Olivenhain $3,750,000

The tiki destination!

The tiki destination!

Available to realtors in the on-going market shift is the chance to elevate their game from the frenzy era. My observations don’t come from being an old veteran because we are far removed from fax machines and the one-page contract (“press hard, there are four copies”). Instead, just basic common sense can reveal changes that would make it easier to sell a home in a tougher market.

Nobody had a problem getting showings and offers during the frenzy. But now it’s different, yet some of the same practices are still with us. You want more showings? Make your listing easier to show!

Two recent examples:

A. Early last Sunday morning, I received a request from a buyer to see six houses priced around $2 million later that afternoon. I guessed that only half of them would be available, and after calling/texting/emailing around to the listing agents, I was able to arrange TWO showings out of the six pursued.

B. Yesterday I had an all-time classic, though some version of this is fairly typical. In spite of the house looking vacant in the photos, the listing agent is requesting 24-hour notice to show. I call, but no answer, so I leave a voicemail. I’m having a busy day, so I had not sent a text yet when I get the call an hour later:

JtR: Hello, this is Jim, can I help you?

Agt: HELLO, you called me?

JtR: Hmmm, yeah maybe – what’s your name (I didn’t recognize the phone number)?

Agt: I’m so-and-so. Are you in real estate? (agent didn’t listen to my voicemail)

JtR: Yes, and I was calling about showing your listing tomorrow.

Agt: Text me your contact info. (I send my name, company, and license number).

The conversation is now changes over to text, instead of by phone.

JtR: I’d like to show your listing.

Agt: What time?

JtR: It’s looks vacant, does it matter?

Agt: Yes, the sellers have cameras, and they like to watch.

JtR: 3:30

Agt: Ok, I’ll send you instructions.

Next, this comes over by text:

Lights in most rooms are on timers (living room, bedrooms, and dining room), so please do not move those light switches.

But Lights in the entry, kitchen, and bathrooms are NOT on timers, so you can turn those on, and then off, when done.

If you want window blinds opened, turn slats 90 degrees open to let light in, but please do not raise the blinds.

When done, turn all window slats fully closed to avoid sun damage.

Use slider door in kitchen to access patio.

Please turn slider door slats to perpendicular first before moving the slats to the right to go outside. There is a ROD in the door track, just remove it.

Please return rod to door track, lock door, fully close blinds when done.

And

All must wear Booties and Masks and all supplies are in entry foyer. If booties have run out, take off shoes.

Water is turned off until accepted offer, so let your party know to plan ahead, as toilet can not be used and no water to wash hands (sorry).

Office upstairs could be turned into mirror image of adjacent bedroom.

Solar panels are owned by Seller.

FYI. Cameras are throughout home.

Thanks so much for showing.

If you have any questions, please ring my cell phone for faster reply and text too. Thank you!

I’m sure the agent is probably thinking that this is all helpful information. But all I’m thinking about is how difficult it would be to try and negotiate an offer with them – they will want everything to go their way. During the frenzy, buyer-agents accepted that the listing agents were going to beat the crap out of you, and we just had to take it. But not now.

Yet, have listing agents adjusted their approach?

When you list your home with me, I’ll tell you up front that it is in our best interest to show the home seven days a week with little or no notice. Not only do we have more showings, but it also sends the message to buyers and agent that we have respect, and want to make it easy to buy the home – with no cameras!

It sets us apart from the rest!

We taped this during the frenzy, and I conveniently forgot about it. It may have been due to price?

It closed in April for 8% under list, which made it the most-expensive non-oceanfront sale ever in Carlsbad:

The local market conditions appear to be getting worse every day, mostly because the headline writers and social-media experts are piling on now. What can listing agents do?

When most agents are content to show their listings and then go wait by the phone, there are alternatives. Hat tip to our manager Steve Salinas for bringing up the Reverse Offer technique in our sales meeting!

For two years, the buyer-agents have just been telling their clients to bid hundreds of thousands of dollars OVER the list price, so now they may need some help with advising their buyer on how to proceed in this market. When a buyer shows some interest in the home, the listing agent can reach out to the buyer’s agent with more than just a casual request for feedback.

The Reverse Offer is where the listing agent suggests price and terms to the buyer-agent that might be the foundation of a potential deal. It needs to be handled tactfully, and with the seller’s knowledge so it’s not a breach of fiduciary or a waste of time.

It can be as casual as mentioning any needs the seller might have in their exit plan, or for terms that would be advantageous to the buyer like seller financing or rate buydowns. But it can also be as formal as issuing written offers signed by the seller for the waiting buyers to consider – here’s more:

https://www.alexwang.com/blog/considering-the-reverse-offer

It’s worth considering because what’s the alternative? To just sit by the phone and hope it rings, and when it doesn’t, go tell the seller to dump on price?

This is the Wait-and-See period when buyers are so comfortable on the fence that it’s going to take something different to get them to buy a home. Dumping on price during the Wait-and-See period only makes the home buyers think that if they just wait longer, the prices will go down more.

Agents should offer their sellers some alternatives to that!

We were discussing the “mold” found by a home inspector, who wasn’t qualified to comment on the subject – though that didn’t stop him from trying to scare the daylights out of the buyer just so he could CYA.

I suggested that it was the garden-variety mildew that could be removed with a squirt of bleach and a wipe of a cloth. After all, it tested ‘dry’ and the minor stain under the kitchen sink looked like it was years old.

Of course, they asked, “What do you know about mold?”

Plenty, lady…..plenty:

Re-purposing commercial and industrial properties into residential developments is an idea that should have been fast-tracked years ago. Bills were signed by the governor yesterday, and they make it look like thousands of new homes will be built shortly.

But there is more to it, of course, since politicians and lobbyists are involved. They want unions to build them, and/or they want some or all of the homes to be for low-income housing.

From this article – an excerpt:

For years, California state lawmakers have tried to reconcile warring views on what labor standards should be required of developers who’d be allowed to build housing more easily and quickly to combat the housing crisis.

Most recently that debate has splintered organized labor over two bills that both unlock commercial real estate for residential use. The Senate’s bill has the backing of the powerful state Building and Construction Trades Council, while the Assembly’s bill counts on support from affordable housing developers and the state’s Conference of Carpenters. The Legislature’s progress on housing for this session was framed as recently as last week as a battle between these two forces over the bill in the Assembly.

But following weeks of tense negotiations between the two unions over the labor provisions in the Assembly’s bill, the labor groups failed to hammer out a compromise.

So instead of choosing sides, leadership in the state Assembly and Senate simply gave their seal of approval to both bills. They opted to give developers two choices if they want to build housing where strip malls once were: Comply with stricter affordability standards or stricter labor standards.

Senate Pro Tem Toni Atkins, a San Diego Democrat, called the two-bill package “a monumental legislative agreement, and one of the most significant efforts to streamline and amplify housing production in decades.”

If passed, both bills would apply to overlapping sites — and leave the choice of which policy to use in the developer’s hands.

Full article here:

https://calmatters.org/housing/2022/08/california-housing-crisis-labor-deal/

I am running short on videos – there are fewer homes for sale, and the list of homes worthy of a video is even shorter. We saw this one a couple of months ago, and it just closed on September 16th for $3,600,000, which was $100,000 over list. Knowing that, the video might be more intriguing now?

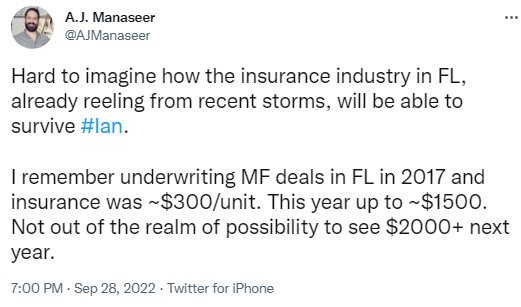

If mortgage rates around 7% weren’t bad enough, today we are experiencing another major setback to the San Diego real estate market.

Florida has been one of the main destination points for those moving away from here.

How many people who were planning to leave San Diego next year are second-guessing their plans now.

Yikes! I expect the local inventory of homes for sale in 2023 to be the lowest ever!

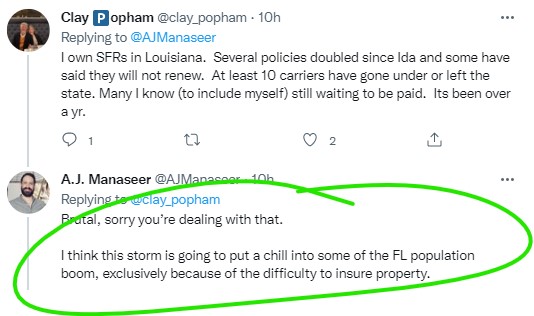

Hat tip to Garry and Rob Dawg who predicted that we’d hit 7% this year, for the first time in over 20 years!

It was in April, 2002 that rates were over 7%, back when the NSDCC median sales price was $635,000. This month it’s $2,075,000!

Rates have never doubled this quickly, and the increase looks like the fastest since 1981:

And it will probably keep going!

I mentioned in my very first blog post seventeen years ago that all it takes to achieve 20% to 25% annual appreciation is for everyone to pay a little more than the last guy. The same principle works in reverse too.

San Diego Non-Seasonally-Adjusted CSI changes

| Observation Month | |||

| Jan ’21 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| Jun | |||

| Jul | |||

| Aug | |||

| Sep | |||

| Oct | |||

| Nov | |||

| Dec | |||

| Jan ’22 | |||

| Feb | |||

| Mar | |||

| Apr | |||

| May | |||

| Jun | |||

| Jul |

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Bob Shiller regularly touts the Case-Shiller futures market but it’s a gambling hall if you ask me. Here’s what those bettors think about our local index:

IF they are accurate about the future of San Diego home pricing, then either you can sell your house now for today’s prices, or wait until 2025 and sell for about the same.