Inventory Watch

Life goes on!

| Week | ||

| Feb 6 | ||

| Feb 13 | ||

| Feb 20 | ||

| Feb 27 | ||

| Mar 6 | ||

| Mar 13 | ||

| Mar 20 | ||

| Mar 27 | ||

| Apr 3 | ||

| Apr 10 | ||

| Apr 17 | ||

| Apr 24 | ||

| May 1 | ||

| May 8 | ||

| May 15 | ||

| May 22 | ||

| May 29 | ||

| Jun 5 | ||

| Jun 12 |

Almost an identical week!

Life goes on!

| Week | ||

| Feb 6 | ||

| Feb 13 | ||

| Feb 20 | ||

| Feb 27 | ||

| Mar 6 | ||

| Mar 13 | ||

| Mar 20 | ||

| Mar 27 | ||

| Apr 3 | ||

| Apr 10 | ||

| Apr 17 | ||

| Apr 24 | ||

| May 1 | ||

| May 8 | ||

| May 15 | ||

| May 22 | ||

| May 29 | ||

| Jun 5 | ||

| Jun 12 |

Almost an identical week!

Doug’ s self-portrait

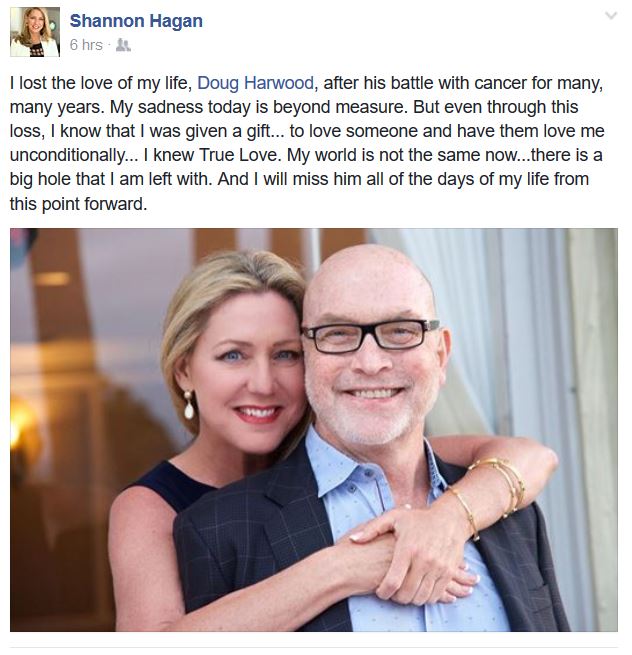

Our favorite realtor has left us – another cancer victim. Doug and I go back to 1994 on Shore Drive in Carlsbad, and there hasn’t been a more gregarious guy in the business since. I have the utmost respect.

I appreciate his willingness to go on camera and share his thoughts. His talks are the best real estate video you will ever see.

Here’s one of our first together from July 14, 2015, plus a link to others:

https://www.bubbleinfo.com/category/doug-harwood/

Doug’s final words to me:

“After the many years, it’s the good friends I have made in real estate that brings me the most joy.”

His Facebook page today:

I am a proponent of San Diego realtors joining the CRMLS (with 80,000+ members) because their system is vastly superior to the crappy MLS version supplied by our Sandicor. But here’s an alternative reason why we should adopt a statewide MLS – because consumers know more than realtors:

It’s My Business, the campaign for statewide MLS listing access in California, traveled to the C.A.R. Meetings in Sacramento in May 2017.

Industry leaders were asked “What is the Future of the MLS?” Hear their answers, plus what they think about 3rd party listing websites and how they’ve changed the business of real estate.

Including testimonials from:

Bryan Forrest – Director of C.A.R.

Monet Love – Director of Pacific Southwest AOR

Max Zaker – Board Member of Pacific Southwest AOR

Claudia Zaker – REALTOR w/ Keller Williams

Brenda Meyer – Past President of East Valley AOR

Joe Prian – President of Scenic Coast AOR

Mike Carunchio – President of North San Diego County AOR

Kevin Williamson – Director of North San Diego County AOR

Rich D’Ascoli – CEO of Pacific Southwest and N. San Diego AOR

Kesha Toler – Broker Associate, Scenic Coast AOR

Jan Farley – 2017 President Elect of Pacific Southwest AOR

Mike DeLeon – Past President of Orange County AOR

This property has several positives, but the best feature is probably the other residents – the hill is full of youthful, active retirees! Open Sunday, June 11th from noon to 3pm:

NSDCC stats at bottom.

The median price of houses and condominiums that changed hands in May in the county zoomed into record territory, with the price of a single-family home crossing the $600,000 mark for the first time, the San Diego Association of Realtors announced Friday.

The median price of the 2,200 or so houses that sold in May in San Diego County was $612,500, up 2.9 percent from April and 8 percent from May 2016. The number of sold listings was up 8 percent from the prior month, but down 6.1 percent from the previous year as inventory continues to be tight, according to SDAR data.

Inventory — the amount of properties on the market — is down roughly 25 percent from the same period last year, according to SDAR.

“While the rise in prices is astounding considering where we were a decade ago, there is less worry about a boom-and-bust scenario with our stronger lending standards,” said SDAR President Bob Kevane. “I am optimistic that our improving economy will make for a strong summer home sale season.”

With the lack of supply causing prices to skyrocket, affordability has fallen. According to the organization’s data, the median household income is only 57 percent of what’s required to purchase a single-family home, down 11 percentage points over the past two years.

The most expensive residential property sold in the county last month was Los Robles Ranch in Santa Ysabel, which went for $8.5 million. The 640- acre, eight-parcel luxury retreat features a 3,550-square-foot, four-bedroom, three-bath main house built in 2006.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

In North San Diego County’s coastal region (La Jolla to Carlsbad), we had the same number of sales year-over-year in May, and only a 0.5% increase in the median SP (The 2016 stats were corrected).

But to show how bumpy the stats can be month to month as the selling season heats up, here’s what we have so far this year:

NSDCC 2017 Monthly Data

| Month | |||

| January | |||

| February | |||

| March | |||

| April | |||

| May |

Get Good Help!

A great article from realtor.com. Excerpts:

As baby boomers look to downsize out of their suburban McMansions, a generational showdown is looming: Millennials might be coming into their own as the nation’s biggest group of first-time home buyers, but they aren’t exactly lining up with bids in hand for those large, expensive homes in the sleepier suburbs. Instead, they’re looking for a different kind of home—the same ones, in fact, that the empty nesters are looking to buy.

It’s a battle of the millennials vs. baby boomers playing out in the nation’s suburban housing markets.

Younger and older generations alike are gravitating toward smaller dwellings in more urban, walkable suburbs and cities, with restaurants and coffee shops around the corner. It’s leading to a real estate traffic jam: Increasingly, boomers are getting stuck, because most can’t buy the home of their dreams until they unload their current ones. And many millennials have neither the desire nor the means to help them out.

“What you have is everyone chasing the same type of home,” says Rick Palacios, director of research at John Burns Real Estate Consulting. “More and more buyers of all ages want to avoid having to deal with a huge yard and all the upkeep and the costs to maintain [a larger] home.”

It’s creating an odd imbalance in a real estate market—a disruption to what has long been considered the traditional generational housing life cycle. And it’s leaving many would-be buyers out in the cold.

When they do make that move to the suburbs, millennials often seek more walkable towns that have many of the urban amenities they’re used to, like bike lanes, social events, and lots of shops and restaurants.

“What’s really attracting millennials are the communities that are bringing the urban flavor out to nonurban towns,” Palacios says. “They don’t want the traditional massive homes and big yards. They want smaller homes and cool things to do.”

“It’s more important to have proximity to the lifestyle they want,” says Jason Dorsey, president and researcher at the Center for Generational Kinetics, focused on millennials and Generation Z. “Their living room is actually the park outside the condo.”

It’s not just the size of boomers’ homes that is a turnoff; it’s also the style. Times and tastes have changed, and today both boomers and millennials are attracted to modern, open floor plans—which aren’t common in the older homes that boomers are hoping to unload. Boomers like the flexibility of these spaces for aging in place, and millennials like the clean design.

And while they’re willing to compromise on size, millennials are less willing to bite the bullet on amenities. Weened on HGTV, they want high-end finishes, nice countertops, upscale appliances, and luxurious bathrooms.

“They’ll buy a smaller house with fancier amenities, close to town, rather than chase square footage,” Dorsey says.

As for Generation X, having weathered the Great Recession during what should have been their prime earning years, they now have to save for their kids’ college expenses, their retirement, and caring for their aging parents. So they’re not likely to trade up from their starter homes. And if they do, many prefer an easier-to-maintain smaller home in a community with activities they enjoy—just like those millennials and boomers, Dorsey says.

Meanwhile, since the boomers see their home as their nest egg, they’re not all willing to reduce their asking price and shortchange their retirement accounts, says Dorsey. So more of them end up staying put.

“There certainly was a lot of speculation about what would happen if the boomers tried to sell their houses en masse, and whether that would flood the market with a supply of large homes that the younger population didn’t want—or couldn’t afford—to buy,” Porter says. But “the boomers do seem to be moving less and aging in place more.”

Read full article HERE.

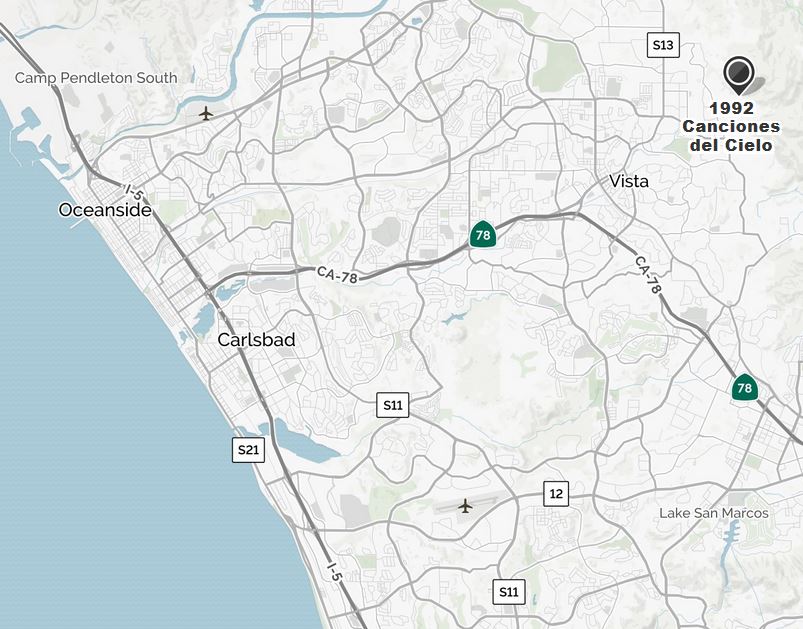

Looking for a newer 3,189sf one-story house at the top of the hill with commanding views for less than a million? Check out my new listing here:

Open houses: Kayla and I on Saturday, Kayla and Donna on Sunday! 12-3pm

https://www.zillow.com/homedetails/1992-Canciones-Del-Cielo-Vista-CA-92084/52506127_zpid/

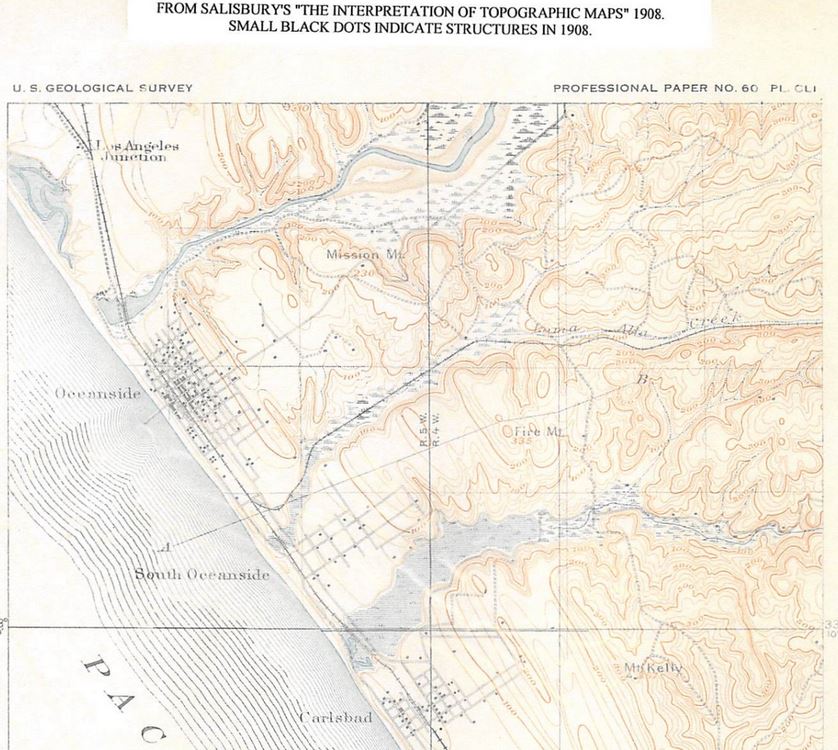

Oceanside was developed much earlier than Carlsbad – the black dots above are the existing buildings in 1908. The Mission San Luis Rey should be the dot right under the O in PROFESSIONAL PAPER at the top right.

Here is a link to the full map document:

Oceanside goes back to the 1800’s:

http://www.oceansidehistoricalsociety.org/history-of-oceanside/

He says C.A.R. would “oppose any such development that eliminates many consumer protections”. Well, are you opposing the Zillow Instant Offers? It doesn’t sound like it. As usual, the leaders of the realtor business are comatose while outsiders strip us down for spare parts.

There is an easy solution. Everyone provide ‘instant offers’.

I have regular buyers for North San Diego’s coastal region that will happily pay 10% under value, and investors that will pay 20% to 30% under value. Both will close in 5-10 days. Contact me today!

| June 7, 2017

Fellow REALTOR®,

No doubt you’ve heard about Zillow Group’s “Instant Offers” pilot program for home sellers where, with or without an agent, homeowners can entertain instant offers and sell their home quickly. This program – which is essentially a new take on another “I’ll buy your house for all cash, below market value” business – is a small segment of the marketplace. The reactions we have received so far falls into either the camp of strong opposition or strong support. For those who are opposed, the pilot has been the subject of much consternation by REALTORS® since its announcement because it creates a path that eliminates the critical role an agent plays in the transaction – another step toward disintermediation. Many see this as an antagonistic step against the very industry that fuels the site with listing content and premier advertising money, only to promote the prospect of excluding REALTORS® from the transaction. For those who see it that way, they have the option of rethinking their participation with the site. Those holding the other opinion have reported that they see business opportunities to enhance their work through this program. No matter how you look at it, we can all agree it’s bad for consumers who need to get sage advice, excellent customer experience, and top dollar when they’re selling their home, especially when consumers have to pay an exorbitant cost to participate in the program. C.A.R. has been asked for its take. First of all, there is no substitute for the tremendous value REALTORS® bring to what is usually the largest, and often the most complicated, transaction a consumer will ever make. The program seems to be geared toward investors or investment groups who are willing to make more speculative investments. Any move which promotes eliminating REALTORS® from their role as a trusted navigator in this complex undertaking would ultimately harm most consumers, leaving them without a duty-bound advisor just when they need one most. C.A.R would oppose any such development that eliminates many consumer protections and will ALWAYS advocate for the unparalled value of using a REALTOR®. This is the perfect opportunity for you to discuss with your clients the value proposition that a REALTOR® brings to the table and look at expanding the services you are uniquely able to offer investors and investment groups. Sincerely,

|

The 56 new multi-gen homes being built on the east end of Carmel Valley are selling briskly – they’ve sold 35 since they started in October, and they ‘re already releasing the final phase.

Prices start around $1,800,000, with the HOA around $232 per month and the Mello-Roos and ‘other direct levies’ being roughly $603 per month.