Previously I said that buyer-agents are getting cut out of the action.

There are so many reasons why:

- Commissions are grinding down. Buyer-agents have to sell more, to make the same $$.

- Working at higher price-points requires advanced skills. Can agents improve?

- Are you good enough to convince the buyer to pay your fee? It’s coming.

- Fewer listings will be exposed to the buyer-agents, and to the public.

Smart sellers who offer a bounty, or reward, to agents will attract the most eyeballs, buyers, and offers. It is a system, powered by the MLS, that has worked well for decades. But it is coming to an end, sadly.

The pending lawsuits against NAR and major brokerages will likely cause the de-coupling of the commissions, and sellers won’t be able to offer a bounty (commission) to buyer-agents.

But buyer-agent commissions have already been dropping over the last two years, in part because the listing-agent teams don’t respect or care about outside buyer agents. During the frenzy, the listings sold themselves, so why not just keep most of the commission? Or all of it?

What will happen post-frenzy?

The frenzy conditions that pushed prices much higher have devastated the move-up/move-down market. Homeowners love living here, and if they have to leave town to make selling their home worth it, they aren’t as interested.

As a result, it looks like the amount of listings will keep dropping:

Detached-Home Listings between La Jolla and Carlsbad

| Year | ||

| 2017 | ||

| 2018 | ||

| 2019 | ||

| 2020 | ||

| 2021 | ||

| 2022 |

Even after mortgage rates rose dramatically, the number of new listings last month were way below previous months of May. As it gets more difficult to sell and potential home sellers get discouraged about not getting astronomical sales prices, the listing counts could dwindle further.

In the squeeze, listing agents will get more desperate and choose not to share their hot new listings with outside agents, or even within their own brokerage. Buyer-agents who are dependent upon the MLS for homes to sell just won’t have any product.

It’s already happening – the homes you see on the open market seem like the leftovers. It’s already happened with commercial listings on Loopnet, and new-home tracts don’t want to pay buyer-agents at all:

It’s inevitable that the same mindset will infiltrate the residential resales too. Buyer-agents will get squeezed out because nobody wants to pay for them, regardless of how valuable their service might be.

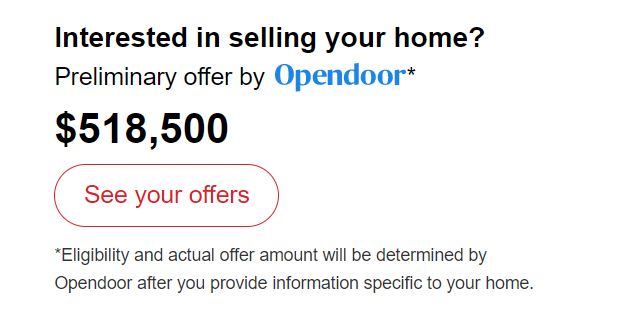

Speaking of infiltration, the impact of OpenDoor probably deserves its own blog post. Because NAR sold our website realtor.com (the best thing we had going for us) to a third party, other entities are now advertising their services on realtor.com that will take away business from realtors.

Input an address of a lower-valued home onto realtor.com, and you’ll see something like this:

As listing counts erode, the desperation among agents will heighten. Buyer-agents will be the first casualty, and then buyers and sellers will feel the pinch too as the MLS dissolves and private websites are used sell homes privately:

https://www.mikedp.com/articles/2022/5/24/the-opendoor-mls

The frenzy interrupted the need for off-market sales because all sellers and listing agents wanted to go on the open market for the thrill of a bidding war. But as the market gets tougher, the off-market sales will likely resume. In the process, the buyer-agents will be the first to go, and because there are already way too many agents (at least twice as many as we need), many other agents will face an early retirement too.

I didn’t mention here the effort by CoreLogic to build the next real estate platform focused on funneling the listing inquiries directly back to the listing agent, instead of third-party buyer-agents like Zillow and realtor.com do currently.

They are supposed to try out their new platform in New York City this summer, an area that has never had its own MLS (surprisingly). Zillow provides their NYC format as StreetEasy which agents have used as a MLS substitute. It’s an interesting environment to try out your new platform!

With prices high and inventory tight, 50% of homebuyers said they cried at least once during the process of purchasing a house, with the stress on par with planning a wedding or being fired, according to a survey from Zillow.

It’s particularly bad for younger Americans, many of whom are trying to crack into the real estate market for the first time. More than 65% of Gen Z buyers said they were brought to tears by their “home-buying journey.”

In April, nearly half of the homes sold in the US went for more than the asking price, up from 37% a year earlier, according to Zillow. There are also roughly 23% fewer homes on the market than there were in 2021.