Delgres

This is where delta blues meets the Caribbean lament. Deep roots music!

This is where delta blues meets the Caribbean lament. Deep roots music!

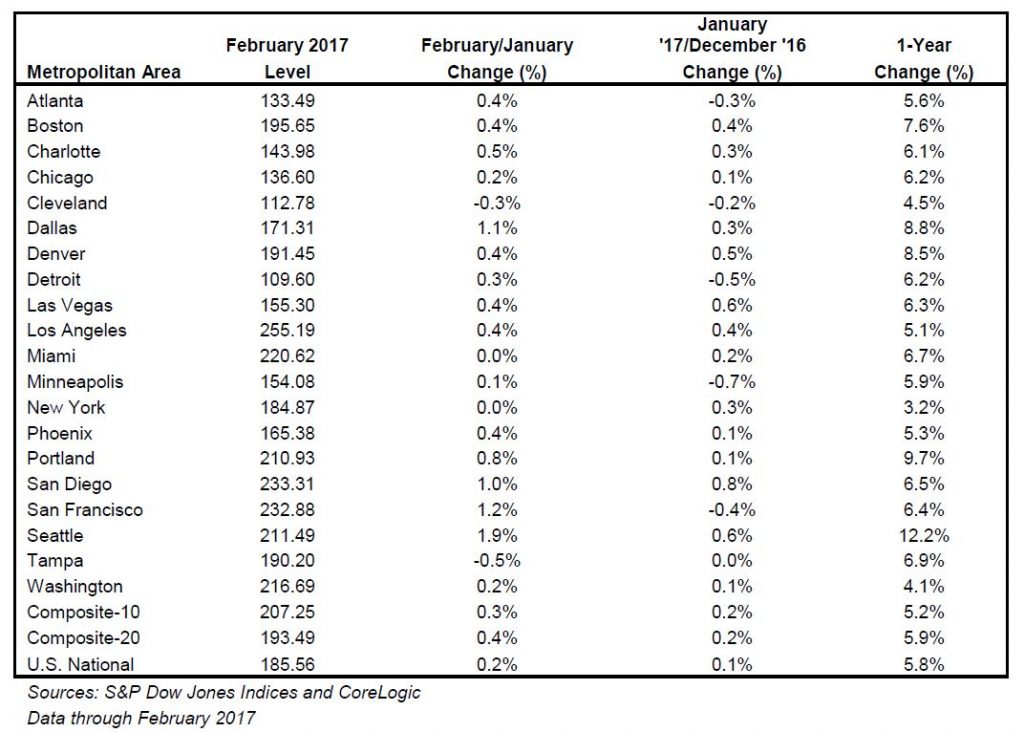

Yesterday it was Seattle that had the highest increase in their Case-Shiller Index, rising 12.2% Y-o-Y. You know that frenzy fever is high when the quotes barely make sense:

Andrea Conway’s home selling story has become the norm for Seattleites. She bought her Ballard home for a little under $500,000 around Easter 2014 and just sold it for more than $750,000

From the time they listed to the time they sold, the Conways, who are moving to California, had multiple offers and closed within a week. Realtors say that is very common right now for Seattle sellers. The buyers paid in all cash.

“Sellers are putting houses on the market, and it’s just normal for things to sell above list price and in some cases well above list price,” John L. Scott Realtor Carl Shaw said. “In a lot of cases, you’re seeing anywhere from four-to-eight, up to 15 or 20 offers on houses.”

The Conways say they may move back to Seattle in a few years, but right now they have decided to leave the city.

“We love it. We love the Seattle vibe, but the real estate market is so hot right now that we’re not comfortable, and we really can’t afford to put our money in this market right now,” Conway said.

She has this advice for buyers.

“Be prepared to spend considerably more than the asking price, especially if it’s in one of the hot neighborhoods like Ballard, or Fremont, or Wallingford, or West Seattle,” Conway said.

Shaw told us that buyers should be prepared to have as much cash ready as possible or have complete loan approvals.

Shaw has been doing this for 28 years and says the only other time when he saw this hot of a job and housing market was in 2006.

“In that market (2006) we had a ton of inventory, we had builders with a ton of inventory, and the difference now is that we have really strong job growth and next to no inventory,” Shaw added.

Next to no inventory is a tough reality for buyers, but for the Conways it is a blessing.

“We’re thankful, and we’ll see what the next adventure holds for us,” Conway said with a smile.

Zillow has another round of high-quality commercials out. It’s amazing that nobody in an industry-leadership position doesn’t try to copy this format – it would seem to be very effective in building long-term loyalty:

I went on the auction mobile app shortly after the auction should have started today, and there wasn’t a trace of any action. On the MLS listing there is no mention of any auction, and it is an active listing, priced at $11,500,000 just like it has been since December 9th.

Did anyone else see or hear of anything?

The clip above from the auction-house’s website shows it being available for offers tonight, so it appears that the postponed auction was actually a dud.

Our reader elbarcosr described what might have happened after the first auction postponed on April 20th:

If we stay on the same pace we’ve had for the first two months of 2017, our local C-S index will rise about 10% this year! Blitzy just kills it with this quote:

David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, said the low stock of existing homes for sale — currently about 3.8 months worth of supply at current sales rates — is bolstering the price increases across the board.

“Housing affordability has declined since 2012 as the pressure of higher prices has been a larger factor than stable to lower mortgage rates,” Blitzer added.

The cities with the biggest annual price gains in February were Seattle, Portland, Oregon and Dallas, according to the groups’ index.

San Diego Non-Seasonally-Adjusted CSI changes:

http://www.cnbc.com/2017/04/24/spring-housing-strongest-sellers-market-ever.html

Spring homebuyers are pounding the pavement at a furious pace, but the pickings are getting ever slimmer.

Even as more homes come on the market for this traditionally popular sales season, they’re flying off fast, with bidding wars par for the course. Home prices have now surpassed their last peak, and at the entry level, where demand is highest, sellers are firmly in the driver’s seat.

“I’ve been selling real estate for 25 years and this is the strongest seller’s market I have ever seen in my entire real estate career,” said David Fogg, a real estate agent with Keller Williams in Burbank, California. “A lot of our sellers are optimistically pricing their homes in today’s market, and I have to say in most cases we’re getting the home sold anyway.

Fogg listed a three-bedroom, two-bathroom, 1,240-square-foot home in Burbank for $789,000 and had three offers before the first open house Sunday. In the Los Angeles-area market, that is considered an entry-level home. The open house drew more than 100 potential buyers, most of them already weary of the competition.

“It’s very tough. Most of the listings are intentionally listed a little low to get a lot of attention, and it’s not uncommon to get 12 to 16 offers on one property,” said Jilbert Mosessian, who has been renting in the neighborhood but wants to buy. “In three properties recently, we did our best, we went considerably over the listing price, and we were told that there were still five people above us and they were only going to deal with them.”

Mosessian said he will have to try another neighborhood and cut his expectations.

Reader Tom had this observation yesterday:

I think the market turned this week. I’m seeing more inventory where I look. I’m seeing more price reductions. I’m seeing houses come on decently priced that aren’t flying off market. I think we will look back in 2 years and see this was the peak month. Downhill from here.

We’re coming off an active spring selling season so far:

NSDCC Detached-Home Sales between March 1 – April 15

| Year | |||

| 2012 | |||

| 2013 | |||

| 2014 | |||

| 2015 | |||

| 2016 | |||

| 2016 |

We might be seeing the real estate tides going out, and the accurate pricing becoming more obvious, which happens this time of year. The over-priced listings start stacking up once we get this far into the selling season (May starts next Monday!).

We also noted last year that the peak time to sell is right now, and that by May 15th the new pendings start to drift off. Could the selling season be closing out earlier this year?

The rest of the selling season is going to be case-by-case. There is a smaller beach house in Oceanside today listed in the low-$700,000s that has so much action that the bids are pushing towards $800,000!

What can sellers do?

Daytrip left this comment:

I think price peaks and drops will be like playing whack-a-mole this season. Take out the noise, and it’ll still be heading up. Quality properties will get good prices.

I agree, but once a house is for sale, it is subject to market forces. Sometimes you just hit a dry spot, and adjusting is more effective than waiting!

A few extra new listings this past week – and it could continue!

We started a run during the last week of April, 2016 where we had 100+ listings in nine out of the next ten weeks. We averaged 70 new pendings per week during the same time frame.

| Week | ||

| Feb 6 | ||

| Feb 13 | ||

| Feb 20 | ||

| Feb 27 | ||

| Mar 6 | ||

| Mar 13 | ||

| Mar 20 | ||

| Mar 27 | ||

| Apr 3 | ||

| Apr 10 | ||

| Apr 17 | ||

| Apr 24 |

All ahead full!

Click on the ‘Read More’ link below for the NSDCC active-inventory data:

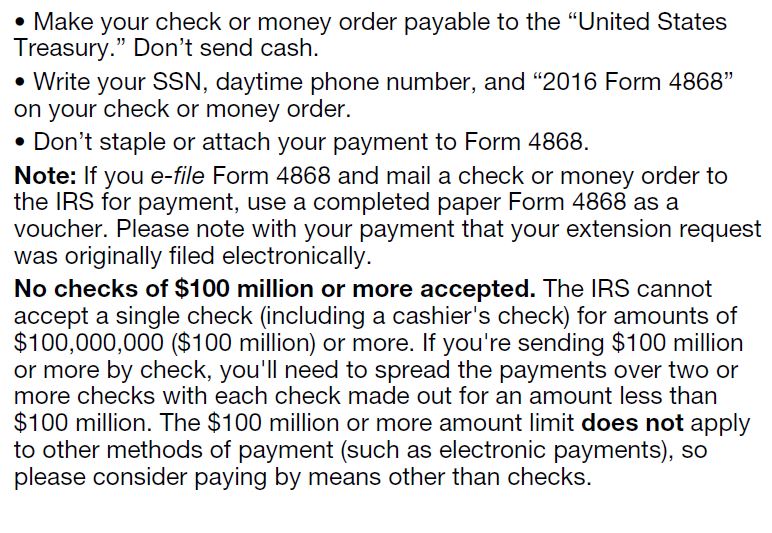

Did you file an extension for your 2016 tax returns, and are trying to buy a house? Have you released your financing contingency yet?

Here’s what you have to do to qualify for a mortgage:

Yes, “Tax Day” has passed, and lenders and investors must consider filed taxes in their underwriting decision. For example, LHFS issued a reminder regarding 4506 transcripts. Loans dispersed on or after April 18th will require the 2015 and 2016 returns or all the following:

Evidence of filing a Tax Extension (IRS Form 4868-Application for Automatic Extension of Time to File U.S. Individual Income Tax Return) filed with the IRS; Tax liability reported must be compared to the borrower’s tax liability for the previous 2 years as a measure of income source stability & continuance. An estimated tax liability that is inconsistent with previous years may make it necessary to require the current years return to proceed. IRS Form 4506-T Transcripts confirming “No transcript available” for the applicable tax year; and Returns for the prior two years.

If you owe additional taxes and sent in an amount with your extension, don’t be surprised if your lender will want to see evidence of that too. Also note:

If you are sending in $100 million or more in taxes, I’ll be happy to drive your money to the post office!

The inventory is a deserted island. Houses in SW Carlsbad that we thought were $1,000,000 just 6-9 months ago are now listed for $1,200,000-ish. What’s worse for buyers is that there is no hope it will change, and now this:

We all know the story. He wants 10 mil + and there aren’t any takers. If you open the bidding and there are no bids, is it really an auction?

Until we get to a point where sellers will commit to a reasonable opening bid with no reserve, auctions will remain a gimmick or a small refuge of the uber-houses. Problem is the opening bid needs to be below ‘perceived’ market value to generate the buzz and most sellers aren’t willing to do that.

But it was George T. that guessed specifically on the afternoon of April 20th that the auction would fail:

JtR: I am guessing it might not have a deal – a failed auction. George T

Pending any other evidence to the contrary, George is the winner of the Padres tickets! Congratulations George – great guess!

This doesn’t look good for the auction house either. If they are going to be advertising no-reserve auctions – which they did in this case – then they need to let ’em fly and the sellers need to bite the bullet.