by Jim the Realtor | Apr 23, 2020 | Boomer Liquidations, Boomers, Jim's Take on the Market, Local Flavor, Market Conditions, North County Coastal, Why You Should List With Jim |

As people hunker down in quarantine throughout the state, many must be asking themselves if they are in the right house for them – and if it isn’t, then where to move.

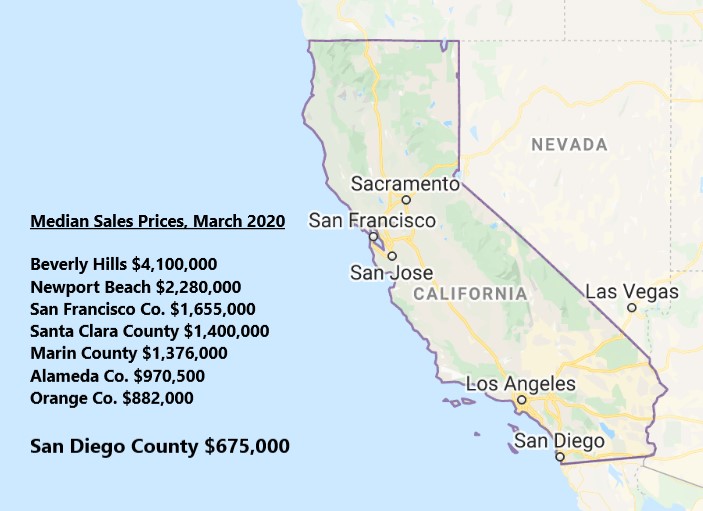

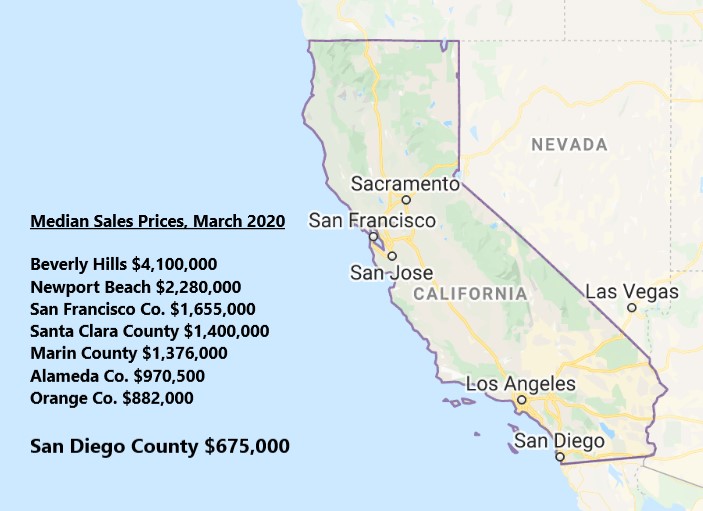

Thankfully, most of the densely-populated parts of coastal California are more expensive than in San Diego County, which makes for a natural progression.

For downsizers who want to live in the same size or larger home, they can come to San Diego and make out nicely! Or get a smaller home AND pocket big profits from their previous sale.

San Diego County real estate should fare well in the coming years – we enjoy a natural housing demand from baby boomers who are looking for a less-costly coastal experience.

It’s good for the ego too – who would criticize them for wanting to move here!

by Jim the Realtor | Mar 30, 2020 | Boomer Liquidations, Boomers, Jim's Take on the Market, Thinking of Selling?, Tips, Advice & Links |

There is no reason to transfer your house to your kids – use a family trust instead. If you need dough, then get a reverse mortgage. Hat tip to just some guy!

Adding an adult child to your house deed, or giving them the home outright, might seem like a smart thing to do. It usually isn’t.

Transferring your house to your kids while you’re alive may avoid probate, the court process that otherwise follows death. But gifting a home also can result in a big, unnecessary tax bill and put your house at risk if your kids get sued or file for bankruptcy. You also could be making a big mistake if you hope it will help keep the house from being consumed by nursing home bills.

There are better ways to transfer a house to your kids, as well as a little-known potential fix that may help even if the giver has since died.

WHY YOU SHOULDN’T GIFT A HOUSE

If you bequeath a house to your kids — which means they get it after your death — they also get what’s known as a “step-up in tax basis.” All the appreciation that happened while you owned the house is never taxed.

Certified financial planner Kenneth Robinson of Rocky River, Ohio, says last year he advised a client not to let his mom give him her house. The mother paid $16,000 for her home in 1976, while the current market value is close to $200,000. None of that gain would be taxable if the son inherited the house, Robinson told his client.

The mother signed a quit claim to give her son the house anyway and died shortly afterward. That potentially meant a tax bill of about $32,000 for Robinson’s client.

Families who realize the mistake in time can undo the damage by gifting the house back to the parent, says Jennifer Sawday, a partner at TLD Law in Long Beach, California.

“We do last-minute deeds to get that house back in place when we know someone is dying,” Sawday says.

OTHER REASONS NOT TO GIFT A HOUSE

Sometimes people transfer a home to try to qualify for Medicaid, the government program that pays health care and nursing home bills for the indigent. But gifts or transfers made within five years of applying for Medicaid can lead to a penalty period, when seniors are disqualified from receiving benefits.

Transferring your home to someone else also can expose you to their financial problems. Their creditors could file liens on your home and, depending on state law, get some or most of its value. In a divorce, the house could become an asset that must be divided.

A POTENTIAL ‘HAIL MARY’ FIX

Robinson consulted a certified public accountant and an estate planning attorney. Both said what Robinson feared was true: The client was stuck paying taxes on the $184,000 gain in value since his mother bought the property.

“They were as discouraged as I was,” Robinson says.

But then Robinson hired a tax research firm and learned of a workaround. Section 2036 of the Internal Revenue Code says that if the mother retained a “life interest” in the property, which includes the right to continue living there, the home would remain in her estate rather than be considered a completed gift.

“Many people do not know about this and are therefore losing out on the step-up and the lower taxes they would be entitled to,” says Michael Eisenberg, CPA financial planner with the American Institute of CPAs’ Financial Literacy Commission.

There are specific rules for what constitutes a life interest, including the power to determine what happens to the property and liability for its bills. To ensure that outcome, the son, as executor of his mother’s estate, filed a gift tax return on her behalf to show that he was given a “remainder interest,” or the right to inherit when his mother’s life interest expired at her death, Robinson says.

THERE ARE BETTER WAYS TO TRANSFER A HOUSE

There are other ways around probate. Many states and the District of Columbia allow “transfer on death” deeds that allow people to leave their beneficiaries their houses without having to go through probate. Another option is a living trust, which typically costs $1,500 to $3,000 to set up but can ensure all a person’s assets avoid probate.

And probate in many states is nothing to fear. Most states have simplified probate procedures for smaller estates. Only in a few, such as California and Florida, is probate so expensive and time-consuming that most people should try to avoid it.

“We see avoidance of probate as a big issue in people’s minds, sometimes bigger than it has to be,” Robinson says.

https://abcnews.go.com/Lifestyle/wireStory/liz-weston-give-adult-kids-house-69869166

by Jim the Realtor | Feb 17, 2020 | Boomer Liquidations, Boomers, Jim's Take on the Market, Remodel Projects |

Wouldn’t it be easier to move? 🙂

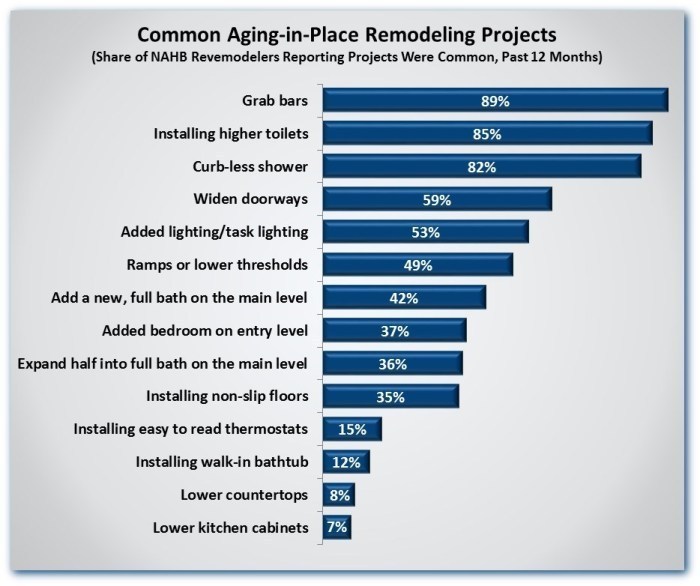

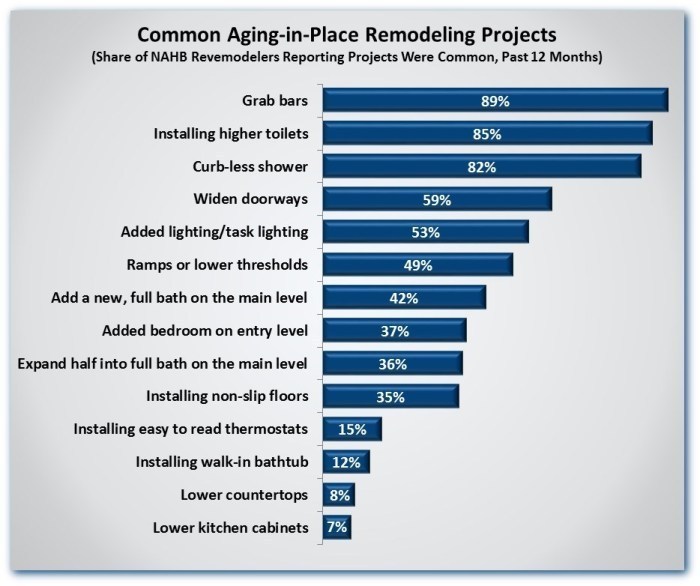

When it comes to the most sought-after aging-in-place projects, bathrooms dominate the top spot.

In a recent NAHB survey of remodelers, more than eight out of 10 reported that installing grab bars (89%), higher toilets (85%) and curbless showers (82%) were the most common aging-in-place projects.

Widening doorways, the next most-common project on the list, came in at a distance 59%.

Even though the underlying motivation seems similar in both cases, walk-in bathtubs have not become nearly as common as curbless showers. Only 12% of remodelers reported installing walk-in tubs.

When NAHB began asking aging-in-place remodeling questions in 2004, curbless showers were about as common as wider doorways. But over the years, the share of NAHB remodelers installing curbless showers has grown from 54% to 82%.

NAHB senior economist Paul Emrath provides more details in this Eye on Housing blog post.

by Jim the Realtor | Feb 16, 2020 | Boomer Liquidations, Boomers, Jim's Take on the Market, Thinking of Selling?

Who is selling? I haven’t checked in a while! This chart tracks when the home was purchased by the sellers. Today’s numbers are from those sold between Jan 22 and Feb 14 of this year:

| Year Purchased |

6/18/16 |

12/13/16 |

4/3/17 |

6/30/17 |

12/4/17 |

2/16/20 |

| 0 – 2003 |

39% |

57% |

48% |

32% |

47% |

34% |

| 2004 – 2008 |

24% |

19% |

15% |

12% |

15% |

18% |

| 2009 – 2011 |

13% |

6% |

7% |

14% |

10% |

4% |

| 2012 – 2019 |

19% |

13% |

25% |

34% |

24% |

35% |

| New Home |

5% |

4% |

4% |

7% |

4% |

9% |

The long-time owners aren’t moving as much as they used to! Those who have purchased since 2012 have no problem selling for a decent-to-huge gain, and more of them have been taking their profits – and hopefully buying another.

There were four flippers in today’s 2012-2019 group.

More stats:

| Other |

6/18/16 |

12/13/16 |

4/3/17 |

6/30/17 |

12/4/17 |

2/16/20 |

| # of Sales |

144 |

112 |

99 |

99 |

116 |

116 |

| Avg. $$/sf |

$550/sf |

$529/sf |

$481/sf |

$532/sf |

$523/sf |

$692/sf |

| Median SP |

$1.291M |

$1.274M |

$1.11M |

$1.25M |

$1.18M |

$1.38M |

| Avg DOM |

42 |

54 |

43 |

52 |

47 |

62 |

| 0-10 DOM |

35% |

28% |

45% |

42% |

28% |

25% |

| Lost $$ |

7 |

7 |

0 |

1 |

2 |

5 |

| DOM = 0 |

7 |

2 |

4 |

3 |

4 |

2 |

by Jim the Realtor | Feb 13, 2020 | Boomer Liquidations, Boomers, Jim's Take on the Market, Tax Reform

Excerpts from the latimes article:

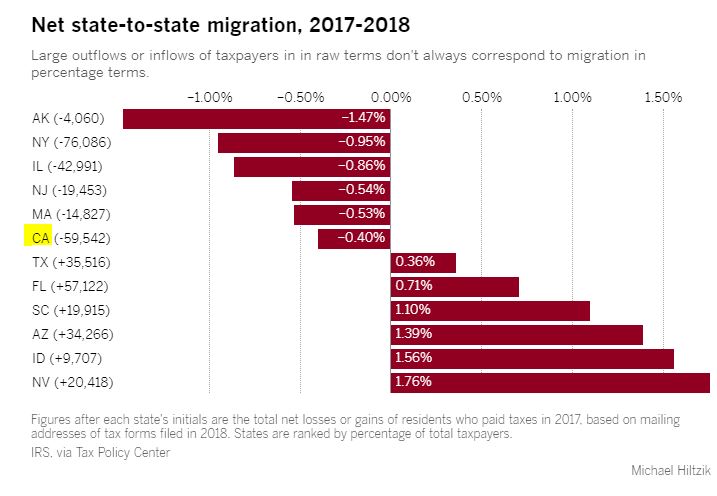

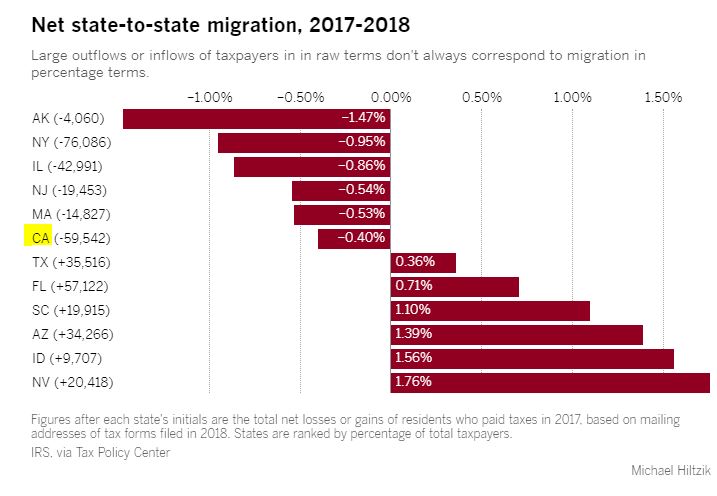

Ever since the SALT cap went into effect in 2018, the hunt has been on for signs that it has prompted more wealthy residents to move from high-tax to low-tax states.

“Despite some recent claims that it has,” Lucy Dadayan of the Tax Policy Center wrote on Feb. 10, “the data available support the view that ‘We don’t have any idea.’”

News articles crop up from time to time about things like surging purchaser interest in Florida condos from residents from New York or California. But they’re anecdotal, not data-driven. It’s hard to say whether the interest doesn’t reflect the pretax bill trend or bargains left over from a lengthy Florida real estate slump.

“Migration has been a problem for a number of years,” Dadayan told me. “SALT cap or not, New York has to be concerned about losing people.” Internal Revenue Service statistics show that New York lost more than 76,000 taxpayers from 2017 to 2018, nearly 1% of its taxpayers and the largest outflow among high-population states.

But as Dadayan observes, attributing that migration to concerns about high taxes in general or the SALT cap specifically is another matter. The top destination for fleeing New Yorkers in recent years has been California, which has a higher top income tax rate. “Migration is not necessarily determined by taxes,” she says.

The SALT cap raised hackles in high-tax states. New York Gov. Andrew Cuomo pronounced it “an economic civil war that helps red states at the expense of blue states.”

Pinpointing the relationship between the SALT cap and interstate migration is difficult for several reasons. One is that it’s too early to tell. The Internal Revenue Service has released taxpayer data only through the 2017 tax year; statistics for 2018 tax payments won’t be available until December.

(more…)

by Jim the Realtor | Feb 10, 2020 | Boomer Liquidations, Boomers, Graphs of Market Indicators |

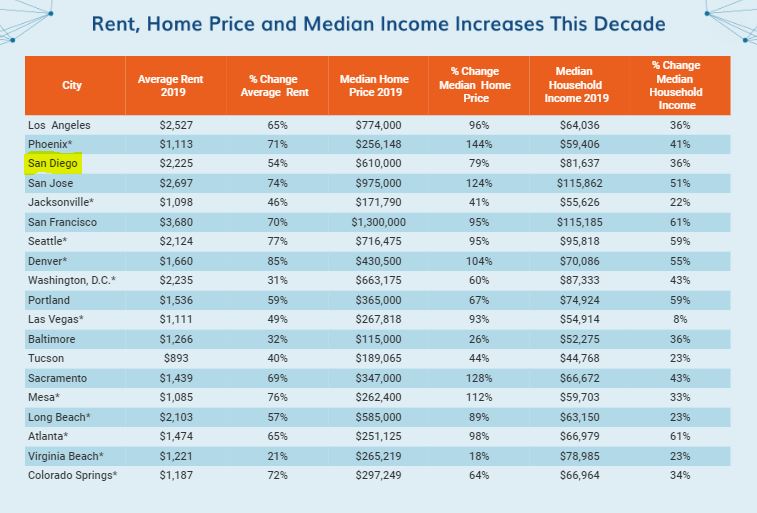

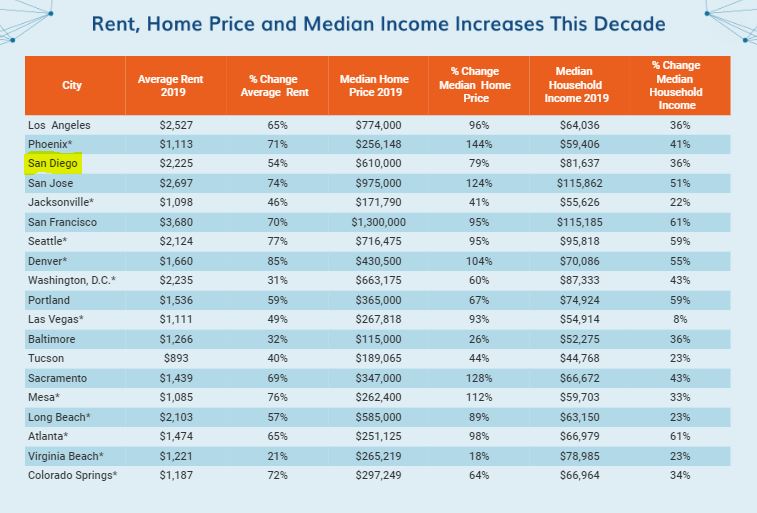

What a decade!

Our median home price – fueled by low rates and the Bank of Mom&Dad – more than doubled the percentage increase in the median household income!

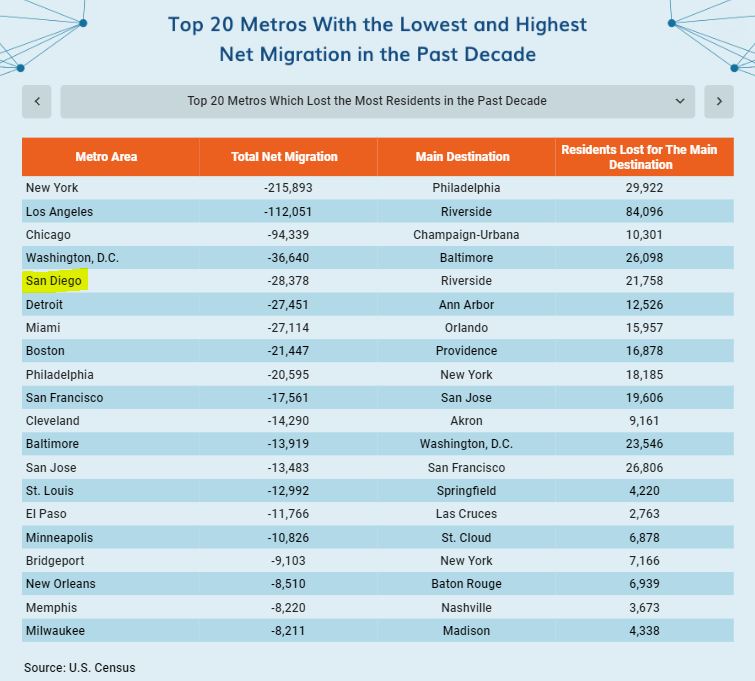

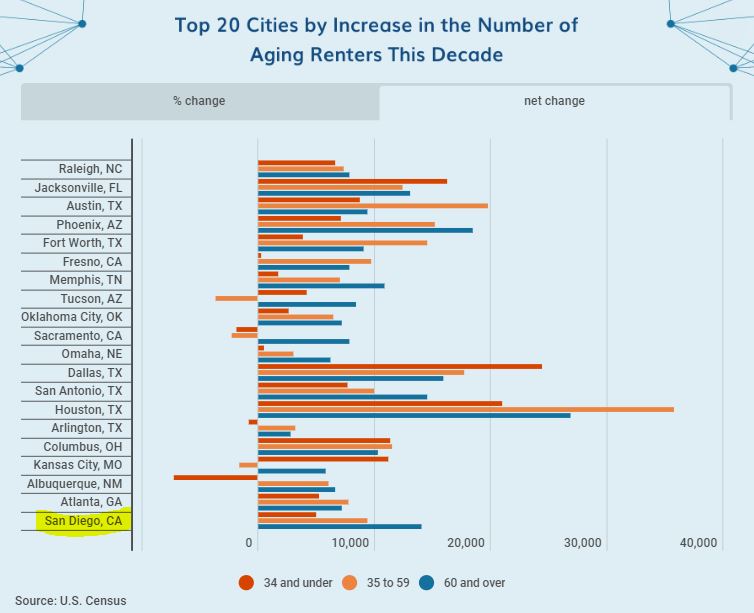

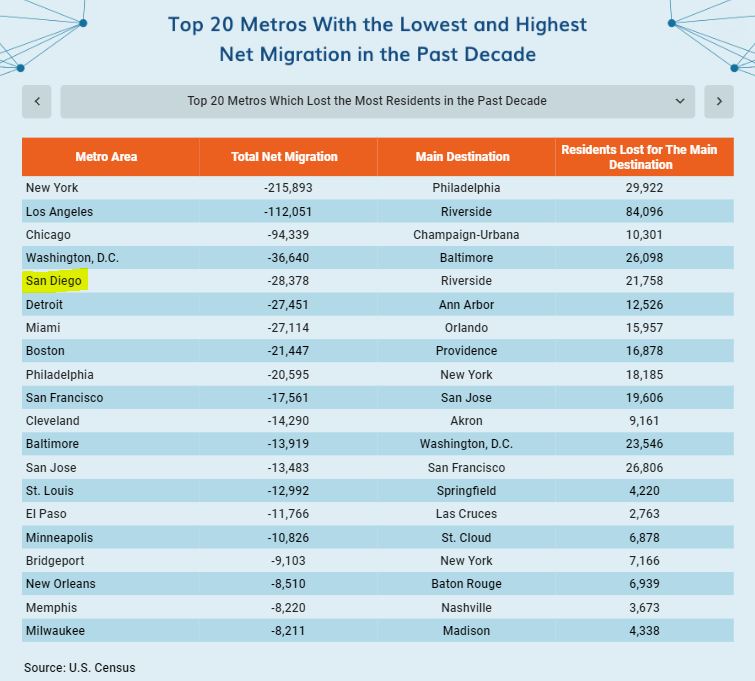

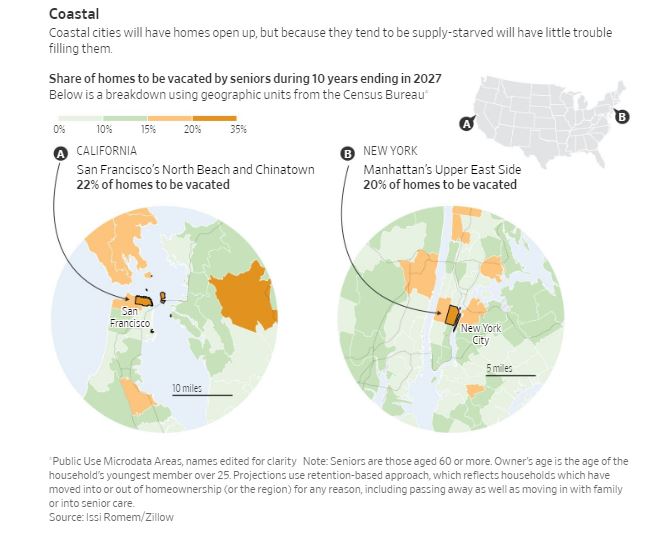

Our net migration was fine really – we must have a steady influx of affluent folks:

Here’s an interesting graph on those renters over 60 years old. San Diego was 20th by percentage, but we were fifth in the total number of additional seniors who rent (could be renters who just reached 60?):

Hat tip to AL for sending in the link – with loads of other data:

https://www.rentcafe.com/blog/rental-market/market-snapshots/renting-america-housing-changed-past-decade/

by Jim the Realtor | Feb 7, 2020 | Boomer Liquidations, Boomers, Jim's Take on the Market, The Future, Thinking of Selling? |

Another chart showing that Americans are light on savings, and retirement is coming. Then consider the graph below – doesn’t there have to be more boomer liquidations on the horizon?

by Jim the Realtor | Jan 23, 2020 | Boomer Liquidations, Boomers, Downsizing, Jim's Take on the Market, Listing Agent Practices |

From the WSJ – thanks Sergio:

As a top Hollywood talent agent for over 40 years, Deborah Miller Lakoff represented big names like William Devane, Ned Beatty, Bob Uecker and Julio Iglesias. For proof, one could just look in her garage.

“There was a massive collection of stuff” stored there, says Fred Meyer, who is Ms. Miller Lakoff’s nephew. In addition to autographed memorabilia and keepsakes, there was furniture, books, records, clothes, family heirlooms, photos and formal dinnerware.

Last year, Ms. Miller Lakoff decided to move from her 2,300-square-foot home in Marina del Rey, Calif., to the 4,000-square-foot house in San Diego where her husband, Sanford Lakoff, lives. (Theirs had been a long-distance marriage for 10 years.) In the next few months, the couple plans to downsize again and move into a roughly 2,000-square-foot apartment in a retirement community. But before any of that could happen Ms. Miller Lakoff had to get rid of a lifetime of accumulated things and sell the house where she had lived for 35 years.

The first hurdle was to decide what items would make the trip to San Diego. Ms. Miller Lakoff and Mr. Meyer, her nephew, worked on that task together. “You need someone who can persuade you to get rid of a lot of stuff. Fred was that person,” Ms. Miller Lakoff says. She resold some of her clothes, record albums and books to second-hand shops, and donated much of her furniture to two young families that had just bought a home. Mr. Meyer digitized photographs and distributed many of his aunt’s heirlooms and keepsakes among family members. “Everybody was thrilled to see this stuff,” he says.

The second—and bigger—challenge was deciding what to do with everything else. For this, she called in reinforcements, hiring Greg Gunderson, president and owner of Gentle Transitions, a Manhattan Beach, Calif., company that specializes in helping people downsize and move.

Mr. Gunderson called in a number of dealers and collectors who purchased some of the high-value items, with all of the proceeds going to Ms. Miller Lakoff. Finally, Mr. Gunderson’s team also packed up everything and did a final “clean out” of the house so it would be ready for the next owner. The whole process took between 2½ and three months and cost $2,300, says Mr. Gunderson. He charges $75 an hour, adding that a typical move to a one- or two-bedroom apartment in a retirement community ranges from $3,000 to $6,000.

The daunting task of downsizing has led to an array of companies and services that promise to make the process easier. Much of the focus is on getting rid of things and coordinating the move. But the real service is persuading people to “let go” of items they’ve held on to for decades.

“There are ways to honor the memory of something without having the physical piece in front of you,” says Mary Kay Buysse, executive director of the National Association of Senior Move Managers, a trade organization with about 1,000 member companies.

When helping their 89-year-old mother downsize in Greenwich, Conn., David Borie and his sister, Mary Zara, turned to a Darien company called The Settler. Their mother, a retired artist and interior designer, had chosen the move-management company to help her deal with the contents of her 6,000-square-foot house and coordinate her relocation into a 2,000-square-foot apartment in a Stamford, Conn., retirement community. The company put color-coded stickers on items to designate their status—if they were going to be moved to the new apartment, given to a family member, sold, donated or thrown away.

Before any artwork was removed, Mr. Borie made giclée reproductions (high-quality prints made with an ink jet printer) of some of the pieces their mother had painted, along with a lesser-known portrait of George Washington by Gilbert Stuart. (Washington is a Borie family ancestor, a seventh great uncle.) He and his other three siblings each received the reproductions and also had the option to get a giclée print of a painting by another ancestor, Adolphe Borie.

The four siblings supported The Settler’s objectives, but to minimize any quibbles, the company listed all of their mother’s possessions on a spreadsheet and let the children rank them from 1 to 75. The Settler’s staffers used a draft system to ensure that items were distributed fairly.

“Nobody got everything they wanted, but we each got some things. And nobody felt someone else got the advantage,” Mr. Borie says. He declined to divulge what the The Settler was paid, but owner Pinny Randall says her company’s services typically range from $10,000 to $15,000.

There were some emotional moments throughout the process. Mr. Borie and his sister worked hard to ensure that their mother was comfortable with downsizing.

His recommendation: Start the process early, when things are less likely to get muddled. And children should be sensitive to psychological struggles when a parent is asked to let go of a lifetime of memories and leave a home they may have occupied for up to 50 years.

Still, once the job is done, many downsizers say they feel a sense of liberation and relief. “Cleaning your shelves and getting rid of things is just a wonderful thing to do,” says Sheri Koones, author of the recently published “Downsize: Living Large in a Small House.” Three years ago, Ms. Koones downsized from a 6,800-square-foot home in Greenwich, Conn., to a 1,700-square-foot home there and got rid of 90% of what she owned.

Link to WSJ article

by Jim the Realtor | Jan 4, 2020 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions |

Homes that are walking distance to excellent schools and/or a retail center (with a Starbucks) will probably do fine – even if they need a little work. Homes out in the boondocks will have more of a struggle.

From the UT:

In a recent column by the Union-Tribune’s Michael Smolens, he discussed the idea of a “silver tsunami” of baby boomers leaving their homes in the coming years. He said this could raise questions about proposals to increase housing production, even imagining an over supply of housing.

Q: Does the “Silver Tsunami” of baby boomer homes mean concerns of a California housing shortage have been overblown?

Bob Rauch, R.A. Rauch & Associates

NO: The concerns are not overblown! The average baby boomer is just over 60 years old and not moving out so quickly. San Diego is not likely to be impacted anytime soon as it was recently ranked No. 8 in the nation for start-ups by Inc. magazine. There is a real need for affordable, detached housing for working adults who are millennials or Generation Z.

Norm Miller, University of San Diego

NO: The exodus of baby boomers from housing in the middle, Florida and northern states will help soften those markets for the next generation, but these markets are already affordable. East coast markets won’t appreciate as fast, but California markets will be immune to such benefits, as Prop 13 keeps many of our residents cemented in place. California tax rates and SALT (state and local tax) limits will have more impact on possible softening of our appreciation rates as negative migration continues.

Jamie Moraga, IntelliSolutions

NO: It may provide some relief to areas of the country where retirees are most concentrated (think Florida or Arizona) or cities where there is a predominant number of older citizens (for example, Pittsburgh or Cleveland). The Silver Tsunami will not be immediate but will be more gradual over a long period of time. While coastal cities in California continue to appeal to potential homeowners of all ages, housing costs should remain a high barrier to entry for the foreseeable future.

Lynn Reaser, Point Loma Nazarene University

NO: While the release of homes by baby boomers may help ease the affordability problem, the process will be gradual. Although some baby boomers may leave the state, most will probably stay. There could be a problem in terms of the mix of housing as some baby boomers downsize and compete for the same smaller housing millennials are seeking. In the short-term, however, builders, not boomers, will be the answer to the state’s housing crisis.

Chris Van Gorder, Scripps Health

NO: The housing shortage in California is real. While there certainly will be many homes up for sale by baby boomers over the next decade, that does not mean the prices will drop nor the supply increase. Most baby boomers will merely be replacing one home for another. So, unless there is a significant decline in the state’s population, the housing shortage will continue. And the shortage will continue to be exacerbated by over-regulation and high taxes — neither of which appears to be going away anytime soon.

Kelly Cunningham, San Diego Institute for Economic Research

NO: There is always significant turnover in housing as residents continuously change homes. The gamut of reasons to change include relocating to better housing, downsizing, moving away or dying. Even as California’s growth dwindles, the population continues to increase. An even larger “tsunami” of the millennial population’s pent-up demand, as well as foreign immigration, will continue to emerge. California’s housing supply still far lags housing demand of an expanding population, although desired optimal home types may vary.

Gary London, London Moeder Advisors

NO: Boomers are not likely to make way for millennials. Many cannot move because the housing shortage presents few alternative choices in San Diego to either downsize or change lifestyles. Many will opt to age in place. The housing shortage is real and affects everyone. In fact, rising home values, which are fueled by the housing shortage, contribute to this inertia, because moving often triggers financial disincentives including capital gains taxes and higher property taxes.

Austin Neudecker, Rev

NO: Retirees selling their homes may help alleviate the housing shortage but far from resolves the problem. We should continue to take action to address the climbing prices rather than rely on unproven predictions. The reported effect will be felt harshest in regions with negative migration. San Diego continues to be a desirable and growing region that must proactively confront housing affordability, homelessness, and cost-of-living increases.

James Hamilton, UC San Diego

NO: Demographics and the number of people wanting homes are ultimately the main driver of house prices. But the aging population is a trend that is going to evolve very slowly. The reality right now is that housing is quite expensive in California generally and in San Diego in particular. I think it is likely to stay that way for some time.

David Ely, San Diego State University

NO: Boomers selling their homes over the next two decades will do little to address the near-term shortage. Given the financial incentives in California for boomers to age in place rather than downsize, it may be years before enough homes are put up for sale to make a dent in the housing shortage. Moreover, the population will continue to grow and young buyers may not even want the types of homes that boomers now own.

Phil Blair, Manpower

NO: My son Trevor and his wife Megan are perfect examples of millennials who are now house hunting in areas of San Diego, while currently loving living in Little Italy. They want a walkable community with good schools for their children. While boomers have historically enjoyed suburban living, they are missing the urban vibes that many young buyers are looking for.

Alan Gin, University of San Diego

NO: The “silver tsunami” will increase the supply of homes in states and regions with large retiree populations. California, in general, and coastal California, in particular, do not fit into that category. More supply will probably be generated by people moving out of the state to retire in less expensive areas. But people who are retiring likely have bigger and more expensive homes that don’t fit the needs of first time home buyers, so that won’t help much either.

Link to Article

by Jim the Realtor | Nov 25, 2019 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Buzz |

This article features our favorite topic today, and they smartly differentiated between areas. I looked up my sales over the last two years and 22% of them involved the last move of the seller (either they had passed away, or close).

Excerpts:

The big question looming in this neighborhood—and dozens of others like it in the Southeast and Rust Belt—is what happens to everything from home prices to the local economy when so many homes post ‘For Sale’ signs around the same time?

The U.S. is at the beginning of a tidal wave of homes hitting the market on the scale of the housing bubble in the mid-2000s. This time it won’t be driven by overbuilding, easy credit or irrational exuberance, but by an inevitable fact of life: the passing of the baby boomer generation.

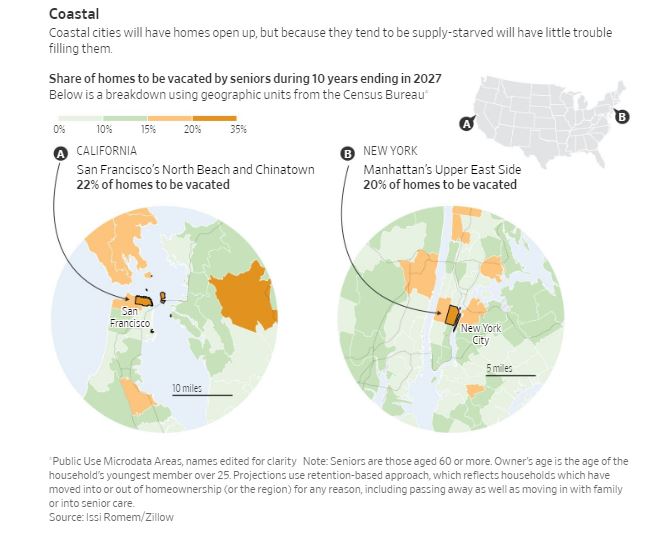

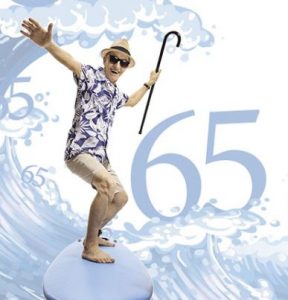

One in eight owner-occupied homes in the U.S., or roughly nine million residences, are set to hit the market from 2017 through 2027 as the baby boomers start to die in larger numbers, according to an analysis by Issi Romem conducted while he was a senior director of housing and urban economics at Zillow. That is up from roughly 7 million homes in the prior decade.

By 2037, one quarter of the U.S. for-sale housing stock, or roughly 21 million homes will be vacated by seniors. That is more than twice the number of new properties built during a 10-year period that spanned the last housing bubble.

Most of these homes will be concentrated in traditional retirement communities in Arizona and Florida, according to Zillow, or parts of the Rust Belt that have been losing population for decades. A more modest infusion of new housing is expected in pricey coastal neighborhoods of New York or San Francisco where younger Americans are still flocking in large numbers.

On the face of it, this doesn’t sound all bad. Dying homeowners have always needed to be replaced by younger ones and the U.S. has for a number of years suffered from a shortage of housing, a development that has dampened recent home sales activity and kept many millennials stuck in rentals.

But the buyers coming behind the baby boomers, the Gen Xers, are a smaller and more financially precarious generation with different preferences, posing a new kind of test for the housing market.

One problem is that the bulk of the supply won’t necessarily be in places where these new buyers want to live. Gen Xers and the younger millennials have shown thus far they would rather be in cities or suburbs in major metropolitan areas that offer strong Wi-Fi and plenty of shops and restaurants within walking distance—like the Frisco suburbs of Dallas or the Capitol Hill neighborhood of Seattle.

They have little interest in migrating to planned, age-restricted retirement enclaves in sunnier corners of the U.S. lined with golf courses, community centers and man-made lakes—like The Villages, a community of 115,000 in central Florida. Innovations such as voice-recognition technology and ride-share drivers are also making it easier for older people to stay in their existing homes and eschew these retirement communities altogether.

Another challenge is that younger buyers also may not have the financial strength to absorb all of this new supply. New research from Harvard University’s Joint Center for Housing Studies found that households in their preretirement years, age 50 to 64, are less likely to own a home than prior generations, have suffered from stagnant income growth since 2000, and are more debt-burdened, including by student loans.

The consequences of a housing sales glut are potentially wide-reaching. A mismatch between supply and demand in places like Florida, Arizona and Nevada could offer new fiscal challenges that are already familiar to aging cities of the Rust Belt: a shrinking tax base and less money for crucial services like roads and police. Home construction could also falter, dampening an important contributor to the local economy.

“To the extent the local economy is dependent on a vibrant senior population, then it will be more difficult,” said William Frey, a senior fellow in the Metropolitan Policy Program at the Brookings Institution. “Homes will be up for sale and not bought as quickly.”

Housing prices are already stagnating in some places like St. Louis and Youngstown, Ohio as older people die and young people aren’t there to replace them, according to Zillow.

More vulnerable, he said, are small towns and rural areas where young people are less likely to migrate, depressing housing prices indefinitely. “Those are the places that are going to seriously struggle,” he said.

Link to WSJ Article