Readers have wondered about the story of the billion-dollar property being bought for $100,000. It was the lender (who was the previous owner) who got the property back, and who is now in position to make a tidy profit on their original $45 million mortgage: On...

Foreclosures/REOs

CV REO Result

Oh well. Start over.

CV Auction Update

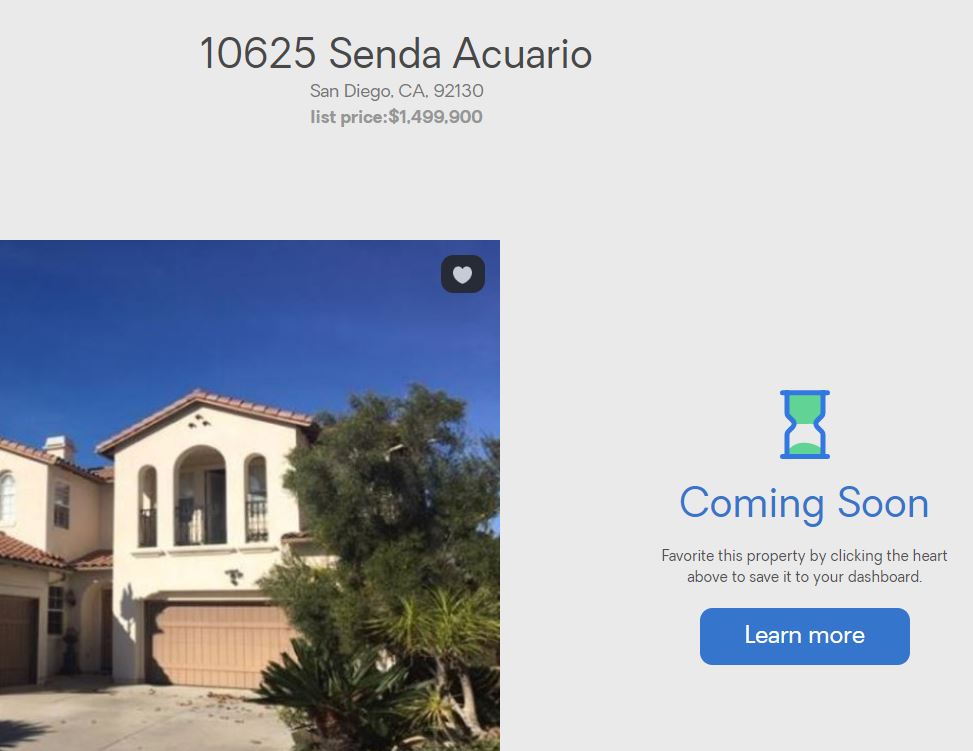

With less than 24 hours to go in the REO auction, it looks like the seller got a little antsy and decided to push the bidding closer to their $1,499,900 list price. Will there be a flurry of activity right at the finish line? We'll see!

Carmel Valley REO Auction

Here's an interesting case in 2019. Wells Fargo foreclosed on this Carmel Valley home in November. It had been listed on the MLS for the previous 12 months, and it looked like the agent had been trying to process a short sale (it was marked 'contingent'). She had it...

Squatting at Tony’s

Hat tip Bode! Neighbors of the late San Diego Padres great Tony Gwynn noticed something strange happening in their upscale Poway neighborhood about two weeks ago. Last summer, the Gwynn family lost their home to foreclosure and it’s been vacant ever since. But...

It’s Different This Time

Our YoY home sales are in decline, and it makes you think, 'Here we go again". We know that sales are the precursor, and historically prices are the last to go. But with so many different variables this time around, could it actually be different this time? Let's...

Foreclosures 2011

Jim the Realtor on cnbc - does the advice sound familiar? Hope for Housing? from CNBC.

Regulating SFR Investors?

Now that the big investors have virtually stopped buying homes, a legislator wants to find a way to regulate them. Typically the term “institutional investor” refers to private investment firms that buy dozens of residential properties with the explicit aim of...

‘Aged’ Foreclosures

Love this little tidbit that was tucked in at the end of the article: LINK

Will The Real Estate Bubble Pop Again?

Our local home prices have risen so quickly that it feels like we're in 'bubble' conditions again - could the bubble burst this time? The last two times the real estate bubble has popped, it was due to banks having to offload their foreclosed properties for whatever...