New York City!

We are in New York City with daughter Kayla, her boyfriend Frank, and Rob and Andrea, the sellers of the Encinitas Ranch house who relocated to Brooklyn. Here’s a tour of the home that Kayla sold them!

We are in New York City with daughter Kayla, her boyfriend Frank, and Rob and Andrea, the sellers of the Encinitas Ranch house who relocated to Brooklyn. Here’s a tour of the home that Kayla sold them!

This is the only other sale located on the Encinitas Ranch golf course that might be considered a comparable sale, but it’s a completely different offering. The house has 5,200sf with pool on a half-acre lot – with no threat of golf balls hitting you while in the backyard.

My buyers thought the price – which was more than a million dollars higher than my sale – was aggressive and not worth it. But as we have seen throughout the coastal region, a cash buyer stepped up and paid the full $4,785,000 price for it seven days after the listing was refreshed:

It closed escrow yesterday, so it’s doubtful that Zillow – or any buyers – would use it when evaluating homes in regular Encinitas Ranch. But if they did, they would be radically over-valuing the more standard tract houses there!

https://www.compass.com/listing/1202-via-zamia-encinitas-ca-92024/1012366247845475561/

Let’s revisit Encinitas Ranch for an example of how the zestimates will affect the post-frenzy era. Consider the ER comps since my $3,760,000 sale closed in November.

This is where the algorithms should perform beautifully because there have been eight sales of similar tract houses built at the same time on similar sized lots and views. All eight of these sales closed at prices at least $200,000 below my sale.

If zestimates are accurate, ours should have dropped to at least $3,500,000, and there is a model-match sale at $3,050,000 in March – the height of the frenzy.

What does Zillow think?

What they are doing to the marketplace should be criminal, because buyers and sellers both want a quick value check to verify their hopes and dreams – yet even in the very typical tract neighborhoods, the zestimates tend to be way off.

What’s worse is once a home goes on the open market, they reset their zestimate to be close to the list price so no one can tell how wrong they are.

Is it feasible that the traditional way we’ve determined home values gets phased out, and we just let our masters shove garbage down our throats? Absolutely, and because the real estate cycles have been eliminated, we won’t know the difference.

This is more evidence of how popular the homes with bigger yards and a pool on a culdesac are – so popular that this buyer paid $401,000 over list for this Carlsbad property:

Previously I said that buyer-agents are getting cut out of the action.

There are so many reasons why:

Smart sellers who offer a bounty, or reward, to agents will attract the most eyeballs, buyers, and offers. It is a system, powered by the MLS, that has worked well for decades. But it is coming to an end, sadly.

The pending lawsuits against NAR and major brokerages will likely cause the de-coupling of the commissions, and sellers won’t be able to offer a bounty (commission) to buyer-agents.

But buyer-agent commissions have already been dropping over the last two years, in part because the listing-agent teams don’t respect or care about outside buyer agents. During the frenzy, the listings sold themselves, so why not just keep most of the commission? Or all of it?

What will happen post-frenzy?

The frenzy conditions that pushed prices much higher have devastated the move-up/move-down market. Homeowners love living here, and if they have to leave town to make selling their home worth it, they aren’t as interested.

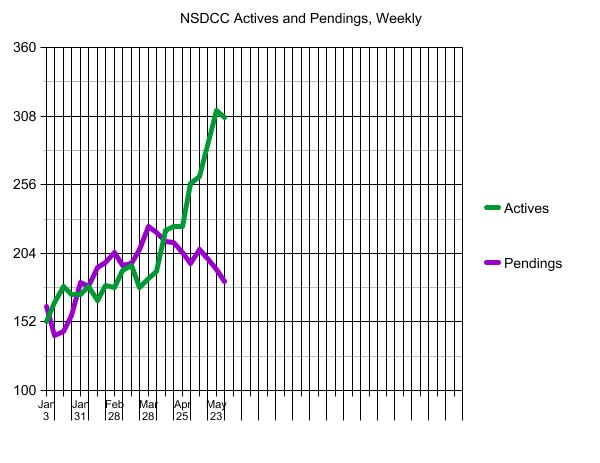

As a result, it looks like the amount of listings will keep dropping:

Detached-Home Listings between La Jolla and Carlsbad

| Year | ||

| 2017 | ||

| 2018 | ||

| 2019 | ||

| 2020 | ||

| 2021 | ||

| 2022 |

Even after mortgage rates rose dramatically, the number of new listings last month were way below previous months of May. As it gets more difficult to sell and potential home sellers get discouraged about not getting astronomical sales prices, the listing counts could dwindle further.

In the squeeze, listing agents will get more desperate and choose not to share their hot new listings with outside agents, or even within their own brokerage. Buyer-agents who are dependent upon the MLS for homes to sell just won’t have any product.

It’s already happening – the homes you see on the open market seem like the leftovers. It’s already happened with commercial listings on Loopnet, and new-home tracts don’t want to pay buyer-agents at all:

It’s inevitable that the same mindset will infiltrate the residential resales too. Buyer-agents will get squeezed out because nobody wants to pay for them, regardless of how valuable their service might be.

Speaking of infiltration, the impact of OpenDoor probably deserves its own blog post. Because NAR sold our website realtor.com (the best thing we had going for us) to a third party, other entities are now advertising their services on realtor.com that will take away business from realtors.

Input an address of a lower-valued home onto realtor.com, and you’ll see something like this:

As listing counts erode, the desperation among agents will heighten. Buyer-agents will be the first casualty, and then buyers and sellers will feel the pinch too as the MLS dissolves and private websites are used sell homes privately:

https://www.mikedp.com/articles/2022/5/24/the-opendoor-mls

The frenzy interrupted the need for off-market sales because all sellers and listing agents wanted to go on the open market for the thrill of a bidding war. But as the market gets tougher, the off-market sales will likely resume. In the process, the buyer-agents will be the first to go, and because there are already way too many agents (at least twice as many as we need), many other agents will face an early retirement too.

This was the Private Exclusive off-market listing that hit our intra-office website late in the afternoon and literally the next day most of the top Compass agents and me rushed over there to check it out.

Both buyer and seller take a gamble on price when transacting off-market. Since this was filmed, two sales on Rancho Encinitas Drive have closed for over $4,000,000, so this buyer should be happy with their $3,230,000 purchase price here (which was $405,000 over the list price).

These people have been insisting for years that prices will be going down because of higher rates, foreclosures, forbearances, recession – you name it!

Will fewer sales will cause higher or lower prices?

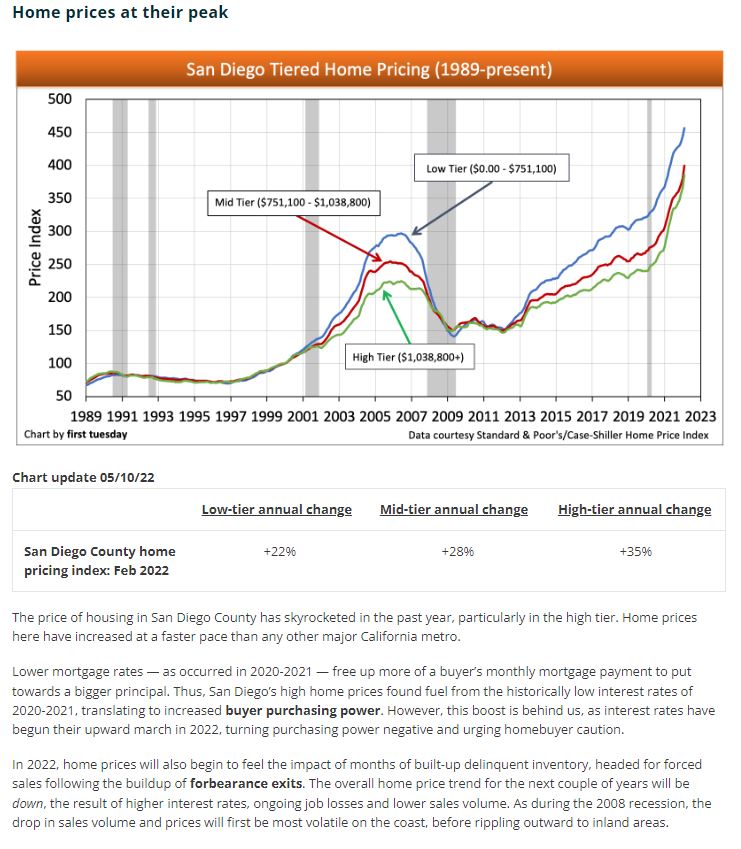

The authors below say that lower sales volume will result in the ‘home price trend for the next couple of years will be down’, which suggests that environment will get so bad that nobody will be willing to pay today’s prices. It means that only the motivated sellers who have to sell for less than today’s prices will succeed in finding a buyer.

But I think that fewer sales will mean that only the superior properties will be selling. They may not get the big pops over their list prices like we’ve seen lately, but the pricing trend should plateau within +/- 5% of where it is today.

There won’t be enough sellers who will dump on price, and agents aren’t going to insist on price reductions. Both would rather not sell, instead of giving it away. It would take at least another selling season (or two) before either would believe they need to drastically alter their price.

The scary part? Every seller has ample equity, and could take a haircut if needed.

Does anyone need to move bad enough to leave the comforts of a decades-long life in California, pay capital-gains taxes, AND dump on price? We’re going to find out, but I’m guessing there won’t be many. And they won’t out-number the desperate out-of-town buyers who can’t wait to move here!

https://journal.firsttuesday.us/san-diego-housing-indicators-2/29246/

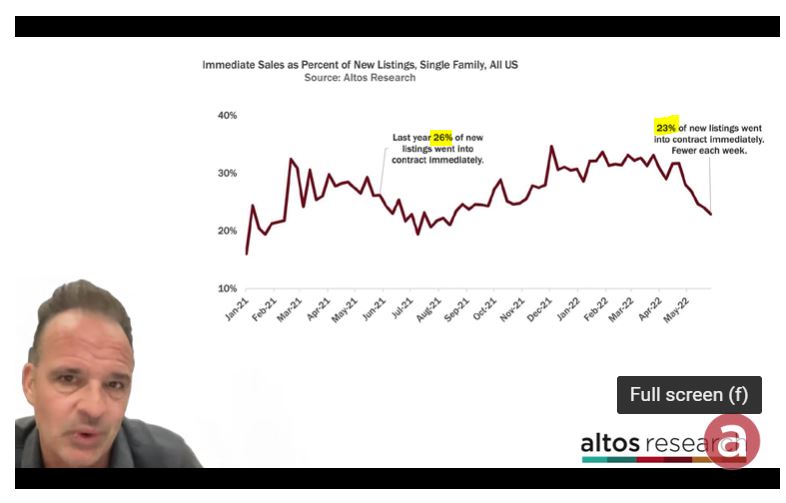

Mike is one of the more level-headed analysts, probably due to the wealth of national data he processes. There will probably be a solid undercurrent of activity as evidenced in the graph above:

Mike’s tweet:

Prices, meanwhile are still strong. 5 bidders instead of 50 bidders will still support your asking price. Prices holding up stronger than I expected frankly. $449,000 for the median single family home in the US now.

Mortgage rates didn’t get into the fives until early April, and up until then, the frenzied-out buyers were grabbing something at any price. The June index will show the full effect, which we’ll get at the end of August.

San Diego Non-Seasonally-Adjusted CSI changes

| Observation Month | |||

| Jan ’20 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| Jun | |||

| Jul | |||

| Aug | |||

| Sep | |||

| Oct | |||

| Nov | |||

| Dec | |||

| Jan ’21 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| Jun | |||

| Jul | |||

| Aug | |||

| Sep | |||

| Oct | |||

| Nov | |||

| Dec | |||

| Jan ’22 | |||

| Feb | |||

| Mar |

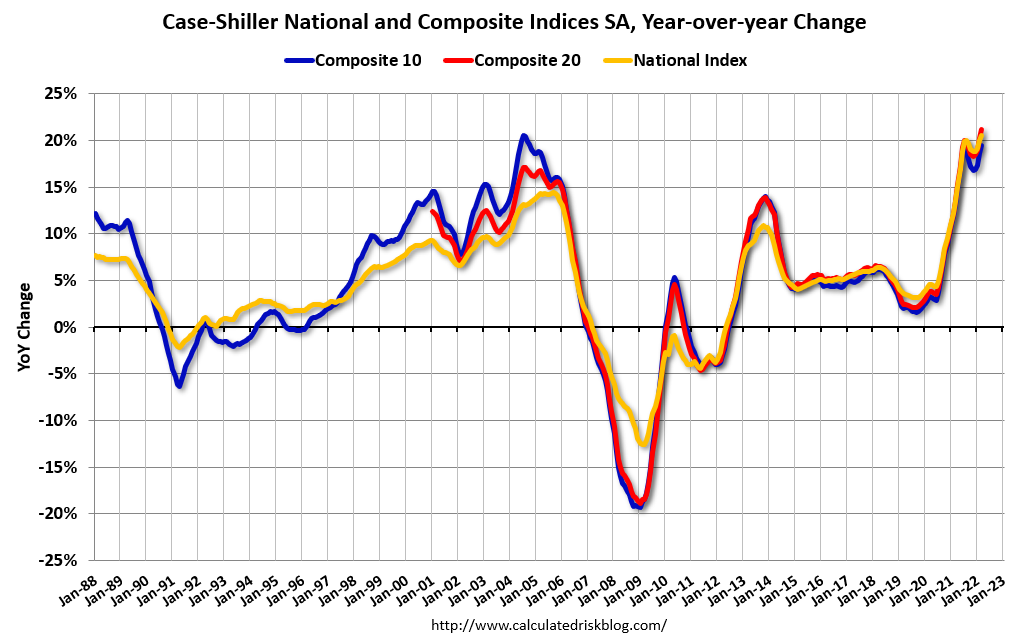

“Those of us who have been anticipating a deceleration in the growth rate of U.S. home prices will have to wait at least a month longer,” says Craig Lazzara, managing director at S&P DJI. “All 20 cities saw double-digit price increases for the 12 months ended in March, and price growth in 17 cities accelerated relative to February’s report.”

The expectation is that prices will begin to ease, since home sales have been falling now for several months. Demand, however, is still high, and real estate agents report that they are still seeing multiple offers for homes that are priced well. More supply is also coming on the market, as sellers worry they will miss out on the last days of the hot market.

“Mortgages are becoming more expensive as the Federal Reserve has begun to ratchet up interest rates, suggesting that the macroeconomic environment may not support extraordinary home price growth for much longer. Although one can safely predict that price gains will begin to decelerate, the timing of the deceleration is a more difficult call,” added Lazzara.

In recent weeks, the housing market has shifted, said Danielle Hale, chief economist for Realtor.com. “As buyer confidence sags and weighs down demand, real estate markets will re-balance, eventually tilting away from the heavy advantage that recent home sellers have enjoyed.”

(The San Diego seasonally-adjusted index was 416.51)

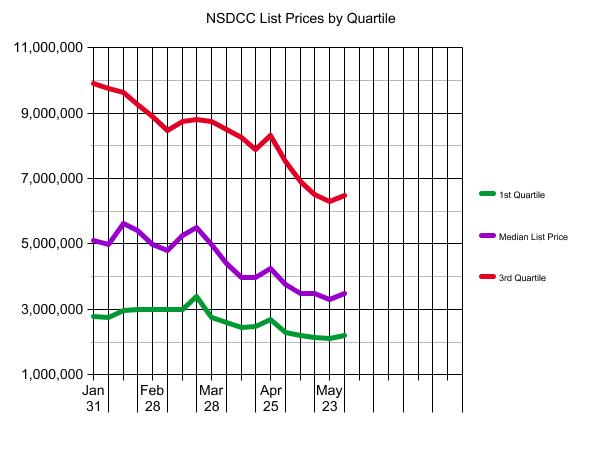

I mentioned how overshoot is part of the program. It will be a miracle if the sellers’ expectations can adjust quickly enough to salvage the rest of the selling season.

It’s probably never been so hard in the history of real estate to get the list-price right!

Even if the price is ‘right’, a new listing might not sell right away just because of buyers wanting to wait-and-see for a while longer. Sellers won’t know what to do, so they won’t do anything and they will wait-and-see too. Only a few might drop their price enough to make a difference.

Welcome to Plateau City – we’ve arrived!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~