To get a feel for when the market is starting to come back, let’s watch these data points.

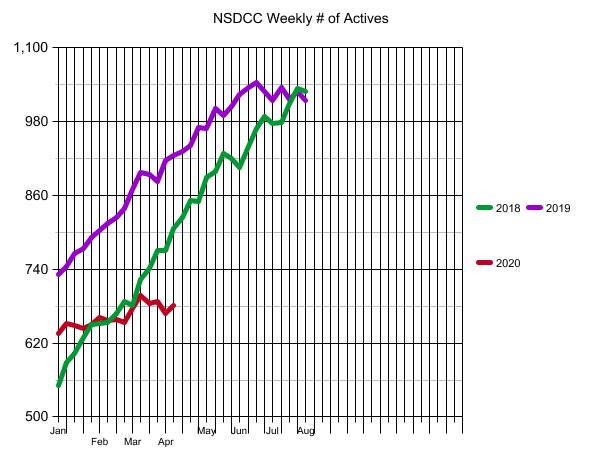

When sellers are feeling more comfortable putting their house on the market, we should see the number of houses for sale begin to increase (or that will be a sign that fewer are selling, and the unsolds are stacking up).

Let’s compare the drastic difference between today and a few years ago – this includes Oceanside:

March Inventory:

2011: 3,350

2015: 1,541

2020: 1,158

The lack of homes for sale was already a problem before the coronavirus hit – with this few on the market now, don’t be surprised if sellers try to push their list prices even higher.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

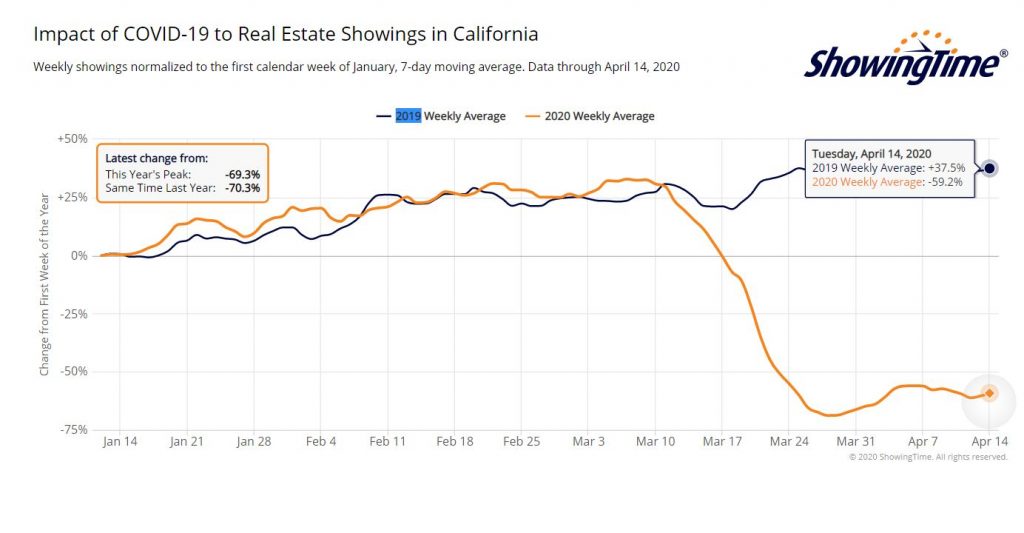

Before we get an increase in new pendings, we will need an increase in showings:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

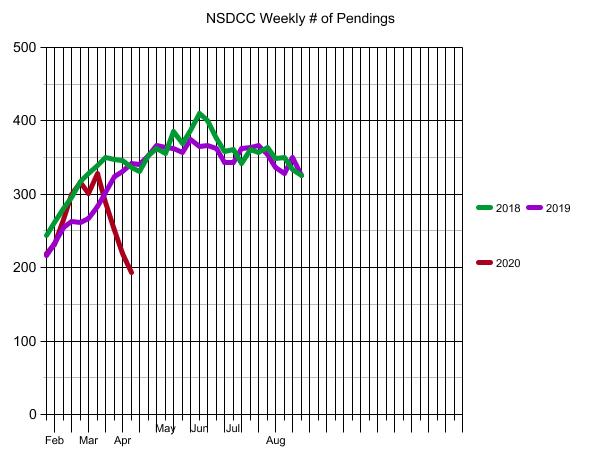

Once showings pick up, then the weekly new pendings should gradually improve. Here’s the latest look:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

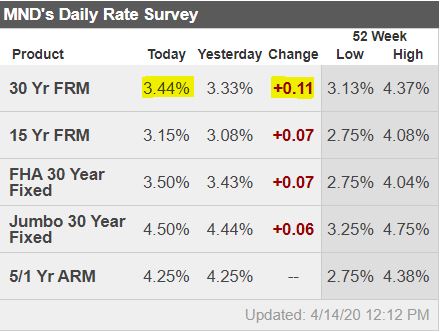

The baseline for the mortgage industry is Fannie and Freddie. Let’s keep an eye on their thoughts – especially if they start pulling back on their loan programs:

Freddie Mac’s Economic and Housing Research Group says that due to the stay-at-home orders in effect in more than half of the states, housing markets will not have their typical spring sales surge. They will probably fall 45 percent on a seasonally adjusted annual basis in the second quarter. House prices, however, will be insulated to some extent by the fiscal stimulus and extended unemployment insurance coverage provided by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The forbearance and foreclosure mitigation programs put into effect by lenders and reinforced by the CARES Act will limit the fire-sale conditions that emerged during the Great Recession. Freddie Mac expects home prices to decline by 0.5 percentage point over the next four quarters.

Also preventing a price collapse is the persistent lack of available homes for sale.In addition, population growth and pent up household formations will provide a “tailwind” to housing demand. When the recovery begins, the company forecasts that price growth will accelerate back to a long-term increases between 2 and 3 percent a year.

When Treasury yields became volatile several weeks ago the Federal Reserve stepped in to shore them up. They then turned to the secondary market in mortgage-backed securities (MBS), buying billions of those when demand dried up and interest rates surged.

Freddie Mac forecasts that inflation will remain in check as economic growth slows and long-term interest rates, including those for mortgages, will remain low for the next two years. Refinancing will regain the momentum seen earlier this year but will slow next year. Purchase mortgage originations will be the mirror image of refinances so total originations will be around $2.4 trillion in both 2020 and 2021.

The economists say their forecast is relatively optimistic and there are significant downside risks. Some of the important data reported over the last month, such as unemployment insurance claims and job growth, have been surprises, and not in a good way. They conclude, “If the economic contraction is larger and longer than what we currently forecast the housing market will suffer. Home sales may be slower to bounce back if potential buyers do not come to market. House price declines could also be larger than what we expect, particularly if forbearance and foreclosure mitigation programs do not successfully limit contagion effects on house prices. In the downside scenario mortgage origination volumes would be significantly lower than we forecast.”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

How about mortgage rates? A general rule-of-thumb today would be when rates are under 3.5%, we can expect a positive effect on the market, and when they are above 4%, it’s a negative:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Let’s watch these indicators, and add others as time goes on. The sellers will probably need to go first, and bring more homes to market. Then once we see showings and pendings start to trend upward, then we can say we are getting somewhere!

I must have always suspected but your second graph , actives by price shows that the lower tranches list to sell while the more expensive properties are much more seasonal.

This will have a huge impact on median pricing.

JtR,

Any thoughts on projections for jumbo loans and down payment requirements?

Great info as usual. Thanks!

Any thoughts on projections for jumbo loans and down payment requirements?

Raising the min FICO from 640 to 700 probably won’t eliminate many affluent buyers, and the 10% down payments were a luxury choice. If rich people have to put down 20% now, it probably won’t impact their decision much – they need a house, and they have the dough. Conversely, if they don’t have the dough, then they shouldn’t be buying a million-dollar house anyway.

This will have a huge impact on median pricing.

Agree, and we gotta come up with a better gauge.

I heard an ‘expert’ today talking about ‘home prices’ and using the median sales price like it was the golden measuring stick. But it can bounce around due to many factors (like you mentioned) and is a poor reflection of price momentum within hundreds of micro-markets.

Watch for changes in the mode of the dataset instead?

Mode = the number which appears most often?

Probably as good as any. We did attempt to devise a new measuring stick here one night, and didn’t come up with a solution.

Ideally, we should acknowledge that every month we have an entirely new set of data points, with different buyers, sellers, and properties. How can any solid trend be determined from that?

All we really know is that everyone needs toilet paper! 🙂