Sunday Wrap

I’m still doing the frenzy format. Sell the first weekend with multiple offers!

Plus, thoughts on a market floor (tight group of recent comps with a upward trend in pricing).

I’m still doing the frenzy format. Sell the first weekend with multiple offers!

Plus, thoughts on a market floor (tight group of recent comps with a upward trend in pricing).

Our listing on Oakridge closed escrow today at 27% over the list price!

We had 18 written offers, and only one of them was cash. There were 17 parties were willing to pay the list price or higher, even with mortgage rates around 7%!

I did what was in effect a reverse offer and raised the list price from $995,000 to $1,150,000 once offers started coming in. Then we asked those who were willing to pay at least that much to submit their highest and best offer.

Five parties were willing to pay over $1,200,000, and the winner paid $1,265,000!

The pic above was the street view when we rolled up in February. It took until the middle of October to list it because we waited until everything was perfect and ready to sell – in this market, you have to!

Here’s me discussing whether it was under-priced:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

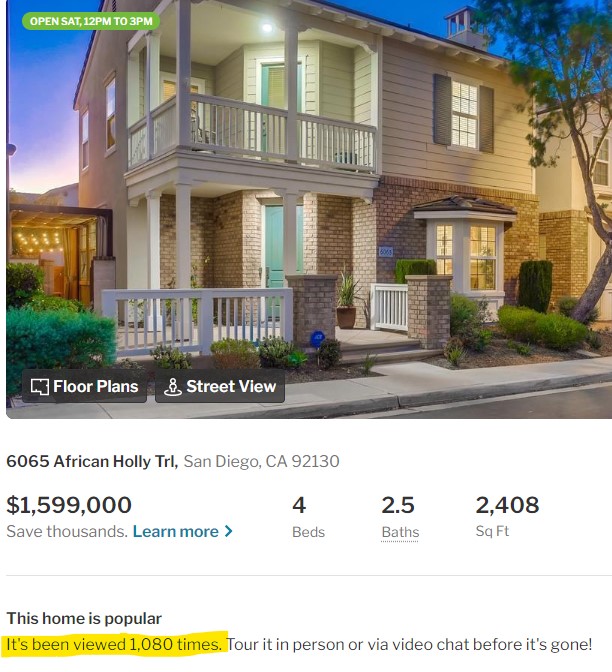

The new listing went active on the MLS at 4:30pm yesterday, and by this morning there have already been 1,700+ views – less than a week before Thanksgiving! You can’t tell me that the market is dead!

Here we go again.

Just as I’m ready to hit the go button on a new listing, I check the realtor hotsheet and THREE other listings provide new market data. Look at how these two dumped on price:

Do sellers wonder if there were any other buyers before dumping 10% and 11% off their price? Beats me, but if they did, lowering the list price in 5% increments promptly would have caused others to surface earlier. Once a listing has been not selling for a couple of months, they are going to get lowballed.

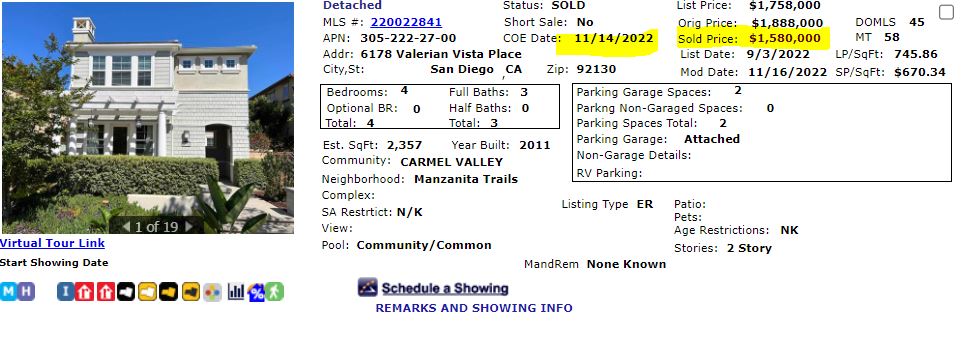

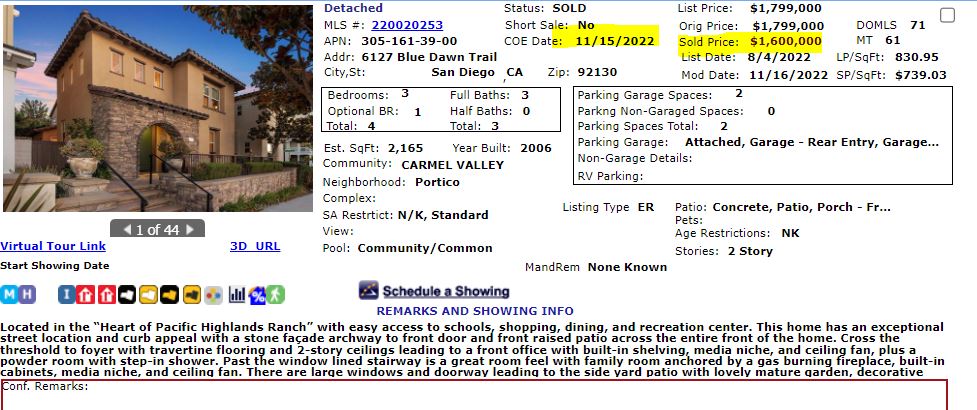

There is an active listing that has been listed at $1,750,000 for the last six weeks on the same street as my new listing. Even though they listed for $2,150,000 on June 24th, they dropped another $100,000 today and are now $1,650,000. It is located close to Carmel Valley Road:

If we would have listed for the $1,675,000 like we planned to do , it would have only caused a standoff. In a market where prices have dropped so precipitously, we want to be the clear front-runner.

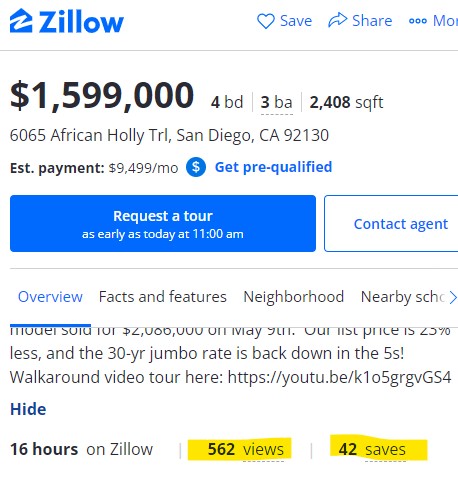

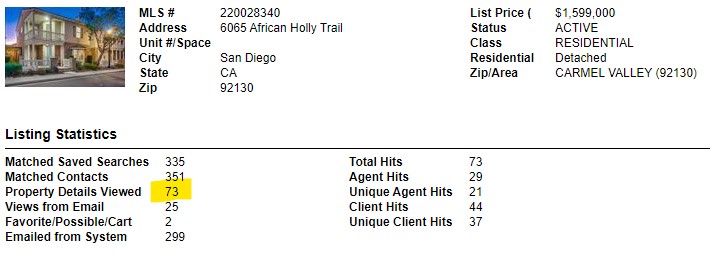

We changed our list price to $1,599,000, and will go head-to-head this weekend!

The jumbo rate above is 6.1% at no points, which means you can get into the mid-to-high 5s with the buyers – or sellers – paying a point or two.

I’m going to mention it in the description of the new listing.

With the discounts already in place in some areas, and last week’s drop in the mortgage rates, this might be the best combination of discounts/declines that we will see in the next 1-2 years.

The Fed is going to keep raising their fed funds rate. Powell, Bullard and others have said that the FFR needs to be at least 1% higher, and they intend to get there next year. They don’t determine the mortgage rates, but you can imagine the impact on the bond/MBS markets.

What they won’t consider is where potential home sellers are going to draw the line.

Today, we might find sellers who are willing to consider a price that is 10% below peak, with an occasional 15% or 20% off. But you can bet that when it comes to selling for 20% to 30% below peak prices, most sellers will become highly resistant.

How many will quit instead? Or not even bother with trying to sell? Plenty.

I think the higher rates go, the lower the inventory will be.

The difficulty of finding the right house, at the right price, will keep getting harder and harder.

If you can find something close to the perfect home today, consider it strongly!

Our new listing in Carmel Valley! Open 12-3 this weekend.

Check out this attractively-priced Portico home with fully remodeled kitchen, hardwood floors, 3 bedrooms + loft and downstairs den, sumptuous primary suite with two walk-in closets, and upstairs laundry room. New paint and carpet, private yard, and cool front porch to watch the balloons go by! Live here and send your kids to Solana Ranch Elementary School – verified with the school district on Nov. 16th. The community pool/clubhouse is like a 5-star resort! It’s a good distance away from Carmel Valley Road too. This model sold for $2,086,000 on May 9th. Look at the savings – our list price is 20% off, and the 30-yr jumbo rate is back down in the 5s! Fed governor Bullard said today that the Fed Funds rate might have to go 1% to 3% higher. This home is the best discounted price/low rate combo you’ll see in the next 1-2 years! Only $1,675,000.

Hang on – here we go!

There are three types of sellers:

Unless the home is a real trophy property, this isn’t the market that tolerates aspirational sellers. For those who will only sell if they get their price – you should wait this out….and it could take a while.

The high-priced listings might get showings, but mostly to buyers who are considering the better-priced home down the street. It will take another six months and some boost from a strong spring selling season before the listings priced at retail-plus will start selling again. And that’s probably optimistic.

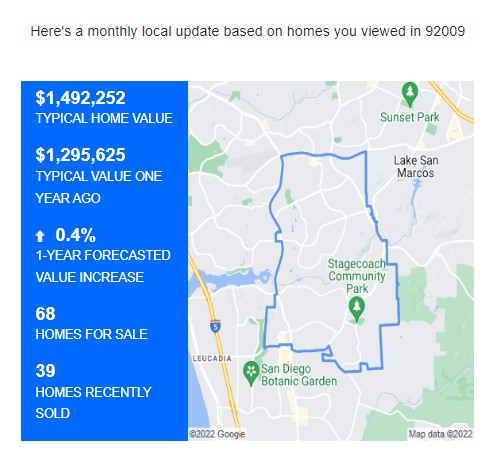

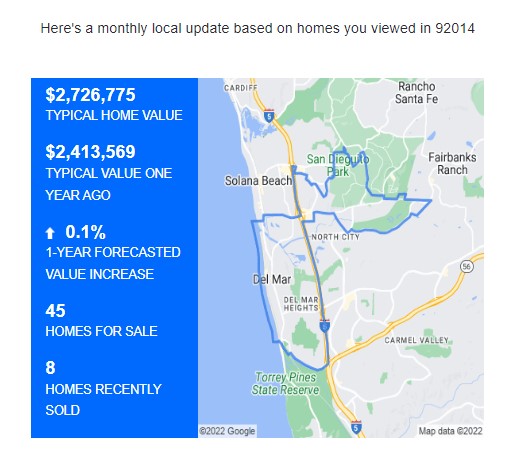

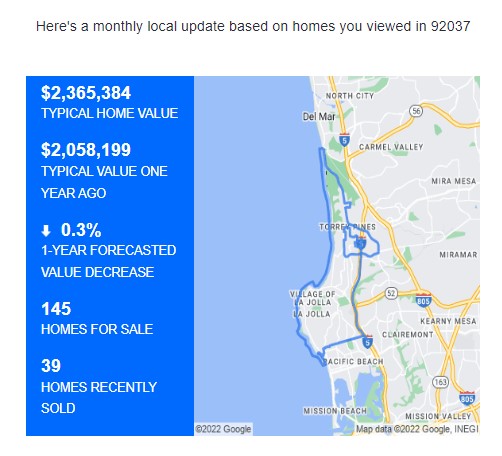

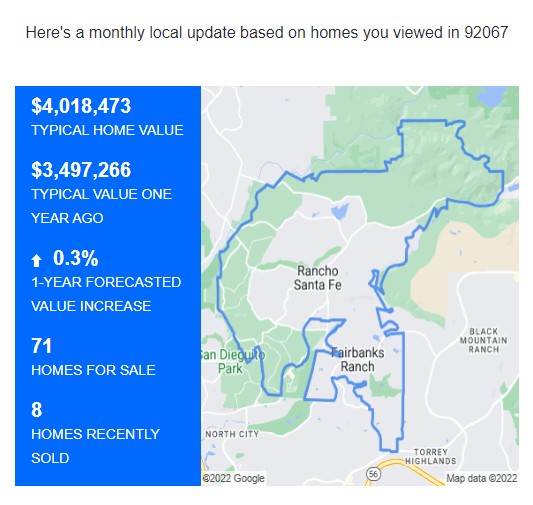

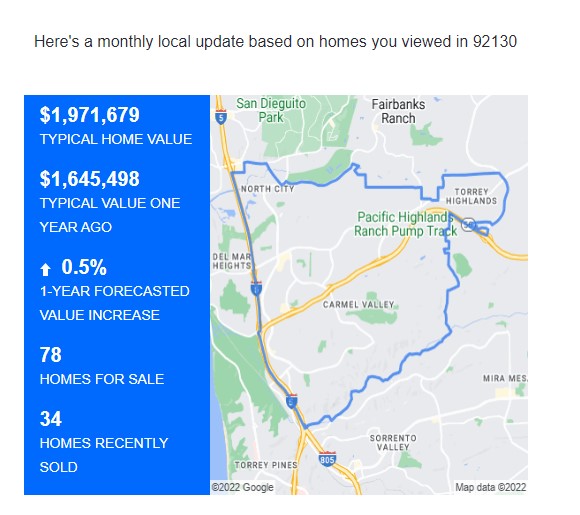

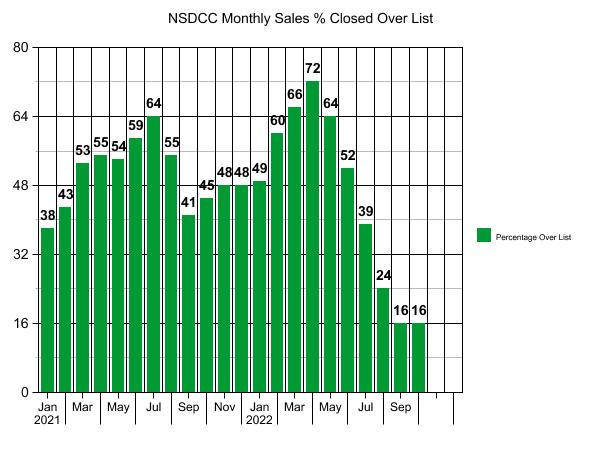

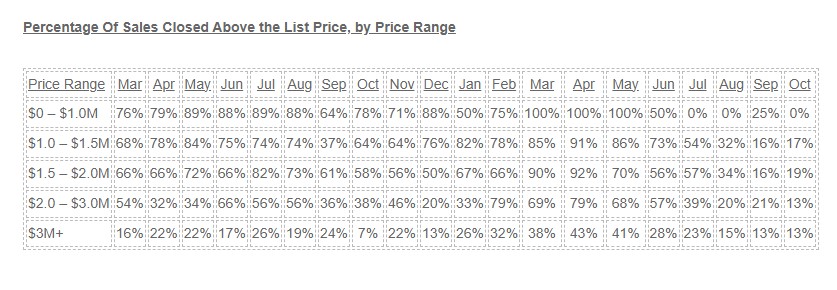

I still think the 2023 Spring Selling Season will be boisterous, and the sales volume will pick up – but generally-speaking, I agree with Zillow that pricing won’t be rising. Here are Z’s latest predictions:

Less than 1% annual increases in prime neighborhoods? Yikes!

There is nothing wrong with being in Plateau City. Sellers just need to recalibrate and be smart about what it takes to sell a home in this environment:

That’s all – and if you don’t do all five, it’s ok because there’s nothing that price won’t fix!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

An example of #1 is the now-famous property for sale in Del Mar on Border. A buyer thought they could get approvals to build a high-end resort there, but it was put to a vote, and the citizens turned it down. A new buyer is now hoping to turn it into apartments.

It’s been for sale since 2007, or 5,573 days!

https://www.compass.com/app/listing/929-border-avenue-solana-beach-ca-92075/25353758691121345

P.S. If there is anyone who wonders why their Over-$4,000,000 stats don’t match up with mine, it’s because I take this listing out every week so it doesn’t skew the averages.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

NSDCC Average and Median Prices by Month

| Month | |||||

| Feb | |||||

| March | |||||

| April | |||||

| May | |||||

| June | |||||

| July | |||||

| Aug | |||||

| Sept | |||||

| Oct | |||||

| Nov | |||||

| Dec | |||||

| Jan | |||||

| Feb | |||||

| Mar | |||||

| Apr | |||||

| May | |||||

| Jun | |||||

| Jul | |||||

| Aug | |||||

| Sep | |||||

| Oct |

OMG – the average & median sales prices went up!

Does that mean home prices went up?

NONONONO!

It means the set of homes that closed escrow in October happen to produce higher numbers because they were larger (October median sf was +12%) and more attractive than the group in September.