Spring Upswing

In spite of higher rates, the spring selling season has delivered, though the second half of 2023 is TBD. Thanks Steve Harney and Ryan Lundquist for the graphics!

In spite of higher rates, the spring selling season has delivered, though the second half of 2023 is TBD. Thanks Steve Harney and Ryan Lundquist for the graphics!

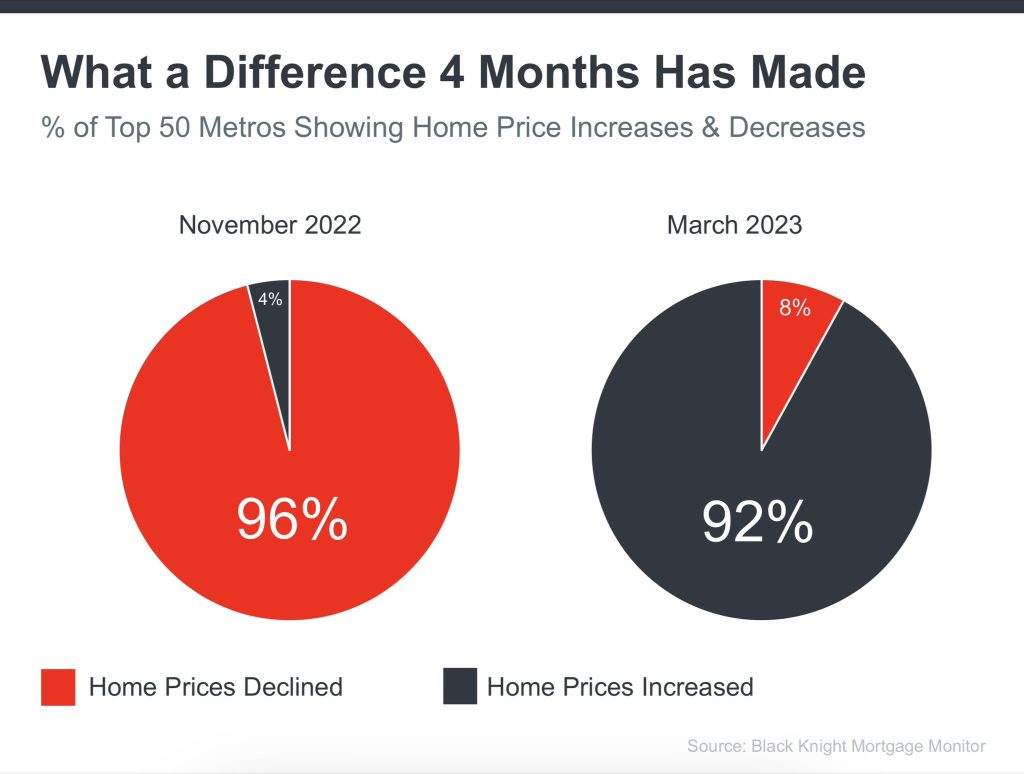

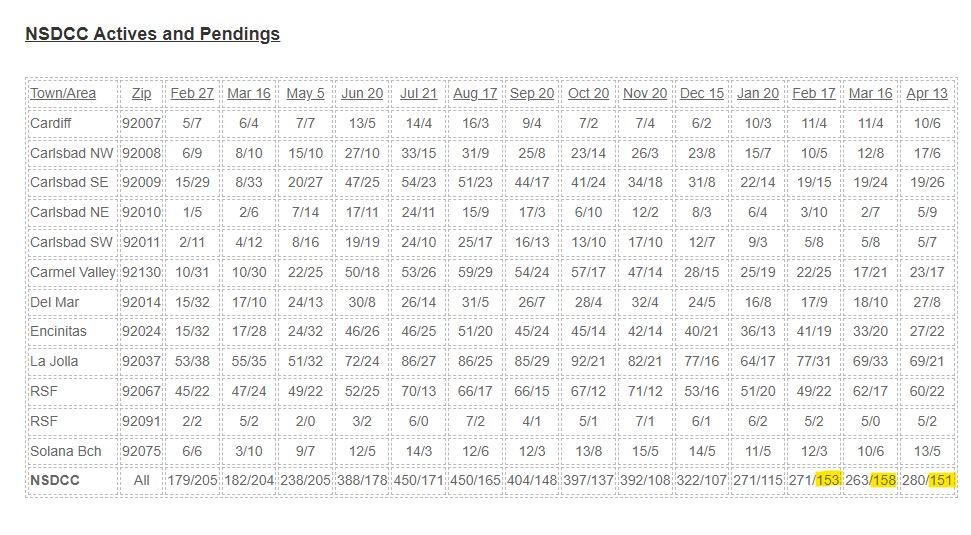

Here is the early count on April sales between La Jolla and Carlsbad, with YoY and MoM comparisons:

There will be some late-reporters but April sales won’t get up to the 184 sales we had in March – which will probably end up being the best month of 2023 (remember that next year). There are only 148 pendings today so the May sales will most likely be under the March and April counts too.

The pricing doersn’t look that much different than last April when the frenzy was peaking. Just more people paying under list, instead of the majority paying over list.

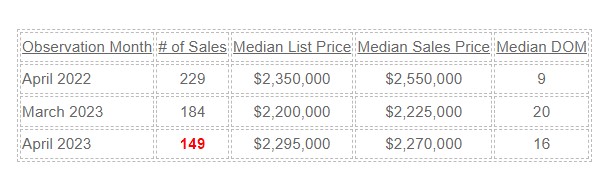

Here is the county’s median sales price:

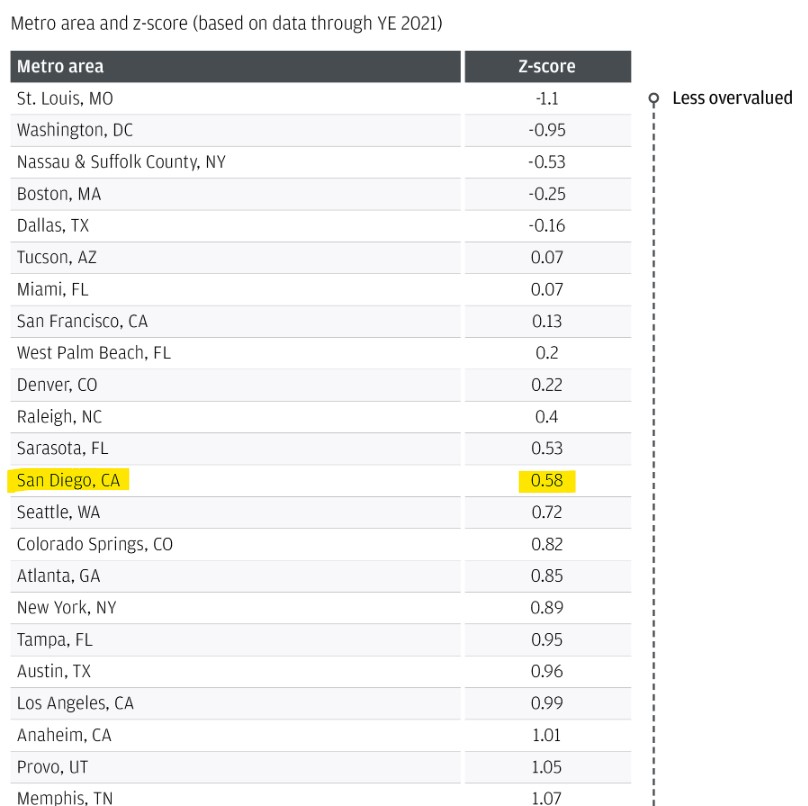

Price-wise, we are back to where we were at the end of 2021, so the data above should still be in the ballpark. Glad to see that San Diego isn’t considered as wildly overvalued – it’s expensive here and people can afford it, apparently.

I like that the J.P. Morgan guys who wrote this article are focused on the individual metros! The more affluent areas will keep losing population to the more affordable towns, and the balance will be determined by how many rich people move here. Could it balance out nicely?

An excerpt:

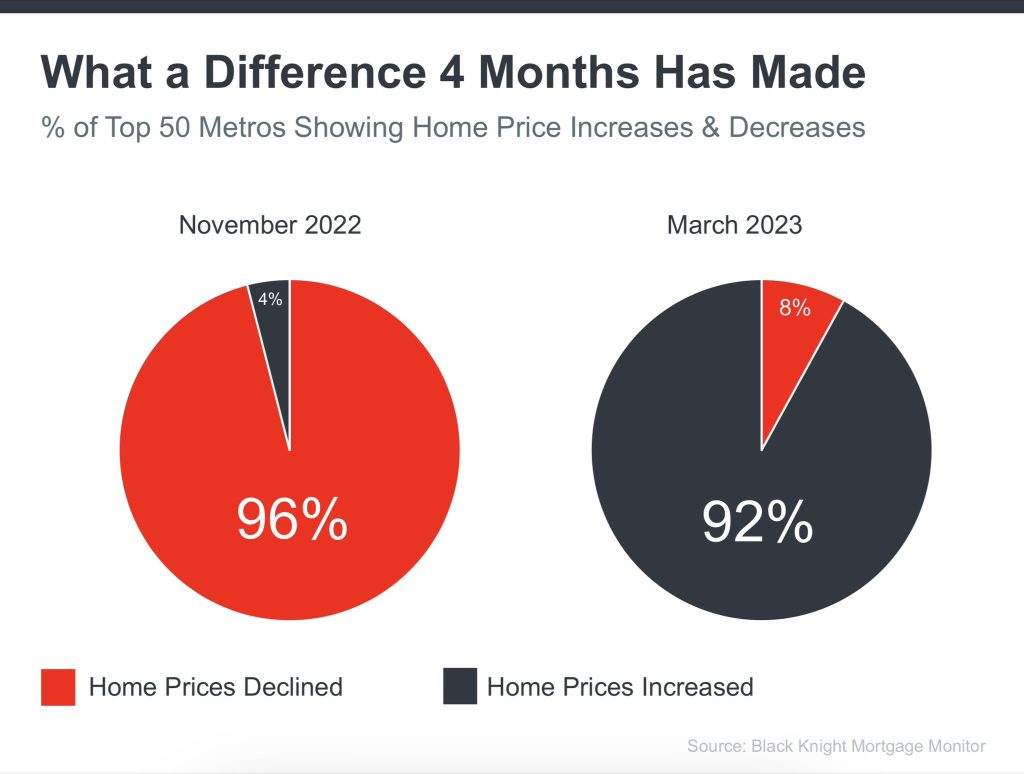

The end of the U.S. housing market’s pandemic-induced volatility seems in sight.

A recent and telling stabilization of single-family home sales—surprising in the face of high mortgage rates—has us expecting prices to finish bottoming out across the nation by the end of this year or in early 2024.

By the second half of 2024, we believe, the national housing market will return to a pre-pandemic historical norm in which residential home prices climb slowly and steadily, keeping modestly ahead of the rate of inflation.

However, we also expect each city’s path back to normalcy to be very different.

Last fall, as the housing market was cooling, we said that national statistics, while informative, would fail to tell the whole story. We expected cities to experience widely differing drops in home prices based in large part on how overheated their particular housing markets were at the start of 2022, before interest rates rose.

Subsequent home price drops have been dispersed, and in the general direction we anticipated.

Link to Article by JPMorgan ChaseWe know that 80% of readers don’t go past the headlines, so the UT is challenging their customers lately to figure out the direction of the real estate market.

These are their headlines from the past two days:

Yesterday

Today

I have reached out to the author previously, but no response.

Get Good Help!

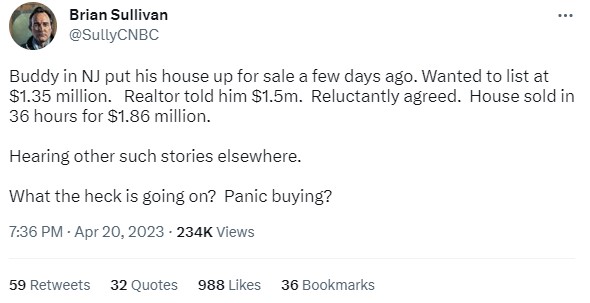

To hear more stories like this and a wide array of opinions, click here:

https://twitter.com/SullyCNBC/status/1649240769658605570

Remember when I was on CNBC with Sully in 2011? He used to live in Carmel Valley!

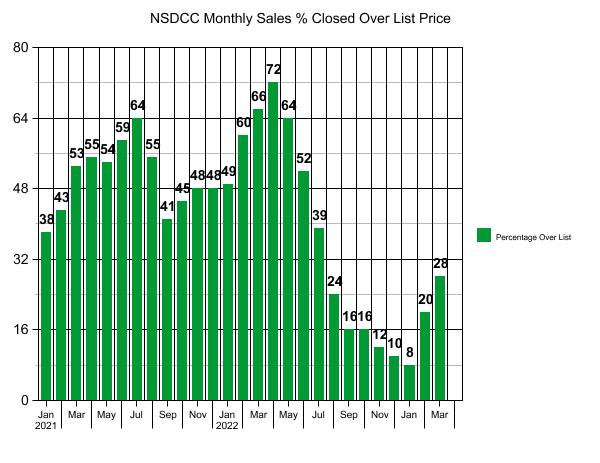

In this graph from two weeks ago we saw that there were 28% of the NSDCC detached-home sales in March that closed over their list price. Because it’s one of my favorite ways to judge the market conditions, I did a check on the numbers for April so far:

NSDCC April Sales (preliminary)

Closed sales: 85

Closed over the list price: 36%

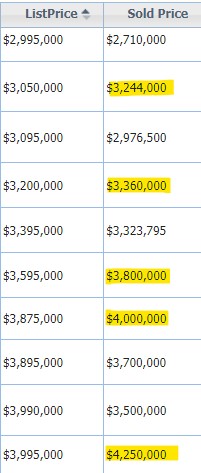

It’s not just on the lower end either:

Of the 85 closings, 41% were all-cash!

My one post-frenzy prediction was that there wouldn’t be any more sales under $2,000,000 in the Davidson-built Starboard tract in La Costa Oaks (the last was $2,150,000 in October).

We’ve finally had a closing here in the middle of April. They had to knock off $4,000 to make the deal:

We are in the middle of the home-selling season, which means this will be as good as it gets for 2023.

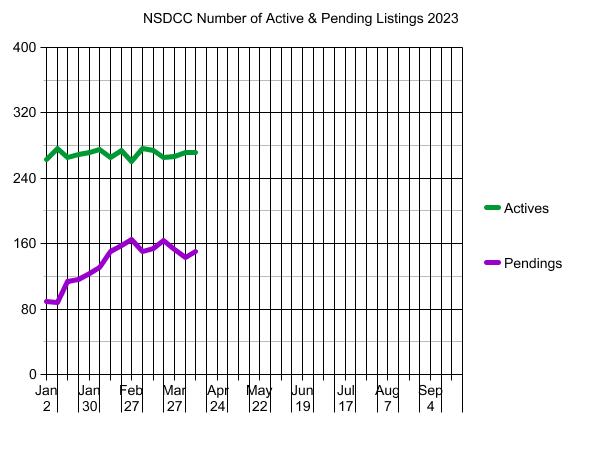

The balance of buyers and sellers has been remarkably steady. Over the last 90 days, the number of active listings has been in a tight 10% range, and the pendings haven’t budged, really, since the Super Bowl.

Those who planned ahead about selling during the season should have listed their home by now. There could be some daredevils who are waiting another 2-3 weeks before going live, thinking that a few more comps might close and help them achieve an extra 5% or so – but it could go either way.

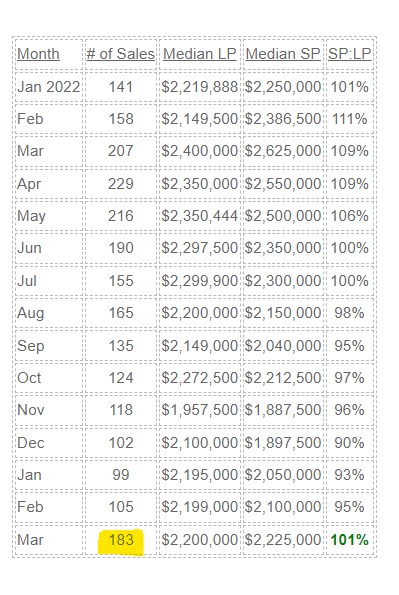

The recent bounce-back has been impressive with 183 NSDCC closings in March, which is better than the sluggish start that I expected.

The 101% looks like a good sign too.

Was it an overall market improvement that will keep growing? Or just a lucky stretch of higher-quality homes coming to market early in the season?

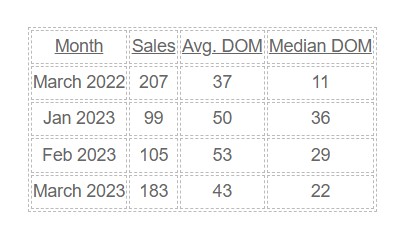

Here is more texture. The market time is improving, though not to the uber-frenzy level of last year:

This note about the March sales was the most interesting:

I think we’ve entered a new frenzy-lite phase where the buyers are more deliberate in their actions, and holding out even more for the higher-quality homes – but willing to pay the premium for them.

While the number of NSDCC active listings has been as steady as anyone could imagine (above), the median list price has been climbing rapidly this year:

January 9th: $3,495,000

April 10th: $4,074,997

The NSDCC median list price has risen 17% in three months! With rates in the 6s, who saw that coming?