Bob Seger in San Diego 1978

This is real 70’s rock and roll, including girls sitting on shoulders of guys, the San Diego Chicken, and the purist 3-stripe Adidas:

This is real 70’s rock and roll, including girls sitting on shoulders of guys, the San Diego Chicken, and the purist 3-stripe Adidas:

An interesting essay on today’s housing crisis – thanks daytrip!

But the pushers of market-friendly solutions, and even most affordable housing activists, miss a central point in the housing debate: we already have enough housing in this country.

The problem is not supply. It’s that the supply is owned by the wrong people.

From downtowns to suburbs, there’s a glut of vacant housing and land owned by the rich. The one neat trick to solving the housing crisis: give the things owned by the rich to the poor.

The richest neighborhoods in many cities are also some of the most vacant. If you walk around Midtown Manhattan or Downtown Brooklyn on a weekday evening and look up at all the residential luxury skyscrapers that have cropped up in the last decade, you might notice they’re relatively dark.

In the stretch of Manhattan between Park and Fifth Avenues and 56th and 59th Streets, 57 percent of apartments were vacant at least ten months a year, according to a New York Times analysis based on data from 2012. Buildings from 60th Street to 63rd Street were also only around 50 percent occupied.

Across the country, even in smaller cities, downtowns are being filled with tall, expensive, and often empty apartment buildings. The apartments in the flashiest of these buildings, like the towers rising along 57th Street in New York (now sometimes called Billionaire’s Row) are often bought by the LLCs of the uber-rich, and they’re used more as investment opportunities than as places to live.

So why do we keep building so much vacant luxury housing? It’s a simple function of how capitalist land markets work.

With demand for housing high and government intervention and spending on affordable housing low, land prices have no reason to drop. If a developer buys a plot of land in, say, Cleveland for $1 million, there’s no reason the lot next to his or hers will be sold for less per square foot, and so whatever developer purchases that land will have to build something that extracts $1 million, plus profits, in rents or sales.

This is not a new phenomenon — it’s one of the central theses of Frederick Engels’ 1872 treatise, “The Housing Question:” if there’s no purposeful depression of prices on land, housing prices have no reason to become cheap. The land at the center of cities will always go up, until they are unaffordable to everyone but the richest.

Read full article here:

For those who are looking for new flooring and don’t mind traveling to the 15 corridor, this new store is just a couple of miles east of Carmel Valley. They have plenty of other extras too – here’s a tour:

Worried about the bubble bursting? You can get insurance!

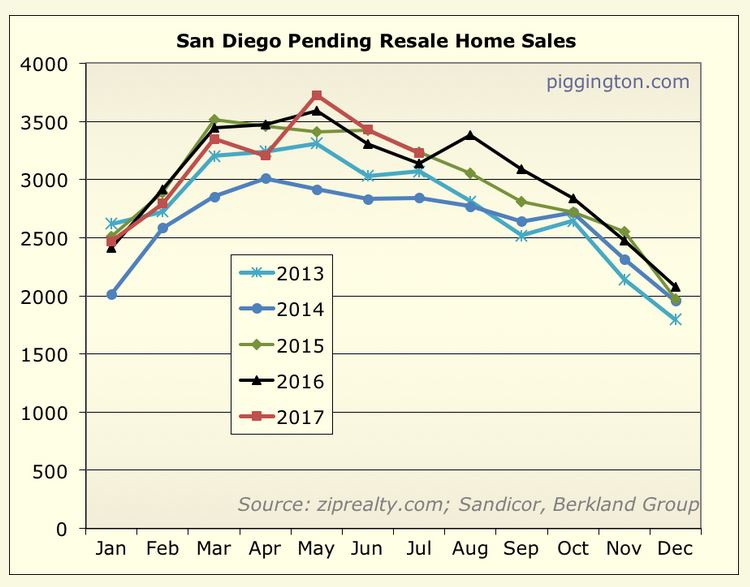

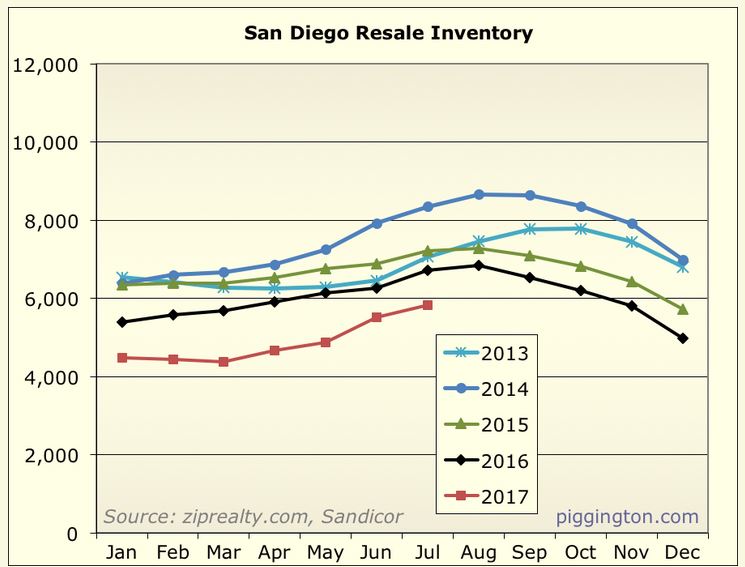

Rich has his latest report on the San Diego stats:

https://piggington.com/july_2017_housing_data_chartsngraphs

In his graph above, you can see that the county has been cooking this summer, with as many pendings as we’ve had in recent years!

In spite of higher pricing, we’ve also had fewer homes to consider. Isn’t it mind-boggling that in a county of more than 3 million people, we’ve had less than 6,000 homes for sale all year?

We’ve been following the weekly new pendings between La Jolla and Carlsbad since 2013, but I haven’t monitored the NSDCC total pendings. Any rise and fall in the total-pendings count would be a precursor to a change in sales count, which would give us a hint of a new trend.

The NSDCC pendings count has been in the 400s over the last few months, so as summer winds up, these numbers aren’t surprising:

NSDCC Total Pendings today: 373

NSDCC Pendings, 20+ Days: 194

The houses that are still pending after 20 days have probably released their contingencies, and are on their way to the finish line. I will keep track of them from now on to see if the trend reveals anything new!

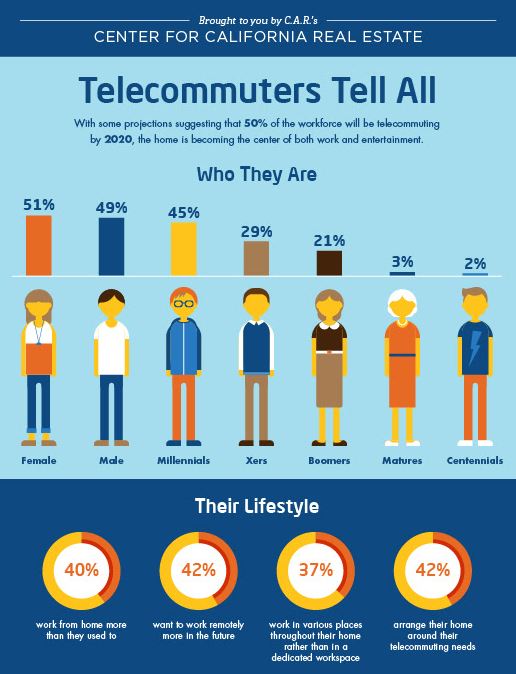

Thinking about the wants and needs of tomorrow’s buyer?

Save your retinas – watch the eclipse on Twitter!

https://twitter.com/i/live/885053575251939328?ref_src=twsrc%5Eemail%7Ctwcamp%5ESolarEclipse

Another good week for new pendings, and we’re running at roughly the same pace as last year:

| Week | ||

| Jul 24 | ||

| Jul 31 | ||

| Aug 7 | ||

| Aug 14 | ||

| Aug 21 |

We’ve had the quandary of the high-end market being bloated for years, while the lower-end has been red hot with very little inventory.

But look at this development in less than two months:

The UNDER-$800,000 Market:

| Date | ||||

| July 3 | ||||

| August 21 |

Stick around, it’s going to be an exciting off-season!

Many thanks to our clients here who were willing to describe the performance of our team on camera, and how they felt about it!

‘Warranty relief’ means that taxpayers will be on the hook.

Freddie Mac announced Friday it is making buying a home a better experience for lender and homebuyers – by cutting the appraiser out of the process.

The company is now offering a new product which will cut the appraisal process out of qualified home purchases and refinances. This could save borrowers an estimated $500 in fees and could reduce closing times by as much as 10 days.

The new Automated Collateral Evaluation assesses the need for a traditional appraisal by using proprietary models and utilizing data from multiple listing services and public records as well as the historical home values in order to determine collateral risks.

“By leveraging big data and advanced analytics, as well as 40+ years of historical data, we’re cutting costs and speeding up the closing process for borrowers,” said David Lowman, Freddie Mac executive vice president of single-family business.

“At the same time, we’re providing immediate collateral representation and warranty relief to lenders,” Lowman said. “This is just one example of how we are reimagining the mortgage process to create a better experience for consumers and lenders.”

Lenders can determine if a property is eligible for ACE by submitting the data through Freddie’s loan product advisor. This will then assess credit, capacity and collateral to determine the quality of the loan. Lenders will receive the risk assessment feedback in real time.

ACE will be available for home purchases beginning on September 1, 2017.

Earlier this summer, the company announced it began using this product on qualified refis beginning June 19, 2017.

“When we launched loan advisor suite in July 2016, we set out to give our customers certainty, usability, reliability and efficiency,” said Andy Higginbotham, senior vice president of strategic delivery and operations for Freddie Mac’s single-family business. “ACE is our most recent capability to deliver on that vision.”

Fannie Mae also updated its policy on appraisals this year, and clarified its “existing policy that allows an unlicensed or uncertified appraiser, or an appraiser trainee to complete the property inspection. When the unlicensed or uncertified appraiser or appraiser trainee completes the property inspection, the supervisory appraiser is not required to also inspect the property.”