by Jim the Realtor | Nov 3, 2021 | ibuyer, Ideas/Solutions, Zillow |

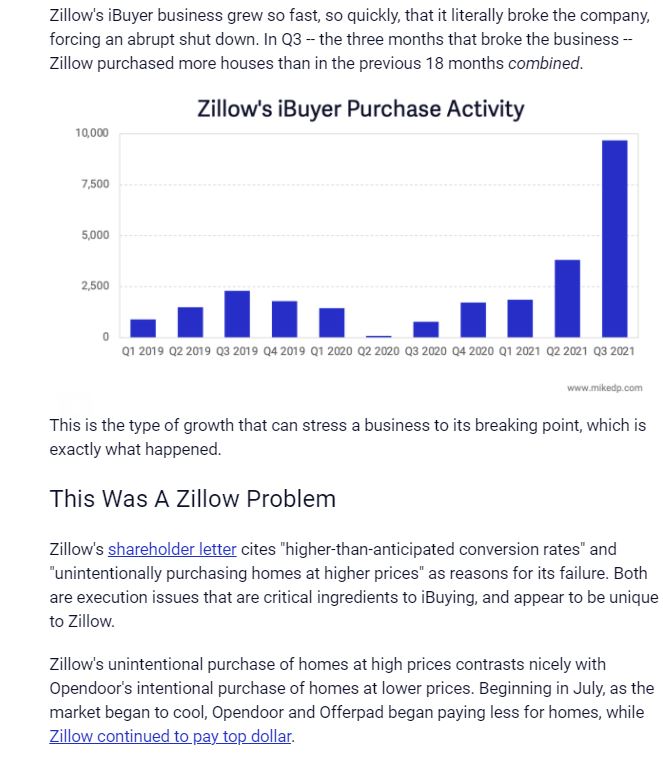

Mike pointed out that Zillow simply kept paying too much for homes, and instead of adjusting on purchase prices being offered, they shut it down yesterday.

But Zillow is too big and too aggressive to rest.

Here’s what Mike thinks could be next:

While Zillow 2.0 may have been a failed experiment in iBuying, what captures the imagination is the next iteration of the business. How will Zillow leverage its massive competitive advantage and its iBuyer learnings for Zillow 3.0?

I wouldn’t be surprised to see Zillow play deeper in the Power Buyer space, a model that is asset-light, easier to scale, less risky with better unit economics, and has a natural overlap with Zillow Home Loans (Opendoor diversified into Power Buying earlier this year).

Zillow as a Power Buyer — either through organic development, partnership, or acquisition — is a natural extension to its existing business of helping home buyers. The world of real estate has evolved significantly since 2018, and Zillow needs to stay relevant to those evolving consumer needs.

It would be a smart move. The buyer side is where the help is needed.

Assisting buyers with making all-cash offers is a very attractive service, with no real downside because all they have to do is funnel the business into their mortgage company to refinance the purchases after the fact. They could flip these buyers to their Premier Agents too – a group who is wondering if it’s worth it to be a Zillow customer today.

The supply and demand will be out of balance for years to come, and buyers are the ones that really need the help. Go Zillow!

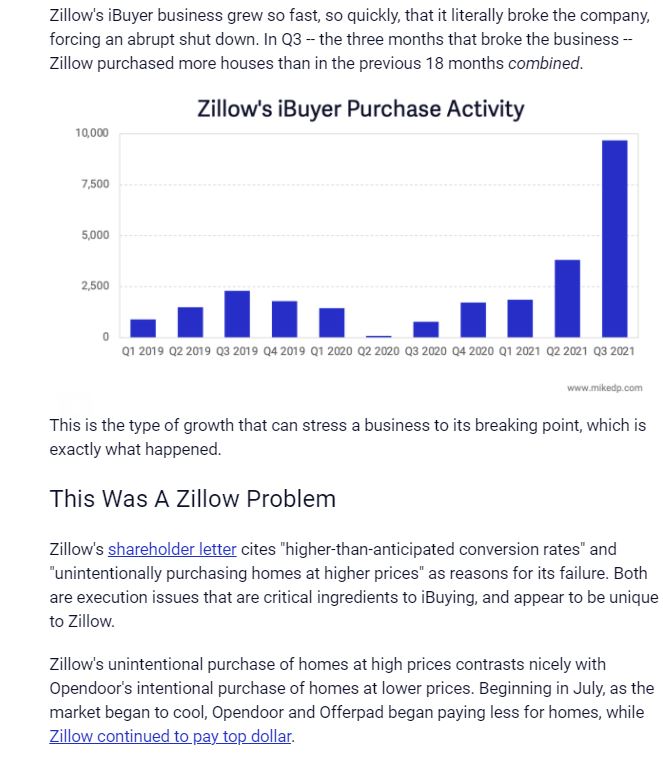

www.mikedp.com

by Jim the Realtor | Nov 2, 2021 | Flips, Zillow

If you can’t make a profit flipping houses in this market, well then yeah, you should probably stop (hat tip G.A.!)

Real-estate firm Zillow Group is exiting the home-flipping business, saying on Tuesday that its algorithmic model to buy and sell homes rapidly doesn’t work as planned.

The firm’s termination of its tech-enabled home-flipping business, known as “iBuying,” follows Zillow’s Oct. 18 announcement that it was halting all new home purchases for the rest of the year. At the time, Zillow pointed to labor and supply shortages for its inability to renovate and flip houses fast enough.

But Chief Executive Rich Barton said Tuesday that Zillow had failed to accurately predict the pace of home-price appreciation, marking an end to a venture the company once said could generate $20 billion a year.

“We’ve determined the unpredictability in forecasting home prices far exceeds what we anticipated and continuing to scale Zillow Offers would result in too much earnings and balance-sheet volatility,” Mr. Barton said in a statement.

Zillow’s share price was down about 12% in late trading on Tuesday, but before it announced the decision to end home flipping.

The move represents a big hit to Zillow’s top line. Home-flipping was the company’s largest source of revenue, but it has never turned a profit.

Zillow, which will release earnings later on Tuesday, said it would report that its home-flipping business, Zillow Offers, lost $381 million last quarter, resulting in a combined loss of $169 million across all of Zillow. The company said it also plans to cut 25% of its workforce.

Zillow has an inventory of more than 9,800 homes across the U.S. that it is currently shopping to investors. There are another 8,200 homes in contract it has agreed to buy. The company expects to lose somewhere between 5% and 7% on these homes, the company said.

Starting in the summer, competitors such as OpenDoor and Offerpad began to pull back from home purchases in one of the biggest home-flipping markets, Phoenix, as the red-hot pandemic market began to cool.

But Zillow accelerated, according to an analysis of sales records by real estate tech researcher Mike DelPrete, scholar-in-residence at the University of Colorado Boulder. Zillow also paid significantly more than those competitors for each home it purchased, buying homes priced $65,000 above the median on average, according to Mr. DelPrete’s analysis.

By October, the company had listed 250 Phoenix homes at an average price discount of 6.2% below what it had paid for them. Mr. DelPrete called Zillow’s price blunder “a catastrophic failure.”

A wider look at Zillow’s national performance by analysts at KeyBanc Capital Markets found it had listed 66% of homes at prices below what it had paid for them, with an average discount of 4.5%.

Zillow said it expects that the wind-down of its home-flipping outfit will take several quarters.

https://www.wsj.com/articles/zillow-quits-home-flipping-business-cites-inability-to-forecast-prices-11635883500

by Jim the Realtor | Nov 1, 2021 | Zillow

It’s too bad they would rather give discounts to insiders, instead of just lowering the price on the individual listings and let the retail buyers benefit.

Zillow Group Inc. is looking to sell about 7,000 homes as it seeks to recover from a fumble in its high-tech home-flipping business.

The company is seeking roughly $2.8 billion for the houses, which are being pitched to institutional investors, according to people familiar with the matter. Zillow will likely sell the properties to a multitude of buyers rather than packaging them in a single transaction, said the people, who asked not to be named because the matter is private.

A representative for Zillow didn’t immediately comment.

The move to offload homes comes as Zillow seeks to recover from an operational stumble that saw it buy too many houses, with many now being listed for less than it paid. The company typically offers smaller numbers of homes to single-family landlords, but the current sales effort is much larger than normal.

If successful, the sale would make a dramatic dent in Zillow’s inventory. The company acquired roughly 8,000 homes in the third quarter, according to an estimate by real estate tech strategist Mike DelPrete.

Zillow shares dropped 8.6% to $96.61 on Monday. The stock had slipped 22% this year through Friday after nearly tripling in 2020. The company is scheduled to report earnings on Tuesday.

Zillow recently said it would stop making new offers in its home-flipping operation for the remainder of the year, though it continues to close on properties that were already under contract. The decision came after the company tweaked the algorithms that power the business to make higher offers, leaving it with a bevy of winning bids just as home-price appreciation cooled off a bit.

An analysis of 650 homes owned by Zillow showed that two-thirds were priced for less than the company bought them for, according to an Oct. 31 note from KeyBanc Capital Markets.

“I think they leaned into home-price appreciation at exactly the wrong moment,” said Ed Yruma, an analyst at KeyBanc.

Zillow put a record number of homes on the market in September, listing properties at the lowest markups since November 2018, according to research from YipitData. It also cut prices on nearly half of its U.S. listings in the third quarter, according to Yipit, signaling that its inventory was commanding prices lower than it expected.

(more…)

by Jim the Realtor | Oct 26, 2021 | Jim's Take on the Market, Zillow

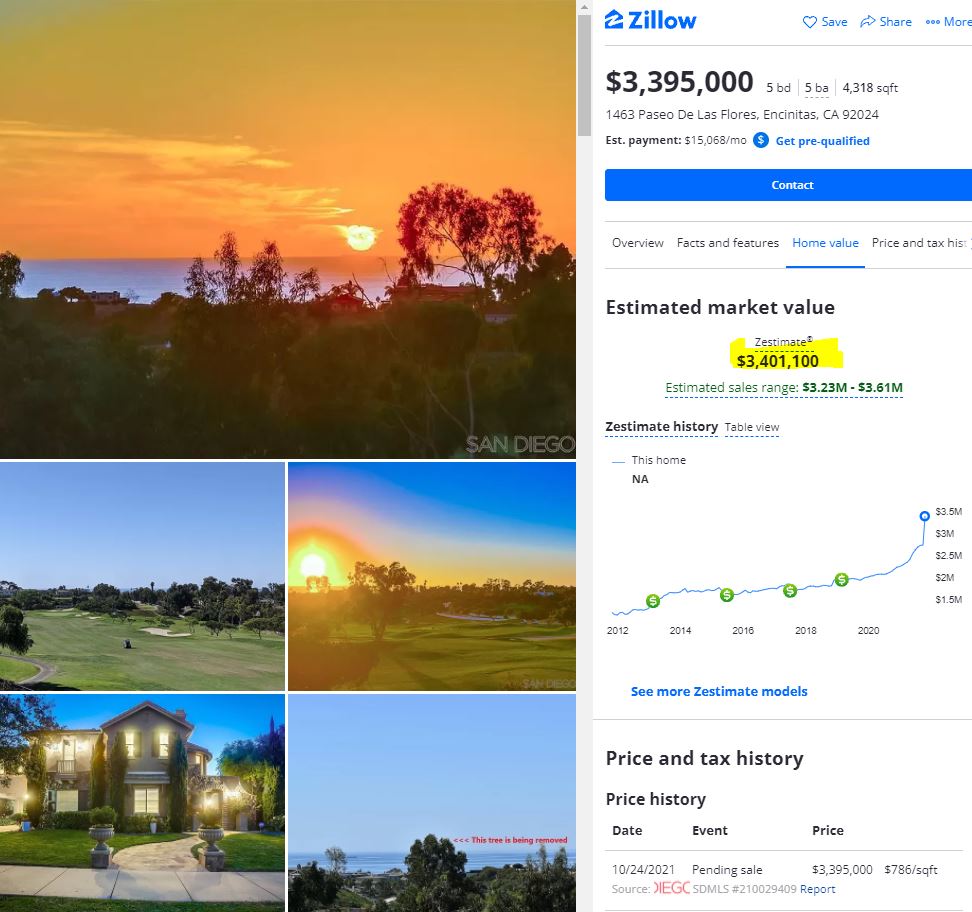

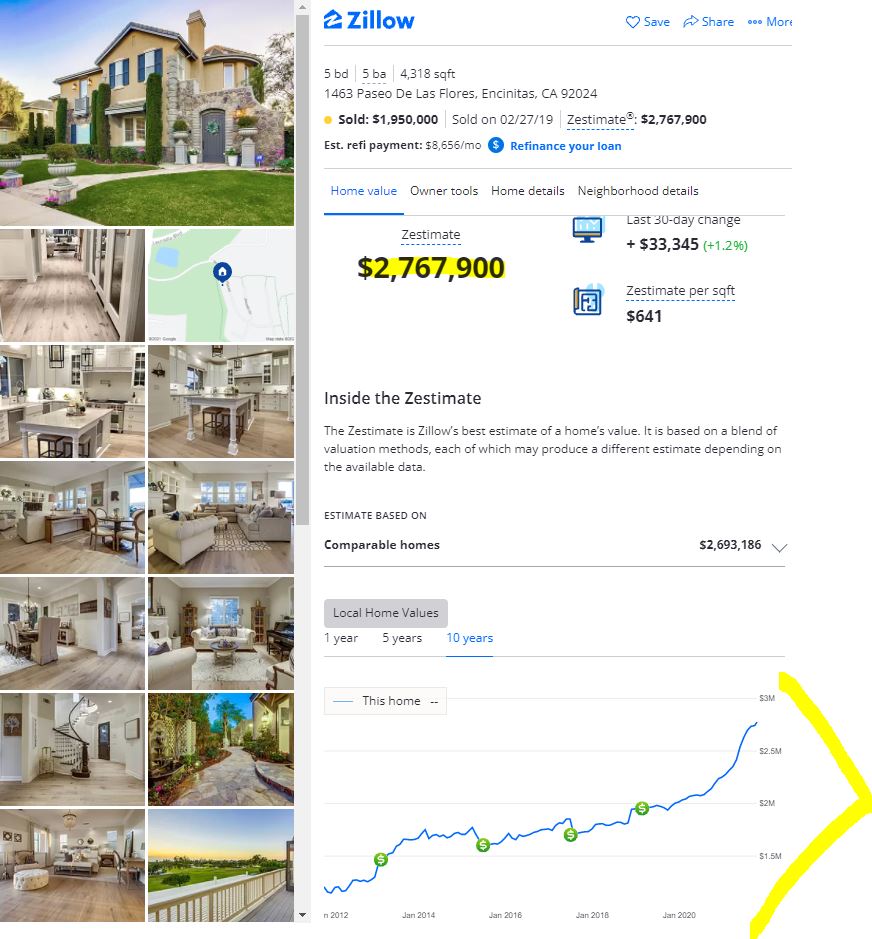

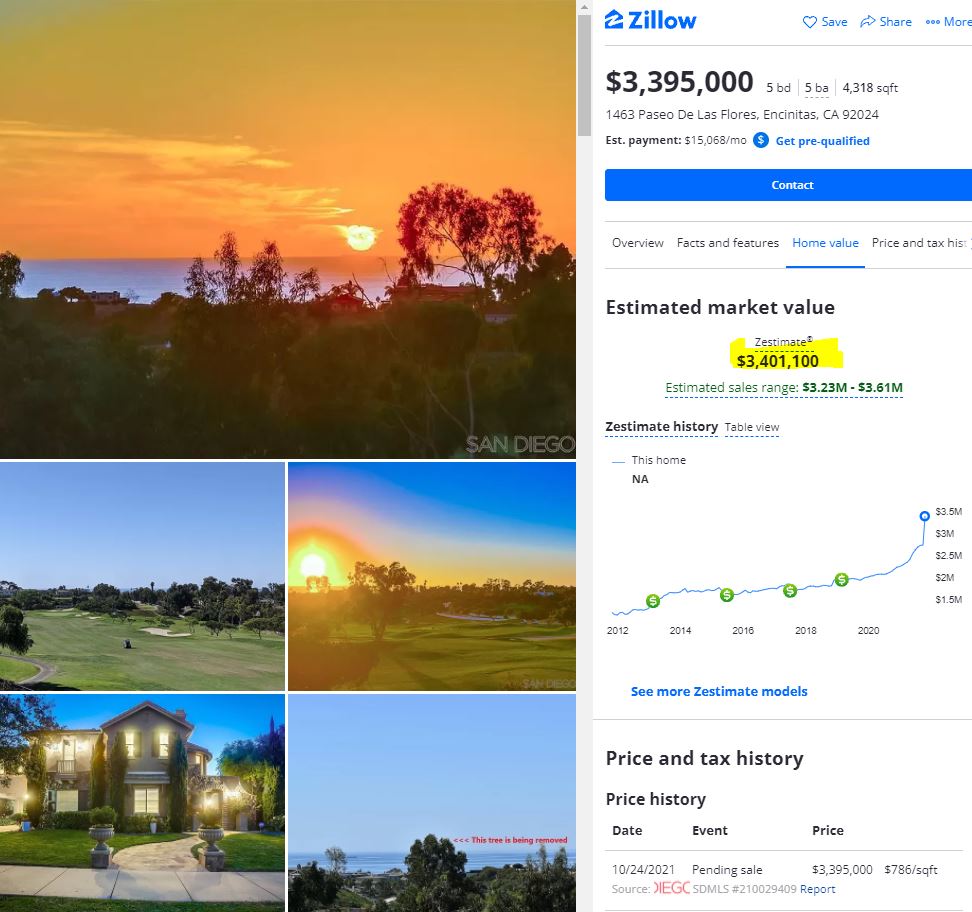

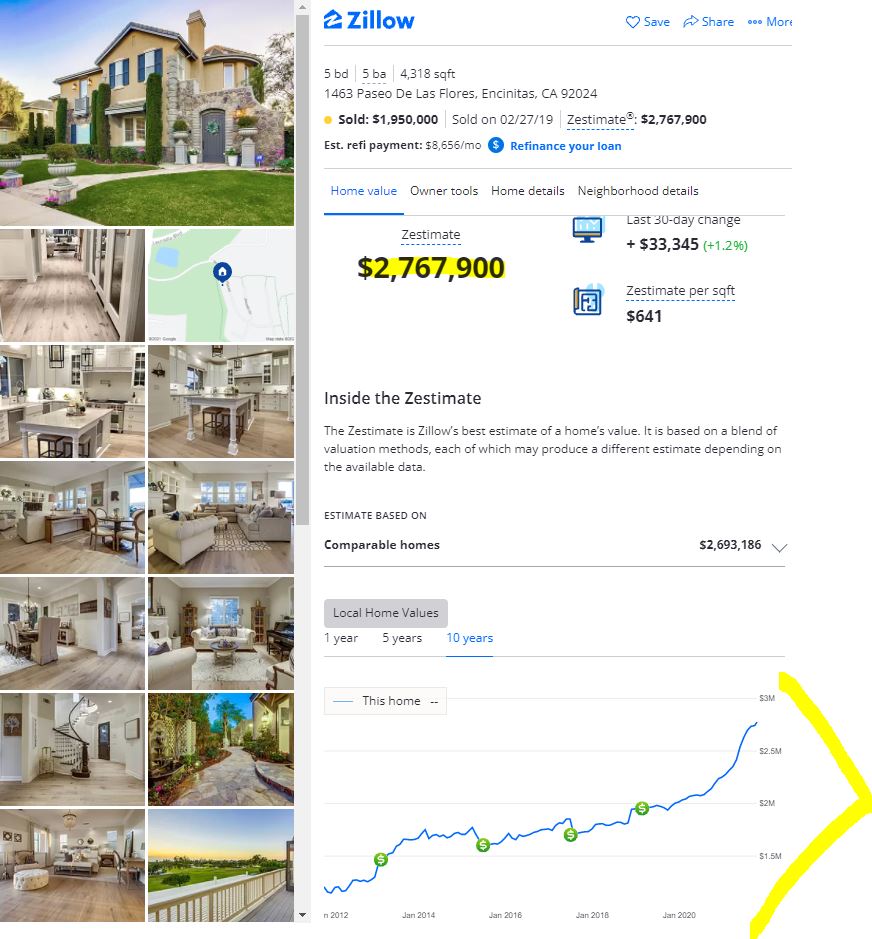

Zillow did get around to updating their Estimated market value after a few days. They kicked up the zestimate by $633,200 to get within 0.18% of the list price – and they are still wrong!

It is incredible how much faith and confidence the consumers put in their zestimate’s accuracy. But after years of being the source for the one-click home valuations – and consistent re-marketing by email – people believe it.

Zillow says their zestimate is within 1.9% of being right on price with the on-market homes, which sounds really good until you realize what that means – they just change the zestimate once a home gets listed…..and they brag about that? They hope you don’t notice.

From last week:

by Jim the Realtor | Oct 18, 2021 | Why You Should List With Jim, Zillow |

Hat tip to GA for sending this in:

Zillow Group Inc. is taking a break from buying U.S. homes after the online real estate giant’s pivot into tech-powered house-flipping hit a snag.

Zillow, which acquired more than 3,800 homes in the second quarter, will stop pursuing new home purchases as it works through a backlog of properties already in its pipeline.

“We are beyond operational capacity in our Zillow Offers business and are not taking on additional contracts to purchase homes at this time,” a spokesperson for Zillow said in an email. “We continue to process the purchase of homes from sellers who are already under contract, as quickly as possible.”

Zillow is best known for publishing real estate listings online and calculating estimated home values – called Zestimates – that let users keep track of how much their home is worth. The popularity of the company’s apps and websites fuels profits in Zillow’s online marketing business.

https://www.bloomberg.com/news/articles/2021-10-17/zillow-pauses-home-purchases-as-snags-hit-tech-powered-flipping

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

They are known for their marketing prowess, so if you’re like me, you probably wondered if they just cooked up a great excuse – and/or if was there any more to the story.

I know one homeowner who got a quote from ZO about a month ago that was around the retail value of the home. Two weeks later, ZO revised their quote downward by 5%, and claimed it was due to ‘market conditions’, not a pipeline backlog. But there’s no obligation for them to tell the same story everywhere.

Let’s check their market conditions.

These are the MLS stats for the broker from Corona who has 91 agents handling the bulk of the Zillow listings for Southern California:

Solds between April 18 – July 18th: 174

Average Days on Market: 14

Median Days on Market: 6

Solds between July 19 – Oct. 18th: 273

Average DOM: 26

Median DOM: 22

ACTIVE LISTINGS TODAY: 294

Average DOM: 29

Median DOM: 21

They were in love with the frenzy, and were able to sell half of their listings in the first 6 days on the market. But today, most of their active listings have been on the market for weeks, and are still unsold.

When their home isn’t selling, amateur sellers cancel their listing and wait for a ‘better market’.

by Jim the Realtor | Oct 5, 2021 | Forecasts, Market Conditions, Sales and Price Check, Zillow |

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

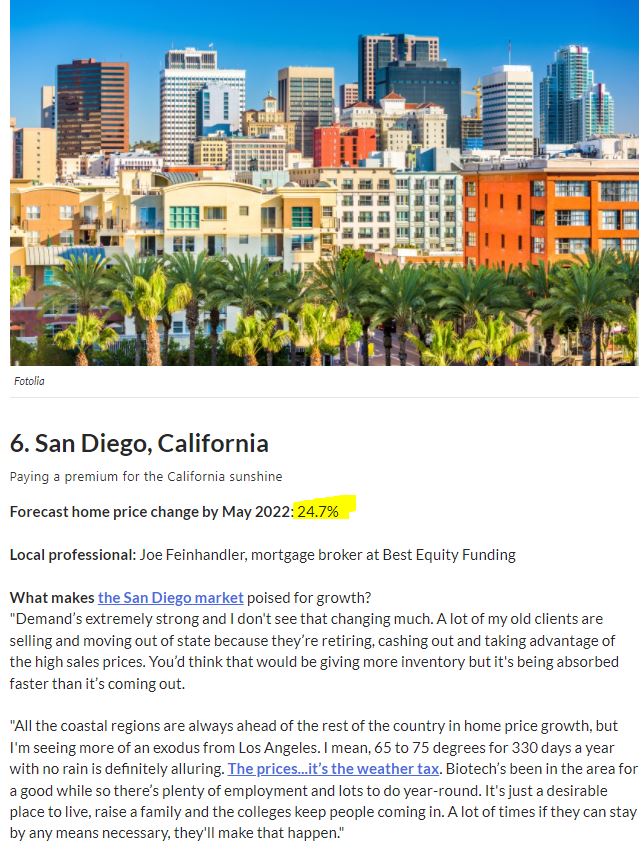

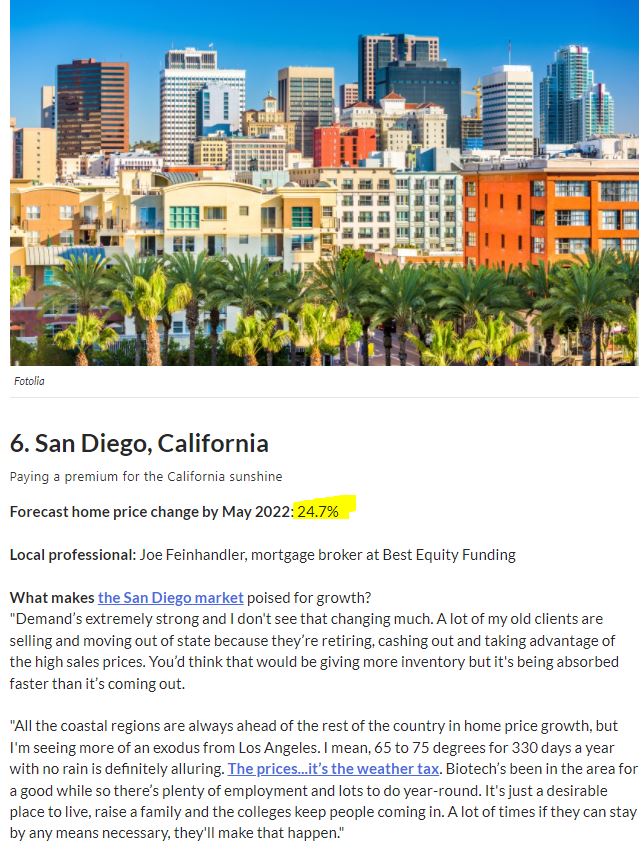

Speaking of Zillow, they also said in this June article that San Diego home prices would rise 24.7% by May.

How are we doing?

There has never been a great measuring stick for home prices, but let’s look at the most common ones:

Yikes – it looks like home prices have been fairly flat over the last 2-3 months, at least according to the standard ways of measuring. Pricing doesn’t have to rise 2% every month to get to their 24.7%, but having upward momentum is critical because once we roll into Plateau City, it gets harder to convince buyers to overpay. They are already cooling their jets:

Get Good Help!

by Jim the Realtor | Oct 4, 2021 | Forecasts, Jim's Take on the Market, Zillow |

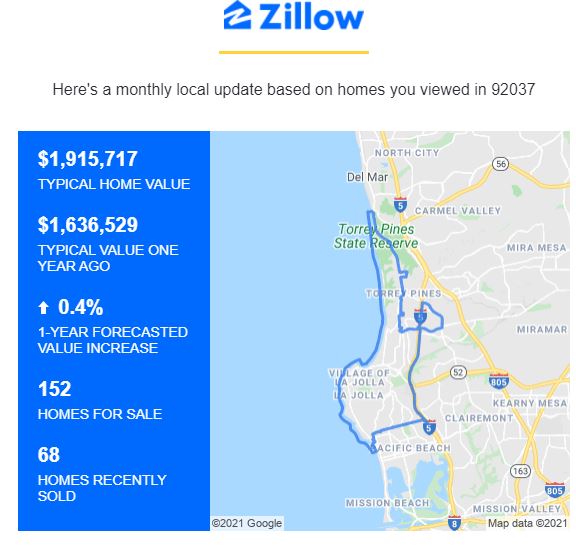

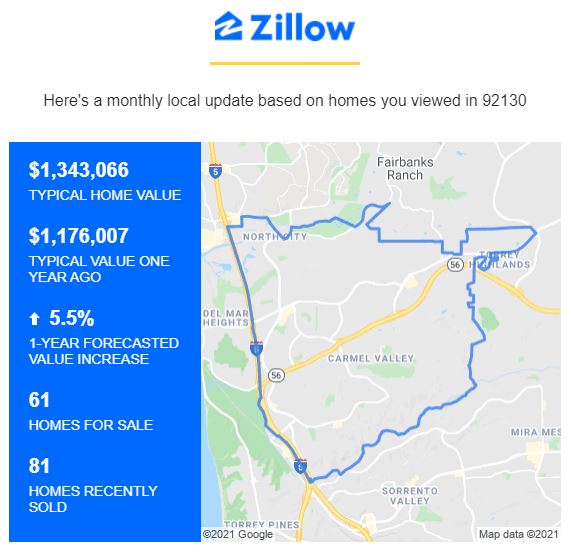

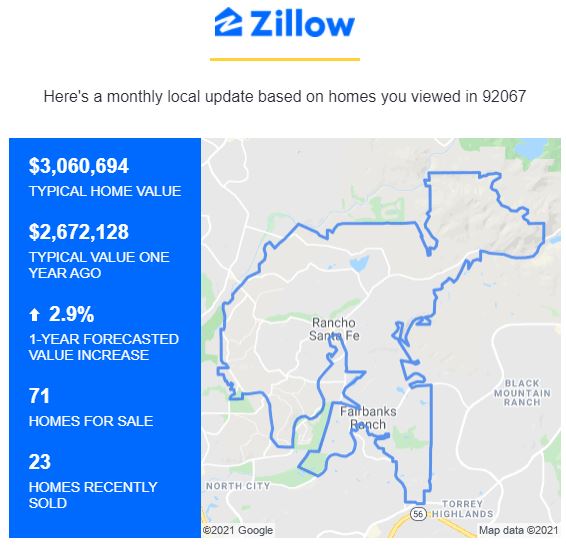

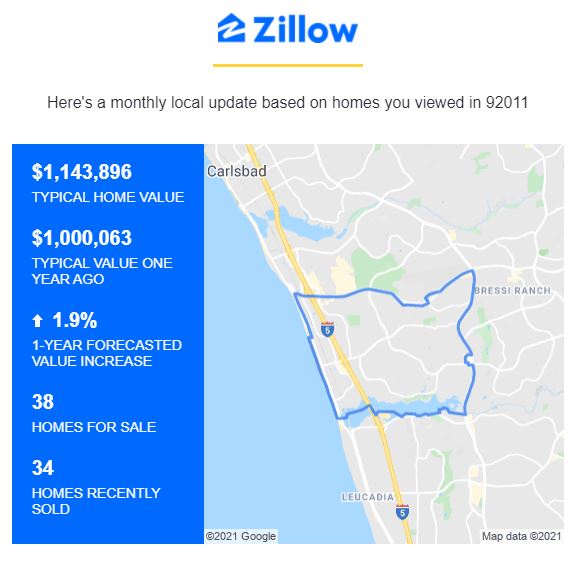

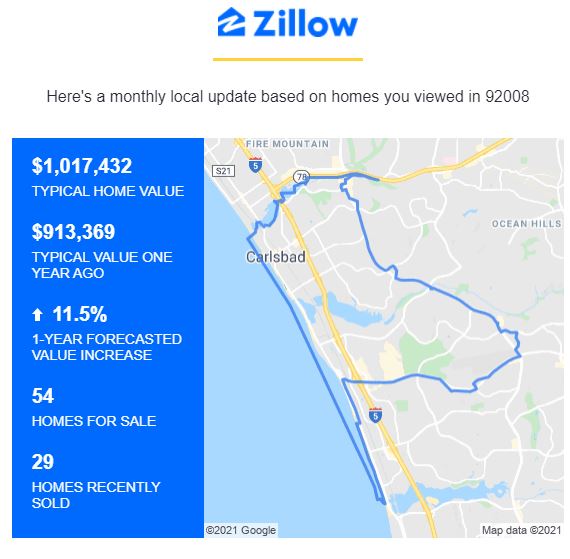

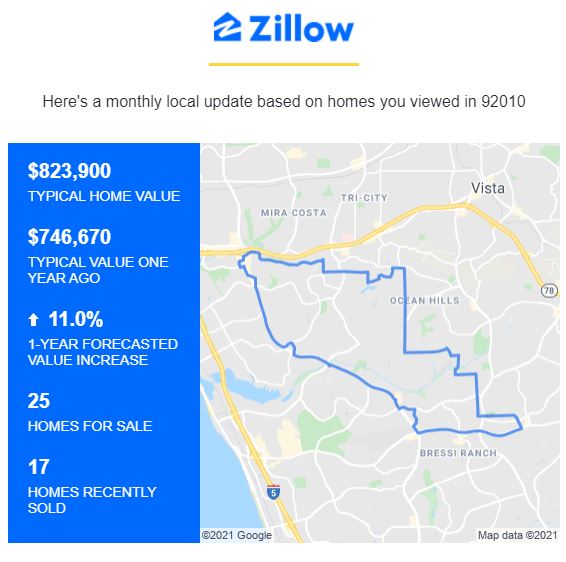

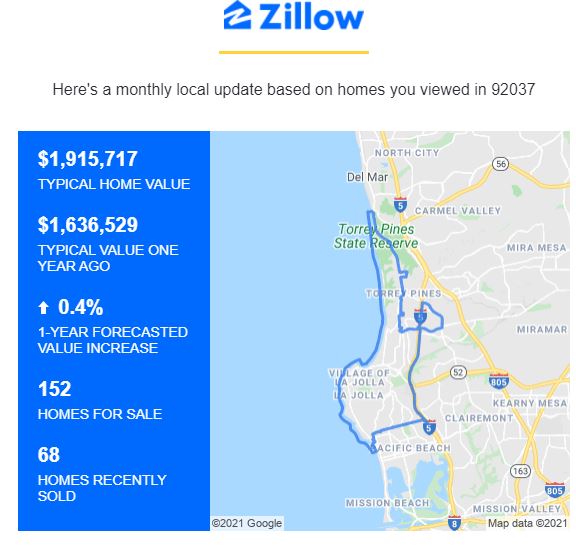

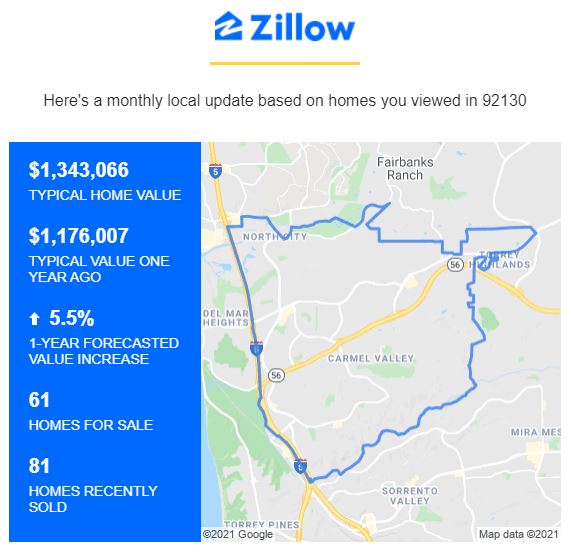

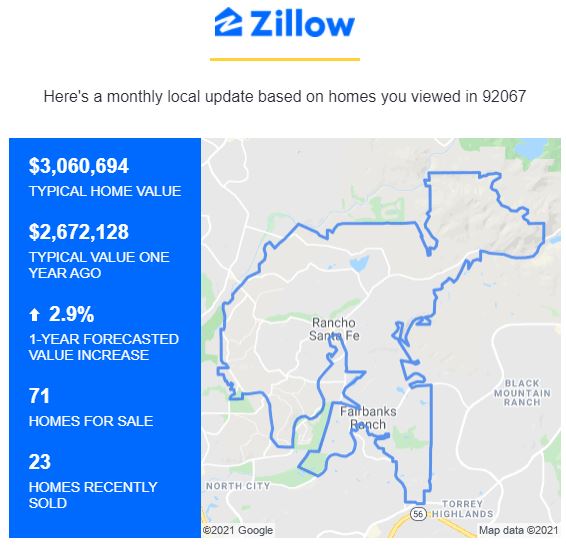

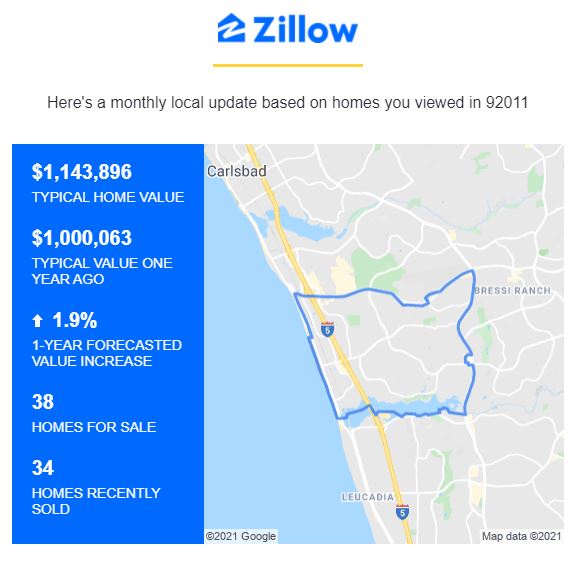

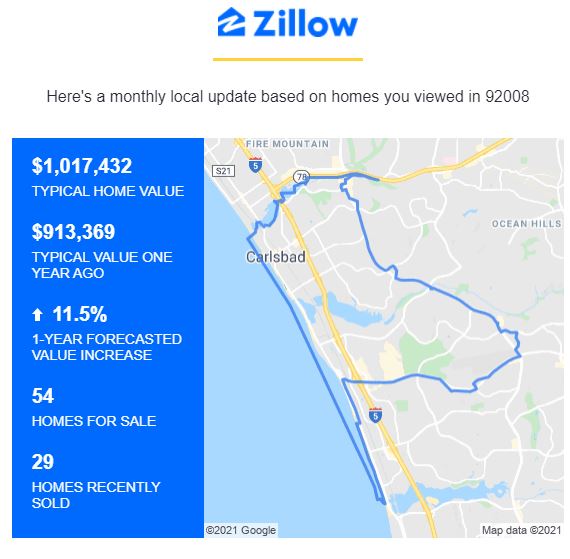

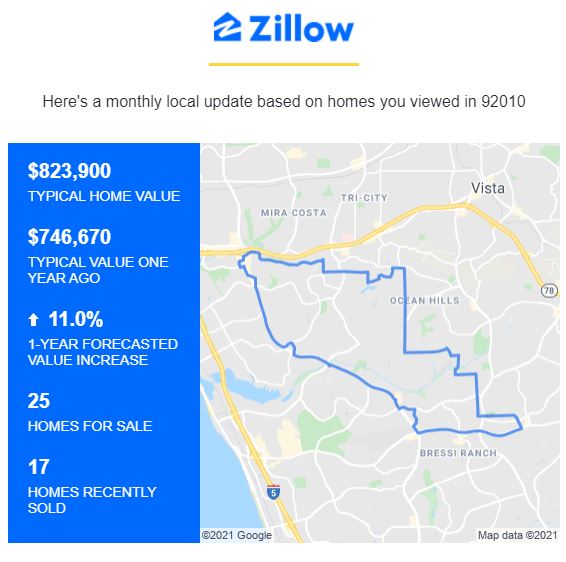

Here are the latest guesses from Zillow that they’ve sent me over the last month. They agree with me that next year will be rip-roaring!

In parentheses are the percentage increases for the last year:

NW Carlsbad 92008 (+28%)

SE Carlsbad 92009 (+30%)

NE Carlsbad 92010 (+28%)

SW Carlsbad 92011 (+28%)

Carmel Valley 92130 (+26%)

Del Mar 92014 (+23%)

Encinitas 92024 (+27%)

La Jolla 92037 (+20%)

Rancho Santa Fe 92067 (+23%)

West Bernardo 92127 (+30%)

Basically, we’re going to have a 40% to 50% increase in local home values over two years!

Get Good Help!

by Jim the Realtor | Aug 19, 2021 | 2021, Frenzy, Over List, Sales and Price Check, Zillow

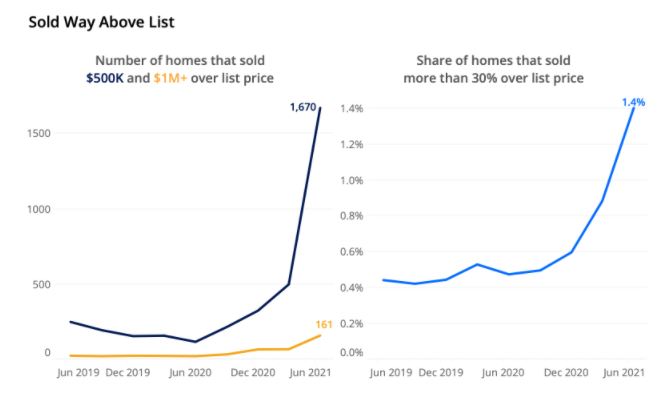

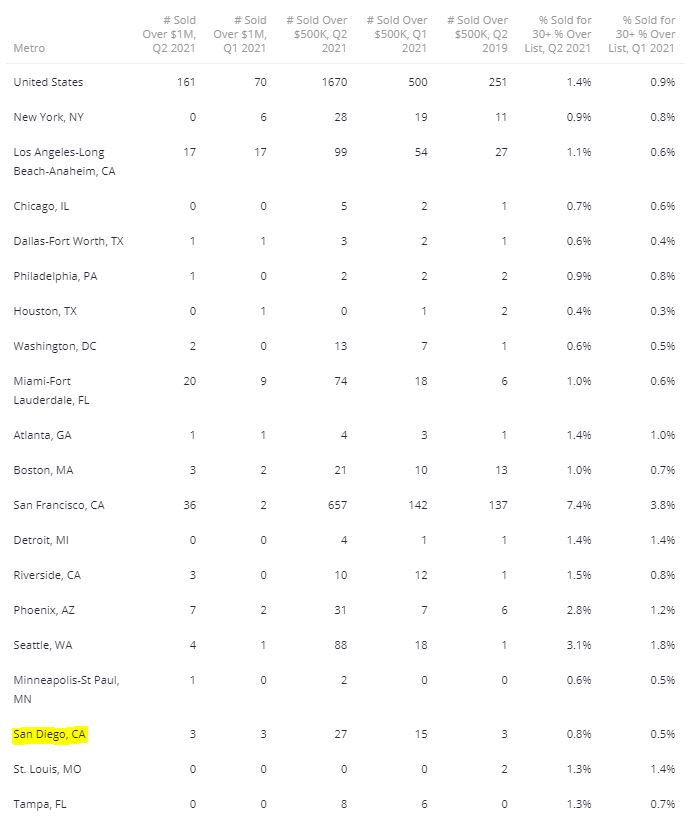

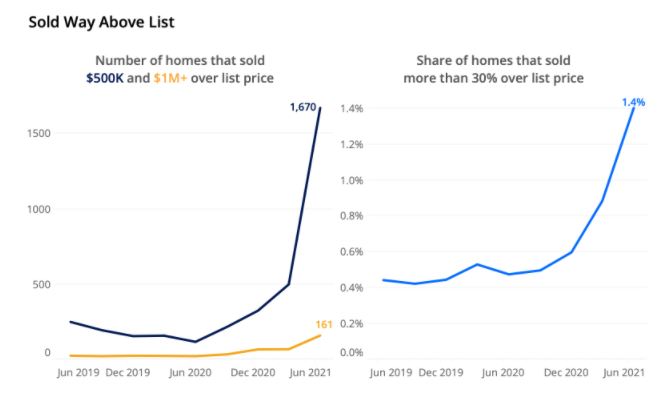

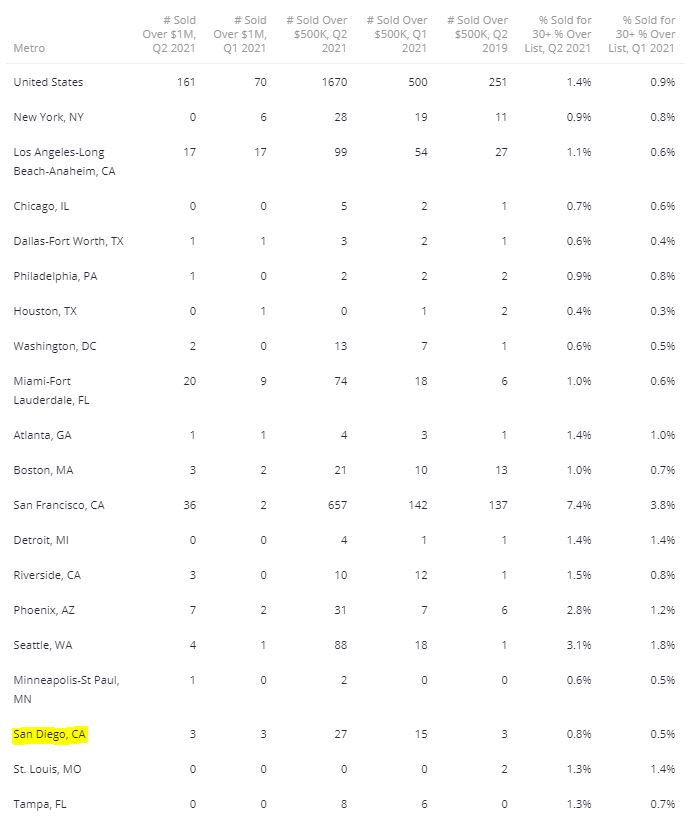

San Francisco leads the 50 largest U.S. metros in the share of homes sold for 30% over their list price or higher at 7.4%. It’s followed by the hot market of Buffalo, NY, where 6.2% of homes sold for more than 30% over list, and Austin (5.3%). All shares in these markets are up substantially over the first quarter.

The markets with the most homes sold for half a million or more over asking in the second quarter are San Francisco (657), San Jose (283), Los Angeles (99), Seattle (88) and Miami (74).

https://www.zillow.com/research/share-of-homes-sold-way-over-list-doubles-29974/

Can we find the six that sold for $1,000,000 over list? I went looking for that needle in a haystack, but couldn’t find any. If you know of the properties that for more than a million dollars over list this year, let us know! The 2021 numbers are staggering, given the pricing:

San Diego County First-Half Sales, All Property Types

| Year |

Total Sales |

Median SP |

Median DOM |

Sales Over $3,000,000 |

| 2017 |

19,236 |

$521,000 |

22 |

150 |

| 2018 |

17,922 |

$554,000 |

14 |

156 |

| 2019 |

16,981 |

$569,000 |

20 |

159 |

| 2020 |

15,037 |

$593,000 |

14 |

155 |

| 2021 |

20,263 |

$702,000 |

9 |

485 |

Record pricing, and record sales at the same time – what a frenzy!

by Jim the Realtor | Aug 16, 2021 | Flips, Frenzy, ibuyer, Zillow

The ibuyers are borrowing money like crazy to build their inventory of homes to flip. Opendoor doesn’t have the brand-name awareness of Zillow, so they are advertising a lot and buying homes directly off the MLS. Zillow has everyone’s email address so they are able to reach their users directly. Both have been fairly well-compensated during the 12-month frenzy – will it continue? From this article:

Opendoor Technologies Inc., which buys homes from consumers and lists them for resale, is in talks with lenders for a new revolving credit facility of roughly $2 billion, according to people familiar with the effort.

The company, which is rapidly accelerating the number of homes it purchases, plans to use the proceeds to help increase acquisitions, said one of the people, who asked not to be named because the matter is private.

A representative for Opendoor declined to comment.

Opendoor, led by Chief Executive Officer Eric Wu, pioneered a data-driven spin on home-flipping known as iBuying. After the company buys a home, it makes light repairs and seeks to resell it, profiting by charging sellers a 5% fee for the convenience of an easy sale.

The company acquired 8,500 homes in the second quarter, more than double the number it bought in the first three months of the year, according to an statement Wednesday. It also had roughly 8,100 additional houses under contract at the end of June.

Opendoor uses debt to fund acquisitions, and had just under $4 billion in borrowing capacity under existing revolving credit facilities as of the end of June. The company had drawn $1.8 billion on those facilities, according to a filing.

Zillow Group Inc., Opendoor’s main competitor, has also moved to increase its firepower for home purchases. The company borrowed $450 million through a first-of-its-kind bond offering earlier this month.

Zillow’s recent activity has been more consistent than Opendoor’s, so let’s look at the Zillow numbers to see if the convenience they offer sellers is paying off. Zillow currently owns 138 homes in San Diego County, and of those, 72 are active listings and 38 are pending. They have sold 48 homes this year – here are the 13 they have closed since July 1st:

| Zip Code |

Purchase Price |

List Price on the Flip |

Sales Price |

| 92021 |

$549,000 |

$586,100 |

$585,000 |

| 92025 |

$542,000 |

$565,100 |

$542,000 |

| 92027 |

$819,000 |

$860,100 |

$930,000 |

| 92054 |

$927,500 |

$949,700 |

$961,900 |

| 92057 |

$369,500 |

$402,900 |

$425,000 |

| 92057 |

$763,500 |

$821,000 |

$890,000 |

| 92058 |

$451,500 |

$486,900 |

$500,000 |

| 92069 |

$831,500 |

$861,700 |

$836,600 |

| 92102 |

$446,000 |

$466,900 |

$475,000 |

| 92111 |

$430,000 |

$442,000 |

$437,600 |

| 92129 |

$463,000 |

$498,500 |

$500,000 |

| 92130 |

$605,500 |

$641,000 |

$641,000 |

| 92130 |

$699,500 |

$732,900 |

$727,000 |

| Totals |

$7,897,500 |

$8,314,600 |

$8,451,100 |

They have a consistent 2-month turnover between the day of purchase, and the day of sale, so it’s a quick $553,600 profit, or an average of $42,585 per sale – though they had to pay out close to half of that in buyer-agent commissions (all fix-ups are included in their purchase prices). It’s a good thing that sellers aren’t in a hurry – Zillow is currently six weeks behind in responding to purchase requests.

Sellers are leaving some money on the table, but as long as Zillow is flipping every home, buyers will still have the same amount of inventory to consider – it’ll just be at a higher price.

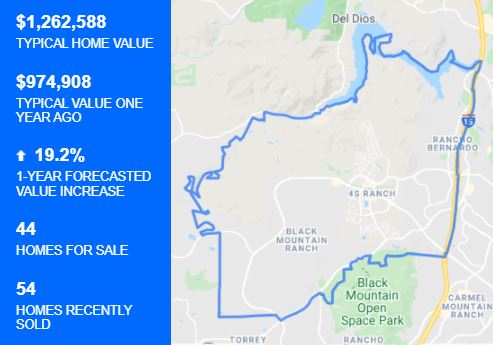

by Jim the Realtor | Aug 9, 2021 | Forecasts, Sales and Price Check, Zillow

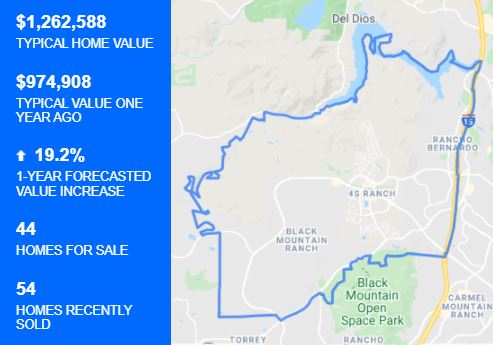

What’s your prediction on local home-price appreciation over the next year?

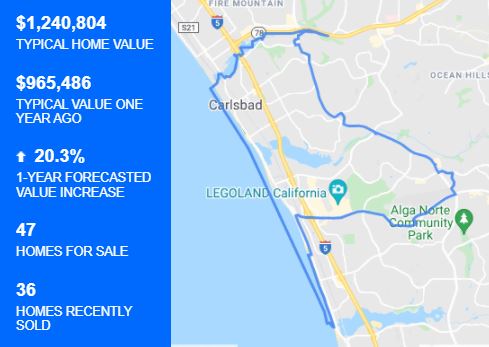

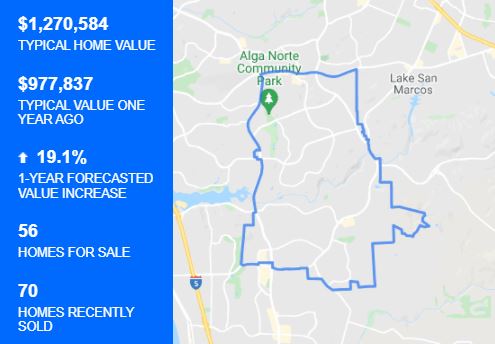

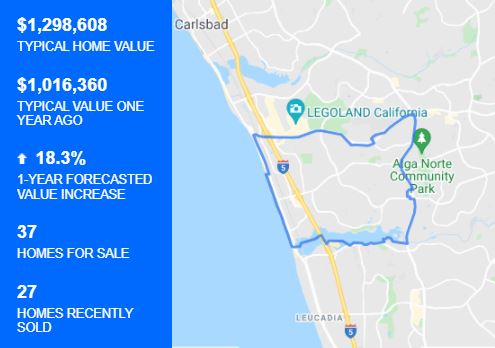

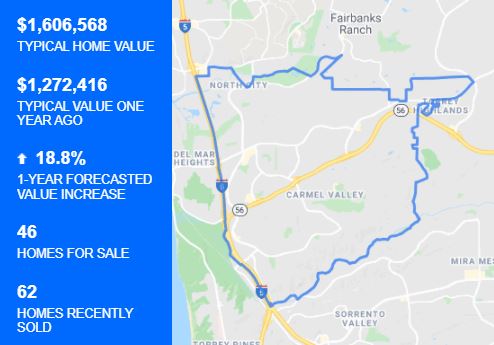

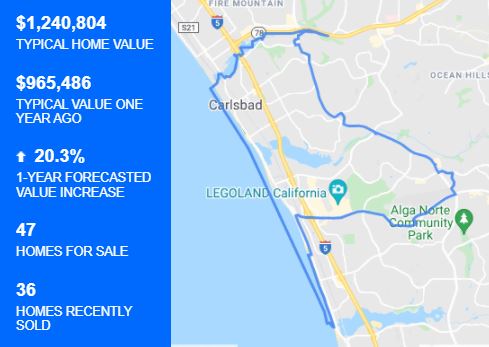

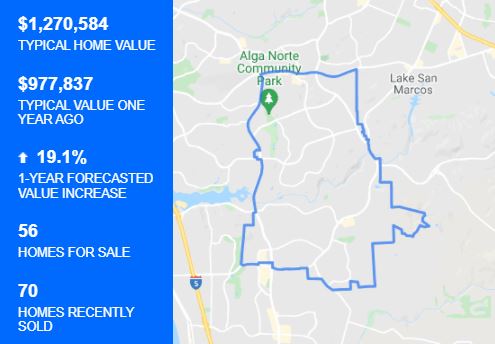

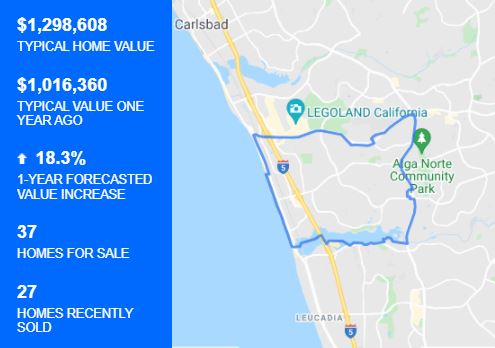

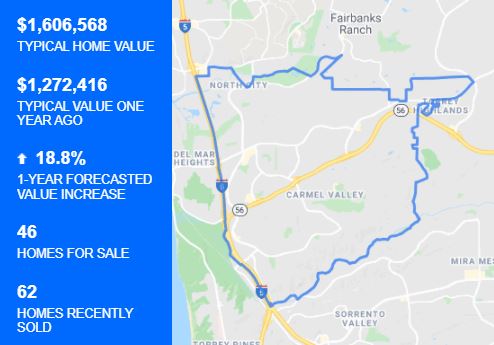

Here’s what Zillow thinks – they sent these to me over the last three weeks:

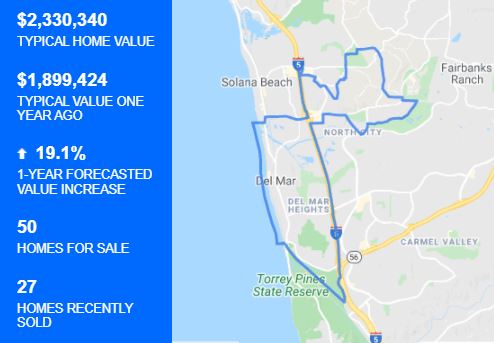

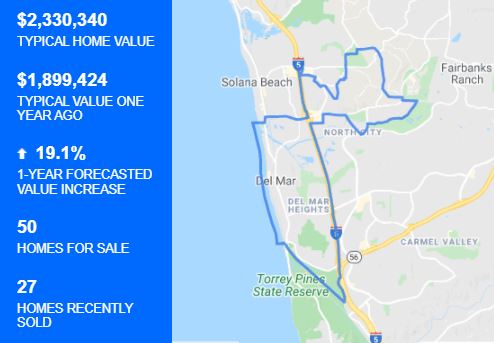

La Jolla:

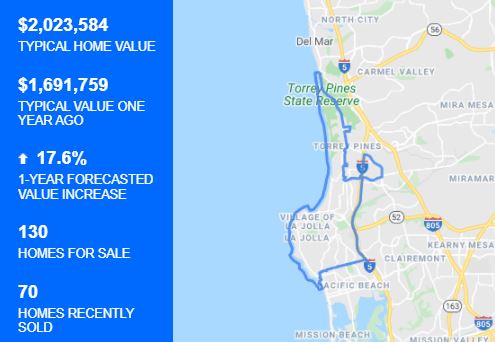

Del Mar:

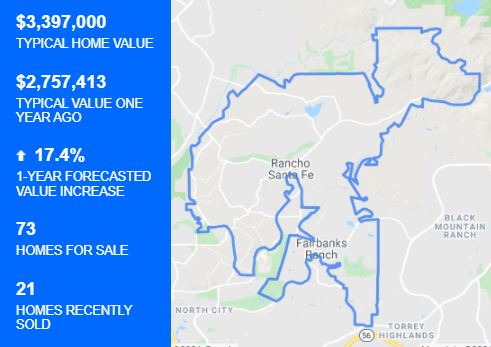

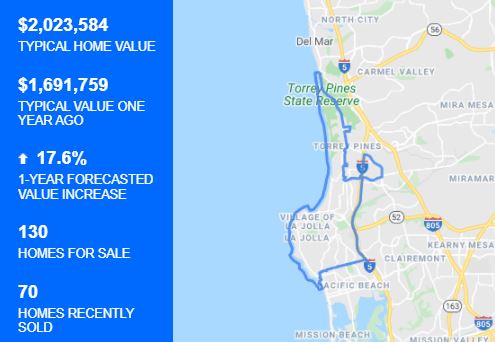

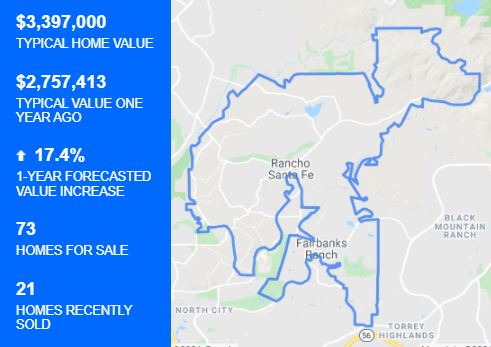

Carmel Valley:

Rancho Santa Fe:

Encinitas:

SE Carlsbad:

SW Carlsbad:

NW Carlsbad:

NE Carlsbad:

Even after the market perked up last year, their guesses were still in the single digits on November 1st:

https://www.bubbleinfo.com/2020/11/01/zillow-2021-forecasts/

In January, they did revise upward and predicted that all of the local areas would hit 10% to 12%:

https://www.bubbleinfo.com/2021/01/11/zillow-increases-appreciation-forecast/

This year, their forecasted-value increases range from 0.4% to 11.5% – quite a spread!