No Code?

The State of California doesn’t have a Code of Ethics…..

This article is Part Two of a series arguing for the reinstatement of the Department of Real Estate (DRE)’s code of ethics. If you haven’t already, take a look at Part One, which provides context for the current vacuum in California ethical standards.

Why a code of ethics?

Every public-facing industry, especially one as complex as the real estate industry, is in need of common standards of practice. Presently, the code providing those standards for California real estate agents is far from an ideal set of rules governing an agent’s conduct in service of the public.

The code in question is a generic product of the National Association of Realtors® (NAR), which NAR’s state-level manifestation, the California Association of Realtors® (CAR), has commandeered as its own.

Real estate practice is rooted in state codes, cases and regulations aimed at protecting residents of that state, and as a result, this national code of ethics is frequently ill-fit to the unique marketplace of California. NAR has next to nothing to do with California, where principals might have little to no personal knowledge of the agent representing them (especially in urban population centers), and have no choice but to operate under a general set of expectations for licensee conduct.

Further, the Department of Real Estate (DRE) has continuously pushed the NAR code as an acceptable standard for those California licensees who also happen to be Realtors®. As we discussed recently, the state nixed the DRE’s code of ethics in 1996, and California has consequently been left without a California code of ethics for the real estate industry — a situation the DRE could rectify.

But before we can argue for the reinstatement of the DRE code of ethics, we need to understand what’s in it. What are we arguing for? And maybe more critically, what are we arguing against?

Read article here:

Link to Full ArticleComing When?

Nancy tagged this listing as another example of what you can get if you’re willing to leave The Golden State.

It comes with the pitch we see a lot these days – ‘Contact us for your private showing before this gorgeous home goes LIVE later this week’.

Thanks for showing.

Can I sell it this week?

The Coming Soons are probably tolerable, as long as the listing agent commits to the specific date they will sell it. I think the seller is better served if the listing is exposed to the open market via the MLS, but if there is some reason not to do that, fine.

Let’s specify when buyers can buy it!

It is the Big Tease to be showing a home without further instruction on when the seller will be entertaining offers up front – and I want to know before the showing too. It is a disservice to everyone for buyers to see a house, just to find out later that the listing agent is going to sit on offers for 5-10 days.

Another reason to be specific and clear is to help keep the listing agents from their own temptations, though most don’t mind laying out the evidence of their own breaches right in the MLS.

There have been two examples this year already.

The listing agent said no showings until open house on Saturday. But he had been showing it to his own buyers, and accepted his own offer on Friday night before the open house. That’s wrong, and his seller probably paid the price – there could have been other offers and a bidding war could have ensued.

The other example was the listing agent who publicly declared that he was entertaining offers on Monday, but then accepted an offer on the Saturday before. When I spoke with him, it was clear that it never occurred to him that there could be other offers if he just would have waited until Monday like he said he would.

Hopefully the industry will commit to conducting live auctions to sell houses some day, so we can eliminate all the hokey pokey.

P.S. Note to NAR. I’m tired of hearing how concerned you are about flood insurance. Can you do something about the ethics please!

Stealing Homes

Those with a paid-off home are only one signature away from losing it. This former attorney was convicted of a similar fraud, gets out of jail and does it again – but worse. Hat tip to daytrip for sending this in:

Authorities have charged a West Hills woman with perpetrating a real estate fraud scheme that netted her $2 million, primarily by duping numerous elderly property owners into transferring over their property titles.

Angela Fawn Wallace allegedly befriended the elderly victims — or found properties where the owners were deceased — then obtained the property titles, the Los Angeles County District Attorney’s Office said, according to KTLA. She then allegedly used those titles to secure herself loans.

Wallace faces 72 felony counts, including identity theft and forgery. She pleaded not guilty to the charges Thursday, and faces up to 40 years in prison if convicted on the top charges, KTLA reported.

Wallace’s alleged scheme lasted from June 2014 to January 2017, and involved four properties and two dozen victims including the property owners, estates, trusts and investment companies.

Wallace took out loans secured by the properties and in some cases sold them off to unknowing purchasers, then kept the proceeds. The district attorney said in one case she rented out several units of a multifamily building and kept the money herself instead of handing it to the estate of the deceased owner.

Wallace was previously convicted of forgery in 2003, and recording false documents in 2007.

Link to ArticleViva Newport

It seems inevitable that all high-end real estate listings will have to include a video of yuppies toasting their success with Lambos and yachts in the background. List price here is $16,000,000+

Good Advice

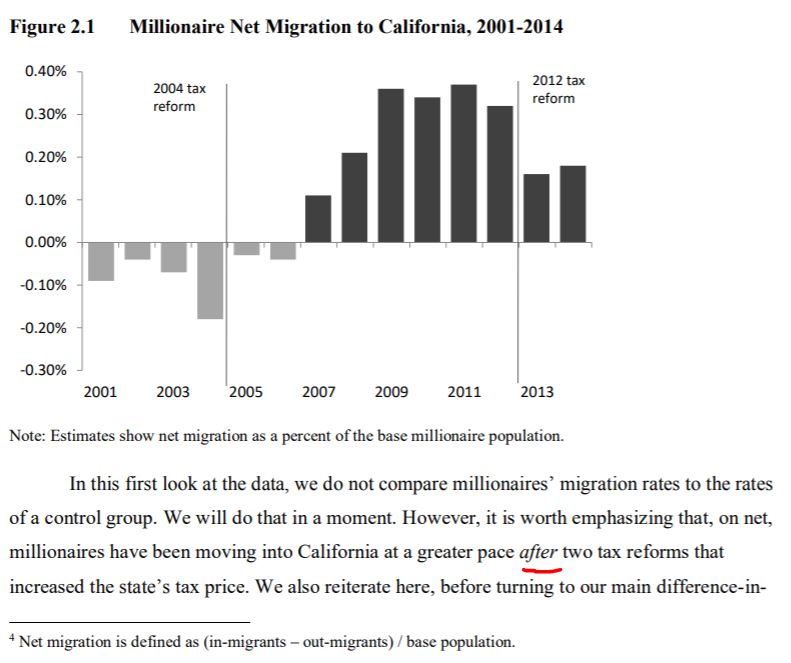

CA Tax Migration

Big money is big money – a change in tax rate won’t cause rich families to uproot everything and move to an inferior place. What is more likely to cause millionaires to move? “The tax policy changes examined in this report are very modest compared to the life-impact of marital dissolution.”

Far more millionaires move into California than leave, despite the state’s highest-in-the-nation income-tax rate, a new study shows.

Researchers at Stanford University’s Center on Poverty and Inequality and the Franchise Tax Board sought to answer the question: Does California’s top state income-tax rate, now 13.3 percent on people earning $1 million a year or more, drive the wealthy to leave for low-tax states?

Short answer: No, except on the far margin.

The researchers reviewed 25 years of California tax returns from all high earners and found that more wealthy people relocate after a divorce.

Republicans regularly cite anecdotes of businesses owners and wealthy people decamping to low-tax states such as Nevada or Texas. But the study shows million-dollar earners moved to California even after voters raised income taxes in 2004 and 2012:

“We often think that the only way for a state to be ‘competitive’ is to be like Texas—a low-tax, low-infrastructure, low-services state. But the reality is that the most competitive places in the U.S., the leading drivers of the economy, and the centers for top talent are New York and California—and they have been for generations, despite higher taxes on top incomes.”

It’s Different This Time

Our YoY home sales are in decline, and it makes you think, ‘Here we go again”.

We know that sales are the precursor, and historically prices are the last to go. But with so many different variables this time around, could it actually be different this time?

Let’s consider the changes:

During the last two local declines (1992-1996 and 2007-2009), banks were the main culprits. They were visibly foreclosing and dumping homes, which affected the whole marketplace. Regular home sellers were burdened with the lower comps, and had to give them away if they wanted to move.

But now they’ve changed the accounting rules for banks, and they don’t have to dump everything they own. In fact, they can do whatever they want now.

Remember this McMansion in Carlsbad?

BofA first began the foreclosure process in 2011, but didn’t get around to actually foreclosing until July, 2017 – six years later! Then they off-loaded it to an investor in March, without having to put it on the open market. Bernanke told bankers in 2011 not doing anything that would harm the economy, and they took him up on it!

BofA first began the foreclosure process in 2011, but didn’t get around to actually foreclosing until July, 2017 – six years later! Then they off-loaded it to an investor in March, without having to put it on the open market. Bernanke told bankers in 2011 not doing anything that would harm the economy, and they took him up on it!

I think it’s safe to say that no matter how bad any future recessions might get, we don’t have to worry about a flood of foreclosures ever again.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

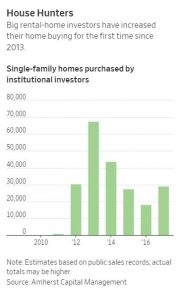

Ok, so if the banks don’t/won’t foreclose and dump, then what about the institutional investors? They are smarter and more nimble – certainly they will be selling once they sense the top!

Not so fast – according to the WSJ, investor buying is on the upswing:

An excerpt:

Wall Street is betting that more well-off Americans will want to be renters.

Wall Street is betting that more well-off Americans will want to be renters.

Financiers who loaded up on homes after the housing bust for pennies on the dollar are buying yet more—despite home prices in many markets being at all-time highs.

Their wager: High prices, higher mortgage rates and skimpy inventory are making homeownership harder. Well-to-do families who might have bought a single-family home in another era are willing to rent a house now, especially if it means access to a good school system.

The number of homes purchased by major investors in 2017 was at least 29,000, up 60% from the previous year, estimates Amherst Capital Management LLC, a real-estate investment firm that made nearly 5,000 of those purchases.

This year, investors have raised billions of dollars from bond buyers, pension funds and even wealthy Chinese individuals to purchase more homes. They have been particularly aggressive buyers in places like Atlanta, Phoenix, and other metro areas with good schools and faster-growing economies.

Cash to acquire and renovate homes has become so abundant lately that some rental investors can’t spend it fast enough. Without enough homes to buy, some investors are now building their own in popular residential markets like Miami and Nashville, Tenn.—upending a traditional pattern of Americans buying starter homes and moving up.

“The American dream no longer includes homeownership,” said Jordan Kavana, chief executive of Transcendent Investment Management LLC, a south Florida firm that has been a big acquirer of rental homes. “You will earn your equity in other ways, not your home.”

Link to Full ArticleThe big-time Wall Street investors are betting on the affluent taking over the real estate market, and turning the country into a renter’s society. It may only affect 10% to 20% of the market for now, but that might be enough to keep it all propped up.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Local flippers and ibuyers are providing another floor. Any homeowner that will sell for 10% under value today will have a host of choices to pick from. If you play it right, and have a great realtor help you, it could turn it into a retail sale quite easily!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The biggest threat? While there are still people underwater, today’s market has to be the most equity-rich in history. If sellers had to dump in order to sell, they could – and still make a profit.

But for there to be an extended trend of declining prices, there would need to be a series of sellers in the same neighborhood that were all in the same boat. For now, we only see an occasional dump, and it doesn’t need to be more than 10% off to attract a crowd.

With the vast majority of recent buyers having to qualify for their mortgage, and use a regular down payment in order to buy their house, you have to like the prospects of them fighting to hold on to it, no matter what. Back in the last bust, too many people got in with little or no down payment, and got stuck with exotic financing that exploded on them. Those days are gone.

We’re most likely going to live in Stagnant City, with fewer sales in most areas. But it’s not the end of the world.

Get Good Help!

Inventory Watch

The pending counts have been dropping precipitously since June 11:

NSDCC All: -15%

Under-$1,000,000: -29%

While a lower number of pendings can be due to more closings from the fat part of the selling season, it not like we’re setting any sales records either. The NSDCC June sales are down 20%, year-over-year, just like they were in May.

Get Good Help!

Vista Village SOLD

Like the idea of being able to walk to shops and restaurants, plus be close to the freeway without hearing it? This one’s for you! A cozy 2br/1ba, 894sf detached house built in 1953 on a 5,088sf lot with a one-car garage!

Sold for $410,000.