by Jim the Realtor | Mar 10, 2014 | Jim's Take on the Market, Local Government, The Future |

Here’s a good review of the recent Dave Camp tax proposal:

http://www.latimes.com/business/realestate/la-fi-harney-20140309,0,7914993.story#axzz2vWoDGLkZ

Under intense scrutiny will be the two-out-of-five-year rule – Congress will find it irresistible to tinker with so much tax-free money:

Under Camp’s proposal, you’d need to own your house for five out of the preceding eight years to claim a tax-free exclusion and you could exercise this privilege only once every five years. Capital gains exclusions for home sellers with high incomes — $250,000 a year for singles and $500,000 a year for joint filers — would be phased out altogether over a period of years.

Under Camp’s proposal, you’d need to own your house for five out of the preceding eight years to claim a tax-free exclusion and you could exercise this privilege only once every five years. Capital gains exclusions for home sellers with high incomes — $250,000 a year for singles and $500,000 a year for joint filers — would be phased out altogether over a period of years.

If Camp’s idea of exercising this ‘privilege only once every five years’ does get approved, it should curtail the move-up market.

Here’s why:

1. People get too comfortable. After 2-3 years, it still feels like you just moved in and there isn’t as much attachment to the home. After five years, real roots have been established.

2. Kids have more friends in the neighborhood. Kids grow up a lot in 5-6 years, and they don’t mind imposing their ideas upon you regarding a move.

3. Remodeling will be a more-likely route. If the two items above are bearing down on you, then just fixing the old house will be a happy compromise.

More of today’s homebuyers are already looking longer-term than any since the 2-out-of-5 rule was enacted in 1997 – let’s face it, the rah-rah days are over. Changing the law will just be the final straw that will cause people to stay put.

Consider these changes when buying your next house – it may have to last you for a long time, and maybe forever! Get good help!

by Jim the Realtor | Mar 10, 2014 | Inventory, Jim's Take on the Market

The number of active listings grew in each category this week, which should be a seasonal shift. But it is the selling season too – so if the active inventory keeps growing, it means buyers aren’t going for the higher pricing:

North SD County’s Coastal Region (La Jolla-to-Carlsbad)

The UNDER-$800,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

DOM |

Avg SF |

| November 25 |

95 |

$376/sf |

47 |

1,988sf |

| December 2 |

79 |

$371/sf |

50 |

2,047sf |

| December 9 |

72 |

$383/sf |

43 |

1,954sf |

| December 16 |

81 |

$378/sf |

42 |

1,948sf |

| December 23 |

77 |

$374/sf |

49 |

1,937sf |

| December 30 |

76 |

$373/sf |

51 |

1,950sf |

| January 6 |

74 |

$370/sf |

49 |

1,995sf |

| January 13 |

71 |

$381/sf |

44 |

1,921sf |

| January 20 |

72 |

$384/sf |

41 |

1,877sf |

| January 27 |

75 |

$399/sf |

40 |

1,891sf |

| February 3 |

78 |

$409/sf |

41 |

1,876sf |

| February 10 |

82 |

$395/sf |

38 |

1,927sf |

| February 17 |

85 |

$387/sf |

35 |

1,929sf |

| February 24 |

90 |

$383/sf |

37 |

2,008sf |

| March 3 |

82 |

$397/sf |

39 |

1,942sf |

| March 10 |

88 |

$377/sf |

37 |

2,008sf |

The $800,000 – $1,400,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

DOM |

Avg SF |

| November 25 |

245 |

$448/sf |

61 |

2,856sf |

| December 2 |

239 |

$448/sf |

64 |

2,851sf |

| December 9 |

226 |

$461/sf |

65 |

2,812sf |

| December 16 |

211 |

$464/sf |

66 |

2,794sf |

| December 23 |

197 |

$453/sf |

73 |

2,813sf |

| December 30 |

173 |

$450/sf |

78 |

2,821sf |

| January 6 |

170 |

$470/sf |

65 |

2,757sf |

| January 13 |

168 |

$463/sf |

59 |

2,764sf |

| January 20 |

174 |

$444/sf |

51 |

2,882sf |

| January 27 |

166 |

$435/sf |

52 |

2,902sf |

| February 3 |

165 |

$441/sf |

53 |

2,857sf |

| February 10 |

175 |

$443/sf |

51 |

2,852sf |

| February 17 |

180 |

$447/sf |

50 |

2,803sf |

| February 24 |

188 |

$438/sf |

44 |

2,846sf |

| March 3 |

202 |

$421/sf |

44 |

2,936sf |

| March 10 |

215 |

$431/sf |

41 |

2,854sf |

(more…)

by Jim the Realtor | Mar 9, 2014 | Bidding Wars, Frenzy, Why You Should Hire Jim as your Buyer's Agent, Why You Should List With Jim |

Share

When there are multiple offers on one of my listings, I am happy to divulge the pertinent information to all parties – because transparency benefits the seller. But most listing agents act like they are guarding Fort Knox, and won’t give any guidance on what it will take to win.

When there are multiple offers on one of my listings, I am happy to divulge the pertinent information to all parties – because transparency benefits the seller. But most listing agents act like they are guarding Fort Knox, and won’t give any guidance on what it will take to win.

What do you do?

I ask these questions of the listing agent:

1. “How many offers are there?” To warm them up, start with an easy math question.

2. “How will you handle? Will you request highest-and-best from each buyer, or just take the highest offer?” In almost every case the agent hasn’t given it a thought, and is caught off-guard. All that matters is how they feel about highest-and-best, and gauge whether they might just sign an offer.

3. “Have you, or anyone in your office, written an offer?” I have won a bidding war when the listing agent wrote an offer with their own buyer, but it takes guile and guts to pull it off. But first, you need to know if that is the case. P.S. If they hesitate, the answer is yes.

Secondly, rank the property. Is it in the 95+ percentile of homes you have seen? If so, big-cash and/or desperation could turn this bidding war into a freak show. Determine an offer price that makes you uncomfortable, and then add some mustard.

If it is a nice home, but has some warts – then use this as a guide:

by Jim the Realtor | Mar 9, 2014 | Frenzy, Jim's Take on the Market

The houses with 1-2 premium features really benefit in a frenzy.

Buyers are happy to at least get a couple of big items on their wish list, and are willing to concede/discard others to ensure that they don’t lose……again:

by Jim the Realtor | Mar 8, 2014 | Frenzy, Jim's Take on the Market, Market Buzz, Market Conditions, North County Coastal |

Can you feel it? The frenzy, creeping in on you?

Those watching closely may have noticed how the market has ‘picked up’ over the last week or two.

We’ve had more buyers than sellers for a while now, so that alone doesn’t constitute a frenzy. In a low-inventory environment, you should have multiple offers on every quality property.

It’s the velocity.

Here are signs of frenzy-building:

1. It’s been hot. A year ago, the frenzy was just becoming obvious – but at this point, the market has been hot for the 18 months.

Both buyers and sellers are expecting a frenzy now.

| NSDCC Feb. |

#Sales |

Median SP |

Median DOM |

| 2011 |

166 |

$844,000 |

60 |

| 2012 |

184 |

$795,000 |

69 |

| 2013 |

184 |

$900,000 |

25 |

| 2014 |

172 |

$906,500 |

24 |

All three indicators from last month are pointing to more frenzy.

2. How fast listings go pending. With listing agents riding high on their horse, you typically see them play around for 7-10 days before a new listing gets marked pending. It seems like more listings are going pending faster – and it’s about the same as last year (though this year’s haven’t all closed):

| NSDCC 2/22 to 3/7 |

# Pendings with DOM<6 |

# New Pendings |

% |

| 2013 |

42 |

136 |

31% |

| 2014 |

35 |

119 |

29% |

3. The percentage-paid-over-list-price. It’s been standard to see homes sell for 5% to 10% over list price, but it can get crazier.

This was a fascinating – though extreme – example. A great-looking house with fantastic view, but it is right on La Costa Ave. and located in an area with terrible soil quality:

http://www.sdlookup.com/MLS-140009811-2662_Galicia_Way_Carlsbad_CA_92009

Look how steep the hill is – it looks like it could slide down the hill any day:

From the remarks: This property is for cash buyer, builder, or investor. Home has compaction and soil issues. Only shown to qualified buyers.

The soils problem must be serious, given their initial list price of $500,000. Yet it sold for $685,000 cash, or 37% over list price and closed in ten days.

It must have been worth it to someone, and probably worth close to that for many, but it is the percentage that gets me. With the problems, wouldn’t you try to buy it for 10% or 20% over list?

4. It’s March. The wait-and-see buyers haven’t had any indications of inventory flooding the street – in fact, we’ve had fewer new listings this year than last (between Jan. 1 and March 5th):

| Year |

# New Listings |

LP Avg $/sf |

| 2013 |

886 |

$494/sf |

| 2014 |

858 |

$541/sf |

Buyers are getting antsy – for them, there aren’t any signs of relief.

It is a great time to sell – contact Jim the Realtor to get started today!

(858) 997-3801 cell or jim@jimklinge.com.

by Jim the Realtor | Mar 7, 2014 | Interesting Houses |

Designs Northwest Architects have recently completed the Tsunami House, located on Camano Island in Washington State.

The Tsunami House is a waterfront home located on a 3,140 square foot site in a high velocity flood (V) zone on the northern end of Camano Island. The building footprint was limited to a 30’ x 30’ pad.

The 887 square foot main living level had to be located 5 feet above grade and the foundations had to be designed on pilings capable of withstanding high velocity tsunami wave action. The lower 748 square foot space had to be designed with walls that were able to break away in the event of a storm surge.

Our design strategy was to locate the main living level nine feet above grade and leave the lower level to be used as a flexible multi use space dubbed the “Flood Room.” Clear glass overhead doors open up to the waterside deck facing north, and translucent overhead doors open to the entry courtyard facing south, allowing privacy from the road.

The depth of the lot is only 50 feet deep and required an above ground sand filter drain field that was 10 feet wide. In order to integrate the sand filter into the limited site, it was encased in 3-ft high architectural concrete walls and covered with a pervious sun deck on top of the drain field. The drain field/sun deck also acts as a visual barrier between the road and the house providing privacy when all the overhead doors are open.

http://www.contemporist.com/2013/12/31/the-tsunami-house-by-designs-northwest-architects/

by Jim the Realtor | Mar 7, 2014 | Frenzy, Market Conditions |

Rich Toscano does a nice job dissecting the San Diego markets, and explaining the differences. An excerpt, plus one of five graphs from the VOSD:

http://voiceofsandiego.org/2014/03/06/cheaper-homes-still-rebounding-fastest/

Cheaper homes have done a lot better in the rebound, but they also suffered far worse during the crash. Here’s what happens when we start the graph at the bubble peak:

Read full article here, and donate if you can!

http://voiceofsandiego.org/2014/03/06/cheaper-homes-still-rebounding-fastest/

by Jim the Realtor | Mar 6, 2014 | Local Flavor

Will the Olympics be coming to San Diego?

by Jim the Realtor | Mar 6, 2014 | Market Conditions |

From the NAHB:

http://eyeonhousing.org/2014/02/25/why-are-new-homes-getting-so-big-look-at-whos-buying-them/

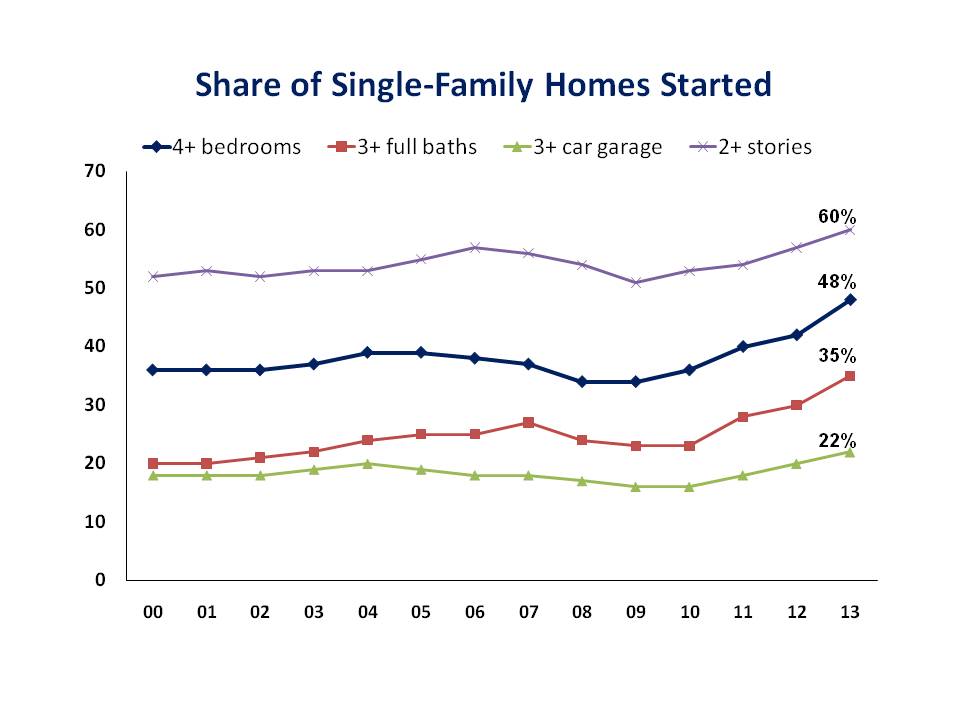

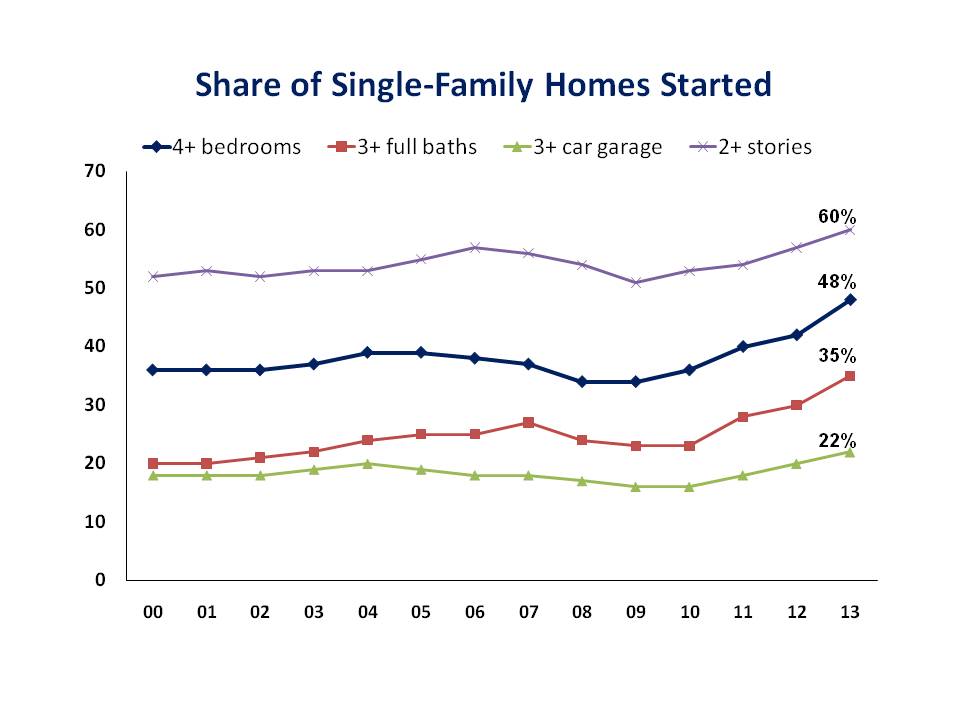

Preliminary data provided to NAHB by the Census Bureau on the characteristics of homes started in 2013 show the trend toward larger homes continued unabated last year, as did the share of new homes with 4+ bedrooms, 3+ full baths, 2-stories, or 3-car garages.

The average size of new homes started in 2013 was 2,679 square feet, about 150 square feet larger than in 2012 and the fourth consecutive annual increase since bottoming out at 2,362 square feet in 2009.

New homes started in 2013 were also more likely to have additional features: nearly half, 48%, had 4 or more bedrooms; 35% had 3 or more full bathrooms; 22% had a garage for at least 3 cars; and 60% were 2-stories.

The share of new homes started with these features has been increasing consistently for 3 or 4 years, and the most obvious question is “why?” Why are homes getting this BIG?

To get an answer, just take a look at WHO is buying new homes?

(more…)

by Jim the Realtor | Mar 5, 2014 | Wednesday Rock Blogging |

These guys can probably claim to have played every venue in the state, including CSU Fullerton around 1982. From wiki:

The Untouchables are a soul/mod revival band from the Silver Lake, Los Angeles, California area. Described by original lead singer Kevin Long as “mods who played ska music,” The Untouchables are credited with being America’s first ska band.

They formed in 1981 as part of the embryonic L.A. mod revival, after being inspired by the ska revival/punk rock band The Boxboys. Since some couldn’t play instruments, they either hastily learned, or became vocalists.

After a shaky start playing at parties, the integrated septet were eventually booked at the O.N. Klub (known as the On to regulars). The band had guaranteed the club that they would pack the venue, and they did not disappoint. In middle of that year, they released their first (ska-styled) 7″ single, copies of which were snapped up by local mods. Late in 1982, the band began a stint as the house band at the Roxy Theatre.

Their second single, “The General,” became a minor local hit, despite poor distribution. The band performed “The General” in the 1984 comedy The Party Animal, and they appeared as a scooter gang in the movie Repo Man. In early 1984, they were signed to Stiff Records. Concerts with The B-52’s, Black Uhuru, Bow Wow Wow, Red Hot Chili Peppers, Fishbone, No Doubt and X all over California gave the group a disparate following of whites, blacks, mods, punks, surfers and rockabilly fans, with the local performances drawing up to 1,500 people. The band also appeared in the 1984 film Surf II, performing “Dance Beat”, and 1987’s No Man’s Land, performing “What’s Gone Wrong”.

Under Camp’s proposal, you’d need to own your house for five out of the preceding eight years to claim a tax-free exclusion and you could exercise this privilege only once every five years. Capital gains exclusions for home sellers with high incomes — $250,000 a year for singles and $500,000 a year for joint filers — would be phased out altogether over a period of years.

Under Camp’s proposal, you’d need to own your house for five out of the preceding eight years to claim a tax-free exclusion and you could exercise this privilege only once every five years. Capital gains exclusions for home sellers with high incomes — $250,000 a year for singles and $500,000 a year for joint filers — would be phased out altogether over a period of years.