The Dandy Warhols

The Dandy Warhols performed in bars throughout Portland and became well known for their nudity-filled live shows in the 1990’s:

The Dandy Warhols performed in bars throughout Portland and became well known for their nudity-filled live shows in the 1990’s:

Some degree of luck is involved on every sale.

We have already closed 202 NSDCC sales this month, which is the most November sales since 2012 – and we still have 349 sales pending!

Pending home sales eked out a 0.1 percent gain in October. The National Association of Realtors® said its Pending Home Sales Index (PHSI) barely managed a second straight month of gains, rising to 110.0 from a downwardly revised 109.9 in September (the previous reading was 110.0, which would have made today’s reading “unchanged,” officially). Even though NAR’s chief economist Lawrence Yun called the increase “minuscule,” it still pushed the index to its highest level since last July. The index was also 1.8 percent higher than In October 2015 when it stood at 108.1.

The PHSI is a forward-looking indicator based on contracts for home purchases. Those signed contracts are generally expected to become closed transactions within two months.

Yun said, “Most of the country last month saw at least a small increase in contract signings and more notably, activity in all four major regions is up from a year ago. Despite limited listings and steadfast price growth that’s now carried into the fall, buyer demand has remained strong because of the consistently reliable job creation in a majority of metro areas.”

Regarding the continuing limited housing supply, Yun explained that the unwelcome but expected seasonal retreat in new listings is arriving at a time when price growth remains around triple the pace of wages and properties continue to sell at a much faster pace than a year ago. As an indication of the imbalance between supply and demand, 40 percent of sales in October sold at or above list price, an increase from 33 percent a year earlier.

“Many of the successful shoppers in October likely had to move fast and outbid others for the few listings available in the affordable price range,” explained Yun. “Those obtaining a mortgage last month were likely the last group of buyers to lock in a rate near historically low levels now that rates have marched to around 4 percent since the election.”

Read full article here:

http://www.mortgagenewsdaily.com/11302016_pending_home_sales.asp

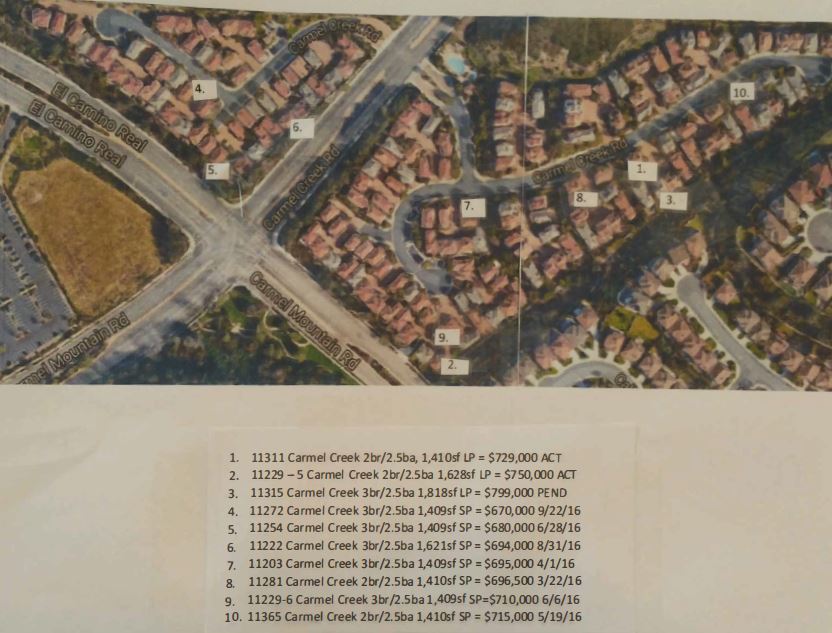

We did open escrow before Thanksgiving on the sale of the two-bedroom home in Trilogy 2 in Carmel Valley.

The MLS entry had been on Friday morning, with open house scheduled for 12-3 on Saturday and Sunday. The weather was somewhat overcast, it is a gated community, and it was the week before Thanksgiving – how many would attend?

Being the least-expensive detached-home in the whole zip code probably drove the activity, and we had parades of people both days. By Tuesday, I had received seven written offers!

Here are my notes:

If I had a chance to do it over, for easier reading I would group 1,3,7,8,10 as the more-valid comps, and those with street noise (2,4,5,6,9) as the inferior group.

3. We issued requests to every buyer for their highest-and-best offer, which helps to make it a fair race – the early offerors may not have known how competitive it is, and they deserve a chance to re-bid. Another benefit of requesting highest-and-best offers is that it buys time for other buyers to get in the game. In this case, the winner saw the house on Monday, and made offer right away.

4. I was working the phones all weekend, so once we opened escrow on Tuesday, I thought the action might die down. But I got another handful of calls from people who saw a rental ad in Craigslist – and it’s not the first time it’s has happened. Somebody took my pro photos and remarks off my listing and created a Craigslist rental ad for $1,975 per month, which is well under market. It is a scam that has been running for years – the guy on the phone tries to convince people that the rent is so attractive that you won’t mind sending the first and last month’s rent to a faraway address and wait by your mailbox for the keys. But they never come.

I notified Craigslist immediately, and they are quick to take these scam ads down, but you feel sorry for anyone who gets duped.

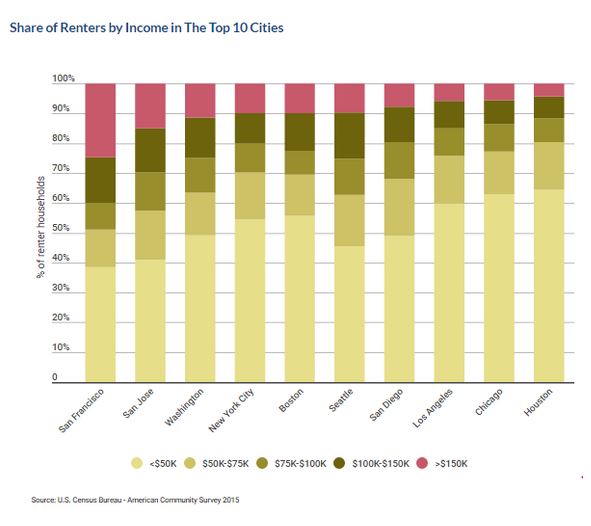

The good doctor pointed out that there are more high-paid renters in San Francisco than homeowners now:

http://www.doctorhousingbubble.com/wealthy-renter-households-in-san-francisco-outnumber-owners/

The graph shows 20% of renters in San Diego are making more than $100,000 per year – are those the people you see at open houses every weekend, hoping to find the right house at the right price? Certainly a portion of those renters are in the hunt, which should keep the market going for now.

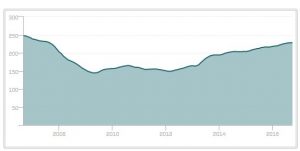

Our local Case-Shiller Index has slowed down considerably, rising just 1.3% over the last five readings. The September reading rose 0.057% – be prepared for an occasional negative reading from now on.

“The housing market has been favoring sellers for the past few years,” said Zillow Chief Economist Dr. Svenja Gudell. “Sellers in the current housing landscape often have the luxury of listing their home ‘as-is’ without fixing it up or with only minimal window-dressing since demand for homes has been high and inventory low. It’s common for sellers to receive multiple bids, and in the hottest markets, sell for over asking price, but these conditions will change in the future.”

The supply of homes for sale is still very tight, with six percent fewer listings in October than October of 2015 nationally, according to Zillow. Among the nation’s largest metropolitan housing markets, Boston, Indianapolis and Kansas City showed the biggest drop in inventory. In Boston there are 26 percent fewer homes for sale than there were a year ago, and 24 percent fewer in Indianapolis. Gudell predicts, however, that supply will slowly increase and home value appreciation will slow.

“We expect the market to meaningfully swing in favor of buyers within the next two to three years,” she said.

Here are the recent San Diego Non-Seasonally-Adjusted CSI changes:

| Month | |||

| December | |||

| January ’15 | |||

| February | |||

| March | |||

| April | |||

| May | |||

| June | |||

| July | |||

| August | |||

| September | |||

| October | |||

| November | |||

| December | |||

| January ’16 | |||

| February | |||

| March | |||

| April | |||

| May | |||

| June | |||

| July | |||

| August | |||

| September |

The highest reading of the San Diego NSA CSI was 250.34 in November, 2005.

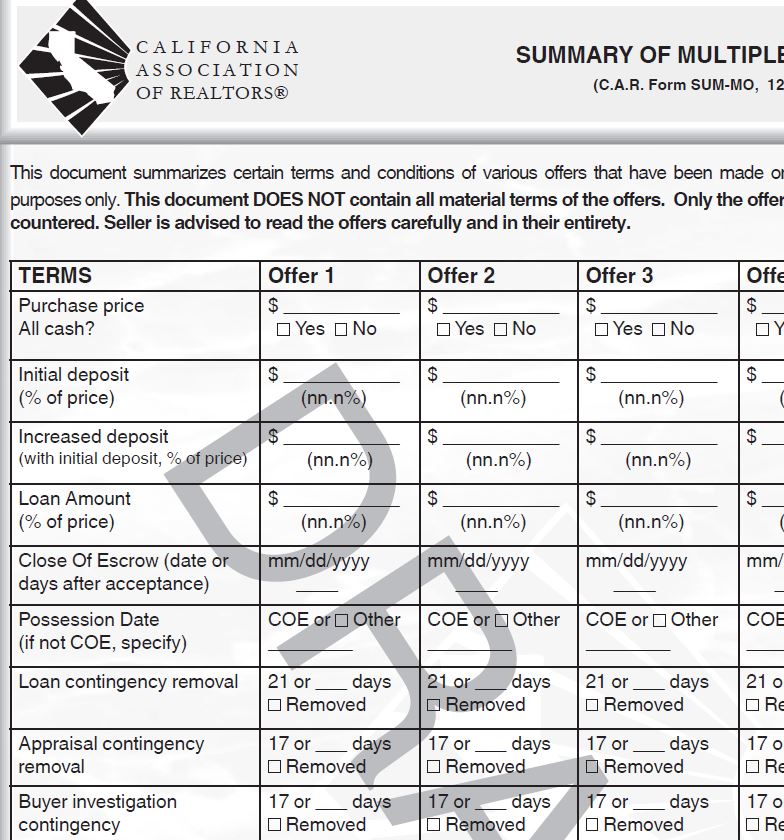

Have you ever been frustrated with a bidding war?

Don’t despair – we have a new form!

I hope every broker has been using some version of this for the last 6-7 years.

What struck me was how this could perpetuate the belief that all we do is fill out forms. Ask what your potential listing agent does besides the paperwork – because salesmanship is what gets top dollar.

Here’s what I do for my sellers:

Salesmanship is pursuing the desired result – top dollar. Not taking orders.

It’s that time again – experts making predictions for next year!

We might as well start with the big kahuna, whose predictions are a tad vague:

Here is Zillow’s look ahead at the 2017 housing market:

Zillow’s 2017 Predictions

Statement from Zillow Chief Economist Dr. Svenja Gudell:

“There are pros and cons to both existing homes and new construction, and the choice for home buyers can often be difficult. For those considering new construction in 2017, it’s worth considering the added cost that may come amidst ongoing construction labor shortages that could get worse if President-elect Trump follows through on his hard-line stances on immigration and immigrant labor. A shortage of construction workers as a result may force builders to pay higher wages, costs which are likely to get passed on to buyers in the form of higher new home prices.

“Those looking for more affordable housing options will be pushed to areas farther away from good transit options, in turn leading more Americans to drive to work.

“Renters should have an easier time in 2017. Income growth and slowing rent appreciation will combine to make renting more affordable than it has been for the past two years.”

Here are their 2016 predictions from a year ago (+3.5% was the guess by the 100+ experts, and the actual was +4.8% according to the above):

https://www.bubbleinfo.com/2015/12/23/zillow-2016-predictions/

The Inventory Watch started the last week of November in 2013.

Here is how the La Jolla-to-Carlsbad market has fared:

Last Week of November

| Under $800,000 | ||||

| 2013 | ||||

| 2014 | ||||

| 2015 | ||||

| 2016 |

| $800,000 – $1.4M | ||||

| 2013 | ||||

| 2014 | ||||

| 2015 | ||||

| 2016 |

| $1.40M – $2.40M | ||||

| 2013 | ||||

| 2014 | ||||

| 2015 | ||||

| 2016 |

Once you get over $1,000,000, it’s been steady/flat.

But look how the $800,000 – $1,400,000 category has dropped in numbers, just like the Under-$800,000 range has done. Fewer and fewer people are willing to sell for less.

The inventory over $2,400,000 has risen from 340 active listings in November, 2013 to 415 houses for sale today, which is a 22% increase.

Click on the ‘Read More’ link below for the NSDCC active-inventory data:

Unfortunately for the sellers of view homes, the local marine layer tends to impact the prime selling season. Buyers would much rather see the view with their own two eyes, rather than rely on photos!

https://en.wikipedia.org/wiki/June_Gloom