Goodbye La Costa Resort Office

My farewell to La Costa – the virus has delayed a new Compass office in Carlsbad, but it’s coming:

My farewell to La Costa – the virus has delayed a new Compass office in Carlsbad, but it’s coming:

March 12th was the day that US stock markets suffered the greatest single-day percentage fall since 1987, and the day after Tom Hanks and Rudy Gobert tested positive – the latter shutting down the NBA season. Let’s call it the day that the coronavirus started having a major impact on real estate sales.

NSDCC Stats Between March 12th and April 12th

| Listing Status | |||

| 2018 | |||

| 2019 | |||

| 2020 |

The Pend/Sold counts of previous years have all closed escrow.

This year’s count of 137 includes 99 that are still pending, and may not make it to closing.

Although realtors were not considered essential workers for nine days in this period, it looks like we’re going to have 50% to 60% fewer sales.

Mike talks about sales dropping up to 50% in 2020, but there’s a bigger problem.

We have 10,000+ baby boomers retiring every day in America, but they aren’t moving – they are staying put. This lockdown is training folks on how to survive at home, and if boomers don’t have the savings, they can get by on social security and not have to sell their house to survive.

Sales could drop 50% this year, and not come back much – especially at these prices.

Everything seems like “If” these days, but if we had a market comeback, the dates of a modified and compressed selling season would be fairly predictable, looking at it logically.

The actual results will be a matter of compression and intensity.

If there isn’t much of a market rebound, then we might only have a couple of hot weeks in July, and a lot of standing around, relatively. If things get cooking, then we could have a solid 4-6 weeks before school starts (in red above) when the most sales will be made.

The dates in green is when buyers will be looking hard – and might be when the best deals are made.

Two to four weeks in October will be a lost cause, due to the election. In December, buyers and sellers will both pack it in early for the holidays, and prepare to GET ‘ER DONE IN ’21!

Next year’s selling season is 11-12 months away – we gotta be ok by then, right?

Then all we have to do is get through 2020!

To get a feel for when the market is starting to come back, let’s watch these data points.

When sellers are feeling more comfortable putting their house on the market, we should see the number of houses for sale begin to increase (or that will be a sign that fewer are selling, and the unsolds are stacking up).

Let’s compare the drastic difference between today and a few years ago – this includes Oceanside:

March Inventory:

2011: 3,350

2015: 1,541

2020: 1,158

The lack of homes for sale was already a problem before the coronavirus hit – with this few on the market now, don’t be surprised if sellers try to push their list prices even higher.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

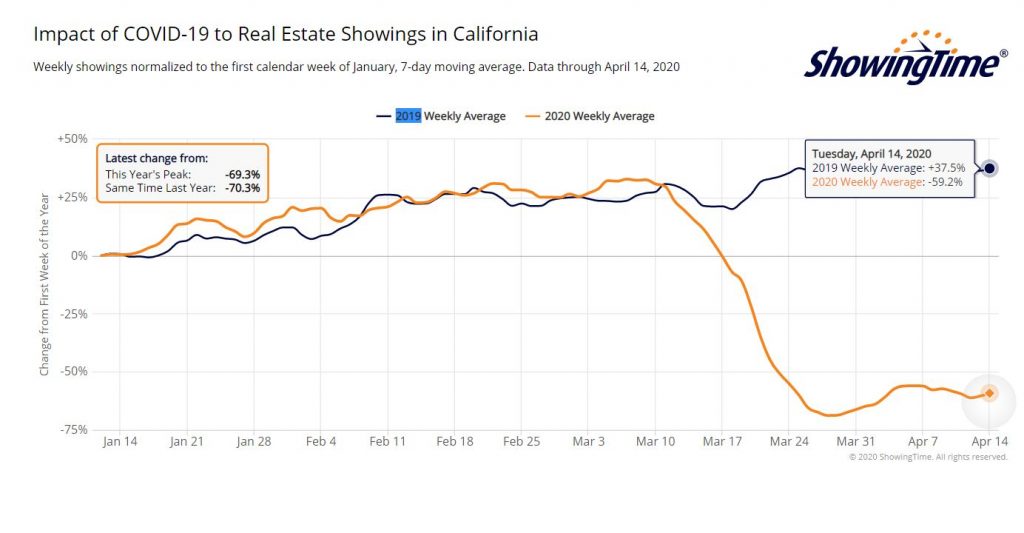

Before we get an increase in new pendings, we will need an increase in showings:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Once showings pick up, then the weekly new pendings should gradually improve. Here’s the latest look:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The baseline for the mortgage industry is Fannie and Freddie. Let’s keep an eye on their thoughts – especially if they start pulling back on their loan programs:

Freddie Mac’s Economic and Housing Research Group says that due to the stay-at-home orders in effect in more than half of the states, housing markets will not have their typical spring sales surge. They will probably fall 45 percent on a seasonally adjusted annual basis in the second quarter. House prices, however, will be insulated to some extent by the fiscal stimulus and extended unemployment insurance coverage provided by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The forbearance and foreclosure mitigation programs put into effect by lenders and reinforced by the CARES Act will limit the fire-sale conditions that emerged during the Great Recession. Freddie Mac expects home prices to decline by 0.5 percentage point over the next four quarters.

Also preventing a price collapse is the persistent lack of available homes for sale.In addition, population growth and pent up household formations will provide a “tailwind” to housing demand. When the recovery begins, the company forecasts that price growth will accelerate back to a long-term increases between 2 and 3 percent a year.

When Treasury yields became volatile several weeks ago the Federal Reserve stepped in to shore them up. They then turned to the secondary market in mortgage-backed securities (MBS), buying billions of those when demand dried up and interest rates surged.

Freddie Mac forecasts that inflation will remain in check as economic growth slows and long-term interest rates, including those for mortgages, will remain low for the next two years. Refinancing will regain the momentum seen earlier this year but will slow next year. Purchase mortgage originations will be the mirror image of refinances so total originations will be around $2.4 trillion in both 2020 and 2021.

The economists say their forecast is relatively optimistic and there are significant downside risks. Some of the important data reported over the last month, such as unemployment insurance claims and job growth, have been surprises, and not in a good way. They conclude, “If the economic contraction is larger and longer than what we currently forecast the housing market will suffer. Home sales may be slower to bounce back if potential buyers do not come to market. House price declines could also be larger than what we expect, particularly if forbearance and foreclosure mitigation programs do not successfully limit contagion effects on house prices. In the downside scenario mortgage origination volumes would be significantly lower than we forecast.”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

How about mortgage rates? A general rule-of-thumb today would be when rates are under 3.5%, we can expect a positive effect on the market, and when they are above 4%, it’s a negative:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Let’s watch these indicators, and add others as time goes on. The sellers will probably need to go first, and bring more homes to market. Then once we see showings and pendings start to trend upward, then we can say we are getting somewhere!

Our daughter Natalie is part of our team now as marketing director (in between her dance gigs). We got started yesterday with a few short answers (less than a minute each) to three basic questions about today’s market that she will be using individually on social media – here they are as a group:

If you have questions you’d like me to entertain, leave them in the comment section or email them to jim.klinge@compass.com!

A tour with the architect around the house that Alicia Keys purchased for $20,800,000 in August, 2019:

Demand for San Diego County homes has waned in recent weeks as the fallout from the coronavirus pandemic ripples through the real estate industry.

The number of pending sales in the county has dropped by 27 percent in two weeks, said data from Reports on Housing released late Tuesday. Also, the average time on market for a home has increased from 46 to 66 days.

Besides anecdotal reports from real estate agents, the information from Reports on Housing is the first evidence that San Diego County is experiencing any downturn.

Analysts have been split so far on what it could mean for the expensive San Diego market. On one hand, it would seem a global pandemic where there is a concern about dying or losing employment would halt buyer interest. But, the San Diego market also has high demand with a very small pool of homes for sale.

For instance, the San Diego County market has seen the number of homes for sale increase by 210 in the last two weeks. However, that still makes it 5,018 listed compared to 6,751 at the same time last year.

San Diego is still a seller’s market, especially on the low end of prices, said Steven Thomas of Reports on Housing.

Homes under $750,000 still make up more than half the sales in San Diego County and stay on the market an average 48 days. But, the time it takes to sell increases as prices go up.

New pendings continue to plummet, with only 17 logged this past week (we had 59 new pendings in the second week of April last year).

Last Monday we had 660 houses for sale between La Jolla and Carlsbad, and today’s count is 671.

We will keep hearing about the ‘pent-up demand’, so should sellers wait it out? There will be pent-up supply too, and buyers will be hesitant to jump in if they see several new listings in a neighborhood.

Any new gains in pricing will likely be slowed by the additional supply, and we will have to re-trace any potential losses between now and then to get back to where we are today. Sellers who want to sell for more money than they can get now might be in for a long wait.

I’ve been convinced for years that we can sell homes by video, and the coronavirus will present that challenge to us now. If agents can be handy with their phone, a decent representation can be made that should be enough to get buyers to make offers – and we’ll figure out the rest:

Value buy in Santa Fe Summit, where the last four sales were $1.75M to $2.0M! Located at the far-north end of Winstanley near miles of walking trails yet close to TPHS. Hardwood floors, new carpet, new paint, three fireplaces, and kitchen has new quartzite counters/newer stainless appliances to go with a walk-in pantry! Downstairs bedroom with attached full bath too. The Mello-Roos ends in April, 2027, which means big savings over PHR!

4 br/3 ba, 2,751sf

YB: 1994

LP = $1,380,000 Jim represented both the buyers and sellers.

https://www.compass.com/listing/13689-winstanley-way-san-diego-ca-92130/482638905699812401/