by Jim the Realtor | Jan 24, 2019 | Jim's Take on the Market, Market Buzz, Slowdown

When it comes to real estate quotes, this guy is gold:

“I describe the current boom in U.S. home prices as the third largest boom since 1890. And so it’s big, and people are starting to think that housing is expensive, and that could lead to a turnaround and a drop in home prices,” Shiller said in an interview with Yahoo Finance at the World Economic Forum in Davos, Switzerland. “But I’m not ready to forecast that yet.”

“The housing market, when it starts to slow, that’s a leading indicator that it could turn down,” Shiller said.

Shiller described the housing market as “remarkably trendy,” having gone up smoothly for about the past 50 years. Housing isn’t as easily tradable as equities or other financial assets, Shiller pointed out.

“You don’t have the smart money going in and out from day to day,” Shiller said. “[The housing market] shows momentum, and that momentum is slowing down a bit. There could be a reversal in home prices and a recession. But I’m not giving it a probability of greater than 50% for this year.”

The key factor leading to a contraction are changes in confidence, Shiller said. And on that front, President Donald Trump has delivered a bump to the housing market.

“I think Trump does have a psychological boost for the housing market because of who he is. He kind of exemplifies lavish living. He writes books about success. He’s our first motivational speaker president,” Shiller said. “His motivation will tell you that you have to live the life of a successful person.”

“That’s an important reason why people buy homes,” Shiller added. “They want to be part of the successful people in the country.”

Watch his 10-minute interview with more nuggets here:

Link to Full Article

by Jim the Realtor | Jan 11, 2019 | Boomer Liquidations, Boomers, Jim's Take on the Market, North County Coastal, Sales and Price Check, Slowdown |

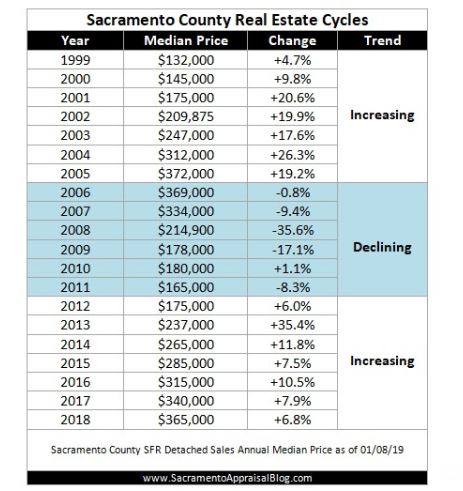

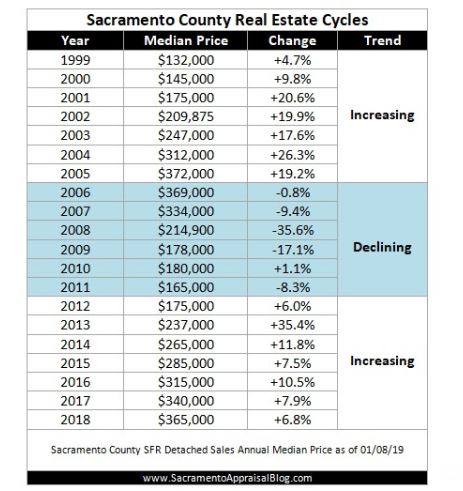

www.sacramentoappraisalblog.com

Ryan posted the history of real estate cycles in Sacramento County, so here are the same years for North San Diego County’s coastal region for comparison. Human nature tends to flow in the same direction everywhere, and as a result, our history looks a little like his:

| Year |

Number of Sales |

Median Sales Price, Annual |

Change |

| 1999 |

3,236 |

$475,000 |

+8% |

| 2000 |

3,285 |

$555,000 |

+17% |

| 2001 |

2,926 |

$570,000 |

+3% |

| 2002 |

3,717 |

$630,000 |

+11% |

| 2003 |

3,932 |

$732,500 |

+16% |

| 2004 |

3,363 |

$948,000 |

+29% |

| 2005 |

3,014 |

$1,000,000 |

+5% |

| 2006 |

2,626 |

$985,000 |

-2% |

| 2007 |

2,479 |

$1,000,000 |

+2% |

| 2008 |

2,037 |

$890,000 |

-11% |

| 2009 |

2,223 |

$817,000 |

-8% |

| 2010 |

2,461 |

$830,000 |

+2% |

| 2011 |

2,562 |

$825,000 |

-1% |

| 2012 |

3,154 |

$830,000 |

+1% |

| 2013 |

3,218 |

$952,250 |

+15% |

| 2014 |

2,850 |

$1,025,000 |

+8% |

| 2015 |

3,079 |

$1,090,000 |

+6% |

| 2016 |

3,103 |

$1,160,000 |

+6% |

| 2017 |

3,084 |

$1,225,000 |

+6% |

| 2018 |

2,797 |

$1,325,000 |

+8% |

At the time it seemed like sky was caving in, but looking back we only had two bad years (2008 and 2009) in the last twenty. There was some scuffling around as we found our way in 2006-2007, and 2010-2012, but given that our market had been injected with the most exotic financing ever known to man, and then tanked by foreclosures and short sales, I think we did pretty good to survive it as well as we did.

Now what?

With 90% of the NSDCC active listings priced over $1M, all we need is wealthy people to keep coming here to buy their forever home. We’re still cheaper than the LA/OC and Bay Area, so we look attractive to downsizers.

Our pricing may bounce around, but without brainless bank clerks dumping properties for any price, who else is going to cause a collapse? We could run low on the number of buyers – and if we did, all it would do is cause a protracted descent; re: soft landing over years.

Boomer liquidations?

Here’s a conversation I had yesterday with a guy who is 80+ years old and who has lived in his house since the 1960s:

Him: Convince me why I should sell my house.

Me: How are you getting around?

Him: I ride my bike to the store.

Me: Do you need the money?

Him: No.

Me: Have you ever dreamed about buying a house on the lake and fishing the rest of your life?

Him: No.

Me: Are you married?

Him: No.

Me: Did you know that if you did sell, you’d have to pay six-figures in taxes? How would that make you feel?

Him: What? I only paid $19,500! I’d never pay that much in taxes!

Me: What happens upon your demise?

Him: My daughter will inherit – she grew up here, and will likely move back in. But I told her if she doesn’t move in, it’s ok with me to sell it.

Me: Do you have a family trust?

Him: Yes.

Me: Did you know that if she sells the house, she will pay no tax?

Him: You’re kidding? If I sell it, I have to pay the tax man six-figures, but if she sells it, she pays nothing? Jim, I think we have the answer!

There will be occasional sales where sellers hire bad agents and get taken advantage of, but there won’t be an avalanche of desperate sellers dumping for any price. It would take a tsunami, earthquake, or terrorist event at the border to cause a drastic shift in housing – which could happen!

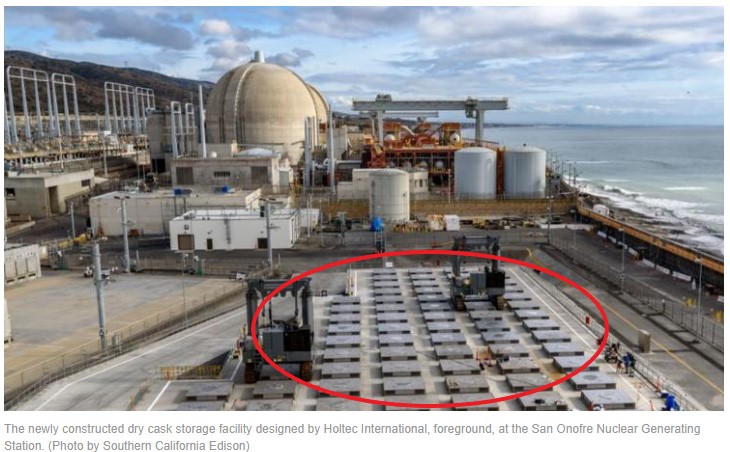

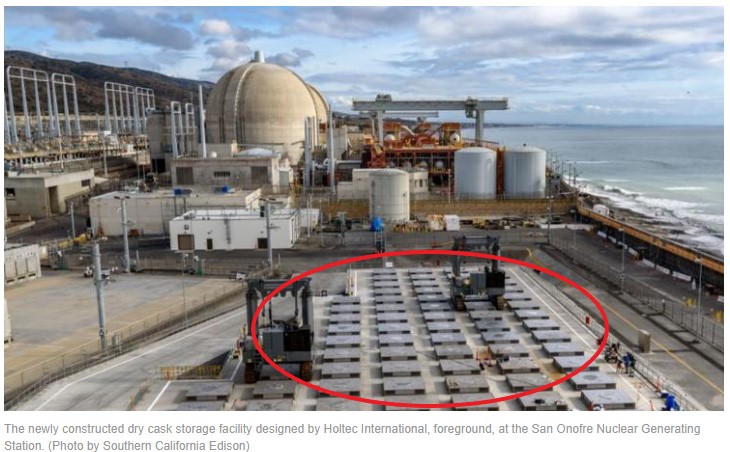

Here’s the latest photo of the nuclear waste being stored right on the surf at San Onofre. All we need is one crack in a storage cask…..

Without a catastrophic event, what’s the worst we can expect?

Maybe 5% drop in pricing in the short-term?

Any more than that, and sellers will just wait it out.

by Jim the Realtor | Dec 10, 2018 | Inventory, Jim's Take on the Market, Market Surge, Slowdown |

The slowdown started during the summer, so there was some evidence of it by the beginning of August – and it has been in the news non-stop ever since.

Are sellers getting the message?

Maybe, but they must think it applies to someone else:

NSDCC Average List-Price-Per-SF:

| Week |

Under-$1M |

$1.0M to $1.5M |

$1.5M to $2.0M |

| Aug 1 |

$434/sf |

$493/sf |

$590/sf |

|

$434/sf |

$496/sf |

$596/sf |

|

$426/sf |

$494/sf |

$608/sf |

|

$430/sf |

$493/sf |

$622/sf |

| Sep 3 |

$427/sf |

$486/sf |

$611/sf |

|

$436/sf |

$489/sf |

$603/sf |

|

$439/sf |

$483/sf |

$613/sf |

|

$440/sf |

$476/sf |

$618/sf |

| Oct 1 |

$441/sf |

$476/sf |

$624/sf |

|

$441/sf |

$481/sf |

$612/sf |

|

$434/sf |

$487/sf |

$612/sf |

|

$426/sf |

$492/sf |

$602/sf |

|

$422/sf |

$495/sf |

$601/sf |

| Nov 5 |

$418/sf |

$490/sf |

$601/sf |

|

$449/sf |

$498/sf |

$605/sf |

|

$449/sf |

$498/sf |

$624/sf |

|

$450/sf |

$492/sf |

$620/sf |

| Dec 3 |

$454/sf |

$478/sf |

$611/sf |

|

$455/sf |

$487/sf |

$619/sf |

Lower their price? They’d rather not sell – and this is December, when you’d think the sellers who are on the open market must be motivated.

Don’t get your hopes up about seeing a big dump on price in Spring, 2019. If it were to happen, it will happen quietly, and you’ll only see it after the fact in late summer, once sellers have exhausted their optimism.

(more…)

by Jim the Realtor | Dec 8, 2018 | Jim's Take on the Market, Same-House Sales, Slowdown |

Link to NYTimes article

We are, once again, experiencing one of the greatest housing booms in United States history.

How long this will last and where it is heading next are impossible to know now.

But it is time to take notice: My data shows that this is the United States’ third biggest housing boom in the modern era.

Since February 2012, when the price declines associated with the last financial crisis ended, prices for existing homes in the United States have been rising steadily and enormously. According to the S&P/CoreLogic/Case-Shiller National Home Price Index (which I helped to create) as of September, the prices were 53 percent higher than they were at the bottom of the market in 2012.

That means, on average, a house that sold for, say, $200,000 in 2012 would bring over $300,000 in September.

Even after factoring in Consumer Price Index inflation, real existing home prices were up almost 40 percent during that period. That is a substantial increase in less than seven years.

(more…)

by Jim the Realtor | Dec 1, 2018 | Jim's Take on the Market, Market Conditions, Sales and Price Check, Slowdown |

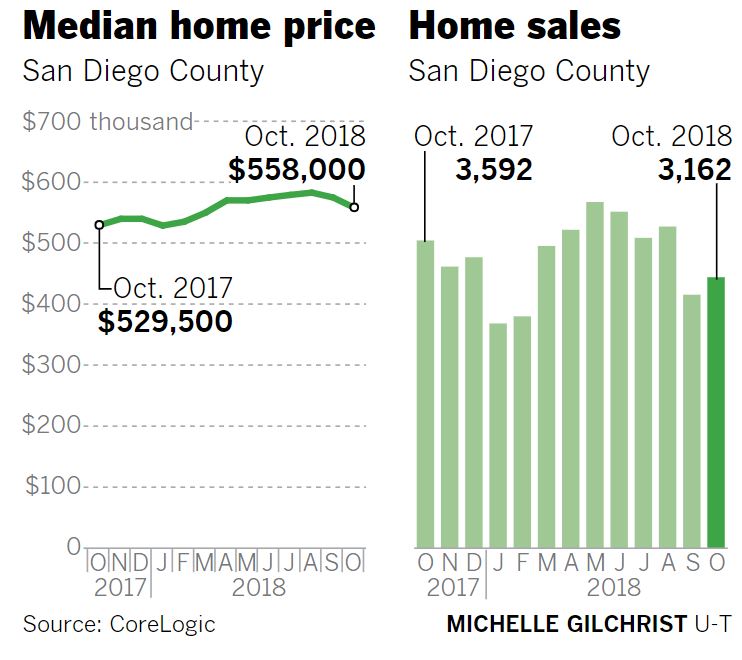

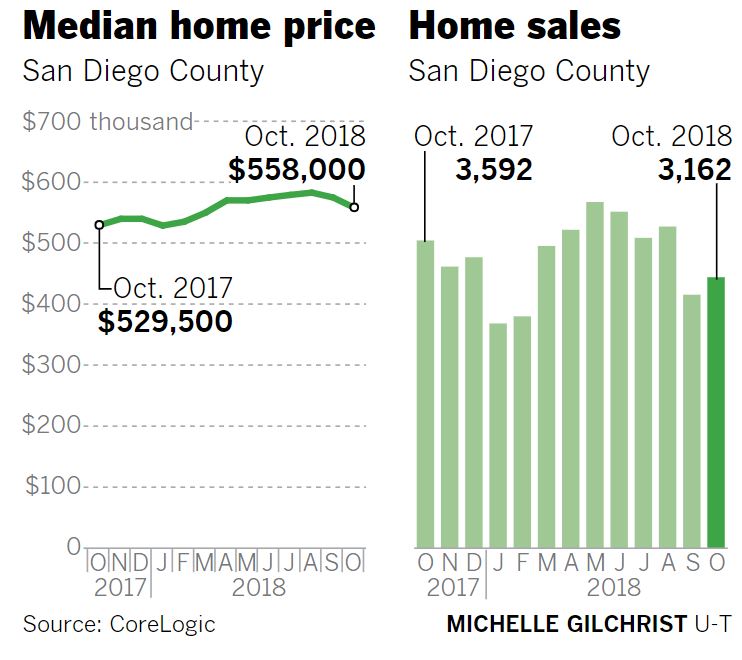

October sales in San Diego County were down 12% year-over-year, and the freefall should continue. While the experts will keep pointing to housing being not as affordable now that rates and prices are up (this article states that the median-priced San Diego home in October costs an additional $321 per month this year), the plummeting sales can also be attributed to sellers being comfortable waiting for that perfect couple with 2.2 kids to come along.

This article also mentions that the current inventory is 46% higher than it was last year, but on the MLS the total number of 2018 listings for the county is only up 8% YoY, which demonstrates more standoff conditions – sellers are waiting and listings are stacking up.

Add the buyers’ unaffordability to lowly-motivated sellers and we have the perfect ingredients for standoff stew.

From the U-T:

In October, the median home price was $558,000, down by $25,000 from the all-time peak reached in August, but still up 5.4 percent for the year. Sales were down 12 percent compared to the same time last year and at their lowest level since 2011. There were 3,162 home sales in October, down from 3,592 in 2017, 3,597 in 2016 and 3,356 in 2015.

“I think the boom is over,” said financial analyst Rich Toscano, who predicted the housing crash in November 2005 on his housing blog Professor Piggington’s Econo-Almanac.

(more…)

by Jim the Realtor | Nov 28, 2018 | Jim's Take on the Market, Kayla Training, Slowdown, Thinking of Buying?, Tips, Advice & Links, Why You Should Hire Jim as your Buyer's Agent |

Kayla returned from Manhattan for the long Thanksgiving weekend, and we were talking about the sluggishness in New York City market, which has been going on for 2+ years. By now agents have learned that there’s no use fighting it – you have to learn to adapt.

It was in the year of her birth, 1991, when I experienced my first market slowdown. All I knew was that there wasn’t a buyer for miles, and with a newborn child, I need to hurry up and figure this out!

This is my third time around the block, so I offered her a few ideas.

First let’s acknowledge how it works in a seller’s market. Buyers find a house that is a good fit, and they buy it. Agents might offer up a strategy to get a discount, but for the most part, buyers pay the sellers’ price. It’s binary – it is yes or no, is this the right house? If it is, then pay the price.

Now it’s different, and if you can get a buyer to look at homes, their answer will be the same everywhere – ‘no’. Because they are looking for any reason not to buy – and every house has one – once they find it then it’s game over. But rather than just saying no to every house and never buying anything, let’s take it a step further.

At what price would you be a buyer?

Price will fix anything, and the price itself is usually the problem – it’s too high.

If the buyer would be interested at a lower price, then all you have to do is present a powerful case to the seller and listing agent to see if there is enough motivation to at least listen, and hopefully make a deal.

If you just make a lower offer without justification, I can already tell you what the answer will be: “No, and get off my lawn”.

To get something, you have to give a little. Here are ideas:

- Make an clean offer with quick close date. These work best on vacant properties where sellers might be eating an extra payment.

- Make an offer using older comps, and point out that the Case-Shiller pricing (or other) has retreated back where it was X months ago.

- Make an offer based on the cost of the needed improvements, and include contractor quotes when possible.

In all cases, include a photo of the family and pets, and an introduction that explains the offer. Usually the listing agent will just forward the explanation right to the sellers, so it’s a way to have influence over the outcome. Without an introduction and explanation, the listing agent has to justify the low price himself, and he won’t try too hard and risk looking bad.

We need price discovery!

The only way to find out what the seller might take is to put an offer on the table. It may seem risky to be among the first to take the plunge, but by April/May we should see more people finding a way to make a deal. Those will probably be with the sellers who have been trying to sell for 90+ days, and are tired of the process. Let’s give it a shot!

by Jim the Realtor | Nov 26, 2018 | Jim's Take on the Market, Market Conditions, Slowdown, Why You Should Hire Jim as your Buyer's Agent, Why You Should List With Jim |

The local birdcage liner has an article on price reductions, and mentions that San Diego leads the nation this year. This is how they introduced it:

This isn’t a sign that the bottom is falling out of the market. Instead, after years of rapid price increases, experts say the market is becoming more stable and for the first time in quite a long time, it is shifting in favor of buyers.

That shift is most evident when you look at the number of times sellers have reduced prices. The share of home listings with a price cut grew to its highest level in at least eight years, says a recent analysis from Trulia. San Diego had the most reductions — 20.5 percent — of the 100 biggest metro areas in the United States so far this year. (It tied with Tampa, which also saw 20.5 percent of homes with a price cut.)

The full article (linked here) included examples:

- 7171 Terra Cotta Road — $545,000. The four-bedroom house (1,804 square feet) in the Bay Terraces area has had four price reductions, starting at $569,000 at the beginning of November.

- 4225 Florida St., Unit 4 — $395,000. The two-bedroom condo (794 square feet) in University Heights has had three price reductions, starting at $425,000 in mid-October.

- 3655 Ash St., Unit 2 — $322,100. The two-bedroom condo (824 square feet) in Fairmount Park has had six price reductions, starting at $330,000 in mid-September.

Listing agent April Khamphasouk said the tough thing about selling the house at 2873 Upas St. is that it is basically two homes in one (the property is 1,698-square-feet and has a guest suite above the garage).

She first listed the home for $1.1 million in early October. By mid-October, the price was lowered by $19,000. There were three more price reductions and by Nov.12, the asking price for the home had decreased by $55,900. It is still on the market.

Khamphasouk said the recent price reduction seemed to be greatly increasing interest. Still, she said a lot of the issues in the past month have been related to rising mortgage interest rates.

No mention was made about the Upas property selling for $775,000 in May. The Terra Cotta house just had a model-match sell for $415,000 nearby, and the Florida St. condo is on the corner of El Cajon Blvd. and next to a paint store. If these homes represent the types of properties that need to lower their price, then the shock is that only 20% needed a price reduction.

The real news was that nearly 80% of the listings didn’t lower their price!

by Jim the Realtor | Nov 25, 2018 | Jim's Take on the Market, Market Conditions, Slowdown, Thinking of Buying?, Why You Should Hire Jim as your Buyer's Agent |

Home sellers and agents will conveniently write off today’s market sluggishness as typical year-end slowdown, and in 2019 they will simply do what they’ve always done – put a bloated list price on their real estate.

You can’t blame them – it’s their chance to win lottery-type money. If you got to name any price, you’d want more, not less, right? It is a common mistake to over-price a home though, and homebuyers need to beware.

But over-pricing has been around since the beginning, and is just a reflection of how motivated the sellers are – which in 2019 will be ‘not much’.

What are the additional challenges that will be with us in 2019?

A. The realtor industry favors the home-sellers. Realtors have a contract with the sellers, so no surprise that listings are the name of the game. But now that realtor teams dominate the landscape, the new and inexperienced agents are dispatched to represent the buyers – who won’t be too impressed with the lack of quality assistance offered on today’s market conditions. Buyers without proper guidance will be happy to stay on the fence, unless they find the perfect home, and then they will….

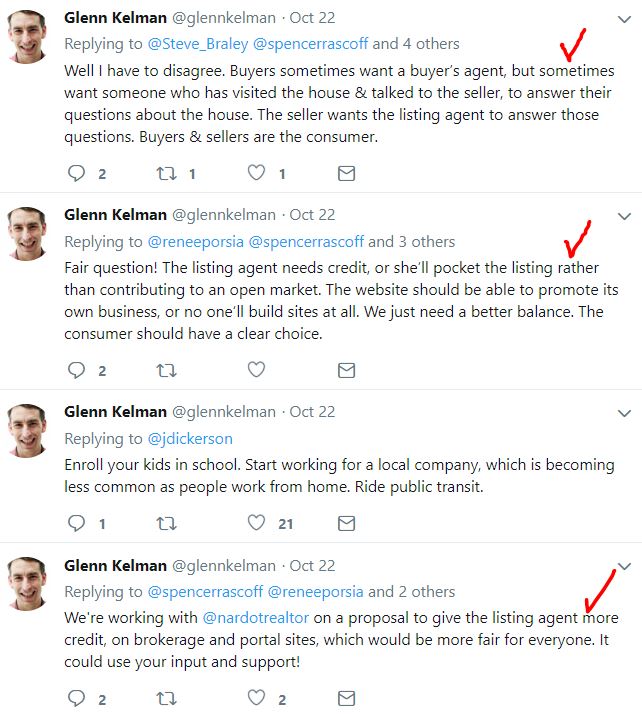

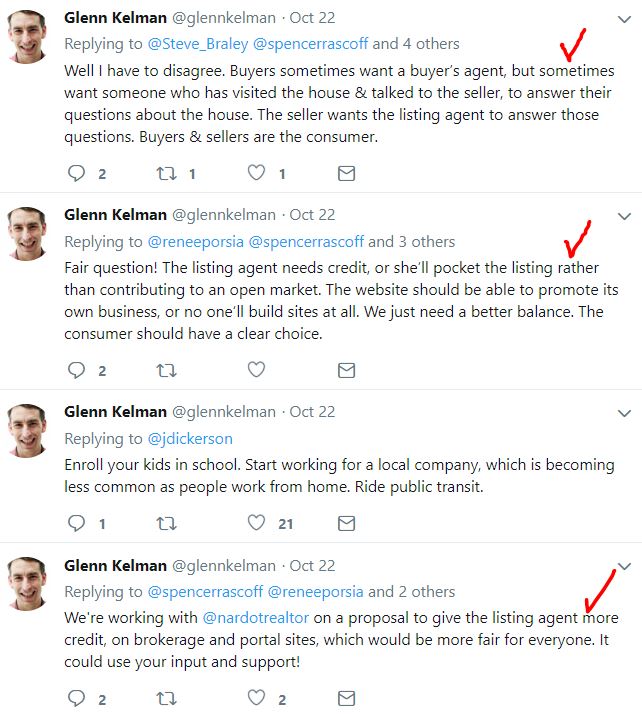

B. More Buyers Will Go Direct to Listing Agent. With fewer experienced agents being willing and able to represent the buyers, we’ll see single agency (disguised as dual agency) become more popular than ever. Consumers don’t really seem to care, as long as the deal gets done, and listing agents encourage the idea. Expect more blatant attempts to exploit the practice, like…..

Glenn first played the race card and tried to disguise his coming-soon plan as a ploy to reach all consumers, rich and poor (but was going to refer low-income people to outside agents). Now he is trying to force N.A.R. to insist on prominently displaying the listing agent on all websites, with a link back to their website. If passed, will be the final dagger in the buyers getting their own representation.

Here he attempts to sell the concept as fair and clear (start at bottom):

C. Coming Soon. The traditional brokerages are promoting their listings on their company websites before putting them on the MLS/open market, and you can’t blame them. Zillow and Redfin started it (see above), and now it’s a war.

But what are buyers going to do, monitor every real estate website? Yes, at least the ones that allow you to set up auto-notifications. If you see one you like, and you inquire with the listing office/agent – who do you get? The faceless internet agent who reps the seller but will process your order as long as it’s reasonable. It gets worse – there is one listing agent in north county who insists that you do a 30-minute, in-person consultation and then agree to see at least two of their listings before they will show you their coming-soon listing advertised on Zillow (and not in the MLS).

D. Sea Change in the Home-Selling Business. The market plateau will cause more desperation among realtors, and the disruption that everyone has been predicting will finally arrive – it will just look differently than people expected. Eliminating the traditional buyer agents will be uncomfortable, especially for older consumers who were used to having their own agent represent them in previous transactions. We should see fewer sales as a result.

E. Fewer Sales Means Fewer Comps. We had 10% fewer sales in 2018, which means fewer comps to help buyers easily reach a conclusion on values. Add in the built-in reluctance to trust the listing agent and we could have a downward spiral of fewer sales….which leads to even fewer comps. Stagnant City!

F. Creampuffs only. At these lofty prices and with fewer comps to justify exact values, nobody will want a fixer unless they can get a real deal. There should be a price gap of roughly 10% between the ‘puffs and the fixers in older neighborhoods, but will sellers agree? Will buyers be willing to pay +10% for a creampuff when they see a fixer down the street not selling, even when priced for less? They did in a frenzy, but now?

G. Prices Might Not Change Much. Buyers going directly to the listing agent won’t find much of an audience for lowball offers. Going direct only means you have an inside shot at buying the house at the sellers’ price, not that you’re going to get a deal – unless it’s been on the market for months.

H. No Help Anywhere in Sight. You won’t hear about any of these market changers in the mainstream media – instead, we will be pelted with reminders that homes are unaffordable and other doomy assumptions to explain fewer sales. Nobody will look beyond the usual excuses – instead, we’ll see more reflections back to previous cycles that have no relation.

Example: This guy compares the 1990s bust caused by the S&L crisis – but ignores that we bail out the banks now, so no bank bust is coming:

Forbes article on 1990s bust

Conclusion: In 2019, potential home buyers will be hearing more doom talk and getting less help. They will see more listings at higher prices, and more escrows falling out. It will be natural for them to proceed cautiously, and be resigned to the fact that if they don’t buy this year, prices aren’t going up much so let’s be picky and wait it out – maybe another year or two!

Sellers might get miffed, but they will shrug it off and blame the market or their agent for no sale. Prices won’t be going down much (mostly because only the superior homes will be selling…and getting their price). Sellers will be picky and wait it out – maybe for another year or two!

In the meantime, the industry will be transitioning into single agency.

by Jim the Realtor | Nov 25, 2018 | Jim's Take on the Market, Slowdown, Tax Reform, Thinking of Buying? |

This talking-head guy was trying to create a ruckus about the new limit on SALT deductions being the cause of the real estate slowdown, but he backed into what will be the real effect.

Higher mortgage rates and the limit on SALT deductions might keep those who are money-conscious from moving up, which means fewer higher-end sales.

But fewer sales don’t automatically mean lower prices.

The affluent pay the price to get the home they want, and those not so fortunate lower their sights and buy a cheaper house (which is very unlikely if you’ve ever looked at million-dollar houses and then try to price-down and consider those in the $800,000 range).

These guys want to put labels on it like The New Normal, but home sellers will adapt the old normal – pay my price or close, because I’m not giving it away:

Fleming: This is the new normal for the housing market from CNBC.