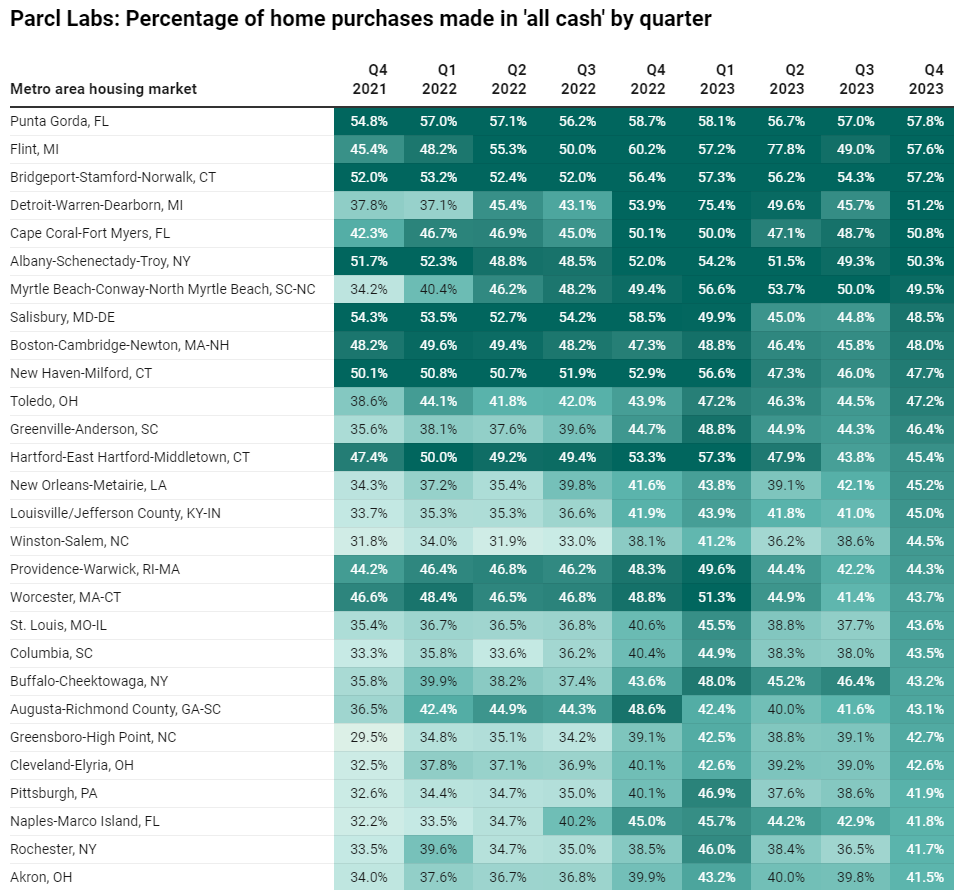

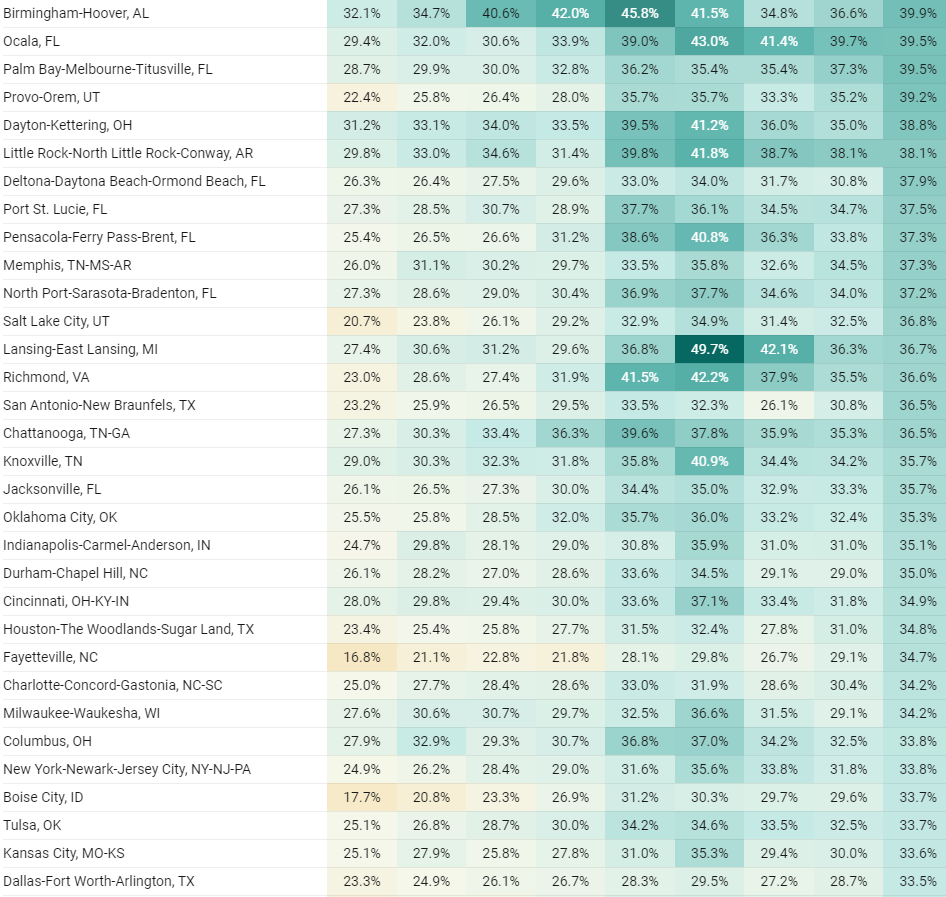

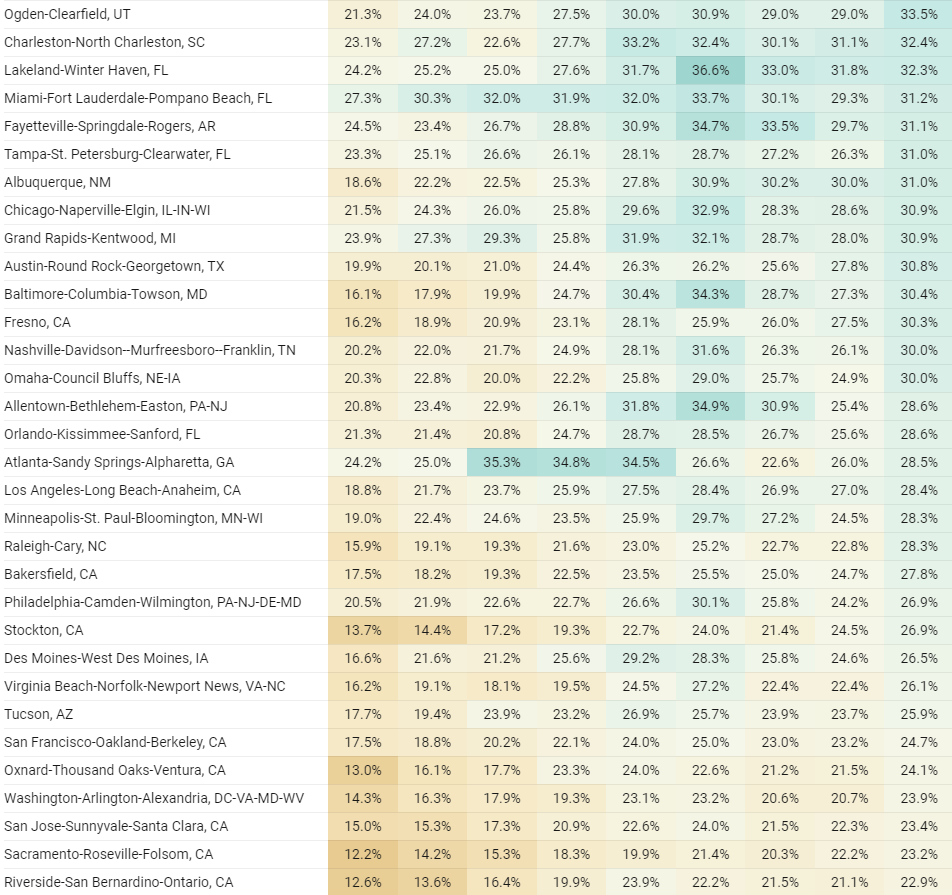

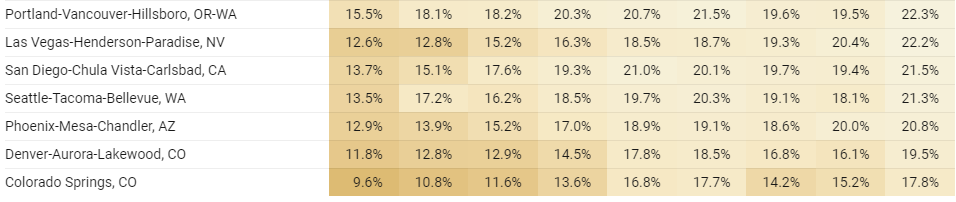

The locked-in effect has been bandied about for the last couple of years as the reason why the inventory remains thin. But it’s not stopping those who want to pay cash and avoid a mortgage altogether – every area is showing increases in the all-cash purchases.

If you don’t want to leave your local neighborhood, then yes, you’re locked in – the higher prices and rates make it prohibitive to move. But for the homeowners who don’t mind leaving town, they can take their winnings and pay cash for their next house!

Don’t let higher rates stop you. Thirty-eight percent of the homes in America are paid in full – join the club!

> “Thirty-eight percent of the homes in America are paid in full – join the club!”

The top “all cash” locations are fascinating. I have to delve deeper. Punta Gorda and Cape Coral FL bracketing Detroit and Flint MI. What could be more different?

Anyway. Not just paid in full but those mortgages as “rounding errors” makes the number bigger. 3% notes right now are golden tickets and are arguably better than paid in full as an investment.

3% notes right now are golden tickets and are arguably better than paid in full as an investment.

Agree but don’t let it be the only reason people don’t move who want to move. Zero is lower than 3%!

My parents used to own a house in Punta Gorda, complete with canal and neighborhood alligator. Apparently just shooting them is not allowed. Ft Meyers and Puta Gorda are big retirement areas, more conservative than the decadent and costly FL Atlantic coast. And unlike Orlando you get a beach. Houses are cheap because there is no shortage of flat land to build on, and there are no industries or jobs beyond serving the retirees. Not even much tourism. So I can imagine incoming retirees cash-flush from selling property in more expensive areas pay cash so not to worry about paying a mortgage in their golden years.