An employee of the Bank of America recently told me that they are not extending any of the loan modifications that have been issued over the years, to which I chuckled.

“What are they going to do, foreclose?”

“Yes” was the response, which got a chortle out of me. After all the taxpayer support and bending of the foreclosure rules, now you’re going to tell people to start making their payments…or else?

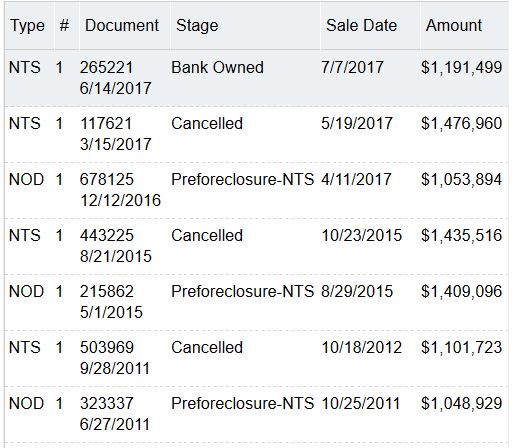

Lo and behold, it looks like it, at least for this one example:

This was the house mentioned HERE that had been in foreclosure since 2011. Yesterday, the lender finally foreclosed on the ‘homeowner’ who probably wasn’t making many, if any, payments over the last six years.

Up until now the properties being foreclosed were those that had sufficient equity where the lenders weren’t taking much of a loss. It was good to see the opening bid here come out well below what was owned – though it was all interest accrued from non-payment.

No takers at the trustee sale though, in spite of Property Radar’s guesstimate of value was over $1,600,000, which was way off.

I can’t imagine there being a flood of these after all we’ve been through, and you can bet the eventual list prices of these will be full retail.

But it’s good to see the deadbeats getting challenged.

Well with prices having rebounded to bubble levels, banks can now foreclose without taking a huge loss.

That was the plan all along.

It just ain’t right…

https://twitter.com/mcmansionhell