Lowball Season

Let’s face it, at least 90% of the current listings aren’t coming off their price much. To get a deal, you have to make offers! Here are some good tips:

Let’s face it, at least 90% of the current listings aren’t coming off their price much. To get a deal, you have to make offers! Here are some good tips:

By John Burns

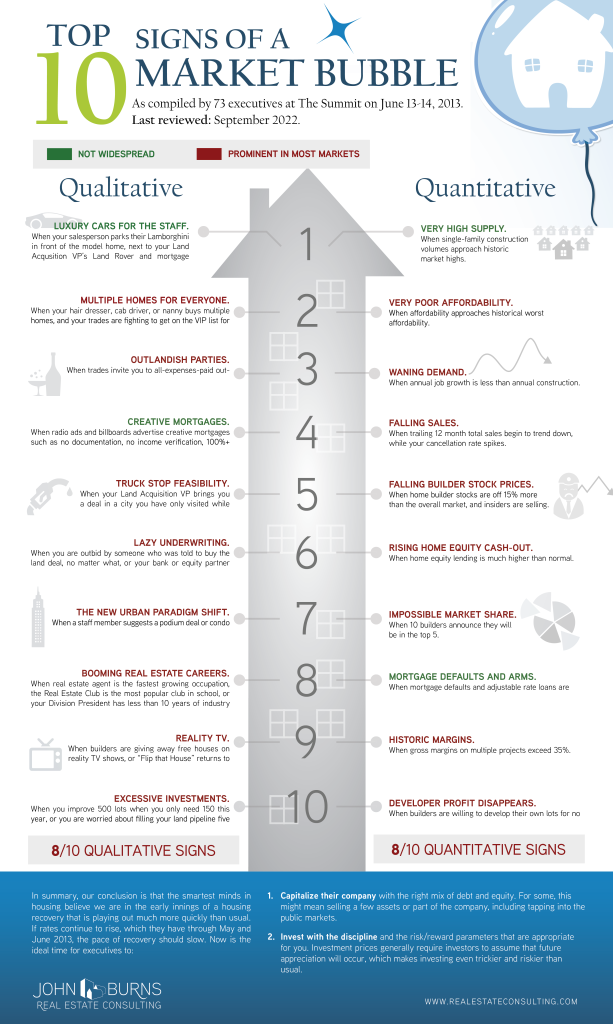

In 2013, fresh off the biggest housing downturn in their lifetimes, 73 housing industry executives compiled the Top 10 Signs of a Housing Market Bubble at our Summit Conference in Laguna Beach, CA. Assessing the criteria that we set almost a decade ago (10 quantitative and 10 qualitative), we have found that 16 of the 20 housing bubble signs are now flashing red.

In last month’s client-exclusive housing outlook webinar, we called out some signs we are seeing:

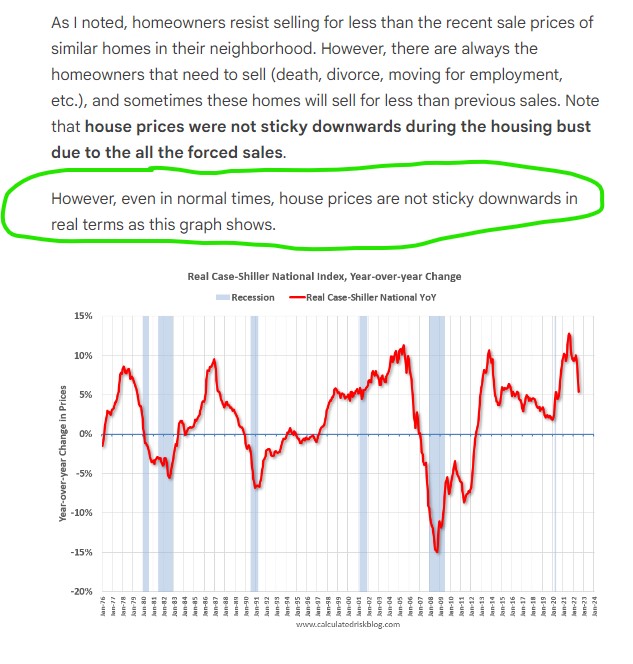

There will always be an occasional low sale here and there.

What would cause home prices to really slide?

There would need to be a series of low sales in the same area to create downward momentum. The next seller would have to be convinced that lower prices are a fact, and without an obvious trend, they will be reluctant to believe it.

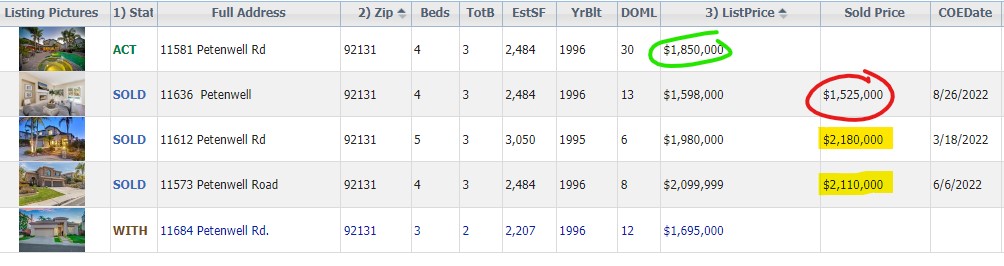

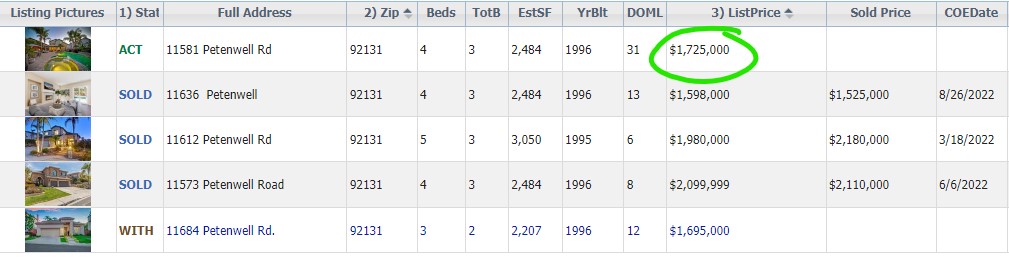

Here’s an example. Even though this lowball listing (in red) undermined the two comps over $2 million, the next seller wasn’t convinced, and they listed their home for $1,975,000. They have lowered it since, but you can bet they are digging in now – and the market is in their hands:

If they hold out and get close to their price, then the lowball sale will be dismissed as one-off, and other sellers in the future will ignore it….and hope the buyers do too.

These are the standoffs happening everywhere now. ALL sellers have plenty of equity and could go down in price if they really wanted – or needed – to make the sale.

But will they?

Generally speaking, the agents might go along for 30 days or so, but they aren’t used to sitting on unsold listings for months. They are going to nudge the sellers to lower their price, but those drops need to be in 5% increments to cause a meaningful reaction from the buyers.

Will some sellers surrender? Yes, but only when confronted with a lower offer. Currently we are in the Buyer-Vacation stage where few are in the game and making offers, and without solid proof, the sellers are more likely to wait, than dump.

The 2023 Selling Season will be the most anticipated market in the history of the world!

New update – another price reduction. Buyers are on vacation now, we’ll see about 2023:

For those who are willing to investigate the sales data in our local areas, here are the detached-home sales from the last 90 days. Poke around a little, and I doubt you’ll believe that we’re getting ‘creamed’.

NW Carlsbad 92008 sales – last 90 days

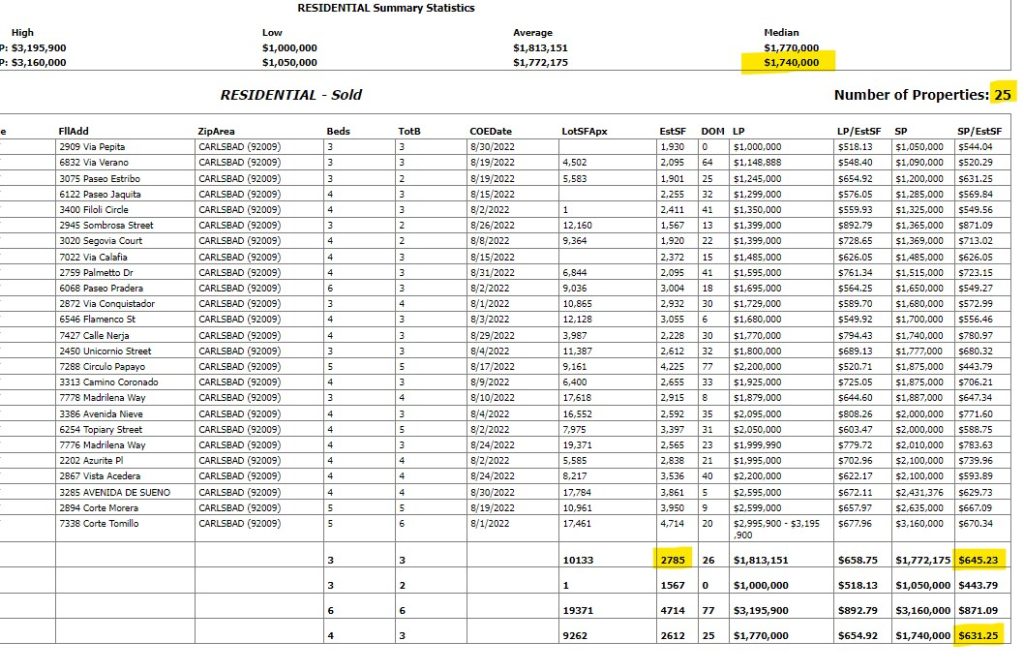

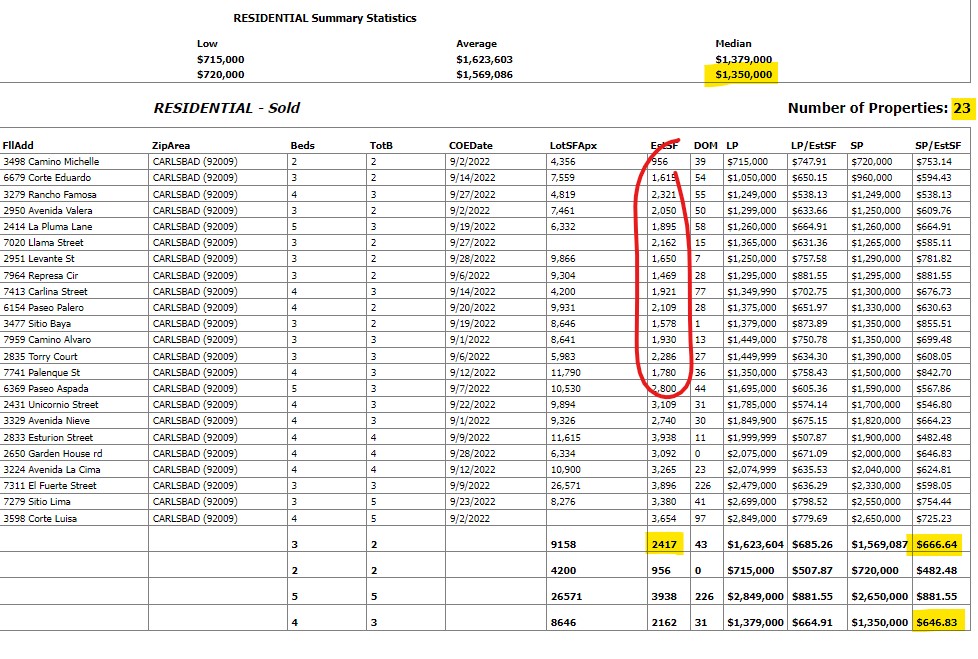

SE Carlsbad 92009 sales – last 90 days

NE Carlsbad 92010 sales – last 90 days

SW Carlsbad 92011 sales – last 90 days

Encinitas 92024 sales – last 90 days

La Jolla 92037 sales – last 90 days

Rancho Santa Fe 92067 sales – last 90 days

Del Mar 92014 sales – last 90 days

Solana Beach 92075 sales – last 90 days

Carmel Valley 92130 sales – last 90 days

The highlights: three RSF sales over $10 million in the last 90 days; nine sales above $5,000,000 in La Jolla (and 60 sales overall!), 81 sales in Encinitas – more than one every business day; and of the 182 sales in Carlsbad, 46 of them were $2,000,000 and higher.

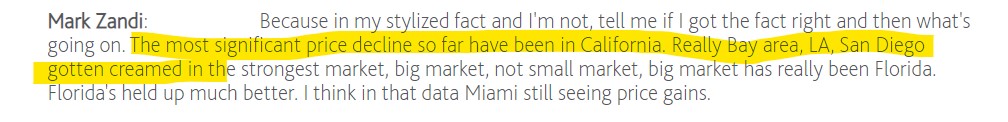

Dr. Doom said in his podcast here that the California markets have had the most significant price declines, and the Bay Area, LA, and San Diego have ‘gotten creamed’.

He didn’t provide any data to back it up, so let’s look at what we have from the MLS which includes September data so we’re including the most relevant information.

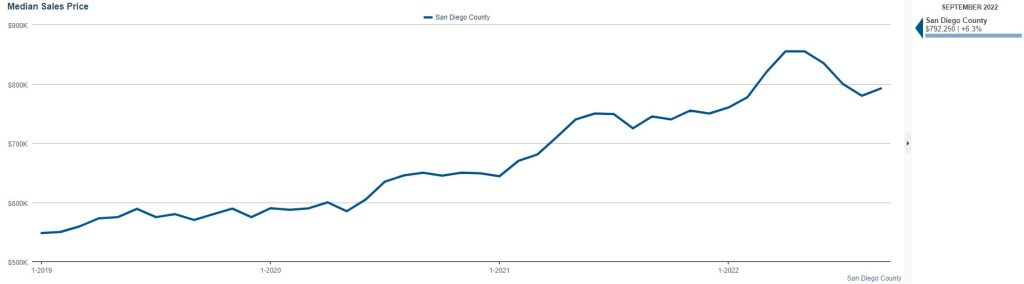

San Diego County, All Property Types:

The San Diego County median sales price was $855,000 in June and July, and last month it was $792,500 – which was a 7% decline from the peak this summer. It was also 2% higher than in August. Is that creamed?

We’re coming off the greatest real estate frenzy of all-time, and now the Fed has caused mortgage rates to double in less than six months. All considered, I think we’re doing great, and better than expected.

These guys who just fling it around on their national platforms are doing undue harm to our market. Don’t listen to them until they get out of their mom’s basement and actually investigate what’s really happening!

The The Will Of The People World Tour by Muse is underway, and will be in San Diego on April 10th.

Donna said,”Oh that’s the Twilight band”. Huh? Oh, they were included on all three Twilight films:

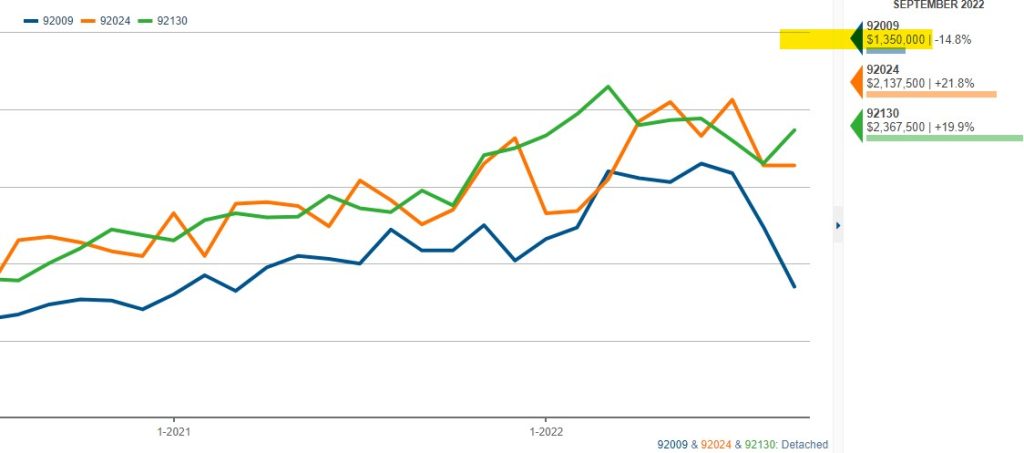

Last month, the 92009 median sales price declined 14.8% YoY, and was -22% MONTH-OVER-MONTH.

Keyboard warriors everywhere will be jumping all over news like this.

What really happened?

The facts:

There were only 23 sales last month. Fewer sales means more volatility in the data, and the numbers will be bouncing all over the place. The average SP:LP was 97%, so nobody was giving it away, and when you look at sales like the last one on the list on Corte Luisa, know that it was an agent selling his own house for a $980,000 profit above what he paid in 2020.

You have to look deeper into the data to get the full picture of what’s really happening!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Here are the August and September stats:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Let’s revisit a previous blog post for an update, and more detail.

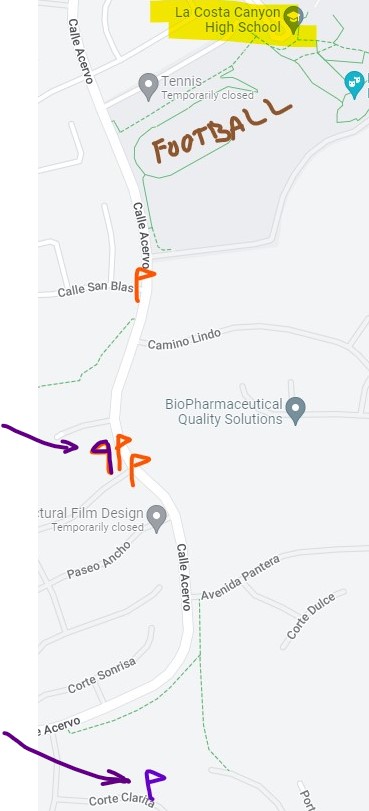

I featured a group of listings near La Costa Canyon HS a couple of weeks ago. The day the blog post ran, the most-expensive listing was pending, but it fell out of escrow that day. It’s back in escrow this week, and judging by how the listing agent ran my rather-sizable nose in it, they must have gotten pretty close to their list price. Tracey sold hers too, and together the two highest-priced listings are the ones that are pending, which demonstrate that buyers want quality and are willing to pay for it.

Pendings = purple:

Realtors who have no game will be reading juicy headlines on social media and be telling their sellers to dump on price, rather than dig for the truth and get to work.

GET GOOD HELP!

And just wait until I tell you the story about this one!

It was back when some homeowners had little equity that my favorite seller quote became a t-shirt legend.

But we still hear it today – when it comes to price, home sellers regularly say, “I’m Not Giving It Away!”.

Their equity positions used to be pennies, compared to today. Back in 2009, there were plenty who were just hoping to break even, and maybe come out with enough cash at closing to buy a steak dinner!

Now that every NSDCC homeseller has hundreds of thousands of dollars’ worth of equity, will they loosen up a bit? After all, the last 20% to 30% came pretty easy (in just a year or two) and if they had to give up some or all to make the deal, they certainly could

But will they?

Many potential sellers get so mad about paying the capital-gains tax that it prevents them from moving. Those who are on the open market in October of 2022 have already dealt with that fact mentally, so they must have a fairly good reason to sell.

Those who will dump on price must be really motivated. It probably also means their house isn’t that great because nobody wanted to buy it at retail, or for a little under. Can you live with one of those?

The stock market has been cooking this week, and bond yields coming down in hopes the Fed might slow down the pace of their rate increases. Or maybe even pause, and take a look around at what they created?

If that were to happen, then the 2023 Selling Season should be somewhat healthier as rates dip into the 5s just as more quality homes are coming to market. If current sellers start to get a sniff of that, then they will cancel their listing and wait until next year.

Which means those who are still actively trying to sell the rest of this year must be unusually motived – and your best candidates to test whether they will give it away! Stay in the hunt!

Bill’s take – there may be more deals available sooner than you think:

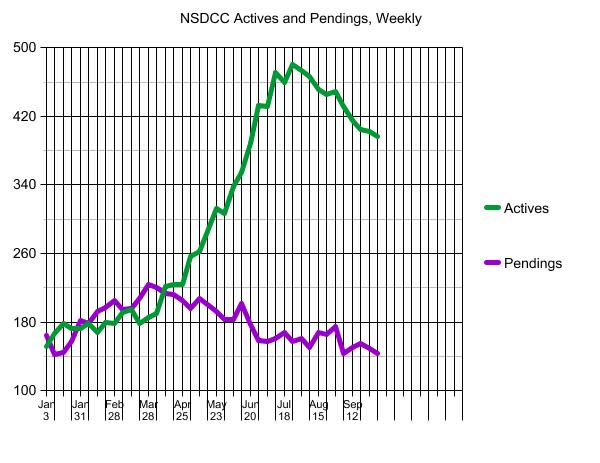

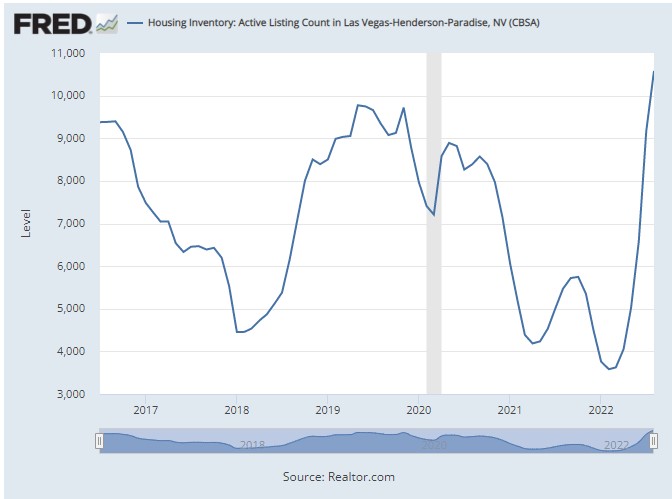

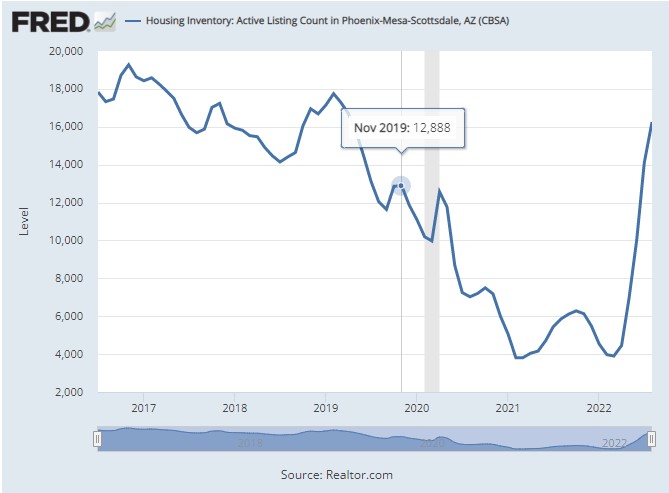

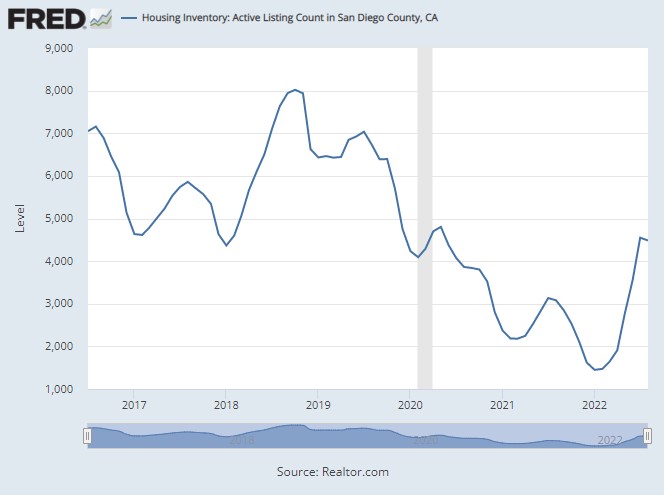

Hat tip to Mark for pointing out how much different our local inventory has performed, compared to other markets around the country. When you hear the doom and gloom from the national talking heads, this is what they are talking about:

Our inventory topped out in July, and has been declining since – where many other markets are exploding. In September, Las Vegas and Phoenix will probably set all-time highs for their number of homes for sale, where we are around half of our peak inventory numbers.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

7141 Aviara Drive, Carlsbad

4 br/4.5 ba, 4,978sf

10,835sf lot

SP = $3,675,000

Super-custom estate with commanding ocean views from the best lot in the neighborhood! The previous owner had invested over $1,000,000 in upgrades, and these sellers added their own touches to create a magnificent property. Once through the private gates, it is immediately apparent that the attention to detail is paramount. Expert stone and woodwork set the stage for an elegant example of interior design, sure to impress the most discerning of palates. An open foyer shines in marble. Columned archways, hint at spacious parlors. Custom ironwork adorns the graceful, winding staircase – which frames a grand wine room. The entryway flows past the formal dining room and into an expansive family room – ideal for entertaining and complete with a functional bar and ocean view. A richly appointed, chef’s kitchen is at the ready, for functions large or small, and effortlessly incorporates the finest appliances, rich woods and exotic slab granite. Upstairs, a luxe master suite offers spa-like comfort- whether it’s relaxing in front of the fireplace or taking in your own private sunset, via the secluded balcony. Secondary rooms are beyond comfortable, and there is even a guest room, with en-suite bathroom, down stairs. Choose to step off the beaten path, once again, and take your place at the top of Aviara Point.