$340 Million

After eight years of construction, the largest and most expensive home in the world is for sale….only 105,000sf!

~~~~~~~~~~~~~~~~~~~~~~~

After eight years of construction, the largest and most expensive home in the world is for sale….only 105,000sf!

~~~~~~~~~~~~~~~~~~~~~~~

Median home price: $279,050

A good friend works at Bandon Dunes and I’ve been there a couple of times. It takes all day to get there – fly to SFO then take a 30-seater planer to Bend and then drive two hours – but once you get there, you’re at the coast for a great price!

Most folks probably don’t imagine spending their beachy retirement huddled up under layers of sweaters and blankets, but they’re missing out. The cliff-edged and chilly shoreline of Bastendorff Beach, just a short trip over the bridge from Coos Bay, is gorgeous, a wholly relaxing place to collect shells, pitch a tent, or ride a horse.

Many locals also take whale watching tours by boat, view masterpieces at Coos Art Museum, swing a 9-iron, or watch the pros play golf at the Bandon Dunes Resort, home to the Curtis Cup. Homeowners can look at the bay from their two-bedroom bungalow for just $169,000 or smell the salt air in a grand four-bedroom Dutch Colonial in the heart of town for a cool $649,000.

https://www.realtor.com/news/trends/best-affordable-beach-towns-retirement/

https://www.realtor.com/realestateandhomes-search/Coos-Bay_OR/with_waterfront/with_waterfront

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Let’s do a final round-up of the 2020 numbers:

NSDCC Annual Sales & Pricing

| Year | ||||

| 2013 | ||||

| 2014 | ||||

| 2015 | ||||

| 2016 | ||||

| 2017 | ||||

| 2018 | ||||

| 2019 | ||||

| 2020 |

The median sales price went up 11% YoY, and the number of $2,000,000+ sales went up 38%!

And it feels like 2021 could be crazier!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

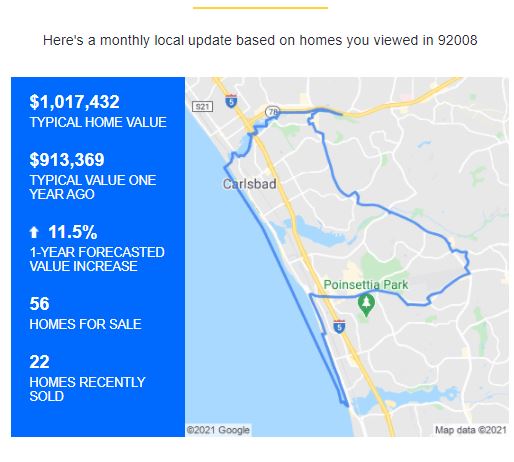

In November, Zillow busted out of the pack of prognosticators and predicted around 7% appreciation for NSDCC zip codes over the next 12 months. They have revised again – now predicting that our North San Diego County coastal areas will appreciate at least 10%:

Where will they be next month?

It doesn’t really matter how they got to these predictions, or if they are realistic. They are broadcasting these to the masses, and with their reach, their forecasts alone can influence the market!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The contest for guessing the number of listings in January is now closed. We are running about 20% behind last January’s count, so the few sellers who are willing to brave the early-2021 market will do nicely.

We had 31 showings and five offers on our new listing over the weekend, and three of them were willing to pay $90,000 over list!

If you are the kind of buyer who wants to use logic and common sense – and tie your offer price to the comps – well, this isn’t the market for you. Pay tomorrow’s prices, today!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The worst thing for home sellers is to be unprepared for the immediate reaction from buyers.

Those who haven’t sold a home in years will sign a listing agreement and settle in for what they expect will be a few months of marketing and showings until that nice young couple with 2.2 kids comes along to relieve them of the family homestead. Virtually every seller says, “I’m in no hurry!”

But the motivated buyers – those who pay the most – are scanning their search portals every minute, and when they see a possible contender, they react!

We have 29 showings this weekend of our new listing, and have received five offers – all over list price.

Be Ready, and Get Good Help!

The seven showings of our new listing yesterday went well. People generally show up on time and understand the predicament that the demand is overwhelming the supply. We’ve received two offers, and we are way over list price already.

There tends to be some standing around, so I like to engage with agents about how my slow-motion auction process works. They appreciate the transparency, and tells stories about how other agents are handling their showings. I heard a story about one listing agent who demands that agents submit the buyer’s preapproval letter and proof of funds JUST TO BE PUT ON A WAITING LIST TO SHOW, and another where no human interaction was allowed (which is common).

In my case, you deal with me, and I make myself available by phone, text, or email. I want to give every buyer ample opportunity to buy the home – isn’t that what you want in your listing agent?

Get Good Help!

Our new listing hit the MLS about 5:30pm yesterday. By 9:15pm, I received six requests to show it, and another three requests before 8am this morning!

https://www.zillow.com/homedetails/4743-Crater-Rim-Rd-Carlsbad-CA-92010/79572379_zpid

The zestimates and Redfin estimates are really a joke now. If they are willing to derive their number off the list price and try to make you think it is the actual value, what else are they willing to do to you?

Are you looking for a quiet south-facing yard full of sunshine where you can watch the hawks soaring above and the crystal-blue enchantress calling from the west? Check out our new listing of this dazzling 4 br/3 ba, 2,597sf listing in Carlsbad! LP = $1,100,000!

Either we are undervalued, or we’re getting more popular….and maybe both!

The price of a San Diego home could increase by more than 8 percent this year, more than anywhere else in the nation, according to a forecast released Tuesday.

Real estate analysts CoreLogic said the price of a single-family home in San Diego County will increase 8.3 percent from November 2020 to November 2021. That means the median price of house in San Diego could be around $776,000 by the end of the year.

CoreLogic said main reason is a lack of homes for sale that will push up prices as buyers fight it out. A secondary factor is income growth for highly skilled positions in San Diego County.

It isn’t out of the ordinary for San Diego homes to increase a lot in a year — in fact, single-family homes here were up 9.5 percent last year — but the forecast is noteworthy because CoreLogic predicts most markets will see price appreciation slow in most markets.

The only regions that the real estate analysts say will come close to climbing as much as San Diego will be: Miami, predicted to increase 3.2 percent; Los Angeles, up 3.2 percent; and Washington, D.C., up 2.9 percent. CoreLogic said the total national increase should be around 2.5 percent.

“San Diego is just one of those markets that has had a lot of income growth and not enough supply to meet demand,” said Selma Hepp, CoreLogic deputy chief economist.

She said San Diego is an example of what has been seen a lot across the nation: High-wage workers who have been able to work from home have seen fortunes increase during the pandemic while low-wage workers lost income because their jobs were among the first shuttered during shutdowns.

“Income inequality is being exacerbated by all of this,” Hepp said.

Link to full U-T Article