Inventory Watch

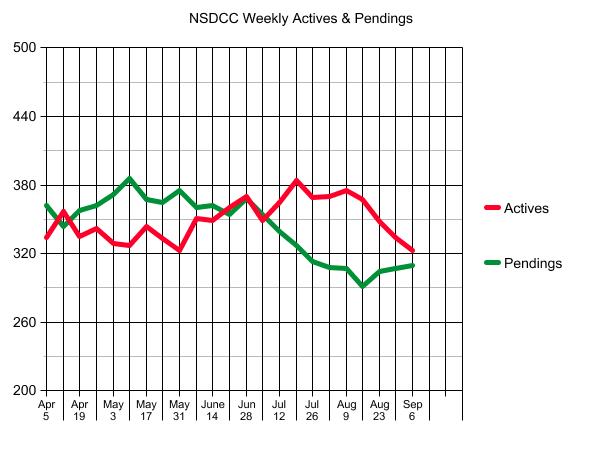

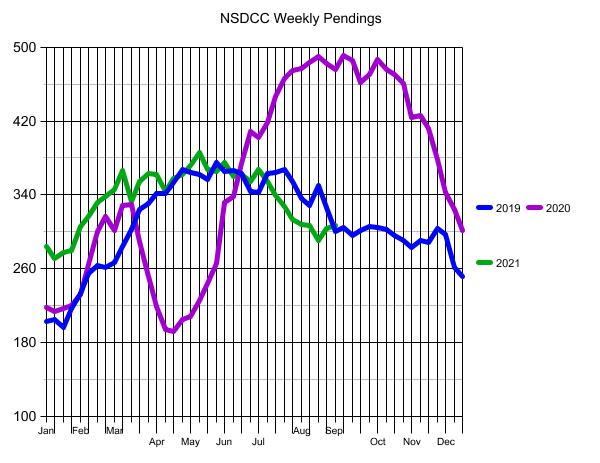

The number of pendings has increased in each of the last four weeks, and by next week could exceed the number of active listings again. The rest of the year should be exciting!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The number of pendings has increased in each of the last four weeks, and by next week could exceed the number of active listings again. The rest of the year should be exciting!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Last year, 16-year old Jack Munday was tragically killed in a car accident in Carlsbad.

Between June and August 2021, Carlsbad based artist Bryan Snyder worked with the Munday family to design and create a public art memorial bench for Jack Munday. The bench was installed on the shore of the Agua Hedionda Lagoon in Carlsbad, CA on August 7, 2021.

http://carlsbadcrawl.com/the-making-of-the-jack-munday-memorial-bench-in-carlsbad-by-bryan-snyder/

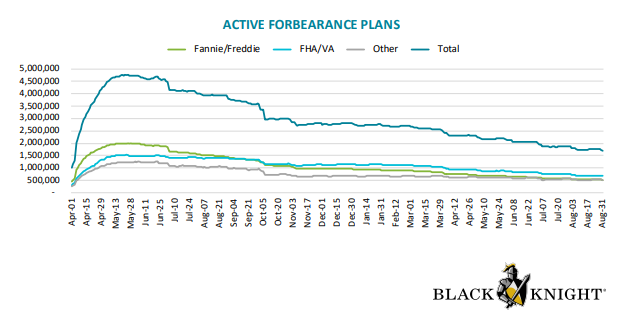

Another update on the forbearance exits. Nobody is going to get foreclosed in North San Diego County’s coastal region, mostly because of the ample equity position every homeowner has in place – but those positions could cause them to sell. Won’t the homeowners be spoiled from the 12+ months of free rent, and, once they recognize the alternatives (renting for ridiculous rates here or moving out of state), be more likely to work out a payment plan with their lender? Yes! But this would be a good time for a surge, if it happens!

Black Knight estimates that nearly 630,000 forbearance plans, more than one-third of those currently active, are slated for review this month. Of those, 400,000 will have reached the end of their 18 months of forbearance eligibility unless the maximum term is extended again.

The end of August saw a significant decline in forbearance numbers as servicers worked through the month’s crop of three-month reviews. Plans declined by 53,000 over the week ended August 31 with more than 23,000 from FHA or VA portfolios. The number of GSE (Fannie Mae and Freddie Mac) loans dropped by 20,000 and loans serviced for bank portfolios or private label securities (PLS) saw a 10,000 unit decline. The number of plans is down by 9 percent since the end of July.

Black Knight estimates that approximately 1.71 million borrowers remain in forbearance, 3.2 percent of the 53 million outstanding mortgages. Those loans have an unpaid balance of $331 billion. The total includes 514,000 GSE loans, 676,000 FHA and VA loans, and 520,000 portfolio/PLS loans. The loans remaining in forbearance represent 1.8 percent of the GSEs’ totals and 5.6 percent and 4.0 percent of FHA/VA and portfolio/PLS loans, respectively.

http://www.mortgagenewsdaily.com/09032021_black_knight_forbearances.asp

Over the last six months in Encinitas:

There were 183 sales of two-story homes, and they averaged $744/sf.

The 98 sales of one-story homes averaged $952/sf, or a 28% premium!

Let’s also note the price discovery here.

The sellers and agent were smart to lower the price early and often to keep the urgency alive. There was nothing wrong here that price wouldn’t fix, so they did three reductions in less than a month:

Let’s also mention Carlsbad’s efforts to meet state requirements for low-income housing:

https://thecoastnews.com/carlsbad-city-council-approves-70-affordable-housing-units/

CARLSBAD — Affordable housing is a challenge for many cities as the housing crisis rages statewide.

But the Carlsbad City Council chipped away at its state-mandated affordable housing requirements by approving 70 units for very-low to low-income households during its Aug. 31 meeting.

Additionally, the council approved a $3.1 million loan as requested by Bridge Housing, which partnered with Summerhill Apartment Communities, to develop the Aviara Apartments.

The loan will allow Bridge Housing to cement its application for state and federal tax credits to help fund its affordable portion of the 329-unit project on Aviara Parkway just south of Palomar Airport Road, according to Mandy Mills, Carlsbad’s director of housing and homeless services.

The Aviara East Apartments, where the 70 units will reside east of Aviara Parkway and north of Laurel Tree Road, make up the bulk of the affordable units for the project

In total, 81 units, or 25% of the total project, will be affordable units, Mills added.

The cost for the entire project, which rests on lots east and west of Aviara Parkway, is estimated at $30.9 million, Mills said.

“The project started the process in 2017 (with design and environmental reviews) before the Planning Commission approved it in December 2020,” Mills said. “Bridge will submit tax credit and bond allocation requests next month … and construction is expected to start in summer 2022.”

Rent will run between $600 and $1,700 depending on area median income (AMI) of each resident. Mills said seven units each are allocated for 30% and 50% of AMI and 55 residences for 60%.

Summerhill will manage the market-rate units, while Bridge Housing will operate the affordable units, she explained.

Jeff Williams, of Bridge Housing, said his company has two other developments the company manages in Carlsbad.

Bridge Housing owns the 334-unit Villa Loma project and 92 units at Poinsettia Station Apartments.

Bridge Housing intends to secure tax-exempt bonds and tax credit equity to finance the majority of the project’s cost to improve its competitiveness for bond and tax credit financing, according to the staff report.

Per the estimates, state and federal tax credits would account for $15.3 million along with a permanent loan of $7 million for the bulk of the funding.

The $3.1 million, though, will come from the Housing Trust Fund, which has a current balance of $13.6 million.

“Our mission is to provide housing, services and opportunities for residents of all income levels,” Williams said. “We do that by building on our record.”

The average cost per unit, though, is about $442,000, while city staff cited a Terner Center Report of the cost-per-unit for affordable units in the state is at $480,000, an increase of nearly $70,000 since 2008.

Another benefit of the 81 units is pushing the city closer toward its required affordable housing allotment under the Regional Housing Needs Assessment.

The RHNA numbers set by the county is 3,873 units for Carlsbad and more than 2,000 must meet very low to low-income residences.

This RHNA cycle runs from 2021 through 2029.

https://thecoastnews.com/carlsbad-city-council-approves-70-affordable-housing-units/

There were 158 two-story detached-home sales in the last 12 months in the 92011 (SW Carlsbad).

They averaged $543/sf.

There were 43 one-story sales. They averaged $685/sf.

The premium? About 26%!

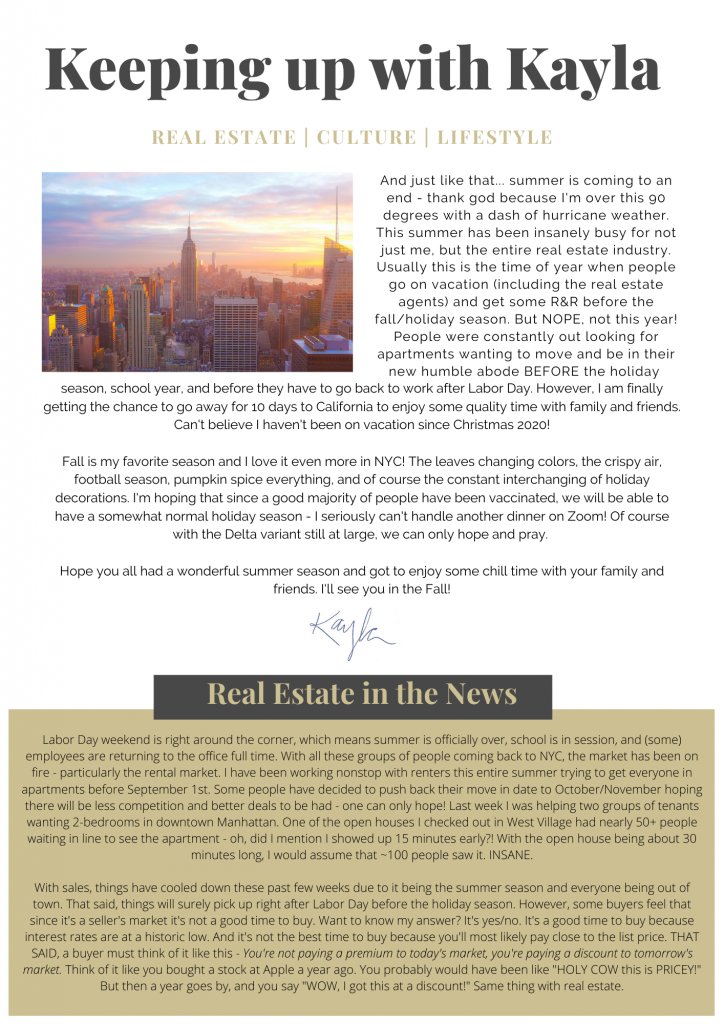

Our daughter Kayla was planning to be here anyway, and was due to arrive yesterday. Thankfully, she was able to catch a flight on Tuesday, and missed all the excitement in the Big Apple!

I’m hoping to get her on video before she goes home.

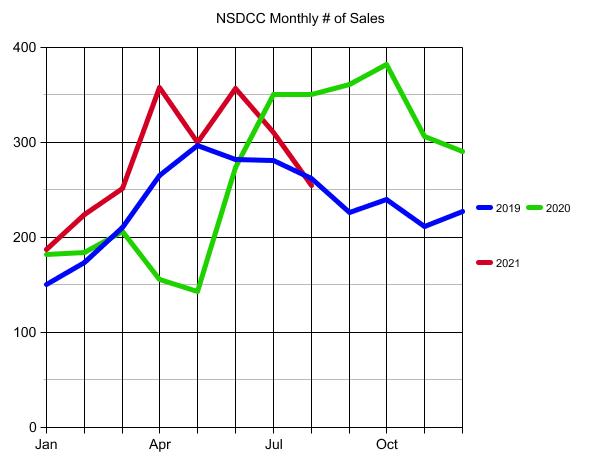

This year, we are ahead of both of the previous years in total sales, in spite of having 14% fewer listings – and prices being 30% to 40% higher!

NSDCC Listings & Sales, Jan 1 to Aug 31

| Year | ||||

| 2019 | ||||

| 2020 | ||||

| 2021 |

Prices probably need to go a bit higher to slow this thing down!

The NSDCC Weekly Pendings are tracking similar to 2019, so there should still be some gas in the tank:

The developer paid $4,900,000 cash for this site in 2020, so he must have had some assurance from the Encinitas City Council/Planning Commission that he could build his 72-unit apartment house here.

It appears that expanding La Costa Avenue to four lanes will be required – though there aren’t plans or money to do so – yet the Encinitas City Council approved the development:

https://thecoastnews.com/encinitas-council-approves-new-plans-for-vulcan-avenue-project/

An excerpt:

The site of the project is 1967 N. Vulcan Avenue in the northernmost part of Leucadia near La Costa Avenue. The intersection of Vulcan and La Costa is a major concern to residents who oppose the development.

Wermers said the updated project plans now include changes to Vulcan Avenue that are meant to make the area safer for pedestrians and bicyclists.

“When we do this it also promotes vehicle safety,” Wermers said.

Wermers also made a commitment to pay his company’s fair share in whatever changes the city decides to make at the Vulcan and La Costa intersection.

“Whatever you guys decide, we want to pay our fair share,” Wermers added.

There was more support for the newly redesigned project, some pointing to the need for low-income housing in the area and the project will boast 12 units designated as low-income.

“We need more roofs over our heads. This housing project is the perfect one to bookend Vulcan Avenue and Leucadia,” resident Kevin Daniels said. “I can’t express this enough, this project is a perfect fit.”

https://thecoastnews.com/encinitas-council-approves-new-plans-for-vulcan-avenue-project/

Though this is probably intended to be a direct shot at Zillow (who gets their feed from the IDX}, it will be the next step in the elimination of buyer-agents and encourage single agency.

CHINO HILLS, Calif., Aug. 26, 2021 /PRNewswire/ — On September 1st, 2021, California Regional MLS (CRMLS) will officially update its rules regarding Internet Data Exchange (IDX) websites to benefit agents and consumers on both sides of the residential real estate transaction.

IDX is the term the real estate industry uses for the portions of agent and broker websites devoted to searching MLS data. IDX sites using CRMLS data will soon give consumers a much clearer picture of agents’ relationship with the listings consumers find online.

The newly updated rule, number 12.16.5 in the CRMLS Rules and Regulations, will read as follows:

“12.16.5 Listing Credit. All Listing Brokers grant permission for any Advertising Broker to display any listings submitted to the service by the Listing Broker only if the listing display or advertisement is clear so that a reasonable real estate consumer understands:

a) Who is the Listing Agent & Broker,

b) Who is the Advertising Broker and

c) How to contact that Listing Agent or Broker.”

In describing the updated rule, CRMLS CEO Art Carter said, “It shouldn’t take a consumer more than a few seconds of looking at a listing to determine who the Listing Agent, Listing Broker, and Advertising Broker are.”

The CRMLS Rules Committee, composed of active real estate professional CRMLS users, devised the rule based on feedback from members of CRMLS’s participating Associations, Boards, and MLSs. The CRMLS Board of Directors, also working real estate professionals, approved the rule.

“CRMLS leadership has been discussing this subject, and this proposed solution, for years now,” said Carter. “Now that we have approval to update the rule, we’re beyond excited to help increase transparency and reduce friction for consumers, brokers, and agents.”

Link to press release