by Jim the Realtor | Apr 4, 2024 | Bidding Wars, Commission Lawsuit, Jim's Take on the Market, Over List, Why You Should List With Jim |

This was going to be the big test.

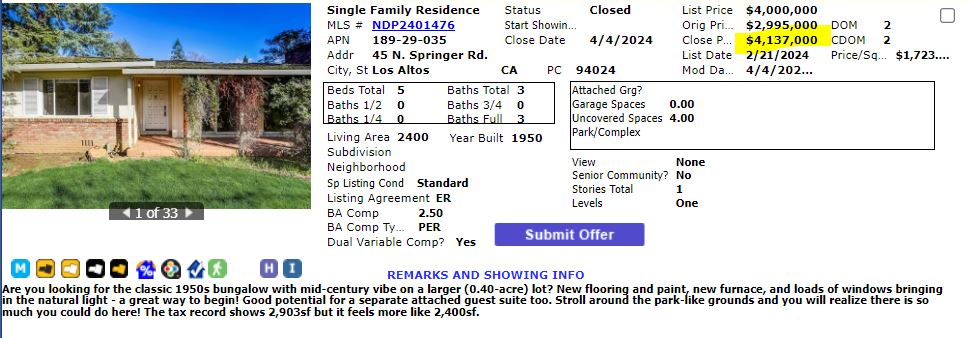

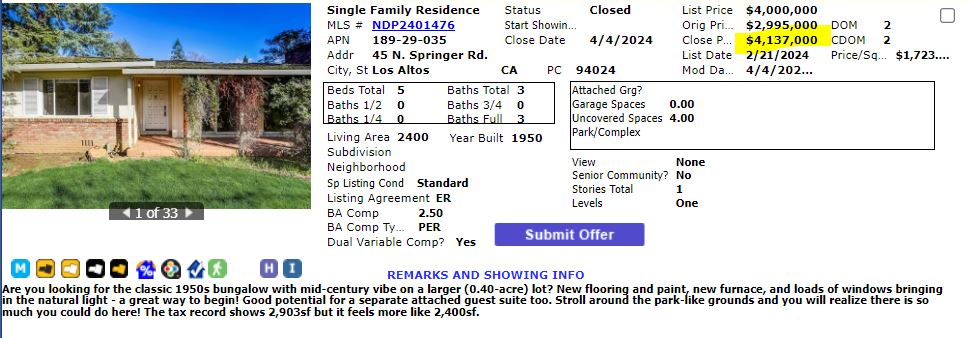

The controversial local brokerage in Los Altos was offering a measly $10,000 commission to the buyer-agents on their listings, most of which were $4,000,000 and up. They listed a similar house on a quiet street about a mile away for $2,988,000 and then marked it pending a week later.

So I followed their lead and priced my listing at $2,995,000 even though mine needed EVERYTHING and was on a heavily-traveled street.

My video tour of my listing HERE.

I wanted to prove that paying 2.5% commission to the buyer-agent would cause a better result.

Theirs closed for $4,200,000 (and was put up for rent for $2,900/mo).

Mine sold for $4,200,000 too, but then our buyer-agent volunteered to cut 1.5% of her 2.5% commission and deduct it from the sales price. In those cases, the lender has to get the appraiser to re-issue their appraisal at the revised price – but she forgot, which delayed closing for another week. I’ve never prayed so hard for an earthquake not to happen!

I don’t know if the agent on the other sale only got paid $10,000 to support her buyer with paying $1,200,000 over their list price, but she deserved more.

But combined with my buyer-agent being so generous, and the other comments at open houses, the agents around the Silicon Valley are so desperate that they are begging for business. The amounts buyers pay over the list prices indicate the same.

I still think my result was better than the $10,000 guy due to our harsh condition and busy street. But I can’t say that the 2.5% made any difference at all.

We can probably come to this conclusion though. In a scorching-hot entry level market, you don’t need to pay much to a buyer-agent, if anything at all. If the buyer-agent is smart, they will have their own agreement with their buyer to cover it.

In areas where the actives-to-pendings ratio is 4:1 or higher (Rancho, I’m looking at you), paying a reward or bounty to a buyer-agent is worth considering. Is that steering? No, it’s America, where paying incentives to get what you want should be legal and encouraged.

by Jim the Realtor | Apr 4, 2024 | Auctions |

There is a new disrupter born every day! This one was created by a VC-backed appraisal company, so their gadget begins with a free appraisal to help determine the list price. Then they offer a little something for everyone – a week on the MLS for full exposure, then an auction-like event using the appraised value as the opening bid….unless a buyer wants to pay the Buy-It-Now price during the showing week! It doesn’t matter much what the whizbang feature is – all that matters is spending millions to advertise it to the masses:

https://buyglasshouse.com/how_it_works

Two highlights:

If no offers are submitted once the Showcase Week ends, the home remains on the market at the pre-appraised value for a total of 30 days. This means that as long as a single buyer is willing to offer the pre-appraised value, the home will go under contract for fair market value within 30 days.

Fortunately, even if the Winning Offer Price is above the pre-appraised value, it’s unlikely that the second appraisal would come in below the contract price. See this FAQ to understand why.

by Jim the Realtor | Apr 3, 2024 | Commission Lawsuit, Commission War, Jim's Take on the Market, Realtor, Why You Should List With Jim |

In January, 30% of the NSDCC sales offered less than a 2.5% commission to the buyer-agents, and in February it was 25%.

Since the NAR settlement was announced on March 15th, 40% of the listings are offering less than a 2.5% commission to the buyer-agents.

There isn’t a new rule that directed listing agents to offer less commission. They just felt like doing it.

Is it due to the listing agents being weak and inexperienced? Or are the listing agents are still charging their full fee and taking more for themselves? Either way, they are under-appreciating of the job of buyer-agents, which isn’t good for their sellers.

What’s going on?

- Agents who lack solid sales skills will offer a reduced commission rate as their reason to hire them. Importantly, these agents are unwilling to improve their skill set. They believe that completing the forms is all there is to being a realtor, and offering a reduced fee is the only way for them to get business.

- Those who still charge their full fee but are now paying less to the buyer-agent are flat out greedy. Their commission rate is never disclosed to anyone besides the seller – at least not yet, and if the DOJ wants to focus on the nefarious, they can start right there.

Would you want either of those agents in your corner when the action starts?

Smart home sellers will recognize a critical issue.

The eventual sales price matters more than the commission rate.

Homeowners who don’t want to pay ANY commissions can sell their house to the buffoon who advertises on television. But he only pays 70% of the home’s value – yet he gets business because there are people who fall for the ‘quick cash and no fees’ enticement.

In addition, there are plenty of agents who offer a reduced rate in exchange for reduced services – but what real estate services can you do without? What are the vital sales skills needed to sell for top dollar?

The best agents have sales skills that cause your home to sell for more money, and they are successful enough that they don’t need your listing. Do you think they are going to discount their rate?

Are you going to hire a great agent who will push the sales price higher? Or will you settle for any old licensee just to save a point on the commission?

Reducing commissions aren’t going to make agents better, or have them put in extra effort. They aren’t going to do the same job for less pay. Because they agreed to be paid less, they will want to do less.

Is that who you want working for you?

The top agents employ a collection of superior sales skills that deliver a top-dollar sales price AND make the experience easy and enjoyable. Isn’t that what you want?

by Jim the Realtor | Apr 2, 2024 | Commission Lawsuit, Commission War, Realtor |

Most people think that the lawsuits are going to cause lower commissions, but if that happens, it will be in conjunction with the buyer-agents being eliminated. I’m calling it single agency for now.

Here is this week’s installment on the evidence supporting my theory. Even though I suspect this is BS like most of the things he says, he put this out for public consumption:

Kelman, for one, doesn’t seem too concerned about the settlement’s impact on his business.

“We’re just getting more aggressive about selling homes directly to consumers,” Kelman answered in response to a question about how Redfin is adjusting in the aftermath of the settlement. “There are so many people who called us over the weekend after the news of the settlement broke and said, ‘I don’t want to pay a buyer’s agent. I want to hire you to sell homes directly to homebuyers.’”

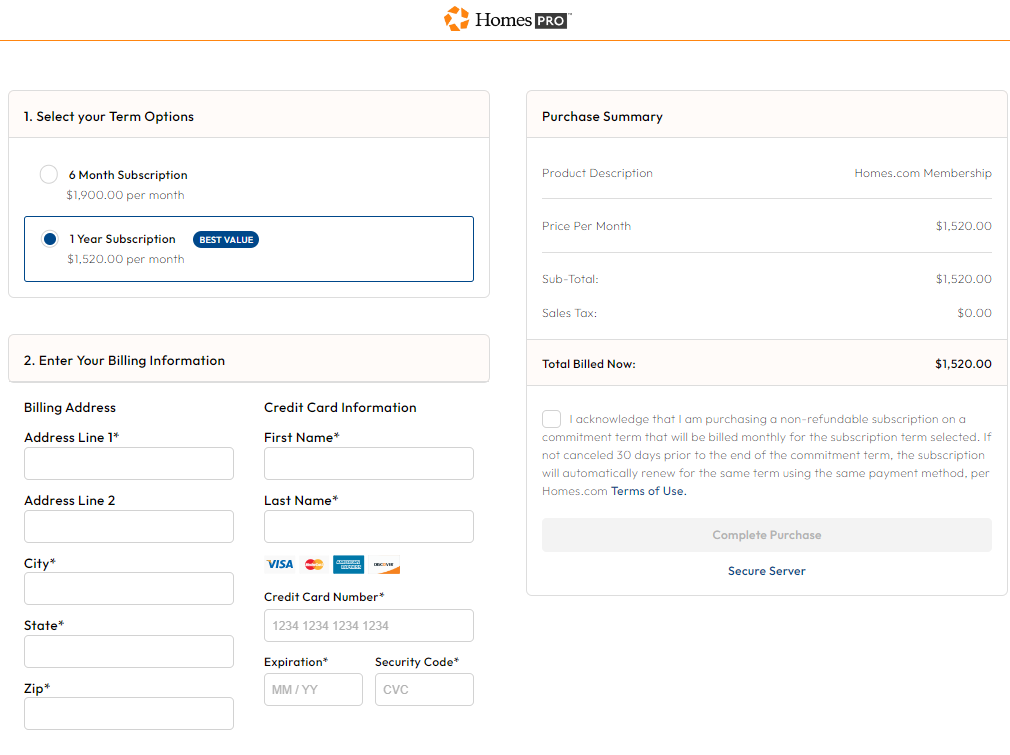

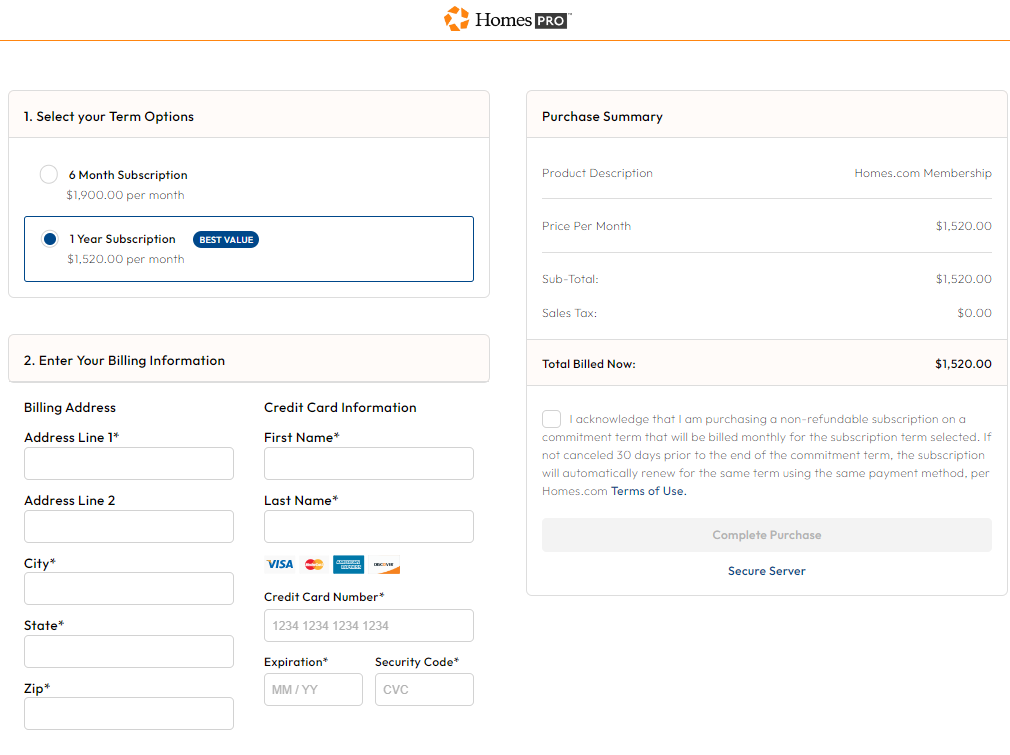

The new search portal, Homes.com (who wasn’t kidding about spending boatloads of money on advertising) is making a campaign out of Your Listing, Your Lead. They direct all buyer inquiries back to the listing agent, instead of sending to a third-party agent who pays for the lead.

But look at how much they are charging!

The only listing agents who are going to pay this money are the big teams – who will then be more excited about selling their listings directly to their own buyers, rather than co-op with buyer-agents via the MLS.

Forty percent of the NSDCC listings since March 15th (the day the NAR settlement was announced) have a buyer-agent commission under 2.5%. We saw the Berkshire Hathaway listing that didn’t offer any commission to a buyer-agent.

Being a buyer-agent is so tough that they aren’t going to do it for nothing – they will quit instead. Will buyer-agents convince buyers to pay them a full commission directly? No – they will quit instead.

It’s only a matter of time.

It isn’t what is best for buyers, and when buyers are harmed, it isn’t good for sellers either. Especially if the market slows. But here we are!

by Jim the Realtor | Apr 1, 2024 | Inventory, Jim's Take on the Market

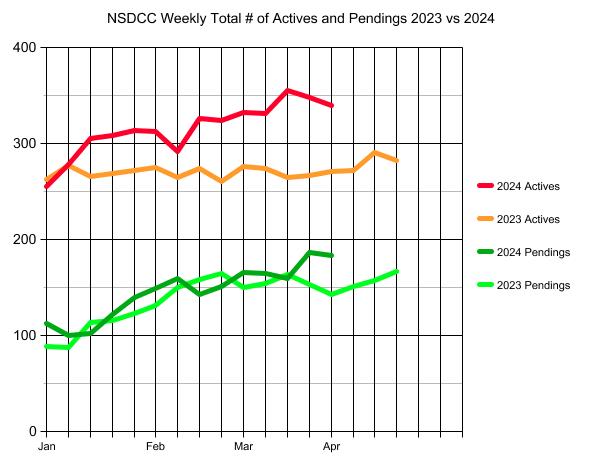

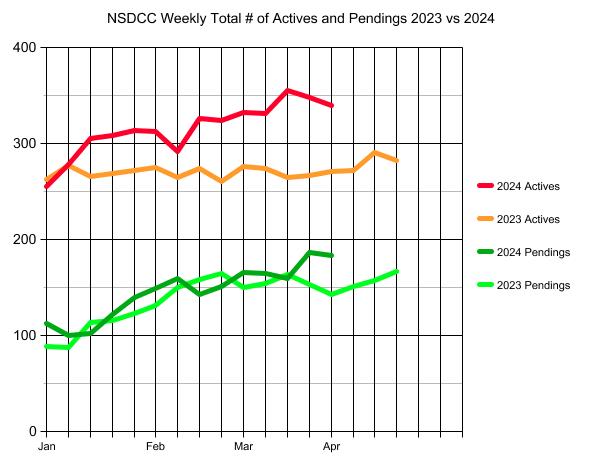

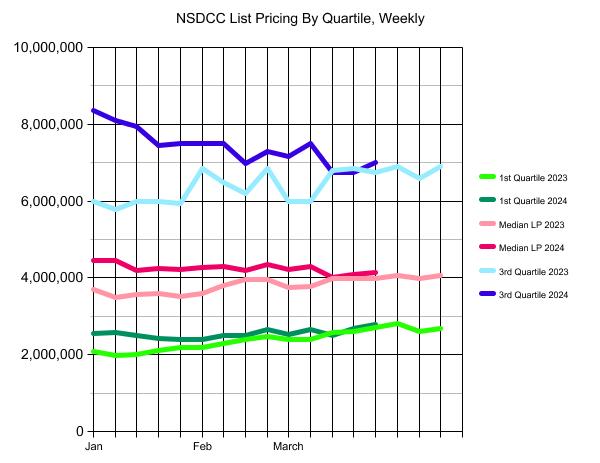

The potential surge in new listings has stalled, and for the second week in a row we had more new pendings than listings! But something has to give, doesn’t it?

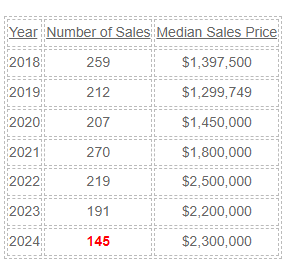

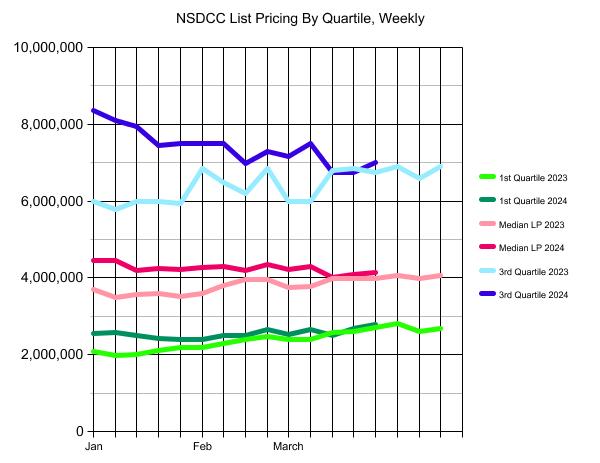

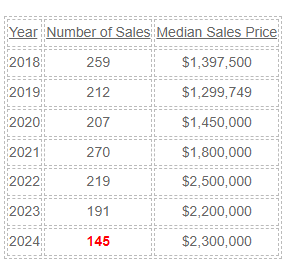

The pricing continues to levitate, at the cost of sales:

NSDCC Monthly Detached-Home Sales, March

There will be the usual late-reporters that get this year’s number of sales up to 155-160 or so, and this trend should continue for the next 2-3 month where just the deserving homes get sold. It would seem to be inevitable that the number of active (unsold) listings start to pile up by the end of summer. Get ‘er done!

(more…)

by Jim the Realtor | Apr 1, 2024 | Interesting Houses, View |

I did a day trip yesterday and due to the weather, the airplanes were taking off west-to-east. Here’s a view of San Diego you don’t see too often:

by Jim the Realtor | Mar 31, 2024 | Jim's Take on the Market |

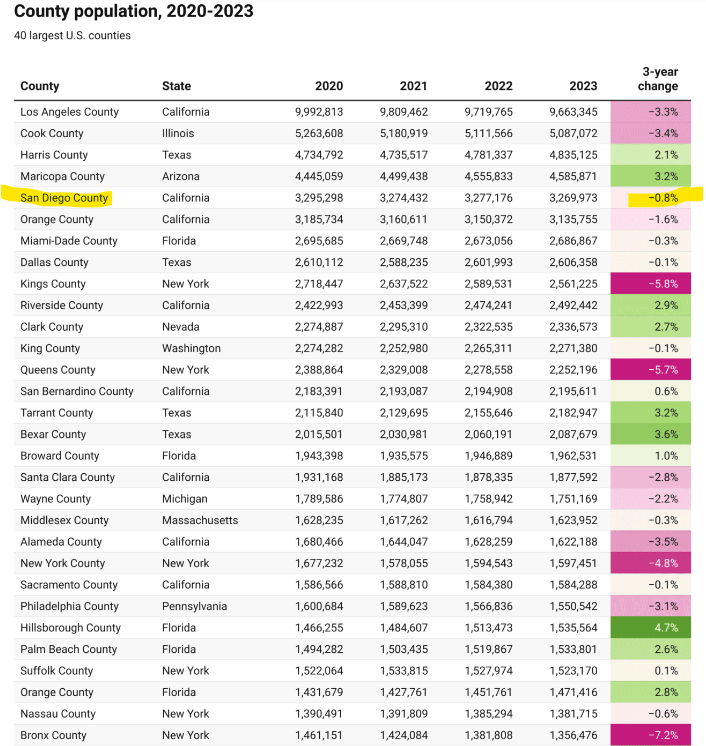

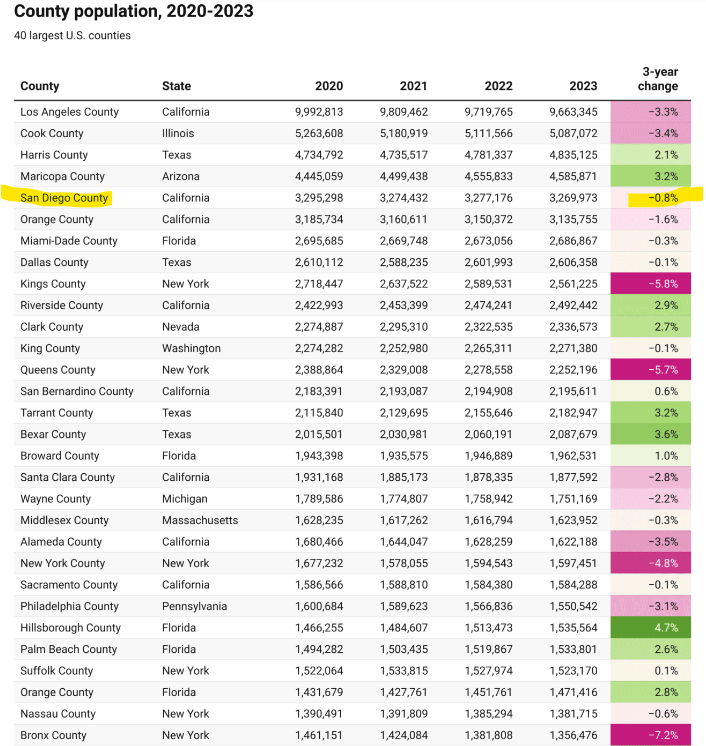

It appears that for every person that has left San Diego County over the last three years, there has been a replacement – and an affluent one at that!

by Jim the Realtor | Mar 30, 2024 | Commission Lawsuit, Realtor

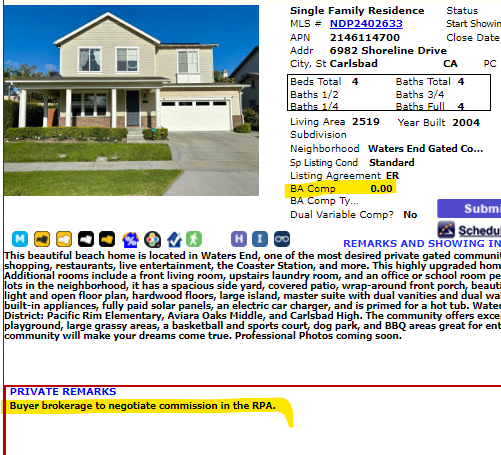

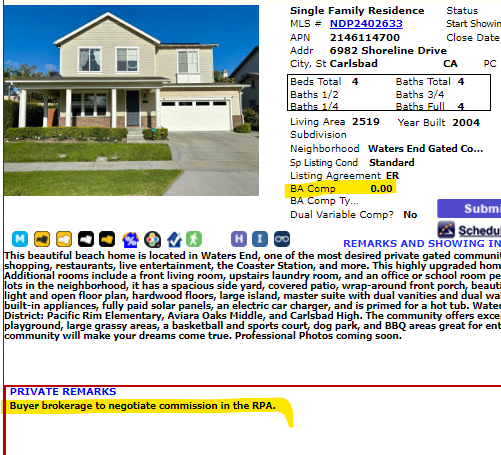

In this new listing, Berkshire Hathaway agents are boldly offering no commission at all to the buyer-agents, and instead suggest that we take it up later – which leaves the amount uncertain, at least for now.

It has the potential to be anything from 3% to zero. Will it be a moving target?

I think there will be different trends for different areas, and the outcome will depend on how bold and brash each individual brokerage wants to conducts itself. The $10,000-commission brokerage in Silicon Valley is offering a downright insulting fee for high-end neighborhoods ($4 million and up), and I wish they would just do zero/negotiable. But they have enough market share that they will get away with it.

If this is company-wide among Berkshire Hathaway agents, it will hurry up the overall transition, that’s for sure. Every buyer-agent will need a written employment contract with their buyers immediately.

Weren’t we going to work this out slowly over the next few months? Guess not! 😆

by Jim the Realtor | Mar 30, 2024 | Where to Move

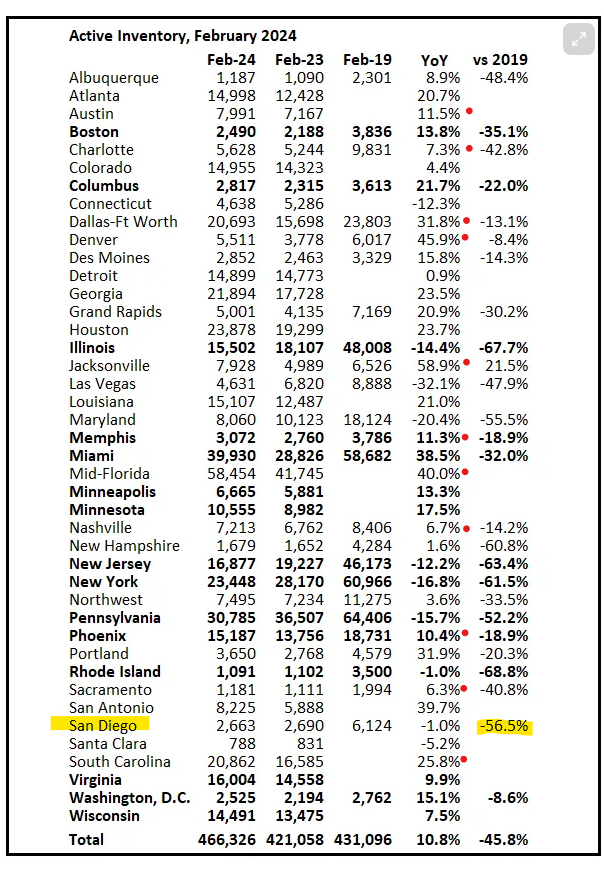

The San Diego inventory is still woefully low. But most of the feeder areas have more homes for sale, which might make it easier for you to find a good match – and maybe even a better price than you expected?

A couple of years ago, I had a client who thought about moving to Dallas. He rented a house there and moved the family, but didn’t sell his house here. The market was so hot there that he lost several bidding wars and was completely frustrated with trying to buy a decent house at a decent price. They gave up and moved back to the Sandy Bagel. With more listings now, maybe it’s a good time to reconsider.

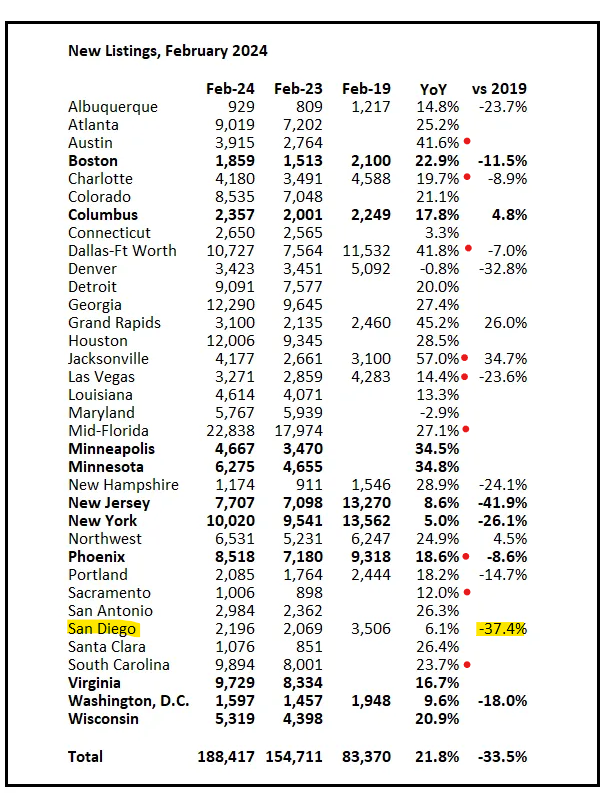

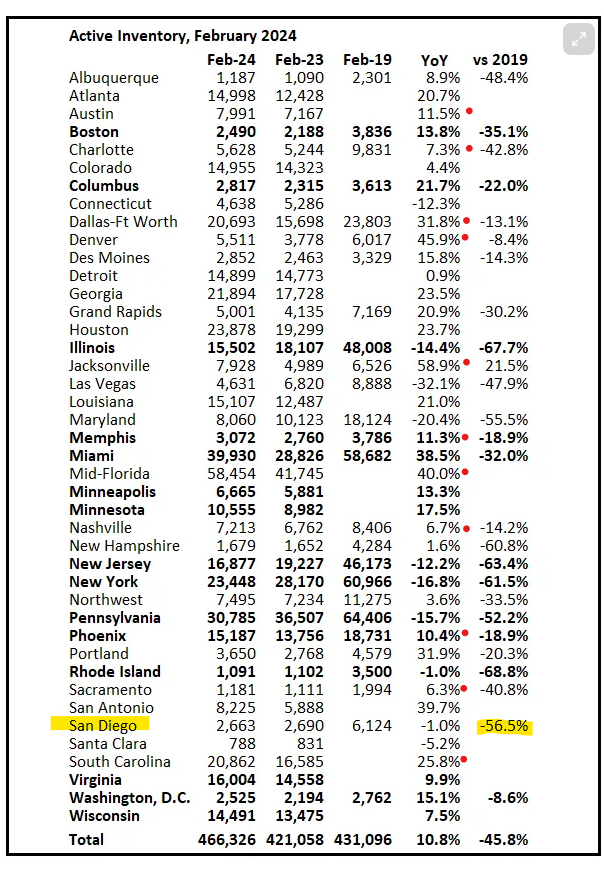

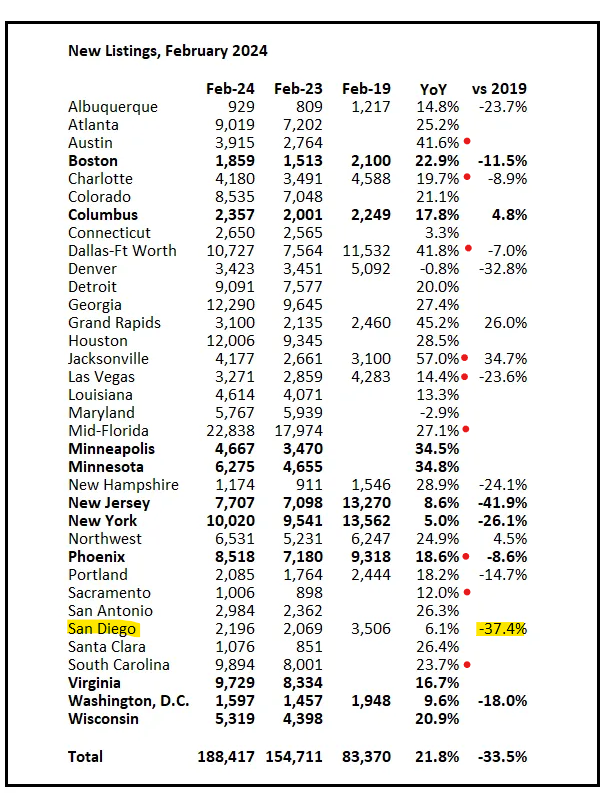

Same thing below. A few more San Diego houses listed last month, but still well under the 2019 count prior to the pandemic. Other areas where you might move are surging with new listings (red dots), and their selling seasons are just beginning:

The NSDCC sales in March will be about the same as they were in February – from Bill: March sales will be mostly for contracts signed in January and February and mortgage rates increased to an average of 6.8% in February. My early expectation is we will see a sales decrease in March on a seasonally adjusted annual rate basis (SAAR) compared to February. There were two fewer working days in March 2024 compared to March 2023, so seasonally adjusted sales will be higher than the NSA data suggests.

https://open.substack.com/pub/calculatedrisk/p/final-look-at-local-housing-markets-5eb

by Jim the Realtor | Mar 29, 2024 | Jim's Take on the Market, Tips, Advice & Links |

This is getting to be a real problem, and there doesn’t appear to be a Plan B. Hat tip to Richard!

As home insurers flee California, the state’s last-resort insurance plan is warning that it’s being pushed toward insolvency, forced to cover a rapidly growing number of properties that have lost traditional coverage and unable to collect enough in premiums to cover potential losses.

The number of homes and commercial properties in high-risk wildfire areas covered by the California FAIR Plan has more than doubled, from 154,000 in 2019 to 375,000, and liability exposure has ballooned from $50 billion in 2018 to $336 billion in February, its president told lawmakers at an insurance committee hearing last week.

“These are huge numbers,” California FAIR Plan President Victoria Roach told the committee. “And they continue to grow. … As those numbers climb, our financial stability comes more into question.”

Roach added that one bad wildfire or even a series of smaller fires could overwhelm the plan’s resources, forcing it to bill all the state’s insurers for liabilities it cannot cover, which they in turn would pass on to all their insured home and business customers as higher premiums.

“It’s a gamble,” Roach said. “We are one event away from a large assessment, there’s no other way to say it, because we don’t have a lot of money on hand, and we have a lot of exposure out there.”

Roach said the FAIR Plan has cash on hand “somewhere in the neighborhood of $700 million.”

The FAIR Plan’s financial instability has emerged as collateral damage from the state’s insurance market meltdown. Major carriers have discontinued or restricted coverage in recent years following a series of costly wildfires — 14 of California’s 20 most destructive wildfires burned the state in the last 10 years. That’s forced property owners who’ve lost coverage onto the FAIR Plan in rapidly growing numbers — with 1,000 applications now every work day.

Elected Insurance Commissioner Ricardo Lara last fall announced plans for a major overhaul of the state’s home insurance regulations and already has rolled out proposed new rules to speed approval of rate increases and allow computer catastrophe modeling to factor into them. Those changes are on track by the end of the year, Lara said.

But it isn’t coming fast enough for both consumers and insurers. State Farm, the state’s largest insurer, last year rocked the market by declaring it wouldn’t issue new policies in California. The company dropped another bomb when it announced this week it will begin shedding coverage of 72,000 California homes and apartment buildings over the next year. Those customers are expected to end up on the FAIR Plan as well.

The state created the California FAIR Plan in the 1960s in response to insurers refusing to cover inner-city businesses following riots in Los Angeles’ Watts neighborhood. It’s a nonprofit association of all the state’s authorized property insurance providers, chartered to provide temporary basic insurance for properties deemed so high risk that companies refused coverage.

The FAIR plan isn’t tax supported, and its bare-bones coverage — just fire and smoke damage — is paid from policy premiums that can be much more expensive than regular insurance because the risk pool is much higher.

The plan also isn’t subject to the insurance regulation under Proposition 103, the check on rates voters approved in 1988. But it is regulated by the state legislature and its rates approved by the elected insurance commissioner, though not under the review of consumer groups, which can intervene on regular policies.

Roach said that the FAIR Plan has encountered the same problems as regular insurance providers in getting policy rate increases approved to provide enough revenue to cover its risk exposure. Approvals take too long and don’t allow the plan to include the cost of reinsurance — which helps insurers absorb losses — or to factor in catastrophe risk models.

“Our rates are never actuarially sound because not all of our expenses are included in that ratemaking,” Roach told lawmakers. The plan must file for rate adjustments every two years, and she said its last increase requested in 2021 should have been “around 70%” but the plan asked for 48.8%. The insurance department approved only a 15.7% increase, she testified.

At the same time, the huge increase in properties needing last-resort coverage has greatly inflated the plan’s risk liability.

Read the full article here: