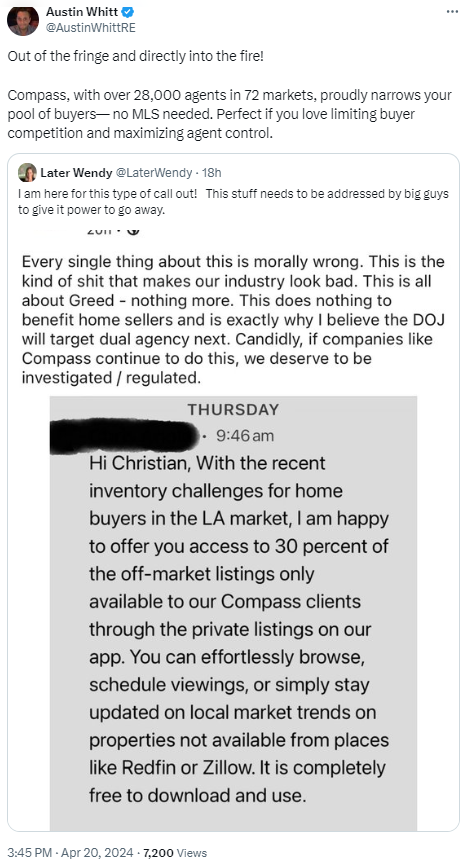

by Jim the Realtor | Apr 21, 2024 | Compass, Market Conditions, The Future |

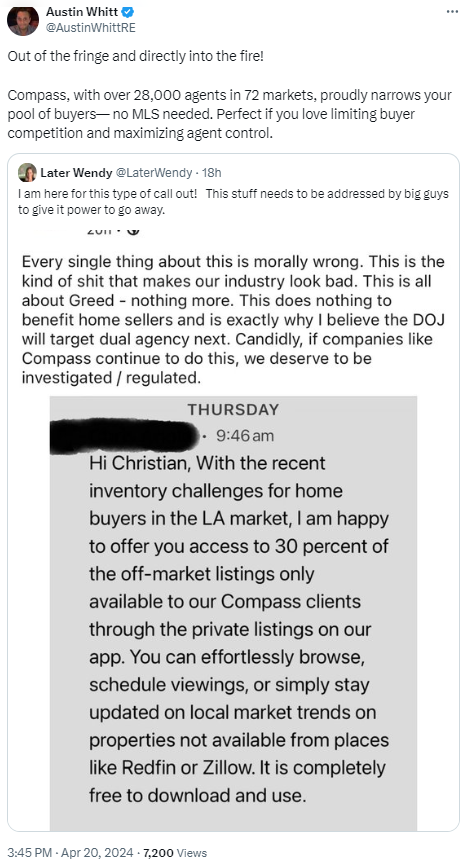

This is the #1 reason I went to Compass, and I didn’t really feel like I had a choice.

When realtors get disrupted, this is the way the big brokerages can survive while the little guys die.

Hoard the listings in-house as ‘private exclusives’, like they do in the commercial real estate. The practice is legal (per the Clear Cooperation Policy) and is a choice for home sellers to make.

The big benefit for sellers is that they don’t get penalized by the days-on-market statistic, which buyers normally consider as the best way to know if the price is wrong after the first week on the market.

Compass has this option available for sellers, as do all the other brokerages, but nobody in management is pushing it around here. It’s used more like a Coming-Soon feature while homes are being prepared for open-market exposure. But there are deals being made.

If there was an organized, committed effort to use it as a survival tool, then I could see 30% of our sales happening off-market. But we’re not there yet.

Maybe next year?

by Jim the Realtor | Apr 20, 2024 | Where to Move |

First-time home buyers are a growing share of the market, making up half of all home buyers last year, according to Zillow’s Consumer Housing Trends Report. Homeownership is easier to break into in some markets than others, and Zillow has named this year’s best markets for first-time buyers, where their dollars go further and starter homes are relatively plentiful.

Affordability is a tough hill to climb in today’s market, and it is especially steep for first-time buyers who do not have equity from a previous home purchase to tap into. Markets with relatively more affordable rent, more options and less competition for starter homes provide the best opportunities.

Zillow’s 2024 list of the best markets for first-time buyers is based on four metrics:

- Rent affordability, as defined by the share of median household income spent on rent.

- The share of available inventory on Zillow that the median household can comfortably afford, meaning spending no more than 30% of income on the estimated monthly mortgage cost.

- The ratio of affordable for-sale inventory to renter households. More inventory per renter household is an indicator of less competition for each listing.

- The share of households age 29-43. More households of similar age means a higher score in Zillow’s ranking.

More affordable rent shortens the time it takes to save for a down payment, and a higher number of active for-sale listings relative to the potential homebuyer population means more options – and more bargaining power – for potential first time home buyers in those markets.

These are Zillow’s 10 best markets for first-time home buyers this year:

- St Louis, MO

- Home Buying Age Households As a Share of Total Households: 26%

- Percentage of Median Household Income Spent on Rent: 20%

- Affordable Listings As a Percent of Total For-Sale Inventory: 67%

- Affordable Listings To Renter Household Ratio: 3.4 per 100 Renters

- Detroit, MI

- Home Buying Age Households As a Share of Total Households: 24%

- Percentage of Median Household Income Spent on Rent: 21%

- Affordable Listings As a Percent of Total For-Sale Inventory: 64%

- Affordable Listings To Renter Household Ratio: 4 per 100 Renters

- Minneapolis, MN

- Home Buying Age Households As a Share of Total Households: 28%

- Percentage of Median Household Income Spent on Rent: 20%

- Affordable Listings As a Percent of Total For-Sale Inventory: 48%

- Affordable Listings To Renter Household Ratio: 2.5 per 100 Renters

- Indianapolis, IN

- Home Buying Age Households As a Share of Total Households: 29%

- Percentage of Median Household Income Spent on Rent: 22%

- Affordable Listings As a Percent of Total For-Sale Inventory: 50%

- Affordable Listings To Renter Household Ratio: 2.6 per 100 Renters

- Austin, TX

- Home Buying Age Households As a Share of Total Households: 34%

- Percentage of Median Household Income Spent on Rent: 20%

- Affordable Listings As a Percent of Total For-Sale Inventory: 23%

- Affordable Listings To Renter Household Ratio: 1.3 per 100 Renters

- Pittsburgh, PA

- Home Buying Age Households As a Share of Total Households: 24%

- Percentage of Median Household Income Spent on Rent: 22%

- Affordable Listings As a Percent of Total For-Sale Inventory: 63%

- Affordable Listings To Renter Household Ratio: 3.7 per 100 Renters

- San Antonio, TX

- Home Buying Age Households As a Share of Total Households: 31%

- Percentage of Median Household Income Spent on Rent: 23%

- Affordable Listings As a Percent of Total For-Sale Inventory: 33%

- Affordable Listings To Renter Household Ratio: 2.6 per 100 Renters

- Birmingham, AL

- Home Buying Age Households As a Share of Total Households: 25%

- Percentage of Median Household Income Spent on Rent: 22%

- Affordable Listings As a Percent of Total For-Sale Inventory: 47%

- Affordable Listings To Renter Household Ratio: 4.2 per 100 Renters

- Kansas City, MO

- Home Buying Age Households As a Share of Total Households: 27%

- Percentage of Median Household Income Spent on Rent: 21%

- Affordable Listings As a Percent of Total For-Sale Inventory: 51%

- Affordable Listings To Renter Household Ratio: 2.2 per 100 Renters

- Baltimore, MD

- Home Buying Age Households As a Share of Total Households: 27%

- Percentage of Median Household Income Spent on Rent: 22%

- Affordable Listings As a Percent of Total For-Sale Inventory: 56%

- Affordable Listings To Renter Household Ratio: 2.3 per 100 Renters

https://www.zillow.com/research/best-markets-first-time-home-buyers-33901/

by Jim the Realtor | Apr 19, 2024 | 2024, Market Conditions, Market Surge, North County Coastal, Spring Kick |

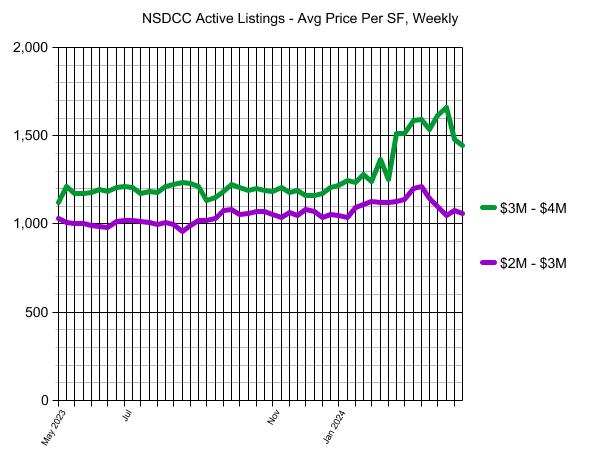

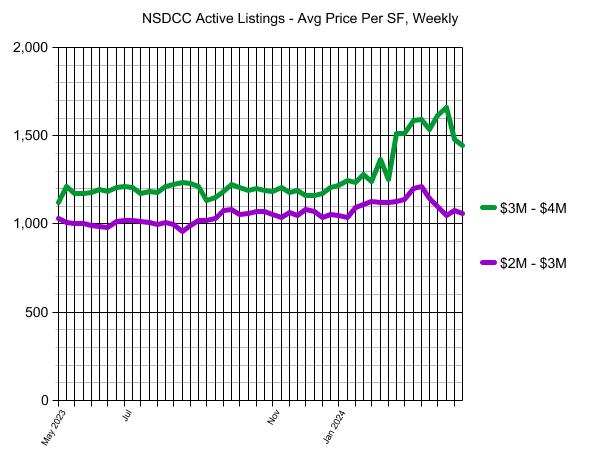

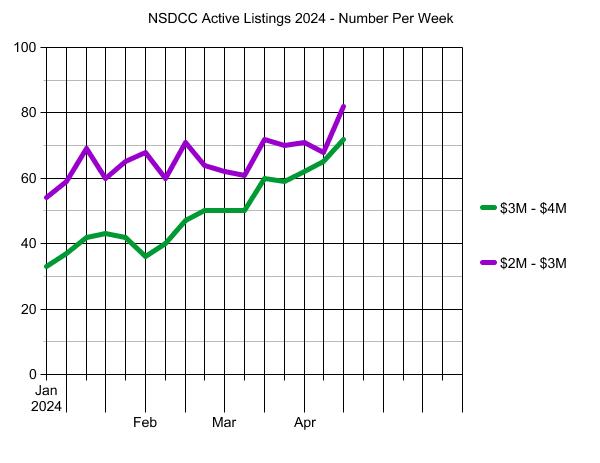

Pardon the casual presentation. I’m used to working with this same basic graph format but it’s limited to 50 datapoints – we’d really like to take these back a few years to see the long-term trends.

But in early 2023, the active listings in the $3M – $4M category were range bound between 1,170/sf and 1,342/sf, so there is some normal optimism in springtime. But not like this pop in 2024 (above). These two subsets are the meat of the market, and aren’t swayed by radical outliers that would tweak the averages.

Starting right after the Super Bowl, there was a huge swing from $1,252/sf to $1,515/sf in the $3M – $4M category, and it has stayed elevated until the last couple of weeks. The reason for pricing to relax a little?

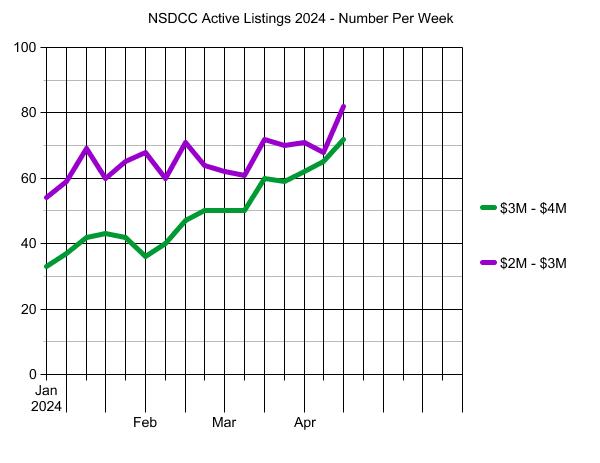

The number of unsold listings are starting to stack up now:

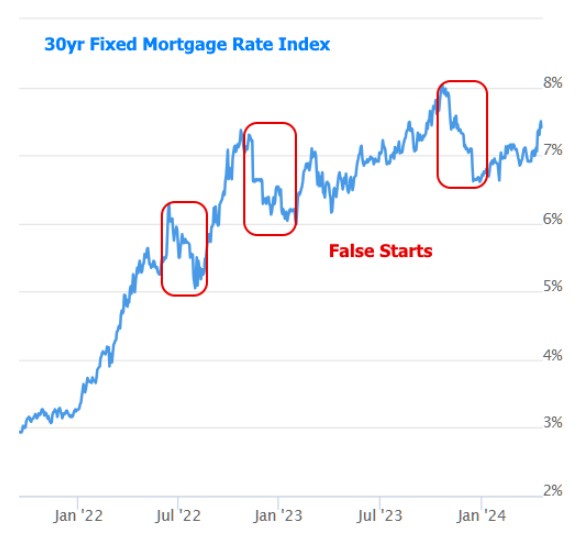

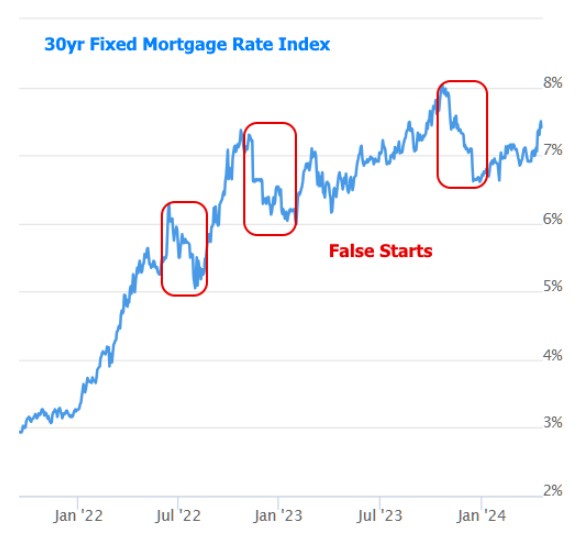

There isn’t any reason for home buyers to think mortgage rates are going to drop significantly this year. If there were one or two Fed cuts, it would only cause mortgage rates to get back into the 6s which isn’t enough to compensate for the sky-high prices that buyers are seeing today.

Then we have the changes from the commission lawsuit, which will have a clunky start over the next few months as buyers grapple with hiring a buyer-agent in writing just to tour a house. All we need is the Padres to go on a run this summer and we will have all the excuses we need for a very sluggish rest of the year.

by Jim the Realtor | Apr 19, 2024 | About the author |

This is where we lived when I went to high school in Phoenix Arizona. My parents paid around $35,000 for it in 1972, and when they sold it in 1979 and moved back to California they got around $80,000 for it.

The owners have done the obligatory update, but the house itself hasn’t changed much since. They paid $300,000 for it in November, 2018, and it’s now listed for $699,900.

Every house had a flat roof. One day, we took our bikes up on the roof and rode them into the pool!

https://www.zillow.com/homedetails/11801-N-37th-St-Phoenix-AZ-85028/7817958_zpid/

by Jim the Realtor | Apr 18, 2024 | 2024, Commission Lawsuit, Realtor |

While the benefits of buyer-agents may be obvious, will anyone stop their demise? Probably not.

Will it become easier or harder to buy a home?

The answer is unclear amid widespread confusion over what’s happening to real-estate agent commissions. On April 5, a federal court determined that the Justice Department can reopen its investigation into the policies of the National Association of Realtors, indicating that the association’s March settlement in a separate case may not be the final word on this issue. Yet in their effort to deliver lower costs for home buyers, federal officials and courts may inadvertently undermine consumer protections without addressing the root causes of high home prices.

The settlement is a positive development: It could lower real-estate agents’ commissions, benefiting home buyers. It also increases transparency and negotiating power for home buyers who use agents for representation. The settlement will also increase professionalism among agents, who will now sign an agreement detailing their services before showing a buyer a home. These policies should put downward pressure on commission prices, which currently average 5.3% and are split between buyer’s and seller’s agents.

Despite these wins, federal officials seem to want a more aggressive solution. In a February court filing, the Justice Department noted that U.S. commissions are “two to three times more than” those in “other developed countries,” a point the media frequently repeats. That gives the impression that federal officials want to cut commissions at least in half as quickly as possible, and the department appears to be pursuing this goal. Yet dramatically slashing commissions can be achieved only by reducing the use of buyer’s agents—a move that would be unwise for a few reasons.

Consider the pitfalls that home buyers face in countries where buyer’s agents aren’t commonly used. In Australia, where I grew up, home buyers typically work directly with listing agents, who have a fiduciary duty only to the sellers. In some Australian territories and states, if a buyer looks at a home on a flood plain or in a region prone to bush fires, the seller’s agent isn’t necessarily obligated to tell him about the risks.

The U.S. model provides lower overall costs and better representation for buyers and sellers alike. Americans chose this model for good reasons. Before the 1990s, few people in the U.S. used a buyer’s agent. Yet home buyers began to demand representation, especially low-income and first-time buyers who needed help navigating the process. Consumer-rights advocates championed this development. As buyer’s agents became more popular, eight states even banned the old model of a single agent representing both parties. Americans effectively gained two agents for the price of one, and that price has fallen from over 6% to closer to 5% today.

Discouraging the use of buyer’s agents would reverse this progress. Although it would likely lower home buyers’ costs, it would do so at the price of sacrificing their interests. Without a buyer’s agent, no one would be legally required to help buyers understand their risks and options. There would also be nothing to stop seller’s agents from increasing their commissions to match what previously went to buyer’s agents.

There are better ways to help home buyers save money, policies on which state lawmakers should take the lead. Most U.S. states have transfer taxes, which can add thousands of dollars to the cost of a home purchase. Lawmakers should either cut these taxes, leading to lower costs and more home sales, or reduce property taxes after windfall gains post-pandemic. State and federal lawmakers could also ease burdensome licensing, zoning and environmental regulations, all of which add nearly $94,000 to the cost of a new single-family home and lead developers to build fewer homes. The best way to decrease housing’s cost is to increase its supply.

The alternative is to erode the hard-fought victory that American home buyers have achieved. While the U.S. system is far from perfect, it serves home buyers better than any other arrangement, and it’s moving in an even better direction after the recent settlement. As federal officials and courts weigh whether to push further, they should remember that some cures are worse than the disease.

Mr. Eales is CEO of Move Inc., which operates Realtor.com. Move Inc. is owned by News Corp, which also owns The Wall Street Journal.

Link to Article

by Jim the Realtor | Apr 17, 2024 | Actives/Pendings, Jim's Take on the Market |

There isn’t as much fluff as we used to have in the pre-pandemic days.

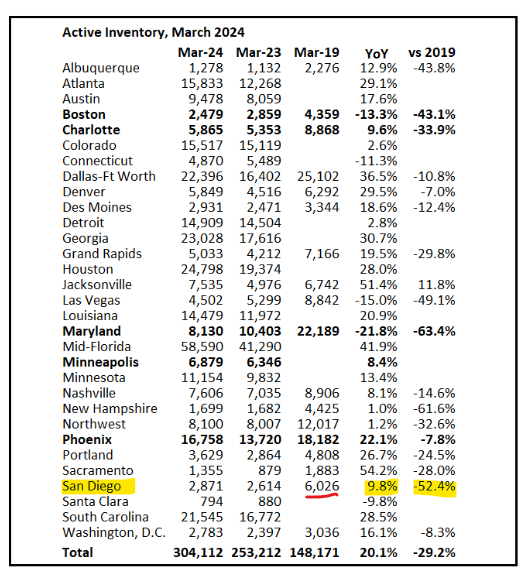

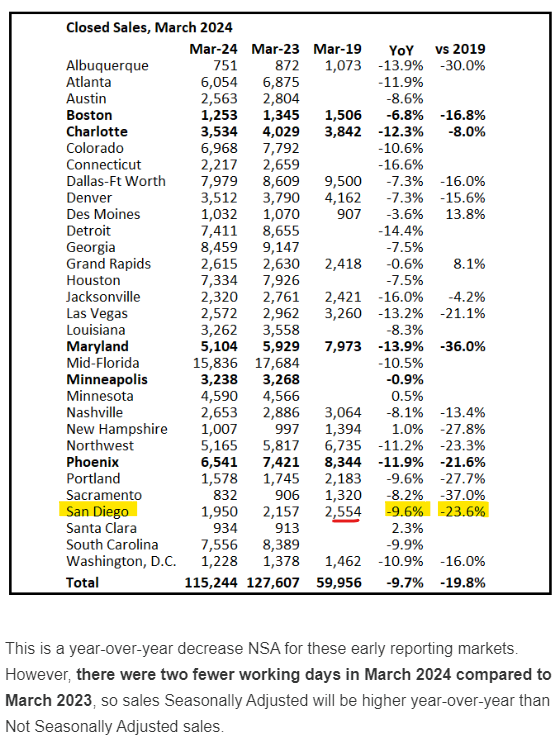

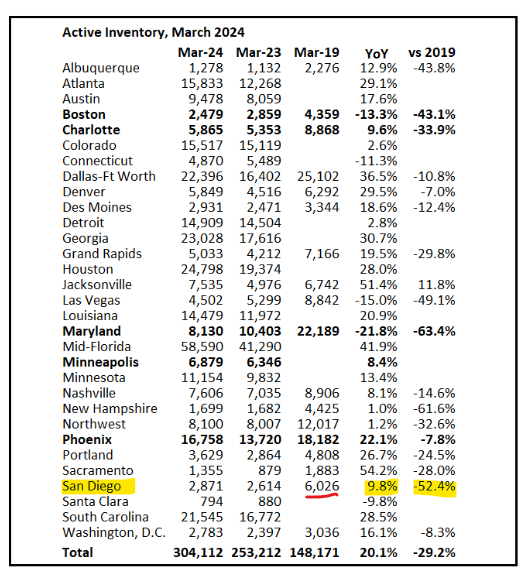

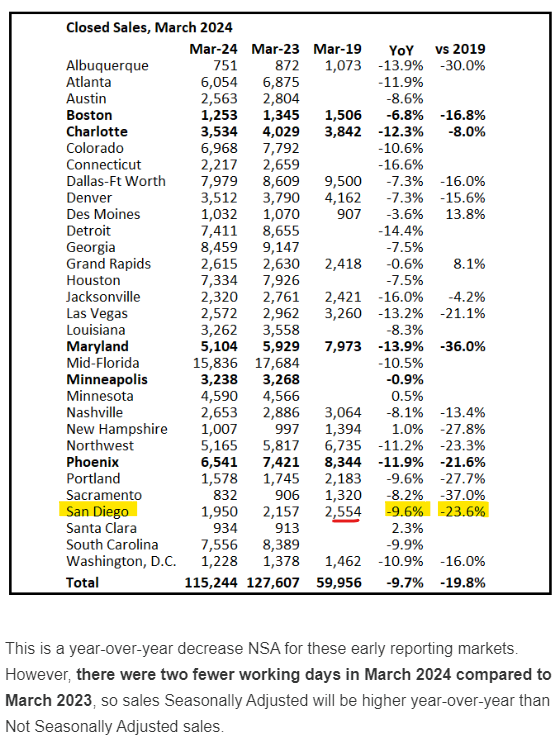

In March 2019, there were 6,026 homes for sale, but only 2,554 sold, which means there were lots of sellers and agents on the open market who were in price-discovery mode – and they found out what the market wouldn’t bear.

We’re heading back that way again.

For the last three years, we’ve been spoiled by maximum demand (caused by low inventory combined with low rates). But now that both are creeping upward, there will be sellers/agents who are overly-optimistic and don’t factor the negative impact into their equation.

Last month’s ratio of 2,871/1,950 = 1.47 is still better than the 2019 numbers of 6,026/2,554 = 2.36, but don’t be surprised to see an upward trend of unsold listings forming over the next few months.

by Jim the Realtor | Apr 17, 2024 | Commission Lawsuit, Commission War |

Are commissions negotiable?

The common perception is Yes, because commission rates aren’t determined by any regulatory body, and brokerages/agents are free to devise their own compensation plan.

But the agents who have a meaningful skill set and a book of business have determined their fee. They aren’t going to work for less just because the NAR blew their defense of a two-bit lawsuit in Missouri. In addition, the consumers who are convinced that their agent is worth it will pay their fee to ensure they get quality help that delivers the best results.

If you want to negotiate the fee, you will have to find a different agent.

The exodus of incompetant realtors leaving the business over the next 2-3 years will be significant, and their commission rate will be more negotiable than ever. Will consumers take a chance on the has-been agent hoping to eek out one last deal before they quit, just to save a point? Unfortunately, the answer will be yes in many cases.

How bad is it? I could tell a new story every day.

How about the listing agent wants to give his 80+ year old seller the personal touch, but he doesn’t like driving the 30 minutes to her house….so completing the final documents to close escrow has been stalled. The seller is moving to Arizona, and she had to get her realtor there to help her fill out the forms!

Hopefully the result of the Big Shakeout will be that consumers investigate thoroughly the services that realtors offer, and understand that different agents do different things. There will always be the agents that offer to do less – carefully examine whether reduced services are in your best interest.

by Jim the Realtor | Apr 16, 2024 | Frenzy Monitor |

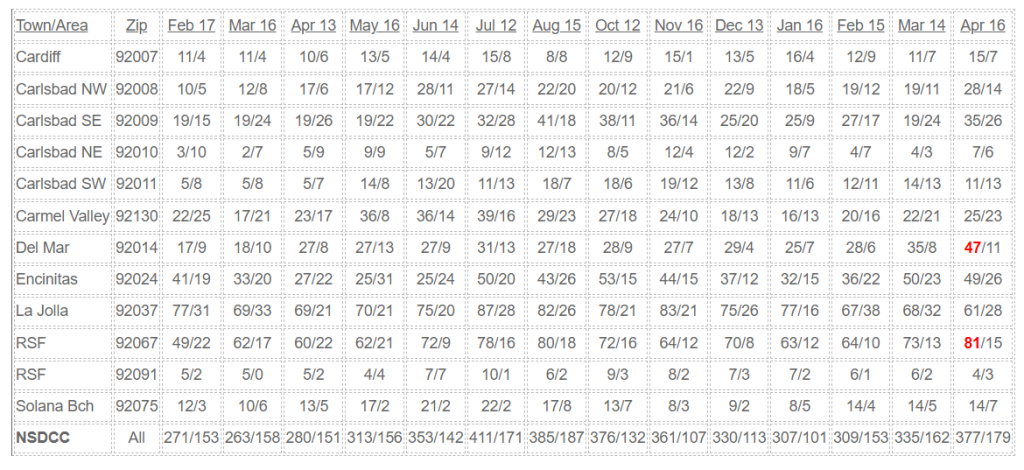

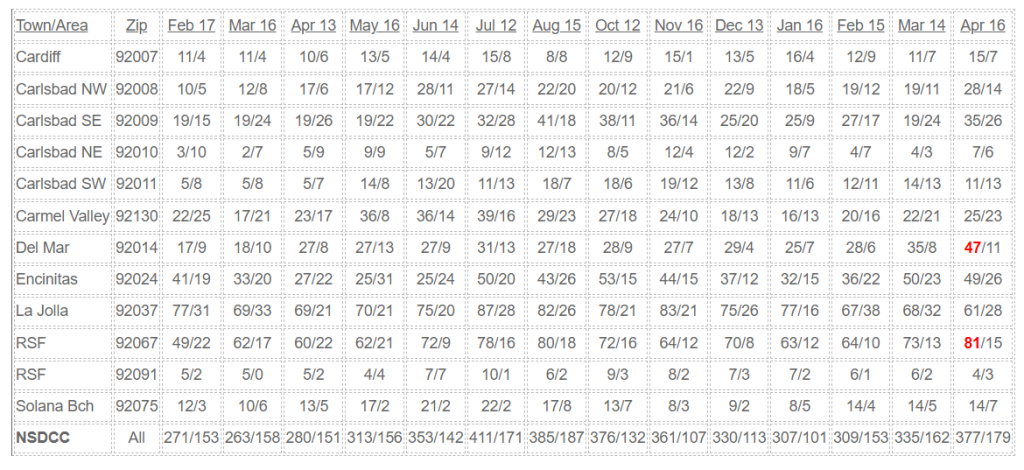

NSDCC Active and Pending Listings

The unsold listings are stacking up earlier than normal in Del Mar (Median LP = $4,750,000) and in Rancho Santa Fe (Median LP = $7,895,000) but no one is going to feel sorry for them.

The other areas are hanging tough around the 2:1 ratio or better, which has been the healthy-market zone.

But look at SE Carlsbad for an example. It has the exact same number of pendings as there were at this time last April, but the number of actives are almost doubled, even with a reasonable median LP of $2,099,000.

This year, there will be more listings that price too high, don’t adjust, and get left behind.

by Jim the Realtor | Apr 15, 2024 | 2024, Jim's Take on the Market, North County Coastal, Sales and Price Check, Why You Should List With Jim |

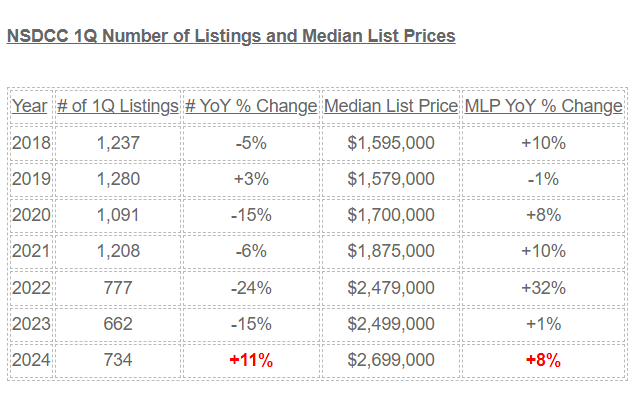

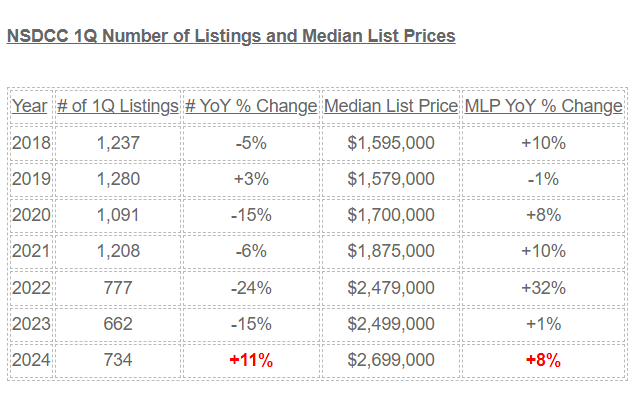

The first quarter of 2024 is the only 1Q in recent history to have increases in BOTH the number of listings AND the median list price. Previously, increases in pricing had a corresponding dip in the number of listings available for buyers to consider.

If you are like me, you’ve seen a noticeable surge in seller optimism in 2024. It’s not just the median list price that is up 8%, doesn’t it seem like everything is $200,000 higher than last year?

by Jim the Realtor | Apr 15, 2024 | Inventory, Jim's Take on the Market |

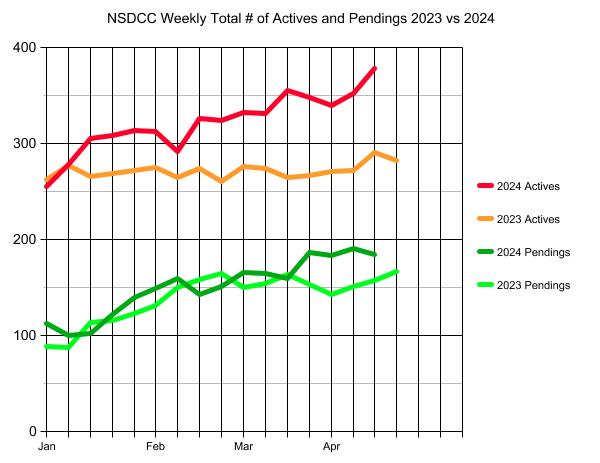

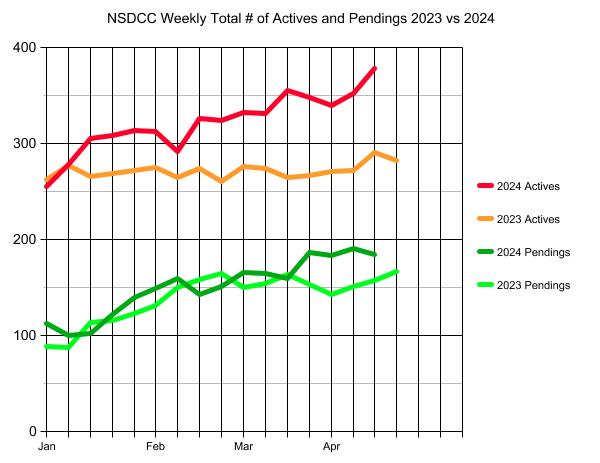

It looks like we’ve found the number.

Because the inventory was so low last year, I thought the market could easily handle a 10% to 20% increase in active listings this year.

But now the number of actives is +30% YoY, and the pendings aren’t increasing in a similar fashion. If sales don’t pick up, it means a glut of unsold listings could be forming over the next 1-2 months.

Will buyers care?

Probably not, because they have shrugged off worse (higher prices and rates). But once a listing goes unsold for 2-3 weeks, it will take something drastic to get the buyers’ attention again.

(more…)