Open House Report

A lively day at open house in Carmel Valley, the hotbed of San Diego real estate. A flood of lookers, but as of Saturday night, no written offers…yet. Open house 12-3 on Sunday!

Party Palace

http://la.curbed.com/2016/11/18/13680508/mansion-rentals-house-parties-ordinance-airbnb

There are a lot of headaches that come with homeownership in Los Angeles, property values, repairs, whether or not your neighbors are a German millionaire couple who have made it their stated goal to show LA “what it means to make party.” (It involves bikinis and caged lions).

Extravagant parties in once quiet (and wealthy) neighborhoods are becoming a lot more popular now that party planners and real estate agents have short-term rental websites such as Airbnb at their disposal. BizBash, an online resource for party and event planning professionals, has seen a 60 percent increase in searches for private homes and mansions on its venue directory, according to The Real Deal.

The real estate news website says party hosts shelling out sums ranging from $20,000 to $500,000 to throw weekend soirées in some of LA’s most lavish houses.

The problem is apparently so widespread, the Los Angeles City Council is weighing in. It has asked the City Attorney to draft an ordinance that would punish partying tenants and homeowners. The Real Deal says impending ordinance has some homeowners, event planners, and realtors concerned.

Along with this increased demand for party rentals, companies such as Along Came Mary have sprouted up to assist in event production. For a fee, it will find a willing homeowner and negotiate a rental price, set the menu, take care of all the small details, and clean up the place when it’s done. One recent Along Came Mary event for the Hallmark Channel came with a price tag of $45,000 for three days.

Yes, corporate entities are also using private homes as branding opportunities.

And, it’s not just brand awareness that party hosts are after. Sometimes parties are thrown for the house itself. Instead of a boring open house, big bashes are thrown to show off newly listed homes.

Luxury realtor Michelle Oliver tells The Real Deal that for some clients, she’ll “hold a special invitation-only event at a mansion I am selling, with catering and valet parking.” To get even more exposure for the home, Oliver will even “partner with a high-end magazine and media for targeted coverage.”

The City Council’s new party ordinance was probably aimed at preventing neighborhoods from having to look at “strippers dancing on kitchen countertops,” but they may have picked a fight with big business instead.

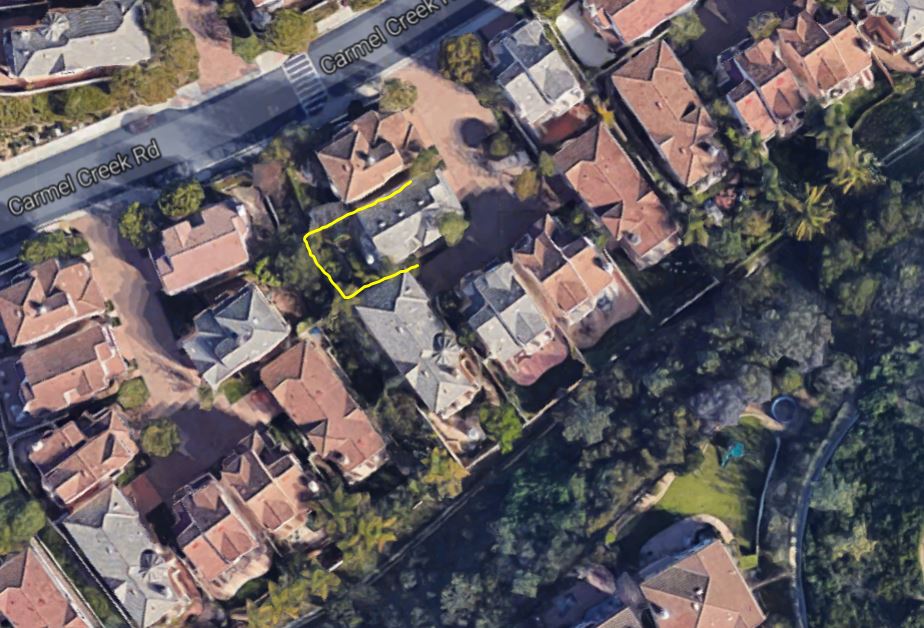

Carmel Valley New Listing

Holy cow – only $729,000 for a spectacular detached-home in gated Trilogy!

This is one of the premium locations high up the hill and away from road noise. The kitchen has been updated with new stove, refrigerator, dishwasher and backsplash, plus there is new carpet, new paint inside and out, hardwood floors, and the backyard is a tropical oasis with privacy!

Located in the coveted Del Mar school district too – where the least-expensive detached home for sale today is $899,000 – WOW! Close to the I-5 Bypass/Carmel Mountain Rd. exit – skip the traffic jams – and only 3 miles to the beautiful Torrey Pines State Beach!

http://www.zillow.com/homedetails/11311-Carmel-Creek-Rd-San-Diego-CA-92130/16777923_zpid/

Open 12-3pm Saturday and Sunday!

Trump Effect on Real Estate

What is the consensus on the Trump impact on our local real estate market?

After speaking to agents on broker preview the last couple of days, I think we can divide the buyer pool into two camps:

- There have never been more reasons to wait-and-see.

- But some buyers will want to hurry it up, before anything else happens.

Yellen made it sound like the next Fed move is imminent, which hopefully means next month. There is 1/4% (or more) already baked into the market, so if they do bump the Fed Funds rate, it should have a calming effect on mortgage rates – it did last time. If we can stay around the current 4%, it should motivate people to buy before it goes higher.

But there is also the anxiety that comes with buying or selling that gets aggravated by uncertainty. Have you ever felt more desire to hunker down?? The motivated buyers and sellers want to get it done.

I think we will see a very active selling season – and it already is!

NSDCC October Sales and Pricing

| Year | |||

| 2012 | |||

| 2013 | |||

| 2014 | |||

| 2015 | |||

| 2016 |

Our current momentum should carry us well into 2017. But look at the stumble in 2014 – I’m more worried about 2018.

Leon Russell, R.I.P.

We lost the great Leon Russell this week. Watch his Rock and Roll Hall of Fame induction speech for an incredible tribute:

Floating Homes

More on new housing alternatives, primarily suited for the younger folks:

Argh, matey! A new trend in housing is afloat in Denmark, with college students from Copenhagen solving their cash-strapped housing woes with a series of floating apartments.

The Copenhagen-based housing startup Urban Rigger designed a series of low-cost modular housing to float in Copenhagen’s urban harbors. At only $600 a month (a real deal in the trendy city), these shared living spaces provide students with a private bedroom, bathroom and kitchen.

Built with the help of Danish architecture firm Bjarke Ingels, each unit—crafted from modular shipping containers—can house up to 12 students. The spaces also include community gardens, kayak landings, bathing platforms, and outdoor cooking areas—and who wouldn’t want to attend a college rager on a boat?

Read full article here:

http://blog.rismedia.com/2016/rad-floating-units-solve-student-housing-issues-in-denmark/

Luxury Bunker

Worried that the end is near? How about a bunker! H/T daytrip:

DALLAS (CBSDFW.COM/AP) — Some upper-income Texans are headed down below, not Australia, but below the surface.

An investor group is planning for a doomsday scenario by building a $300 million luxury community replete with underground homes. There will also be air-lock blast doors designed for people worried about a dirty bomb or other disaster and off-grid energy and water production.

The development, called Trident Lakes, is northeast of Dallas.

Are Rising Rates A Problem?

Are rising rates that big of a deal?

Maybe – and only if they mess with the buyers’ psychology.

We have been spoiled with rates in the mid-3s for the last six months – including jumbos – and our local market has been cooking. Buyers have been hoping for any break, but if they find the right house at a decent price, will an extra 1/2% on rate stop them?

Probably not – we are lucky to live in a very affluent area, where the majority of houses sell for more than $1,000,000:

NSDCC Detached-Home Sales, Jan-Oct

| Year | ||||

| 2012 | ||||

| 2013 | ||||

| 2014 | ||||

| 2015 | ||||

| 2016 |

Some buyers will dig in just on principle – if they have to pay a higher rate, logically the seller should be more flexible on price. But if the right house is found, and wifey kicks you in the shins and says ‘buy the house’, the extra half-point isn’t going to matter.

Especially in these areas:

Percentage of Detached-Home Sales Over $1M, Jan-Oct, 2016:

La Jolla, 92037 = 97%

Del Mar, 92014 = 97%

RSF, 92067 = 100%

Chinese Demand Accelerating?

More optimism about Chinese buyers purchasing overseas:

Welcome to ground zero for the world’s largest cross-border residential property boom. Motivated by a weakening yuan, surging domestic housing costs and the desire to secure offshore footholds, Chinese citizens are snapping up overseas homes at an accelerating pace. They’re also venturing further afield than ever before, spreading beyond the likes of Sydney and Vancouver to lower-priced markets including Houston, Thailand’s Pattaya Beach and Malaysia’s Johor Bahru.

The buying spree has defied Chinese government efforts to restrict capital outflows and shows little sign of slowing after an estimated $15 billion of overseas real estate purchases in the first half. For cities in the cross-hairs, the challenge is to balance the economic benefits of Chinese demand against the risk that rising home prices spur a public backlash.

“The Chinese have managed to accumulate very large amounts of wealth, and the opportunities to deploy that capital in their own market are somewhat restricted,” said Richard Barkham, the London-based chief global economist at CBRE Group Inc., the world’s largest commercial property brokerage. “China has more than a billion people. Personally, I think we have just seen a trickle.”

“Properties in Shanghai are ridiculously expensive,” Chen Feng, 38, said as he evaluated prospects at a property fair in Shanghai in September, lured by television commercials for the event the night before. “With the amount of money it takes to buy a small apartment here, I can buy a building of apartments in many places in the world.”