Election Day

Let’s don’t get into modern-day politics because there is no civil discourse any more. Instead, let’s reminisce how it used to be – above is Part 2 of the famous Reagan interview from January, 1975. Part 1 is here:

Let’s don’t get into modern-day politics because there is no civil discourse any more. Instead, let’s reminisce how it used to be – above is Part 2 of the famous Reagan interview from January, 1975. Part 1 is here:

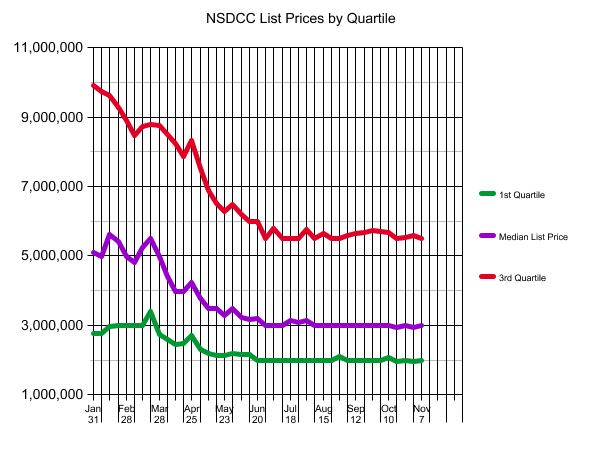

A benefit of prices going up so fast in early 2022 was that future sellers may not have noticed – and they might be happy to sell for 2021 prices next year. But there are other items that will complicate the matter:

The only hope is that there will be enough decline in pricing between now and March that buyers will be pleasantly surprised, and proceed with their plans to purchase. Working in our favor are the lousy tools we use to measure ‘pricing’, and how nobody wants to look any deeper.

It was here that I estimated that sales prices would have to come down by 30% to fully offset the effect of higher rates. I suggested that it would be a comfortable ride if that happened over the next five years, because sellers today shouldn’t mind getting 0.5% to 1% less than the last guy. It’s the cumulative effect of years’ worth of prices dropping that could see declines of 30% or more.

Will there be sellers who go for a 30% hit next year? Very doubtful, and most would rather wait it out for years before surrendering that much equity – and they may decide to never move.

What might revive the market next spring are reports that prices are 10% to 20% lower.

Could we get there by March?

The San Diego median sales price in May was $913,750.

In October, it was $850,000, or 7% lower.

The sales volume will be hitting all-time lows over the next 2-3 months – there are only 2,756 houses for sale in the county today – and only the highly-motivated sellers will be getting out. If the median sales price drops 2% per month, by March it will be around $770,000, or 16% lower than it was in May!

It may not impress everyone, but it should be enough to get buyers to take a look around! Of course, a lower median sales price is a lousy gauge and it doesn’t mean prices have dropped everywhere. There will be plenty of new listings priced really high, but will buyers keep in the fight? They should, because there will be 10% to 20% of the sellers who really need to move – you just need to dig them out.

Get Good Help!

Thanksgiving is right around the corner! Are your holiday pies handled yet?

Please join us and help make an impact on those in need this holiday season.

Mama’s Kitchen is an organization that delivers meals to homebound individuals vulnerable to malnutrition due to conditions such as HIV, cancer, heart disease, and more. Their primary fundraiser is Mama’s Pies and with the purchase of each pie, they’re able to produce and deliver 12 meals to those in need!

Sales end Nov. 19th or as long as supplies last, so get your orders in ASAP.

To buy pies and/or donate, here’s the information:

1. Visit our selling page: https://mamaspies.org/

2. Click “Buy or Donate Pies.”

3. Add your desired pies to your cart.

4. Under the “Select a Seller” section, click “Yes” and select “Seller: Jim & Donna Klinge.”

5. Choose your desired pick up location OR under Private, choose “PRKLINGE” to have our team deliver it to your home in San Diego! If choosing delivery, we’ll reach out for your address.

6. Add in any donation amount if you’d like.

7. Put in your payment method and click submit!

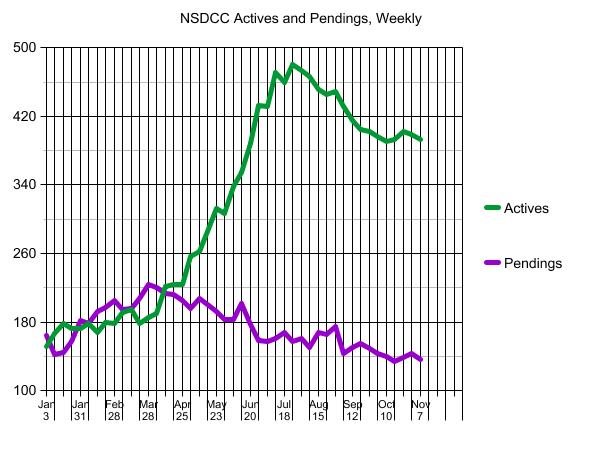

Of the ~400 NSDCC homes currently for sale, only 16 went pending in the last week – the lowest number since the first week of the year.

96% of the active sellers would rather hold out on price and stay on the open market in mid-November!

If they are priced under $2,000,000, you can see why:

NSDCC Active Listings Under $2,000,000 – First Week of November:

2018: 472

2019: 381

2020: 163

2021: 47

2022: 105

A house in this location would be a party!

Priced at $35,995,000.

https://www.compass.com/listing/2168-east-oceanfront-newport-beach-ca-92661/1152385497636404881/

I don’t mind a home inspector bringing up every detail – what matters most is how they present them. We call it ‘bedside manner’; like the doctors who are able to tactfully tell their patients the truth in a way that they gently understand and accept.

After this sale fell out of escrow, the key positive was that we had 100% clear mold remediation, unlike every other house for sale (because buyers rarely test for mold). Yet when today’s very soft and afraid buyers hear the m-word, they run for the hills, instead of sensing an opportunity. We closed the second escrow at $50,000 under list, instead of $300,000 over.

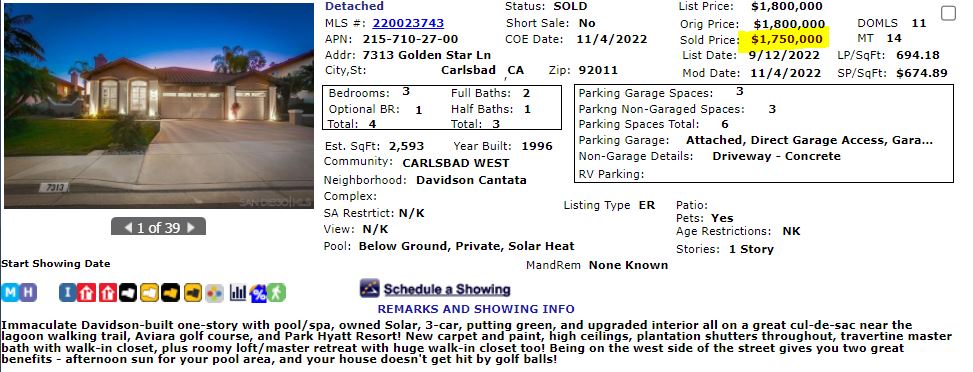

Our one-story listing in Aviara closed escrow today.

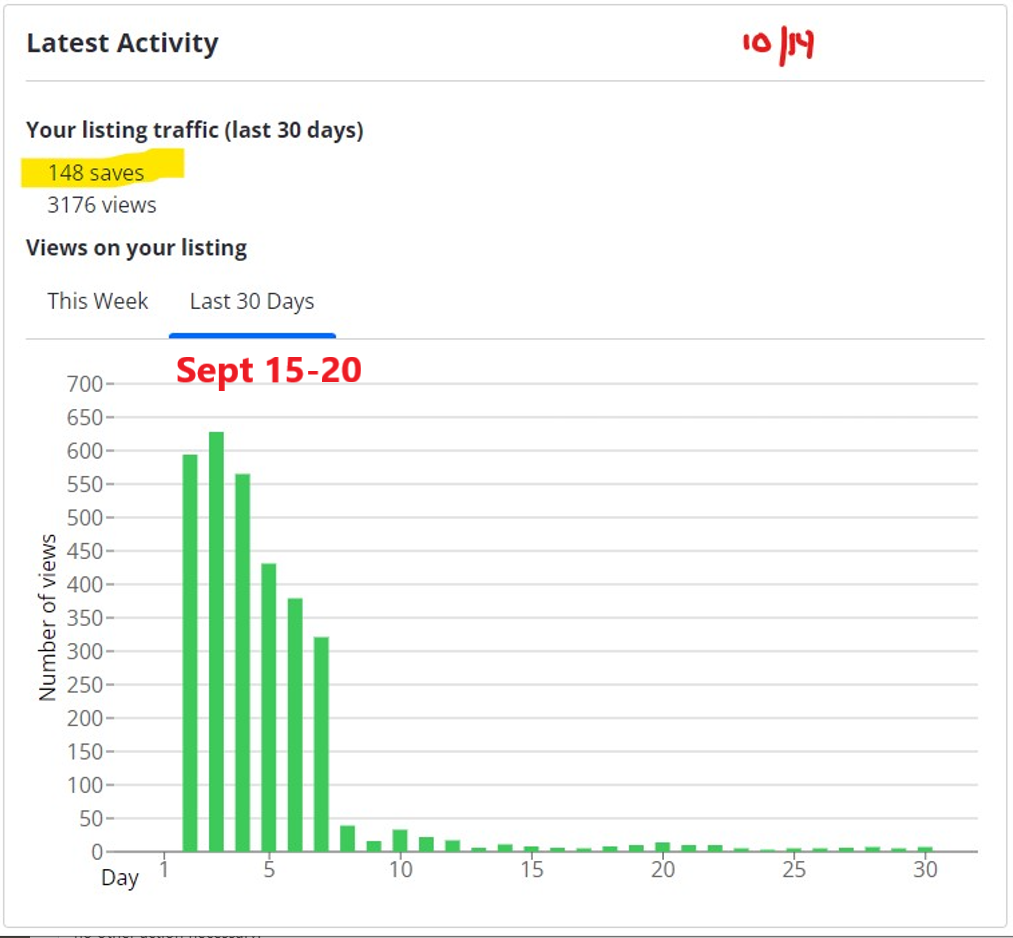

We had listed for an attractive $1,800,000 in mid-September, and had about 2,600 views on Zillow in the first five days (see above). We received three offers, and accepted the highest at $2,100,000 cash.

Previously I told the story of how the home inspector’s lack of bedside manner put the buyer on edge. Their mold inspection didn’t detect anything in the air, but a swab behind a toilet did cause a positive result. We offered mold remediation and re-test to ensure the problem was corrected – the standard solution – but the buyer said she couldn’t handle the stress and cancelled escrow instead.

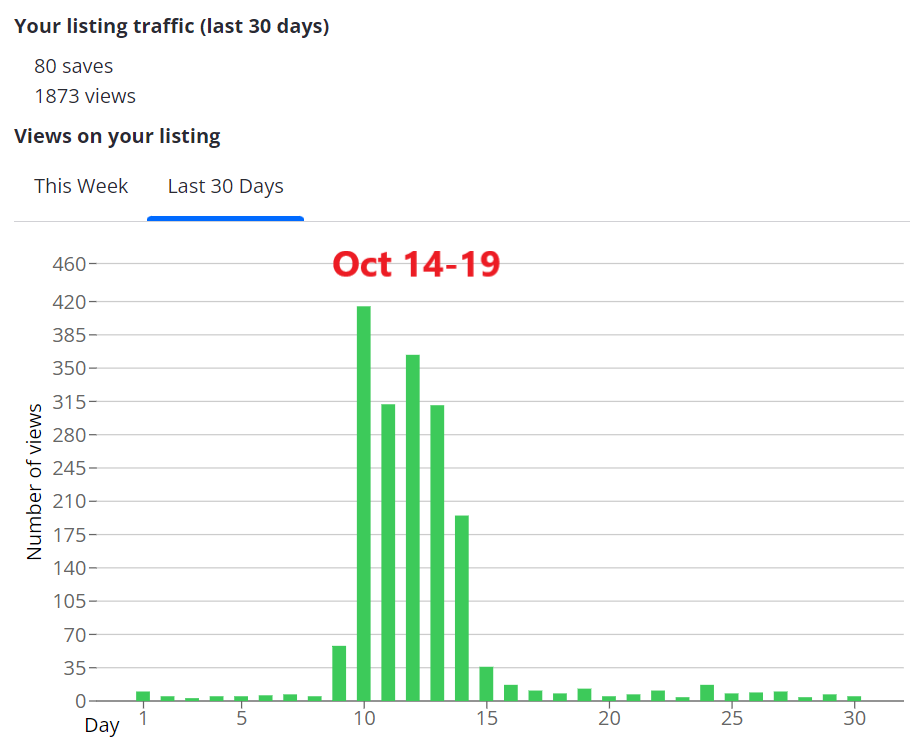

You never get the same buyer enthusiasm the second time around, so I knew going back on the open market in mid-October was going to be a challenge – especially now that my seller was getting used to the idea of a $2,100,000 sales price.

We completed the mold remediation so at least the problem was solved. But I didn’t make any mention of it in the MLS or in other advertising because I wanted to control the message. We went back on the market on Friday, October 14th, and I did the open house extravaganza on the 15th and 16th where I planned to discuss the mold remediation in person with the interested parties.

We only had about 1,580 views in the first five days – which is 40% lower than the original effort:

I had already contacted the previous bidders from the first round, and the second-place finisher who had offered $2,000,000 cash was still interested. They weren’t willing to put another offer on the table until after the open houses were done, and when they did, it was a disappointing $1,650,000.

No one else made an offer.

We went back and forth, but the best they were willing to do was $1,750,000.

By then, it was Tuesday night and the first game of the Padres vs. Phillies playoffs. Without any hope of another offer to rival the deal on the table, the next day the seller decided to take it, and stay on track to purchase the replacement home that we had in escrow, contingent upon this one selling.

Did the value drop $350,000 in a month?

You could say that, but it the double whammy of falling out of escrow/mold remediation didn’t help. The original $2,100,000 offer was too optimistic to stick, and given that the eventual buyer had dropped from $2.0 to $1.75, their original offer probably wouldn’t have closed either.

An offer of $1,800,000 would have made it to the finish line, and maybe as high as $1,900,000. Having the general negativity increasing about real estate market every day was bad enough, and then include the wicked combo of second try/mold/Padres playoff fever. I’m glad we got as much as we did.

Did you know that a garden gnome is a sign that the homeowners are swingers?

They do say no one knows what goes on behind closed doors – but is your neighbor giving out secret clues that they’re a swinger?

Yesterday we told how sales of garden pampas grass have plummeted because it’s believed to be a secret signal that swingers live in the home it belongs to. But it turns out that the exotic plant isn’t the only giveaway that the house’s residents are into liberal sexual practices.

They also cite white landscaping rocks and pink or purple decorations in the front garden as a signal of swinger activity. Bizarrely, the website identifies pineapples as another swinger signal – in the form of a door knocker. They may look sweet and innocent, but it turns out garden gnomes are a likely indicator that the resident is into swinging too.

Read full article here:

https://nypost.com/2017/06/02/secret-signs-your-neighbor-might-be-a-swinger/

This home listed for $3,595,000 but didn’t have any takers over the first five weeks. They ‘refreshed’ the listing (let it expire and then relisted as a new listing), with a lower price of $3,445,000 – a discount of 4%.

They found the buyer a week later who paid $3,400,000 cash. I’m not sure if it was the lower list price that caused it, or the refresh?

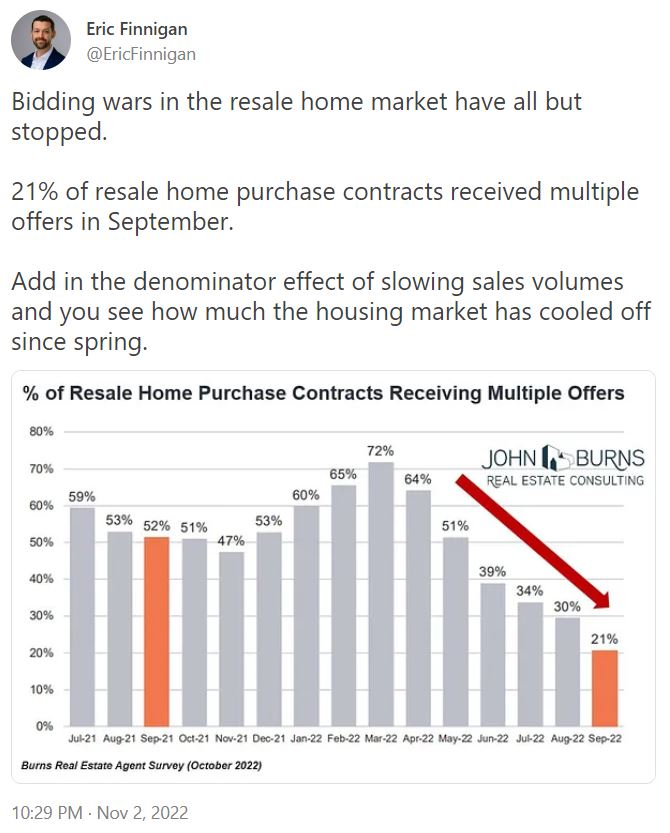

Of course the current conditions look worse when comparing to the hottest real estate market ever. Having bidding wars on 21% of homes for sale sounds great to me.

The discouraging part about Bill’s post today is how the realtors have bought into the negativity.

This is the first downturn to be affected by amateurs on social media, and realtors can either price ’em high and repeat these same negative talking points seen everywhere now, or they can get better at their craft, price their listings attractively, and be part of the solution:

#Houston, TX: “Home prices have most first-time home buyers priced out of home ownership. It’s even worse with the higher interest rates decreasing what the buyers can qualify for.”

#Denver, CO: “Cost of living [and] interest rate [increases] are keeping most buyers from buying.”

#Baltimore, MD: “The market is transitioning. Inventory is still low and the number of buyers looking is less due to rising interest rates. Buyers are qualifying for less, so they are pulling back. [I am] seeing less as-is sales, more home inspections, and negotiations overall.”

#Sarasota, FL: “I’ve had numerous buyers looking but the prices are much higher than they want to spend. Many pulled back waiting for the market to go down.”

#LosAngeles, CA: “Skyrocketing interest rates are pushing buyers out of the market (they can no longer afford homes that were in their price range just a few months ago) and making homes more difficult to sell for sellers and their agents.”

#Phoenix, AZ: “Buyers are very nervous about making a decision.”

#NewYork: “Open house attendance is weaker than usual, and sales take longer.”

#Minnesota, MN: “Still seeing a fair number of cash sales as competition to financed sales.”

#StLouis, MO: “Things are slowing down slightly, but I have found that the good properties are still moving quickly with multiple offers and going above ask.”

#Barre, VT: “Our local market in Lamoille County is very flat and challenging. Local working families are outpriced by the prices and interest rates. The neighboring resort town has slowed but there are still cash buyers for the million plus market.”

#OrangeCounty, CA: “Interest rates have put the brakes on the market.”

I did sign up to be on their realtor-comments list!

https://open.substack.com/pub/calculatedrisk/p/interest-rates-have-put-the-brakes