by Jim the Realtor | Mar 24, 2022 | Interest Rates/Loan Limits, Jim's Take on the Market |

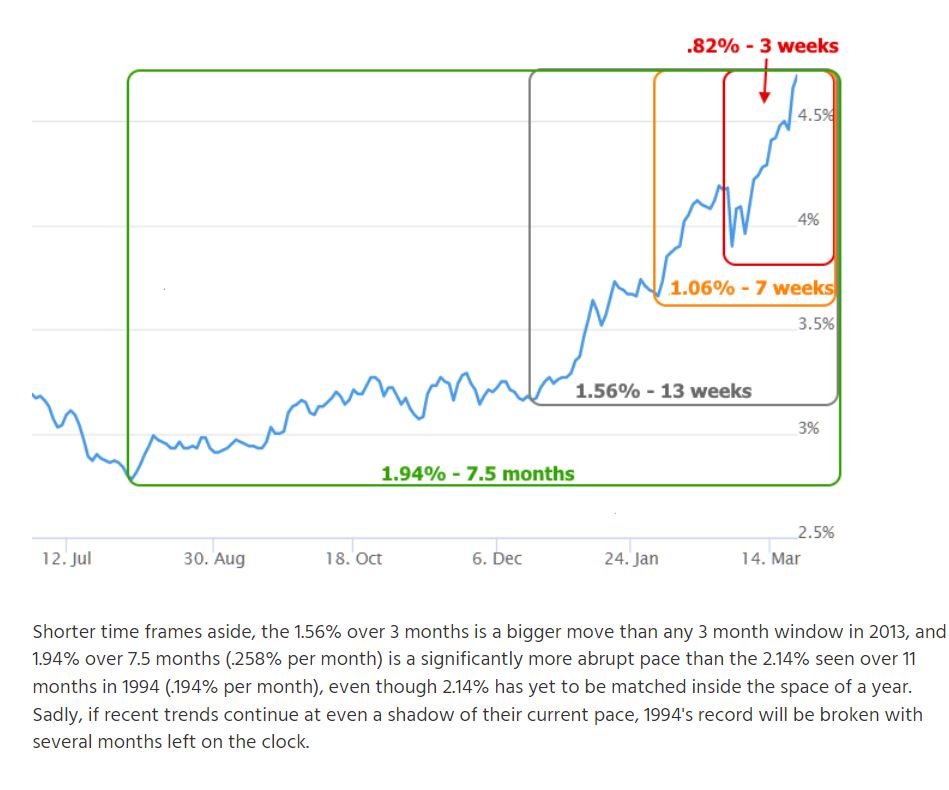

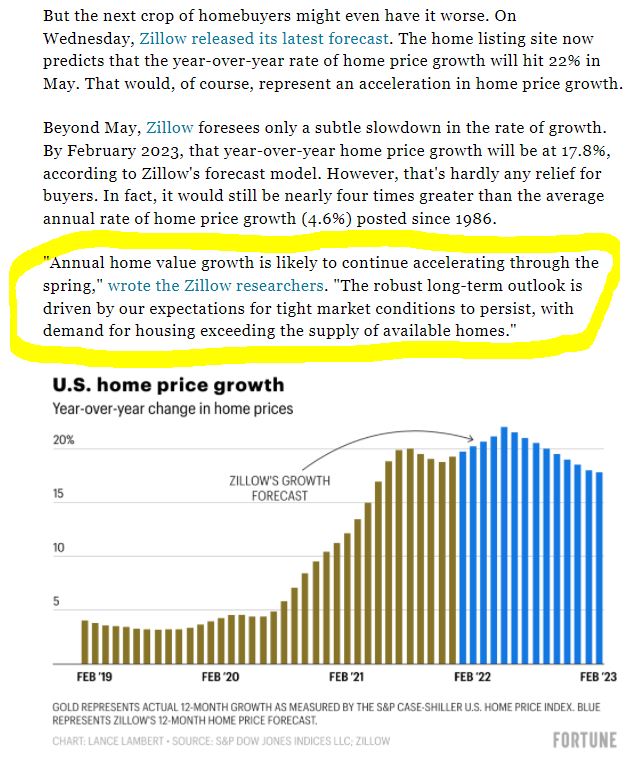

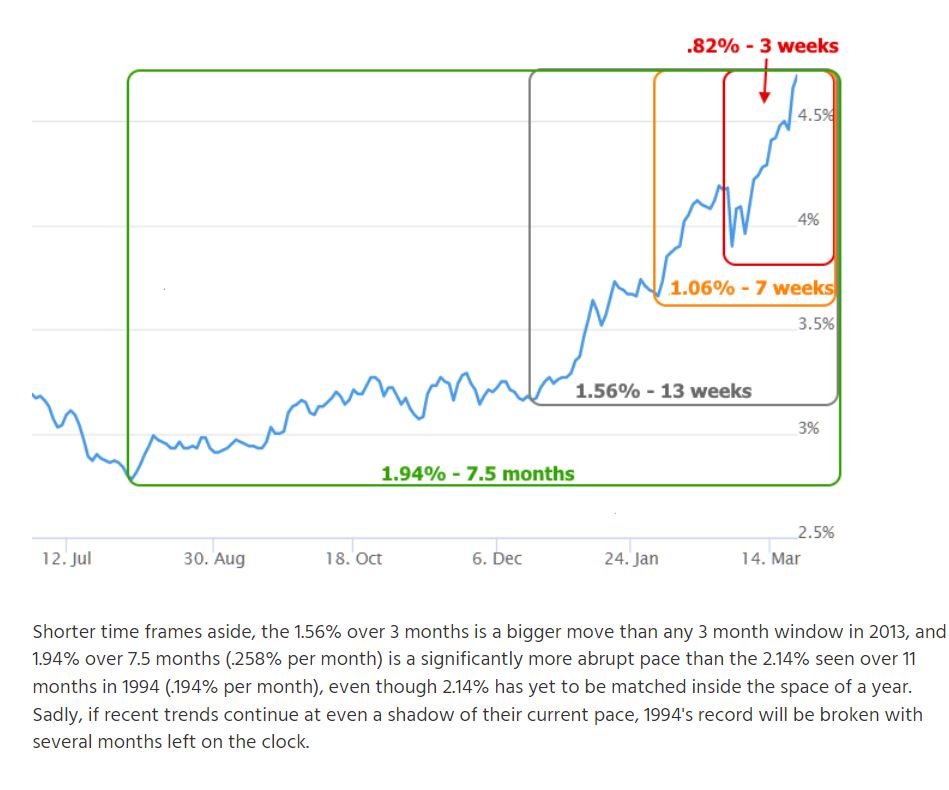

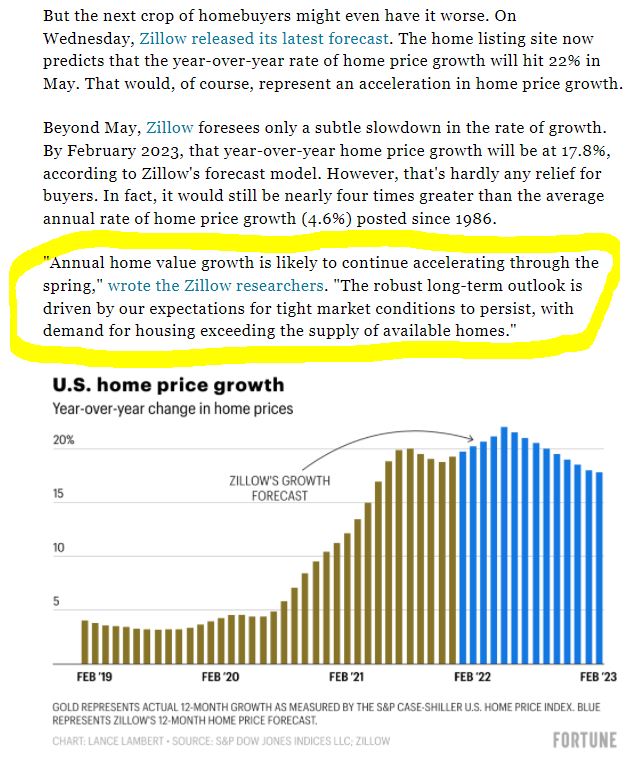

We are in the midst of the fastest increase in mortgage rates in history.

It was only 6-8 months ago that home buyers were financing their purchase with a 30-year fixed rate in the twos. Now they are in the fours!

We had the lowest rates ever due to the pandemic. They aren’t coming back.

It is natural for home sellers to think it might be better to wait until later – especially if they tested the market with an aspirational price, and the home didn’t sell.

But the 30-year fixed rates are heading above 5%, which won’t bode well for buyers OR sellers.

What are other alternatives?

- Sellers offer to buy down the interest rate for buyers (guarantee a lower rate).

- Sellers complete more repairs/upgrades to stand out from others.

- Sellers offer a larger commission to the buyer-agents.

- Get an adjustable-rate mortgage.

I’ve already seen adjustable-rate mortgages starting at 2.375% for ten years, up to $1,600,000 with a 10% down payment. When buyers compare those to a 30-year fixed payment, they will be very tempted.

We don’t need the frenzy to last forever – we just need to get comfortable with a post-frenzy market.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-03222022

by Jim the Realtor | Mar 23, 2022 | Frenzy, Market Conditions |

Real estate practices have been evolving with the frenzy.

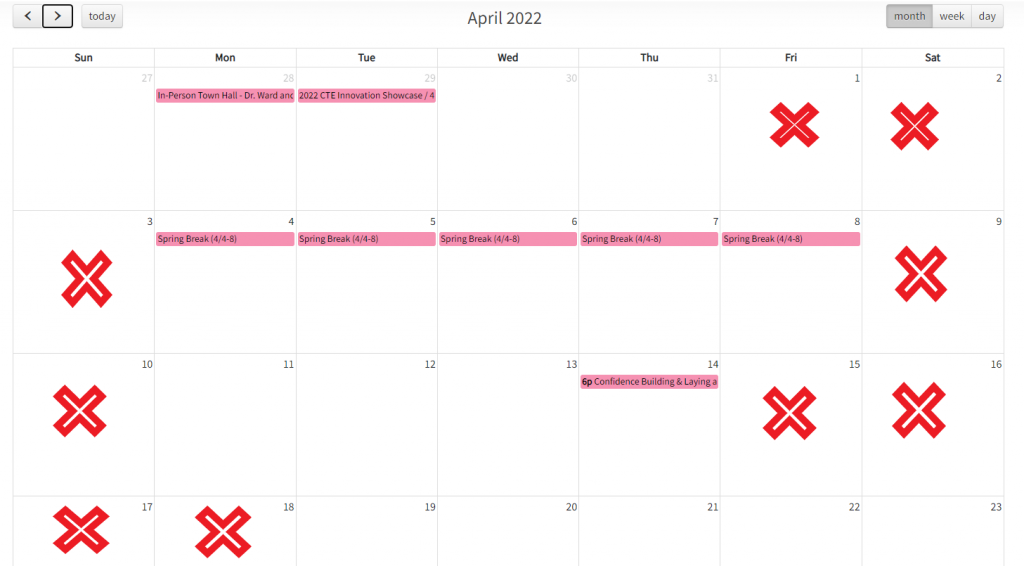

The market used to be lively seven days a week, but that’s gone away. Looking at homes during the week is futile now, because the new listings tend to hit the MLS on Thursday or Friday with NO SHOWINGS UNTIL OPEN HOUSES ON SATURDAY AND SUNDAY!

By Monday, the listing agents shut it down with NO MORE SHOWINGS, NO MORE OFFERS.

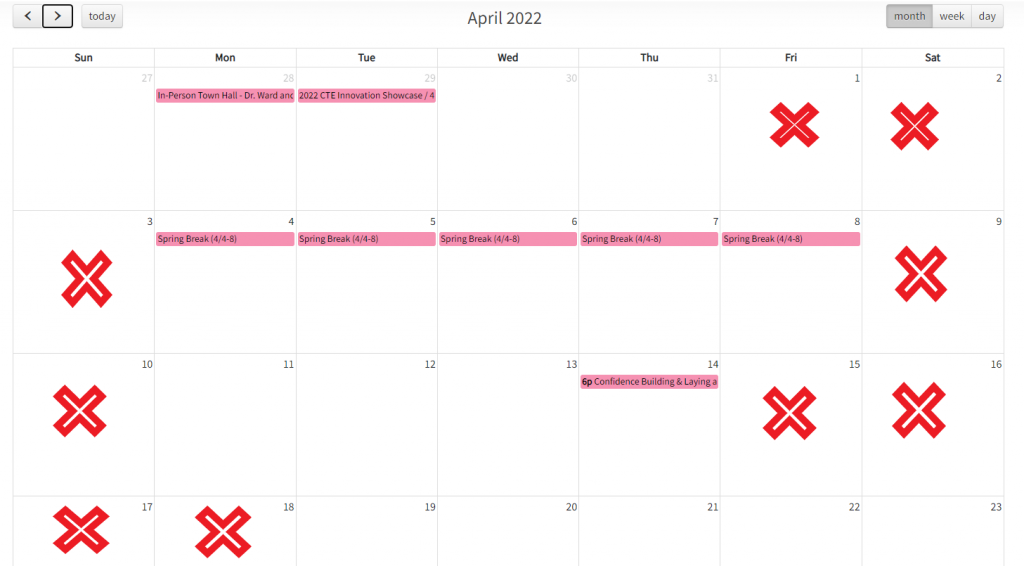

It makes you wonder how the market will react to spring break/tax day.

All the NSDCC schools except Carlsbad are taking spring break between April 4-8, which will limit the action on those weekends of April 2-3 and April 9-10. Then income taxes are due the day after Easter, which is on April 17th. The Carlsbad spring break is April 18-22.

Will agents recognize the schedule, and alter their showing plans?

If not, will the lighter traffic cause those open houses attendees to think the market is getting soft?

The end of the frenzy might be forming right before our eyes!

by Jim the Realtor | Mar 22, 2022 | Compass

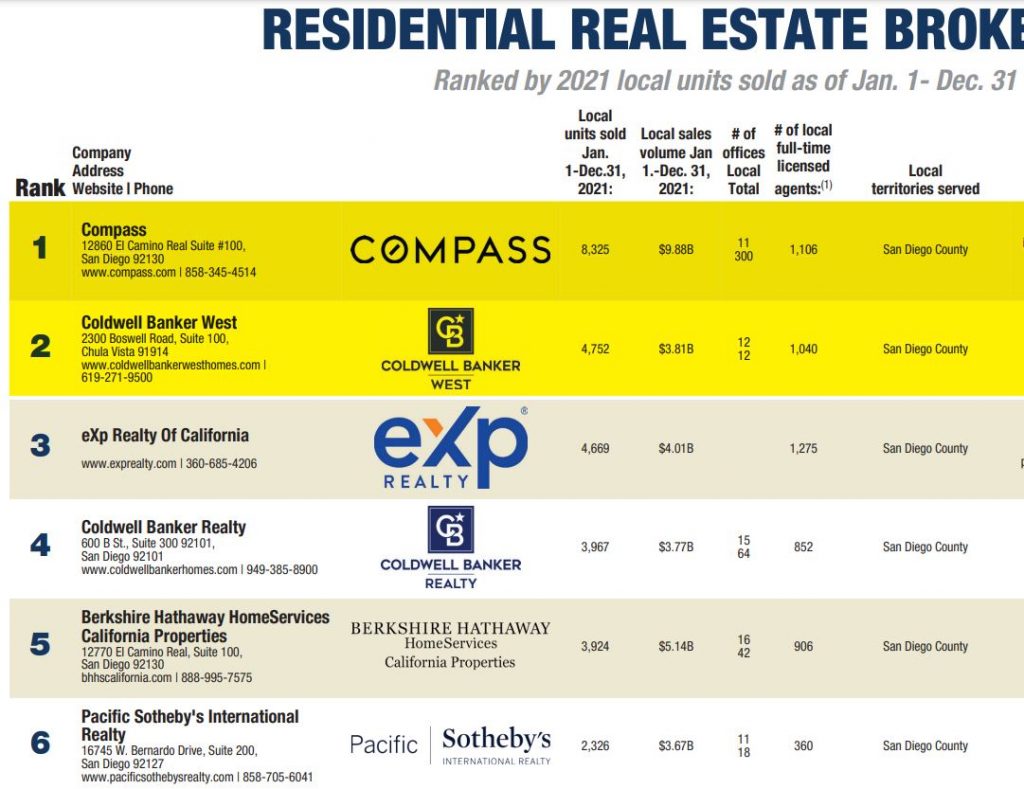

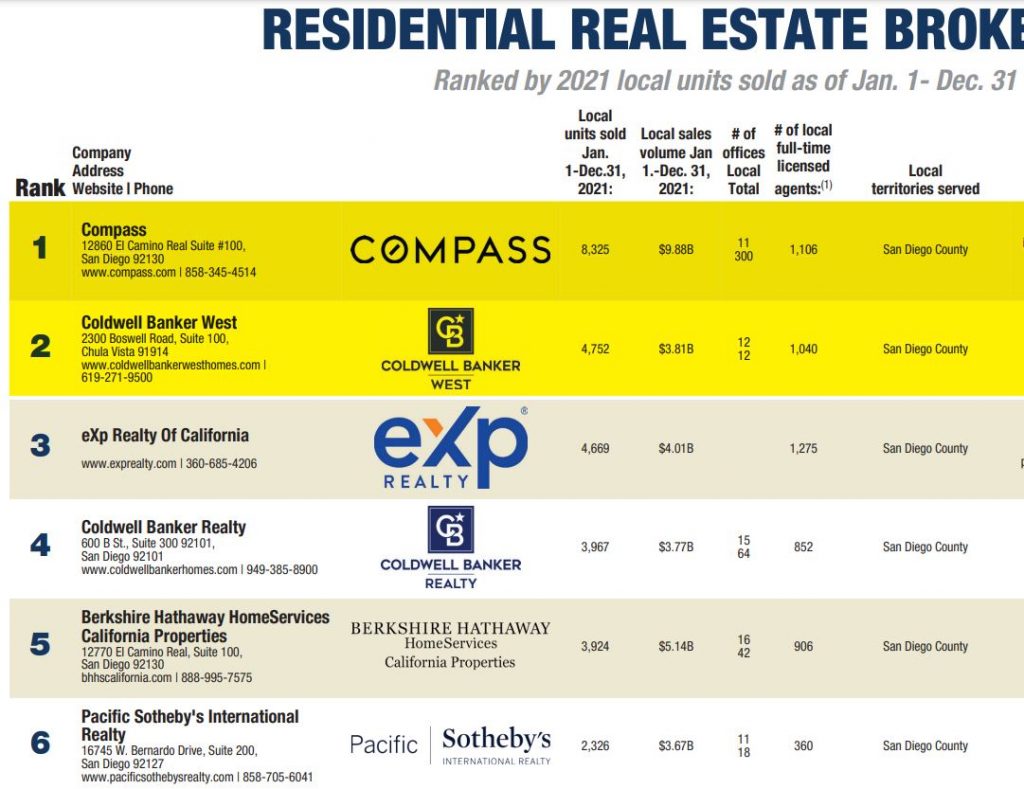

Compass has been in business locally for four years! Last year, we averaged 7.5 sales per agent.

It’s remarkable how Compass and eXp came into a rather staid and unchallenged brokerage environment and hired away nearly 2,400 productive agents so quickly.

by Jim the Realtor | Mar 21, 2022 | 2022, Frenzy, Inventory |

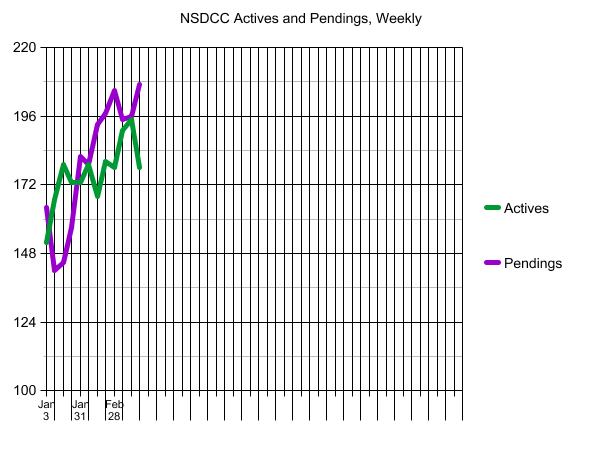

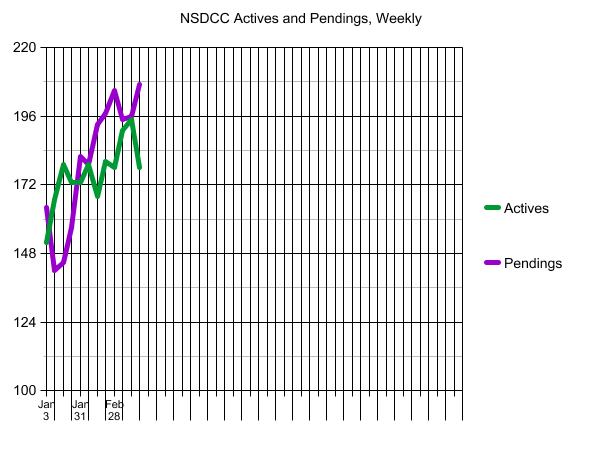

Numerically, the inventory isn’t getting any better yet:

NSDCC New Listings between March 1-15:

2018: 228

2019: 277

2020: 221

2021: 199

2022: 120

There will be a few more added to this year’s total but the homedemic continues – without additional inventory, the market will struggle to pick up momentum. The intensity of the fight over the quality homes could increase while other buyers have a hard time keeping their chops up, and become disinterested.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

(more…)

by Jim the Realtor | Mar 20, 2022 | Spring Kick

Hat tip Leonard @Compass:

Today is the last day of Winter 2022, and as Spring arrives, consider the following:

1. Clean up winter debris, old leaves, fallen branches, etc.

2. Check your roof. Winter winds may have caused damage that requires your attention.

3. Clean out gutters: they probably collected all sorts of debris over winter.

4. Clean and/or replace AC filters.

5. Deep clean your dryer vent and other appliances.

6. Check your washing machine hoses: Maybe install a leak detector?

7. Clean and repair screens…the bugs are coming!

8. Pressure wash decks, fences, etc. and check for damages.

9. Fix cracks in sidewalks and driveways before rains cause more decay.

10. Paint! Some surfaces may be overdue for some painting.

11. Replace smoke detector batteries if they are not hard wired.

12. Sharpen blades for garden equipment and kitchen knives.

13. Check caulking around doors and windows to conserve energy.

14. Trim bushes/trees and clean thoroughly around any mechanical equipment.

15. Drain your water heater to clear out sediment.

Ongoing small maintenance items can prevent larger ones. Keeping any home in tip-top shape year-round is smart. Doing these things just before selling is wonderful for the next homeowner, but you may wish to enjoy a spiffy home too!

by Jim the Realtor | Mar 19, 2022 | ADU

“We really didn’t intend selling them,” says Kevin Regan over the phone from the northwest of Ireland.

Converting a slice of airplane into a sleek and durable home office had been a personal project in 2021, but after his sister-in-law put photos of the cabin on social media, requests rolled in and things started to snowball.

Now, Regan and his business partner Shane Thornton — both builders by trade — have started their own company named Aeropod, recycling commercial airplanes into home offices, glamping pods and ready-made accommodation.

They’ve only spent €100 (about $110) so far on advertising (the company’s still “brand new out of the wrapper!,” says Regan) but they’ve already sold 11 pods and are preparing to have more shipped to wherever clients want them.

Airplanes are built to last. Strong, thickly insulated, and made of sturdy aluminum alloys. And with some 15,000 aircraft estimated to be due for retirement in the next 20 years, there’s a steady supply of them available for dismantling and recycling.

(more…)

by Jim the Realtor | Mar 19, 2022 | Market Conditions |

Even though we are racing towards mortgage rates in the 5s (should be there by summer), there won’t be much adjustment by sellers because they aren’t going to give it away!

by Jim the Realtor | Mar 18, 2022 | Where to Move |

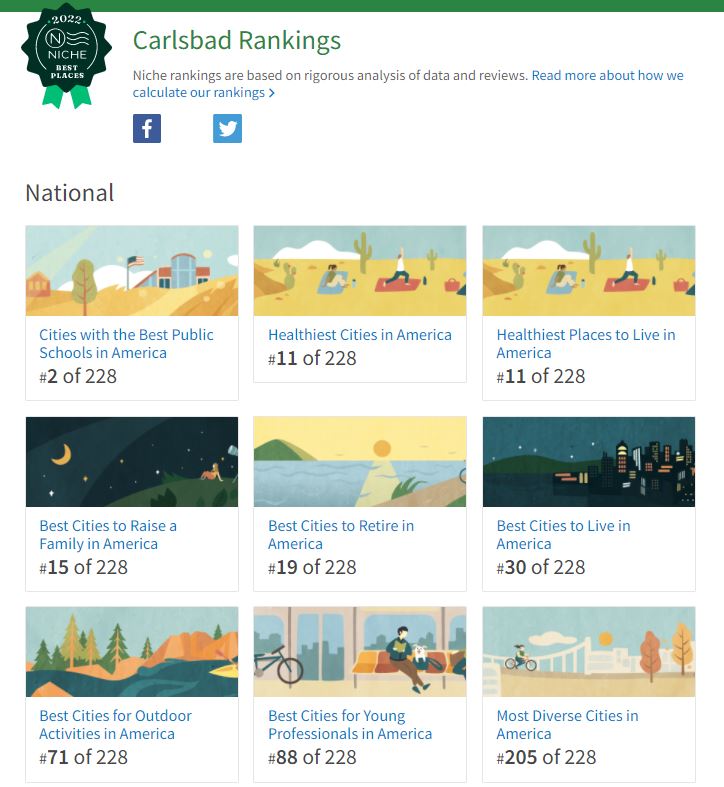

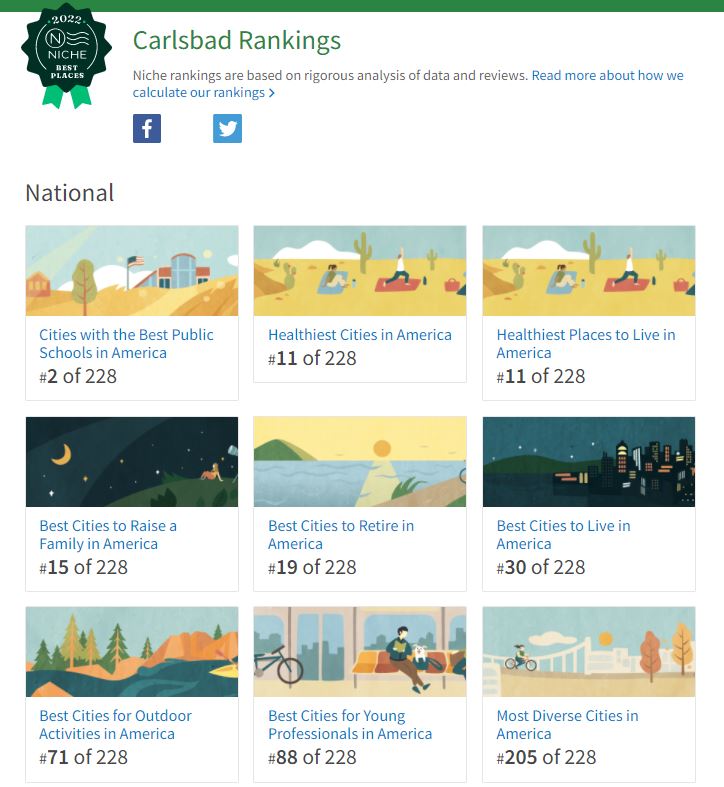

Here are the best California cities in which to buy a home – Carlsbad is #8!

All of the demographics plus hundreds of reviews of each town too:

https://www.niche.com/places-to-live/search/best-cities-to-buy-a-house/s/california/

by Jim the Realtor | Mar 17, 2022 | About the author, Jim's Take on the Market, Why You Should List With Jim |

Yesterday, I had two similar occurrences take place so it must mean I should address it!

This comment was left here on the blog:

I just wanted to thank you for your bidding war info. I have followed your blog for many years. We listed our house in Ramona last week and had open house on Fri/Sat. By Monday morning we had six offers. The highest was a very good offer and well over list. The realtor encouraged us to take that one, and said she had asked everyone for highest and best. I pushed her to counter the next two lower offers with the same amount as the first offer and gave permission for her to reveal the offer amount. She was hesitant but I insisted. Both of them came back with the same amount as the highest offer, and the highest original offer then went higher through an escalation clause. I know we don’t have the same prices as NSDCC, but the same principle applies and I wanted to give you credit. MC

MC – thank you for giving me credit!

But did you recognize that his agent’s results aren’t exactly the way I do it?

There are probably blog readers who are emboldened by what they read here. Selling homes doesn’t look that hard, and in a hot market it has to be even easier, right? After listening to me talk about it for a few weeks, it’s probably natural to think you can do it yourself, or direct your agent how to do it.

Are you guessing that MC probably didn’t get top dollar?

The other occurrence was a for-sale-by-owner who suggested he was as good as me – and insinuated that he was better. He will sell his house too, and declare it as top-dollar to feed his ego. But his listing is riddled with things I’d never do, and he’s been on the market for 2-3 weeks with no sale.

ANYBODY CAN SELL THEIR HOUSE THEMSELVES!

You don’t need me – heck, just go stick a sign in the front yard and wait for the phone to ring.

But you’re not going to sell it for the same price that I can get.

Even if you read every word on this blog, it’s not enough. It’s because the most important part of my job is doing one thing really well:

Asking the right questions, the right way, at the right time.

Even if you had the questions, it’s asking them the right way, at the right time, that causes a top-dollar sale.

You can tell that MC was on the right track, but in the heat of the moment, his agent didn’t handle it like I do. But he’s happy, the agent is happy, and they sold it for more money than expected, so all is well. But it didn’t sell for top dollar – which only happens when you ask the questions the right way, at the right time.

Not only will I sell your house for more money than you can, I will sell it for more than virtually all the other realtors. I’m not your typical order-taker; I’m a professional salesman who practices his sales skills daily. Those skills really pay off in the heat of the moment, when I sense that the buyer or their agent is a contender – I know how to say the right thing, the right way, at the right time to capitalize on the moment. Who would you trust in that moment?

It looks easy, but you don’t know what you don’t know.

Wouldn’t you be better served to have Jim the Realtor in your corner?

by Jim the Realtor | Mar 17, 2022 | Compass, Listing Agent Practices, Realtor, Realtors Talking Shop |

A remarkable achievement considering that Compass has only been a nationwide company for 3-4 years.

It will matter more later too.

CoStar is going to change the search-portal landscape, and if they spend enough advertising money to get all the eyeballs, the buyer-agents will be cooked. Unlike Zillow and Redfin who encourage viewers to contact their own set of agents, CoStar will direct people back to the listing agent of each property.

You can imagine the advertising that could change everything:

“Would you rather be represented by a third-party who doesn’t know a thing about the house in question, or do you want to speak to the listing agent who knows everything about the property – including how to get you the best deal?”

CoStar got a head start when they bought homes.com, and are rolling out their first version this summer in New York City.

Buyer-agents will be forced to join realtor teams who have the listings, or just fade away.

Who has Compass been recruiting for the last four years? That’s right, the realtor teams.

Stay Tuned!