Let's call it the Big Confluence: Covid concerns keep diminishing over the next few months. More sellers feel safe to put their home on the market. More sellers find a way to hurry up and get their home on the market. Buyer skepticism rises. Agents get too cocky....

Bubble-Era Pricing

Double Bubble?

More doomer talk at Wolfie's, though he doesn't say much other than some slight skittishness in the Case-Shiller Index equates to home prices going down - click here for 131 comments:...

Casey

Hat tip to Rob Dawg for sending in the latest sighting of the guy who was the face of the mortgage crisis. Here are two links that outline his story: [button...

San Diego Bubble Meter

The local NSA Case-Shiller set a new record this week too. From the U-T: The San Diego County median home price soared to its highest point ever, $550,000, in March, said real estate tracker CoreLogic. Home prices increased 6.8 percent in a year, which experts...

San Diego Peak-to-Trough-to-Now

The trough for San Diego was April, 2009. Interestingly, only four of the 10 largest metros in the study - Washington D.C., Seattle, Austin and Denver - are considered overvalued. This indicates that despite the growth in home prices in metros like San Diego and...

Housing Bubble? Just Wait It Out

An article comparing the performance of residential and commercial real estate during the boom-bust-boom: https://niskanencenter.org/blog/ever-bubble-housing-prices/ An excerpt: Housing prices have been on a tear over the last five years. The Case-Shiller national...

Bubble Talk

This survey of ivory-tower guys indicates that the threat of a bubble-bursting is low. The last bubble was full of people who couldn't afford to hang on; this one has been built by the affluent. Historically, Thornberg has been the most rational analyst: LINK Will...

Peak Pricing?

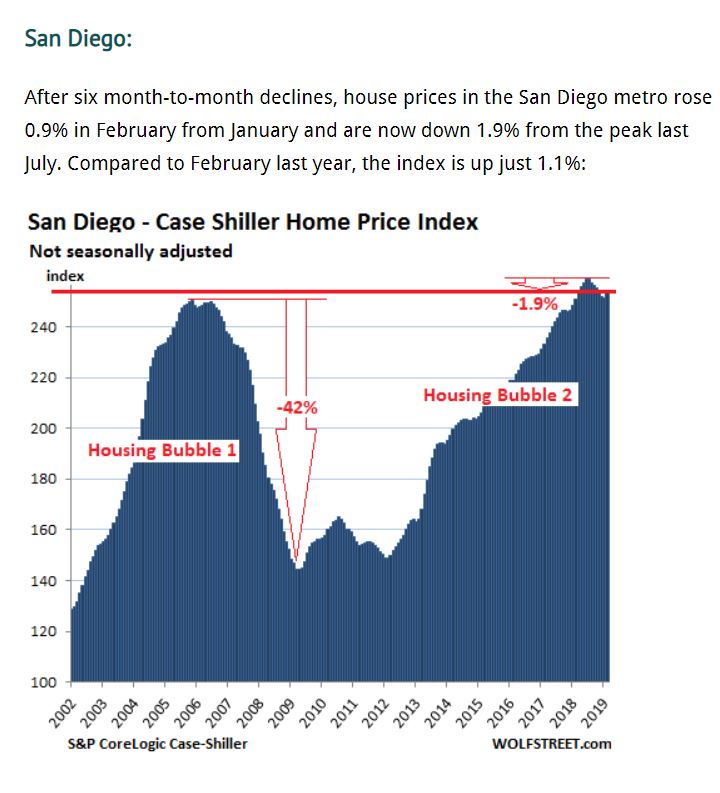

Above is a graph of the San Diego Case-Shiller Index for the last ten years. How much higher can it go? 1. The highest reading was 251.71 in March, 2006. After that, the index dropped 42% in three years, bottoming at 145.70 in April, 2009. We have gotten about 61%...

Frenzy vs. Frenzy Sales Overlay

Every day we hear some pundit talking about the latest real estate bubble forming. Can we learn anything from comparing recent sales to those during the bubblicious 2004-2007 era? Sales were dropping precipitously in 2005 and 2006 after the 2003-2004 run-up. There...

Bubble or No Bubble 2

Analyst Chris Thornberg doesn't think this is a bubble market, and suggested that you should go buy anything you can get your hands on. While the current environment may have the same frenzy/intensity of the last bubble, there are three reasons it won't blow up like...