by Jim the Realtor | Aug 23, 2016 | Jim's Take on the Market, Market Conditions |

Dogs are people too! A few examples of how dogs influence real estate decisions. H/T to daytrip:

http://www.nytimes.com/2016/08/21/realestate/when-the-dog-decides-where-you-live.html?_r=0

Two excerpts:

“These are people who have a great deal of empathy,” Dr. Kagle said, “so they worry about their pets as they would worry about another human being — though some have been known to carry it to extremes.”

That group might well include the couple whose elderly dog had a pet peeve about being stuck in New York traffic. “They had a weekend house and they wanted their primary residence to be close to the F.D.R. so they could get out of town quickly for the sake of the dog, because otherwise he would get very stressed,” said Barbara J. Dervan, an associate broker at Fox Residential Group. The solution: an apartment on East End Avenue.

Three years ago, when Mr. Saville, 39, a marketing manager at Pernod Ricard U.S.A., the wine and spirits company, moved to New York from Miami, he knew what he wanted: a walk-up, preferably in a brownstone; failing that, an apartment on a high floor with a grand view of the city. Dreams, dreams, idle dreams. None of this was going to work for Wesley, Mr. Saville’s harlequin Great Dane. Climbing stairs would have been tough on Wesley’s legs, so an elevator building was a must. But an apartment high in the sky, Mr. Saville’s preference, wouldn’t have served Wesley’s needs, either.

“I wouldn’t say I’m ruled by my dog, but I have to give up a certain number of things because of him,” Mr. Saville said. Despite his own preferences for an eyeful of cityscape and sky, he looked for a vacancy on the lowest floor available.

“Elevators can stop at every floor and when there’s an emergency and Wesley’s got to go, being able to get out of the building quickly was important.” Also important: a bedroom large enough to accommodate a California king bed — another Wesley-driven necessity, because the dog bunks down with Mr. Saville. Oh, and the apartment had to have a washer and dryer. It seems that Wesley sheds.

Read full article here:

http://www.nytimes.com/2016/08/21/realestate/when-the-dog-decides-where-you-live.html?_r=0

by Jim the Realtor | Aug 22, 2016 | Forecasts, Jim's Take on the Market, Market Buzz, Market Conditions, Zillow |

Zillow is the latest to suggest that the ‘market’ might be slowing.

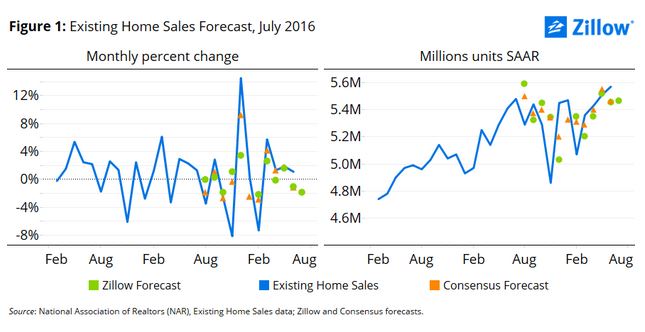

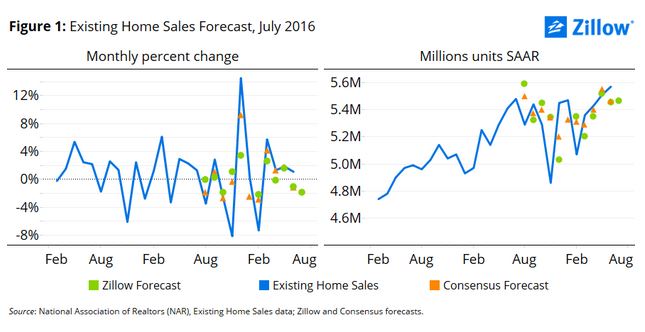

But looking at their own graph, it looks like the monthly percent change begins to decline every year at the end of summer. The second graph also shows that sales are at a new peak – if it fell off a bit we should still be fine.

But all that matters is what readers glean from the headlines and a quick scan.

Maybe it’s just a seasonal thing. This guy was spewing doomer talk in 2014!

http://www.marketwatch.com/story/this-house-market-is-falling-apart-2014-08-26

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

From Zillow:

http://www.zillow.com/research/2016-july-home-sales-forecast-13087/

- Zillow expects existing home sales to fall 1.9 percent in July from June, to 5.46 million units at a seasonally adjusted annual rate (SAAR), ending a string of four consecutive monthly gains.

- New home sales should fall 6.65 percent to 553,000 units (SAAR) after a stronger than expected June.

- Given the recent string of home sales beating forecasts, we view risks to the upside and would not be surprised if results are slightly stronger than we expect.

Thus far, it has been a pretty sweet ‘16 for home sales. But according to our July home sales forecast, the party looks like it could be coming to an end, at least temporarily and especially for sales of existing homes that must eventually face the harsh reality of tight inventory and rising prices.

Despite tight inventory, existing home sales have been surprisingly buoyant lately, beating or meeting expectations in each of the four months from March to June. We expect that streak to end in July. If nothing else, the odds that home sales continue to rise are increasingly dim. Since the series began in February 1999, runs of five months or more of consecutive monthly gains have only occurred five times – and only one of those streaks lasted six consecutive months or more.[1]

Shifting seasonal patterns may be behind some of this apparent resiliency. By some reports, the height of the home shopping season – historically most concentrated during the summer months – shifted earlier this year as buyers sought to get ahead of the competition. But sooner or later, tight supply and rising prices should take their toll.

Our forecast for existing home sales points to a 1.9 percent decline from June to 5.46 million units at a seasonally adjusted annual rate (SAAR) (figure 1). This would place existing home sales down 0.3 percent compared to a year earlier.

Read full report here:

http://www.zillow.com/research/2016-july-home-sales-forecast-13087/

Save

by Jim the Realtor | Aug 22, 2016 | Inventory, Jim's Take on the Market

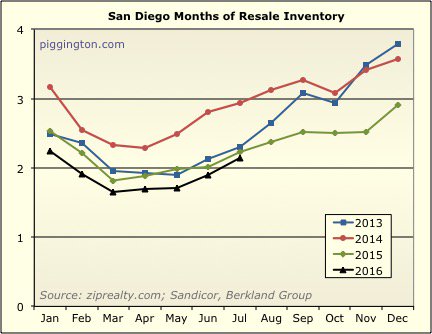

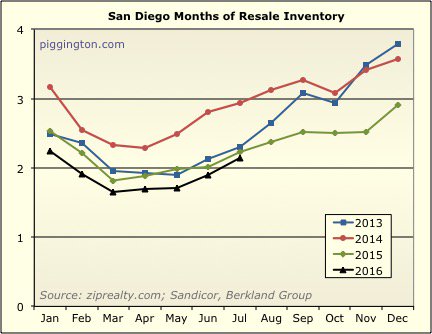

There has been more hubbub about the market changing, but around San Diego, the stats look solid and remarkably similar to previous years. Our NSDCC new pendings are staying in a tight range – in the 60s for the last six weeks straight, and generally the inventory is in check – no explosions.

Rich’s additional qualifier of dividing the inventory by the number of sales to determine the “months’ of resale inventory” here helps to show how sales are holding up too:

Click on the ‘Read More’ link below for the NSDCC active-inventory data:

(more…)

by Jim the Realtor | Aug 21, 2016 | Jim's Take on the Market, Real Estate Investing |

If you’re closing in on retirement, trying to put your money to work in a zero interest rate world is not an easy job. Financial writers and gurus are obsessed with the stock and bond markets. But despite the lack of attention, many Americans have fallen in love with real estate as an investment option.

- 28 million Americans are real estate investors (according to data shared by Landlordstation.com in 2013)

- 35% of Americans now believe real estate is the best long-term investment (Gallup), compared to 32% who favor stocks

- Stock ownership is at a low point: Just over 50% of Americans have money invested in the stock market (Gallup)

Americans may believe in real estate, but they don’t necessarily do anything about it when it comes to retirement. Real estate plays only a minor role in most people’s retirement portfolios, according to USA Today, and there are three good reasons.

- Liquidity. Stocks and bonds are much easier to buy and sell.

- Fear of bubbles. Many investors (and homeowners too) were traumatized by the credit crisis of 2008 and 2009 when the U.S. housing bubble burst.

- Too complicated. Investing in real estate can seem very complex because there are multiple ways to own real estate.

Most financial advisors lean heavily on the stock market for retirement for these reasons. Then there’s the not unimportant fact that stock investors have seen massive gains over the past five years.

The issue is what will happen in the next five years and beyond. There are now big questions about how long the bull market will last, and fixed-income investments are paying less and less. All are good reasons to consider what role real estate could play in your retirement portfolio.

Read full article here:

http://www.investopedia.com/news/real-estate-your-retirements-secret-weapon/

by Jim the Realtor | Aug 20, 2016 | Jim's Take on the Market, Staging |

This might work at the entry level, but higher-priced homes deserve the full treatment:

Pop-up staging, a new, inexpensive method that can eliminate the cost of not only hiring a stager, but also renting, transporting and storing décor and furniture. Flat-pack pieces made of lightweight materials like cardboard and corrugated plastic “pop up” in each room, effectively setting the scene as real housewares (and stage productions!) would.

One pop-up sets provider, Dandy Pack, purveys slip-covered cardboard furniture sturdy enough to withstand 1,000-plus pounds without collapsing. The company’s starter kit, which includes a full/queen bed, a sofa, an oversized chair and an ottoman, costs $1,031. The pieces, which ship in as few as two business days, can be assembled by the listing agent or the seller, further controlling costs.

http://blog.rismedia.com/2016/set-selling-scene-pop-staging/

by Jim the Realtor | Aug 19, 2016 | Bubbleinfo Readers, Jim's Take on the Market, Local Government |

An interesting case underway in Santa Ana over whether oceanfront property owners have the right to protect their property. According to PLF attorney (and good friend) Larry Salzman, it was a good day in court yesterday:

by Jim the Realtor | Aug 19, 2016 | Jim's Take on the Market, The Future |

How much longer before we see cannabis in our listings?

A horse in a kitchen. A dog posing in the bathtub. A blowup doll in clothes sprawled out on the floor. A basement S&M dungeon. Nude photographs decorating walls, and stripper poles. Estately has seen a lot in the listings on its real estate website.

Yet, the index for homes from the Multiple Listing Service (MLS) found a recent house listing in Portland, with its visible marijuana plants, especially “hilarious.” It’s right in the middle of the City of Portland.

“At first I thought, ‘Oh, no! Oh, my goodness please don’t let that be the wacky tobacky that I was warned about,” Ryan Nickum, Estately marketing manager, said. “‘Please don’t allow this to be the evil marijuana lurking in this wholesome family home?’”

But, then, he remembered that it’s the year 2016 and it’s actually quite legal for Oregon homeowners to possess a handful of pot plants. “So it’s really not unlike coming across someone’s home brew operation,” he noted.

Estately has seen marijuana related items in its listings before. “We’ve seen bongs on shelves or tables occasionally in photos of homes for sale, and we’ve definitely seen some sizable greenhouses that hinted at marijuana production, but only recently have we seen actual plants appearing in listings,” Mr. Nickum said.

Not much has changed for Estately since recreational marijuana became legal in the states of Washington and Oregon – except the website did add a ‘Weed Score’ feature to its real estate search options, which would allow home buyers to see how close homes for sale are from dispensaries and other businesses that would be of use to cannabis enthusiasts.

Estately operates in numerous states, including Washington, Oregon, where medical or recreational marijuana is legal. Mr. Nickum thinks the marijuana plants in the photos could even be a selling point of the properties.

“The fact that the real estate agent didn’t remove the plants and even prominently photographed them would lead one to believe that some sizable pot plants in the yard are a selling point for the house,” Mr. Nickum said. “And that’s really no surprise because we’re talking about Oregon here, a state where real estate agents frequently price houses at $420,000.”

Mr. Nickum’s only concern is neighbors climbing the fence to help themselves to the plants. “And I’m sure potential buyers will want to know whether the plants will still be there when they buy the house. It could turn into a negotiating tool. ‘We’d be willing to waive the home inspection in exchange for leaving the landscaping in the backyard.’”

https://www.merryjane.com/news/marijuana-gardens-becoming-a-real-estate-selling-point-in-recreational-states

Save

by Jim the Realtor | Aug 18, 2016 | Foreclosures, Jim's Take on the Market, Short Sales, Short Selling |

California used to lead the nation in exempting mortgage-debt relief from taxation. But the latest extension of that law was defeated, leaving short-sellers and those being foreclosed in a prickly position – do they hang in there now?

The reason the bill died is because Jerry Brown and other state politicians want to reap the additional tax – but these beleaguered folks can’t or won’t pay it and will have to hang on to their over-encumbered properties.

Senate Bill 907, which had won unanimous approval of the state Senate, died in just a few seconds last week, and that angers Peggy Spatz.

She and her husband, George, took out a $150,000 second mortgage on their modest suburban Sacramento home 11 years ago, only to see home values and their retirement investments crash in the Great Recession that struck shortly thereafter.

They, like millions of other Californians with underwater homes, eventually negotiated a settlement with their lender to write down the loan, only to learn that the canceled debt was what’s called “a taxable event.”

Congress had declared that loan write-downs, short sales and other forms of mortgage relief would be free of federal income taxes. The California Legislature and then-Gov. Arnold Schwarzenegger followed suit for several years, extending relief through 2013.

However, when Jerry Brown returned to the governorship, facing an immense budget deficit, he refused to continue the tax exemption for any relief actions since 2013, last year vetoing a bill that would have added two years to the window. It created, a Senate staff analysis said, “a fine mess.”

Brown said the state budget “has remained precariously balanced (and) I cannot support providing additional credits that will make balancing the state’s budget even more difficult.”

SB 907, carried by Sen. Cathleen Galgiani, D-Manteca, would have extended the tax break through 2016. She represents a region hardest hit by the housing meltdown and during one hearing cited her own underwater mortgage.

“Many years later, it still isn’t worth what I paid for it,” said Galgiani, adding that many Californians are in the same situation and “for us to hit them a second time is unconscionable.”

The Spatzes hoped that with the Senate’s passage and a heavyweight list of supporters, including Attorney General Kamala Harris and real estate and banking lobbies, it would at least get to Brown’s desk.

In anticipation, they wrote a letter to Brown, laying out their experience and concluding, “This letter is written by two people, but there are hundreds of thousands of us. Please don’t turn your back on us.”

SB 907 never made it to Brown. Although it also won unanimous support in the Assembly Revenue and Taxation Committee, it was placed on the Assembly Appropriation Committee’s “suspense file” because of its cost – an estimated $95 million in lost revenue during its first year and $57 million in the next two years.

Last week, the appropriations chairwoman, Lorena Gonzalez, announced the fate of dozens of Senate bills, spending just a few seconds on each. SB 907, she said, would not be sent to the Assembly floor.

As is the custom, no reason for its demise was offered. But it probably had something to do with its heavy cost, more than 10 percent of the total for bills on the suspense file, and the strong likelihood that Brown would have vetoed it, as he had done in 2015.

“The thing that breaks my heart is that people aren’t marching in the street,” Peggy Spatz said after learning of Gonzalez’s decree. “I’m a bitter person at this point.”

http://www.sacbee.com/news/politics-government/politics-columns-blogs/dan-walters/article95999242.html

by Jim the Realtor | Aug 18, 2016 | Jim's Take on the Market, Sales and Price Check

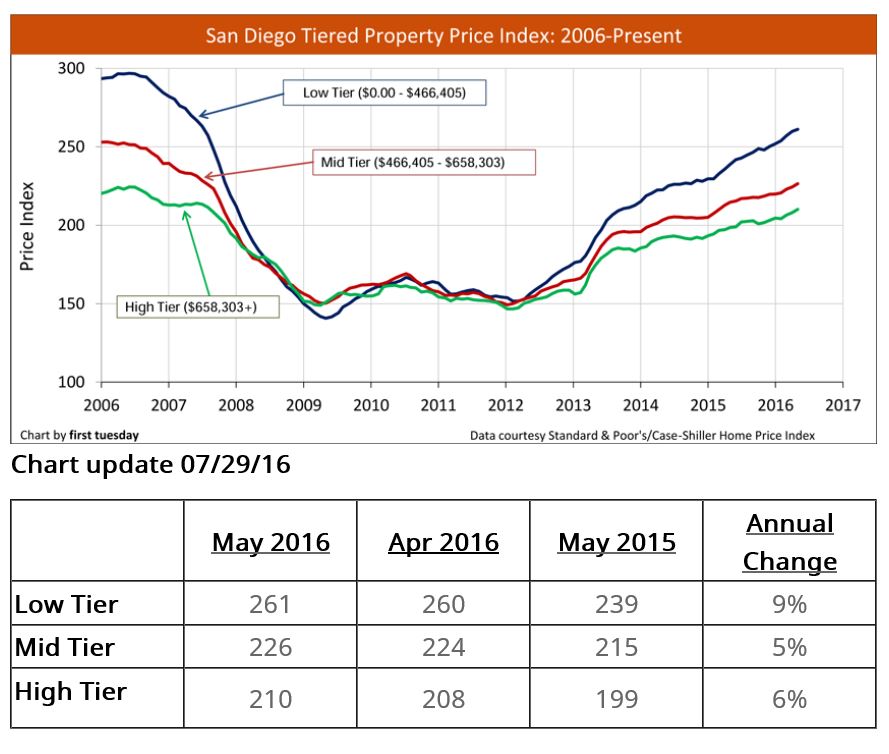

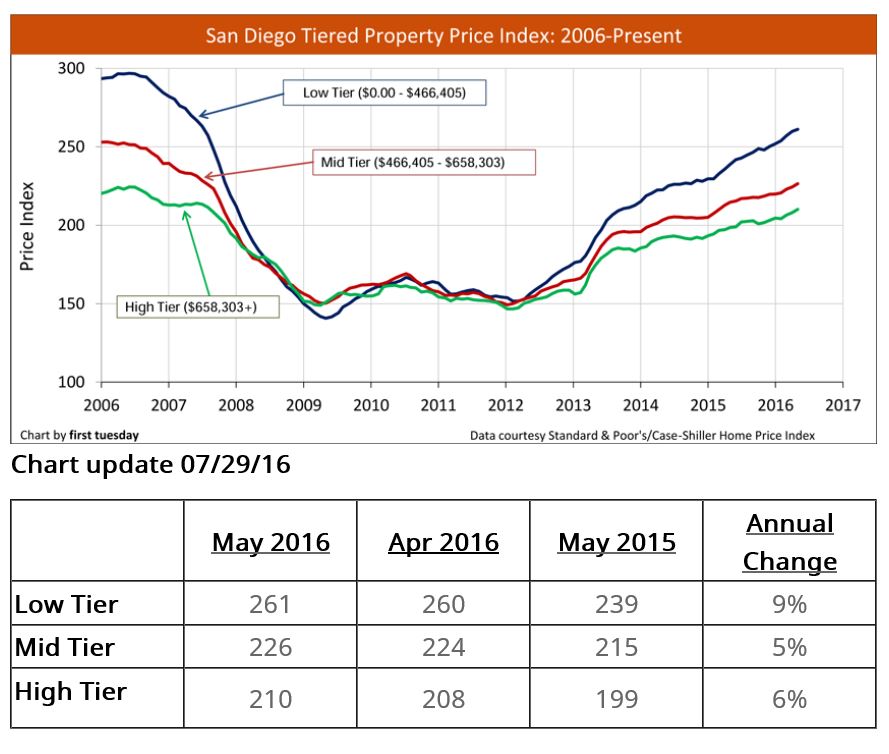

I wish they had a fourth tier…

http://journal.firsttuesday.us/california-tiered-home-pricing-2/1592/

by Jim the Realtor | Aug 17, 2016 | Actives/Pendings, Jim's Take on the Market, North County Coastal |

In June, we checked the local markets by comparing their active-to-pending ratios, which historically have been relatively ‘healthy’ when around 2.0.

Since then, the ratios in four of the eleven areas have improved (gone lower), including Del Mar, La Jolla and Rancho Santa Fe – wow!

| Area |

Zip Code |

June ACT/PEND |

Aug ACT/PEND |

June Ratio |

Aug Ratio |

| Cardiff |

92007 |

21/9 |

28/8 |

2.3 |

3.5 |

| Carlsbad NW |

92008 |

45/23 |

54/24 |

2.0 |

2.3 |

| Carlsbad SE |

92009 |

113/69 |

120/59 |

1.6 |

2.0 |

| Carlsbad NE |

92010 |

13/18 |

17/19 |

0.7 |

0.9 |

| Carlsbad SW |

92011 |

53/34 |

47/32 |

1.6 |

1.5 |

| Del Mar |

92014 |

73/23 |

68/27 |

3.2 |

2.5 |

| Encinitas |

92024 |

108/81 |

118/66 |

1.3 |

1.8 |

| La Jolla |

92037 |

221/46 |

215/49 |

4.8 |

4.4 |

| RSF |

92067 |

247/30 |

246/39 |

8.2 |

6.3 |

| Solana Bch |

92075 |

26/9 |

31/8 |

2.9 |

3.9 |

| Carmel Vly |

92130 |

132/80 |

116/64 |

1.5 |

1.8 |

| All Above |

All |

1,052/428 |

1,060/395 |

2.5 |

2.7 |

Most importantly, there hasn’t been any explosions of additional active (unsold) inventory in a month when we usually see the peaks of the year.