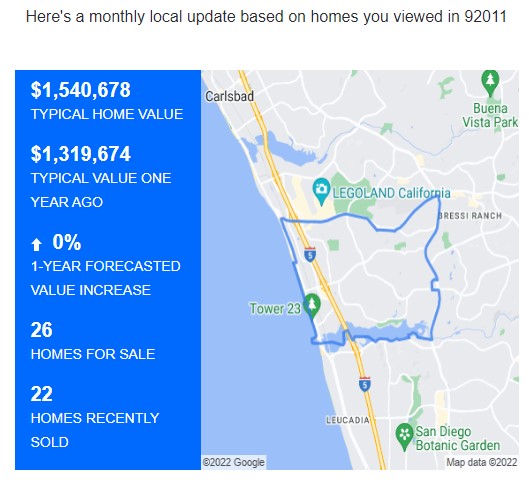

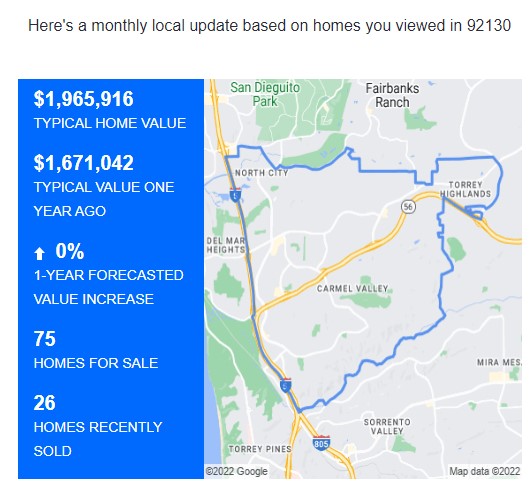

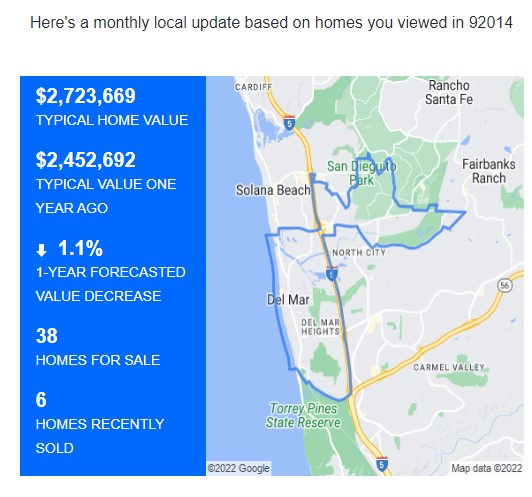

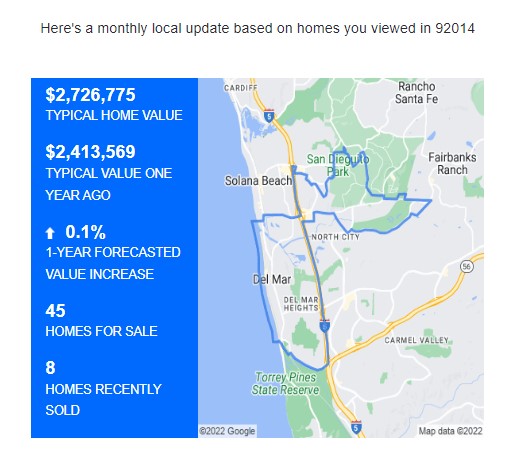

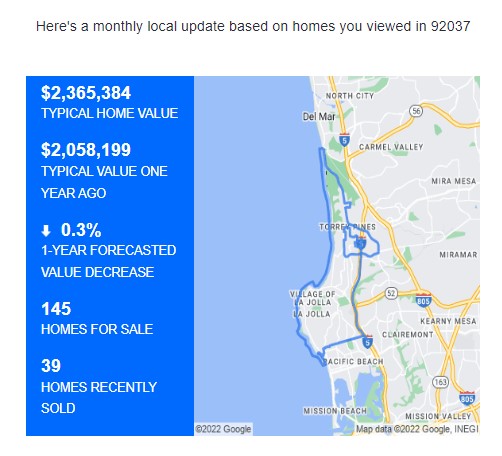

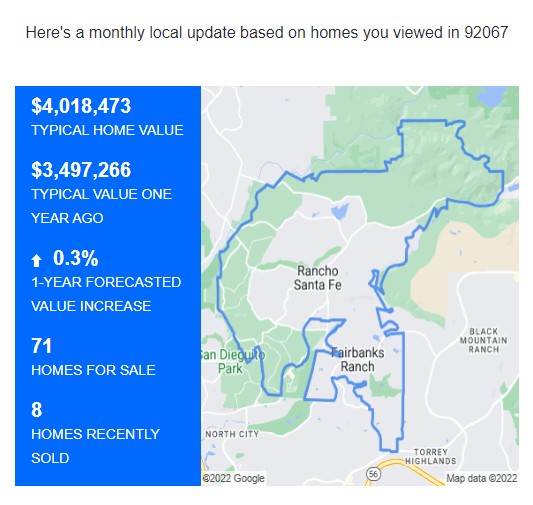

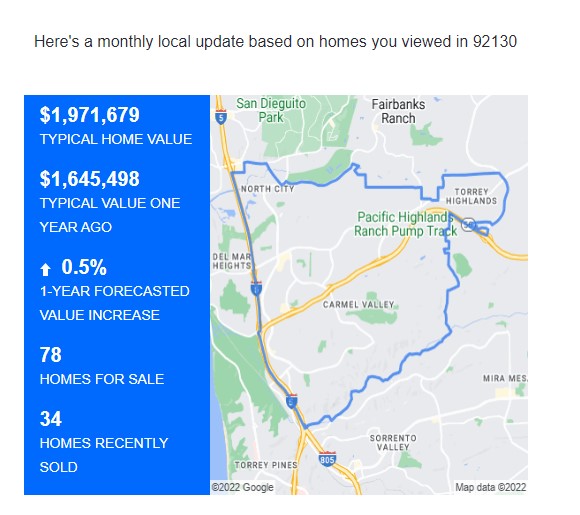

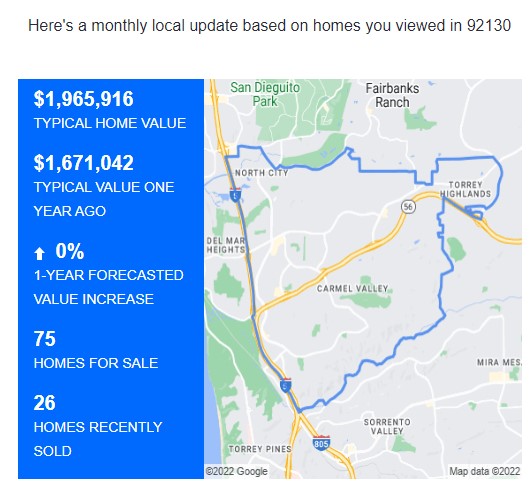

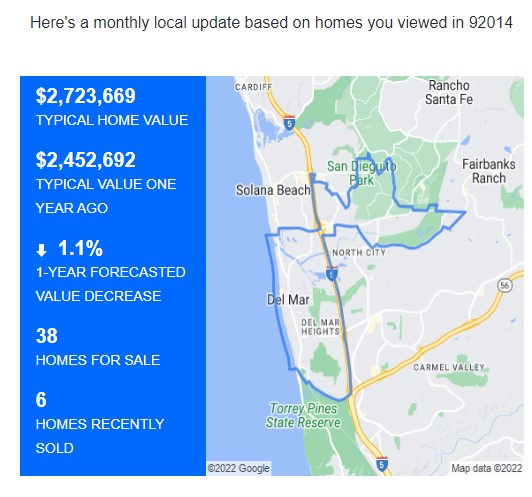

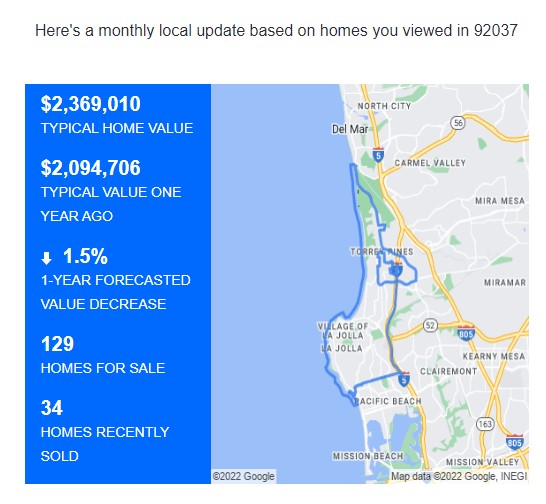

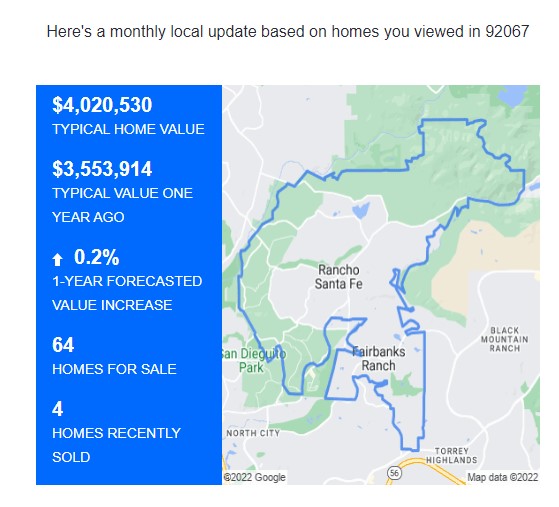

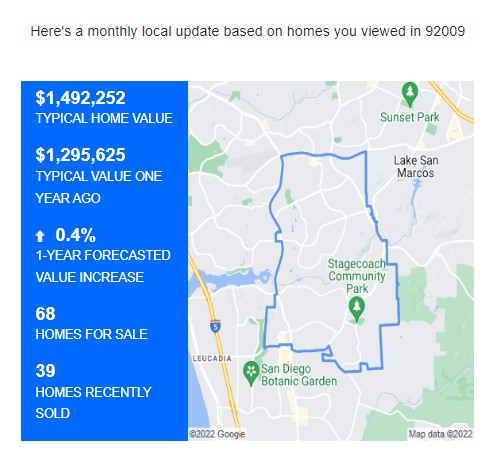

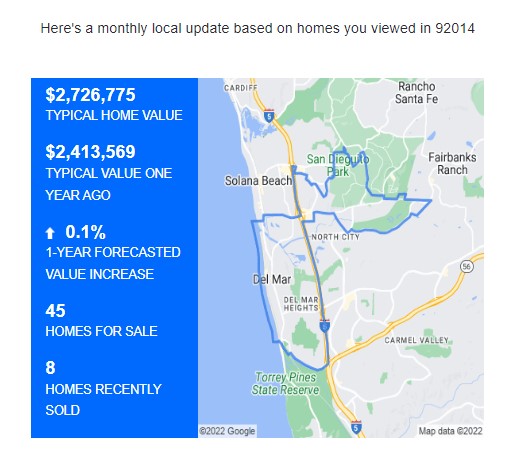

I still think the 2023 Spring Selling Season will be boisterous, and the sales volume will pick up – but generally-speaking, I agree with Zillow that pricing won’t be rising. Here are Z’s latest predictions:

SE Carlsbad 92009

Del Mar – 92014

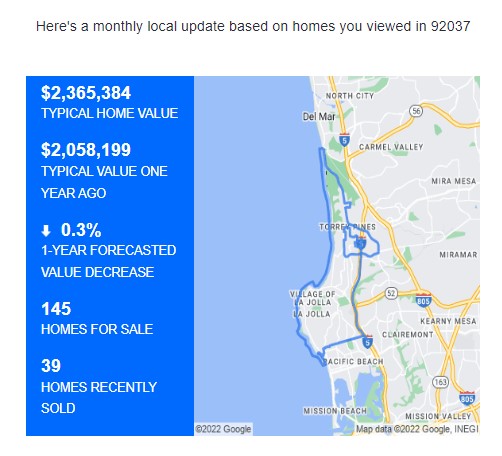

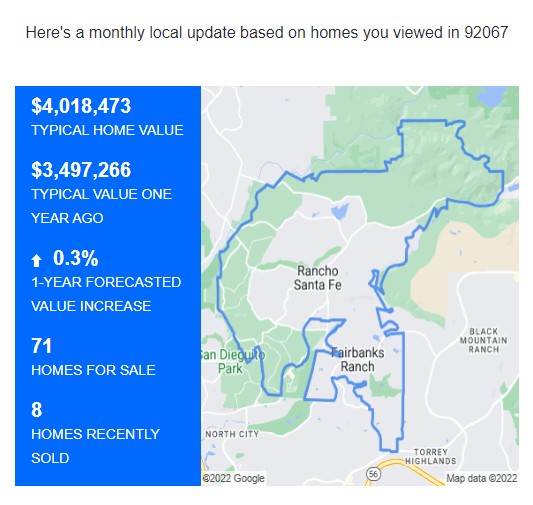

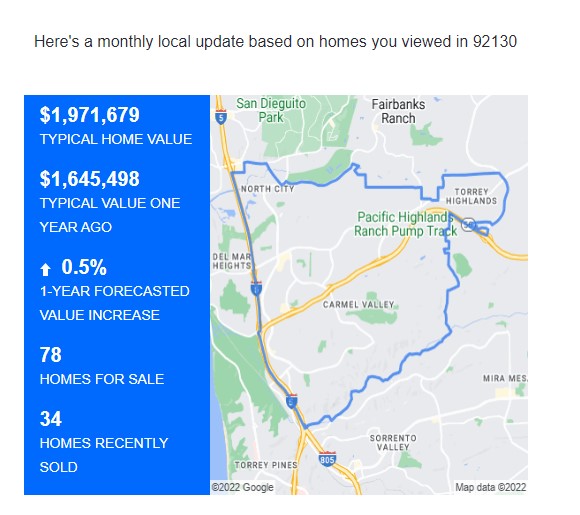

La Jolla – 92037

Rancho Santa Fe – 92067

Carmel Valley 92130

Less than 1% annual increases in prime neighborhoods? Yikes!

There is nothing wrong with being in Plateau City. Sellers just need to recalibrate and be smart about what it takes to sell a home in this environment:

- Hire a great agent.

- Spruce up the home.

- Utilize effective staging.

- Price attractively (be the best-priced active listing).

- Make it easy to show.

That’s all – and if you don’t do all five, it’s ok because there’s nothing that price won’t fix!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

An example of #1 is the now-famous property for sale in Del Mar on Border. A buyer thought they could get approvals to build a high-end resort there, but it was put to a vote, and the citizens turned it down. A new buyer is now hoping to turn it into apartments.

It’s been for sale since 2007, or 5,573 days!

https://www.compass.com/app/listing/929-border-avenue-solana-beach-ca-92075/25353758691121345

P.S. If there is anyone who wonders why their Over-$4,000,000 stats don’t match up with mine, it’s because I take this listing out every week so it doesn’t skew the averages.

by Jim the Realtor | Nov 4, 2022 | Jim's Take on the Market, Why You Should List With Jim, Zillow |

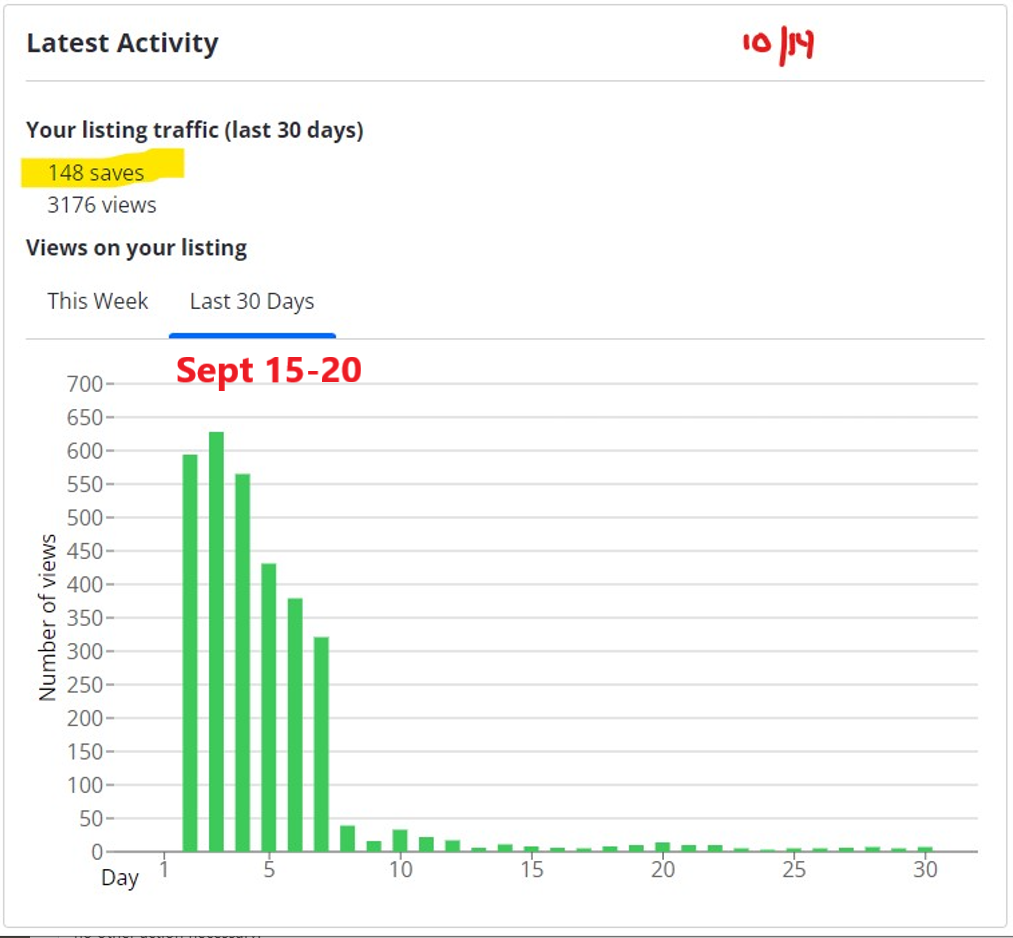

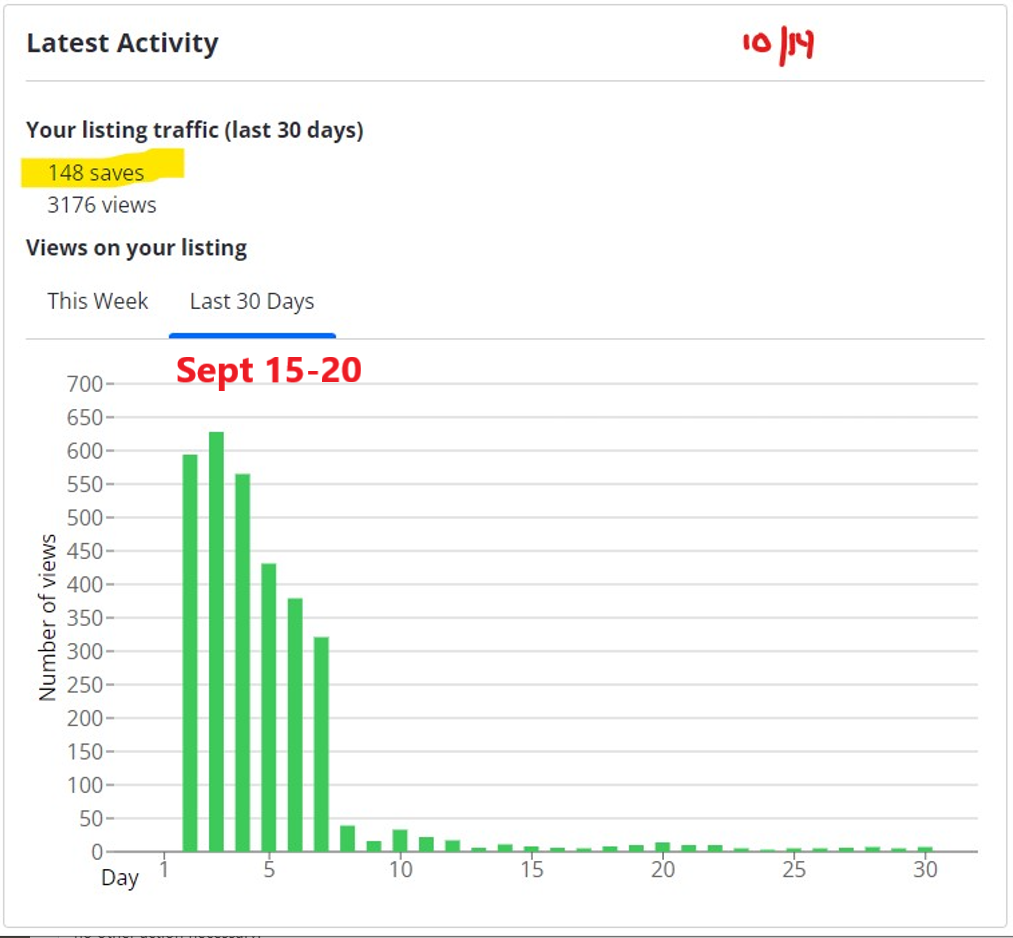

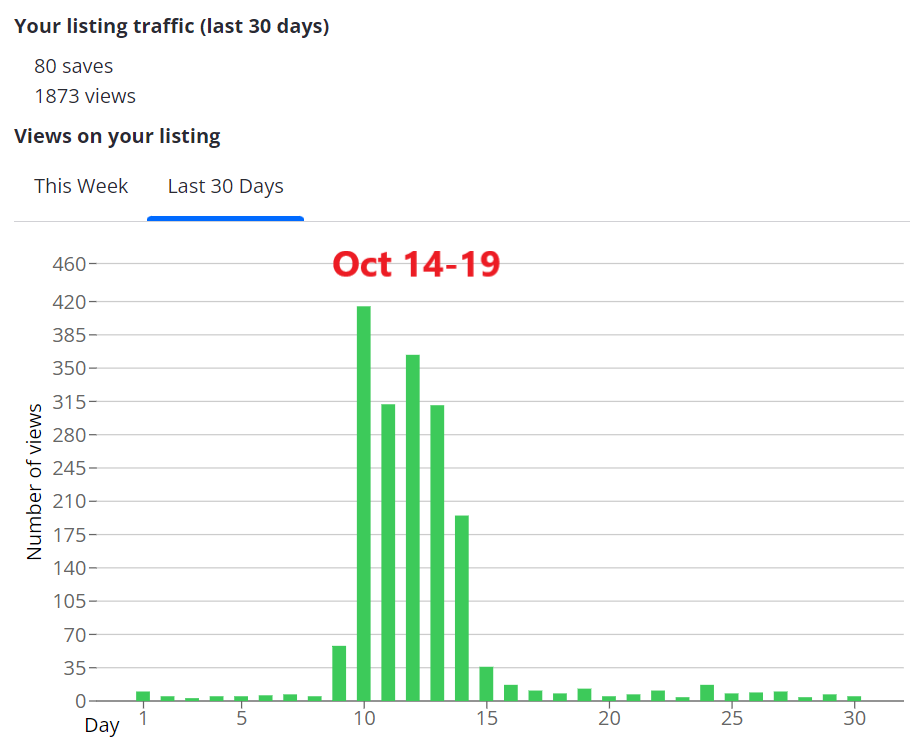

Our one-story listing in Aviara closed escrow today.

We had listed for an attractive $1,800,000 in mid-September, and had about 2,600 views on Zillow in the first five days (see above). We received three offers, and accepted the highest at $2,100,000 cash.

Previously I told the story of how the home inspector’s lack of bedside manner put the buyer on edge. Their mold inspection didn’t detect anything in the air, but a swab behind a toilet did cause a positive result. We offered mold remediation and re-test to ensure the problem was corrected – the standard solution – but the buyer said she couldn’t handle the stress and cancelled escrow instead.

You never get the same buyer enthusiasm the second time around, so I knew going back on the open market in mid-October was going to be a challenge – especially now that my seller was getting used to the idea of a $2,100,000 sales price.

We completed the mold remediation so at least the problem was solved. But I didn’t make any mention of it in the MLS or in other advertising because I wanted to control the message. We went back on the market on Friday, October 14th, and I did the open house extravaganza on the 15th and 16th where I planned to discuss the mold remediation in person with the interested parties.

We only had about 1,580 views in the first five days – which is 40% lower than the original effort:

I had already contacted the previous bidders from the first round, and the second-place finisher who had offered $2,000,000 cash was still interested. They weren’t willing to put another offer on the table until after the open houses were done, and when they did, it was a disappointing $1,650,000.

No one else made an offer.

We went back and forth, but the best they were willing to do was $1,750,000.

By then, it was Tuesday night and the first game of the Padres vs. Phillies playoffs. Without any hope of another offer to rival the deal on the table, the next day the seller decided to take it, and stay on track to purchase the replacement home that we had in escrow, contingent upon this one selling.

Did the value drop $350,000 in a month?

You could say that, but it the double whammy of falling out of escrow/mold remediation didn’t help. The original $2,100,000 offer was too optimistic to stick, and given that the eventual buyer had dropped from $2.0 to $1.75, their original offer probably wouldn’t have closed either.

An offer of $1,800,000 would have made it to the finish line, and maybe as high as $1,900,000. Having the general negativity increasing about real estate market every day was bad enough, and then include the wicked combo of second try/mold/Padres playoff fever. I’m glad we got as much as we did.

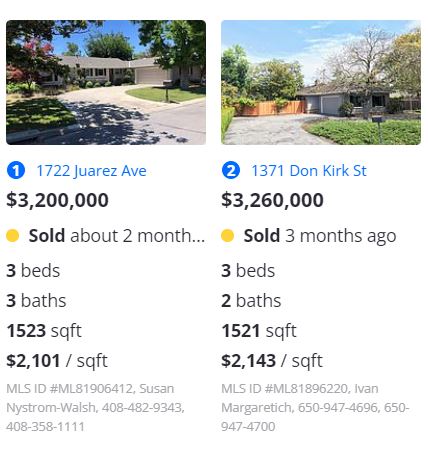

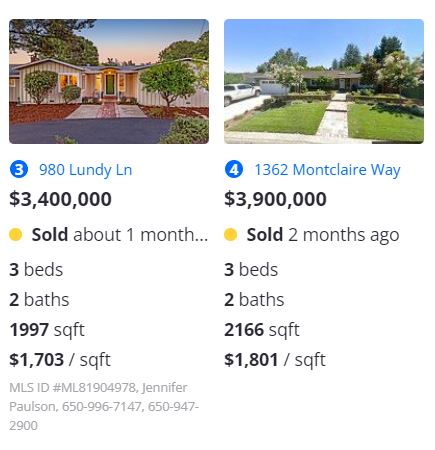

by Jim the Realtor | Oct 27, 2022 | Frenzy, Market Buzz, Zillow |

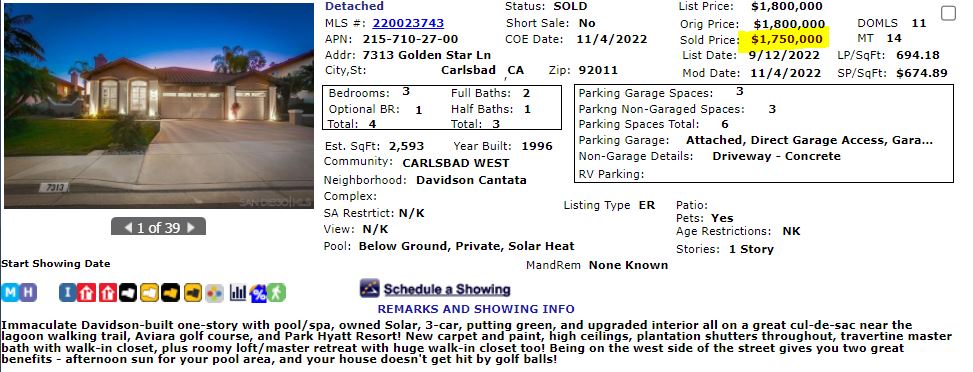

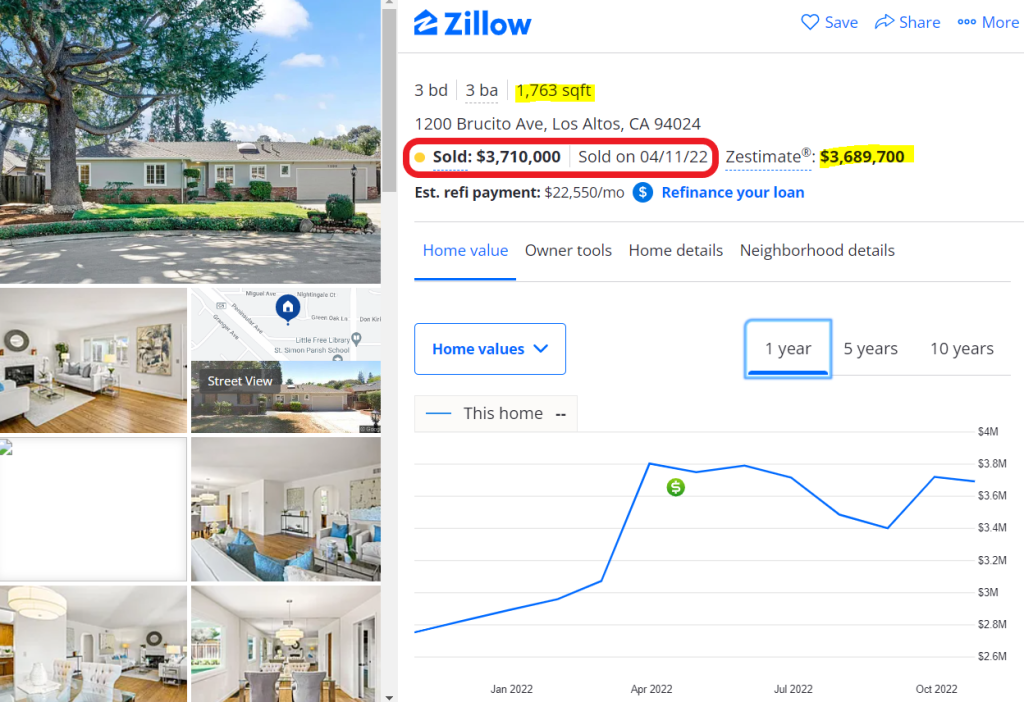

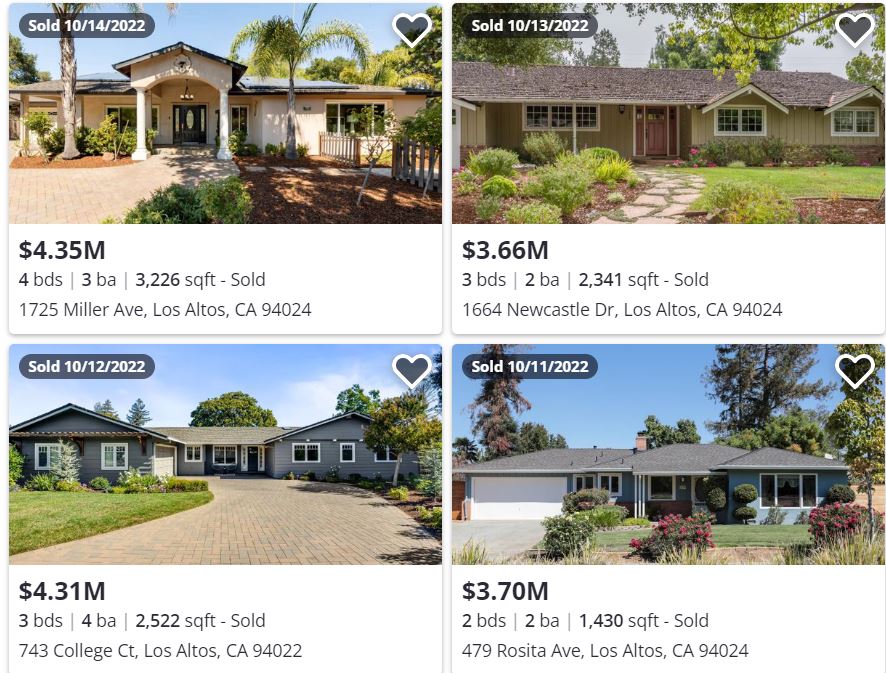

The biggest fear for the North San Diego County coastal region is a meltdown in Bay Area prices.

It’s been estimated that 50% or more of the buyers who were bidding up homes here during the frenzy are from the Bay Area, and Silicon Valley in particular. If prices were to drop 23% to 30% there, it would impact how much they would be willing to spend on replacement homes here.

This is only one example but we can say that this sold at the peak of the market, or close.

This was my uncle’s girlfriend’s house, and when I was there in November to pay my last respects, I told them that my guess at the current value was high-$2,000,000s.

They hired a good agent who spruced it up and staged it, and they listed for $3,195,000 on March 2nd.

A month later, it closed for $3,710,000 for 1,763sf.

How does it look today?

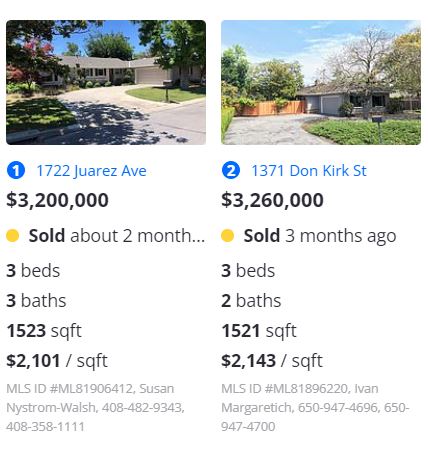

Today’s zestimate is within 1% of the sales price in April, which had been bid up $515,000 over the list price at the time. What are the comps that Zillow says they used to determine the value?

Four recent closings:

It is only one example, and certainly, not everyone from Los Altos is moving here. But just looking at those four recent sales, it seems like that area is holding up pretty good.

https://www.zillow.com/homedetails/1200-Brucito-Ave-Los-Altos-CA-94024/19620416_zpid/

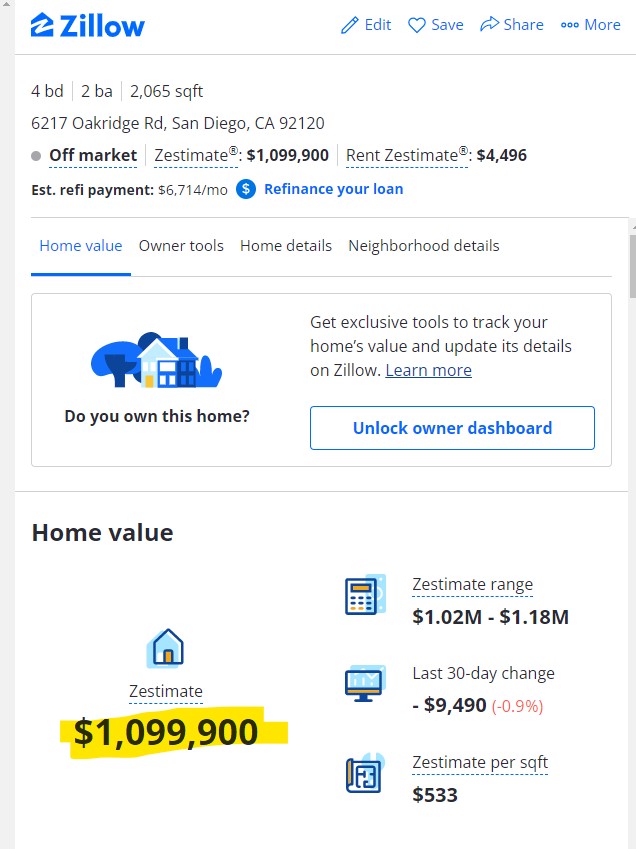

by Jim the Realtor | Oct 22, 2022 | Thinking of Buying?, Thinking of Selling?, Tips, Advice & Links, Why You Should List With Jim, Zillow |

Just a quick reminder of the constant grift in real estate.

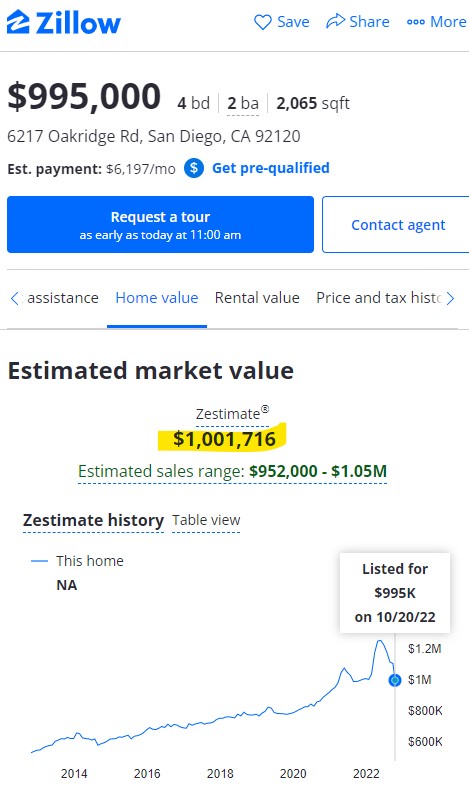

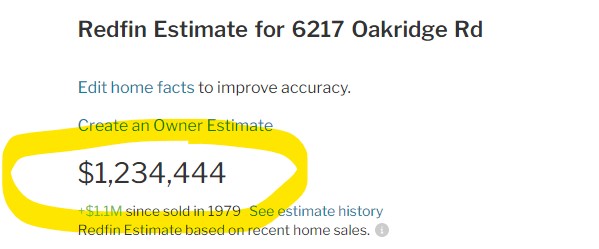

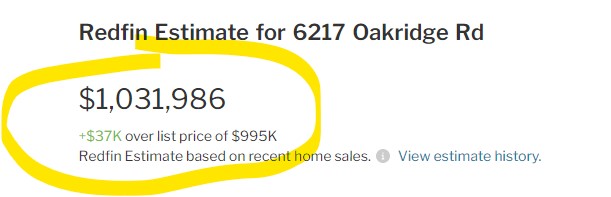

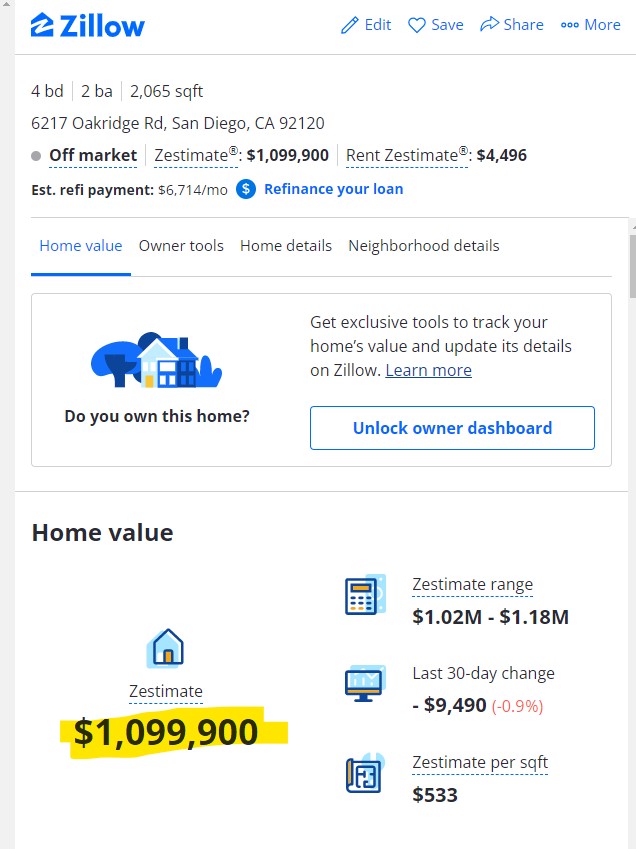

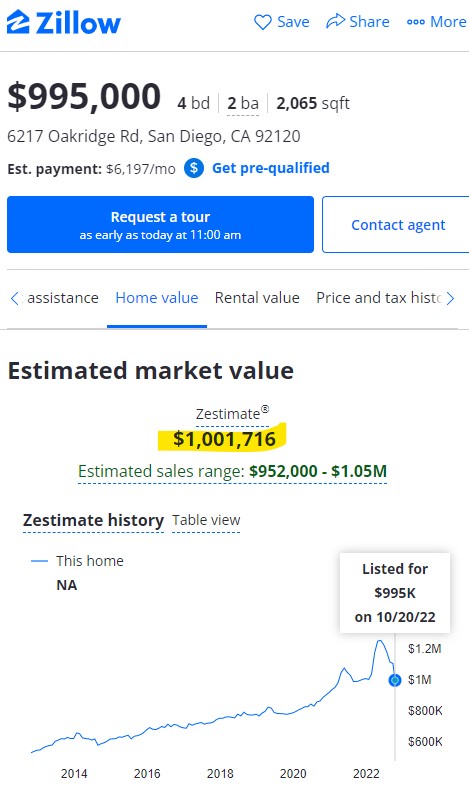

Before the listing was entered onto the MLS:

After the MLS listing was inputted – at least they didn’t recreate the history graph…..yet:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Before the listing hit the MLS:

After MLS input:

Why does it matter? Because too many people – both buyers and sellers – are relying too much on these to be their accurate value estimators. People are moving too fast, they don’t want to spend much if any time investigating, and it’s too hard to get good help. Everyone just wants to grab and go!

The second set says they are based on recent home sales? How can it fluctuate 20% in one day? These revised real estate values aren’t a result of an algorithm; they are purely derived from the list price.

You are being manipulated by the Corporate Warlords – watch yourself!