Prescott

We have sent a few people to Prescott and Prescott Valley recently and they have loved it! The 2020 population of Prescott was 45,000 and the elevation is 5,300 ft. so you are out of the searing desert heat and get some snow occasionally.

We have sent a few people to Prescott and Prescott Valley recently and they have loved it! The 2020 population of Prescott was 45,000 and the elevation is 5,300 ft. so you are out of the searing desert heat and get some snow occasionally.

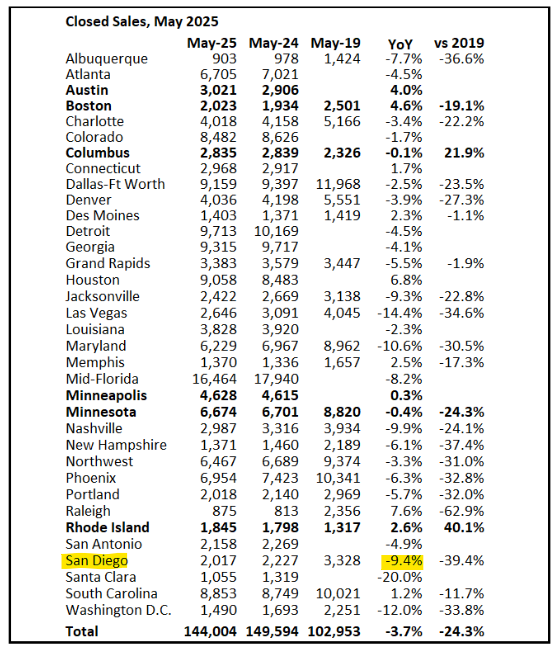

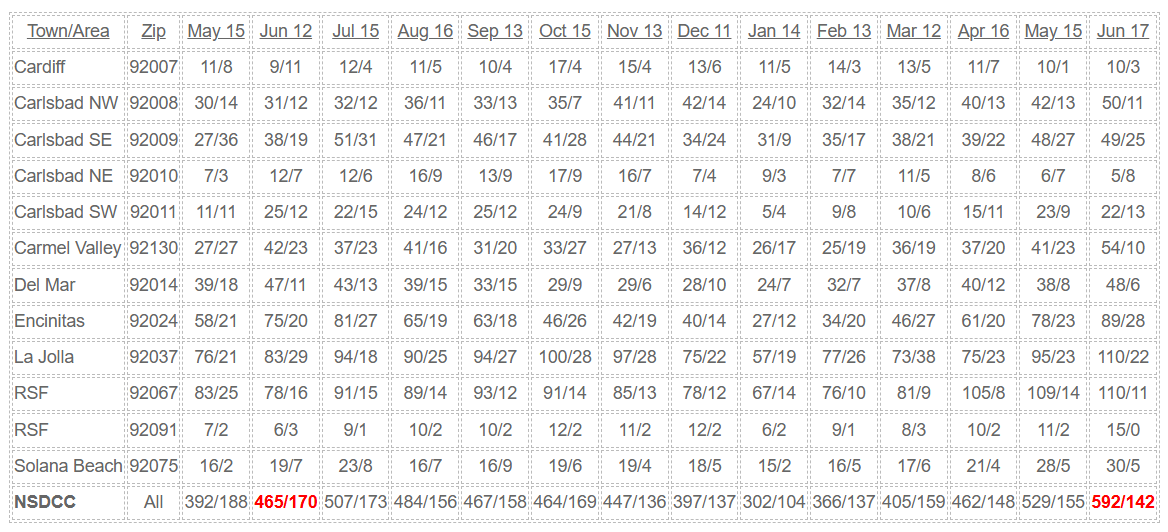

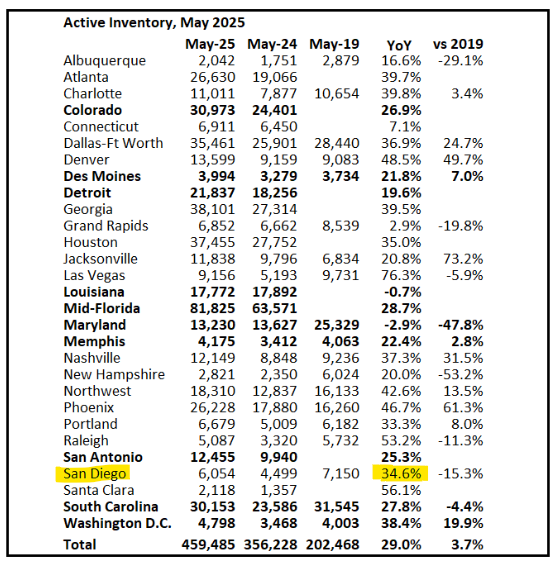

Bill is showing a 9.4% decrease in SD May sales, year-over-year.

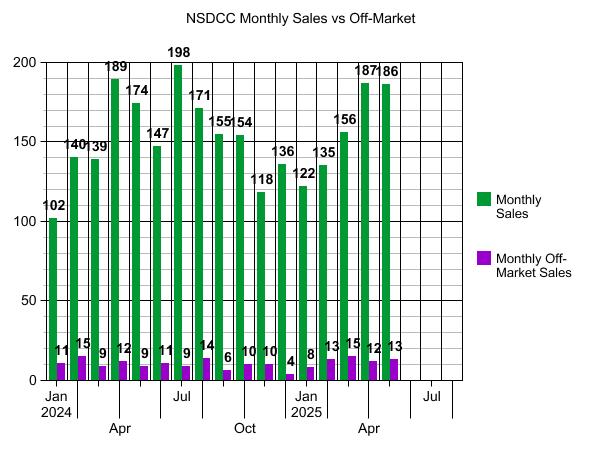

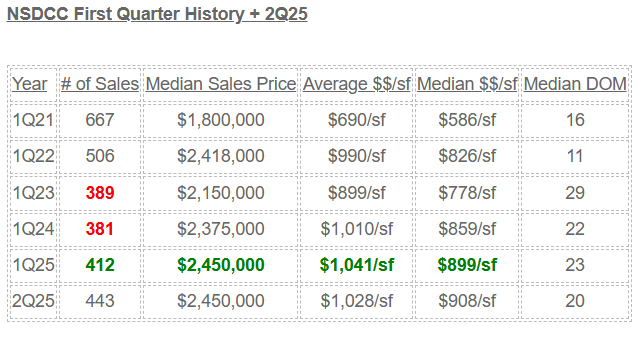

But around the north coastal area, sales have been holding up. The NSDCC sales in May were +7% YoY, and for the first five months, it’s +6%! We can live with those!

The number of off-market sales (which are a part of the total sales count in green) continues to be muted. They might increase a bit if we ever have another frenzy, but with these market conditions, buyers are too cautious.

P.S. Is your life full of Ups and Downs? Now you can live right on the corner:

https://www.compass.com/listing/2046-ups-circle-oceanside-ca-92054/1866926146381690585/

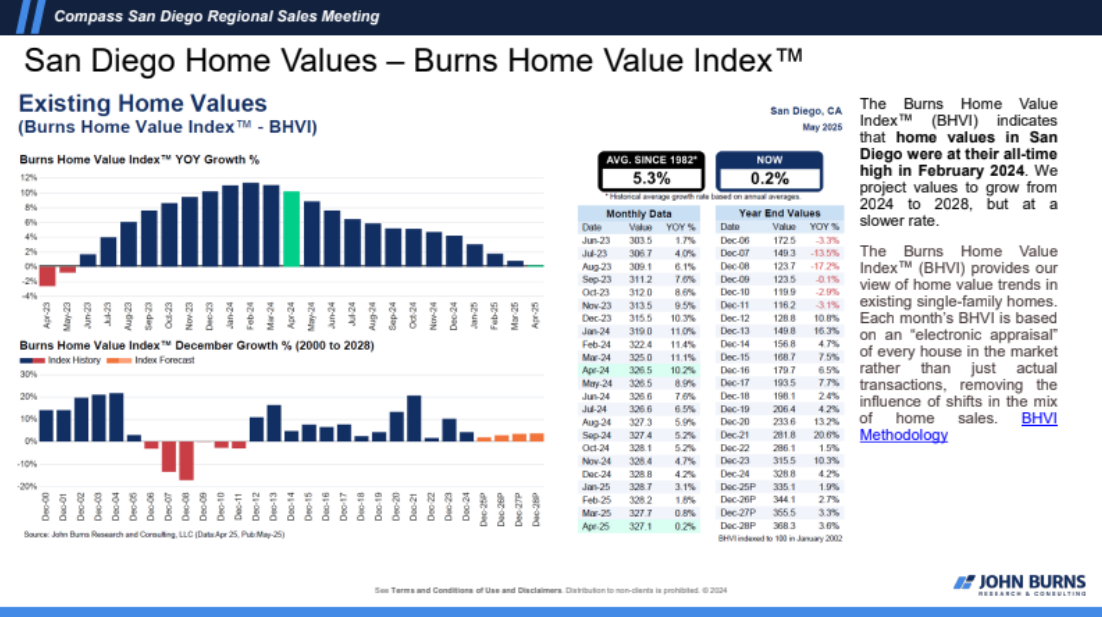

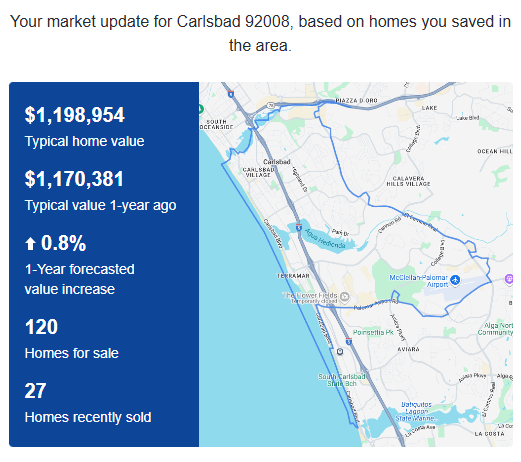

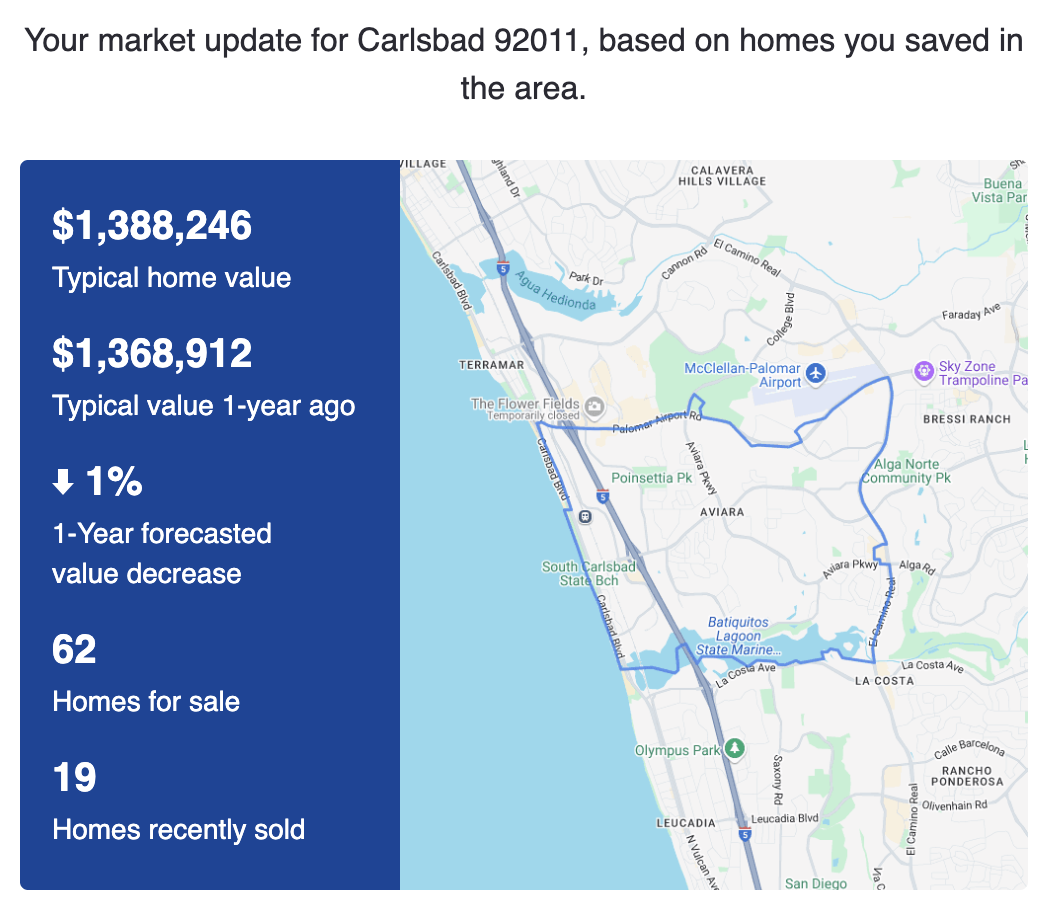

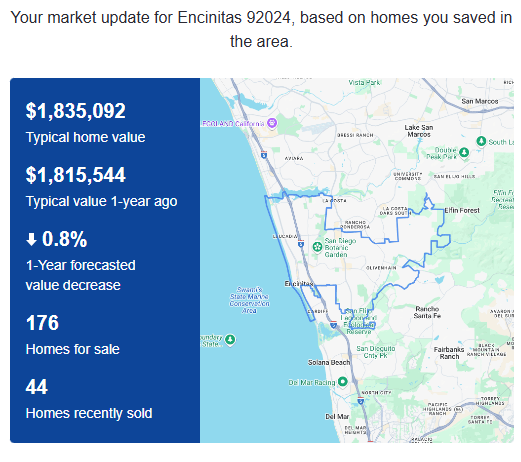

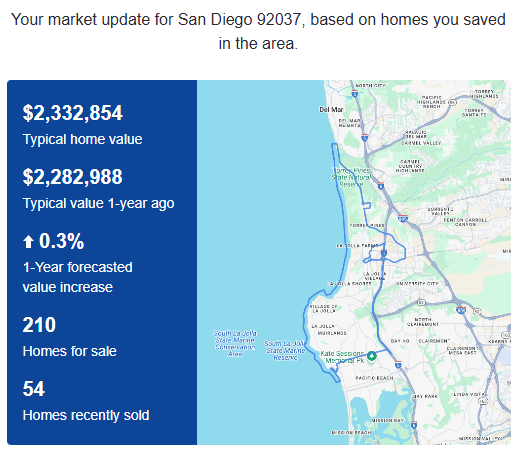

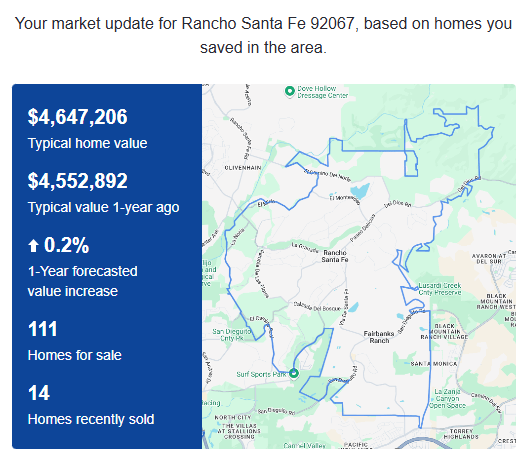

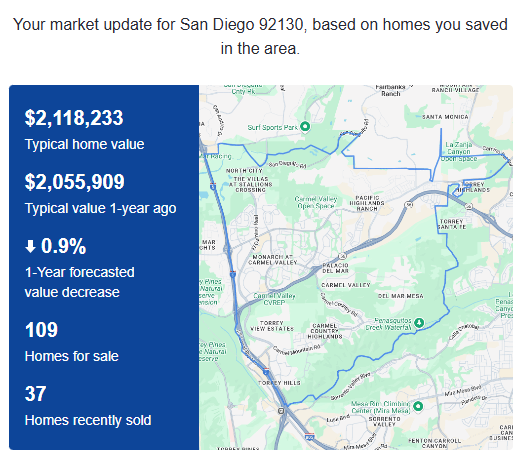

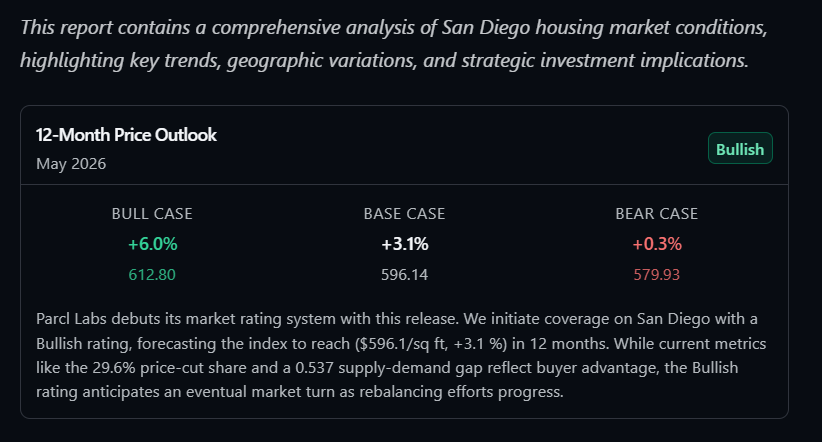

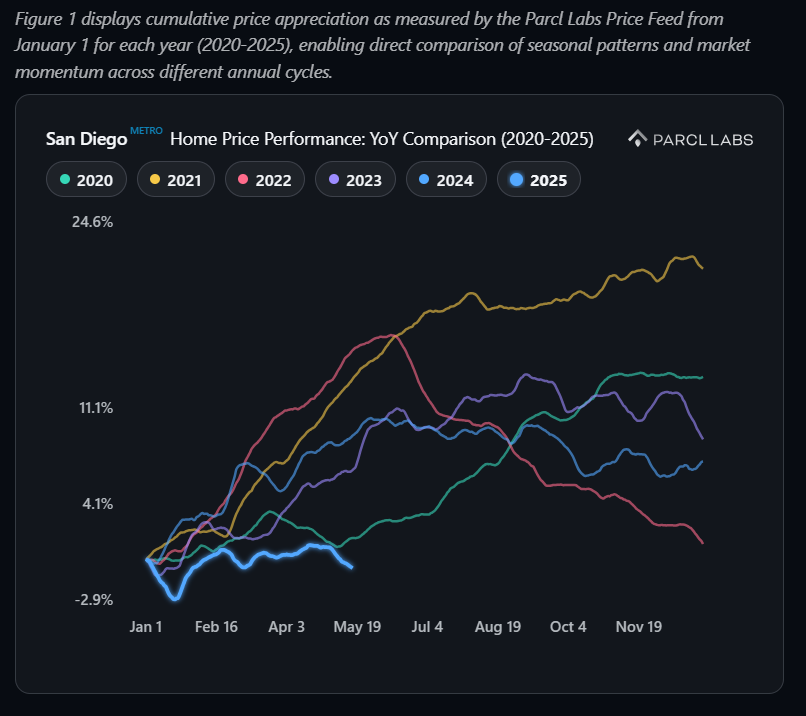

JB is predicting that the local appreciation will be positive for the next few years, though not by much. Zillow thinks the same thing, and if it bounces around in a tight range for the next 3-5 years, it probably won’t surprise many.

It means there won’t be much, if any, benefit in waiting – for buyers or sellers. Rates aren’t going down significantly, and America minted 379,000 new millionaires last year, or more than a thousand each day – combine that with the generational wealth transfer and the buyers’ ability to purchase should be there.

Could there be a boomer liquidation event? It’s probably the biggest threat to pricing, and it could pick up speed in areas where several boomers are aging in place. But how can you time that?

Buy when you find the right house, and sell when you have good comps and low competition!

Carmel Valley going down? I’ll have to see it, to believe it!

I know that Brian Wilson died but Sly had a bigger influence on my musical upbringing. Not only was his greatest hits cassette was the first one I ever bought, but later I met Rich Romanello who was their first manager and one of my favorite clients of all time. He promoted Sly and The Family Stone when they first got started in San Francisco and made them into a world-wide juggernaut that was the basis of R&B music for decades to come.

Usually, the lowball season is limited to the 4th quarter each year. With the excess inventory today, some buyers will be attempting to get a deal now.

Buyers – Where do you start? Getting a deal on a fixer can be counterproductive because of the time and money needed to get it back in shape – and you end up with a retail investment that dominated your life. But if it’s in a superior location, it might be worth it.

The market is healthy enough that the creampuffs are going to get good or great offers from the less-informed. If you like the home and don’t mind paying retail, then battle it out and maybe you will get lucky and be able to shave a couple of bucks off the list price.

But if you want to lowball, the best chance of getting a deal is on the aged listings – those that have been on the market for more than 30 days.

It’s likely that you will have to make several offers before landing one, but if you have the time, go ahead. The hope of holding out for a superior property will likely out-weigh your willingness to risk it all on one that might seem discounted today.

Sellers – Are you kicking yourself for not selling when rates were 3%? Why? Pricing is BETTER today than it was in 1Q22, the peak of the covid frenzy.

But let’s say a buyer is willing to cash you out in three weeks, but only if you knock 10% off your list price. If your home has been on the market for more than 30 days, we already know that the price is at least 5% too high, so the 10% discount is only slightly under market – and it could be retail by the end of the year.

Nobody is asking you to go back to 2021 pricing (and that pricing sounded fantastic in 2021, just four short years ago). At worst, the buyer is asking you to go back to 2023 pricing when there was a little dip.

You really ought to consider it.

Oh, ok you want to hold out for the extra couple of percentage points? You will need lower rates and/or less competition, and neither of those are likely this year or next. Yes, Trump will replace Powell in May, 2026 and rates might go down to 6% or less. But the likelihood of 1-2 of your neighbors taking a lowball offer is high, and their reset of the comps will thwart any future benefit of slightly lower rates.

Somebody in your neighborhood is going to take a lower offer. It might as well be you. Sell for less now, or sell for less later – your choice.

It’s just money!

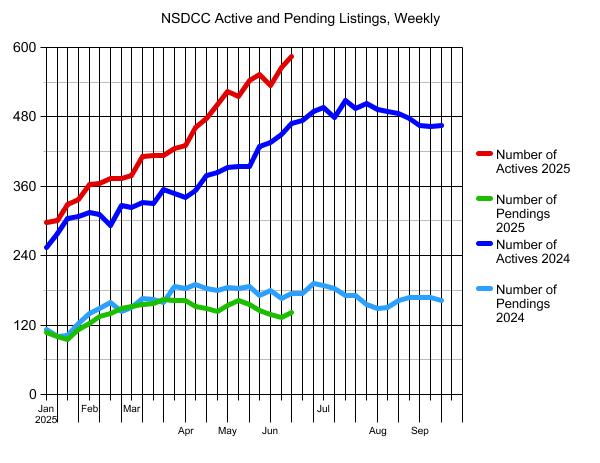

NSDCC Actives and Pendings

The local markets are sinking further into a stallout that will probably last for the rest of the year.

Actives are up 27%, and pendings down 16%, year-over-year. Yikes!

Hunch: ‘Rebalancing’ might take longer than expected.

Executive Summary

San Diego housing market exhibits a pronounced -2.38% YoY price decline with 3,245 unit surplus inventory, creating a buyer-favorable landscape with 29.6% of listings showing price cuts (+50.3% YoY) – significantly outpacing the national increase of 17.4%. Market segments reveal contrasting realities with strategic pockets of opportunity.

Rating and 12-Month Price Forecast: Parcl Labs initiates coverage of San Diego with a Bullish rating, forecasting a 12-month price of ($596.1/sq ft, +3.1%) – just clearing our 3% threshold for a bullish designation. While a 29.6% price-cut share currently indicates buyer leverage, this Bullish outlook anticipates a market shift, supported by ongoing rebalancing. We will review this forecast if current headwinds persist.

San Diego’s absorption rate has fallen to 0.482 as supply (6,262 units) substantially outpaces demand (3,017 units), creating a 0.537 supply-demand gap – significantly wider than the national gap of 0.326. Price cuts have reached a 12-month high at 29.6%, signaling accelerating market rebalancing.

Extreme submarket divergence exists with premium ZIP 92129 showing severe correction signals (supply +137.5% YoY, prices -9.0% YoY) while Imperial County demonstrates robust appreciation (+41.5% YoY) against San Diego County’s -1.1% YoY price decline.

ZIP-level data exposes the most pronounced correction signals in premium neighborhoods, with ZIP 92129 registering a 137.5% supply increase against a 7.0% demand decline, creating a 144.5% market gap that has driven prices down 9.0% year-over-year to $1,351,000. This premium market deterioration contrasts sharply with pockets of resilient demand in ZIPs 92117, 92114, and 92056, which registered exceptional transaction growth of 28.4%, 19.8%, and 15.1% respectively. These localized demand growth areas represent tactical opportunity zones for investors seeking counter-cyclical appreciation potential amid the broader market deceleration, highlighting the importance of granular sub-market analysis in the current transitional environment.

Mid-market property segments command significant yield premiums over luxury (Mid-Century Starter: 5.28%, 1980s Suburban: 5.17% vs. Luxury Estate: 3.64%), with Vintage Family homes showing persistent buyer advantage (supply-demand gap: 0.1203) as other segments approach equilibrium.

We really should break down every sub-market.

The number of homes for sale between La Jolla and Carlsbad is 15% above the highest count in 2024 – which was in mid-July.

Where will we be next month?

I thought many would be giving up by now, but instead more are pushing to get out. Are they aware of the difficulty, and that half won’t be selling this year?

The current chaos combined with the decline of the buyer-agent is causing buyers to stay on the couch – unless they see a compelling deal online. With high rates and prices, you can’t blame them for being very picky!

Yet there are still lucky sales happening. Ones that you wouldn’t think had any chance of selling but they end up closing over list anyway with a buyer-agent who has only closed 1-2 sales in the last 12 months. It is a very treacherous environment!