Big money is big money – a change in tax rate won’t cause rich families to uproot everything and move to an inferior place. What is more likely to cause millionaires to move? “The tax policy changes examined in this report are very modest compared to the life-impact of marital dissolution.”

Far more millionaires move into California than leave, despite the state’s highest-in-the-nation income-tax rate, a new study shows.

Researchers at Stanford University’s Center on Poverty and Inequality and the Franchise Tax Board sought to answer the question: Does California’s top state income-tax rate, now 13.3 percent on people earning $1 million a year or more, drive the wealthy to leave for low-tax states?

Short answer: No, except on the far margin.

The researchers reviewed 25 years of California tax returns from all high earners and found that more wealthy people relocate after a divorce.

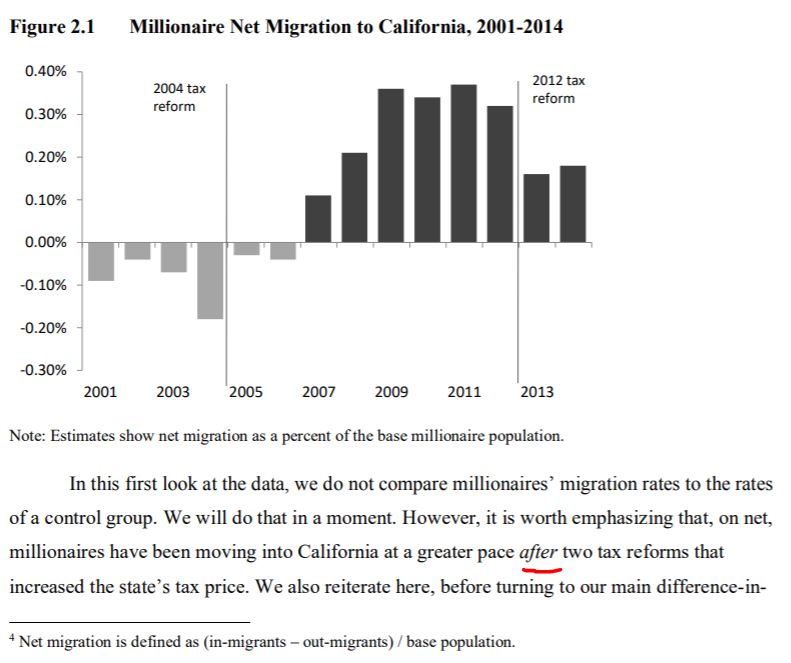

Republicans regularly cite anecdotes of businesses owners and wealthy people decamping to low-tax states such as Nevada or Texas. But the study shows million-dollar earners moved to California even after voters raised income taxes in 2004 and 2012:

“We often think that the only way for a state to be ‘competitive’ is to be like Texas—a low-tax, low-infrastructure, low-services state. But the reality is that the most competitive places in the U.S., the leading drivers of the economy, and the centers for top talent are New York and California—and they have been for generations, despite higher taxes on top incomes.”

Wait. What? I read the news so I know California is losing population among all income levels by the millions every year, leaving only a couple hundred of us to sink into the Pacific. Anything else is fake news.

Both sides are using statistics to lie. “Income” vs “Taxable wealth.” Setting the bar at $1.00 million. And the worst: “sales tax.” Sales tax is regressive. Of course it is a draw for the very wealthy.

Rob_Dawg, I read the first half of the cited study and it consistently discusses income level, specifically individuals with more than $1M income per year. On the other hand, the second link is to an opinion piece by “JON COUPAL [who] IS PRESIDENT OF THE HOWARD JARVIS TAXPAYERS ASSOCIATION” and contains lots of highly partisan language, but no actual data that I could find.

In short, both side are NOT the same. To be blunt, the Republicans and conservatives are the liars, and the only honorable thing is to call them out as such.

$1 million doesn’t mean anything! You can have a million in assets and still be stuck restricting your “fancy meal” to jack in the box. A million bucks is easy to blow thru. What’s a million supposed to represent? The rich? Middle class? A retired government worker with two pensions?

Can one of the loyal readers write me a check that’s cashable for a million bucks so I can demonstrate how fast I can blow thru it without leaving a trace, please? I’m trying to prove a point here!

“In short, both side are NOT the same. To be blunt, the Republicans and conservatives are the liars, and the only honorable thing is to call them out as such.”

We wouldn’t have to lie if we could just figure out how to bleach out tens of thousands of our emails. On the other hand, we have managed to not claim heroic deeds in Iraq when there’s cameras running, so I guess it all evens out.

In any case, thanks for going out on a limb to show us what’s what, “Name.”

As the excerpt says itself, the top centers for talent are New York and California “despite” the high taxes. It does not say we are the top centers because of high taxes.

In other words, this study does not mean high taxes are a good idea. High taxes are not what is helping to attract high income people. High taxes are simply tolerated because our state has other advantages and is great enough place to live that it outweighs the burden of high taxes for high income people.

It says more people with income over 1M moved here than left after taxes increased twice.

How do we know we wouldn’t attract even more high income people if taxes were lower?

The other thing is how many people think our state is using or tax dollars wisely?

This state has a lot of great things but high taxes isn’t one of them.

In other words, think how bad the traffic would be if we didn’t have high taxes!