by Jim the Realtor | Sep 7, 2022 | 1-story, Boomers, Thinking of Buying?

For those who prefer a single-level home and would like to peruse a curated group, check out this on-going collection of my favorite one-story homes for sale between La Jolla and Carlsbad here:

https://www.compass.com/c/jim-klinge/nsdcc-one-story-houses?agent_id=5b51d51d9474a8364b9a8353

by Jim the Realtor | Sep 7, 2022 | Realtor, Realtor Training, Realtors Talking Shop |

Over the last few years there are two groups of buyers who have been left behind; the self-employed who have a tough time qualifying for a mortgage, and the contingent buyers because there have been enough non-contingent buyers that sellers would prefer.

There hasn’t been any relief for either group, and probably none forthcoming.

Those who want to use the equity in their home to purchase their next house can usually find a solution if they want to move bad enough. You can always do the double move, where you sell first, then rent and wait patiently to buy the next one. You can get a bridge loan, though expensive and qualifying isn’t easy. You can leverage yourself to the hilt and buy the next home before selling.

But for some, those options don’t fit. Just the ease of having the next purchase be simply tied to the sale of the last home might be a relief for some sellers to get comfortable with moving. But will listing agents consider an offer that is contingent upon the sale of another?

They just might – especially over the next four months. Those who should consider it are the listing agents of the 171 homes for sale between La Jolla and Carlsbad that have been on the market for more than 60 days (41% of the total number of active listings).

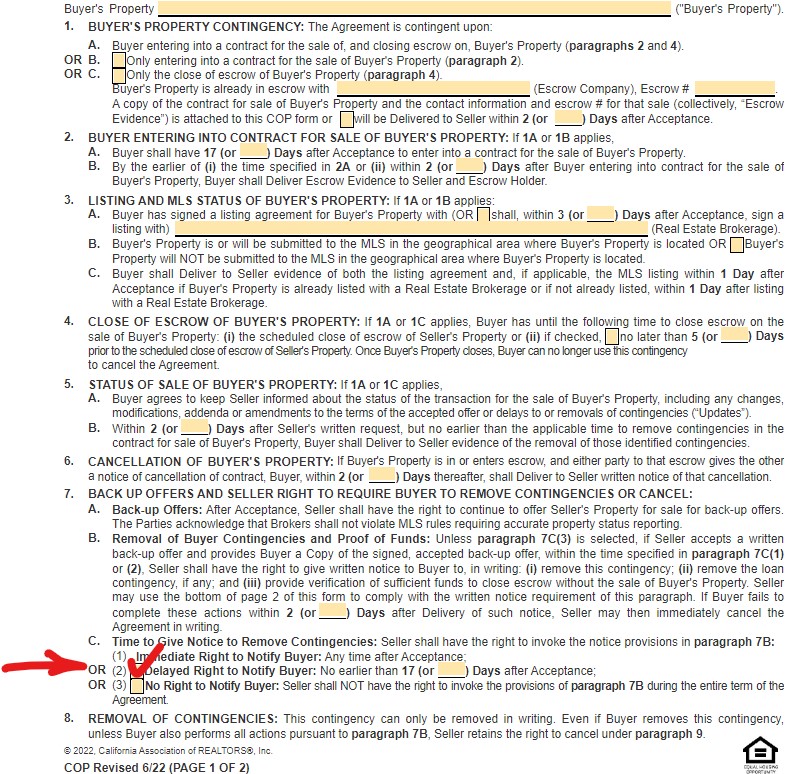

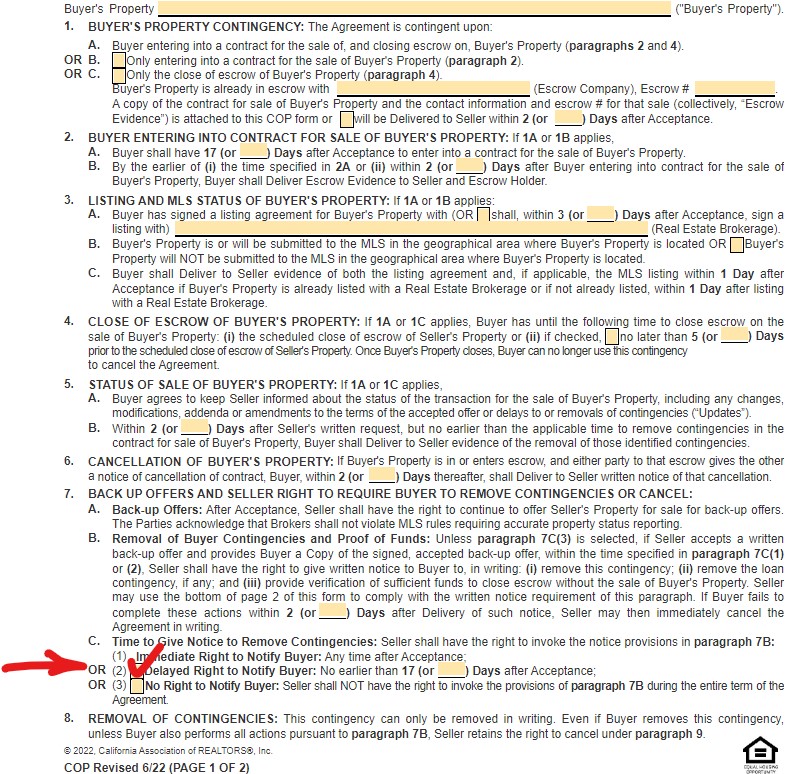

The CAR just revised the COP form in June:

I’m sure all of these paragraphs are necessary, but they leave out the most important ingredient and the fact that would make a difference – the listed price of the contingent property!

If I had a listing that had been on the market for 60+ days and was heading into the 2022 off-season (otherwise known as the Post-Frenzy Apocalypse), I’d consider an offer contingent upon the buyer’s home selling – and I’d give them the 17 days in paragraph 7C2 checked in red above. But I’d want to know what your list price is!

If I thought the buyer’s home was priced aggressively, then what do I have to lose? Seventeen days of market time, during which I can still be looking for back-up buyers……in an era when I might not get another showing, let alone an offer?

Heck yeah, I’d consider a contingent offer – if I just knew what the list price was!

If I was representing the buyer, I’d include my signed listing of the buyer’s home to show – and sell – the listing agent on how our contingent offer would be a viable solution. Let’s do it!

by Jim the Realtor | Sep 6, 2022 | Market Conditions

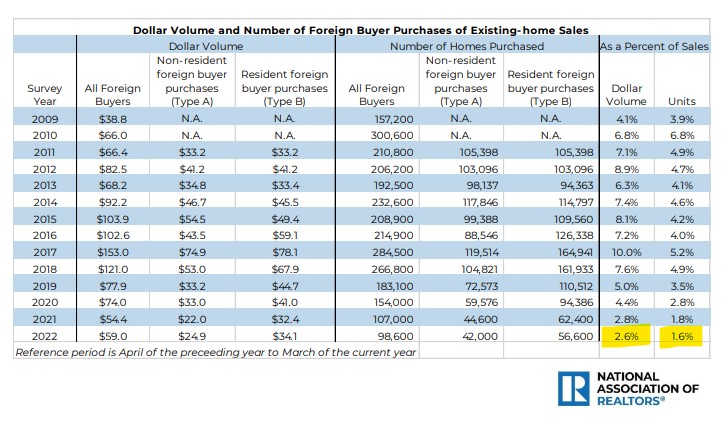

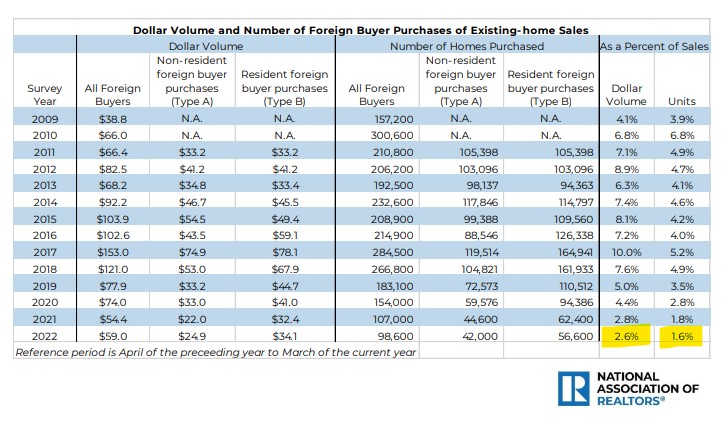

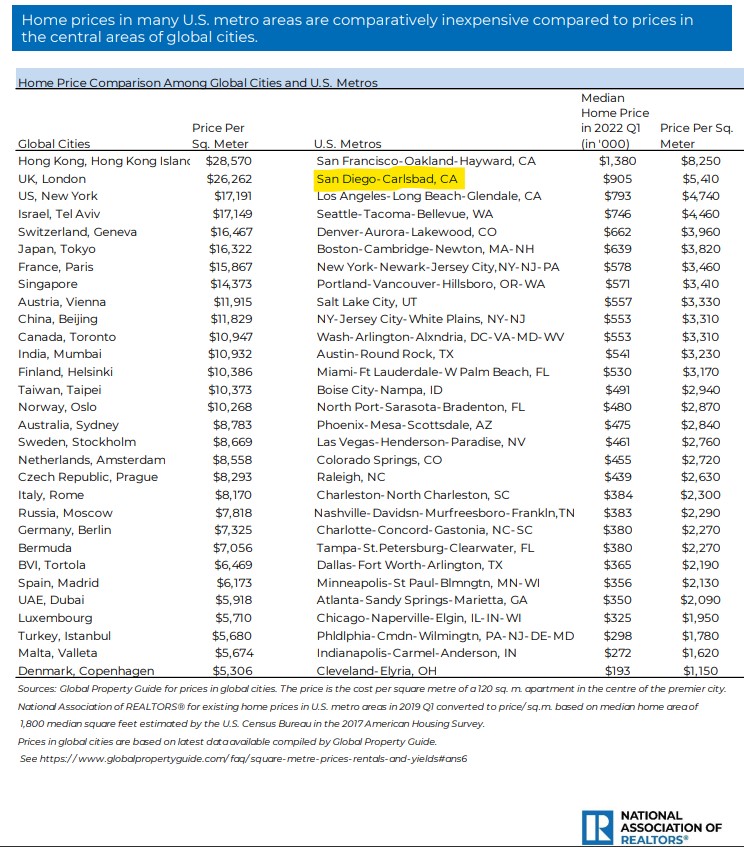

People have wondered if the foreign buyers will have an impact on how this turns out. But that segment of the buyer pool isn’t what it used to be, according to a recent report by NAR:

https://cdn.nar.realtor/sites/default/files/documents/2022-international-transactions-in-us-residential-real-estate-07-18-2022.pdf

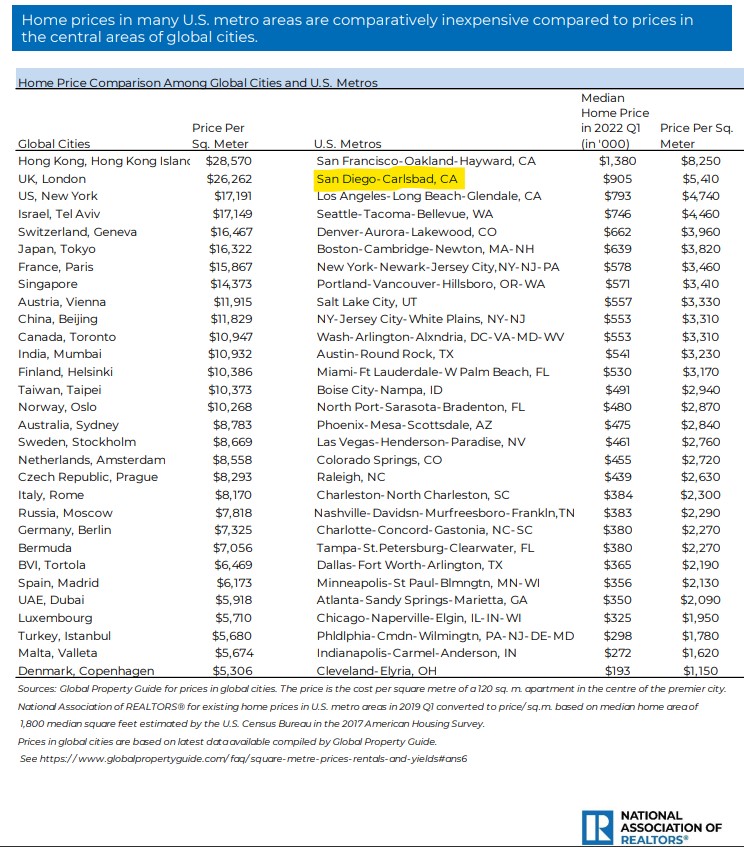

We’re #2 in America, and about the same price-per-square-meter as Copenhagen!

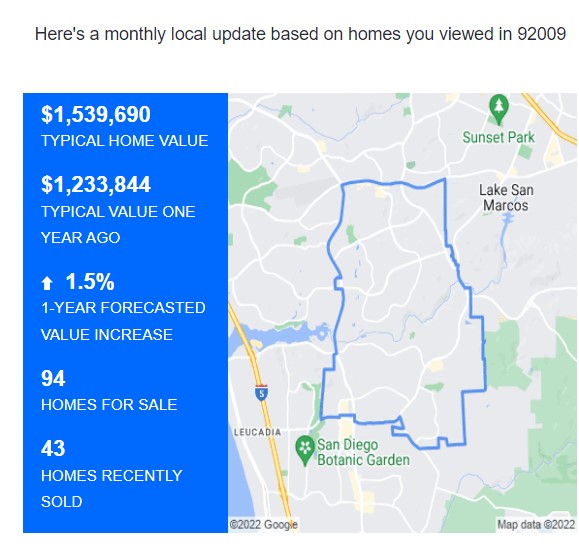

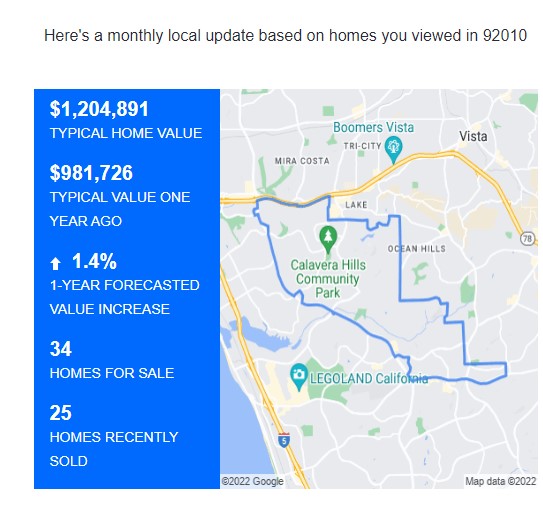

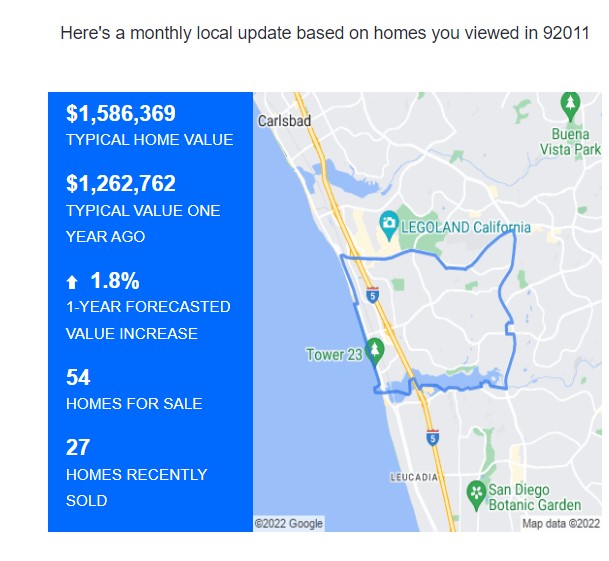

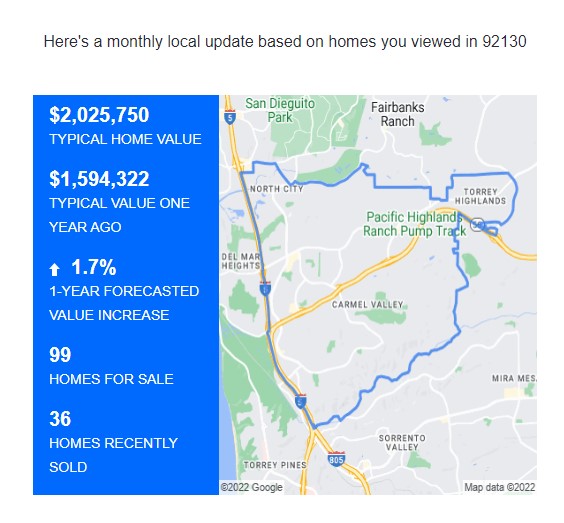

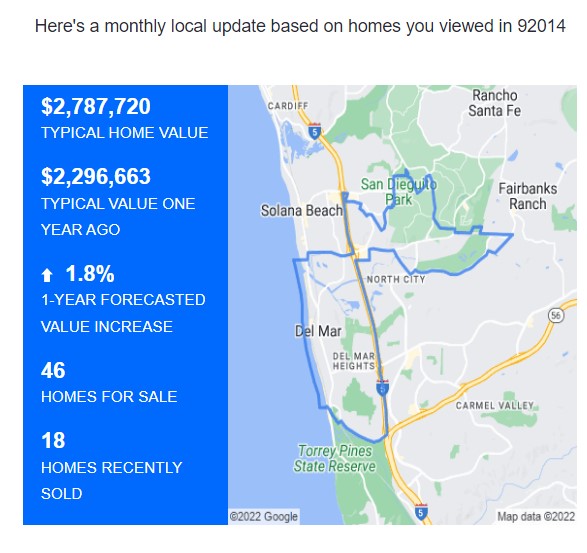

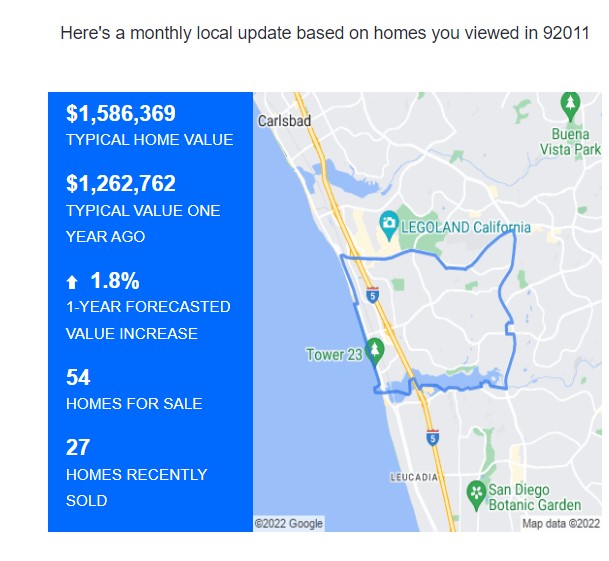

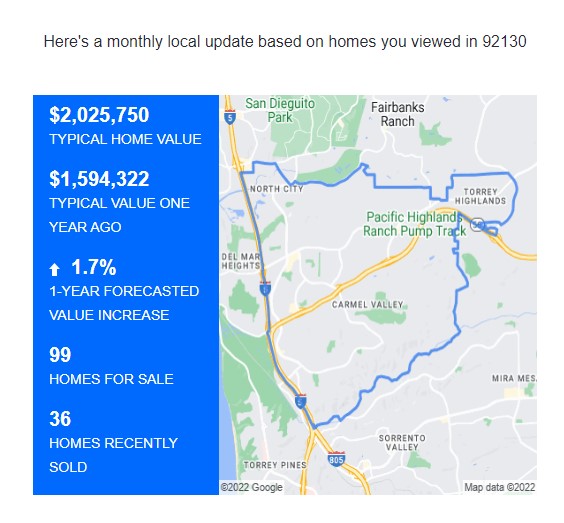

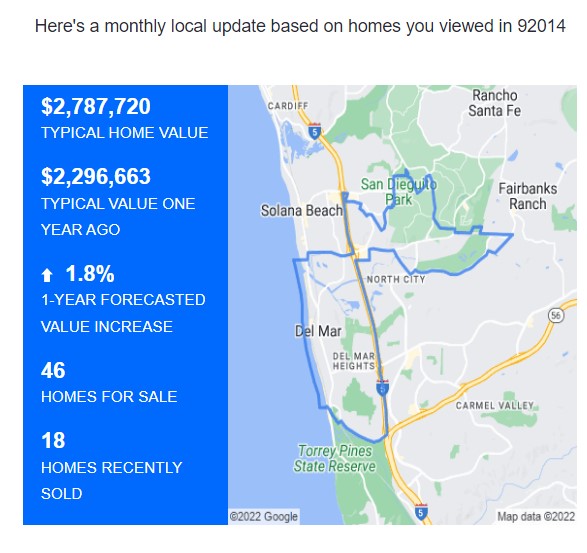

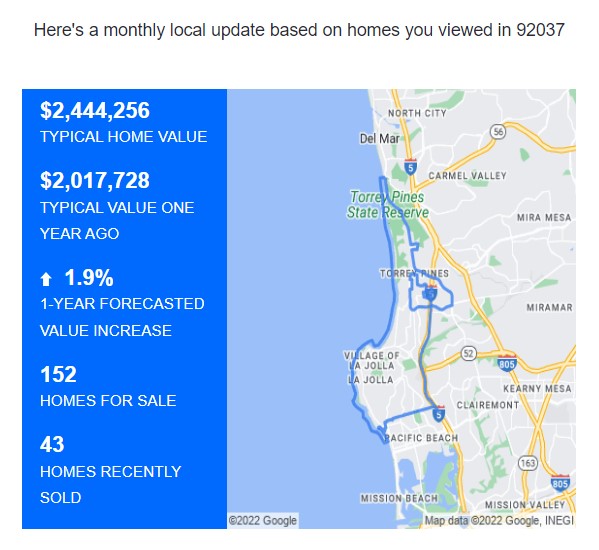

by Jim the Realtor | Sep 6, 2022 | Forecasts, Zillow |

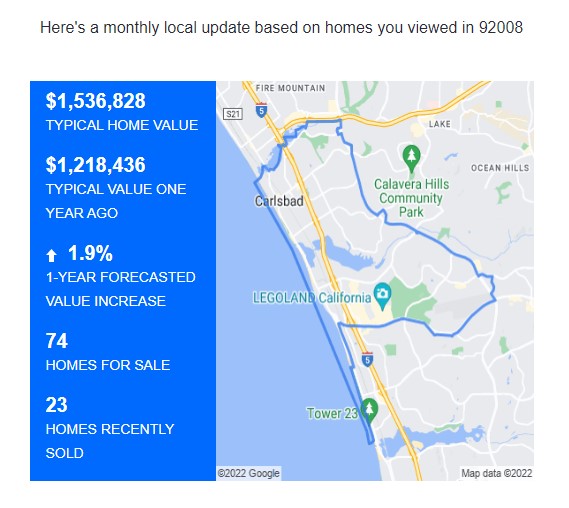

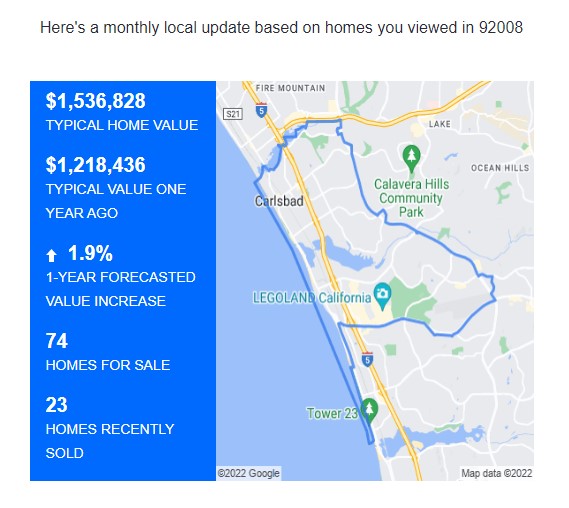

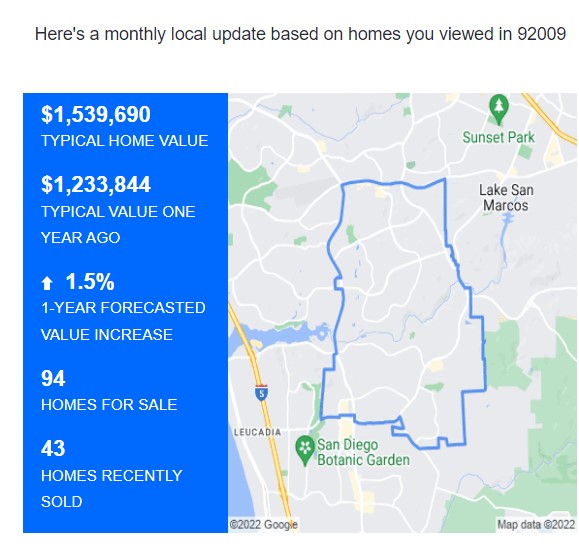

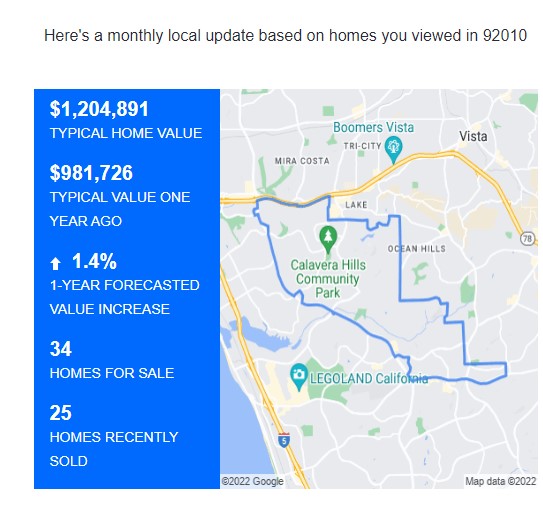

Zillow has recalibrated and is predicting a fairly flat 12 months ahead.

Here are the zip codes I’ve received so far, all ranging between +1.5% and 1.9% appreciation over the next 12 months – the rest of the local zip codes should be similar:

NW Carlsbad

SE Carlsbad

NE Carlsbad

SW Carlsbad

Carmel Valley

Del Mar

La Jolla

by Jim the Realtor | Sep 5, 2022 | Coffee Bet, Jim's Take on the Market, Market Conditions, North County Coastal |

The last coffee bet began in 2006 when it was obvious to me and others that the market bubble was popping, so let’s examine the data back to those years to see if we can learn anything that might be helpful when trying to predict the future:

NSDCC Listings and Sales between January 1st and August 31st:

| Year |

Number of Listings |

Number of Sales |

Median Sales Price |

| 2006 |

4,596 |

1,822 |

$997,375 |

| 2007 |

4,046 |

1,883 |

$1,000,000 |

| 2008 |

3,865 |

1,413 |

$915,500 |

| 2009 |

3,741 |

1,346 |

$803,503 |

| 2010 |

4,065 |

1,684 |

$826,407 |

| 2011 |

3,988 |

1,780 |

$828,745 |

| 2012 |

3,423 |

2,086 |

$825,000 |

| 2013 |

3,747 |

2,355 |

$925,000 |

| 2014 |

3,640 |

1,978 |

$1,020,000 |

| 2015 |

3,797 |

2,169 |

$1,086,000 |

| 2016 |

3,926 |

2,084 |

$1,157,465 |

| 2017 |

3,549 |

2,125 |

$1,225,000 |

| 2018 |

3,578 |

1,957 |

$1,320,000 |

| 2019 |

3,597 |

1,927 |

$1,310,000 |

| 2020 |

3,254 |

1,853 |

$1,410,000 |

| 2021 |

2,861 |

2,265 |

$1,870,000 |

| 2022 |

2,190 |

1,451 |

$2,400,000 |

The most recent non-pandemic years, 2018 and 2019, were eerily identical, which suggests that the same market conditions can prevail for years in spite of rates (which varied from 4.03% in January, 2018 to 4.87% eleven months later, and then back down to 3.72% in December 2019).

The most stunning data point is how the number of listings has plummeted this year, even though sellers could have sold for all-time high prices. Record pricing used to motivate more people to sell, not fewer!

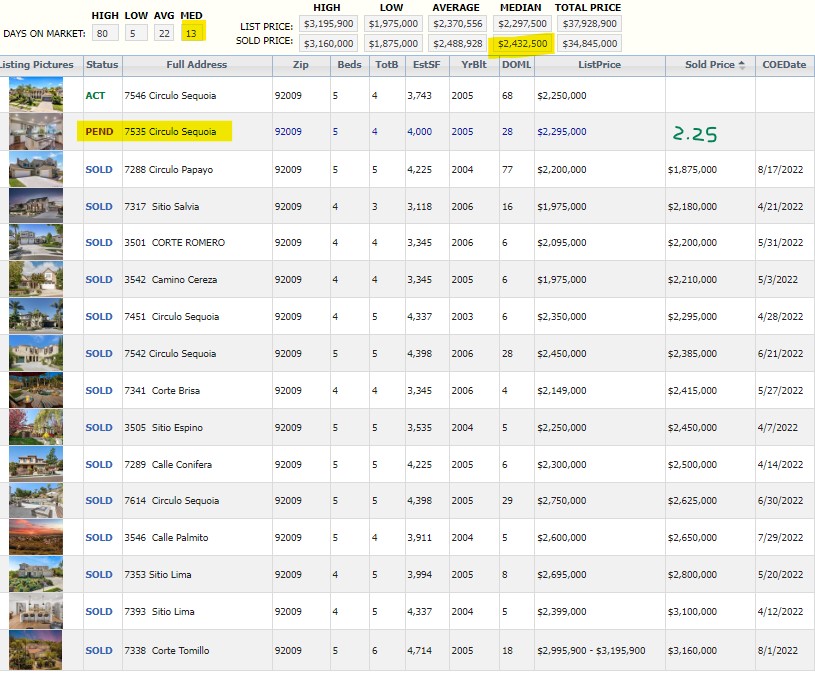

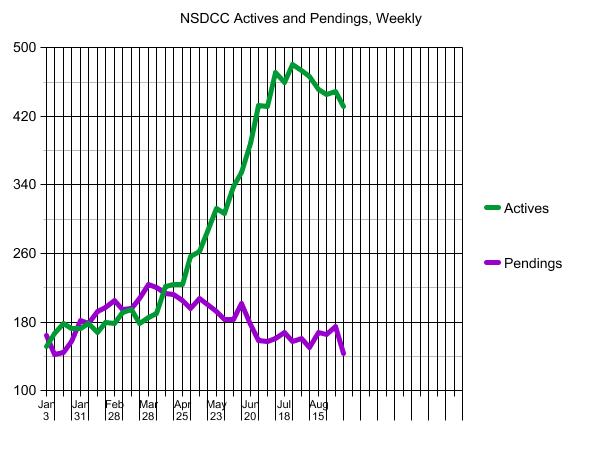

Agents sitting on unsold properties will ‘refresh’ their listings every month or two, and those days are back so we’ll probably have at least the same amount of 2023 listings just due to the extra 10% to 20% of refreshers. But the inventory is going to be bleak no matter what happens, so that alone will drive the market in 2023 and beyond. Here is a visual:

The thing I remember most from the last downturn was how the market turned earlier than expected. There was a blog post from April, 2009 entitled Coffee Bet 2 where I thought prices would go down another 25%, when that month ended up being the actual trough for the SD Case-Shiller Index.

Even with the buyers who over-analyze and stay on the sidelines for 2-5 years, there will be others – mostly those out-of-towners who don’t have a house here yet – who will buy when they find the right house.

Sales will likely be dreadfully low, and I think NSDCC pricing will be FLAT in 2023.

During the selling seasons, there will be some spectacular sales of those family estates with big yards and pool on culdesacs…..and prices trend higher! But then as the inventory diminishes over the rest of the year, the pricing either goes flat or we give it all back in the second half of the year – like what happened in 2018 and 2019…and what will probably happen in 2022 too:

Here are NSDCC markers for this year:

January 2022:

Median List Price: $2,219,888

Median Sales price: $2,250,000

August 2022:

Median List Price: $2,200,000

Median Sales Price: $2,150,000

If it weren’t for those crazy three months before rates went up last spring, the 2022 data would probably have already looked fairly flat anyway, so it’s really not risky for me to guess that it will continue. There will be crazy-high sales, and stunningly-low sales too, but in the end, we’ll be living in Plateau City.

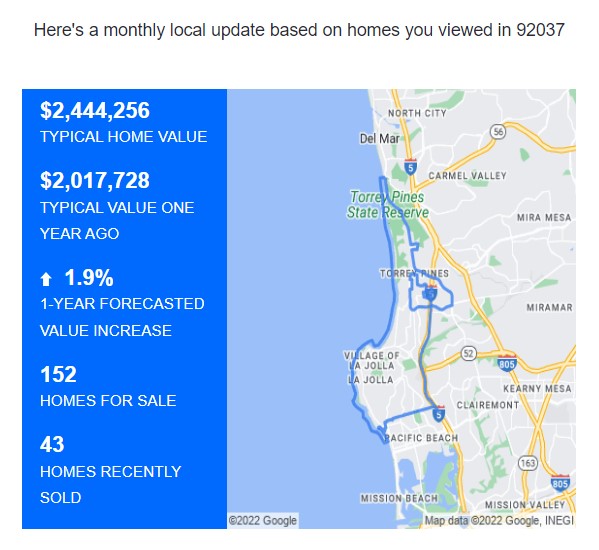

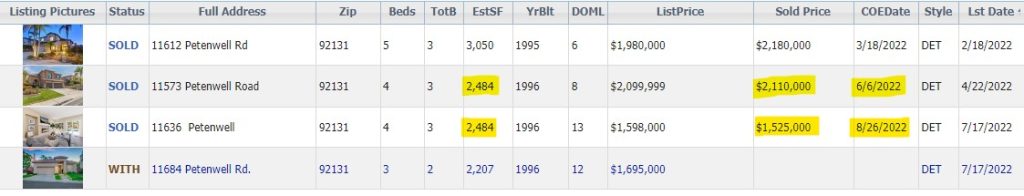

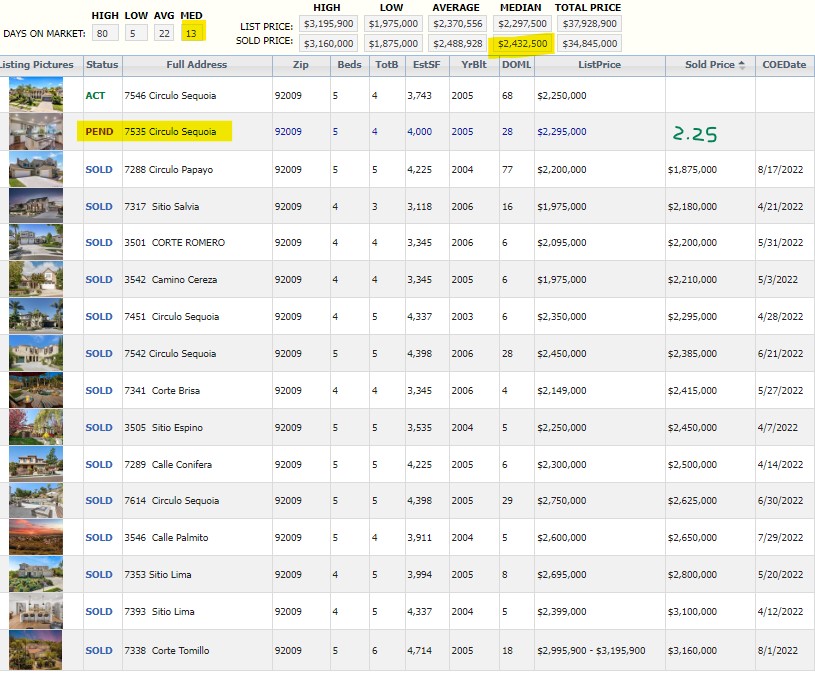

In the first coffee bet of 2006, I used the Davidson Starboard tract as a marker, and coincidentally I have a listing there now. The neighborhood is arguably the best in the area, and La Costa Oaks South homes in general, are among the newest and most desirable homes in SE Carlsbad.

Let’s look up at the end of 2023 and see how the LCOS median sales price compares – even with it being inflated by early-2022 sales. These closings are from the last six months:

Even if the median sales price deteriorates somewhat in the next 15 months, I predict that my sale will be the lowest Plan 2 sale in the interim, and there won’t be any LCOS sales below $2,000,000 between now and the end of 2023 (the $1.875M sale was FSBO).

The ultra-low number of listings in 2023 will throttle any big price changes in either direction.

My NSDCC pricing guess for 2022 was +/- 5%, and is close, and next year will probably be similar too.

I’m sticking with ZERO change in pricing next year – which isn’t a sexy number but will reflect the general malaise and discomfort among the participants we hope for lower rates but know they won’t change enough to make much difference anyway.

by Jim the Realtor | Sep 5, 2022 | Inventory

Even though the August sales count is up to 159, it looks like September might be the first month with fewer than 100 sales between La Jolla and Carlsbad (population 300,000+). There are only 144 pendings!

Back in 2009 when nobody wanted to sell their house, there were 5,039 listings (the low for the era).

This year, we’ve only had 2,205 listings so far – we’ll be lucky to make it to 3,000 this year, which will be a new record low. Last year, there were 3,632 NSDCC listings (the current record).

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

(more…)

by Jim the Realtor | Sep 4, 2022 | 2023, Sales and Price Check, Thinking of Buying?, Thinking of Selling? |

The wildcard on pricing is that every potential seller has sufficient equity to dump on price if needed.

Why a seller would give it away when there are so many other alternatives (renting, reverse mortgages, hard-money loans, etc.) is beyond me. Even flipper companies like Opendoor (who owns 197 properties in SD County today), have to pay somewhat close to retail to get business.

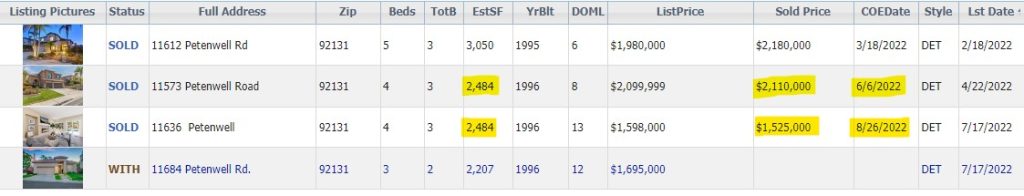

But there are cases where sellers can, and do, dump on price – like here, where I had the competing listing and we withdrew and rented, rather than give it away:

Those sellers paid $875,000 in 2016, so they still left town with a smile on their face – but you can guess that the neighbors didn’t appreciate it. Especially the two who paid over $2,000,000 just months earlier.

It would take a few desperate sellers dumping at the same time to call it a trend.

But if there were enough of those closings sprinkled throughout the county, the median sales price (a terrible measuring device) could fall 10% or more pretty easily.

When looking at 2023 and beyond, you can probably expect that there won’t be many realtors like me that advise sellers to hold out on price. It doesn’t change their paycheck much if they dump and run, and there won’t be anybody in the press or social media sticking up for sellers either.

There is a chance it could get ugly – just because sellers have so much equity that it feels like free money, and they will still walk with hundreds of thousands of dollars, even if they decide to give it away.

by Jim the Realtor | Sep 3, 2022 | 2023, Interest Rates/Loan Limits, Market Conditions |

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Trying to predict what will happen to our local real estate market in the short-term?

No surprise that mortgage rates will play a big role in how it plays out, and they have been extremely volatile lately. But it’s just not about affordability, and ‘losing’ buyers. They can always recalibrate by either looking at cheaper homes or cough up more down payment if they really need to buy a home. But will they?

The invisible impact on the market will be how buyers expect higher mortgage rates to convince sellers to lower their price. But sellers aren’t very empathetic, and most will go with their retail list price based on the highest comps ever recorded, and hope that cute young couple with 2.2 kids falls in love and just pays what it takes to win it.

If rates miraculously drop back down to 5% and under, then buyers won’t have a good reason to expect better pricing, and they will be tempted to give in and just pay what it takes. But if rates are 6% and higher, they have a rallying cry and the Big Standoff will be on.

How much lower will prices need to be to satisfy those buyers? They probably won’t have a number in mind, and the answer will just be ‘less’. It will likely end up being a binary decision – either rates are low enough that we’ll just go ahead and pay these prices, or we won’t.

When the bigger challenge is to find the right house, it will be most interesting to see if the superior homes – the real creampuffs – sit for long, or if they blow out to cash buyers or to those who care more about getting the right house, than the right mortgage rate.

If there is a steady trend of creampuffs selling, it will help to get more buyers to engage.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-09022022

by Jim the Realtor | Sep 2, 2022 | Coffee Bet, Doomer, Interest Rates/Loan Limits |

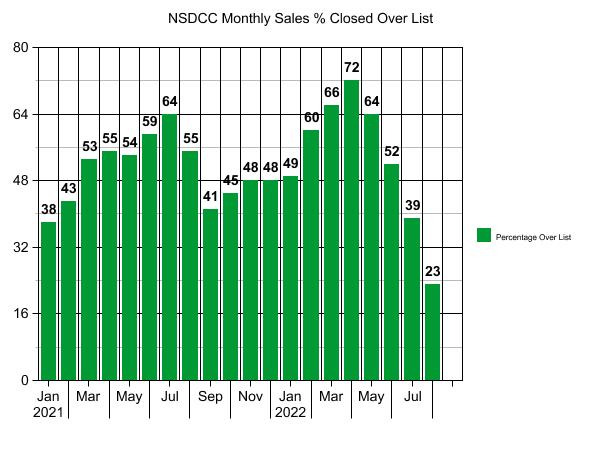

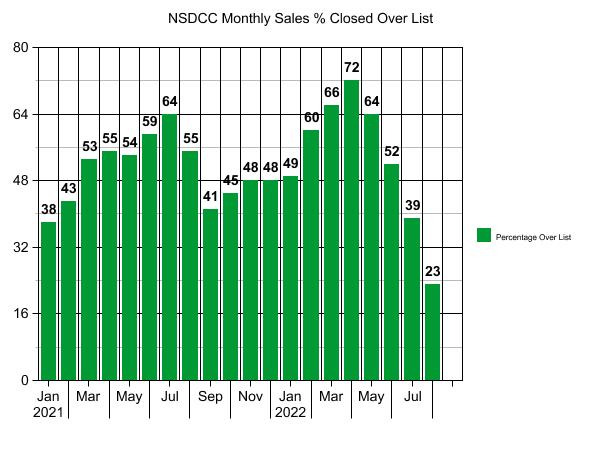

After mortgage rates went over 6% again yesterday, the doomers will be burying the real estate market over the next few months. You can see why – rates have been dropping for a generation; for them to now go up from 3% to 6% in a few months is unprecedented for today’s buyers:

But having the majority of buyers paying over the list price (especially those paying $100,000+ over list) was unprecedented too. Those who haven’t bought a house yet must be suffering from real estate whiplash today!

Where is it going to go now?

Is there any sort of precedent to reflect on? When this blog was in its infancy, I made the now-infamous Grand Poobah of Predictions on September 16, 2006 on how I thought the market was going to unravel. It was contested by many, and Rob Dawg issued his challenge which evolved into the Coffee Bet.

If you’d like to revisit history, scroll down to the bottom here and read the comments too:

https://www.bubbleinfo.com/category/coffee-bet/

Yesterday, I told Rob that I will post my latest thoughts on Monday, and asked him to do the same – or at least critique what I had to say. It will give me a couple of days to think of all the variables – which there are several now that have never been in play before!

Come back next week with your thoughts too!

by Jim the Realtor | Sep 1, 2022 | Jim's Take on the Market, Over List |

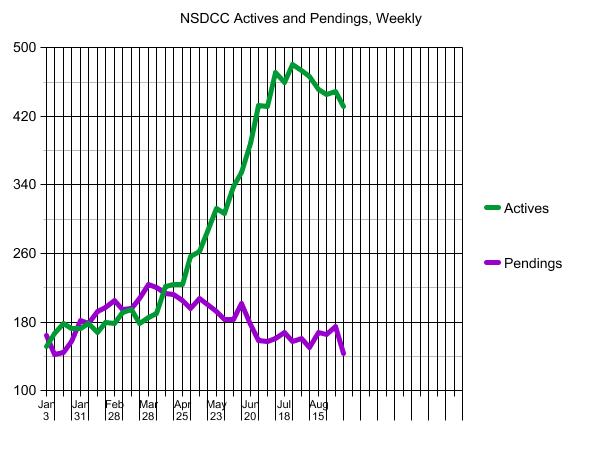

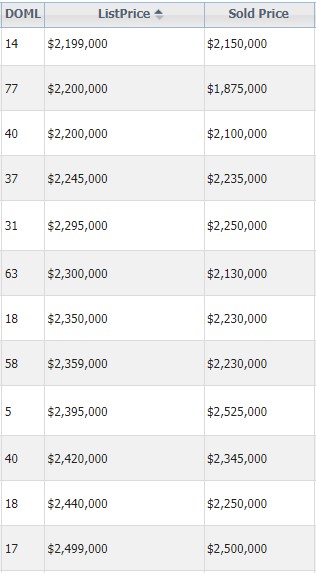

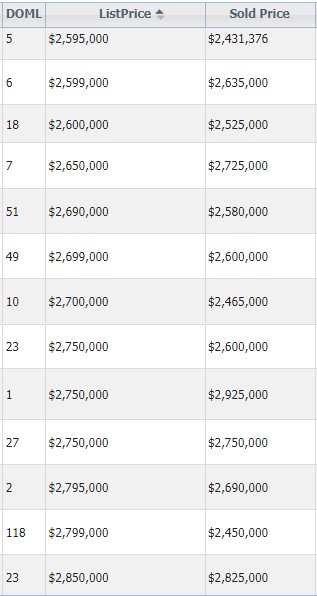

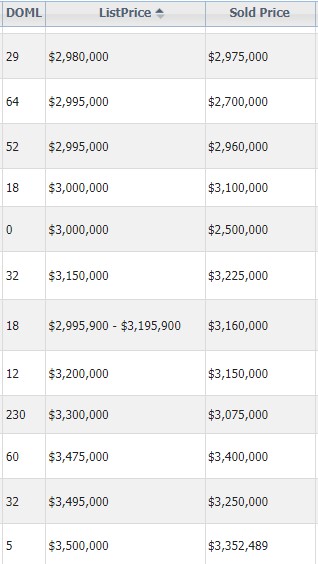

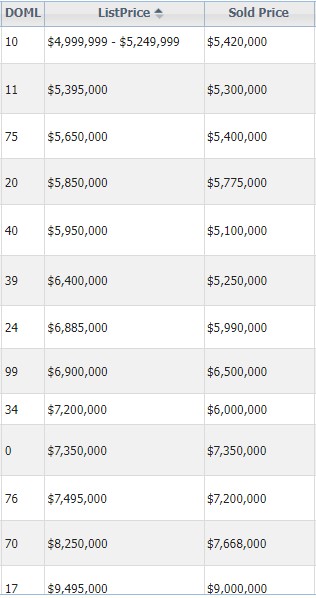

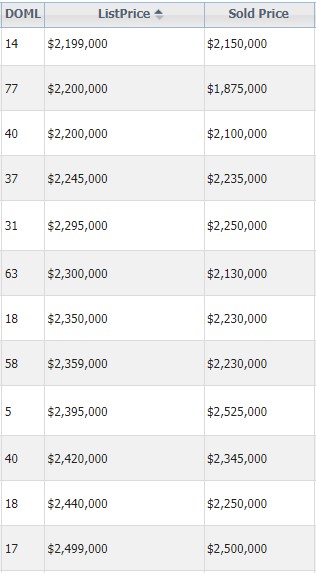

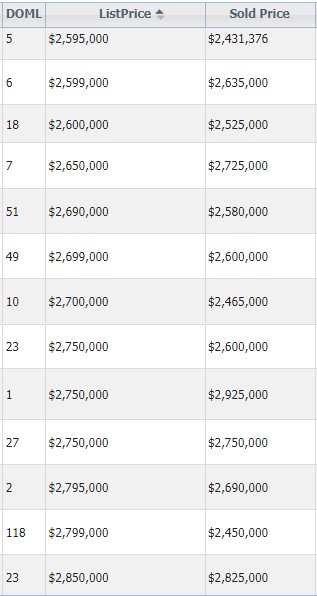

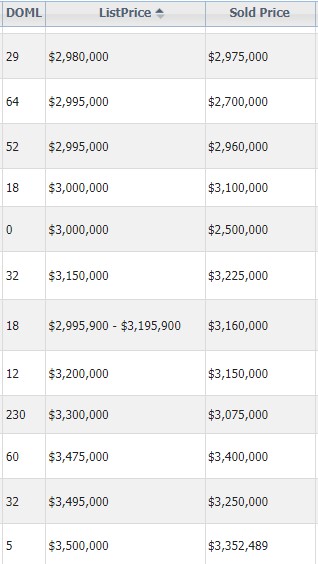

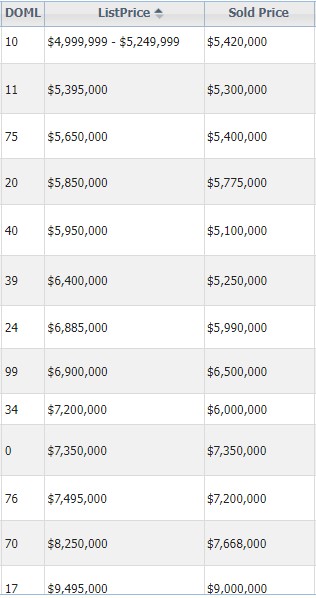

Want proof that Jay Powell has tamed the housing frenzy, and reversed the trend of buyers having to pay well over the list price to win a house? Here are examples of the list and sold prices of August home sales between La Jolla and Carlsbad – note the relationship to the days-on-market (DOML):

So far, we’ve had 154 August closings reported, which means we should get up to 175 or so by the time every sale is inputted.

I’ll do the final count later, but of the 154 sales, there were 23% that sold over their list price. But it is much more reasonable and sustainable if buyers only have to pay $25,000 to $50,000 over the list price for the creampuffs, rather than $400,000 to $800,000!

Sellers shouldn’t be bummed either, because their huge gains are priced in now.