Real Estate Porn?

Hi-definition movies to sell homes – this one gives you enough to make you want more, which is the goal of marketing. It closed for $16,300,000 in April:

Hi-definition movies to sell homes – this one gives you enough to make you want more, which is the goal of marketing. It closed for $16,300,000 in April:

Hat tip to W.C.Varones for sending in this article. I read it, and all of the supporting documentation, but didn’t find any surveys or data to back up the president’s claim below that well over 1 million additional properties will change hands – he just made that up.

If you can afford the cost and hassle of moving up, the increase in property taxes isn’t going to be what stops you. If we’re going to change Prop 13, let’s do it based on surveys and valid research, not some cheerleader popping off:

Local Realtors President Bob Kevane, who unveiled the Proposition 13 change, said he has been touting the idea for a decade and believes it is needed more than ever because of low inventories.

“I think the majority of California property owners who have owned their homes for five or six years are not moving because of Proposition 13,” he said. “It’s basically locking them into their current residence and not providing the normal move-up markets we’ve had in the past.”

In the first two or three years after changing Proposition 13, he said, “You would see well over 1 million additional properties change hands.”

Under Kevane’s proposal, buyers would carry over their own tax basis plus what’s owed on the difference between the sales prices on the old and new properties. (If the new value is less than the old value, the old tax bill would apply.)

Kevane offered this example for a move-up buyer:

Home 1: Purchased for $300,000 in 2000. The original tax bill of $3,000 has now risen to $4,000 because of the annual assessment adjustments plus any permanent improvements. It sells for $500,000.

Home 2: Purchased for $600,000. Current law would set the tax price at $6,000. But Kevane’s proposal would reduce it to $5,000 — $4,000 carried over from the Home 1 bill plus $1,000 covering the tax difference between the two home prices.

The break is similar to a senior discount enacted in two Proposition 13 amendments. But under those provisions, owners aged 55 or older can keep their old tax base only if their replacement home price is no more than their sold property’s price. That senior discount can be invoked only once for a couple or individual.

In effect, Kevane’s proposal would make the senior discount available to all sellers every two years without age, income or price restriction. Older owners would also benefit because they no longer would be limited to invoking the tax discount once and children who inherit their parents’ homes could continue enjoying the lower tax base if they choose to move.

“How it’s going to benefit lower-income people is it’s going to free up all the houses that have not been on the market for years,” Kevane said.

Kevane said the state association is expected to announce the ballot campaign by Aug. 22, the deadline set to launch statewide citizen initiatives. But he also said he will speak with state Sen. Toni Atkins, D-San Diego, and other legislative leaders to see if they will put on the measure on the ballot directly.

In the last post we saw that the median sales price for San Diego is up 11.2% year-over-year. Let’s check the individual areas between Carlsbad and La Jolla, using the combined May/June Y-O-Y data for larger sample sizes:

| Area | |||||

| Cardiff | |||||

| Carlsbad NW | |||||

| Carlsbad SE | |||||

| Carlsbad NE | |||||

| Carlsbad SW | |||||

| Del Mar | |||||

| Encinitas | |||||

| La Jolla | |||||

| RSF | |||||

| Solana Beach | |||||

| Carmel Vly | |||||

| All Above |

Comparing the sales counts is the best way to gauge the overall health of the market, and they are looking good in all areas.

Neither of the price metrics are that great, but in areas where both are heading in the same direction suggests a trend.

As the national drought in home supply dragged into its 21st straight month, competition among buyers drove prices up once again.

And the fiercest competition was in the Bay Area.

A new report from Redfin shows that 73.7 percent of homes sold above the listing price in the San Jose metropolitan area in June. That was the highest percentage in the nation, followed by the San Francisco metropolitan area (70.6 percent, second highest in the U.S.) and the Oakland metropolitan area (69.8 percent, third highest). They were followed by Seattle (62.3 percent) and Tacoma, Wash., (52.6 percent).

“Every record in market speed and competition that was set in May was broken again in June,” the report stated.

The Redfin report comes two days after the Mercury News reported on a rash of over-asking home sales in Sunnyvale and Cupertino. In the last month, more than 50 homes in those two cities sold for at least $200,000 over the asking price. One modest Cupertino house — 1,046 square feet — sold for $660,000 above its listing price.

According to Redfin, San Jose had the nation’s largest decrease in housing inventory, falling 42.2 percent in June from one year earlier. The second largest year-over-year contraction of the home supply was in Rochester, N.Y., where inventory fell 29.7 percent. The third largest shrinkage happened in San Francisco, where inventory fell 26.6 percent.

Read full article here:

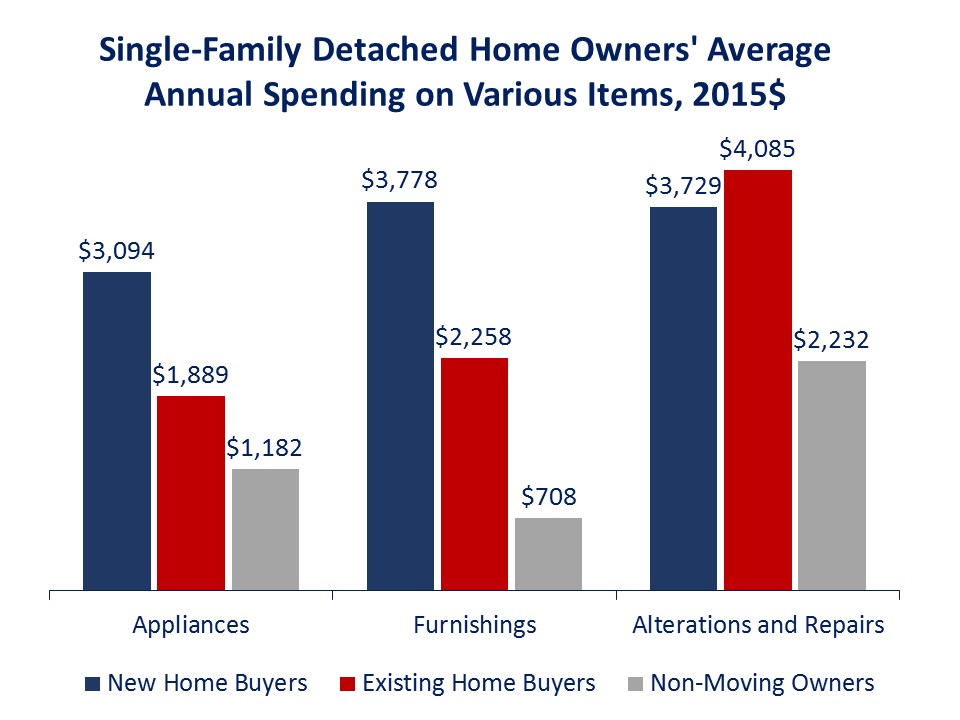

Buying a house just gets you started – there are the other goodies too. In the tony coastal regions, add a zero to these numbers!

http://www.mortgagenewsdaily.com/07132017_home_buying_behavior.asp

An excerpt:

Specifically what do home buyers purchase?

The biggest ticket item for new home buyers is sofas, spending an average of over $700, 60 percent more than spent by buyers of existing homes and 6.4 times more than spent by non-movers in a year. There is also a large effect on purchases of living room (other than sofas), dining room, and kitchen furniture with new home buyers spending $687 on living room chairs/tables and another $345 on kitchen and dining room future, outspending existing home buyers 12 to 1 in both categories and non-buyers by 5 and 9 times respectively.

The differences in spending patterns are similarly large when comparing spending on window coverings. New home buyers spend 10 time more than existing home buyers and 4 times more than non-buyers.

The biggest outlay in the appliance budget of new home buyers are for laundry equipment, landscaping equipment and computer hardware/systems. They outspend both existing home buyers and non-buyers on all of these and on big-ticket items like refrigerators and televisions as well.

The high level of appliance spending may seem surprising given that many new homes come equipped with them. However, she cites a survey by the Home Innovation Research Labs found that two-thirds of new homes built in 2015 came without laundry appliances and 36 percent had no installed refrigerator.

Also unexpected, new home buyers spend almost as much ($3,729) as existing homes buyers ($4,085) and outspend non-moving owners ($2,232) on property alterations and repairs, but they spend on quite different things. Existing home buyers and non-movers spend more on various repairs and replacements and on kitchen/bathroom renovations and purchase and installation of new systems while new home owners spend on outside additions and alterations, including new driveways, walks, or fences.

The analysis further shows that home buyers don’t compensate for their higher level of spending by cutting back on other things like entertainment, travel, restaurants meals, etc. “This confirms that home buying indeed generates a wave of additional spending and activity not accounted for in the purchase price of the home alone,” NAHB says.

The easiest way for anybody to make money from real estate – refer a realtor. Costco, Lowe’s and others have tried it, but you don’t get the best realtor – you get the best realtor who is willing to pay to be on the list, and/or willing to discount their commission too.

As shoppers scoured Amazon’s website on Tuesday for its annual Prime day deals, the online shopping giant quietly disclosed a new service coming soon to its users: “Hire a Realtor”. The move would turn the company into a competitor with Zillow and Redfin. Shopping for a new television? How about adding a new home to put it in?

Tucked into the website’s Home and Business Services section, where users can receive quotes from professionals for various services including assembling new purchases or setting up new technology, Amazon now lists a “Hire a Realtor” webpage, seen below.

The website offer very little information on the possible service other than what is shown above, and Amazon did not get back to a request for comment by the time of publication.

An article in GeekWire, however, by Monica Nickelsburg, stated, “When reports of the Amazon page surfaced, Zillow’s stock price slumped from $46.15 a share to $44.54 as of Wednesday morning, showing just how closely investors are watching the Seattle retailer.”

If Amazon does get into the real estate world, it wouldn’t be the first service market its decided to disrupt this summer.

Amazon also revealed earlier this month that it was rolling out its own version of Best Buy’s popular Geek Squad service, which offers in-home product installations and repairs on electronics and appliances, according to an article in CNN Tech by Kaya Yurieff.

Amazon is also a source for homeowners to find house cleaners, local carpenters, electricians, etc.

“The new ‘Amazon Smart Home Services Store’ on its website allows users to book appointments for installations or free consultations. Company experts will answer questions and set up products like smart lights, thermostats and of course, Amazon’s line of smart devices,” the article stated.

Amazon took down their realtor webpage later.

The Redfin IPO has been announced, and people are wondering what effect it could have on the home-selling business. Notorious Rob started with the impact on brokerages:

http://www.notorious-rob.com/2017/07/the-impact-of-redfin-post-ipo-part-1-brokerages/

I agree with Rob that the real-estate-portal battle could be a two-horse race between Redfin and Zillow – the others just don’t seem to be interested in spending enough advertising money to get ahead.

Rob called his post ‘Part 1’, so he’ll have more on the topic as we go. I’m not sure where he’s going with it, but I’ll add my two cents:

What Redfin is not:

You could probably accuse all agents, to some degree, of the ten items above. I’m not down on the individual Redfin agents – the experience I’ve had with them has been mixed, just like with non-Redfin agents. We are probably more alike than different – I’m an employee, with medical benefits, of a non-traditional brokerage with a consumer-facing website used to create business. Maybe I should IPO? 🙂

In fact, the actual Redfin agents are pretty far down my list of concerns. If we ever have a realtor revolution, this is who we should be fighting:

These are the people who are the real threat to the 1.2 million realtors in America. Unfortunately, like politicians and other rich people in power, they will be allowed to pick us apart from their mansions on the hill.

The Village Church in Rancho Santa Fe was packed today – over 500 people by my count – to pay our respects to Doug Harwood. Five people spoke from the pulpit, but it seemed like everyone there could tell a story or two about Doug.

I’ll tell my favorite here.

A few years back, I had tracked down the owner of a house that was in default, and told him I had a buyer. Because the loan balance exceeded the value, and the owner didn’t live in the house, he had nothing to gain really. He was an upstanding citizen who was beset by medical issues that prevented him from working, and had gotten behind.

He said he’d be willing to work out a deal, but he wanted his agent to help. Great, who’s your agent? “Doug Harwood”, he said.

Though we had done business before, I didn’t know Doug that well. We arrange a meeting at the owner’s residence, and I came wearing my usual tie and driving the luxury sedan.

Doug pulls up in his older Suburban, and jumps out wearing the big hat he made famous. He then introduces me to his passenger.

“Jim, I want you to meet me Dad. We’re on our way to our weekly lunch.” I had just lost my Dad, and I remember how envious I was for them – and recognized that this wasn’t going to be the usual business meeting.

Selling houses was the byproduct of Doug’s relationship-building. Sure, we would need to get to some paperwork details later, but first – and more importantly – Doug engaged in a jovial conversation between all of us. Most agents would never think of letting you speak with their client, but Doug insisted. We even joked that if the short-sale went bad and the bank screwed us out of the commission, we’d just swap weekends driving the seller’s old Ferrari around!

It was obvious today that this was how Doug treated everyone. Shannon told the great story of how Doug would approach a homeless person. He wouldn’t ask if they were homeless; instead he’d ask if they were ‘living outside’ – and then reel off a hundred-dollar bill to make their day.

David Miller said that Doug loved the ‘Word of the Day’, and recently the word was nexus, which perfectly described Doug. He was the center of the community, judging by the 500 people who attended today, and there will never be another one like him – which makes our memory of Doug even more special.

I cut my favorite passage of our talks here:

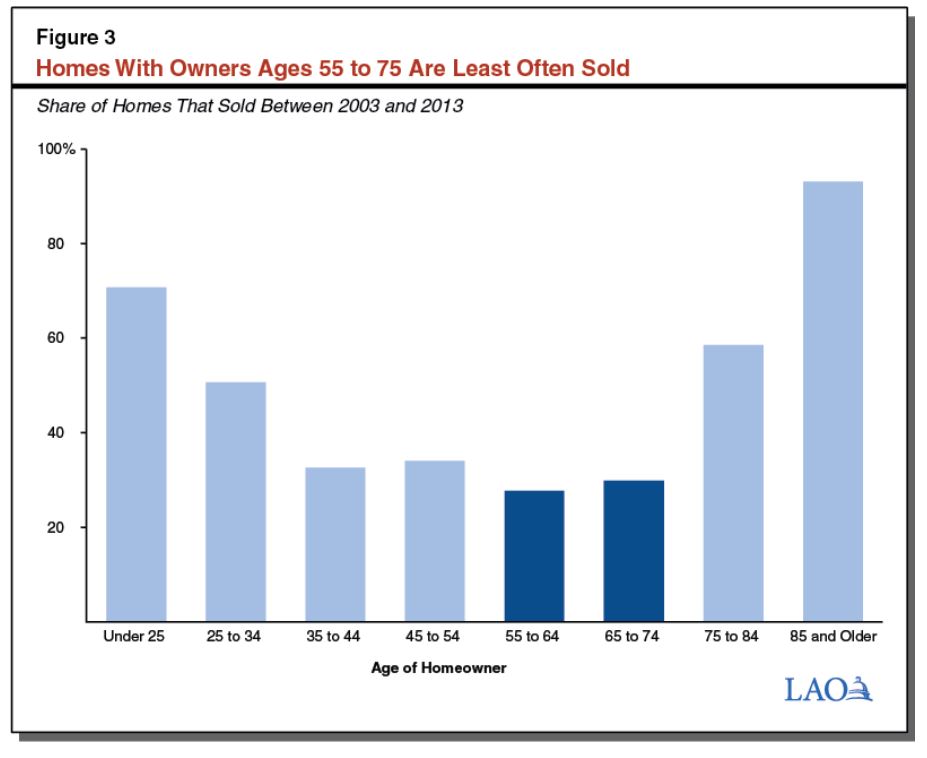

Daytrip sent in this article (link below) on baby boomer sales, and how the transfer of homes from parents to children are likely to dampen the supply of homes for sale – and somewhat limit the property-tax receipts:

But then I went to the actual report for more info and graphs:

http://www.lao.ca.gov/Publications/Report/3693

They do expect more boomer sales – it looks like a growing trend as more boomers get into their mid-70s:

Home Sales Likely to Pick Up as Homeowners Get Older. Although the aging of California’s homeowners has depressed home sales in past years, this pattern is likely to reverse in the future.

As California’s homeowners continue to age—transitioning from the 55 to 75 age group to the over 75 age group—more and more will begin to downsize, move into assisted living or with family, or die. When this occurs, home sales are likely to rise.

Between 2003 and 2013, over two-thirds of homes in California with owners 75 or older were sold to a new owner, compared to less than one-third of homes with owners ages 55 to 75.

Different Rules Apply to Homes Passed From Parents to Children. In general, when a home is transferred to a new owner, its taxable value is reset to its purchase price.

California voters, however, passed Proposition 58 in 1986, which amended the California Constitution to exempt transfers between parents and children (and later grandparents and grandchildren under certain circumstances under Proposition 193 [1996]) from revaluation. This allows a child to inherit their parent’s lower taxable property value.

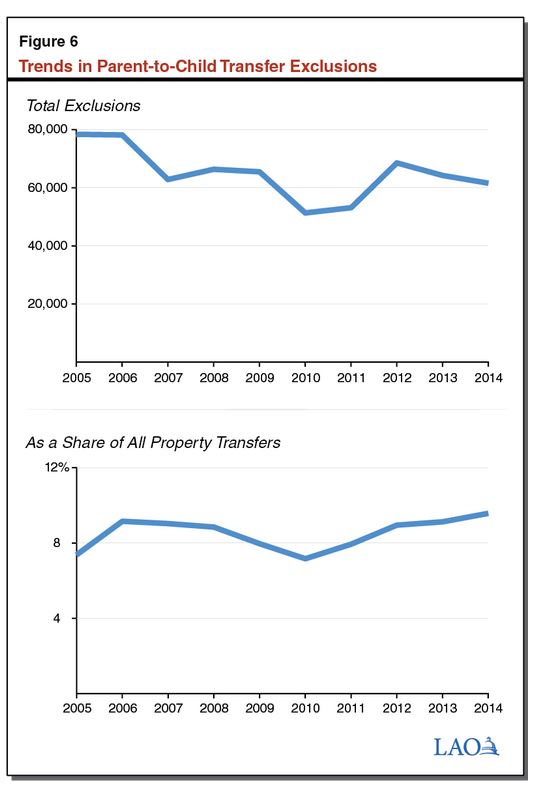

The report shows the parent-to-child transfers to be around 10% over the total homes sales over the last decade, but it should be going higher, especially in the higher-cost coastal counties!

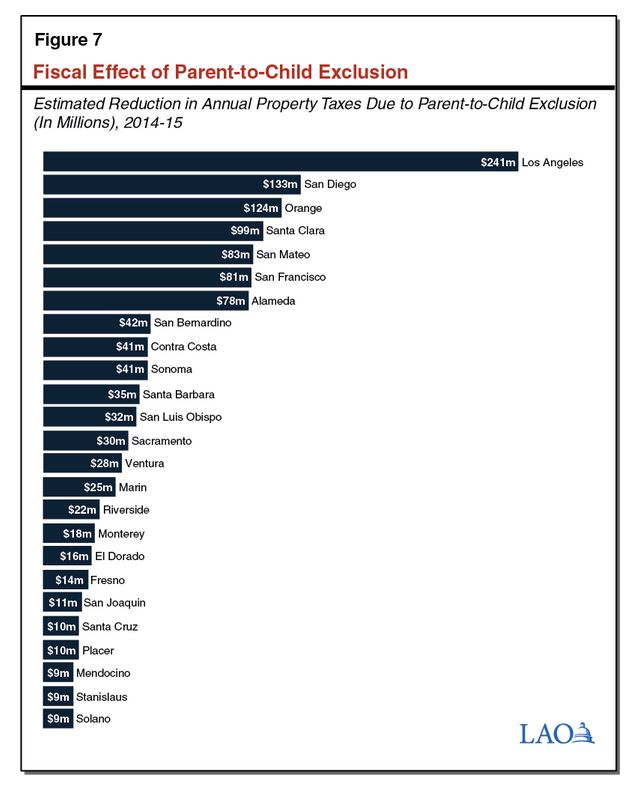

Parent-to-Child Exclusions Have Had a Notable Impact on Revenues. Over the past decade, around 10 percent of property transfers have taken advantage of the parent-to-child exclusion to prevent an increase in property tax payments. Figure 6 shows how many of these exclusions have been used each year during the past decade.

JtR:

San Diego County is the second most populated county in the state, so no surprise we’re #2 on list at $133,000,000 in estimated reduced taxes. Those are a substantial number of homes being transferred within the family!

If the average tax savings was $10,000 per house sold, it would mean 13,300 homes transferred from parent to child – and this is from 2014-2015. We had 35,382 homes sold on the MLS in the same period. Add the FSBOs and new-home sales and we might have had 40,000 to 45,000 total homes transferred in fiscal 2014-2015.

The parent-to-child transfers could be as many as 25% of the homes moved! (40,000+13,300 = 53,300. 13,300/53,300 = 25%)

Their $133,000,000 estimate could be a tad off, but we probably have 10% to 20% of the potential supply of homes for sale being transferred within the family. No wonder the public supply is so limited.

It is a trend that probably started to increase in 2013 as prices took off. Parents realized that with the low tax basis, a child would be better off moving into the family homestead, rather than buying a resale home and paying full boat on the property taxes!

Let’s take a look at how the NSDCC market has changed since the spring selling season kicked into gear

Here are the differences in active inventory between March 6th and today:

| Price Range | ||||

| 0-$800K | ||||

| $800-$1400K | ||||

| $1400-$2400K | ||||

| $2400K+ |

The average list-price-per-square-foot in the $800,000-$1,400,000 category has risen 15% in four months, and the number of active listings ballooned 45% in the same time. Buyers must be price-sensitive!