CV Reasonable

Reader M noted that there is a lot of building underway in PHR – this builder is actively selling four different tracts that range from $1M to $2M.

Here is a tour of the less-expensive homes up the hill from the last set we saw:

Reader M noted that there is a lot of building underway in PHR – this builder is actively selling four different tracts that range from $1M to $2M.

Here is a tour of the less-expensive homes up the hill from the last set we saw:

An employee of the Bank of America recently told me that they are not extending any of the loan modifications that have been issued over the years, to which I chuckled.

“What are they going to do, foreclose?”

“Yes” was the response, which got a chortle out of me. After all the taxpayer support and bending of the foreclosure rules, now you’re going to tell people to start making their payments…or else?

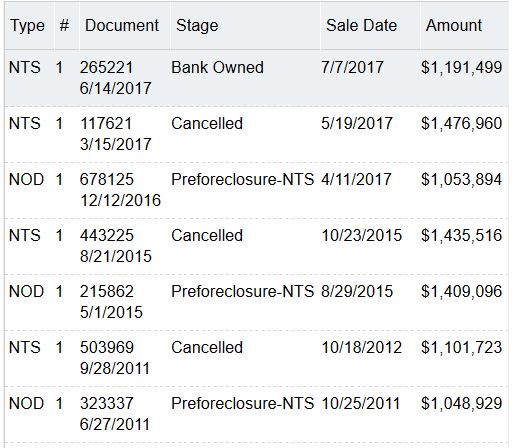

Lo and behold, it looks like it, at least for this one example:

This was the house mentioned HERE that had been in foreclosure since 2011. Yesterday, the lender finally foreclosed on the ‘homeowner’ who probably wasn’t making many, if any, payments over the last six years.

Up until now the properties being foreclosed were those that had sufficient equity where the lenders weren’t taking much of a loss. It was good to see the opening bid here come out well below what was owned – though it was all interest accrued from non-payment.

No takers at the trustee sale though, in spite of Property Radar’s guesstimate of value was over $1,600,000, which was way off.

I can’t imagine there being a flood of these after all we’ve been through, and you can bet the eventual list prices of these will be full retail.

But it’s good to see the deadbeats getting challenged.

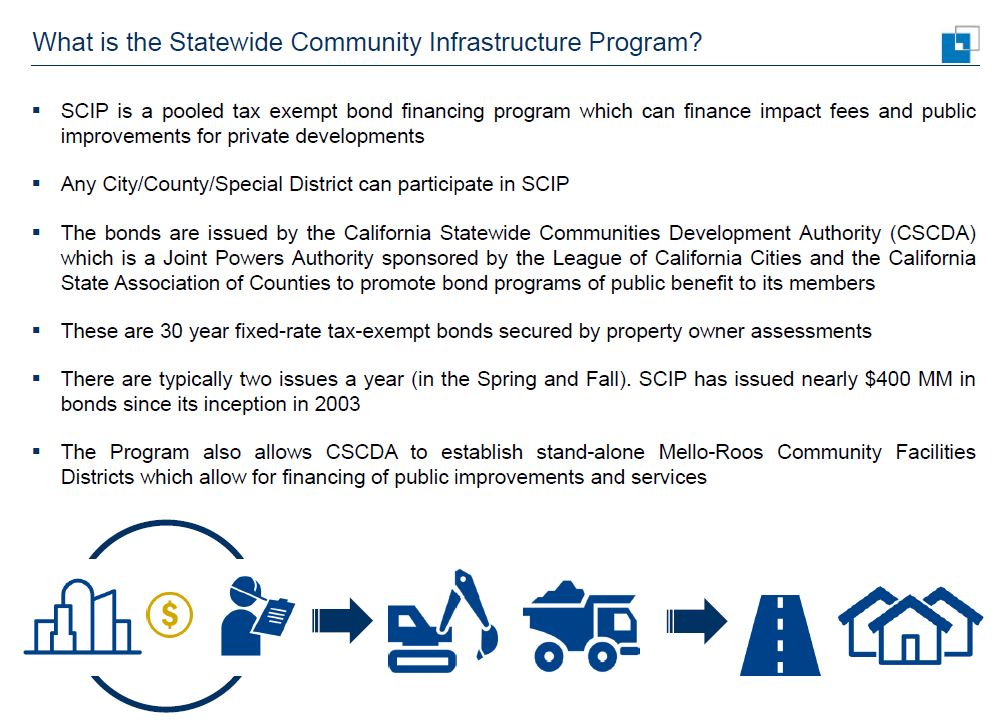

The Statewide Community Infrastructure Program (SCIP) sounds like another name for 30-year Mello-Roos-type bonds whose proceeds are used to pay for things that governments or home builders used to cover.

Here is their intro:

The Mello-Roos at this Carmel Valley new tract is $2,932.90 per year, plus the Statewide Communities Infrastructure Program requires another $4,300 per year (total = $7,232.90 or about $603 per month):

Sales have been remarkably steady for the first half of the last three years, with only a slight variance in the sales count:

| Year | ||||

| 2012 | ||||

| 2013 | ||||

| 2014 | ||||

| 2015 | ||||

| 2016 | ||||

| 2017 |

In the first half of 2012, there were 331 houses that sold under $600,000.

This year we had 11.

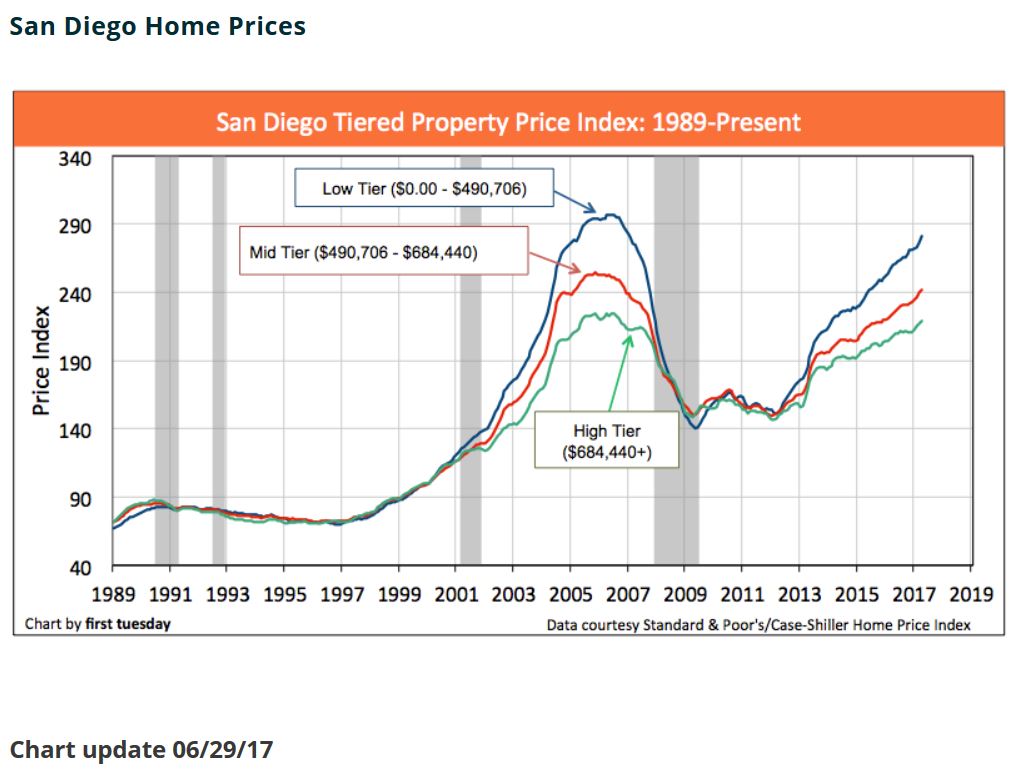

Note that last time the rise in prices was quicker (steeper curve), and it only took about a year – 2006 – to reverse course.

This time, the increase looks more reasonable (more-gradual slope), but it still has to look daunting to buyers.

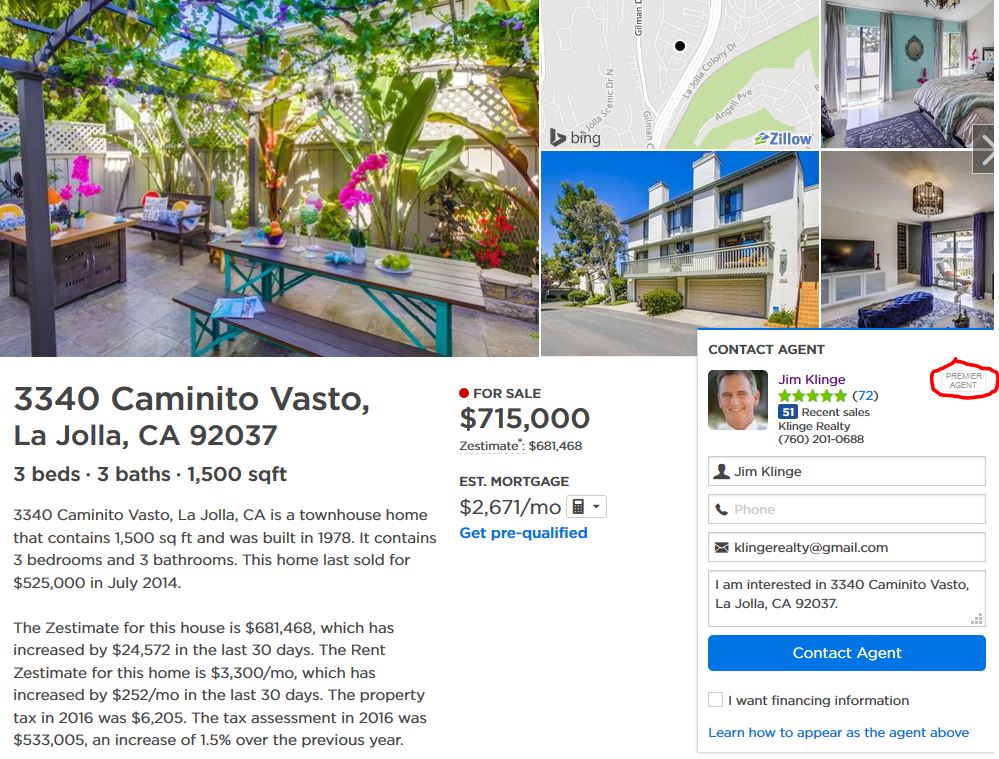

Zillow has uploaded my Caminito Vasto listing! The MLS remarks didn’t pull through – but the photos did, go figure. They also called me a Premier Agent, and eliminated the three-headed monster.

We had two offers on Vasto, and I marked it pending on Monday, but they still show it as an active listing – but at least it’s on their website.

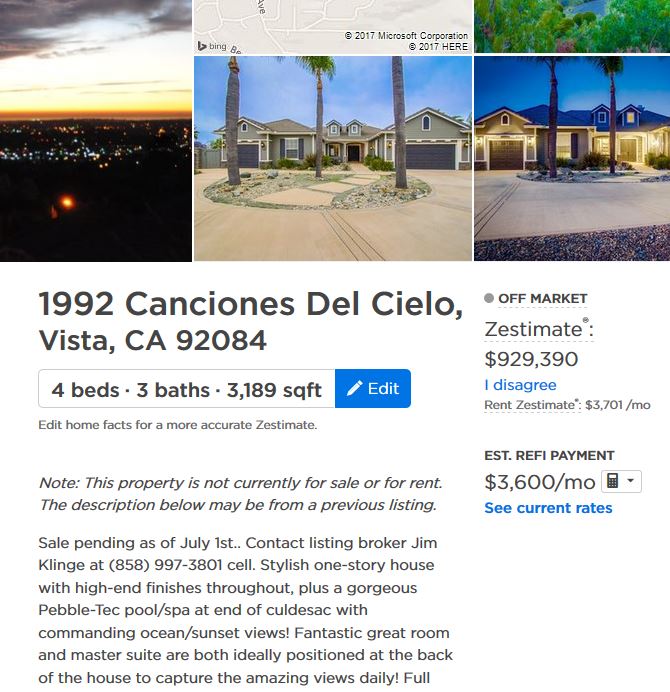

They are still having trouble with the listings that go pending, like the one below where they remove the list price and listing agent and just call it off-market, which isn’t accurate either for people who may have seen the for-sale sign or who are checking out the listing agents. I added the first couple of sentences in the remarks to help:

When my Caminito Vasto seller saw her listing finally appear on Zillow today, she said, “I used to use Zillow all the time but I never realized how crappy and slow they were until now….”.

It doesn’t take much to lose your stature in the marketplace when there are plenty of similar alternatives available!

For those of you who use Zillow as their go-to real estate portal, you may have noticed that we had a wild and wacky weekend – and the party is still going!

It was on May 1st that Zillow started uploading our listings directly from our MLS, Sandicor. The new system prevents agents from inputting new listings, or marking our existing listings as pending.

On Friday there was a breakdown in the uploading process, but it wasn’t across the board. Here are the real estate companies and the effects:

Coldwell and Berkshire – they both had their corporate direct feeds set up before May 1st, and it looks like they are running fine.

Sotheby’s – some new listings have been uploaded since Friday, and some haven’t. No rhyme or reason as to who was affected.

It looks like all other companies are NOT having their listings uploaded to Zillow, nor are they being marked pending automatically like they were previously – and you can’t do it manually either.

I did open house in La Jolla both Saturday and Sunday, and I had visitors on both days asking why my listing wasn’t on Zillow.

It’s a mess, and let’s add these extras too:

The mix-up is isolated to the San Diego market, and could be part of the uneasy union between Zillow and Sandicor, who was a reluctant partner in the past.

But both entities stated publicly that this auto-upload package was good for all, and a big step towards accuracy on Zillow. We’ll see how long it takes them to fix it – today is Day 6.

For those who think this might be an opportunity for a competitor to take advantage, read this:

http://www.notorious-rob.com/2017/07/random-thoughts-on-redfin-going-public/

My mom shares her birthday with the U.S.A. – here she is celebrating her 83rd while on her summer tour of kids and grandkids this week.

She moved in with us about three months ago, and while it has its challenges, overall it’s been good. She likes her chair yoga classes, and we’re hoping to have her attend multiple times per week to keep up her fitness.

Happy Birthday Mom!

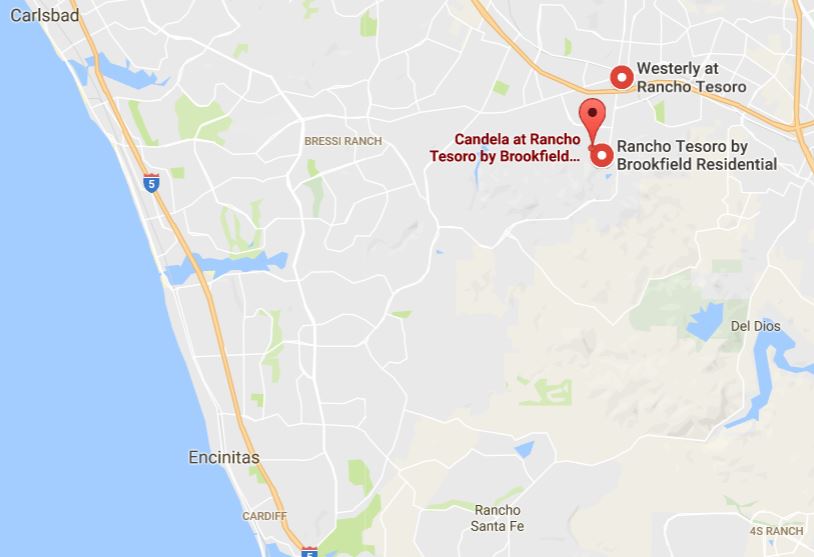

Sure, he shows all that fancy stuff for over a million, how about some decent new homes in the $800,000s?

If you have flexibility on where you live and yet want easy access to south Carlsbad/Encinitas over the hill, here are good-sized new homes that start in the mid-$800,000s:

Thanks daytrip for sending this in – a surprising verdict, and if it wasn’t such a high ticket price, it may not have gone this way:

MSNBC host and former ad exec Donny Deutsch scammed a real estate broker out of a $1.2 million commission in the sale of Deutsch’s $30 million Hamptons home, a Manhattan judge seethes in new court papers.

Justice Charles Ramos says Deutsch’s lawyer was acting on his client’s behalf when Sotheby’s broker Edward Petrie was schemed out of his 4 percent commission, The Post’s Julia Marsh reports.

Petrie had brought a potential buyer, LA hedge funder Howard Marks, by Deutsch’s Tyson Lane home in 2010.

After Deutsch realized he knew Marks, he went behind Petrie’s back and brokered the sale privately to avoid the fee, Petrie claimed.

“This court considers that and refusal to acknowledge [Petrie] as the broker to be marks of dishonesty and greed,” Ramos writes in the Oct. 23 decision awarding Petrie’s employer, Sotheby’s, $1.2 million.

“Both characteristics are particularly unbecoming when exhibited by those blessed with great wealth,” the judge scolds.

A representative for Deutsch says, “Mr. Deutsch is shocked and outraged by this ruling, which is wrong based on law and fact. The ruling was based on the Sotheby’s broker’s contention that Mr. Deutsch agreed to a 4% commission arrangement. This is an outright and absolute lie. There was no such agreement, neither verbal nor written, and internal Sotheby’s email communications confirm this. Mr. Deutsch will vigorously defend his position in court and is very confident this decision will be reversed on appeal.”