Migration Report

This must mean that Allied’s best salespeople are in San Diego!

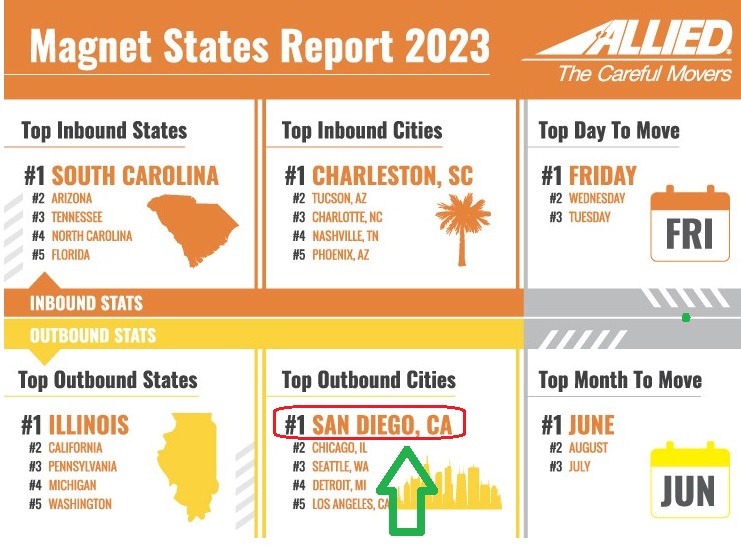

The 2023 Allied US Migration Report presents a detailed analysis of the current trends in interstate moves across the United States, highlighting significant patterns and underlying economic factors.

This year marked another decrease in the volume of interstate moves. Following the 20% decrease in 2022 compared to 2021, there was a further 12% decline in 2023 relative to the previous year. This continuous decline indicates a notable shift in migration patterns over the last two years.

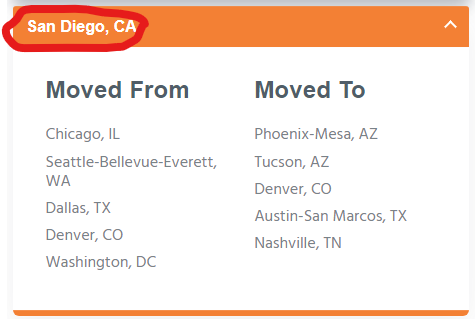

San Diego #1 in 2023

Hartford was a little higher but I never liked them much. Let’s not count them.

Carlsbad’s Inclusionary Housing Policy

The City Council unanimously agreed on Tuesday to rezone 16 properties across the city to facilitate needed housing developments and set new affordability requirements on these sites. The action rezones 16 of the 18 properties previously identified for study by the council, except the Cottage Row property on Aviara Parkway on Site 8 and the city-owned “Oak Yard” property on Site 15.

Carlsbad’s inclusionary housing policy currently requires 15% of all units in new developments to be deed-restricted as affordable. Among the rezoned sites, the council agreed to raise that rate to 40% on city-owned properties and 20% on those not owned by the city, following last month’s Planning Commission’s recommendation.

This massive effort completes several years of work and community outreach and checks off one of the largest programs mandated as part of the city’s Housing Element, which requires the city to build 3,873 new units by 2029.

City leaders warned that not completing this rezone by the April deadline would result in the city’s Housing Element being out of compliance and make the city susceptible to Builder’s Remedy projects. This state law allows developers to ignore zoning codes when constructing projects with affordable units in non-compliant cities.

Natalie Back On Tour!

Our daughter Natalie leaves tomorrow to start the next leg of the Karol G tour, which begins in Mexico City on February 8th. They have shows in Latin/South America over the next three months, then they go to Europe for another two months!

https://www.karolgmusic.com/tour-dates/

They did two shows in Medellin, Colombia (Karol G’s home town) in early December:

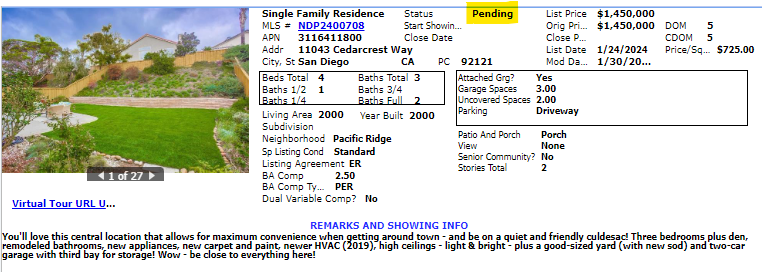

Julie’s Listing

NSDCC Jan. Listings & Sales, Prelim

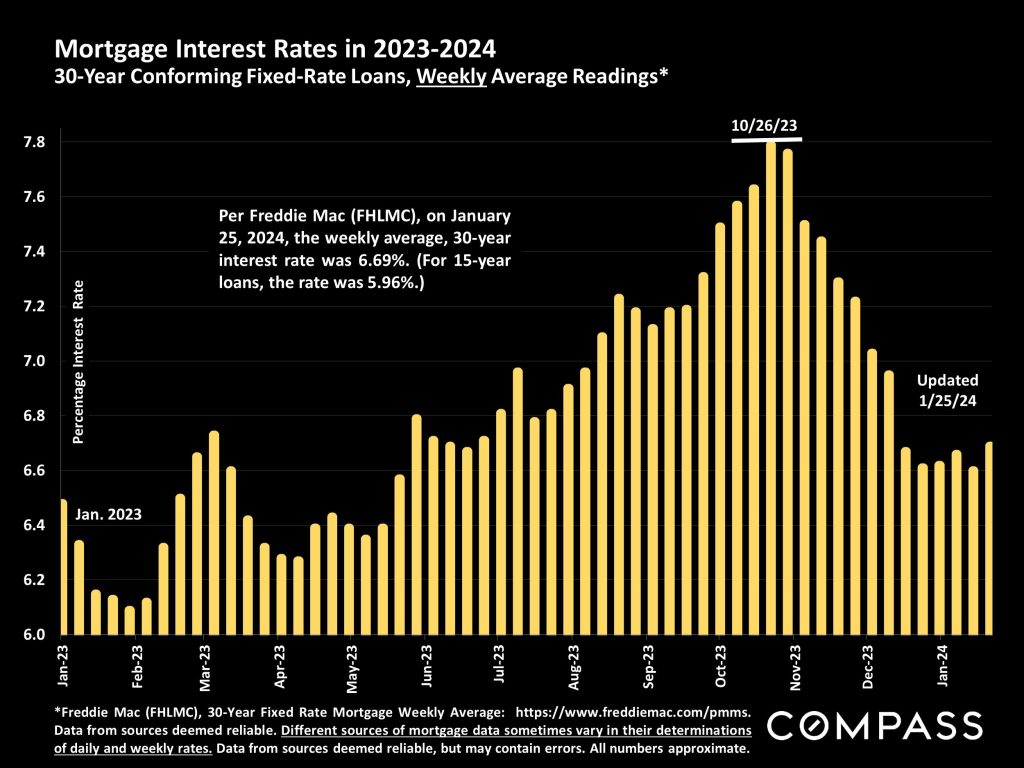

As of February 1st, the January sales count is 103, with the median sales price at $2,275,000, which is a nice pop over the 87 sales from last month. The graph above shows how any momentum was thwarted by rising rates in October, and some relief now is probably contributing to more sales and activity locally (though the mortgage purchase apps were down 11% nationwide today).

By Monday we’ll be able to crown Joe as the winner of the Padres tickets!

Slightly more inventory is the best-case scenario for a healthy selling season. Too many new listings might cause buyers to pause and see where it’s going, but we’re not close to a surge today. A bigger threat would be running out of affluent buyers.

217 – January 2024 Listings (205 in January, 2023)

103 – January Sales so far (median sales price = $2,275,000)

42 – January Sales Under $2,000,000

15 – January Sales Over $4,000,000

$1,100,000 – Lowest-priced sale in January (a detached condo)

$18,500,000 – Highest-priced sale in January (Oceanfront sold off-market)

20 – Median Days on Market

February should be incredible with momentum increasing rapidly. The selling season is here!

Mortgage tip: For those getting a loan under $1,000,000, you can get an FHA rate in the high-5s today!

Beach Condo

We agree that location is everything…..especially if you can squeeze into something smaller!

Slow-Motion Auction Underway

There is no guidance on how to effectively handle a bidding war.

I don’t see or hear anything from NAR, CAR, brokerage managers, or team leaders on how listing agents should handle a bidding war, other than to put the offers on a spreadsheet and let the seller decide. But they are paying us a lot of money to give them advice, and that’s all we got? Embarrassing.

For realtors who think that’s good enough, then fine. Do you mind hurrying up with that retirement?

I made an offer on behalf of buyers last Thursday that was 6% over the list price. The listing agent won’t tell me how many offers they have, what price they are at, or even how the winner will be determined. After five days of waiting, we are left with nothing except “I’m trying to get you a counter” that came last night.

It never occurs to them that their inaction for days causes the buyers to cool off in the hurry. The agent will finally get around to picking a buyer they like, and the home will finally sell. But it won’t be for top dollar.

When I receive multiple offers, I’m transparent with everyone.

With our Cedarcrest listing, I’ve been telling every buyer and agent exactly what to expect. I encourage all of them to make a written offer, we will request their highest-and-best offer on Monday, and then find the winner on Tuesday.

Once the offers are in, usually half of them won’t submit a highest-and-best because they already did, or they cooled off quickly. No problem, and thank you for your offer.

We’re up to nine offers now, yet only two or three have expressed their sincere desire to buy this house. What a great filtering system to find the real players! Once I’ve confirmed with every agent that their highest-and-best offer has been received, I ask them if they want to go any higher – and tell them that if they don’t they are going to lose.

The efficiency is spectacular. The buyer-agents have the intel they need to literally tell their buyers, “If you don’t go higher, you’re going to lose out”. Every buyer would like that clarity in which to make a decision – yet every other listing agent thinks it’s better to keep them guessing in the dark for days.

A few will be startled by the transparency because they have never seen it before.

They think they deserve some favoritism because they are a cash buyer, or because they were first, or because their agent is a sweet-talker…..but what they really want is to score an off-market deal at a lower price because they see a lot of those happening – and they’ve never seen anything like mine.

Another agent asked about the action because she has a new listing coming in the neighborhood that is on the canyon side. She got what she wanted out of me, but then wouldn’t tell me anything else about hers, other than, “You’ll see it when it’s on the open market”. Great – we’ll see how she does vs. me!

4:40pm:

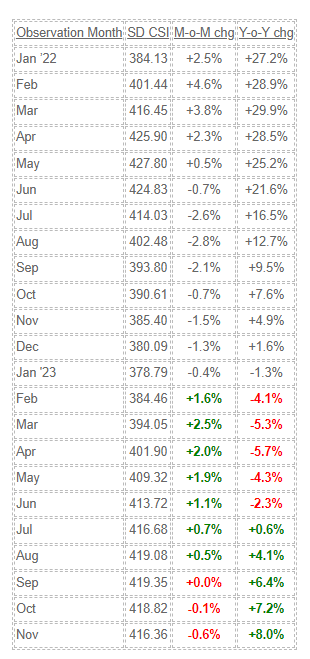

San Diego Case-Shiller Index, November

After seasonal adjustment, the U.S. National Index and the 10-City Composite posted month-over-month increases of 0.2%, while the 20-City Composite posted a month-over-month increase of 0.1%.

“U.S. home prices edged downward from their all-time high in November,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P DJI. “The streak of nine monthly gains ended in November, setting the index back to levels last seen over the summer months. Seattle and San Francisco reported the largest monthly declines, falling 1.4% and 1.3%, respectively.”

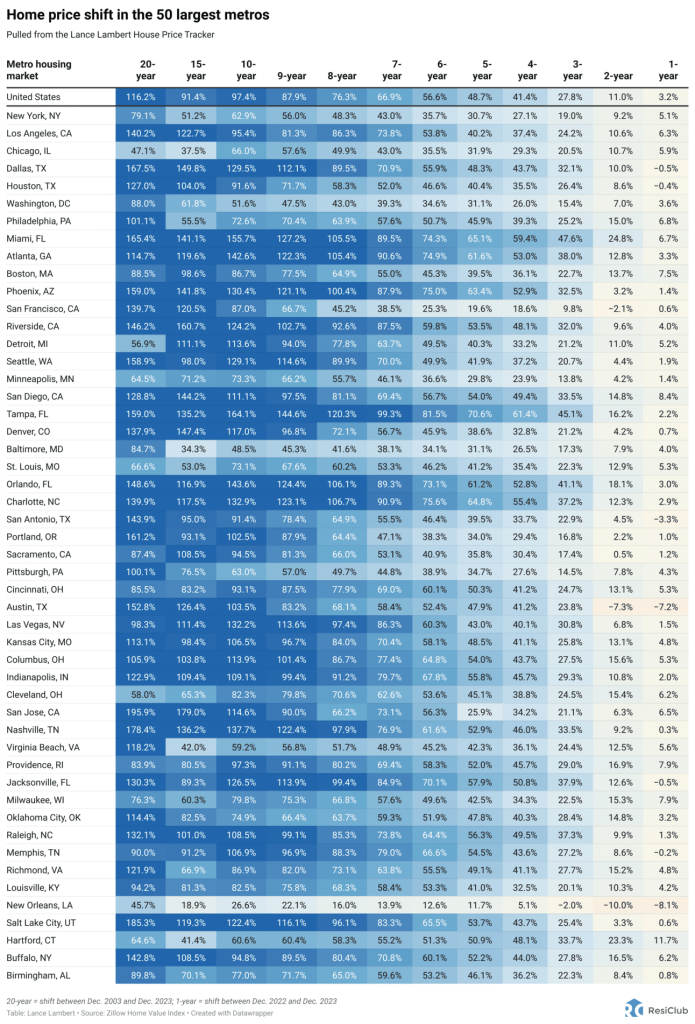

“November’s year-over-year gain saw the largest growth in U.S. home prices in 2023, with our National Composite rising 5.1% and the 10-city index rising 6.2%. Detroit held its position as the best performing market for the third month in a row, accelerating to an 8.2% gain. San Diego notched an 8% annual gain, retaining its second spot in the nation. Barring a late surge from another market, those cities will vie for the ‘housing market of the year’ as the best performing city in our composite.”

“Six cities registered a new all-time high in November (Miami, Tampa, Atlanta, Charlotte, New York, and Cleveland). Portland remains the lone market in annual decline. The Northeast and Midwest recorded the largest gains with returns of 6.4% and 6.3%, respectively. Other regions are not far behind with the slowest gains in the West of 3%. This month’s report revealed the narrowest spread of performance across the nation since the first quarter of 2021.”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The decline in the local index is picking up speed, but it’s not falling as fast as it was last year.

Who cares – September, October, and November were forever ago.

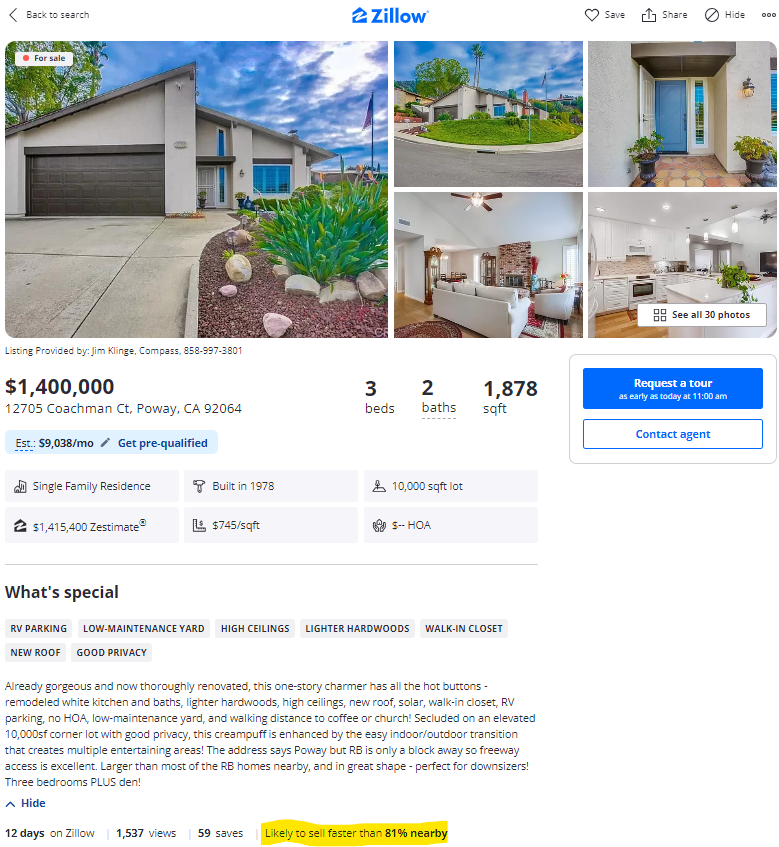

Either a house has been improved to sell and gets a lot of attention, or it sits.

Take our listing here:

Judging by the statistics, Zillow thinks this house should sell fast, a smaller house down the street just had seven offers and sold over $1,400,000, and we are up to NINE offers on our similarly-priced new listing. But here the owner refused to do staging, in spite of our recommendation – and they have bought and sold three other houses with us!

The impact? Only two people came to the open house on Saturday, and we haven’t sniffed an offer.

Buyers don’t have the vision or patience to imagine what a house could be – they are attracted to those homes who have already done the work for them. At these prices, you can’t blame them!