by Jim the Realtor | Apr 23, 2024 | 2024, Market Conditions, Where to Move |

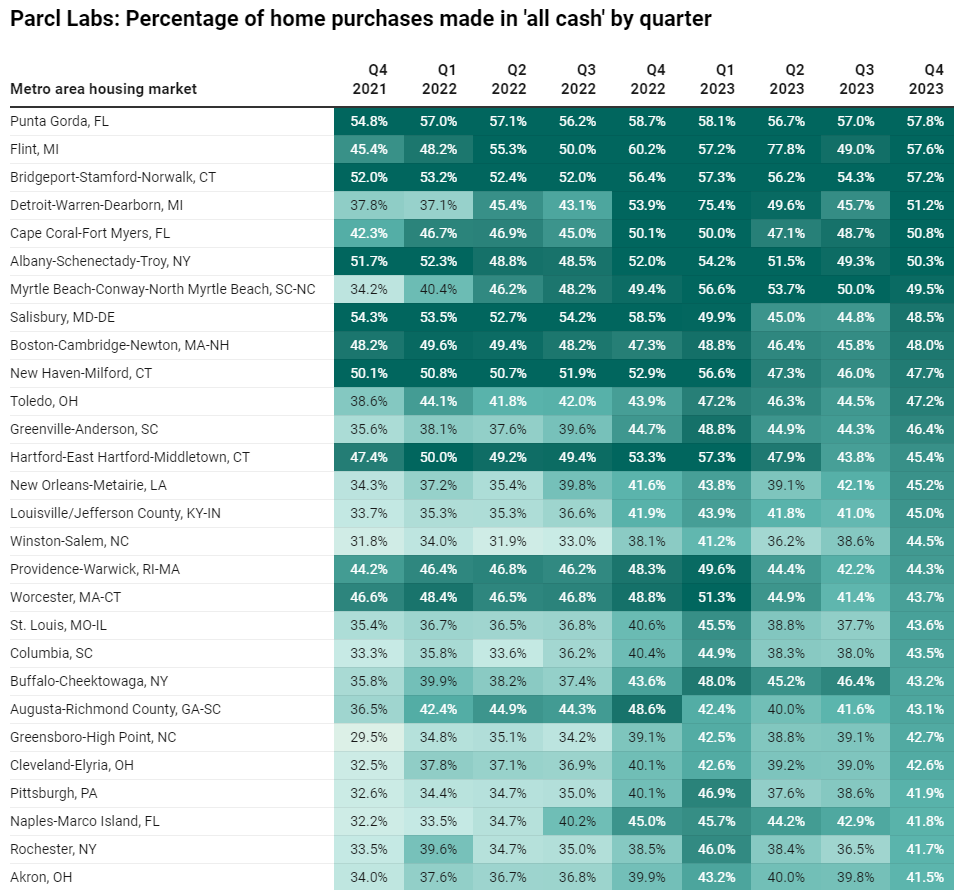

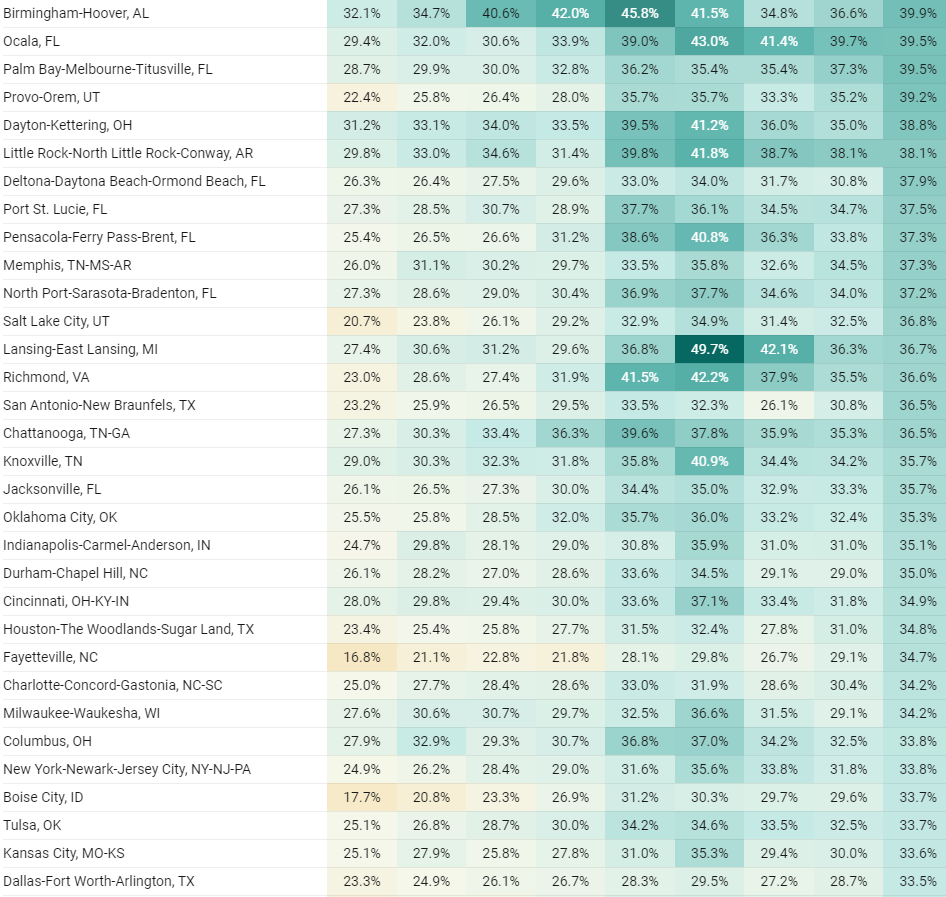

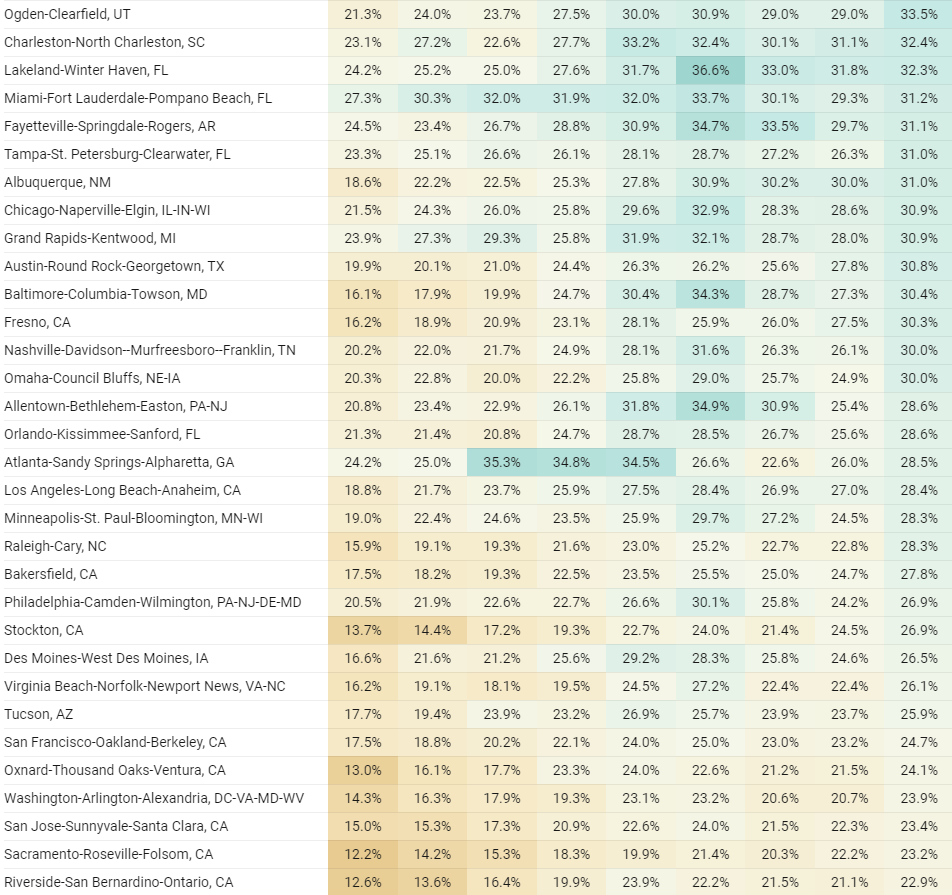

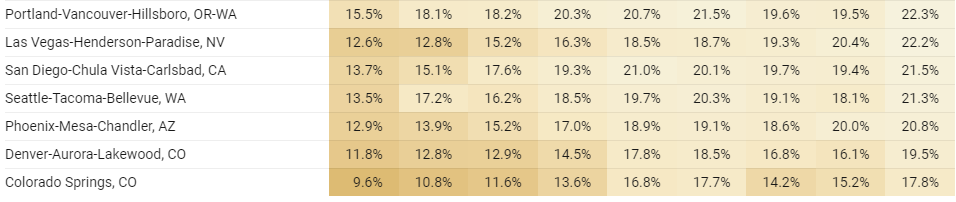

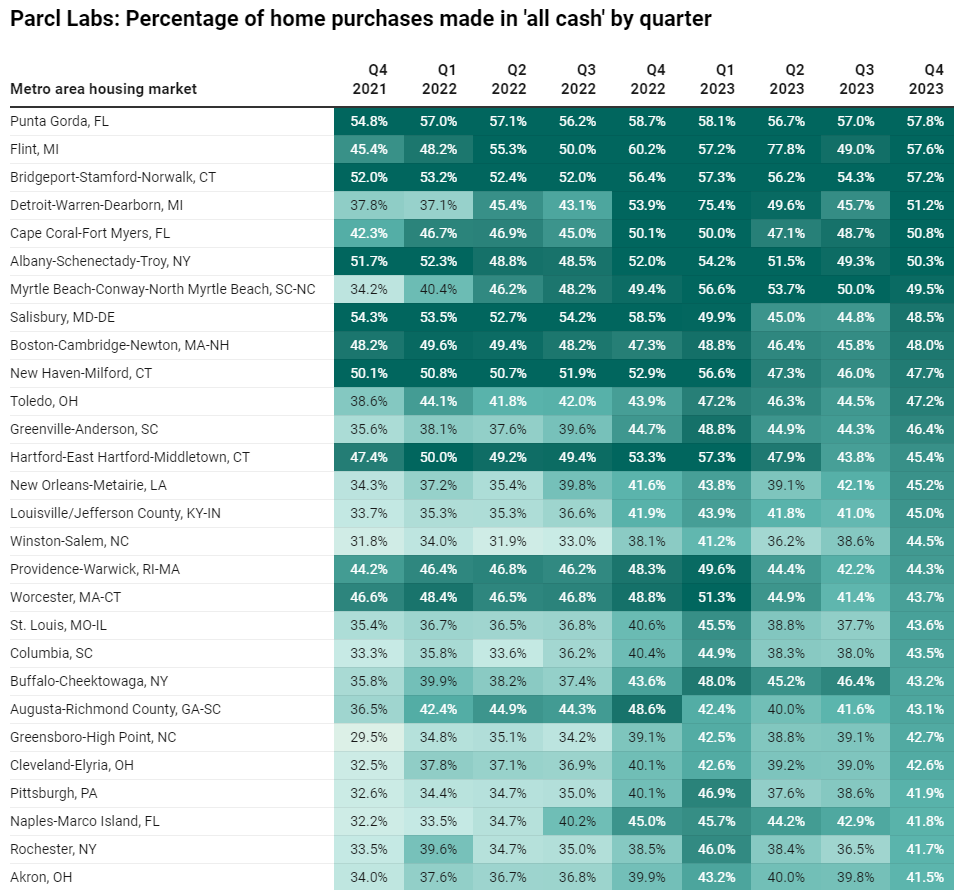

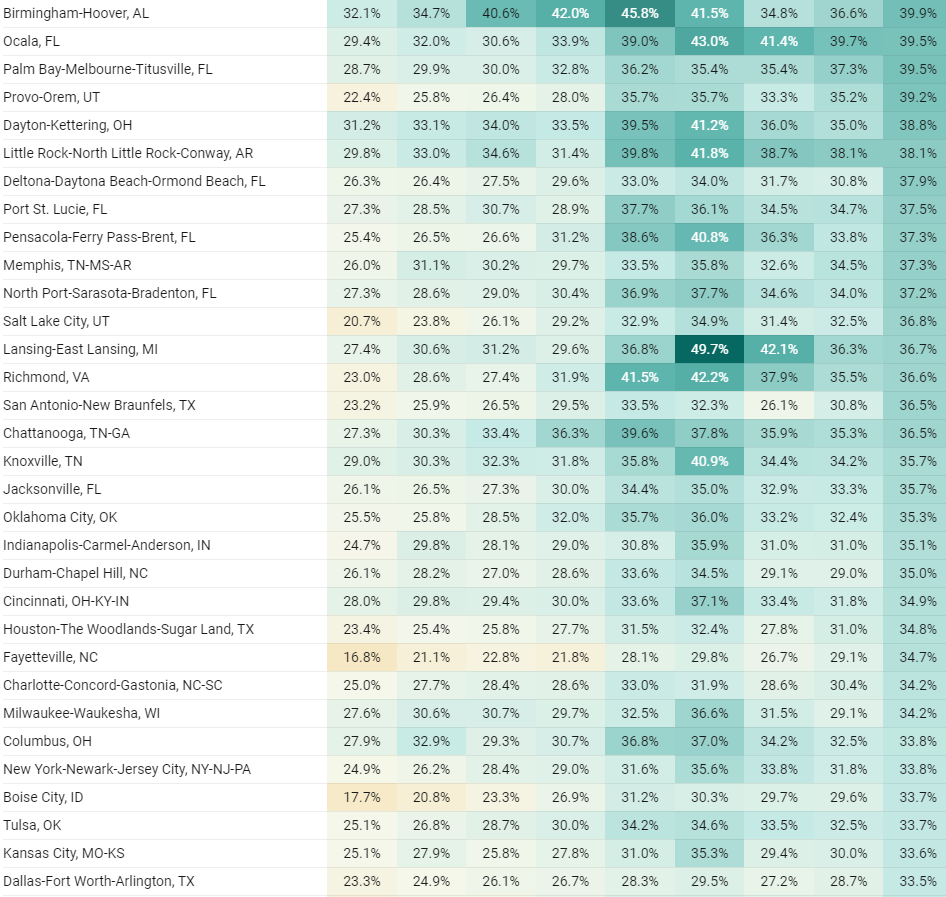

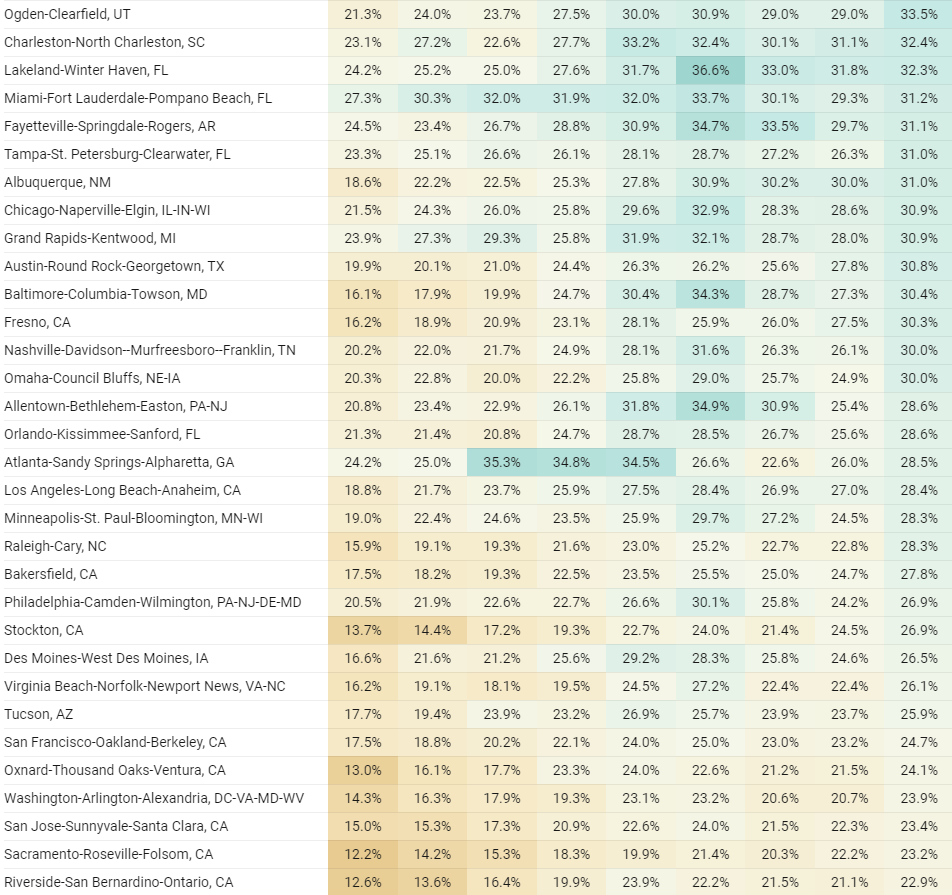

The locked-in effect has been bandied about for the last couple of years as the reason why the inventory remains thin. But it’s not stopping those who want to pay cash and avoid a mortgage altogether – every area is showing increases in the all-cash purchases.

If you don’t want to leave your local neighborhood, then yes, you’re locked in – the higher prices and rates make it prohibitive to move. But for the homeowners who don’t mind leaving town, they can take their winnings and pay cash for their next house!

Don’t let higher rates stop you. Thirty-eight percent of the homes in America are paid in full – join the club!

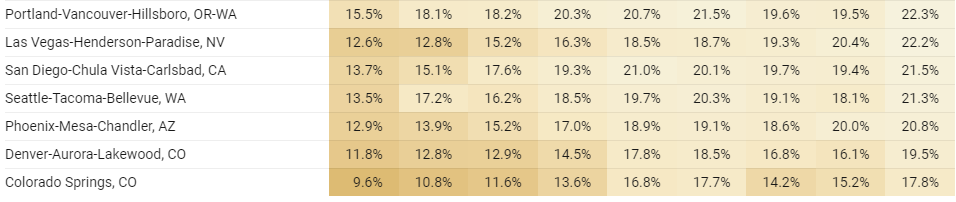

by Jim the Realtor | Apr 23, 2024 | Commission Lawsuit, Commission War, Realtor, Why You Should List With Jim

Yesterday, it was announced that CoStar is buying Matterport. Excerpts:

I look forward to welcoming Matterport to the CoStar Group family and believe that we will be stronger together, in pursuit of our common mission,” said Andy Florance, Founder and CEO of CoStar Group. “The world has changed and today a Matterport is the new open house or property tour. People now select their next home, apartment, office, store, hotel, or warehouse on their mobile device often without ever visiting the property. There is no better way to remotely experience space than via Matterport. CoStar Group intends to support and invest in research and development opportunities to further develop Matterport’s spatial technology, including the application of AI and machine learning to extract information from the 3D spatial data library as well as using generative artificial intelligence to imagine and reimagine physical spaces.”

CoStar Group operates some of the most effective and widely recognized real estate information solutions and online property marketplaces in the world including Apartments.com, LoopNet, CoStar, and Homes.com, all of which feature Matterport’s 3D virtual tours.

In March 2024, there were over 7.4 million views of Matterport 3D Tours on Apartments.com, with consumers spending 20% more time viewing an apartment listing when Matterports were available. CoStar Group intends to utilize Matterports in a similar fashion on Homes.com to further enhance the most comprehensive agent, seller and buyer friendly residential portal on the market.

Great timing! Just when a new rule is going into effect that requires home buyers to hire an agent before touring a home, CoStar will be pushing their 3D tours as a way to experience the home virtually. Buyers who haven’t signed with an agent or those who wish to be unrepresented will have a great tool to use to preview the homes online without commitment.

But then what?

What will happen when a buyer who has only seen the home online wants to buy it?

The renegade buyers will have their attorney draw up a contract. Good luck with presenting that to the listing agent! Others will finally grab an agent friend and comply with the new rule to tour the house in person with their hired buyer-agent.

If you are going to wait until the last minute to hire a buyer-agent, then make sure to check their Zillow profile to see how many buyers they have represented in the last 12 months. It won’t do much good to hire an agent, only to find out the hard way that they aren’t very good at getting buyers to the finish line.

The Unrepresented Buyer

Between the advanced online tools and the realtor implosion, more and more buyers will resist hiring a buyer-agent, especially with the real threat of having to pay them a big fee out of pocket now.

By now, you know where this is going.

More buyers will be going direct to the listing agent – a practice which listing agents will be encouraging!

But the buyers will be divided into two camps.

Those who want to go direct to the listing agent to ‘save the commission’, and those more desperate buyers who just want to buy the house. Guess which one will get the house.

But let’s say there is only one buyer, and he insists on being unrepresented and wants to save the commission. The conversation with the listing agent will go like this:

Buyer: I see you are offering a 2% commission to the buyer-agents, and I’m unrepresented so I want to save the 2%. Will you knock it off the price or give me a credit for closing costs?

Listing Agent: Every buyer has to be represented, sorry.

Buyer: Ok, adios.

Listing Agent: Now hang on, maybe we can work something out. I’ll talk to the seller.

Listing Agent to Seller: I have an offer of $2,940,000 on your $3,000,000 house. Close enough?

Seller: It’s only been 30 days – is that all we got?

Listing agent: Yes, and rates are going up and Trump will be tweeting from jail soon. You should take it.

Seller: Ok, but I want to take my $4,000 toilet.

Listing Agent to Buyer: Ok, I got you the house for $2,940,000.

Buyer: Did you knock 2% off your commission?

Listing Agent: That’s between me and the seller.

The listing agents will be charging their regular commission rate well beyond July when the new rules take effect. They hope more buyers will be coming direct to them to buy their listing. At first, they will want all buyers to have their own representation (dual agency) so they can keep both sides of the commission.

If the buyer wants to be unrepresented, that will be ok too. The listing agent will keep the full commission and just get the seller to eat a little discount instead – and commissions are never disclosed to the buyer.

by Jim the Realtor | Apr 22, 2024 | 2024, Commission Lawsuit, Realtor Training, Why You Should List With Jim |

On Friday, the Plaintiffs’ counsel filed a Motion for Preliminary Approval of the commission-lawsuit settlement agreement with the federal court, so the two new rules will go into effect in late July, apparently. The plaintiffs have requested a hearing on final approval of the settlement by the court to be held on November 22, 2024.

The second rule about buyers having to hire a buyer-agent before touring a home is a done deal, mostly because nobody is objecting. At least not yet. It will become a major headache for all.

The first rule about home sellers not being required to pay a buyer-agent commission will be affected by the overall market conditions. Red-hot markets like Silicon Valley will likely be seeing zero percent (or close) being offered as a reward to buyer-agents. The demand is so strong there, the inventory is so thin, and the buyer-agents are so desperate that the sellers will get away with it. How much will buyers be willing to pay to hire a buyer-agent there? Not much – 1% tops – but the entry level there is $3,000,000.

But other markets will have different challenges – especially those that are slowing (or buckling under) from a heavier load of unsold listings and stingier demand.

The conversations will go like this:

Seller: It’s been thirty days, how come my house isn’t sold?

Listing Agent: I feel good, and it should be selling any day now. People are looking.

Seller: What are you doing to sell my home?

Listing Agent: I’m showering every day now in case someone wants to show your home.

Seller: Are you advertising in SF, LA, and NYC where all the rich people live?

Listing Agent: We are advertising world-wide.

Seller: Then what do you suggest we do?

Listing Agent: You should lower the price and pay more commission to the buyer-agents.

Seller: The last thing I’m going to do is lower the price. Aren’t I paying 4% commission already?

Listing Agent: Yes, because you saw in the news that realtors imploded, so commissions are less now.

Seller: You’re saying 4% isn’t enough?

Listing Agent: Correct, because I work for 3% and that leaves only 1% for the buyer-agents. You should increase it to encourage more buyer-agents to show it.

Seller: It sounds like you’re backing into a 6% listing.

Listing Agent: I’m sorry you feel that way, but yes. But hey, you got to try out lower commissions!

Seller: Well, I guess you got me because I want to sell. Knock off $5,000 off my price too.

Listing Agent: Off your $3,000,000 listing?

Seller: Ok, ok, knock off $10,000, but that’s it. I’m Not Going To Give It Away!

Realtors will still be holding all the cards, and will game any system you throw at them. I said this will blow over quickly, and a softer market will help keep the status quo. Listing agents may appreciate buyer-agents (finally), though paying them more won’t be an obvious solution for many. Expect a slower market instead.

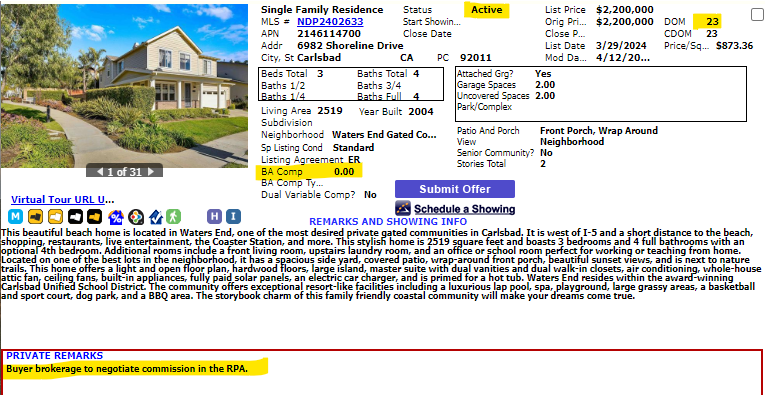

by Jim the Realtor | Apr 22, 2024 | Inventory

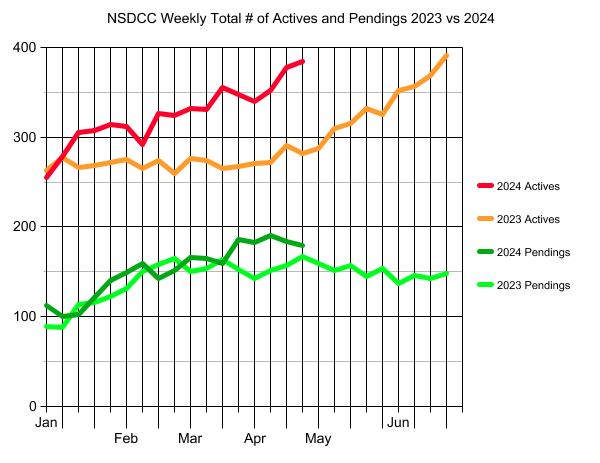

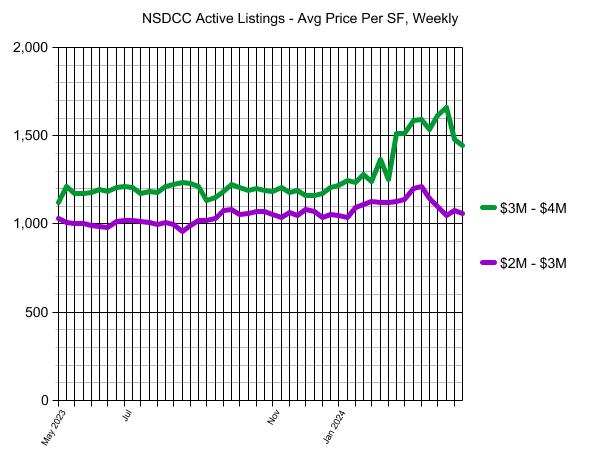

The graph above should give us all some guidance on where the 2024 market is going.

Sales are hanging tough though. There have been 117 NSDCC closings this month, so we should get close to the 165 sales we had last April. The median sales price is running +5% above last April too.

(more…)

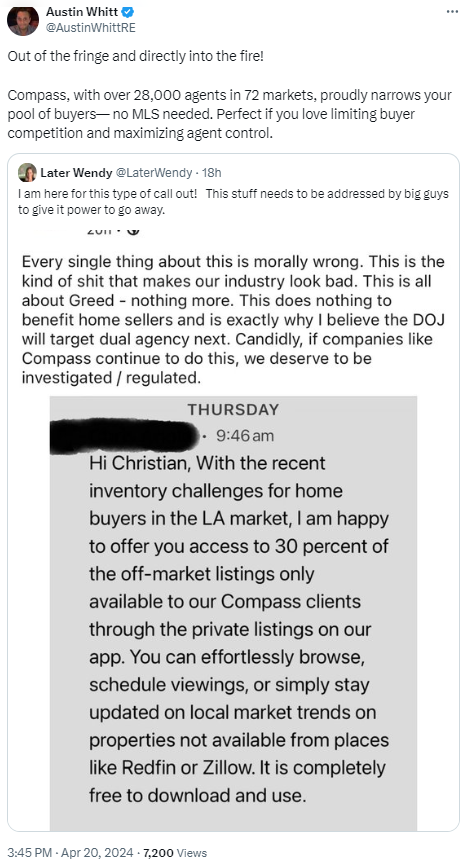

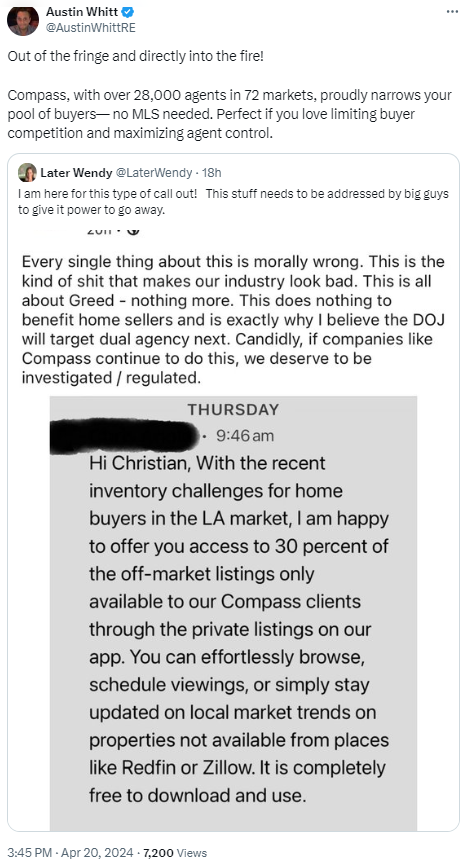

by Jim the Realtor | Apr 21, 2024 | Compass, Market Conditions, The Future

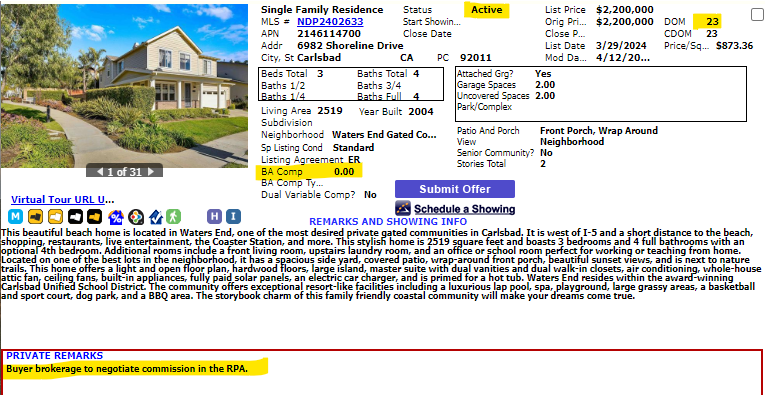

This is the #1 reason I went to Compass, and I didn’t really feel like I had a choice.

When realtors get disrupted, this is the way the big brokerages can survive while the little guys die.

Hoard the listings in-house as ‘private exclusives’, like they do in the commercial real estate. The practice is legal (per the Clear Cooperation Policy) and is a choice for home sellers to make.

The big benefit for sellers is that they don’t get penalized by the days-on-market statistic, which buyers normally consider as the best way to know if the price is wrong after the first week on the market.

Compass has this option available for sellers, as do all the other brokerages, but nobody in management is pushing it around here. It’s used more like a Coming-Soon feature while homes are being prepared for open-market exposure. But there are deals being made.

If there was an organized, committed effort to use it as a survival tool, then I could see 30% of our sales happening off-market. But we’re not there yet.

Maybe next year?

by Jim the Realtor | Apr 20, 2024 | Where to Move

First-time home buyers are a growing share of the market, making up half of all home buyers last year, according to Zillow’s Consumer Housing Trends Report. Homeownership is easier to break into in some markets than others, and Zillow has named this year’s best markets for first-time buyers, where their dollars go further and starter homes are relatively plentiful.

Affordability is a tough hill to climb in today’s market, and it is especially steep for first-time buyers who do not have equity from a previous home purchase to tap into. Markets with relatively more affordable rent, more options and less competition for starter homes provide the best opportunities.

Zillow’s 2024 list of the best markets for first-time buyers is based on four metrics:

- Rent affordability, as defined by the share of median household income spent on rent.

- The share of available inventory on Zillow that the median household can comfortably afford, meaning spending no more than 30% of income on the estimated monthly mortgage cost.

- The ratio of affordable for-sale inventory to renter households. More inventory per renter household is an indicator of less competition for each listing.

- The share of households age 29-43. More households of similar age means a higher score in Zillow’s ranking.

More affordable rent shortens the time it takes to save for a down payment, and a higher number of active for-sale listings relative to the potential homebuyer population means more options – and more bargaining power – for potential first time home buyers in those markets.

These are Zillow’s 10 best markets for first-time home buyers this year:

- St Louis, MO

- Home Buying Age Households As a Share of Total Households: 26%

- Percentage of Median Household Income Spent on Rent: 20%

- Affordable Listings As a Percent of Total For-Sale Inventory: 67%

- Affordable Listings To Renter Household Ratio: 3.4 per 100 Renters

- Detroit, MI

- Home Buying Age Households As a Share of Total Households: 24%

- Percentage of Median Household Income Spent on Rent: 21%

- Affordable Listings As a Percent of Total For-Sale Inventory: 64%

- Affordable Listings To Renter Household Ratio: 4 per 100 Renters

- Minneapolis, MN

- Home Buying Age Households As a Share of Total Households: 28%

- Percentage of Median Household Income Spent on Rent: 20%

- Affordable Listings As a Percent of Total For-Sale Inventory: 48%

- Affordable Listings To Renter Household Ratio: 2.5 per 100 Renters

- Indianapolis, IN

- Home Buying Age Households As a Share of Total Households: 29%

- Percentage of Median Household Income Spent on Rent: 22%

- Affordable Listings As a Percent of Total For-Sale Inventory: 50%

- Affordable Listings To Renter Household Ratio: 2.6 per 100 Renters

- Austin, TX

- Home Buying Age Households As a Share of Total Households: 34%

- Percentage of Median Household Income Spent on Rent: 20%

- Affordable Listings As a Percent of Total For-Sale Inventory: 23%

- Affordable Listings To Renter Household Ratio: 1.3 per 100 Renters

- Pittsburgh, PA

- Home Buying Age Households As a Share of Total Households: 24%

- Percentage of Median Household Income Spent on Rent: 22%

- Affordable Listings As a Percent of Total For-Sale Inventory: 63%

- Affordable Listings To Renter Household Ratio: 3.7 per 100 Renters

- San Antonio, TX

- Home Buying Age Households As a Share of Total Households: 31%

- Percentage of Median Household Income Spent on Rent: 23%

- Affordable Listings As a Percent of Total For-Sale Inventory: 33%

- Affordable Listings To Renter Household Ratio: 2.6 per 100 Renters

- Birmingham, AL

- Home Buying Age Households As a Share of Total Households: 25%

- Percentage of Median Household Income Spent on Rent: 22%

- Affordable Listings As a Percent of Total For-Sale Inventory: 47%

- Affordable Listings To Renter Household Ratio: 4.2 per 100 Renters

- Kansas City, MO

- Home Buying Age Households As a Share of Total Households: 27%

- Percentage of Median Household Income Spent on Rent: 21%

- Affordable Listings As a Percent of Total For-Sale Inventory: 51%

- Affordable Listings To Renter Household Ratio: 2.2 per 100 Renters

- Baltimore, MD

- Home Buying Age Households As a Share of Total Households: 27%

- Percentage of Median Household Income Spent on Rent: 22%

- Affordable Listings As a Percent of Total For-Sale Inventory: 56%

- Affordable Listings To Renter Household Ratio: 2.3 per 100 Renters

https://www.zillow.com/research/best-markets-first-time-home-buyers-33901/

by Jim the Realtor | Apr 19, 2024 | 2024, Market Conditions, Market Surge, North County Coastal, Spring Kick

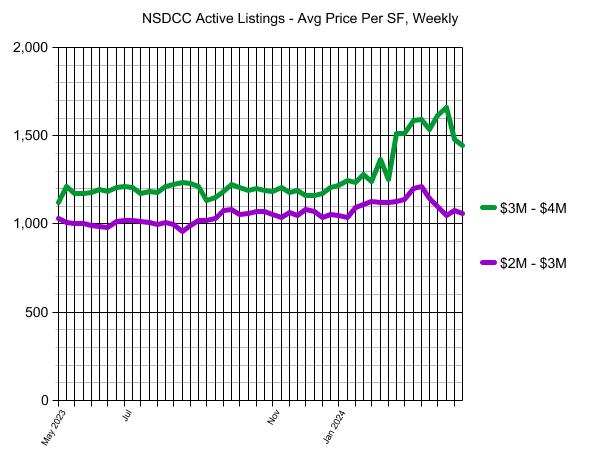

Pardon the casual presentation. I’m used to working with this same basic graph format but it’s limited to 50 datapoints – we’d really like to take these back a few years to see the long-term trends.

But in early 2023, the active listings in the $3M – $4M category were range bound between 1,170/sf and 1,342/sf, so there is some normal optimism in springtime. But not like this pop in 2024 (above). These two subsets are the meat of the market, and aren’t swayed by radical outliers that would tweak the averages.

Starting right after the Super Bowl, there was a huge swing from $1,252/sf to $1,515/sf in the $3M – $4M category, and it has stayed elevated until the last couple of weeks. The reason for pricing to relax a little?

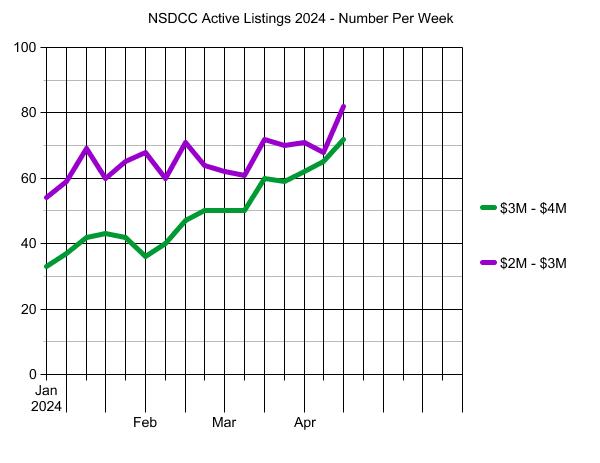

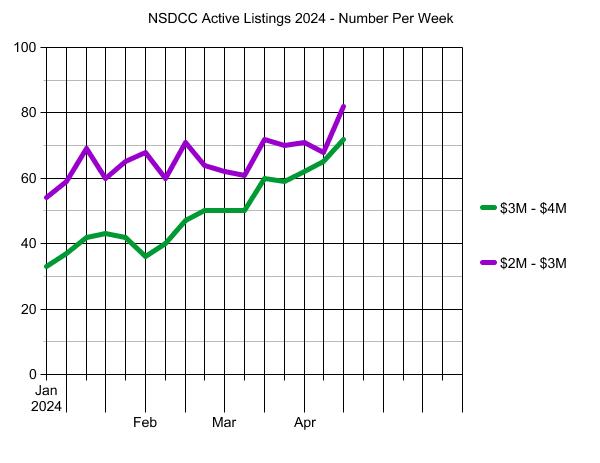

The number of unsold listings are starting to stack up now:

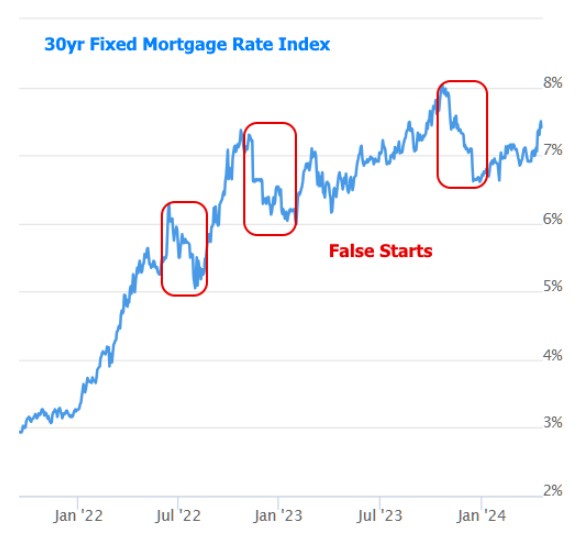

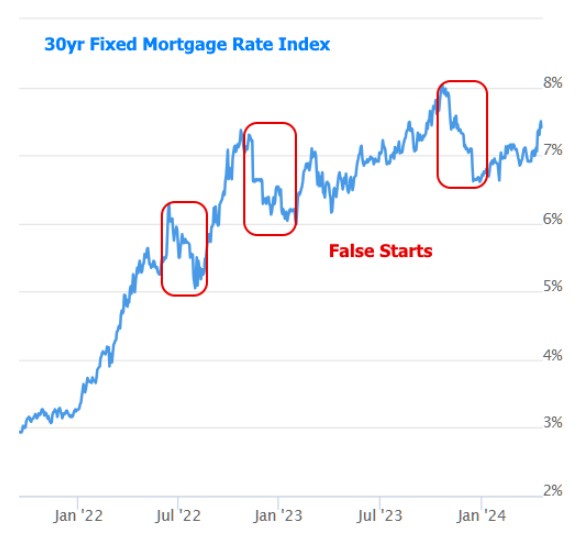

There isn’t any reason for home buyers to think mortgage rates are going to drop significantly this year. If there were one or two Fed cuts, it would only cause mortgage rates to get back into the 6s which isn’t enough to compensate for the sky-high prices that buyers are seeing today.

Then we have the changes from the commission lawsuit, which will have a clunky start over the next few months as buyers grapple with hiring a buyer-agent in writing just to tour a house. All we need is the Padres to go on a run this summer and we will have all the excuses we need for a very sluggish rest of the year.

by Jim the Realtor | Apr 19, 2024 | About the author |

This is where we lived when I went to high school in Phoenix Arizona. My parents paid around $35,000 for it in 1972, and when they sold it in 1979 and moved back to California they got around $80,000 for it.

The owners have done the obligatory update, but the house itself hasn’t changed much since. They paid $300,000 for it in November, 2018, and it’s now listed for $699,900.

Every house had a flat roof. One day, we took our bikes up on the roof and rode them into the pool!

https://www.zillow.com/homedetails/11801-N-37th-St-Phoenix-AZ-85028/7817958_zpid/

by Jim the Realtor | Apr 18, 2024 | 2024, Commission Lawsuit, Realtor |

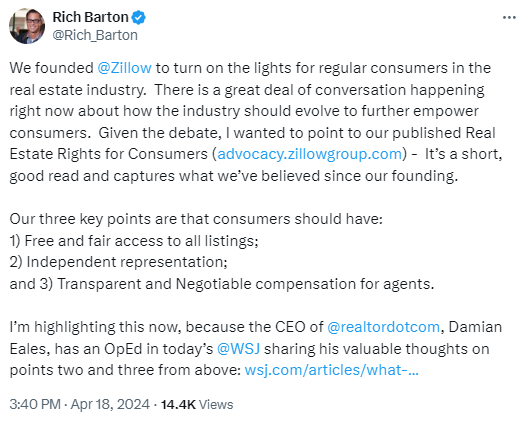

While the benefits of buyer-agents may be obvious, will anyone stop their demise? Probably not.

Will it become easier or harder to buy a home?

The answer is unclear amid widespread confusion over what’s happening to real-estate agent commissions. On April 5, a federal court determined that the Justice Department can reopen its investigation into the policies of the National Association of Realtors, indicating that the association’s March settlement in a separate case may not be the final word on this issue. Yet in their effort to deliver lower costs for home buyers, federal officials and courts may inadvertently undermine consumer protections without addressing the root causes of high home prices.

The settlement is a positive development: It could lower real-estate agents’ commissions, benefiting home buyers. It also increases transparency and negotiating power for home buyers who use agents for representation. The settlement will also increase professionalism among agents, who will now sign an agreement detailing their services before showing a buyer a home. These policies should put downward pressure on commission prices, which currently average 5.3% and are split between buyer’s and seller’s agents.

Despite these wins, federal officials seem to want a more aggressive solution. In a February court filing, the Justice Department noted that U.S. commissions are “two to three times more than” those in “other developed countries,” a point the media frequently repeats. That gives the impression that federal officials want to cut commissions at least in half as quickly as possible, and the department appears to be pursuing this goal. Yet dramatically slashing commissions can be achieved only by reducing the use of buyer’s agents—a move that would be unwise for a few reasons.

Consider the pitfalls that home buyers face in countries where buyer’s agents aren’t commonly used. In Australia, where I grew up, home buyers typically work directly with listing agents, who have a fiduciary duty only to the sellers. In some Australian territories and states, if a buyer looks at a home on a flood plain or in a region prone to bush fires, the seller’s agent isn’t necessarily obligated to tell him about the risks.

The U.S. model provides lower overall costs and better representation for buyers and sellers alike. Americans chose this model for good reasons. Before the 1990s, few people in the U.S. used a buyer’s agent. Yet home buyers began to demand representation, especially low-income and first-time buyers who needed help navigating the process. Consumer-rights advocates championed this development. As buyer’s agents became more popular, eight states even banned the old model of a single agent representing both parties. Americans effectively gained two agents for the price of one, and that price has fallen from over 6% to closer to 5% today.

Discouraging the use of buyer’s agents would reverse this progress. Although it would likely lower home buyers’ costs, it would do so at the price of sacrificing their interests. Without a buyer’s agent, no one would be legally required to help buyers understand their risks and options. There would also be nothing to stop seller’s agents from increasing their commissions to match what previously went to buyer’s agents.

There are better ways to help home buyers save money, policies on which state lawmakers should take the lead. Most U.S. states have transfer taxes, which can add thousands of dollars to the cost of a home purchase. Lawmakers should either cut these taxes, leading to lower costs and more home sales, or reduce property taxes after windfall gains post-pandemic. State and federal lawmakers could also ease burdensome licensing, zoning and environmental regulations, all of which add nearly $94,000 to the cost of a new single-family home and lead developers to build fewer homes. The best way to decrease housing’s cost is to increase its supply.

The alternative is to erode the hard-fought victory that American home buyers have achieved. While the U.S. system is far from perfect, it serves home buyers better than any other arrangement, and it’s moving in an even better direction after the recent settlement. As federal officials and courts weigh whether to push further, they should remember that some cures are worse than the disease.

Mr. Eales is CEO of Move Inc., which operates Realtor.com. Move Inc. is owned by News Corp, which also owns The Wall Street Journal.

Link to Article

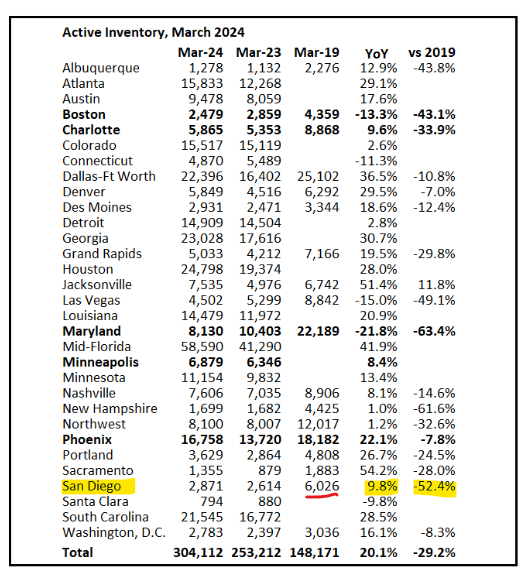

by Jim the Realtor | Apr 17, 2024 | Actives/Pendings, Jim's Take on the Market

There isn’t as much fluff as we used to have in the pre-pandemic days.

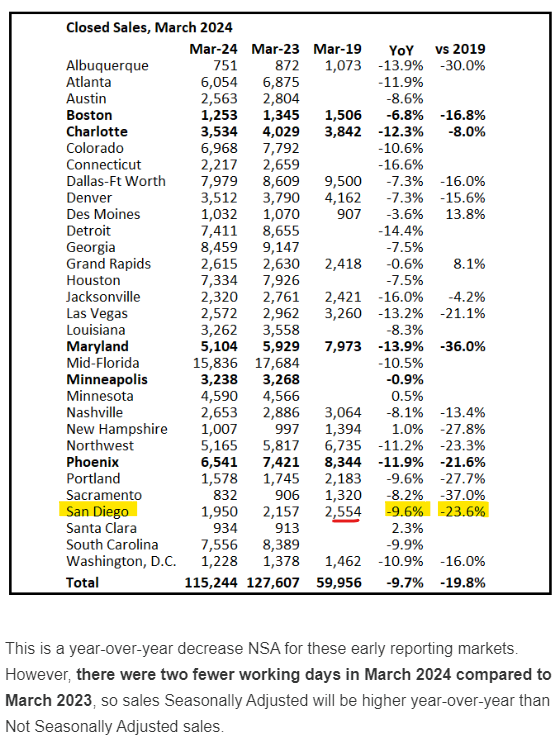

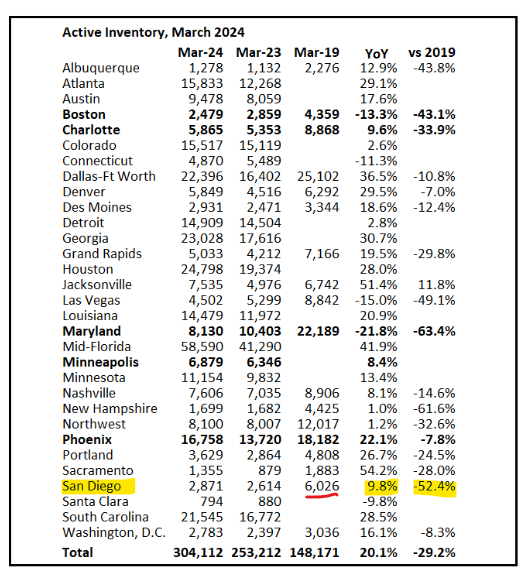

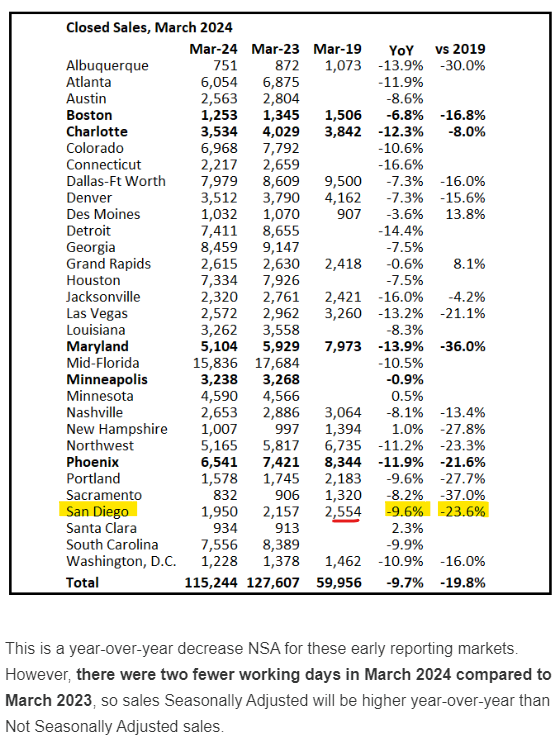

In March 2019, there were 6,026 homes for sale, but only 2,554 sold, which means there were lots of sellers and agents on the open market who were in price-discovery mode – and they found out what the market wouldn’t bear.

We’re heading back that way again.

For the last three years, we’ve been spoiled by maximum demand (caused by low inventory combined with low rates). But now that both are creeping upward, there will be sellers/agents who are overly-optimistic and don’t factor the negative impact into their equation.

Last month’s ratio of 2,871/1,950 = 1.47 is still better than the 2019 numbers of 6,026/2,554 = 2.36, but don’t be surprised to see an upward trend of unsold listings forming over the next few months.