by Jim the Realtor | Oct 15, 2014 | Auctions |

Just had to hedge it a little….from CAR:

This law, on and after July 1, 2015, with respect to an auction that includes the sale of real property, prohibits a person from causing or allowing any person to bid at a sale for the sole purpose of increasing the bid on any real property being sold by the auctioneer.

The law, however, does allow an auctioneer or another person to place a bid on the seller’s behalf during an auction of real property if notice, as specified, is given that liberty for that bidding is reserved. The law also requires in this regard that the person placing that bid contemporaneously disclose to all auction participants that the particular bid has been placed on behalf of the seller.

The law exempts a credit bid made by a creditor with a security interest in the property that is the subject of auction when the credit bid can result in the transfer of title to property to the creditor.

Finally, this law prohibits a lender or an auction company that is retained to control aspects of a residential real property transaction from requiring, as a condition of receiving a lender’s approval of the transaction, a homeowner or listing agent to defend or indemnify the lender or auction company from any liability alleged to result from the actions of the lender or auction company and declares a clause, provision, covenant, or agreement in violation of this prohibition to be against public policy, void, and unenforceable.

Assembly Bill 2039 (codified as Civil Code §§ 2079.23 and 1812.610) (effective July 1, 2015).

by Jim the Realtor | Oct 15, 2014 | North County Coastal, Sales and Price Check |

Here’s an excerpt from the Dataquick sales release for September:

http://www.dqnews.com/Articles/2014/News/California/Southern-CA/RRSCA141013.aspx

Irvine, CA—Southern California home sales hit a five-year high for a September, rising slightly above a year earlier for the first time in 12 months amid gains for mid- to high-end deals. The median sale price fell below an 80-month high reached in August and for the first time in more than two years none of the Southland counties posted a double-digit year-over-year price gain, CoreLogic DataQuick reported.

A total of 19,348 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 2.9 percent from 18,796 sales in August, and up 1.2 percent from 19,112 sales in September 2013, according to CoreLogic DataQuick data.

On average, sales have fallen 9.4 percent between August and September since 1988, when CoreLogic DataQuick statistics begin. Last month marked the first time sales have risen on a year-over-year basis since September last year, when sales rose 7.0 percent from September 2012.

September home sales have ranged from a low of 12,455 in 2007 to a high of 37,771 in 2003. Last month’s sales were 18.3 percent below the September average of 23,695 sales.

The median price paid for all new and resale houses and condos sold in the six-county region last month was $413,000, down 1.7 percent from $420,000 in August and up 8.1 percent from $382,000 in September 2013. The August 2014 median was the highest for any month since December 2007, when it was $425,000.

Southland sales were 2.9% higher in September than August, when on average there is a 9.4% decline? Considering how high prices are, that’s good. We didn’t do as well locally. Here are the stats for NSDCC detached-home sales:

| Mo./Year |

# of Sales |

Avg. $/sf |

Avg. DOM |

| Sept. ’13 |

263 |

$470/sf |

52 |

| Aug. ’14 |

245 |

$500/sf |

45 |

| Sept ’14 |

231 |

$478/sf |

49 |

Sales were down 12% year-over-year, and 6% lower than August.

by Jim the Realtor | Oct 14, 2014 | Interest Rates/Loan Limits, Market Buzz, Market Conditions

We should see a resurgence in buyer interest now that rates are under 4%. They probably won’t pay a lot more, but if sellers can live with the same price as the last comp, they should be able to sell.

From MND:

http://www.mortgagenewsdaily.com/consumer_rates/398692.aspx

Mortgage rates continued living the dream today, falling decisively past last week’s lows to claim another instance of “best rates since June 2013.” Today’s move was exceptional compared to last week’s (or just about any other move lower of 2014 for that matter). After heading into the weekend in relatively conservative territory, the bond markets that underlie mortgages were greeted with massive movement in broader financial markets over the 3-day weekend.

Some of that movement took place late on Friday–too late for rate sheets to experience much benefit–but most of it occurred in global bond markets during Asian and European trading overnight.

Motivation varies depending who you ask, but the concept of “global growth concerns” is the common thread running through most of the reasons offered for the drop in rates.

Last week’s best moments saw the most prevalently-quoted conforming 30yr fixed rates hover between 4.0 and 4.125% for top tier borrowers. Today’s rates all but eliminated 4.125% from that list. In fact, 3.875% would now be more common than 4.125% (assuming a flawless loan file, 75% or lower Loan-to-Value, and a competitive lender). Rates haven’t been any lower since the first half of June 2013.

by Jim the Realtor | Oct 14, 2014 | Local Flavor |

San Diego ranks high on every list of the most expensive places to live.

Are you thinking about leaving town? Here is a website that compares the cost of living between cities around the world:

http://www.expatistan.com/cost-of-living

by Jim the Realtor | Oct 13, 2014 | Builders, Thinking of Buying? |

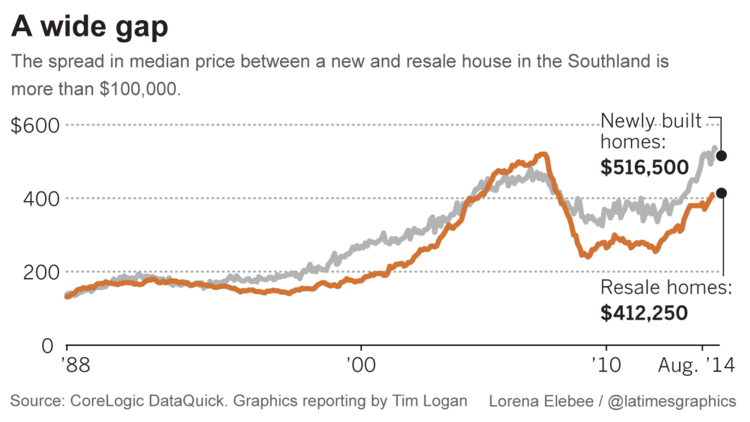

The higher-priced new homes help to accelerate the values of existing homes. All sellers have to do is undercut the price of new tracts nearby – if there are any! HT to daytrip for sending this in from the latimes.com:

http://www.latimes.com/business/la-fi-new-home-prices-20141014-story.html#page=1

Builders have piled in to pricey ZIP Codes — bidding up land costs there in the process — and polished their projects to a high gloss to woo wealthy buyers with cash or good credit.

“Builders have been focusing very heavily on the move-up market as opposed to entry level,” said Bradley Hunter, chief economist at housing research firm MetroStudy. “There’s a simple reason: That’s where the profits are.”

Meanwhile, projects aimed at the middle of the market remain scarce, and overall home building is off about 60% from a decade ago. The shortage of new lower-priced product is one factor making Southern California among the toughest housing markets in the country for middle-income families.

New homes have almost always sold at a premium. They come with bells and whistles — including energy-efficient appliances and often a warranty — that a decades-old house can’t match. But that premium has hit new highs this year.

In January, the gap between median-priced new and resale homes in Southern California peaked at $151,000, a 41% premium for a new house. And although it has eased a bit since, it has been larger than $100,000 in nine of the last 10 months, compared with an average of $38,000 over the last 25 years, according to CoreLogic’s figures. The same trend is playing out nationally, though in less dramatic fashion.

Higher-end home builders see this dynamic too, and they’re gobbling up what land is left. Luxury builder Toll Bros. acquired 3,200 lots in Southern California this year when it bought Shapell Homes, part of its plan to expand from its East Coast base into higher-growth markets. Now Toll is working on five new communities, from Santa Clarita to Carlsbad, in prime spots with good schools. It will start selling homes next year, said Jim Boyd, head of Toll’s California operations, and expects to do well.

“I think the market is pretty strong,” he said.

Read full article here:

http://www.latimes.com/business/la-fi-new-home-prices-20141014-story.html#page=1

by Jim the Realtor | Oct 13, 2014 | Inventory, Jim's Take on the Market |

Figuring that not many readers make it all the way to the bottom of this weekly inventory report, I clipped the bottom category and brought it to the top. This is the last 2.5 months of weekly counts of new listings, and new pendings:

It is remarkable how steady the market has been – there hasn’t been any drop off in demand, even after school started and the Chargers began their roll.

The new listings coming to market have been steady too, and in reviewing the active inventory below, you’ll see that sellers aren’t giving up yet either. Very few are cancelling their listing, and Halloween is within sight!

The UNDER-$800,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

DOM |

Avg SF |

| November 25 |

95 |

$376/sf |

47 |

1,988sf |

| December 2 |

79 |

$371/sf |

50 |

2,047sf |

| December 9 |

72 |

$383/sf |

43 |

1,954sf |

| December 16 |

81 |

$378/sf |

42 |

1,948sf |

| December 23 |

77 |

$374/sf |

49 |

1,937sf |

| December 30 |

76 |

$373/sf |

51 |

1,950sf |

| January 6 |

74 |

$370/sf |

49 |

1,995sf |

| January 13 |

71 |

$381/sf |

44 |

1,921sf |

| January 20 |

72 |

$384/sf |

41 |

1,877sf |

| January 27 |

75 |

$399/sf |

40 |

1,891sf |

| February 3 |

78 |

$409/sf |

41 |

1,876sf |

| February 10 |

82 |

$395/sf |

38 |

1,927sf |

| February 17 |

85 |

$387/sf |

35 |

1,929sf |

| February 24 |

90 |

$383/sf |

37 |

2,008sf |

| March 3 |

82 |

$397/sf |

39 |

1,942sf |

| March 10 |

88 |

$377/sf |

37 |

2,008sf |

| March 17 |

89 |

$366/sf |

34 |

2,038sf |

| March 24 |

79 |

$369/sf |

34 |

2,031sf |

| March 31 |

78 |

$367/sf |

39 |

2,069sf |

| April 7 |

87 |

$373/sf |

32 |

2,054sf |

| April 14 |

97 |

$380/sf |

31 |

2,000sf |

| April 21 |

87 |

$377/sf |

32 |

2,062sf |

| April 28 |

107 |

$379/sf |

29 |

2,044sf |

| May 5 |

114 |

$376/sf |

27 |

2,046sf |

| May 12 |

108 |

$385/sf |

31 |

2,012sf |

| May 19 |

107 |

$385/sf |

0 |

0sf |

| May 26 |

105 |

$375/sf |

34 |

0sf |

| Jun 2 |

102 |

$376/sf |

36 |

0sf |

| Jun 9 |

102 |

$377/sf |

37 |

0sf |

| Jun 16 |

104 |

$369/sf |

35 |

0sf |

| Jun 23 |

111 |

$380/sf |

34 |

0sf |

| Jun 30 |

119 |

$376/sf |

36 |

0sf |

| Jul 7 |

122 |

$387/sf |

36 |

0sf |

| Jul 14 |

127 |

$388/sf |

34 |

0sf |

| Jul 21 |

135 |

$381/sf |

36 |

0sf |

| Jul 28 |

144 |

$382/sf |

37 |

0sf |

| Aug 4 |

148 |

$379/sf |

39 |

0sf |

| Aug 11 |

135 |

$375/sf |

42 |

0sf |

| Aug 25 |

135 |

$374/sf |

43 |

0sf |

| Sep 1 |

126 |

$377/sf |

46 |

0sf |

| Sep 8 |

130 |

$375/sf |

46 |

0sf |

| Sep 15 |

134 |

$369/sf |

45 |

0sf |

| Sep 22 |

127 |

$376/sf |

49 |

0sf |

| Sep 29 |

132 |

$378/sf |

48 |

0sf |

| Oct 6 |

130 |

$367/sf |

48 |

0sf |

| Oct 13 |

131 |

$378/sf |

44 |

0sf |

(more…)

by Jim the Realtor | Oct 12, 2014 | Bubbleinfo TV, Jim's Take on the Market |

Of the people who came to the open house today, only one was a neighbor, and none were agents. Yeah sure Jim, but how serious were they?

There are plenty of drivebys; anyone who is willing to park, get out of their car and trudge up to another open house knowing they have been constantly disappointed by others all year (and have to endure another salesman) must have sincere motivation to buy a house at some point. If they could only find the right house, at the right price!

by Jim the Realtor | Oct 12, 2014 | Foreclosures/REOs, REO Inventory, REO Pre-Listings, Short Sales, Short Selling |

I hope the headline porn grabbed you! 😆

REO listings have increased lately around NSDCC, though they are still a small fraction of the overall marketplace (there have been 2,238 detached-home sales closed this year between Carlsbad and La Jolla).

The short-sale listings coming to market haven’t changed much all year, which would be the first place you would see the effect of mortgage servicers getting tougher with deadbeats:

| Type of Listing |

Jan 1 – June 30 |

July 1 – present |

| REO |

4 |

8 |

| Short-sale |

36 |

18 |

| Non-Distressed |

2,672 |

1,262 |

| Total |

2,712 |

1,388 |

This guy borrowed $3.75 million to do a spectacular remodel on this Del Mar home (the house with the glass-bottom pool), but he wasn’t going to give it away. The original list price was $6,750,000 in October, 2013, and dropped to $5,950,000 before getting foreclosed in June. The bank promptly listed for $5,495,000, and sold it for $5,210,000 last month:

http://www.sdlookup.com/MLS-140036477-116_Nob_Ave_Del_Mar_CA_92014

There is some hope that lenders and servicers are increasing the flow now that prices are so much higher than before, and it would make sense that they would cherry-pick the properties on which they could make a profit.

But no flood of notices yet:

by Jim the Realtor | Oct 10, 2014 | Mortgage News, Mortgage Qualifying |

From the wsj.com:

A new mortgage lender is loosening documentation requirements, allowing applicants to provide less paperwork on income and assets than is typical to get a home loan.

Social Finance, a peer-to-peer lender often referred to as SoFi, rolled out mortgage lending in five states—New Jersey, North Carolina, Pennsylvania, Texas and Washington—and the District of Columbia on Tuesday. The San Francisco-based lender began offering mortgages in California in August.

The firm has specialized in student loans since it launched in 2011. The move into mortgages comes as SoFi prepares to file to raise $200 million to $250 million in an initial public offering early next year, according to its chief executive Mike Cagney.

SoFi’s mortgages will be geared toward borrowers with high credit scores, though other criteria will be less onerous than what most other lenders require. The firm isn’t requiring tax returns to verify applicants’ income or proof of funds to verify the source of borrowers’ down payments—requirements that most lenders have had in place since the housing downturn. Instead, SoFi is accepting applicants’ most recent paystub or W2 as proof of income. It will also take all applicants at their word that their down-payment funds aren’t coming from a loan they have taken out elsewhere, says Mr. Cagney. Borrowers will have to make a minimum 10% down payment.

Read the full article here:

http://blogs.wsj.com/totalreturn/2014/10/07/new-mortgage-lender-demands-less-documentation/

by Jim the Realtor | Oct 9, 2014 | Bubbleinfo TV, Commission War, Forecasts, Jim's Take on the Market, Listing Agent Practices, The Future |

Though I speculate in this video that buyer agents will get phased out, it’s not the best alternative – buyers should have representation, it is just a matter of cost/quality.

In this futuristic scenario, the listing agent will only be representing the seller, and will likely want to process your order at the seller’s price.

Buyers may prefer to get their own representation.

There will likely be real estate consultants available to assist buyers with pricing, and to help address the major deal points.

If you were buying, would you be willing to pay for good help?